|

guggs posted:The person who gave me the stock is still alive, so I'll get full control once he passes. For the ESPP, I get the stock at 15% below market price, so if I sell it right away I make 15% on the sale. I still have a 401k with employee matching, so I'm taking advantage of that. I don't really have any big purchase plans in the future, so maybe it's best to use most of my extra money to pay down the debt. Don't you have to pay capital gains taxes on that 15%, though?

|

|

|

|

|

| # ? May 26, 2024 03:17 |

|

Sophia posted:Don't you have to pay capital gains taxes on that 15%, though? No worse, it's straight income because it's short term, but based of the basis (which would be your price with discount). The best way to avoid it in my experiance is to open an IRA and dump like 20% of what you sold into it. That usually is enough to cancel it out.

|

|

|

|

LorneReams posted:No worse, it's straight income because it's short term, but based of the basis (which would be your price with discount). The best way to avoid it in my experiance is to open an IRA and dump like 20% of what you sold into it. That usually is enough to cancel it out. Iím not an expert on this, so Iím trying to learn something here. Let me make up numbers. They give him the option to buy $100 of stock for $85? If he sells it immediately, then the $100 is considered regular income and he pays taxes on it based on his marginal tax rate? Am I right? If I am wrong, please someone correct me.

|

|

|

|

Sophia posted:Don't you have to pay capital gains taxes on that 15%, though? I believe it's just regular compensation. When I did my taxes this year I didn't have any short term capital gains I had to declare. So I guess I don't get 15% because I do have to pay taxes on that extra compensation.

|

|

|

|

Zeta Buttforce posted:Iím not an expert on this, so Iím trying to learn something here. Let me make up numbers. They give him the option to buy $100 of stock for $85? If he sells it immediately, then the $100 is considered regular income and he pays taxes on it based on his marginal tax rate? Am I right? If I am wrong, please someone correct me. As I understand it, that $15 difference shows up as extra compensation on my W2, so I think it gets taxed at my normal tax bracket rate. So if I sell the stock right away, the gain or loss is based on the $100, not the $85. EDIT: Spelling Autistic Speculum fucked around with this message at 19:45 on Mar 20, 2012 |

|

|

|

guggs posted:As I understand it, that $15 difference shows up as extra compensation on my W2, so I think it gets taxed at my normal tax bracket rate. So if I should the stock right away, the gain or loss is based on the $100, not the $85. If thatís the case, suppose you are in the 25% tax bracket, you would owe $21.25 in federal taxes on $85 in income. If you sell the stock right away, you will owe $25.00 in taxes. That is $3.75 and you get to keep the other $11.25. I know this is a fraction of the actual amounts, but the proportions would be accurate. Talk to a tax advisor, but be forewarned that tax advisors sometimes are uni-directional and want to structure everything to minimize taxes while they ignore everything else. If I were you, and Iím certainly not you, is I would take advantage of this stock plan, sell it right away, take the tax hit, and plow everything into your student loan that you can. I am OK with paying an extra $3.75 in taxes to lower my debt by $11.25 and I would do that before I do anything fancy, or before I held onto the stock and had a significant amount of my net worth tied up in one stock. If other people have differences in opinion, we can still be friends. I just see people view student loans as the debt thatís OK to mosey along through and they end up going on the 20 year repayment plan because of it. Zeta Taskforce fucked around with this message at 18:57 on Mar 20, 2012 |

|

|

|

Zeta Buttforce posted:Good stuff Thanks. This makes sense and I want to pay it off ASAP.

|

|

|

|

Zeta Buttforce posted:That isnít that much debt. What seems to be the main barrier to paying it off? I ask not to pick on you or run you down. Are you unemployed/underemployed and just eating is a struggle? Are you making what should be enough but you get to the end of the month and you have not made much progress? I'm underemployed. Living expenses are about 70 percent of my current monthly income, so little debts that add up become harder to shake. I am actively pursuing additional employment but have not been successful to date.

|

|

|

|

Is there a thread for tips on rebuilding credit?

|

|

|

|

Woodsy Owl posted:Is there a thread for tips on rebuilding credit? Here's a tip: stop caring about your credit and get your finances in order. When your finances are in order, your credit will follow. Poor people care a lot about their credit; prosperous people don't.

|

|

|

|

Fraternite posted:Here's a tip: stop caring about your credit and get your finances in order. When your finances are in order, your credit will follow. Poor people care a lot about their credit; prosperous people don't. Is this true? You can be poor and still focus on building good credit.

|

|

|

|

Woodsy Owl posted:Is there a thread for tips on rebuilding credit? This thread is fine, but you can also try: http://forums.somethingawful.com/showthread.php?threadid=3234974 I tend to stay out if it because although there is good advice about how to deal with collectors, there is also a fair amount of strategies on how to outsmart the system. Iím more about living within your means, budgeting, and not trying to outsmart anyone. What exactly did you do to your credit? Where are you now? If you fill in the details I can give more specific advice. Generally if you had slow payments but most of the accounts are still open and you bring everything current, your credit will heal and the passage of time is the best remedy. If you have things that have gone to collection, medical bills, utility bills that have been reported, you are better served by paying them off first, otherwise if you try to get more credit to rebuild it, you are rebuilding it on a rotten foundation. Either way, you need to periodically check it because credit reporting mistakes are common, and if you get a letter that says an account is paid and settled, you need to save it for the rest of your life. We can debate how much effort you should put into your credit. I am of the thought that if you live within your means, never be late on anything, pay off your credit cards every month, use cash and debit for the day to day things, borrow sparingly for the large stuff with a plan to pay it off, not just a belief you can make the payment, your credit will take care of itself. I think it is counterproductive to be one of these people who worries about closing an account, or is afraid to open one, or doesnít want to pay a loan off early so they can squeeze more reporting out of it, and they think they can squeeze a few more points out of it.

|

|

|

|

mfaley posted:Is this true? You can be poor and still focus on building good credit. When people say "building credit", they usually refer to a credit score. Without income and collateral, your credit score means very little though. And of course if you don't need to borrow money, your credit score means nothing.

|

|

|

|

baquerd posted:And of course if you don't need to borrow money, your credit score means nothing. That's unfortunately not true, though. Your credit score is often used as a shorthand for reliability even when you aren't trying to borrow money. Most of my previous landlords have checked my credit, for instance, regardless of how much cash I had in hand or what my verifiable income was.

|

|

|

Ashcans posted:That's unfortunately not true, though. Your credit score is often used as a shorthand for reliability even when you aren't trying to borrow money. Most of my previous landlords have checked my credit, for instance, regardless of how much cash I had in hand or what my verifiable income was. Usually they're just looking for things like previous apartment complex collections.

|

|

|

|

|

My impression was, credit checks were only to make sure you could make the payment. Because essentially renting is similar to taking a loan. Generally speaking, where I've been if you didn't have any credit, they just asked you to pay 6 months up front.

|

|

|

|

Rurutia posted:My impression was, credit checks were only to make sure you could make the payment. Because essentially renting is similar to taking a loan. Generally speaking, where I've been if you didn't have any credit, they just asked you to pay 6 months up front. Iíve never heard of having to pay that much rent up front. Not saying no one has, just seems like an exception. I suppose if you wanted to live in a very specific, sought after area, but other than that, there are tons of places that will rent to you with no credit/bad credit. Think of the millions of people who lost their houses due to short sales or foreclosures. Their credit is messed up, they donít have 6 months worth of cash, and they donít wander around the streets or live under bridges. They rent.

|

|

|

|

Zeta Buttforce posted:Iíve never heard of having to pay that much rent up front. Not saying no one has, just seems like an exception. I suppose if you wanted to live in a very specific, sought after area, but other than that, there are tons of places that will rent to you with no credit/bad credit. Think of the millions of people who lost their houses due to short sales or foreclosures. Their credit is messed up, they donít have 6 months worth of cash, and they donít wander around the streets or live under bridges. They rent. Absolutely, my experience has been mostly at apartment buildings for students.

|

|

|

|

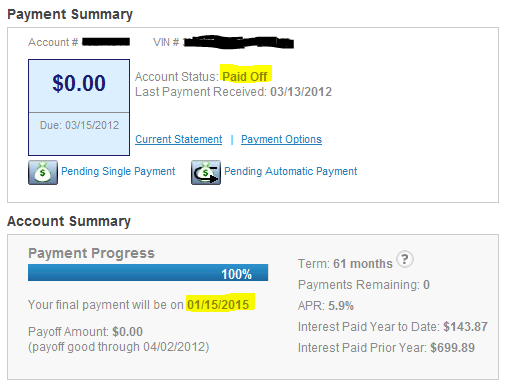

My last payment: Almost 3 years ago I ended up losing my job and had no idea how much debt I had. I had no savings, no retirement, no planning for my future. I had around 40k debt spread across 2 cars and 5 credit cards and now my wife and I were trying to live on CA unemployment which was around $1200/mo I turned to BFC who turned me onto some great books, one of them being Dave Ramsey's book. I read a few threads here and started doing the debt snowball others suggested. I opened up a recommended ING account and setup a emergency fund and a saving account for paying off my debts. A few months later I found a new job making almost twice as much. I've now paid off about 6k on all my credit cards, just paid off both cars 2 years and 3 years early, saved up a 15k emergency fund, setup a 401k, had a kid and bought a house with enough of a down to owe less than it's worth. I feel much more financially secure and no longer have the stress of daily money worries hanging over my head. My wife was even able to quit her job and stay home with our 1 year old son now. It was pretty tough the last couple years but the hard work really paid off and I plan on never being in debt again. I just wanted to thank everyone in BFC for such great information and resources in helping me take control of my finances and people like Zeta being so helpful and people like Fraternite and Kobayashi being a hard rear end. There's great motivation in reading threads like Corholio's and Zaurg's and seeing other people also pay off their debt and feel free and also seeing others continue to drown. It makes you want to do something. Thanks again BFC, you changed my life!

FCKGW fucked around with this message at 17:33 on Mar 23, 2012 |

|

|

|

Congratulations! It makes me so glad to see people sort things out, get out of debt, and enjoy the security and freedom that comes with that. We see so many stories of people burdened by debt and bad finances in this forum, but so few success stories. You're proof it can be done, and done well and in a relatively timely fashion.

|

|

|

|

loving awesome. GOOD JOB!

|

|

|

|

What a success story. Nice loving job. Any quick tips for anyone who might be in a similar spot? I feel like a lot of folks come here with similar situations.

|

|

|

|

Zeta Buttforce posted:If thatís the case, suppose you are in the 25% tax bracket, you would owe $21.25 in federal taxes on $85 in income. If you sell the stock right away, you will owe $25.00 in taxes. That is $3.75 and you get to keep the other $11.25. I know this is a fraction of the actual amounts, but the proportions would be accurate. Talk to a tax advisor, but be forewarned that tax advisors sometimes are uni-directional and want to structure everything to minimize taxes while they ignore everything else. Your tax seems kind of high. He is paying $85 for the shares - so that isn't taxable income. I believe in a disqualifying disposition of ESPP shares only the bargain element is included in compensation. In this case, he can exercise at $85/share but the market price is $100/share. Thus, if he exercised and sold simultaneously, he would owe $15*.25=$3.75 in tax through compensation on his W-2. His basis would then be $100 in the shares (he paid $85 per share + he paid tax on $15 per share) which would be sold at market, also $100, so no additional capital gains tax. So if my math is right, he's taking home $11.25/share in profit.

|

|

|

|

Sophia posted:Then it sounds like you only need one more month of using your card to buy only the bare minimum of things (i.e. food and toilet paper) and starting in May you won't need to use your card anymore at all and can move to a cash system with minimal extra debt. It's seriously your best bet, as you've gotten used to spending more than the money you currently have because of difficult circumstances. You need to retrain your brain to spend only what you have in your pocket and no more. Overdrafts and increasing credit card balances should be a thing of the past. I spoke to the bank I have the credit card and overdraft with today, was offered a Managed Loan which I didn't think sounded like a good idea. Was told that if my other bank is offering me a loan I should take it. If I were to go that way my plan would be to wait another month, until after my third pay day with my new employer and go back to the bank that might give me a loan and see if I get an improvement on the 18.8% APR they offered previously, hopefully closer to the 8.8% typical they advertise. Or would it be better to pay off the debt as they are? I'm not sure I will have much left after paying the minimum payments, and I'm concerned about how much interest I'm going to pay.

|

|

|

|

If you could get a loan for anywhere between 8% and 12% I would take it. This is assuming it can consolidate all the debts.

|

|

|

|

|

Harry posted:If you could get a loan for anywhere between 8% and 12% I would take it. This is assuming it can consolidate all the debts. Do yo mean you would dismiss one of 18.8% out of hand as too high? £7000 should be plenty (any lower and APR will be 20% at least, from what I gather) whilst giving me a buffer to actually pay it back for the first few months whilst I get everything in order. Last time I tried a bunch of places a couple of weeks back(Tesco, Royal Bank of Scotland) I was turned down, as I was by Halifax (my bank) who offer 8.8% on their website application form but offered 18.8% when I spoke to them in branch, presumably having all my details. I don't know all the criteria, maybe Tesco will be willing to give me 6.8% after I've had a couple months of income come in. Should I try again in a few weeks (a month on from my previous attempt)?

|

|

|

|

You're looking to pay off the 3 that have interest and leave the one at 0% alone right? If you do that, you would be saving a little bit really long term you might end up paying more on interest due to how easily you should be able to knock out the overdraft charge. Also I'm dismissing the 18% just because it's so absurdly high. I think you can shop around and have it drop a few points.

|

|

|

|

|

BizarroAzrael posted:Or would it be better to pay off the debt as they are? I'm not sure I will have much left after paying the minimum payments, and I'm concerned about how much interest I'm going to pay. I'm not a Brit so I don't really know anything about Managed Loans, but from what I'm reading online they sound like a scam to put poor and desperate people over a barrel. If I were you I would do everything in my power to pay off the overdraft that's charging a pound per day (which is an insane interest rate) and after that just pay everything normally. Stop monkeying around with loans, or taking out more debt to cover the current debt, or any of this. Just pay the things off, as quickly as you can. Your current debts are not that large, and from your last post you get paid enough to put an extra 500 pounds into your huge overdraft account, so that should be more than enough to start paying down 21.9% debt above the minimum. You're going to be living lean for quite awhile, and you are going to have some interest, but that is the price that you pay for borrowing their money. Every month or so, call the creditors up and ask them to lower your rates. After you show a consistent level of repayment, they might be willing to do that. If not, keep chugging away and you'll eventually get there. Once you've been managing your money consistently for a year, paying the minimums on the 0% and 19% one and paying as much as you can to the 3rd, then take a look into getting a low interest rate loan to try to cover the rest. All of this effort you're expending to shave a few % off of your interest rates is folly. Set up a budget, take it to the budget thread, and stick to it.

|

|

|

|

I just got my first credit card through my bank. I pretty much just want to use it for emergencies. But I have a question since the card can easily be paid off on the bank's website with funds in my checking account. Let's say I bought something early this morning. Then later in the night, I go on the bank's website and transfer over money from my checking account, paying off the balance in full. Since I didn't wait for the balance to be billed at the end of the month, does that even affect my credit rating? EDIT: To clarify - since I don't plan to be using it much, would it be worth it to charge a small amount each month and immediately pay it off to build my credit, or is that a bad idea? EugeneJ fucked around with this message at 21:30 on Mar 24, 2012 |

|

|

|

EugeneJ posted:I just got my first credit card through my bank. I pretty much just want to use it for emergencies. The Something Awful Forums > Discussion > Ask / Tell > Business, Finance, and Careers > Newbie Personal Finance Thread: no you dont need to carry a credit card balance

|

|

|

|

Fraternite posted:The Something Awful Forums > Discussion > Ask / Tell > Business, Finance, and Careers > Newbie Personal Finance Thread: no you dont need to carry a credit card balance Let me rephrase - would it be better for my credit score to leave the card in my wallet and not use it, or to use it for $5.00/month which gets paid off immediately?

|

|

|

|

EugeneJ posted:Let me rephrase - would it be better for my credit score to leave the card in my wallet and not use it, or to use it for $5.00/month which gets paid off immediately? Yes. Edit: Okay, that was snarky. There is no difference between either situation as far as the issuer is concerned (unless they close your account because of inactivity, but that usually takes 1 year). More generally, if you make good financial decisions you won't have to and shouldn't worry about your score. Fraternite fucked around with this message at 22:44 on Mar 24, 2012 |

|

|

|

To clarify how credit reporting works, there is a difference between zero activity and activity on the account and you just happen to have a zero balance at the end of it. In the former, if you go 6 months with absolutely zero activity, it will show up as an inactive account, and the issuer after a couple years may close it. But it takes very little activity for it to show up as an active account. The credit card will report every month to the credit bureau your balance, your credit limit, your minimum payment, if it the account is current, and if not, how late it is. The date they report all this is the date the account cycles, i.e. the date your statements get mailed out. They do not measure if you carry a balance or if you don't. It is not necessary to pay off your balance the day after you use it, but you will not be harmed by it.

|

|

|

|

Hi friends, just looking for some suggestions on how to best handle my money for the most benefit. I'm 23, generally very disciplined with money and saving. Graduated from college in May 2011. Monthly income is $1480 after taxes. Rent - 400 Utilities - 50ish, may be going up soon because of air conditioning Phone - 67 Gas - I budget 150, usually spend closer to 100, but it's only gonna get worse I expect groceries - 100 eating out - 60 (although pretty variable) Other random stuff - maybe 100 or 200, it varies a lot depending how often I go out and stuff Generally speaking I have about $400 left over each month to save. I'm still mooching car insurance from the parents, and I'm on their health coverage still. My only debts are two student loans: $2900 @ 6.7%, Federal Direct $4500 @ I think ~4 or 5%, Perkins Both loans are deferred until the end of October because I have an Americorps job. I already credited an $1100 Americorps award to the direct loan since it has a higher rate and is less forgiving than the Perkins. At the end of my current contract in November I'll get another $5500 from Americorps which I will probably use to finish off the Direct loan and start on the Perkins. They are both accruing interest right now, but I should be reimbursed for that after completing this contract. I have three credit cards, one of which I never use anymore, and a Visa and a Discover that I use a lot for the cashback rewards. I pay them off every month. I have about $3500 in an ING savings account. I am transitioning from a US Bank checking account to an ING one, but I have probably $400 kicking around between the two. The only large purchase I plan on making any time soon is about $1000-1200 for new tires for my truck. From summer jobs in high school and early college, I have an Ohio Public Employee retirement account with ~$1100 in it. After navigating their archaic website, it seems as though that account has only made about $40 total, which is...disappointing. I haven't actually gotten a paper statement from them in three years, so I obviously wasn't keeping track of that like I should have been. I'd like to roll it over into an IRA that will make me more than $40 in like 6 years, heh. I was looking at Vanguard target retirement accounts, since they seem to be the only ones that don't have a minimum of $3000, but I'd like to hear from you guys some suggestions on what to do with that account. I guess if I cash it out I'd have to pay social security taxes on it, but rolling over into an IRA or some-such should avoid that? I'd also like any suggestions about whether I should just keep dumping all of my extra money into the ING savings, or if there's some better way I could handle it. It's very likely I'll be unemployed for a few months after my contract is up in early November, as that is a terrible time of year for job searching in my field, so I should probably keep at least a few thousand easily accessible. In conclusion, I guess I feel pretty secure with my financial situation, I just feel like I could be managing it a little better, and thought you all might be able to help out.

|

|

|

|

I could have sworn that there was a student loan thread somewhere around here... I just had a simple question, so I'll try here! I'm an undergraduate with subsidized and unsubsidized direct loans, and I'm about to start graduate school right after I finish undergrad. Do my loan payments for undergrad kick in 6 months after I graduate from the program the loan was for (a bachelor's) or will the fact that I'm still working towards A degree continue to defer either 1) interest, 2) balance, or 3) both?

|

|

|

|

Has anybody gone all online with their banking? I use Chase for my checking but I'm starting to get fees now because of no direct-depositing. I use ING for savings and I have a checking account and a brokerage account with Etrade. I was thinking of just canceling canceling my Chase account to avoid fees and go all online but it seems that like it might be problematic if I have to say, deposit cash for instance. Has anyone done this?

|

|

|

|

PRADA SLUT posted:Has anybody gone all online with their banking? I use Chase for my checking but I'm starting to get fees now because of no direct-depositing. I use ING for savings and I have a checking account and a brokerage account with Etrade. I was thinking of just canceling canceling my Chase account to avoid fees and go all online but it seems that like it might be problematic if I have to say, deposit cash for instance. Has anyone done this? I use ING and a the credit union through my job. the best thing is to find somewhere with an ATM deposit. I have debit cards for both accounts and I just deposit cash through the ATM at my work and if I really need it to be in my ING account, I just transfer it over.

|

|

|

|

Quick question: I have a student loan I want to refinance to a less face raping rate. Here's the facts: * Just under $30k * Private loan (nelnet, if it matters) * I graduated in 2006 * It's at 8%, fixed * It's a 20 year loan * It's in my father's name, though I make the payments. Any suggestions on who to go to about refinancing? I don't have nearly enough home equity to cover that, but I do have great credit (~780). I tried Wells-Fargo about a year ago and got nowhere (declined, even with two cosigners). Would a CU possibly cut me a loan on this? I can imagine it's going to be tough, since there's really no collateral. Dragyn fucked around with this message at 18:14 on Mar 26, 2012 |

|

|

|

Well how much is the loan?

|

|

|

|

|

|

| # ? May 26, 2024 03:17 |

|

Harry posted:Well how much is the loan? ..and I knew I'd manage to leave something out. fixed above. It's Just a hair under 30k now.

|

|

|