|

Berke Negri posted:401ks (little better than a scam by this point) Depends on the company. Unfortunately a lot of them force you into lovely mutual funds with high expenses so that the employer can pay less to administer the plan. Matching is great (if you get it) and you can roll the account into an IRA as soon as you leave though.

|

|

|

|

|

| # ? May 24, 2024 04:12 |

|

Radish posted:Yes excuse me for confusing raising the retirement age, making disability payments stricter, gutting social security (I assume since "letting people be in charge of their own savings" is code for this), advocating businesses with fewer but more overworked employees, and absurd Laffer curve nonsense about increasing taxes will lower revenues when the rich Go Galt with economic conservatism. When did I even mention Laffer curve nonsense? I didn't state increasing taxes will lower revenue, I said that increasing taxes on the wealthy to pay for a UBI might backfire in encouraging the wealthy to collude and/or expatriate. sweart gliwere posted:Just to get it out there, would you disagree that government's role includes "Ensure every citizen has access to a life worth living" - without any unrealistic assumptions like everyone gets a pony and has a castle? Yes, I would agree to that - however I see that as being "government makes sure the ceiling isn't low" rather than "government makes sure the floor is high enough for you to touch the ceiling". Joementum posted:party that wants to pay for relatively minor increases for programs like an infrastructure bank by ending some tax write-offs. The Dems 1) don't want to actually make an attempt at closing various tax loopholes as they, too, are bought by businesses, and 2) in lieu of ending these loopholes/write-offs, instead throw out the populist chant of "tax the rich rah rah!" when that actually wouldn't really pay for anything. AreWeDrunkYet posted:By regulating American entities. Other countries can do what they want, the issue is that American incorporated companies can do things like indefinitely avoid repatriating profits to dodge taxes and reincorporate American assets overseas to dodge taxes. The US can also be more proactive about working with foreign governments to share information about Americans dodging taxes, as it has done to decent effect with Switzerland over the last few years. I would be all for reducing the R&D exemption and rewriting/getting rid of the look through and active financing exemptions.

|

|

|

|

Amergin posted:But honestly I don't think it's the government's role to "protect you from homelessness." What else am I paying taxes for? You don't think it's the government's job to ensure its citizens have basic necessities?

|

|

|

|

Amergin posted:So then focus on the carrot rather than the stick- There are two fundamental problems with improving government, both linked to the current Overton window 1) the payback period for om&is improvements is longer than the election cycle. So if you vote to spend the money for a new it system you get campaigned against on "high spending" even if it will save money 2) the terribleness of government is a major campaigning issue. So if you try to fix it the GOP has reason to oppose you (it being terrible undergirds their platform) and gave them an avenue for attack. Hence why things like fixing Indiana's tax system require an audit to set enough hair on fire to get things done. quote:Would you replace all current benefits with a UBI? A UBI wouldn't do anything to curb wealth inequality unless you paid for it by raises taxes on the wealthy - which would either encourage them to collude in hiding their finances better or encourage them to simply leave. quote:UBI would also inflate prices - housing isn't going to become "suddenly affordable" for the poor, especially in urban areas. Plus not all poor families will spend the money wisely, so now you have fungibility concerns.

|

|

|

|

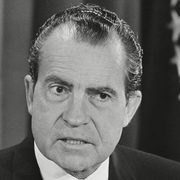

Amergin posted:This is part of the reason why I would try and adjust things to make firing employees easier and encourage a more "meritocratic" system. Would it be truly meritocratic? Of course not. But if you can reward federal employees for effort and curb the number of employees down to those who are most effective, possibly boost their pay, I would hope things would quicken. You start out in 1954 by saying, “friend of the family, friend of the family, friend of the family.” By 1968 you can't say “friend of the family” — that hurts you. Backfires. So you say stuff like forced busing, states' rights and all that stuff. You're getting so abstract now [that] you're talking about cutting taxes, and all these things you're talking about are totally economic things and a byproduct of them is [that] blacks get hurt worse than whites. And subconsciously maybe that is part of it. I'm not saying that. But I'm saying that if it is getting that abstract, and that coded, that we are doing away with the racial problem one way or the other. You follow me — because obviously sitting around saying, “We want to cut this,” is much more abstract than even the busing thing, and a hell of a lot more abstract than “friend of the family, friend of the family.” - Lee Atwater, republican strategist. Amergin posted:But honestly I don't think it's the government's role to "protect you from homelessness." At the very least I would raise the retirement age and attempt at making the disability benefits more strict. But I don't think the government should be in the business of helping people save money, rather it should focus more on educating folks on how to save money and let them have at it. HootTheOwl posted:This is really interesting, can you source it so I can refer back to it later?

|

|

|

|

Amergin posted:When did I even mention Laffer curve nonsense? I didn't state increasing taxes will lower revenue, I said that increasing taxes on the wealthy to pay for a UBI might backfire in encouraging the wealthy to collude and/or expatriate. The wealthy are already colluding and have expatriated their money. There are two ways we can combat this either we get the torches and pitchforks or we are pool our collective voices into a singular body (this is what a government is a organization you are a part of to have a voice when you otherwise would not) in order to rein them in. Giving the wealthy what they want (even less taxes then the historical lows they already pay) will not satiate them they will just want more, so you want millions to suffer and starve to maybe appease our wealthy masters for a short period of time. "2) in lieu of ending these loopholes/write-offs, instead throw out the populist chant of "tax the rich rah rah!" when that actually wouldn't really pay for anything." Why won't taxing the rich pay for anything? Where else would the money come from perhaps you mistake just how rich the rich are, the Walton family alone has more wealth then 42% of the nation combined, are you saying we should wring hundreds of millions of poor people dry instead of taxing the Waltons more? http://www.politifact.com/wisconsin/statements/2013/dec/08/one-wisconsin-now/just-how-wealthy-wal-mart-walton-family/

|

|

|

|

Amergin posted:When did I even mention Laffer curve nonsense? I didn't state increasing taxes will lower revenue, I said that increasing taxes on the wealthy to pay for a UBI might backfire in encouraging the wealthy to collude and/or expatriate. Yea the idea of raising taxes on rich will make them all move is kind of that magic laffer curve stuff. I don't see how a good tax policy can be crafted when it's all based on "Don't raise taxes on the rich because they'll just move". quote:Yes, I would agree to that - however I see that as being "government makes sure the ceiling isn't low" rather than "government makes sure the floor is high enough for you to touch the ceiling". Huh? I'm not sure what you're saying here. quote:The Dems 1) don't want to actually make an attempt at closing various tax loopholes as they, too, are bought by businesses, and 2) in lieu of ending these loopholes/write-offs, instead throw out the populist chant of "tax the rich rah rah!" when that actually wouldn't really pay for anything. Why wouldn't raising taxing the rich pay for anything? Because you assume they're going to move to China the second we raise their taxes?

|

|

|

|

AreWeDrunkYet posted:By regulating American entities. Other countries can do what they want, the issue is that American incorporated companies can do things like indefinitely avoid repatriating profits to dodge taxes and reincorporate American assets overseas to dodge taxes. The US can also be more proactive about working with foreign governments to share information about Americans dodging taxes, as it has done to decent effect with Switzerland over the last few years.

|

|

|

|

If all the rich move rather than pay taxes than so what anyway? What exactly were they providing?

|

|

|

|

Amergin posted:Yes, I would agree to that - however I see that as being "government makes sure the ceiling isn't low" rather than "government makes sure the floor is high enough for you to touch the ceiling".

|

|

|

|

I'm curious about something that someone with a background in economics might be better at answering. What exactly happens if the uber rich decided to leave? The natural resources, grown food, skilled laborers, and buyers are still all here. In GOP theory there is no longer anyone there to pay people to do anything, however obviously the reality is that people wouldn't just sit around and starve, they'd pay for people to do stuff and another economy would emerge. However does that economy use the same dollar, a new currency, or does the dollar get massively devalued? I really have no idea how that sort of incredibly improbable situation would work out but I'm curious if knowledgeable people have thought about it.

|

|

|

|

|

Install Windows posted:If all the rich move rather than pay taxes than so what anyway? What exactly were they providing? It points to some kind of big systemic problem when we care so much about a small number of people leaving.

|

|

|

|

Rep. Virginia Foxx decided to talk about Buddhism on the House floor today. Also, Benghazi. https://www.youtube.com/watch?v=sO73mAewWNY

|

|

|

|

e: eh, I'm taking this one back.

eviltastic fucked around with this message at 21:17 on May 6, 2014 |

|

|

|

"I didn't say big mac, I said a burger with two all-beef patties, special sauce, lettuce, cheese, pickles, and onions on a sesame seed bun, that's totally different."

|

|

|

|

Chantilly Say posted:What else am I paying taxes for? You don't think it's the government's job to ensure its citizens have basic necessities? Following this: would our hypothetical shrunken government still provide free housing for soldiers? If so, is it because they deserve it or because of institutional inertia?

|

|

|

|

made of bees posted:https://www.youtube.com/watch?v=qtTaokySAfU Was... was there supposed to be a voiceover on this?

|

|

|

|

sweart gliwere posted:Following this: would or hypothetical shrunken government still provide free housing for soldiers? If so, is it because they deserve it or because of institutional inertia? I'd rather they make anything relating to our currently serving military and veteran soldiers to be meritocracy based. Only soldiers who kill other people should be able to qualify for free housing and have the government take care of their college tuition, and only veterans who have actually lost something tangible (like an arm or a leg or something) should get the free healthcare ride. These are the soldiers who actually do/have done things, the rest are a bunch of loving freeloaders.

|

|

|

|

mooyashi posted:Was... was there supposed to be a voiceover on this? Nope

|

|

|

|

mooyashi posted:Was... was there supposed to be a voiceover on this? Gravel's campaign was the ronpaul blimp before the ronpaul blimp was the ronpaul blimp.

|

|

|

|

Install Windows posted:If all the rich move rather than pay taxes than so what anyway? What exactly were they providing? The scent of their money attracts the Confidence Fairy.

|

|

|

|

Radish posted:I'm curious about something that someone with a background in economics might be better at answering. What exactly happens if the uber rich decided to leave? The natural resources, grown food, skilled laborers, and buyers are still all here. In GOP theory there is no longer anyone there to pay people to do anything, however obviously the reality is that people wouldn't just sit around and starve, they'd pay for people to do stuff and another economy would emerge. However does that economy use the same dollar, a new currency, or does the dollar get massively devalued? I really have no idea how that sort of incredibly improbable situation would work out but I'm curious if knowledgeable people have thought about it. Check out Argentina (wrt closed factories). I wish Americans had that set of cojones.

|

|

|

|

nutranurse posted:I'd rather they make anything relating to our currently serving military and veteran soldiers to be meritocracy based. Only soldiers who kill other people should be able to qualify for free housing and have the government take care of their college tuition, and only veterans who have actually lost something tangible (like an arm or a leg or something) should get the free healthcare ride. These are the soldiers who actually do/have done things, the rest are a bunch of loving freeloaders. You realize this is the case, right? Because it comes off as sarcasm about glorifying death rather than sarcasm mocking ameriga for not knowing how government employee promotion and firing works. Being deployed to a war zone (being a combat veteran) gets you a different and more extensive suite of benefits, and while all veterans are means tested health care, at a certain level of disability the means testing is waved and it is all free.

|

|

|

|

nutranurse posted:I'd rather they make anything relating to our currently serving military and veteran soldiers to be meritocracy based. Only soldiers who kill other people should be able to qualify for free housing and have the government take care of their college tuition, and only veterans who have actually lost something tangible (like an arm or a leg or something) should get the free healthcare ride. These are the soldiers who actually do/have done things, the rest are a bunch of loving freeloaders. Congratulations every soldier ever, you've got a confirmed kill!

|

|

|

|

Yeah in every real life experience of dudes going galt, someone else has just stepped up to the plate and done what needed to be done. This worship of the rich, as if they are the only ones capable of doing what they do (and ignoring just how much money they spend on making sure them and people like them are the only ones allowed to do what they do) is frankly one of the most confusing and pathetic aspects of this early 21st century. I've known a number of super rich people, they are just people who got super lucky, they are no more competent or ethical or intelligent then any other random person and often their privilege actually cuts them so far off from reality that they are the last people you actually want in charge of anything.

|

|

|

|

mooyashi posted:Was... was there supposed to be a voiceover on this? There's also one where he gathers sticks in a forest and lights a fire which the camera then focuses on for like ten minutes. A couple of art students ask Gravel if they could make some videos for his campaign and that's what they created. The rock is supposed to be a metaphor for his campaign creating ripples in the pond of politics. Oh, and he did some music videos too, including a half-decent version of Helter Skelter. None of that was as funny as when he quit the Democratic primary to run in the Libertarian primary and spent the entire debate at their convention arguing that universal healthcare was the ultimate expression of personal liberty.

|

|

|

|

Amergin posted:Is it "fiscally conservative" if I want government spending to be curbed slightly?

The fiscally realist's response is to optimize benefits versus costs. "SNAP is currently spending $1.50 to provide 2000 kCal of food to a poor child. By end of FY2020 I want to see that number reduced to $1.40." Hence, you're giving program administrators a few options:

There are few reasons why someone would care about raw cost numbers rather than cost/benefit ratios, but none of them are compelling:

When you skip the nuanced discussion about productivity and spending-efficiency and regulatory capture and historical performance and statistical analysis and the various goals and metrics behind social programs, yet insist on cuts... yeah, we're going to label you a "fiscal conservative."

|

|

|

|

Relentlessboredomm posted:Social Security wouldn't be an IOU box any longer. It'd be as locked down as I could make it. No government would have permission to bower from it now or in the future. It would exist solely to hold money for SS. And it would not be invested. At absolute most it could be converted into a certain percentage of T bills. I don't trust banks with a pile of money that big for investing. My understanding is that, because it's the Fed's job to control the money supply, the federal government can't meaningfully save money because that would effectively be taking money out of circulation, which reduces the money supply, which is the Fed's job... etc. So you can't do that without screwing with the central banking system. I could easily be wrong about that, though. I'd add that I'd rip out the siloed IT departments at the various agencies and replace them with the Central Information Systems Administration which would have the mission of aggressively modernizing and improving the efficiency of communications and administration of all federal agencies; ensuring the security of the information of the federal government; and guaranteeing maximal public availability of all non-secret data. Under this model, healthcare.gov would likely have been an internally-produced fork (clone) of the existing SS, Medicare or Medicade system with some updates that could be made very quickly by people who have been maintaining the other systems for years. You'd have one convenient source for current and past climate data, census information, EPA measurements, crop reports, spending data, current federal law, etc.

|

|

|

|

Just a note here: Raising taxes on the rich, while a desirable way to blunt wealth concentration, is not necessary to improve the lot of the poor. Government ability to create and spend money is limited only by desired inflation and the available real resources in the economy. Politically, it is foolish for liberals to campaign on taxing the wealthy in order to pay for anti-poverty measures (or for that matter any measures), because that argument implicitly accepts the conservative talking point that the national budgets of sovereign currency issuers are ideally balanced and that national deficits and the issue of Treasuries are comparable to private debt. Even pointing out the fact that US treasury bonds can be issued for extremely low rates misses the fact that the US government need not issue them at all in order to "finance the deficit". However, for the purposes of politics it is fine to continue the current system because US Treasuries themselves are helpful in creating stability in world markets (whether stability is desirable given the current status quo of wealth distribution is another matter). One can certainly have a discussion of government efficiency, but that puts the cart before the horse because in a depressed or struggling economy, spending on literally anything is better than restricting government spending when there is not enough effective purchasing power in the economy to support maximal employment and the housing, feeding and clothing of the nation's people. This is doubly true when it is self evident that the real (non-monetary) products of the national economy are more than sufficient to feed, clothe, and house the entire population. What is lacking? Only money. And it just so happens that the federal government has a limitless supply. It is also worth noting that when and if the private economy is booming, it is perfectly reasonable for the government to scale back some spending, since if the real products of the economy are scarce due to consumption or investment then the government contributes to unneeded inflation by continuing to buy. But even in this case the example is almost nonsensical, as the only time when government needed to command such a large proportion of the national output that they were competing with private enterprise was during World War 2, and in this event rationing and the mass private purchase of US bonds served to reduce private demand for vital war materials.

|

|

|

|

Amergin posted:But honestly I don't think it's the government's role to "protect you from homelessness." At the very least I would raise the retirement age and attempt at making the disability benefits more strict. But I don't think the government should be in the business of helping people save money, rather it should focus more on educating folks on how to save money and let them have at it. Hi, I'd just like to chime in and say that it's barbarian attitudes like yours that make my job necessary. Are you OK with the government protecting children from homelessness? Do you realize that the easiest way to do that is to provide their parents with housing? You're proud of not knowing anything.

|

|

|

|

Install Windows posted:If all the rich move rather than pay taxes than so what anyway? What exactly were they providing? I know you're probably not going to want to hear this, but they provide taxes. Majority of the taxes are paid by the wealthy, despite it not being fairly distributed, by sheer volume of their wealth they pay the most. It's often used as an argument that the rich are over-taxed which is a completely rear end backwards way to look at it. In any case, if all the wealthy (however you define it) were to up and leave, the government would be economically devastated by the loss of revenue. This of course has no bearing on policy because it's a completely ludicrous idea. By and large the top 5-10% can get hosed and deserve to pay much more than they are at upper tiers.

|

|

|

|

Radish posted:I'm curious about something that someone with a background in economics might be better at answering. What exactly happens if the uber rich decided to leave? The natural resources, grown food, skilled laborers, and buyers are still all here. In GOP theory there is no longer anyone there to pay people to do anything, however obviously the reality is that people wouldn't just sit around and starve, they'd pay for people to do stuff and another economy would emerge. However does that economy use the same dollar, a new currency, or does the dollar get massively devalued? I really have no idea how that sort of incredibly improbable situation would work out but I'm curious if knowledgeable people have thought about it. Not much of anything directly. The network of international trade and ownership means that if the 1% packed off to Mexico to take advantage of those lower income taxes and converted their fortunes to pesos very little would change. You'd have the major corporations in America be foreign owned instead of domestically. The companies continue to pay taxes just like they do now. Their purchasing agreements and production schedules aren't linked to the nationality of the owner/majority of stock holders. Corporate personhood would benefit the little guy! Assuming they still work in the US they would file as a Non-Resident Alien for their income taxes (you pay income based in where you made the money) Withholding is based on residency and assumes full year and they aren't residents so that will be interesting but only if you are a nerd like me, it won't impact public policy since it will be a drop in the bucket compared to the usual 1% tax tricks. Anyways the tax base would remain the same. If they quit their jobs someone new would take over. CEO/board compensation would look very different for a while since that is set through votes and this networks rather than the market, and the networks all just packed off to Mexico. I suppose this could mean something depending on how it shakes out based on how much is paid and how much of it is capital gains but it's not like changing the tax law to adapt to that would be hard. In fact given that the lawyers and accountants who made it all work before will still be here I expect the structure will remain similar even if rate drops. If rate drops that's more for the company's bottom line but without looking at specific examples I'm not sure how much of an impact it would have. The move could generate a shift in the market based off investor confidence, but assuming the market follows the evidence it should steady out. As you said, the fundamentals haven't changed. Of course I'm not particularly convinced the market behaves in accordance with fundamentals these days, but I'm probably far too cynical. 200 years ago, the rich loading up all the gold and taking it with them could trigger a crash. Today less so, the debts and accounts just have a line of currency conversion added to them

|

|

|

|

Thanks for the input!. It's a weird topic.

|

|

|

|

|

It's pretty telling that people who want more government "efficiency" always try to do it by cutting social programs instead of corporate subsidies, tax breaks for the rich, or that 1 trillion dollar f-35 shitheap.

|

|

|

|

Boon posted:I know you're probably not going to want to hear this, but they provide taxes. Majority of the taxes are paid by the wealthy, despite it not being fairly distributed, by sheer volume of their wealth they pay the most. It's often used as an argument that the rich are over-taxed which is a completely rear end backwards way to look at it. In any case, if all the wealthy (however you define it) were to up and leave, the government would be economically devastated by the loss of revenue. Nope. The US does not have a wealth tax, so moving the wealth won't do much (and the wealth taxes we do have, like property taxes, are on things that aren't moving). For the US to have its tax base to evaporate you have to assume that when they leave the income they were getting evaporates as well - that there won't be a replacement CEO or that we can't touch the money as it now because they have a different nationality. The former is Galt's Gulch laughable. Jobs exist because there is a demand for them, if they quit someone new is found to fill that demand; the company doesn't suddenly say "we don't need a CEO" any more than they do now when the CEO retires. The latter doesn't really work because if they telecommute/fly in to work here then they pay taxes as a non resident alien. The money was made here, it gets taxes here. The tax treaty we have with each country they are from (or have moved to in this situation) impacts the rate types of income are taxed at. And if they all quit when they left then nothing changes as we continue to tax the new guy's income like we did the old.

|

|

|

|

Axetrain posted:It's pretty telling that people who want more government "efficiency" always try to do it by cutting social programs instead of corporate subsidies, tax breaks for the rich, or that 1 trillion dollar f-35 shitheap. Oh yeah. You want to see some real waste fraud and abuse look at the tax expenditures. You could save trillions there before you even looked at direct subsidies. In my day dreamy "if they listened to me..." Moments I want to hate on that the way Paul Ryan hates the poor. Start with the HFCS usage credits... Edit: I have a boring fantasy life, I know Fried Chicken fucked around with this message at 22:08 on May 6, 2014 |

|

|

|

Efficiency works like security: there is no reasonable argument for less of it. So what you do is convince the public that your policy goals increase efficiency.

|

|

|

|

Axetrain posted:It's pretty telling that people who want more government "efficiency" always try to do it by cutting social programs instead of corporate subsidies, tax breaks for the rich, or that 1 trillion dollar f-35 shitheap. And when you call them on it their copout is always "oh that's super bad as well." Then they go right back to talking about some guy on disability that they totally saw walking around.

|

|

|

|

Joementum posted:Rep. Virginia Foxx decided to talk about Buddhism on the House floor today. Also, Benghazi. Seriously, it's a one minute speech, memorize the drat thing or sketch out some key points and work with those. Reading line for line off your paper and pausing occasionally for a half-second cross-eyed glance at your audience doesn't fly in even the most basic public speaking classes. Poor effort

|

|

|

|

|

| # ? May 24, 2024 04:12 |

|

Boon posted:I know you're probably not going to want to hear this, but they provide taxes. Majority of the taxes are paid by the wealthy, despite it not being fairly distributed, by sheer volume of their wealth they pay the most. It's often used as an argument that the rich are over-taxed which is a completely rear end backwards way to look at it. In any case, if all the wealthy (however you define it) were to up and leave, the government would be economically devastated by the loss of revenue. Eh, even this isn't a given. After all the taxes are on economic activity. Just because they leave doesn't mean that the economic activity will stop. Now, it might because so much of the wealth is concentrated in the hands of the few that it would only make the liquidity trap worse, but that's an entirely different matter. Edit: Consider this a support vote for Fried Chicken's post earlier. Taerkar fucked around with this message at 22:27 on May 6, 2014 |

|

|