|

Christ, wonder how much lower rates will go. Iím in...uhh month 3 of our 15 year/3% refi. If I refi at 2.75, the break-even point is 4 years and I ďonlyĒ save 19k over the life of the loan. That doesnít seem worth the effort, right?

|

|

|

|

|

| # ? May 16, 2024 12:22 |

|

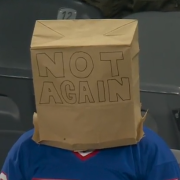

Here we go again

|

|

|

|

Inner Light posted:Was this before or after the Fed just cut interest rates by .5%?

|

|

|

|

I'm 10 months into a 30 year @ 4.125%. If this get to 3 or lower I'm jumping into a refi

|

|

|

|

My credit union has 3.0% on a 30 posted right now on their "power rate" loan. I think i'm at 4.25%, but I don't think we can refinance at this point. My wife works at a bank and we used an employee only loan product that requires us to keep the loan for 36 months or we have to pay back all the closing costs they paid. Still might be worth it though. I'd be saving 250 a month in interest, plus locking in a 30 year at basically inflation which is nuts.

|

|

|

|

Oh good I was hoping an interest rate speculation discussion would pop up. Iím looking to refi into a 15 year (currently have like 22 years left on my 30 year now @ 4.5%) and Iím trying to decide when to pull the trigger. I would expect rates to dip more after this morning, right?

|

|

|

|

I thought I didn't have my spreadsheet set up to compare points but it turns out I did have that option, oops. I could have done 3.25% for $1,260, which would have broken even sometime around 4 years. Honestly, I'm fine with the lower closing costs and the slightly higher payment over the life of the loan. It ends up saving $6.2k over the entire 30 years, which at developer salary is not enough for me to concern myself with. This is me rationalizing my decision.

|

|

|

|

I think Bankrate is broken; it's showing me anywhere from 4.5% to nearly 6% for their "Featured" lenders, and in the low-mid 3s for the others. Better.com shows me 3.335%

|

|

|

|

We're at 4.8 on a 30 and getting adverts from Chase to get a 2.8 rate, so pretty sure we just have to refinance.

|

|

|

|

The Dave posted:We're at 4.8 on a 30 and getting adverts from Chase to get a 2.8 rate, so pretty sure we just have to refinance. Yeah honestly, get on that ASAP. Also, 10 year treasuries are at 1.03%. lol JFC.

|

|

|

|

Oh poo poo I guess it's time, huh? 24 left of a 30-year at 4.125%. I've been wanting to refi to a 15-year for a while now

|

|

|

|

Questions about refis since I've never done one: I'm low on liquid cash right this second, but will have plenty to cover closing costs in a couple months. Does it make sense to go ahead and refi now and roll the closing costs into the loan (I think I'm looking at around 5-8k, but I'm still shopping around and trying to understand what's reasonable), or wait till I can pay them out of pocket? It seems like I could always throw that money at the loan principal when I get it, meaning I'd only be paying the interest on the closing costs for a couple months, so I guess I'm just wondering if there's another reason why rolling in closing costs is bad (or is it not always an option?). One thing I'm worried about is I'll need my appraisal to be high enough to ensure I'm at 20% equity (my original loan had only a 3% down payment and I'm only 3ish years in, but I'm in a volatile market and housing prices are steadily climbing - I know they're mostly bullshit, but fwiw the lowest estimates on Zillow\Redfin are above what I'd need). So if I roll in closing costs, do I need to be worried about the appraisal being that much higher, or does that not factor into the equity calculation? Current loan: FHA 30 yr fixed @ 3.625 1st rate I found (still shopping): Standard 30 yr fixed @ 3.25 ($5103 points) (I'll only refi if I can lose PMI, so that'll knock about $250 off my monthly payment without even accounting for the lower interest rate)

|

|

|

|

Hoodwinker posted:Just got my interest rate for my first home locked in: 3.375%. Hell yes. I mean, I knew it in my head, but it's kind of crazy how quickly you pay off principal with a 15 year. Also, got an email from Wells Fargo private banking offering 2.75% 1M-3M 30 year fixed mortgages. poo poo is kind of crazy right now.

|

|

|

|

gvibes posted:Refinanced the lake house at 2.75% for a 15 year, zero fee. Now both houses are on 2.75% 15 years. I have absolutely no reason to pay this thing off quicker though.

|

|

|

|

When you refinance do you have to jump through all the same hoops as when you originally get a mortgage or is it just a matter of signing forms and paying the bank their money? edit: i've owned 3 houses and never really had a reason to refiance until now. Got my mortgage in December 2018 and it's a 4.875/30 year

|

|

|

|

TheWevel posted:When you refinance do you have to jump through all the same hoops as when you originally get a mortgage or is it just a matter of signing forms and paying the bank their money?

|

|

|

|

TheWevel posted:When you refinance do you have to jump through all the same hoops as when you originally get a mortgage or is it just a matter of signing forms and paying the bank their money? Basically the same. You will probably have to have an appraisal, unless you had a very significant down payment. Proof of income. Lots of signatures. At your rate, I would do it in a heartbeat to a shorter term, the new payment will be close to what you pay now and you pay down principal very quickly.

|

|

|

|

Anyone have a link to a refinance calculator that conveniently shows total savings if you assume you continue to pay your current amount?

|

|

|

|

I've got a 4.5% 30-year loan currently and I've made huge improvements to my home since then so I think with a refi to 15 year I can drop PMI with a higher appraisal and get a better rate and come out about the same payment wise. Plus I got a pretty good Better.com AMEX offer that gives me some cash back essentially if I go with Better.

|

|

|

|

WithoutTheFezOn posted:Anyone have a link to a refinance calculator that conveniently shows total savings if you assume you continue to pay your current amount? Nerd wallet is what Iíve been using.

|

|

|

|

Residency Evil posted:Nerd wallet is what Iíve been using.

|

|

|

|

WithoutTheFezOn posted:Yeah but doesn’t that one just factor in “cash savings” from reduced payments? I’m wondering what those numbers are if you take that cash and put it down to extra principal. Loan Amortization schedule is the name of that excel template if you have that. I think bankrate has a good one online too.

|

|

|

|

How many points are y'all using to get sub-3 rates? I've got perfect credit and I'm not getting anything below 3.5% without points.

|

|

|

|

TheWevel posted:When you refinance do you have to jump through all the same hoops as when you originally get a mortgage or is it just a matter of signing forms and paying the bank their money? One of the key differences with a refi is you don't have a second party with a fixed date on which you are required to close. So if there's some delay with the bank or whoever needing another goddamn form you probably already sent them, at least that doesn't threaten to torpedo the entire affair. You just shrug and go, welp, guess we're closing this refi a couple days later. As long as your rate is locked in, this could change the calculations of various fees (like you pay interest for the remainder of the month so with fewer days left in the month that amount could go down) but that's just shuffling money between piles, it's not actually costing you much. Just not having that looming date makes the process less stressful, I feel.

|

|

|

|

Leperflesh posted:One of the key differences with a refi is you don't have a second party with a fixed date on which you are required to close. [words] Yes -- for our purchase we went with something where we knew things would be smooth, and with good service, and a good rate. Need to ensure a smooth closing. But if rates crater the next couple of months we could refi and at that point I'll just do whatever gets the 100% best deal because, screw it, there's no rush and I don't have to sign.

|

|

|

|

SpartanIvy posted:How many points are y'all using to get sub-3 rates? I've got perfect credit and I'm not getting anything below 3.5% without points. Sometimes the lowest rates are dependent on certain locations, loan amounts, etc.

|

|

|

|

For what it's worth I contacted my lender and refinanced with them as it saved on some of the fees and hassle of transferring a loan.

|

|

|

|

SpartanIvy posted:How many points are y'all using to get sub-3 rates? I've got perfect credit and I'm not getting anything below 3.5% without points. I'm not refinancing, but got a new mortgage in sep at 3.375, no points. Don't know why, perhaps just a local credit union being cool?

|

|

|

|

Hit up my broker today and he says he can get me a 15-year note for $198k @ 2.625 with no points tomorrow morning so we're gonna jump on that poo poo immediately. This will be our third refi, but we're moving down to a 15 year (currently have I think ~24 years left on a 30-year) and our payments are only going up a couple hundo a month. I'll get the costs tomorrow and make a final decision but gosh that sure sounds good. He said we have so much equity that he can probably get us an appraisal waiver which will cut the cost a bit more.

|

|

|

|

Anyone have experience with trees? There's a tree on my property that was damaged by a recent storm and is beginning to fall over on to the wires between the telephone poles (the ones that go from pole to pole). I called our electrical company, who came out and clipped the portion of the tree that was in danger of knocking out the electrical wires on the pole, however said that the poles technically belonged to Verizon, and it was their responsibility to remove the tree. I called Verizon who's coming to take a look, but has anyone had the joy of mediating something like this? The bonus is that if the tree falls, it also knocks over part of our neighbor's fence!

|

|

|

|

Leperflesh posted:Hit up my broker today and he says he can get me a 15-year note for $198k @ 2.625 with no points tomorrow morning so we're gonna jump on that poo poo immediately. This will be our third refi, but we're moving down to a 15 year (currently have I think ~24 years left on a 30-year) and our payments are only going up a couple hundo a month. I'll get the costs tomorrow and make a final decision but gosh that sure sounds good. He said we have so much equity that he can probably get us an appraisal waiver which will cut the cost a bit more. Thatís insane. Currently trying to lock in a 3 or lower myself but I havenít seen them that low. How do you have so much equity? Extra payments?

|

|

|

|

I had a tree I needed to cut down that hung over my neighbors power lines and I solved that problem with a heavy duty ratchet strap. Attach the ratchet to a high point on the tree and the other end to something heavy in the direction you want it to fall. Ratchet it up real tight and cut a little of the base of the tree out with your chainsaw. As it starts to flex and fa in the direction of the ratchet, keep ratcheting it more taught, and continue taking cuts of the trunk out. After some progress is made, take a cut off the backside of the trunk too to help thin out the connecting wood. It worked out well for me and I was able to get the tree to fall over my yard and in-between two other trees I had.

|

|

|

|

Verizon will do nothing to the tree: it's on your property, you own it and thus it's your responsibility. If they own the pole then they'll take care of the pole but it's generally on you to call a tree surgeon.

|

|

|

|

I have 8 years left on a 15-year 3% mortgage, from the last time interest rates cratered. I kinda feel like there's not a lot to be gained by refinancing, beyond of course that payments get lowered if I extend the term of the mortgage. Am I wrong?

|

|

|

|

Based on news/hysteria and the prodding in another thread I am now looking at refinancing as well. Current payment with tax/escrow is $1370 a month. Potentially dropping my payments down a $100 a month and like $40K over the course of my loan! Would also make my mortgage a lower interest rate than even student loans for the wife so we could start tackling those next.

|

|

|

|

AndrewP posted:Thatís insane. Currently trying to lock in a 3 or lower myself but I havenít seen them that low. I bought a house in the san francisco bay area (outskirts) in December, 2009. The house next door just sold in January for more than double what I paid for mine back then. I put 5% down with an FHA mortgage and got the $8k cash the government was giving away, refinanced the next year to get a lower rate, refinanced two or three years later to get rid of the mortgage insurance (but also got a slightly higher rate), and this will be my third refi but we're both droppign the rate and reducing the remaining term of the mortgage significantly. This morning I'm locked in at 2.625% for $198k, estimated costs of around $3500, my broker is giving me $410 credit back towards closing costs, and if we get that appraisal waiver that should knock another ~$500 off the cost. My payments will go up a little, but that's moving from a 30-year at 4.375% with around 23 years left to a 15-year, so I haven't done the math yet but I think I hit my breakeven pretty quickly. And our incomes have risen significantly since we bought ten years ago, so it's still a very comfortable payment, and far lower than renting even a lovely apartment around here would cost these days. Factor in maintenance and taxes and insurance and it's still approximately what it costs around here to rent like a 2br apt. So basically we built equity by being lucky, not smart. I don't suggest others do what we did, but we were in a position to take the risk.

|

|

|

|

kw0134 posted:Verizon will do nothing to the tree: it's on your property, you own it and thus it's your responsibility. If they own the pole then they'll take care of the pole but it's generally on you to call a tree surgeon. Interesting. The electricity people said because itís a line that goes from pole to pole (and not pole to house), itís the responsibility of the utility company?

|

|

|

|

Residency Evil posted:Interesting. The electricity people said because itís a line that goes from pole to pole (and not pole to house), itís the responsibility of the utility company? The line is their responsibility, sure. It's your responsibility to not drop your tree on it.

|

|

|

|

Leperflesh posted:The line is their responsibility, sure. It's your responsibility to not drop your tree on it. I guess the way the guy explained it, theyíre responsible for taking down the tree (if necessary), we may be responsible for cleanup.

|

|

|

|

|

| # ? May 16, 2024 12:22 |

|

There was someone near me who called the utility to try and get them to trim a tree for him for free and they found it was too close to the line so chopped it completely down. While out there they also discovered that all the neighborhoods trees planted 20+ years ago to act as a sound break from the road had also grown too close to the power lines and chopped all of those down too. So be careful.

|

|

|