|

pmchem posted:I'm reviewing the OP of this thread. Does anyone have freely accessible content to add that they'd recommend for people just trying to do all this for the first time? Of all things, the Fed Reserve apparently has a bunch of free financial education resources. https://research.stlouisfed.org/pub...bout-retirement https://research.stlouisfed.org/publications/page1-econ/2023/02/01/what-is-the-best-strategy-for-paying-off-credit-card-debt https://files.stlouisfed.org/files/htdocs/publications/page1-econ/2022/02/01/on-the-move-mortgage-basics_SE.pdf https://www.stlouisfed.org/education/continuing-feducation-video-series/episode-1-understanding-how-a-fico-credit-score-is-determined https://files.stlouisfed.org/files/htdocs/publications/page1-econ/2019/02/01/cars-and-cash-what-to-know-before-you-go_SE.pdf

|

|

|

|

|

| # ? May 4, 2024 23:48 |

|

Jon Irenicus posted:I have a 403b I've been contributing to for a while now and I'm not a fan of the high fees attached and performance so far. How complicated would it be to swap into another provider my school districts approves of and transfer the current money and manage it myself? It would be from Equitable to something like Vanguard. Are you still an active employee? If yes, then the answer is most likely there isn't anything you can do, but it can't hurt to give them a call and ask.

|

|

|

|

Jon Irenicus posted:I have a 403b I've been contributing to for a while now and I'm not a fan of the high fees attached and performance so far. How complicated would it be to swap into another provider my school districts approves of and transfer the current money and manage it myself? It would be from Equitable to something like Vanguard. Some useful info here for anyone with a retirement account through a school district: http://403bwise.org/

|

|

|

|

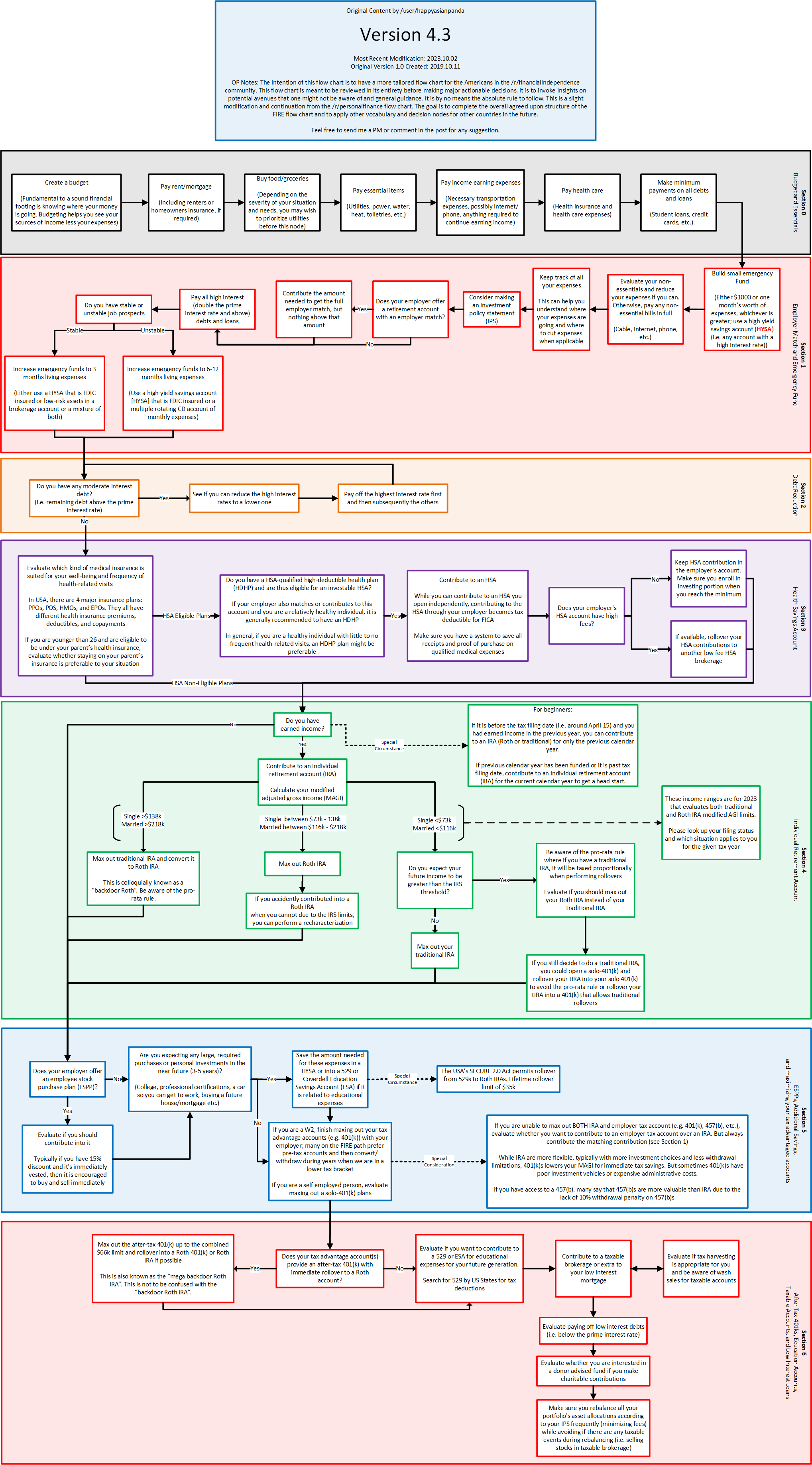

added this nice SEC investor education page: https://www.investor.gov/introduction-investing added this page on financial planner costs: https://www.whitecoatinvestor.com/most-financial-planning-fees-are-excessive/ added this IRS page about retirement stuff: https://www.irs.gov/retirement-plans/plan-participant-employee/saving-for-retirement added STL Fed retirement education page: https://research.stlouisfed.org/pub...bout-retirement updated FI flowchart (easily best flowchart) to v4.3:  added I-Bonds fan page: https://tipswatch.com/i-bond-manifesto/ I think that covers the more general interest, easily readable stuff for now (I wasn't a huge fan of the chooseFI page's format/M1 slant, and it was a bit redundant with other links although I see why some people may like it). thanks, all

|

|

|

|

oh do you have the source file for that flowchart? A downloadable, editable version would be really helpful. To me, anyway. I could maybe do an edit pass, too (this is like, literally my job IRL), but mostly it's so I can like, cut out all the stuff that doesn't apply for a specific relative and leave them with a simpler thing to look at for just their situation.

|

|

|

|

Leperflesh posted:oh do you have the source file for that flowchart? A downloadable, editable version would be really helpful. To me, anyway. there's a PDF of the previous version here: https://drive.google.com/file/d/1ik7gRoDmUsPCRxiLT71gs3wRsEcN9YQ5/view

|

|

|

|

Leperflesh posted:oh do you have the source file for that flowchart? A downloadable, editable version would be really helpful. To me, anyway. no i just grabbed it from the author’s reddit history but if you find it make a source version let me know and we can put in OP. wouldn’t be hard to remake.

|

|

|

|

Leperflesh posted:oh do you have the source file for that flowchart? A downloadable, editable version would be really helpful. To me, anyway. Do you have access to figma? I’ve started rebuilding it for fun. I started it on my work laptop but can transfer it to my personal account if you want access.

|

|

|

|

I have Figma through work, I could see if I have access, but like... my work machine is pretty solidly firewalled from everything else I do so I was hoping it was in excel, visio, powerpoint, draw.io, a .vsg file, or something similar draw.io is open source and I have used it a bunch so that'd be ideal, but I could manage with any of the above formats also if you've already started and want to do it go for it! I think it's way too wordy in some of the tiles, I don't like the arrow style, it uses undefined acronyms, and various other issues but like, if this is from reddit and they're gonna keep updating it I'd hate to create a project fork that then has to be maintained forever, too

|

|

|

|

what's figma VV not the punchline i was expecting but thank you pyknosis fucked around with this message at 00:07 on Apr 30, 2024 |

|

|

|

I dunno, what's figma with you? it's a collaborative graphics tool where you can make an image such as a flowchart or diagram with components and share it and others can comment on parts, update the image, etc. and then you can export it to various formats e. apparently it does a lot of things, but this is the bit I'm familiar with https://www.figma.com/figjam/diagramming-tool/ Leperflesh fucked around with this message at 00:13 on Apr 30, 2024 |

|

|

|

MJP posted:Are there any flowcharts or guides on how to calculate/plan for actual retirement spending? We're DINK, mortgage will be paid off, we don't intend to relocate, and with our incomes combined, even estimating that we'd spend 50% of our combined incomes monthly is WAY too much. I'm actually hopeful to retire at 55 and start Social Security at 62 if I can, but even then my wife will probably still work until she gets to SS age because she isn't of the same opinion as me regarding hanging around the house and doing hobbies and gardening all day. This post is from forever ago, but I'm having the same questions, and the replies to it weren't really helpful. I haven't read the entire thread so if there is a keyword or post that would point me in the right direction that would be appreciated. They were essentially:

And that was pretty much it. I've used Firecalc, and it seems fine, but I'd like other options to compare their assumptions. It currently says that with my current plan/portfolio, I'll never have an issue if I retire at 67. Which is great, but what I have is a lot less than what other sites recommend. I've tried a bunch of the ones from various investment sites, and they suck rear end. Like they will assume a huge amount of monthly spend for housing - but never asked if we would have a mortgage still. I suspect that they just put their finger on the scales to have you over save so they can park your money for you. And the general rules (like the 30x expenses) I've seen don't seem to ever account for Social Security, which between my spouse and I would cover half our needs. The main challenge is estimating the spend. If I assume my current spend rate (current pay minus mortgage (paid off by then), retirement savings, other savings), I'm ok in that assumption. But I suspect I'll be spending even less than that. Do I just have to do my own model from scratch?

|

|

|

|

Bone Crimes posted:This post is from forever ago, but I'm having the same questions, and the replies to it weren't really helpful. I haven't read the entire thread so if there is a keyword or post that would point me in the right direction that would be appreciated. I think the answer you need is probably the one you hinted at: if the general rules and estimates aren't accurate enough, you'll probably need to add more information and detail on your own. The situation after retirement is a lot like the situation before retirement, in that you start by estimating your income and your expenses. If you aren't tracking your expenses at a category level now -- groceries, utilities, entertainment, transportation, housing, insurance, etc -- I'd start there. Having that as a baseline means you can look at/in estimate each category and more accurately plan for retirement expenses relative to what you're spending now. On the income side, you'll probably have to plan it out yourself -- estimate your social security, any pensions, any retirement accounts, etc. Read about "safe" withdrawal rates and variable rates and see what you think. If it's overwhelming, use the estimates for each number, and just pick a possible retirement age/year. Run those numbers, see if you feel like it's accurate, and get more precise if not. Or, if you pick a retirement year and have way more cushion than you need, try moving it a few years earlier. Not sure if that's the answer you're looking for, but it sounds like you're about at the edge of what the general rules and estimates can do for you, so you may just have to start dialing in more precise numbers on your own. Or maybe I'm misunderstanding what you're asking?

|

|

|

|

Bone Crimes posted:This post is from forever ago, but I'm having the same questions, and the replies to it weren't really helpful. I haven't read the entire thread so if there is a keyword or post that would point me in the right direction that would be appreciated. Can you be a bit crisper with your actual question(s)? You're running a pretty wide gamut here. A few things: A) 30x expenses should be good enough for a 60-ish-year retirement horizon. You can go a little less if you're expecting a much shorter horizon (30 years), but not much less. B) Don't build your own model. The Toolkit here - https://earlyretirementnow.com/safe-withdrawal-rate-series/ will allow you to do all you want and more, if you're marginally comfortable with spreadsheets. C) Social Security probably doesn't matter ALL that much unless you're very close to getting it right now. Generally, I've been assuming that it'll cover any incremental medical expenses that I have. But I've also used the tool in B (and others) and for my personal situation, it doesn't move the needle. If you are very close to getting social security, you can "just" reduce your expenses by the amount you're getting, similar to any other fixed income stream (rental income, bond coupons, etc). D) Estimating expenses should NOT be that hard actually? It'll take a few hours the first time, but go in and get all the transactions you've had over the past (month at least, year is MUCH better) and roll your own categories. Some of these ("replaced furnace") are not going to be actual annual expenditures, but will be some sort of amortized amount that hits irregularly. Others ("food") should be more stable. Some ("mortgage") might drop off completely. Others might be "optional" (vacations and poo poo - cross-ocean vs local). You'll probably get a range here, because expenses are very personal and can vary quite a bit. E) Retirement "smile" is a thing. Here's some info I haven't read from someone relatively reliable though now kinda shills annuities. https://retirementresearcher.com/retirement-spending-smile/

|

|

|

|

Two of the links are the same. Did you *want* to use https://www.retirementbudgetcalculator.com

|

|

|

|

remembertorelax posted:I think the answer you need is probably the one you hinted at: if the general rules and estimates aren't accurate enough, you'll probably need to add more information and detail on your own. Thanks- I do have all this tracked. And I suspect you're correct on me needing to build my own. I won't likely retire for another 18 years. My expenses now include all sorts of stuff that I don't expect to be paying for in the future - I have 2 kids for example - and lots of other stuff I expect to change. I'm wondering if there is a tool to help me estimate the amount I'll need to spend considering my lifestyle now, but being older, in different circumstances. CubicalSucrose posted:Can you be a bit crisper with your actual question(s)? You're running a pretty wide gamut here. Sure, More specifically I'm asking for a tool that will help me estimate my actual yearly needs given a set of inputs/assumptions - even some relatively well-reasoned fudge factors would be ok. There are things I can assume from my current lifestyle, but there are a lot of things I can't - like medicare gap insurance - I don't really know what that costs- , or other things around health planning. Even a checklist of things to consider - like I have 4 people in my household now, and won't when I retire - etc. I feel that all these tools either assume that you'll need the equivalent of your current gross salary in perpetuity, which would way over estimate my needs going forward! It's way different if I only consider what my spouse and I would need- Could we live on $120k/year in current dollars with no mortgage and no saving? Yeah we could! CubicalSucrose posted:B) Don't build your own model. The Toolkit here - https://earlyretirementnow.com/safe-withdrawal-rate-series/ will allow you to do all you want and more, if you're marginally comfortable with spreadsheets. This is a big page with a lot of links. The google sheet in the middle this seems to cover portfolio planning and disbursement strategies for FIRE, but not tools to help estimate needs. I assume the FIRE folk would have that type of estimating tool too though, right? CubicalSucrose posted:C) Social Security probably doesn't matter ALL that much unless you're very close to getting it right now. Generally, I've been assuming that it'll cover any incremental medical expenses that I have. But I've also used the tool in B (and others) and for my personal situation, it doesn't move the needle. Why is this? It seems to cover a significant fraction of my current estimate - like 50%. Are you assuming it's going away or something? CubicalSucrose posted:D) Estimating expenses should NOT be that hard actually? It'll take a few hours the first time, but go in and get all the transactions you've had over the past (month at least, year is MUCH better) and roll your own categories. Some of these ("replaced furnace") are not going to be actual annual expenditures, but will be some sort of amortized amount that hits irregularly. Others ("food") should be more stable. Some ("mortgage") might drop off completely. Others might be "optional" (vacations and poo poo - cross-ocean vs local). You'll probably get a range here, because expenses are very personal and can vary quite a bit. I think this is what I'll have to end up doing, and I essentially have this already, but I have 2 issues: -I don't know all the kinds of expenses old me will have - a list of things to consider would be great. - the amounts the other tools are telling me, like needing $2.5M in investments/accounts in addition to SS to be 'safe', seems way out of line based on what I actually need. My estimate based on a ground-up accounting and firecalc that it makes me nervous that I'm missing something. obi_ant posted:Two of the links are the same. Did you *want* to use https://www.retirementbudgetcalculator.com

|

|

|

|

Bone Crimes posted:Thanks- I do have all this tracked. And I suspect you're correct on me needing to build my own. I won't likely retire for another 18 years. My expenses now include all sorts of stuff that I don't expect to be paying for in the future - I have 2 kids for example - and lots of other stuff I expect to change. I'm wondering if there is a tool to help me estimate the amount I'll need to spend considering my lifestyle now, but being older, in different circumstances. I don't imagine that old people have any materially different expenses other than medical costs and maybe gifts (which is toggle-able). If you have all the things you currently spend money on in a decent spot, then...what do you think you will do differently when retired vs now-ish? Travel more? Add money for travel. Golf or something? Add money for golf. Will you drive a whole lot less? Drop your car and/or fuel expenses. Will you have a mortgage anymore? If not, drop that. Actually, posting a spreadsheet of "line item, current annual spend, expected post-retirement spend (in today's dollars)" for the thread (or someone you will pay like $300 to) to critique might be a useful exercise. Medical stuff is going to be a big one and projecting 15+ years into the future seems pretty tricky. One thing you might do is "ask a bunch of old people what all they spend money on" and see if they list anything you don't have on your list. This IS the "fire expense estimation guide" - I am not aware of anything super structured or widely used / talked about (because expense estimation is typically super straightforward), though maybe I've skipped that since I've tracked my own details at the transaction-level for years and have quite a good handle on my own stuff. Re: SS. Based on my actual SS benefits and the many decades until I would get them (3+), and the relatively short number of years until I quit working forever (almost certainly less than 5, probably less than 3), it doesn't really make a difference for me. Yeah I think just "post your stuff" (round to whatever) or "pay a good financial advisor specifically look at your stuff" (and then report back to this thread with what they told you) are going to be the best routes forward.

|

|

|

|

Nobody really has an expense estimating too because expenses are so wildly variable. Making a list of your own expenses now and likely future projections based on what you intend in retirement is going to be the best way to do things. Some of the things you are asking about are google-able (medicare gap insurance costs) and can be easily added.

|

|

|

|

And a lot of the default site calculations are super conservative, like telling someone who already saves ~50% of their income for retirement to have 90% of their pre-retirement income available in retirement…

|

|

|

|

I spent some time updating my FIRE forecasting and did a quick and dirty spending model by starting with 2024's budget and adjusting it for various epochs: kids in college, jet setting empty nesters, too old to travel, too old to live in the house. I then put estimated dates on those transitions based on family history and actuarial tables. This gave me a year-by-year projected spending that I could plug into calculators to determine what nest egg I'd need. Like all models, it's wrong, but it's at least personalized to your lifestyle and comprehends that your spending will change over time, which is highly relevant when looking at sequence of returns risk.

|

|

|

|

SlapActionJackson posted:I spent some time updating my FIRE forecasting and did a quick and dirty spending model by starting with 2024's budget and adjusting it for various epochs: kids in college, jet setting empty nesters, too old to travel, too old to live in the house. yeah, this is what I will do - this post is useful just for the listing of the 'epochs' I should think through. I need to talk to the olds in my family to see what they spend on. Not too many of them are what I would call 'good' with money though.

|

|

|

|

It is virtually impossible to reasonably estimate your medical costs. That sucks but it's true: the lower bound is pretty low if you are lucky enough to be very healthy for most of your retirement, but the upper bound is completely absurd. No, it's not just the cost of insurance, plus more insurance: if you need for example full-time in-home care because you have Parkinson disease, you could "need" (in 2024 dollars) $100k/year for 20 years. Just for that. Your alternative is much worse outcomes in a facility, which can cost that much or more, or somewhat less for even worse care. OK, probably you won't get specifically Parkinson disease, but that's just an example. There are countless ailments that insurance only partly covers, and numerous accommodations that you might want to be ready for that are quite costly. However, how do you take that into account for planning? If you aren't going to retire with $10M+, you can't, really. You can look at averages and aim for somewhat more than the average and hope for the best, and exactly how much is "somewhat more" is a matter of some personal level of risk tolerance weighted against the just how painful saving even more money is for you and your family today. IMO this is part of why tools for estimating your costs in retirement are scarce. An average may be hard to find in the first place because even that figure is complicated by numerous demographic and geographical factors and limits on the data we actually have, but averages are most useful for actuaries making investments to cover an aggregate cost, like an insurance company or a pension fund. For an individual, your actual pathway is rarely bang on average, and winding up in, say, the top 10% of medical cost/needs in retirement when you planned on being at the 50% mark is a disaster. Non-medical costs are IMO much more of a matter of voluntary decisions about how much you think you'll be able to afford. Retirees can, but aren't required to, go on ten cruises a year, make frequent visits to vegas, and send large generous checks to their grandkids. Alternatively, a quiet low cost place in a rural state somewhat near an OKish hospital and occasional vacations down at the local fishing hole for a couple nights in the old camper trailer are cheap as gently caress and not necessarily a bad way to wind up. If you save enough to not be destitute in retirement, and you are reasonably lucky with your health, then the range between "decently OK" and "nearly quite rich" retirements are like... I dunno, maybe from $600k up to $10M in today's money? Assuming you are also getting a decent whack from social security, qualify for medicare, and retire owning your home. I understand this post may be profoundly unhelpful, and I apologize.

|

|

|

|

pmchem posted:

I am still debating internally on the step in the green section where it recommends doing a backdoor Roth if your married income is above 218k. My employer has a low fee 401k that allows Roth contributions with lots of index fund options that I like. Last year I was doing 15% contributions in a Roth, but I switched them all to Pre-tax because I expect to be in the 24% tax bracket instead of the 35% bracket. I'm also doing the "Paying off low interest debts" (mortgage) even though the rate is low because I just don't like owing money. Is there a calculator / spreadsheet out there that can handle all these calculations? daslog fucked around with this message at 12:15 on May 2, 2024 |

|

|

|

daslog posted:I am still debating internally on the step in the green section where it recommends doing a backdoor Roth if your married income is above 218k. My employer has a low fee 401k that allows Roth contributions with lots of index fund options that I like. Last year I was doing 15% contributions in a Roth, but I switched them all to Pre-tax because I expect to be in the 24% tax bracket instead of the 35% bracket. I'm also doing the "Paying off low interest debts" (mortgage) even though the rate is low because I just don't like owing money. I might be reading this wrong because it's early, but green section is all IRA specific, but you're talking about a 401k which is the blue section? The "third column (bottom)" of the blue section gives a very quick commentary on Roth vs Trad 401k contributions (FIRE-types lean traditional). 401k to match > IRA > (max rest of 401k) still broadly seems like the right order. I suppose I could maybe see an argument for (max rest of 401k at trad levels) > backdoor Roth? Would depend on exactly how much income and saving room you had available. If you're not able to max them both first, I would not be paying extra on low-interest debt.

|

|

|

|

If I ever had to do a backdoor roth and had less than 50 cents in my traditional IRA to begin with, am I correct in assuming it would round down to 0 as far as the IRS is concerned and avoid any pro rata nonsense?

|

|

|

|

Jabarto posted:If I ever had to do a backdoor roth and had less than 50 cents in my traditional IRA to begin with, am I correct in assuming it would round down to 0 as far as the IRS is concerned and avoid any pro rata nonsense? Correct

|

|

|

|

CubicalSucrose posted:I might be reading this wrong because it's early, but green section is all IRA specific, but you're talking about a 401k which is the blue section? If your 401k has options as cheap as an IRA and the Roth option exists I can see the argument to not bother with the IRA until you max out the 401k if you have to back door. There are some other advantages to the IRA so I still think that is the better to follow the normal process. If you have to back door because of income limits you should probably be able to max it all out regardless.

|

|

|

|

The advantages of a Roth IRA over a Roth 401k are that you can withdraw contributions penalty-free at any time even before 59 1/2, don't have to take required minimum distributions at 72, and aren't beholden to your plan's administrator. It's just more flexible. If you leave your job, will you be able to rollover your mixed Roth/Trad 401k? I have a Roth/Trad 401k with my old employer. My new employer just recently started offering Roth 401k but still doesn't accept a Roth 401k rollover. I would have to juggle the checks myself to get the Trad money in my current 401k and Roth money in an IRA. Too messy for me, so I don't. (Fees and funds are fine so I'm not in a rush)

|

|

|

|

spwrozek posted:If your 401k has options as cheap as an IRA and the Roth option exists I can see the argument to not bother with the IRA until you max out the 401k if you have to back door. There are some other advantages to the IRA so I still think that is the better to follow the normal process. This is helping. I can understand the logic in doing backdoor Roth IRA before paying off the house (it's the only debt we have) but as a personal preference I want to not owe anything to anyone. There is only 28k left on it anyway so I'll plan on the doing the backdoor IRA step in 2024.

|

|

|

|

Salami Surgeon posted:The advantages of a Roth IRA over a Roth 401k are that you can withdraw contributions penalty-free at any time even before 59 1/2, don't have to take required minimum distributions at 72, and aren't beholden to your plan's administrator. It's just more flexible. These were the other advantages I was alluding to.

|

|

|

|

spwrozek posted:These were the other advantages I was alluding to. Can you Roll over a Roth 401k to a Roth IRA at retirement to avoid the MRD?

|

|

|

|

Did I read that chart correctly and that you can establish a solo 401k, even if you have zero business income, solely to roll in any traditional IRAs into for avoiding prorata rule? I have one with Schwab (and haven't received a good answer on whether I can do that rollover yet, they've been dodgy) for my actual business but have a traditional for my wife that I've been procrastinating on a solution for her. Primarily since I have 3 teen kids with woefully underfunded college accounts so don't really have excess investment into backdoor roth, yet... but intellectually I'd like to know if that's an option for her traditional.

|

|

|

|

The Secure 2.0 act removed RMDs from Roth 401k accounts. So this is no longer a concern. There are possibly other reasons to roll a Roth 401k into a Roth IRA such as a wider selection of potentially cheaper funds. Just make sure you opened and funded a Roth IRA somewhere at least 5 years before you need to make withdrawals from your rolled over funds.

|

|

|

|

E: never mind vvv it must have been delayed or something because the numbers have updated for the day Boris Galerkin fucked around with this message at 22:26 on May 3, 2024 |

|

|

|

Boris Galerkin posted:

What time period is being measured?

|

|

|

|

This is expected. As an ETF the price of VOO changes constantly throughout the day just like a stock. As a traditional mutual fund FXAIX only has its NAV, and thus its price, updated after trading has ended for the day.

|

|

|

|

Can I transfer my Roth i401k from vanguard to fidelity in kind? I just have a TDF in my account.

|

|

|

|

|

| # ? May 4, 2024 23:48 |

|

Should be possible, but they will charge you to trade non-Fidelity mutual funds. Probably better to transfer as cash and buy the corresponding Fidelity target date fund (the index one, not the super expensive nonsense one)

|

|

|