|

Zeta Taskforce posted:You do know that 0% is a gimmick, right? No bank makes money by lending at 0%, so how come they donít go out of business? First, there is going to be a transfer fee. Then they will put you on a very short leash and if you stray by just a bit, or even if they mishandle one of your payments, you know the types of rates that card is capable of. Donít think 21% is a cap. 21% is just one of many possibilities. 0% becomes a game. And you might very well win the game. I donít know. And if you are intellectually honest, you donít know either. If I had the $14k in cash I'd pay it all off and be forever gone of my youthful habits. But here in the real world, I'm trying to pay off my debt in the cheapest way possible. I can afford about $1000/month towards debt in total, about half of which will go toward the 0% card via automatic monthly payments. The $90 in balance transfer fees is well worth it when I'll be saving $75/month in interest charges.

|

|

|

|

|

| # ? May 11, 2024 08:52 |

|

FISHMANPET posted:If I had the $14k in cash I'd pay it all off and be forever gone of my youthful habits. Sounds like you made up your mind, so Iím not sure why you asked. Some points to keep in mind are you are not saving $75/month in interest charges since based on your numbers you are transferring $6000, not $14,000. My math shows that you are saving something like $36 in interest/month, presumably less over time since you will be paying it down. And you might get away with it. Kudos if you do. But if you are really going to pay $1000 per month, will get you out of debt about 7 to 10 days sooner. Thatís assuming everything goes perfect. Of course what usually happens is that people decide to pay their 0% cards the slowest since they view it as free money, they donít pay back the other ones as fast as they hoped, their car needs repairs, they have to fly somewhere to a friends wedding, or they drop their phone in a puddle and decide to upgrade to something cool, and they never pay back as much as they hope, and they come to the end owing almost as much as they started. Unless something messes up the 0% before, and then all bets are off.

|

|

|

|

Zeta Taskforce posted:Sounds like you made up your mind, so Iím not sure why you asked. Some points to keep in mind are you are not saving $75/month in interest charges since based on your numbers you are transferring $6000, not $14,000. My math shows that you are saving something like $36 in interest/month, presumably less over time since you will be paying it down. And you might get away with it. Kudos if you do. But if you are really going to pay $1000 per month, will get you out of debt about 7 to 10 days sooner. Thatís assuming everything goes perfect. By my math I'm paying about $150/month on interest on the 12.99 card with the $14000. Transferring about half of that means I'm saving $70-$75. And this is an even bigger savings, because before I had $6000 on the card at 21% and $8000 on the 12.99 card, so even by putting it all on the 12.99 card I'm saving money. I'm paying quite a bit in interest now, which is pretty  . .I have that $1000/month taken out of my paycheck and put into a separate account, and my credit cards are automatically paid out of that account. Unless the better idea is to just leave it all on the card at 12.99%, which seems like a pretty stupid idea to me.

|

|

|

|

FISHMANPET posted:By my math I'm paying about $150/month on interest on the 12.99 card with the $14000. Transferring about half of that means I'm saving $70-$75. Sorry about that. Your math is right as far as the interest. There might have been a number in the calculator that I didnít clear out. Just be careful. In my loan officer thread I tell the story of a bank president (of a different bank) who was paying nearly 30% on a nearly $30,000 balance that started out at 0%. It happens to smart people too. 12.99% is not an unreasonable rate for a credit card, although there are better ones out there. I would see if there are any lower rate cards or fixed rate loans offered by your local credit union or community bank and you know that if you lose your job or your hours get cut and life gets bumpy, they will work with you instead of charging you 21% interest again. Its just that your plan requires everything to work perfectly.

|

|

|

|

Zeta Taskforce posted:Sorry about that. Your math is right as far as the interest. There might have been a number in the calculator that I didnít clear out. Thankfully I've got an incredibly stable job at a local University. Unless I poo poo on a dean's desk I'm fine. As to worst case, I'm at 21% because I've been late a few times (years ago) so I know how that goes. Ever since I setup my 'bill money' to come right out of my paycheck and go somewhere else I've been doing pretty well on everything paid in time. I'm going with the snowball method to pay off my debt, which prompted the original question. The naive way to look at it say that the 12.99 card is the highest, and try and pay that down, but really I should probably treat the 0% card as the highest APR card. I was wondering if there was some reason that I should maybe be paying them off equally or something like that, so I have some left on the 20% card when the APR resets. I'm doubting it would ever save me any money to let that balance ride ever, but I just thought I'd check. I am of course aware of all the dangers, but worse comes to worse I can just transfer back to the 12.99 card.

|

|

|

|

Zeta Taskforce posted:You do know that 0% is a gimmick, right? No bank makes money by lending at 0%, so how come they donít go out of business? First, there is going to be a transfer fee. Then they will put you on a very short leash and if you stray by just a bit, or even if they mishandle one of your payments, you know the types of rates that card is capable of. Donít think 21% is a cap. 21% is just one of many possibilities. 0% becomes a game. And you might very well win the game. I donít know. And if you are intellectually honest, you donít know either. By that logic, using credit cards like cash and paying them off every month is a bad idea. Ceteris paribus, taking the route that involves the least amount of interest will result in the most efficient debt payoff. With a fixed amount going towards the cards each month, it's worthwhile to play with different options of balance transfers. In this case, making the balance transfer and paying the minimum on 0% card and aggressively targeting the remaining 12.99% card, then transferring the balance back after the year is up (or paying 20.99%, depending on how many months it will take to pay it off completely and the BT fee, whichever is cheaper) will be less expensive than not taking the transfer. Exactly how much less expensive depends on the minimums on both cards. This is assuming that 0% does not disappear and retroactively charge interest (a common tactic in buy-now-pay-later setups, but not in teaser rates for credit cards except for very sketchy subprime stuff). If there is a human element involved, where that 1k towards the cards is not more or less guaranteed, then a more conservative approach would be useful. FISHMANPET posted:Thankfully I've got an incredibly stable job at a local University. Unless I poo poo on a dean's desk I'm fine. If you post the minimum payment calculation, balance transfer fees and amounts for each card, I'll put together a formula to compare different payoff strategies. It likely will save you a bit of money to pay the minimum on the 0% card and finish off the 12.99% card first, but I can't tell you exactly without knowing more. A year at 0% (3% BT fee) averaged with a year at 20.99% for a fixed amount of money averages out to two years at 11.995% - and you'll be paying off the 20.99% card aggressively over the second year, so it'll end up being less than that. I can say conclusively from that back of the envelope calculation that if you pay it all off in less than two years you should pay off the 12.99% card first - which with a total debt of 14k and a monthly payment of 1k will happen. Engineer Lenk fucked around with this message at 00:31 on Aug 27, 2010 |

|

|

|

Engineer Lenk posted:Of course I want people to get the lowest rate possible. But building a financial plan based on credit card teaser rates is like building your house on a pile of shifting mud. I personally have a moral issue with credit card companies offering 100 people 0% because they know statistically they will end up charging 35 of them 30% interest rates because they will somehow become a day late, go a dollar overlimit, apply for too much credit somewhere else, trigger the universal default clause, or in one way or another violate a condition of the 20,000 word card holder agreement that no one reads and even if you did read, you wouldnít understand. I donít agree with a business strategy of kicking people when they are down, and even if you happen to be one of those who doesnít stumble, knowing there is a boot overhead that wants to kick you the moment you do. Rate shouldnít be the only thing that matters. Dealing with financial institutions that are not scum has to fit in there somewhere. Also, if you find it helpful to create detailed spreadsheets with fancy formulas to aid you that is great, and very gracious of you to assist someone else. But I donít think such things are really necessary. In my experience, it is a tossup as to who gets in more trouble. Dumb people who do dumb things, or very smart people who are a bit too smart, especially when they try to outsmart their credit cards. Thereís probably more dumb people, but the smart ones tend to go big.

|

|

|

|

Engineer Lenk posted:If you post the minimum payment calculation, balance transfer fees and amounts for each card, I'll put together a formula to compare different payoff strategies. It likely will save you a bit of money to pay the minimum on the 0% card and finish off the 12.99% card first, but I can't tell you exactly without knowing more. A year at 0% (3% BT fee) averaged with a year at 20.99% for a fixed amount of money averages out to two years at 11.995% - and you'll be paying off the 20.99% card aggressively over the second year, so it'll end up being less than that. I can say conclusively from that back of the envelope calculation that if you pay it all off in less than two years you should pay off the 12.99% card first - which with a total debt of 14k and a monthly payment of 1k will happen. I requested copies of my card member agreements to get the official word, but I found this googling: The 12.99 card is a Chase card: Chase -- Greater of the following: 2 percent of the balance 1 percent plus all interest and any fees And the other is a Citicard: Citi -- Past fees and financing charges due, plus any amount in excess of credit line, plus the greater of the following: The new balance on the billing statement, if it is less than $20 $20 if the new balance is at least $20 1 percent of the new balance plus finance charges and any applicable late fees 1.5 percent of the new balance I've got a $6100 on the Citi card, and a $14000 limit on the Chase card. Right now the exact balance on the Chase card is 13,307.83

|

|

|

|

ZT - I agree that gaming the system with arbitrage is an easy way for people to shoot themselves in the foot, but a modest use of balance transfers as part of a fixed repayment strategy is occasionally worth the risk. Using rewards cards falls into the same gray area to me as taking advantage of balance transfer offers - the rewards are offset partially by the merchant fees, but mostly by higher APRs on those who carry a balance.FISHMANPET posted:I requested copies of my card member agreements to get the official word, but I found this googling: I ran three scenarios, assuming the 13307.83 as a starting balance and that the balance transfer would take effect before any interest charged on it this cycle (real dollar values may be a little off because of that assumption). This assumes a $90 balance transfer fee, and a fixed total monthly credit card payment of $1k. Under the status quo, no transfer, you pay off the credit card in November 2011 and pay a total of $14,281.16 ($973.33 in interest). If you transfer 6k to Citi, assuming 0% from Sep '10-Aug '11, and pay it off fastest, with minimums on the Chase, you pay off the Citi card in April '11 and the Chase card in November 2011, paying a total of $14,051.91 ($744.08 in interest). If you transfer 6k to Citi, assuming 0% from Sep '10-Aug '11, 20.99% afterwards, and pay down Chase the fastest, you pay off Chase in May '11 and the Citi card in October 2011, paying a total of $13,732.93 ($425.10 in interest). As you can see, you save about $550 (and one month) over leaving it on the 12.99% card if you transfer and snowball by interest rate. E: I have the spreadsheet with adjustable parameters if you want it, I just need an email address. Engineer Lenk fucked around with this message at 02:30 on Aug 28, 2010 |

|

|

|

Engineer Lenk posted:ZT - I agree that gaming the system with arbitrage is an easy way for people to shoot themselves in the foot, but a modest use of balance transfers as part of a fixed repayment strategy is occasionally worth the risk. Using rewards cards falls into the same gray area to me as taking advantage of balance transfer offers - the rewards are offset partially by the merchant fees, but mostly by higher APRs on those who carry a balance. Holy crap, thanks a lot. Email is my username at gmail.com. I'd really appreciate a copy.

|

|

|

|

FISHMANPET posted:Holy crap, thanks a lot. Email is my username at gmail.com. I'd really appreciate a copy. Sent (it may end up in junk mail). If you tweak the first month to be present balance + interest, rather than just present balance, it changes the numbers a little - if you transfer the 6000 out at the beginning of the cycle you pay $514.98 in interest with the best method and $1140.83 with the worst (same ranking as above). Engineer Lenk fucked around with this message at 04:26 on Aug 28, 2010 |

|

|

|

I'm wondering if spreadsheets are the best way to do budgets and track expenses. I was thinking something like this. The idea is you add, subtract, and move money between categories by typing in text boxes (it's a calender) and then there's some summary below. There's also a possibility for charts and graphs and interest calculation. Is this any improvement over spreadsheets?

|

|

|

|

Cloak of Letters posted:I'm wondering if spreadsheets are the best way to do budgets and track expenses. I was thinking something like this. The idea is you add, subtract, and move money between categories by typing in text boxes (it's a calender) and then there's some summary below. There's also a possibility for charts and graphs and interest calculation. Is this any improvement over spreadsheets? To me that looks super confusing, but you should do what looks good for you and it only has to look good for you. I personally use Microsoft Money '98. Even though it is a 12 year old program, it still does everything I need it to do. Only thing is I have to manually type everything in, although you can have reoccuring things happen automatically. Once you have everything in the ledgers, it's easy to make pretty charts and graphs. I tried upgrading to the 2005 edition a few years ago and everything got hosed up, and I think they stopped making it. Quicken is similar program. I never tried mint.com but I heard that is good.

|

|

|

|

Zeta Taskforce posted:To me that looks super confusing, but you should do what looks good for you and it only has to look good for you. Yeah, Quicken can do all of this (calendar view, categories, present value), it will automatically download and categorize from bank and credit card info, and will remember categories if you change it on one purchase. It'll interface with TurboTax if you have your paycheck and other taxes set up correctly as well, I think. I like the budget comparison report, but there are a ton of other reports it can generate as well.

|

|

|

|

Engineer Lenk posted:Yeah, Quicken can do all of this (calendar view, categories, present value), it will automatically download and categorize from bank and credit card info, and will remember categories if you change it on one purchase. It'll interface with TurboTax if you have your paycheck and other taxes set up correctly as well, I think. I like the budget comparison report, but there are a ton of other reports it can generate as well. I use and like Quicken, but no summary of it would be complete without at least mentioning that it's also the buggiest piece of software that I own.

|

|

|

|

I see a lot of people here talking about Mint.com. Can anyone vouch that the site is safe? I'm a bit apprehensive about a website asking for the password / account name to my credit card's online pages! VVVVV Thanks!! Sundae fucked around with this message at 14:15 on Aug 31, 2010 |

|

|

|

Sundae posted:I see a lot of people here talking about Mint.com. Can anyone vouch that the site is safe? I'm a bit apprehensive about a website asking for the password / account name to my credit card's online pages! I have not, but here is the mint.com thread that should answer most of your questions. http://forums.somethingawful.com/showthread.php?threadid=3263985

|

|

|

|

How ironclad is the "you should spend no more than 35% of your income on rent" rule? I live in the metro Washington DC area (top 10 in highest rental prices) and am considering renting a place in of my own in November after two years with roommates. I'd be looking at spending about 58% of my income on rent + utilities + cable/internet. Is that absurdly high, or is that actually pretty common for an expensive urban area? Additionally, I am in the process of paying off the last of my debt this month (a car loan worth $9000 at 4.9% APR), after which I will be free and clear.

|

|

|

|

Purely my percentage it is hard. I would say the only reason that could be remotely considered is if you make dirt, and don't want to live in a crack-house. I've heard how terribly expensive DC rents are, so if you have some low paying internship it might be tenable. If however you make a decent salary and you just want a nicer place by yourself, I'd have to say you just don't have the income for it.

|

|

|

|

ChadSexington posted:How ironclad is the "you should spend no more than 35% of your income on rent" rule? I live in the metro Washington DC area (top 10 in highest rental prices) and am considering renting a place in of my own in November after two years with roommates. I'd be looking at spending about 58% of my income on rent + utilities + cable/internet. Is that absurdly high, or is that actually pretty common for an expensive urban area? Additionally, I am in the process of paying off the last of my debt this month (a car loan worth $9000 at 4.9% APR), after which I will be free and clear. That's absurdly high. I live in another top 10 city. I spend 25% on rent + utilities + internet. Is the 58% before or after taxes are taken out? How will you ever save money when you spend that much. I don't think you can afford to get a place on your own. Keep living with roommates.

|

|

|

|

I have a question regarding my current financial situation, particularly with regard to my current plans. After a good two years of fights with Direct Loan Services, I have finally gotten them to agree to drop the loan recall they have on my accounts. As such, I have a choice in what loan plans I can pick again. (Long story short: Without me missing any payments, they recalled my loans, put me in the ICR plan, removed my other options, and set my repayment period to 7 years on over $75,000 of federal loans, claiming my income could support it.) Anyway, I now have a bit under $34,000 in loans after being quite the pauper for three years, and my funding has cleared up into a pretty nice budget shown on the previous page, I think. If I continue my current rate of payment (ICR would be $1,500 per month roughly), I will be done with these loans in three to four more years. This rate of payment swallows all attempts at making savings. I have no more money than I had three years ago. I have been fully funding my retirement accounts, though. They're in fantastic condition, and have been turning a hefty profit for the last three years. The advantage is that my total interest paid is going to be ludicrously low if I follow up on it. I'll have paid about $9,000 in total interest. The disadvantage is that I have one month's expenses put away and have no emergency fund, because my previous fund was swept away in the past three years of payments under that loving loan recall. (Seriously, how the gently caress did they think I was going to make an escalating payment that started at $1100 per month and went up to $1500 after one year?) My family is livid at the idea of me dropping my loan payments to a longer term, and are calling it financially irresponsible. Meanwhile, I think it is financially irresponsible of me to leave no buffer for emergency costs. Not to mention, I'd kind of like to propose to my girlfriend in a year or two. I need to have some money for wedding expenses eventually, though not in the immediate future. So I ask you, fellow BFCers: Continue to play Russian Roulette with my lack of an emergency fund for three to four more years, or extend it out until I have a safety net and then go back to mega-crazy-ultra-payments?

|

|

|

|

ChadSexington posted:How ironclad is the "you should spend no more than 35% of your income on rent" rule? I live in the metro Washington DC area (top 10 in highest rental prices) and am considering renting a place in of my own in November after two years with roommates. I'd be looking at spending about 58% of my income on rent + utilities + cable/internet. Is that absurdly high, or is that actually pretty common for an expensive urban area? Additionally, I am in the process of paying off the last of my debt this month (a car loan worth $9000 at 4.9% APR), after which I will be free and clear. Whatís the reason why your rent is so high in relation to your income? Is it because you just got your first job, it doesnít pay a lot, but itís what you want to do and it will provide good opportunities for advancement? Or is it just because you want to move to an expensive area? I donít know DC at all, but my experience as a landlord in Boston is that there are a handful of areas that are considered very desirable to rent in, like Brighton, Somerville, and Cambridge, and many people will only look at these areas, even if it means living in a crowded and expensive place, and they practically ignore the rest of the city, even if apartments there are cheaper, bigger, and still close to trains and other amenities. They are just missing the flashy zip code. Either way, I agree with Cuban Linux. Sundae posted:I have a question regarding my current financial situation, particularly with regard to my current plans. I agree with you. I see too many people who are one paycheck away from disaster, and I think it makes a lot of sense to temporarily lighten up on the student loan payments in order to build up a few months worth of expenses.

|

|

|

|

Sundae posted:I have a question regarding my current financial situation, particularly with regard to my current plans. Pay off the loans first. Figure out a way to make or save a couple grand extra that you can stash in an emergency fund. You don't need a lot in your emergency fund, just enough that an unexpected expense doesn't completely gently caress you, $1000-$2000 should be plenty.

|

|

|

|

I would lighten up slightly to allow yourself to save up a cushion, but still remain very aggressive on loan repayments. It sounds like the company you're dealing with is a bit uh, aggressive themselves, and the sooner you can be free of them the better for your future planning. I would not defer paying off the loans for saving for a wedding. A wedding is a luxury, and you can get it done cheap in a courthouse wedding with a handful of close friends if you need to get married soon. If you really want to have a standard (expensive) wedding, then it's better to wait for matrimony until your debt is taken care of so you know you can afford it. Especially if your girlfriend has any debt of her own.

|

|

|

|

Can't you just keep paying off loans and use a credit card if you get into an emergency? That was you only pay extra interest if you get into an emergency, rather than paying it in every situation.

|

|

|

|

Built 4 Cuban Linux posted:Can't you just keep paying off loans and use a credit card if you get into an emergency? That was you only pay extra interest if you get into an emergency, rather than paying it in every situation. This has always been my thought on the large savings cushion platform as well. I'd be very interested to hear why this is a bad idea.

|

|

|

|

Dragyn posted:This has always been my thought on the large savings cushion platform as well. I'd be very interested to hear why this is a bad idea. The problem with this is that if your budget is tight, instead of having a $2000 emergency fund that just goes away and gets rebuilt at $50/mo, you've got $2000 of credit card debt that's getting repaid at $50 a month and generating $20 a month in interest. If during that period of repayment/rebuild, you lose your income, now instead of having an expense you can cut if you need to (no more contribution to emergency fund) you have an additional expense you still have to address every month. If you've got lots of free cash, it's not a big deal either way, but if you've got lots of free cash, you should have an emergency fund anyway.

|

|

|

|

herakles posted:The problem with this is that if your budget is tight, instead of having a $2000 emergency fund that just goes away and gets rebuilt at $50/mo, you've got $2000 of credit card debt that's getting repaid at $50 a month and generating $20 a month in interest. If during that period of repayment/rebuild, you lose your income, now instead of having an expense you can cut if you need to (no more contribution to emergency fund) you have an additional expense you still have to address every month. Exactly. A credit card works fine if your emergency is a new transmission. Credit cards work less well if the emergency is losing your job.

|

|

|

|

herakles posted:The problem with this is that if your budget is tight, instead of having a $2000 emergency fund that just goes away and gets rebuilt at $50/mo, you've got $2000 of credit card debt that's getting repaid at $50 a month and generating $20 a month in interest. If during that period of repayment/rebuild, you lose your income, now instead of having an expense you can cut if you need to (no more contribution to emergency fund) you have an additional expense you still have to address every month. Yeah but if you save up all your money instead of paying off debt in the first place... then you still have a bunch of debt to pay off when you lose your job. And if you don't lose your job: everything is cool.

|

|

|

|

Built 4 Cuban Linux posted:Yeah but if you save up all your money instead of paying off debt in the first place... then you still have a bunch of debt to pay off when you lose your job. And if you don't lose your job: everything is cool. I'm not suggesting saving up all your money instead of paying off debt. You'll note that my advice was to save up money AND aggressively pay off debt. I managed to make myself debt-free at the beginning of this month by making sacrifices - I've gone from eating out ~16 times a month to eating out ~4 times a month, I cut down the options on my cell phone plan, and I started going to the library instead of ordering a fuckton of books off of Amazon. I also sold off a bunch of poo poo I don't use anymore to pay down my debts. I wiped out my debt, I have an emergency fund, and now I've got an extra $500/month. My plan is to dump $400/month into my retirement fund and set aside an extra $100/month for shopping/fun. YMMV, but I think that not having an emergency fund is a financial risk.

|

|

|

|

To quickly clarify since I didn't do it in the first post: My current emergency account is about $2,800. This is not sufficient, as it is 1) only slightly more than one month's expenses at the accelerated repayment rate, and 2) is less than the termination fee on my apartment's lease. This area, even though it's in the middle of nowhere, has very high rental costs. I'm paying about average for a decent apartment in this area at $1,020 per month, excluding utilities. I moved up to this one from two previous apartments, one of which was $800 and had constant roach and rat problems. The other apartment would not tell me what my new rent was going to be at lease-renewal time unless I signed the contract first, so I told them to get stuffed and moved out.  So yeah - there's $2,800 available in safety, but if I lose my job (always a risk here) that's not even close to enough, especially since I cannot move back in with either my girlfriend or my parents. She already has three roommates in her studio, and my parents still think it's 1955. quote:I would lighten up slightly to allow yourself to save up a cushion, but still remain very aggressive on loan repayments. It sounds like the company you're dealing with is a bit uh, aggressive themselves, and the sooner you can be free of them the better for your future planning. The company in question is the federal government, actually. I have no private loans at all. quote:I would not defer paying off the loans for saving for a wedding. A wedding is a luxury, and you can get it done cheap in a courthouse wedding with a handful of close friends if you need to get married soon. If you really want to have a standard (expensive) wedding, then it's better to wait for matrimony until your debt is taken care of so you know you can afford it. Especially if your girlfriend has any debt of her own. Absolutely agreed with respect to cutting payment specifically for weddings. The wedding's just something on the horizon. It's going to end up having to be somewhere in between the standard and the courtroom when it happens, because I already know I cannot count on family support for it (financially, I mean). On that note, I would prefer to NEVER charge something to a credit card that I cannot pay off in full within a month. I have a $20K limit on my card, so I could if I really, really had to, but that's basically the absolute worst-case scenario for me. (I carry zero balance, and have paid in full for ten years. gently caress CC companies.) quote:Exactly. A credit card works fine if your emergency is a new transmission. Credit cards work less well if the emergency is losing your job. This is basically my big worry. As long as I remain employed where I currently am, I am basically set for life. Big pharma pays daaaamned well and gives unbelievably good benefits. Plus, where else are you going to get a pension fund and a 401(k) match these days? I'd be insane to leave here. However, I have probably a coin-flip chance of losing my job in the next year and a half. My company is set to lose about 33%-50% of its revenue in November 2011 due to a patent expiring. That'll kill quite a few of our jobs. If I lose my job here, odds are against me getting back into the industry at all due to the number of old-timers that I'll be competing against, as well as the industry's contraction and mergers over the last decade. Sundae fucked around with this message at 21:03 on Sep 7, 2010 |

|

|

|

I am 22 years old, just graduated from college, and recently started my first job. I make about $2100/month after taxes and my only debts are $26,000 in federal student loans that will start coming out of their grace periods in December. I have $4000 in savings. My employer requires me to contribute 5% of my income to a retirement account, and they contribute 8%. However, their contribution only becomes vested after 3 years of employment and I plan on leaving in a year to go to grad school. Would it be wise for me to contribute any more than 5% if my contributions are effectively not being matched? It seems to me like my best option would be to continue paying the 5%, pay down my loans as aggressively as I can, and put the rest of my monthly earnings into savings. Also, I contribute to a TIAA-CREF account, and by default everything is going into their Lifecycle 2050 fund. Is there any reason not to keep it there for now?

|

|

|

|

My wife just got a new job, with set hours and pay, and so I updated my budget as a result. Any advice? I'm 23 and she's 26. Income (Weekly, after tax): Me: 684 Wife: 570 Tithe - 125 Savings - 275 Groceries - 100 Rent - 286 Health Insurance - 23.5 Car Insurance - 22.5 Internet - 22.5 Utilities (Water/Electricity/Gas) - 35 (this is often over budgeted and I end up with money leftover at the end of the quarter) Mobile phones - $34.5 (kind of high, but we both have iPhones and we're actually getting very good deals) Auto Repair - 10 Public Transport - 100 Spending money for both - $90 each Sponsoring a child - Whatever's left over, which is about $10 per week. I think the mobile phone bills are a little high, but we're on contract and we're saving 21% of our paycheck each week, and our rent is only 22% of our paycheck as well after tax. I also save $50 of my weekly spending money every week, and money for clothes, haircuts, etc, comes out of that weekly spend. I think we're doing okay, we have no debt and our emergency fund is nearly filled with three-four months' expenses. We've nearly paid off our $8,000 vacation we're taking in April in cash as well. My employer pays into my super each week (9% of my salary). I don't believe I've missed anything but if anyone can point anything out it'd be appreciated.

|

|

|

|

EDIT: My first post was moronic, because somehow I interpreted your pay as weekly, but your bills other than tithe as monthly. Completely ignore this stupid, shittastic post. Sundae fucked around with this message at 15:33 on Sep 8, 2010 |

|

|

|

Sundae posted:First, I hate you for having that low of rent. Those are per week figures, so he pays $1150/mo on rent. Two things: $180/wk is fairly high for spending money, so if you were looking to save someplace, this might be a good place to look And, what does "savings" entail? Is this an IRA?

|

|

|

|

Well poo poo, you're right. My post is complete bologna. I need to edit that now.

|

|

|

|

waffle posted:Those are per week figures, so he pays $1150/mo on rent. Yeah, $180 is a little high, but that's also split between two people so we only have $90 each week. In my defense, I think it's justified because the cost of living in Australia is higher than it is in the States...a movie ticket costs $17, for instance. But you're right, it is a good area for savings. I save $50 of mine each week and my wife usually socks a little bit of hers away, so it's a good area to target for further savings. Thanks  The $275 in "savings" each week is currently going towards maximising our emergency fund, which will be finished by the end of the year. That's in an ING savings account. After we finish that up, we'll start savings towards a deposit on a house, which will also be in an ING account. The interest rate is currently set at 4.9%.

|

|

|

|

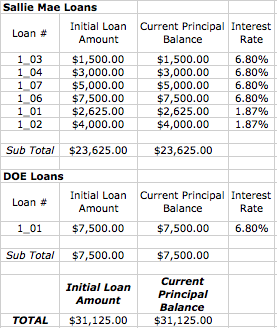

My girlfriend and I have been working on a plan for her to repay her student loans and from what I've gathered from this thread, they should be repaid in the following manner: Pay the minimum amount due on all loans and then pay the highest amount with the highest interest off first, followed by the next highest interest, etc, until you reach the lowest amount with the lowest interest. This is what her loans look like now. Does this seem like the best way to pay them off?

|

|

|

|

mattdev posted:My girlfriend and I have been working on a plan for her to repay her student loans and from what I've gathered from this thread, they should be repaid in the following manner: Pay the minimum amount due on all loans and then pay the highest amount with the highest interest off first, followed by the next highest interest, etc, until you reach the lowest amount with the lowest interest. This is what her loans look like now. Paying the highest interest makes the most mathematical sense. Dave Ramsey would argue that you pay minimums on all of them and then hammer them smallest to largest, ignoring the rate, but he would argue that getting out of debt is just as much psychological as mathematical, and when you get started it feels good to start knocking stuff out of the way. Since so many of them are at 6.8%, maybe pay the smallest to largest off in that group and then hit the 1.87%.

|

|

|

|

|

| # ? May 11, 2024 08:52 |

|

Two comments: #1 - Are those 1.87% loans variable-rate? If they are (and if they're tied to rates like federal direct variables are), they may go up in the future. No risk for a year at least, but make sure you check back on interest rates in about June of next year and see what they're looking to go up to. It's not worth worrying about now, but keep it in mind in the future. #2 - Does Sallie Mae give an interest-rate cut for using automatic electronic debits? For federal loans, it's a 0.25% cut in your interest rates across the board. Might be worth looking into, though it can be difficult to use that in a snowball due to how they'll automatically divide your payment across all your loans usually. Agreed with Zeta, by the way. Mathematically, it's best to pay extra on the 6.80% loans first, as they're generating more interest. On the other hand, getting rid of the smallest loans drops your overall payments and gives you more flexibility. If you are allowed to, I'd target in this order: 1_03, 1_04, 1_07, 1_06, 1_02, 1_01 on Sallie Mae, and then 1_01 DOE. (Assuming DOE stands for Department of Education.) If it does mean that, DOE loans would be left for last, since for the most part, the Direct Loan program doesn't care about loving you over. They just want their money, and they're (usually) amazingly flexible. They can dick you over, but it's much, much less common than other loan providers.

|

|

|

Honestly, every single expense you have is less than the minimum possible here.

Honestly, every single expense you have is less than the minimum possible here.