|

EZipperelli posted:So I have a question regarding contracts. If there was something serious to hide they would not care about a few thousand. Even a rational person would not want the deal to fall through and have to make another mortgage payment while finding new buyers, and have to deal with the legal issues. They just got cold feet and wanted more money.

|

|

|

|

|

| # ? May 28, 2024 11:26 |

|

Currently going through the process of becoming a first time homeowner. Finding a house and having our offer accepted was quick and fairly painless. Shopping around for reputable and affordable lenders/title companies/inspectors within a frighteningly small amount of time (gently caress you 4th of July I had forgot you were this weekend) not so much.

|

|

|

|

Just signed a contract to do solar. Wife and I have been kicking it around basically since we bought the house in 2011. Now that we have our 2nd child on the way, we agreed that we are committing to this house for at least 8 more years and want to take advantage of the tax credit. $26k with around $8k coming back in federal tax credit next year means that our breakeven point is right around 5.5 years. Anyone have horror stories or gotchas to watch out for during the process? I really hope the sun doesn't burn out in the next couple of years or else I'm going to feel like a fool.

|

|

|

|

For some reason, conventional loan secondary market investors hate leased solar panels. So if there is a lien against you for them, you will not be able to refi your house loan until that is paid off, unless there is a guideline change.

|

|

|

|

Spamtron7000 posted:Just signed a contract to do solar. Wife and I have been kicking it around basically since we bought the house in 2011. Now that we have our 2nd child on the way, we agreed that we are committing to this house for at least 8 more years and want to take advantage of the tax credit. $26k with around $8k coming back in federal tax credit next year means that our breakeven point is right around 5.5 years. How close are you to needing a roof replacement? All of that solar stuff has to be pulled off, and that costs a lot of money (not as much as the first installation, but still a substantial amount), so consider whether you're going to need a bunch of roofing work done in the next 5 years. Hypothetically, your solar contractor should tell you about this, but keep in mind that it might not be in their best interest to do so since that could kill the sale. I hope you're going to own your system, because those leased solar deals are a total scam. Groups like SolarCity are notorious for charging hidden fees and performing shoddy work There's also always the chance that your city/county/state will decide to let the power company start hiking the fees that they charge for the privilege of letting you sell power to them. That could suck, but there's not much that you can do other than getting involved in politics. As an example, roof solar users in Tempe, AZ were suddenly given a $50/month fee hike earlier this year.

|

|

|

|

Yep - I appreciate the responses. We are definitely buying outright with cash. I don't want a lien on the house and I can't see a reason to pay the points on a hero loan so we're doing straight cash. The roof is stone tile and is in good shape. Luckily with stone tile, I don't think there's a scenario where the whole thing will ever need to be replaced. I just need to watch out for cracked/loosened tiles. It's a good thought though. I know I have a few that need to be replaced already - I'm going to look into getting that done (the solar company may also offer to do it since they offer some roof damage guarantees in their contract. I briefly considered SolarCity - anecdotally I heard that they are not quite so shoddy now that Google owns them (or whatever). I called them and gave them the specs I came up with with the other two vendors (~6.2Kw DC) and they were a good $6k more. The sales guy sheepishly admitted that they do very few purchase deals - most of their customers lease. I don't understand why people would want to do that. The only thing SolarCity has going for them in my opinion is that they offer a $500 option to move your entire installation to a different house in case you decide to sell/move. I'm going with Stellar Solar http://stellarsolar.net/ They get a lot of solid reviews and a friend of mine from work referred me and since I'm his second referral he's getting $1k out of it ($500 for the first one).

|

|

|

|

If you can find someone to buy the trecs the panels will generate then it might be worth registering as a generator in wregis, but the annual fees and hassle will probably make it not worth your while.

|

|

|

|

One thing that some solar companies don't mention is that the credit score needed for a buyer to assume the lease can be higher than the credit that they'll need for a mortgage. So if you have a buyer in that margin, they'll get forced out of a purchase because they can get a mortgage but not the solar lease. Edit: also, remember to check your water shutoffs occasionally, people!

|

|

|

|

I went with a solar lease instead of a straight buy. Signed a contract, no money down and dropped my bill about $150/mo. My break even point was on day one, I'd imagine that's why solar leases look attractive.

|

|

|

|

FCKGW posted:I went with a solar lease instead of a straight buy. Signed a contract, no money down and dropped my bill about $150/mo. My break even point was on day one, I'd imagine that's why solar leases look attractive. When you gloss over the downsides then they sound ideal, but solar leases are notorious for being full of hidden pitfalls. Many solar leases come with monthly fee hikes, and with some leases the fee schedule actually has you paying more per month than you would be paying for electricity without the solar system. It can be pretty hosed up, although YMMV. But even in the best case, where the monthly fee is never worse than the cost of electricity, you still wind up paying a lot more than you would have paid by just taking out a loan and buying the system outright. Some leases apply a financial penalty during months of low usage. This is another YMMV since it varies so much from business to business, and some won't charge any penalty at all, but a common trick is to "guarantee" the monthly fee regardless of performance and then to charge the difference in electricity cost + interest as a separate fee if there's a cloudy month or if the panels are faulty. The company is also not responsible for damage to your roof, so if they go bankrupt or if they decide not to renew your lease then it's up to you to perform repairs yourself. A lot of these solar leasing companies perform extremely shoddy work, and per the terms of your lease you're typically hosed if they screw anything up during install, removal, or maintenance. Leased systems also greatly complicate the process of selling your house. Many solar leases have a prepayment penalty, so all that you can do is A) hope that a potential buyer is willing to take on the lease and B) hope that the potential buyer has great credit and that the solar company is willing to transfer the lease. But yeah, the solar lease concept is cool because it's as simple as you said: you basically just sign a contract and let them handle the rest. As an investment it's not as good as taking out a loan and buying the system, but under the right circumstances it can be better than doing nothing. I would suggest reading the terms of a solar lease very carefully, however. There are some notoriously bad terms out there if you're not careful.

|

|

|

|

Yeah I pulled about 6 quotes from different companies, including all the big guys and a couple smaller guys. Most were crap, the lease quotes I got had escalator charges if you wanted $0 down, somewhere around a 3% yearly increase. A down of $5k could remove the escalator, even more would drop the monthly payment. Looking at buying outright would have me add the payments to my property tax bill at about 8% interest which would cause my solar bills to be more then my electric bill until my break even around 8 years out. Luckily my home is in a prime spot for solar. All the new homes going in have solar. I would say at least 1 out of the 10 existing homes in my area have solar so it's something that would be out of the ordinary any local realtor. We were also putting up 33 panels which helped me get a better rate. The home is 10 years old with concrete tiles so I don't have to worry about the roof for a while. I know I'll be paying more in the long term for a lease but the piece of mind of not having to worry about replacing any failed panels or inverters or having to scrape up tens of thousands up front for the panels was worth it for me. It brought my summer bills down from a high of $700 in August to a constant $200 every month (and a few bucks yearly to the utility) and I probably wouldn't have done it if I had to front the cash to deal with a higher payment up front.

|

|

|

|

FCKGW posted:It brought my summer bills down from a high of $700 in August to a constant $200 every month (and a few bucks yearly to the utility) and I probably wouldn't have done it if I had to front the cash to deal with a higher payment up front. Where do you live and what size house? I can't fathom a utility bill that high (let alone just for electricity).

|

|

|

|

Thesaurus posted:Where do you live and what size house? I can't fathom a utility bill that high (let alone just for electricity). Seriously. For a 10 year old home? Does he keep it meat locker temperature or something?

|

|

|

|

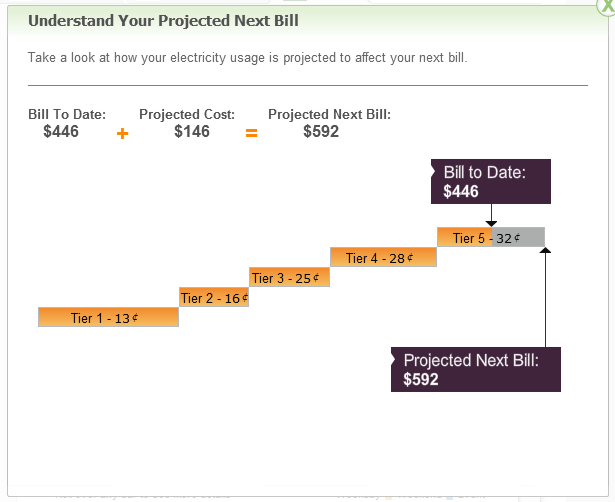

Big house, 4200 sq. ft. , with an extended family living in it. Meaning someone is home all day. It also gets around 110 degrees from July to September in the Inland Empire where I am. I keep the thermostat somewhere between 76 and 78. The big thing that most of you probably haven't encounter though is the joys of tiered electricity pricing.

FCKGW fucked around with this message at 04:24 on Jul 4, 2015 |

|

|

|

Haha omg a $70 electricity bill let alone a $700 bill is difficult for me to imagine

|

|

|

|

Anybody have any thoughts on renovating old lovely homes? All the ones in the neighborhood I'm looking at are stupid Ikea flips with lovely electrical, bad deckwork, sloped lots, no parking, and they're all going for $550k-650k. I found a super run down house on a PERFECT lot - flat slope, good parking, walkable to town - that would basically have to be rebuilt from the foundation up (including retrofitting the foundation, it's pier and beam now with no cripple walls). But it's listed for $400k and I think I could get them closer to $350k. I'd have to pay cash since there's no way a lender would approve. So, how cheap would a lovely house have to be to make a rebuild/renovation worth it? I kind of want to buy a fixer upper anyway since then I'll be able to redo the electrical without the hassle of having walls I want to keep (seriously, every electrical panel in this neighborhood is a Zinsco and the wiring is all 1970's poo poo) but that might just be the desperation talking. moana fucked around with this message at 05:04 on Jul 4, 2015 |

|

|

|

BEHOLD: MY CAPE posted:Haha omg a $70 electricity bill let alone a $700 bill is difficult for me to imagine Yeah, cooling a huge home in the desert can be a real pain. The Inland Empire is basically the LA area, but way inland so you don't get the nice heat-mediating effect of the ocean. In areas like southern CA and Phoenix even it's pretty normal to spend a few hundred a month in the summer months, even for a smaller 1000ish square foot house.

|

|

|

|

moana posted:I'd have to pay cash since there's no way a lender would approve. Maybe they're trying to tell you something.. moana posted:So, how cheap would a lovely house have to be to make a rebuild/renovation worth it? I kind of want to buy a fixer upper anyway since then I'll be able to redo the electrical without the hassle of having walls I want to keep (seriously, every electrical panel in this neighborhood is a Zinsco and the wiring is all 1970's poo poo) but that might just be the desperation talking. If you're breaking the bank to make the purchase in cash then what would pay for the renovations?

|

|

|

|

moana posted:Anybody have any thoughts on renovating old lovely homes? All the ones in the neighborhood I'm looking at are stupid Ikea flips with lovely electrical, bad deckwork, sloped lots, no parking, and they're all going for $550k-650k. I found a super run down house on a PERFECT lot - flat slope, good parking, walkable to town - that would basically have to be rebuilt from the foundation up (including retrofitting the foundation, it's pier and beam now with no cripple walls). But it's listed for $400k and I think I could get them closer to $350k. I'd have to pay cash since there's no way a lender would approve. I think I've heard that you should assume a minimum of $200/sqft to build a new house on an empty lot, but at that rate you're basically building a lovely house like the one that you're talking about renovating. YMMV by area of course. If it's as much of a shithole as you're letting on, it's probably best to just treat it as a teardown, which will add to your expenses. Budget from there. If it's a house listed for $400k in a $600k neighborhood then there's some serious poo poo wrong with it, likely more than just shoddy electrical and bad deckwork which you say is endemic to the entire neighborhood, likely something really loving important to the integrity of the home itself, and tearing the whole thing down might actually be the cheapest option QuarkJets fucked around with this message at 07:22 on Jul 4, 2015 |

|

|

|

Progressive JPEG posted:Maybe they're trying to tell you something.. I'm going to do more research into what such an intense renovation would cost, I guess, maybe get a couple quotes for the major stuff and get reports on the septic. One of the nice things about the property is there's a shed set up as a guest house out back. Probably unpermitted - we'd turn it back into a shed if we bought- but it would be an okay place to live if we needed to while construction happened. Or we could just keep renting where we are. I also need to look into what it take to retrofit a pier and beam foundation, as that would likely be the most costly and immediate fix. also yeah, quarkjets, it's totally an old cabin, not a house, it needs a lot of renovation and tearing apart. But it's very much the perfect neighborhood and the perfect lot, and I've been looking at a LOT of lovely overpriced lots with cheap-construction flipped houses.. The major value is in the lot itself, imo. I suppose I'll wait to see how the reports turn out.

|

|

|

|

What things should I consider when deciding between a 5 year arm and 15 or 30 year fixed. 175-200k home 60-80 down Moving in 2-5 years No options to rent (dogs, crime)

|

|

|

|

Ropes4u posted:Moving in 2-5 years If you're sure about this, then the 5 year arm makes the most sense. That said, buying probably doesn't actually make sense vs. renting over that short of a timespan.

|

|

|

|

moana posted:I'm going to do more research into what such an intense renovation would cost, I guess, maybe get a couple quotes for the major stuff and get reports on the septic. One of the nice things about the property is there's a shed set up as a guest house out back. Probably unpermitted - we'd turn it back into a shed if we bought- but it would be an okay place to live if we needed to while construction happened. Or we could just keep renting where we are. Given the earthquake talk I'm guessing you're in CA? Post and beam isn't necessarily a dealbreaker and can be retrofitted, depending on the size/weight of the structure involved. Eg if it's a small cottage then it's not terrible. Retrofitting is a tradeoff that depends on how much money you're comfortable spending. You could go all-out and pour a whole new foundation, or you could just add bracing to ensure a reasonable amount of safety. In either case there's no such thing as earthquake-proof so it's really a matter of how much mitigation you're comfortable with and what's reasonable for the location. You may be eligible for reimbursement of some of the work too, but that generally tops out at a few thousand. For septic, it's typical for the sellers to have a septic company come by and pump it, and as a part of the process they should also do a visual check on the tank and give the field a quick soak test. You may want to check with the county/city for current septic code but in practice if it ain't broken then you shouldn't need to worry about it provided you avoid frequently exceeding its capacity (with your posting). If the current field failed and there isn't enough qualifying area for a new one then you may need to deal with getting a variance to switch to an alternative system, but this isn't the end of the world. I'm pending on a house in unincorporated San Mateo county with a septic that's functional but waay undersized to current county code

|

|

|

|

baquerd posted:If you're sure about this, then the 5 year arm makes the most sense. That said, buying probably doesn't actually make sense vs. renting over that short of a timespan. Seriously there is no safe place to rent if you own dogs where we are moving. Additionally work picks up the costs in the purchase and sale of our homes along with other incentives.

|

|

|

|

Ropes4u posted:Seriously there is no safe place to rent if you own dogs where we are moving. Additionally work picks up the costs in the purchase and sale of our homes along with other incentives. I'm assuming that's just closing costs and not realtor commission on a home sale?

|

|

|

|

QuarkJets posted:I'm assuming that's just closing costs and not realtor commission on a home sale?

|

|

|

|

QuarkJets posted:I'm assuming that's just closing costs and not realtor commission on a home sale? Both plus a generous bonus based on the price of the home. The fees & bonuses are capped at $500,000, I guess in case you happen to be buying the White House.

|

|

|

|

So I bought a house about a year ago. Steady job with potential for transfers to other areas if I chose to do something along those lines. Nothing I'd planned on doing for at least a couple of years though. A bid for a job on Guam has come out. I'm going to put in for it. I was thinking there would be some extra incentive money to go because it's Guam, but there's not, so I have the issue of my house. I'd be there for 3 years and then have return rights to the job region I'm already in with a good chance of coming back to my current facility. So here are the options I've come up with: Rent the house out for 3 years. Not a terrible idea, I'd probably be able to get at least close to my mortgage payments even with a property management company involved. My only real issue with this is how much work I'm assuming will need to be done on the house within the next 3 years. Paint, A/C, water heater, possibly a roof, giant tree in the back yard that has seen better days, things like that. Stuff I'd have to deal with anyway, but now I'm thousands of miles away wanting to spend that money on traveling to Thailand for, uh, things. Sell the house. Prices in general seem to be up from when I bought, still seems to be a sellers market so I might be able to break even or not lose much. There's a good chance I'd be back here in 3 years though, so this is not necessarily something I want to do. If I could get return rights to a different region this might be more appealing, but I'm not sure if I can make that happen. Right now my thought process is put a bid in for the position and then in all likelihood turn it down if I get an offer. Any other options I'm missing? I'm going to talk to an accountant because I'm told there could be some significant write offs if the rent I'm getting is less than the mortgage and for any travel back to the area to "check on the property", so those will eventually factor into my decision as well.

|

|

|

|

Ropes4u posted:What things should I consider when deciding between a 5 year arm and 15 or 30 year fixed. Compare lenders, but this was my situation and the arm was a 2.75 rate vs 3.25 so I took it. If I don't sell in 5 years I plan to drop a lot of my cash savings into it.

|

|

|

|

My friends are likely moving in the near future and are would be selling their house. My gf and I really like their house so I've been fiddling around with the "how much house can you afford" calculators but they just seem bonkers to me. Pulling in $107k gross, $60k down, $300 car payment but no other debt, 4.25% rate with 2% property tax and 0.6% year homeowners gets "you can afford" number in the 450-480s. That just seems crazy high and isn't even taking into account her income. Am I doing something wrong here? That is pretty far out of the 2.5x income range.

|

|

|

|

|

Shifty Pony posted:My friends are likely moving in the near future and are would be selling their house. My gf and I really like their house so I've been fiddling around with the "how much house can you afford" calculators but they just seem bonkers to me. Pulling in $107k gross, $60k down, $300 car payment but no other debt, 4.25% rate with 2% property tax and 0.6% year homeowners gets "you can afford" number in the 450-480s. That just seems crazy high and isn't even taking into account her income.

|

|

|

|

Shifty Pony posted:My friends are likely moving in the near future and are would be selling their house. My gf and I really like their house so I've been fiddling around with the "how much house can you afford" calculators but they just seem bonkers to me. Pulling in $107k gross, $60k down, $300 car payment but no other debt, 4.25% rate with 2% property tax and 0.6% year homeowners gets "you can afford" number in the 450-480s. That just seems crazy high and isn't even taking into account her income. One thing to note is that as your income goes up, the costs of a mortgage and property tax go down thanks to tax deductions.

|

|

|

|

Andy Dufresne posted:Compare lenders, but this was my situation and the arm was a 2.75 rate vs 3.25 so I took it. If I don't sell in 5 years I plan to drop a lot of my cash savings into it. I am looking forward to the adventure, opportunity and job, but there is no way I am staying for more than five years.

|

|

|

|

Ropes4u posted:I am looking forward to the adventure, opportunity and job, but there is no way I am staying for more than five years. To be honest it feels like you're giving up a bit early on rentals, it may take some work but it feels like it'll be a better deal if you just stick to rentals. Owning property will invest you in the local economy to a degree that sounds unreasonable in your situation.

|

|

|

|

FCKGW posted:It brought my summer bills down from a high of $700 in August to a constant $200 every month (and a few bucks yearly to the utility) and I probably wouldn't have done it if I had to front the cash to deal with a higher payment up front. holy loving christ, my electricity is $40-75 a month depending on the season and my gas bill is a budgeted $115 a month year round.

|

|

|

|

moana posted:Anybody have any thoughts on renovating old lovely homes? All the ones in the neighborhood I'm looking at are stupid Ikea flips with lovely electrical, bad deckwork, sloped lots, no parking, and they're all going for $550k-650k. I found a super run down house on a PERFECT lot - flat slope, good parking, walkable to town - that would basically have to be rebuilt from the foundation up (including retrofitting the foundation, it's pier and beam now with no cripple walls). But it's listed for $400k and I think I could get them closer to $350k. I'd have to pay cash since there's no way a lender would approve. From what I can tell, pier and beam houses don't have a basement. You should pass unless you're willing to pay the cost to dig a basement out. (USER WAS PUT ON PROBATION FOR THIS POST)

|

|

|

|

Progressive JPEG posted:To be honest it feels like you're giving up a bit early on rentals, it may take some work but it feels like it'll be a better deal if you just stick to rentals. Owning property will invest you in the local economy to a degree that sounds unreasonable in your situation. Likely true, I am from the you should home a home generation. I will talk to my wife, she will decide in the end. We have a couple of weeks before we move and will look while we are In town next week.

|

|

|

|

Citizen Tayne posted:holy loving christ, my electricity is $40-75 a month depending on the season and my gas bill is a budgeted $115 a month year round. My gas bill is around $15/mo so we're not too far from each other really.

|

|

|

|

SO we just got a house inspected but we discovered that it has a basement. Inspector says that he can get some guys to fill the whole thing with concrete for about $10k, should I ask the seller for a closing credit? (USER WAS PUT ON PROBATION FOR THIS POST)

|

|

|

|

|

| # ? May 28, 2024 11:26 |

|

What's wrong with a basement, or are you trolling?

|

|

|

|