|

pmchem posted:I don't get it, is he not allowed to learn from his mistakes? The advice he is giving is to try to time the market

|

|

|

|

|

| # ? May 29, 2024 17:27 |

|

pmchem posted:I don't get it, is he not allowed to learn from his mistakes? You should read the (six?) zaurg threads and let us know if you still feel that way. There is overwhelming evidence that this person cannot learn from mistakes.

|

|

|

|

Alchenar posted:The advice he is giving is to try to time the market but, what he's discussing -- rebalancing his assets to buy stocks while the market is cheaper -- is exactly what target date funds do?? Like, if you owned a target date fund, that's precisely what they did in march of 2020, bought the dip. CubicalSucrose posted:You should read the (six?) zaurg threads and let us know if you still feel that way. There is overwhelming evidence that this person cannot learn from mistakes. ok, I haven't read those.

|

|

|

|

How much emergency cash should I keep in the regular bank when dumping the rest into my new IRA? I'm trying to make up for at least a little bit of my lost time by maxing out last year's contributions as well as this year's, but doing that now will require me to clean out my current cash savings almost completely and then continuing to contribute 15% of my pre-tax income, so refilling the simple savings account on top of that may be slow.

|

|

|

|

I have now gotten my first interest payment from HM Bradley at 3% so I'm pretty happy. It's pretty nice to be getting almost $50 bucks each month in interest with 18,500 in the account.

|

|

|

|

|

pmchem posted:I don't get it, is he not allowed to learn from his mistakes? everyone is allowed to learn from their mistakes except zaurg

|

|

|

|

Any reason not to use the fidelity freedom index target retirement funds for my partners Roth ira? Fipfx

|

|

|

|

moana posted:US has had a good run. At some point it won't. If we do a Japan and you're all domestic you're totally hosed. The fact that it's done better recently is actually a decent reason not to invest entirely in US- it's over valued due to the recent high growth. I think the Vanguard white paper predicted the next 10 years of intl coming out ahead by a few percentage points. Hmmmm. Iíve got something like 22% of my stock funds in VTIAX rather than VTSAX. Maybe I should rebalance that a bit...but I still feel like intuitively, I should leave it alone. Guess itís a matter of betting against the US vs not-US, and I certainly donít have any love for it. Pollyanna fucked around with this message at 16:41 on Feb 2, 2021 |

|

|

pmchem posted:but, what he's discussing -- rebalancing his assets to buy stocks while the market is cheaper -- is exactly what target date funds do?? Like, if you owned a target date fund, that's precisely what they did in march of 2020, bought the dip. You're in for a treat

|

|

|

|

|

Pollyanna posted:Hmmmm. Iíve got something like 22% of my stock funds in VTIAX rather than VTSAX. Maybe I should rebalance that a bit...but I still feel like intuitively, I should leave it alone. Yeah, the question on betting against the US when you live in the US, is that if the US goes to poo poo, well, those funds will still help but we may have other worries. I get the doomsayers on the United States , and Iím agreeing that poo poo is hosed up every day. That said, in terms of this thread , Iím still going to keep building my retirement , if the US went to poo poo I think it would still take longer than people think, and either way at that point I have bigger problems than my stock portfolio dropping. I re balanced my retirement recently , and I think Iím like, 70% US (small and large cap, etc), 30% International , which for me feels right. In any apocalypse movie, I am the weak character that is picked off in the first 5 minutes, so I figure Iíll just bank hard on retirement since I wouldnít survive a revolution anyway.

|

|

|

|

People have been pointing out an imminent collapse of US/US financial hegemony since before the Civil War and theyíre constantly wrong. Frustratingly so, Iíd imagine. American finance was probably most likely to collapse before/during the Civil War but it didnít. The Great Depression, coupled with by far the most inept government response to economic ruin the US had ever seen, didnít destroy the US either since the US financial system tends to also destroy everything everywhere when it gets hosed over. Itís like trying to time the market: donít. The reasons to invest in foreign markets isnít to hedge against the US as a country, itís to capitalize on systemic factors in foreign securities markets endemic to those markets (especially in ways it might out-perform US counterparts). Things like subsidies, tax rates, etc. They will enable you to diversify among the various US-aligned securities markets and enable a smoothing of returns in the event that one market booms or busts. But in the event of US collapse youíre hosed. The Great Depression, for example, was a global event started primarily in the US. Betting against the US or any country within the financial tools available to John Everyman is really, really dumb. If you want to bet against the US, investing in our major trade partners is a bad idea. What youíd want to do is have a significant bank of non-invested assets (because US collapse is worldwide collapse) and also be invested in systems completely removed from reliance on the US financial system (good luck), such as through a foreign broker that wouldnít be beholden to US intervention. And even then, your assetsí value would take a significant blow since the world is in financial ruin. Just diversify among all available securities markets according to your own personal preferences or of the securitiesí values, not of speculation at the fate of governments or whatever. I mean, you can do that and people do that, but it rarely if ever works out. Tl;dr: Increasing international exposure isnít designed to hedge against the US falling apart or waning, itís designed to allow you to lean towards higher growth potential in foreign markets since they might not be as matured as the US or might be more spendthrift on subsidies/monetary policy that enable it to do something the US isnít or canít. If the US implodes, finance and capitalism implodes.

|

|

|

|

jokes posted:Tl;dr: Increasing international exposure isnít designed to hedge against the US falling apart or waning, itís designed to allow you to lean towards higher growth potential in foreign markets since they might not be as matured as the US or might be more spendthrift on subsidies/monetary policy that enable it to do something the US isnít or canít. If the US implodes, finance and capitalism implodes. I don't think the concern is implosion. We (new people) are worried about a slow decline. Nobody looking to start their IRA is expecting imminent financial doomsday. But people see that headline about international investment shifting to china for the first time in ever this year and are concerned about what that might mean in the long term. We're taking a long view here, and when you have an unprecedented thing, it's not completely irrational to wonder if maybe that historical precedent that you're pointing to of the US inextricably being global finance and thus our best investment won't hold true forever.

|

|

|

|

Thatís fair. I mean itís always worth considering, but slow declines historically rely on a huge dereliction of duty and I donít think any major political force in America has ever been anti-business. Even todayís most anti-business major political force is advocating for an even stronger economy that would produce sustainably increased overall economic output at the expense of the small elite. Itís kind of a no-lose situation from my perspective, but I realize that I tend to be fervently pro-US when I talk about finance. I guess I should say Iím also invested 90% in domestic securities (except for all this uninvested cash Iím DCAing), for the reasons Iíve laid out.

|

|

|

|

I suppose it's possible, though I think unlikely for a few demographic reasons at least, that you get a Japan-style lost decade(s). I think the US is unlikely to enter in to a zero-economic-growth environment due to a number of factors including a generally pro-business government, fairly strong higher education/innovation, reasonably expansive demographics (assuming no immigration restrictions) and abundant natural resources.

|

|

|

|

KYOON GRIFFEY JR posted:I suppose it's possible, though I think unlikely for a few demographic reasons at least, that you get a Japan-style lost decade(s). I think the US is unlikely to enter in to a zero-economic-growth environment due to a number of factors including a generally pro-business government, fairly strong higher education/innovation, reasonably expansive demographics (assuming no immigration restrictions) and abundant natural resources. Natural resources alone is such a huge leg up on Japan which kinda throws comparisons between the two out of the window. Well, I mean, not that I wouldn't like to see a suppression of debt-based nonsense in the US but that won't happen.

|

|

|

|

jokes posted:People have been pointing out an imminent collapse of US/US financial hegemony since before the Civil War and theyíre constantly wrong. Frustratingly so, Iíd imagine. Two of those major crisis are juxtaposed by Europe deciding to kill a few million people, sink everyone's merchant shipping, and level half the infrastructure on the continent. There's a bit of a comparative advantage in being over to overcome those obstacles. e: I mean I'm longterm betting on the US, but the current context of handling a strategic competitor in the form of China is different from other challenges the US has faced in the past. Economically Russia was always Belgium-with-nukes. China is a genuine economic superpower. Alchenar fucked around with this message at 18:18 on Feb 2, 2021 |

|

|

|

Unsinkabear posted:How much emergency cash should I keep in the regular bank when dumping the rest into my new IRA? I would go with whatever you are comfortable with. I keep 6 months in cash at Ally that I could probably stretch to 9 or 12 if I had to. Personally I wouldn't go less than 6 months but you could be good with less. I wouldn't go below 3 months personally.

|

|

|

|

Alchenar posted:Two of those major crisis are juxtaposed by Europe deciding to kill a few million people, sink everyone's merchant shipping, and level half the infrastructure on the continent. There's a bit of a comparative advantage in being over to overcome those obstacles. I mean there's a billion factors but pre-eminent among them is that the factors that led to China's rise are definitely not sticking around long-term: labor is losing value over the long term. Between automation and exponentially increasing competition in a globalized labor market, it's not a great time for them. I mean, the US has a handful of companies who, together, account for GDP in excess of most other countries in the world. I mean, FAANG alone.

|

|

|

|

Why do some 401(k) plans/providers allow after-tax contributions, but not all? I imagine they would want as much of my money as they can get, but they choose not to sometimes?

|

|

|

|

Roumba posted:Why do some 401(k) plans/providers allow after-tax contributions, but not all? I imagine they would want as much of my money as they can get, but they choose not to sometimes? I think it's something the providers charge the plan sponsors (the company) for, so it's just a matter of whether they want to pony up the extra cash to have it included. If you're a company with everyone making ~$50k a year it might not be worth it since very few people would max out the pre-tax/roth contributions anyway

|

|

|

|

spwrozek posted:I wouldn't go below 3 months personally. Thanks for the answer on this, but also... poo poo. That's going to make this tricky. ~3 months would be most of what I have currently (this is my first year where I've had leftover income of any substance to save), so if I keep that much that liquid and still want to max out last year I'll be trying to come up with like $4k extra before 04/15.

|

|

|

|

Roumba posted:Why do some 401(k) plans/providers allow after-tax contributions, but not all? I imagine they would want as much of my money as they can get, but they choose not to sometimes? I believe it's a fairly recent option, and it's not offered by default in a lot of plan prototypes. Also, by allowing contributions beyond the $19,500, you open yourself up to "means-testing" problems (where you may have a problem if the plan too heavily offers highly compensated employees.)

|

|

|

|

Small White Dragon posted:I believe it's a fairly recent option, and it's not offered by default in a lot of plan prototypes. Also, by allowing contributions beyond the $19,500, you open yourself up to "means-testing" problems (where you may have a problem if the plan too heavily offers highly compensated employees.) A few of us asked about this at work and that was the answer that we got. Kind of seemed unlikely at a 12,000 person company but what do I know.

|

|

|

|

pmchem posted:I don't get it, is he not allowed to learn from his mistakes? Zaurg doesn't learn from anything. He's also forum-banned from BFC as a result of a decade of bad posting.

|

|

|

|

Sundae posted:Zaurg doesn't learn from anything. He's also forum-banned from BFC as a result of a decade of bad posting. I couldnít find this recorded in the BFC rules Thread and thus wasnít sure whether it was still current. I am glad this is still a smoothbrain-free space.

|

|

|

|

spwrozek posted:A few of us asked about this at work and that was the answer that we got. Kind of seemed unlikely at a 12,000 person company but what do I know. Your company's probably correct. What will happen is that HCEs will push post-tax dollars in to the 401(k) and gently caress up your ACP ratios. It's percentage based on populations, not absolute $. HCE's average actual contribution percentages can't be higher than the greater of: a) 125% of NHCE average actual contribution percentages b) or the lesser of 200% of NHCE average actuals, or NHCE ADP% + 2% Kind of confusing but basically what this means that if your NHCE's contribute very small percentages, you aren't restricting HCEs to similarly small percentages. If you have say, a match up to 5% of salary, let's assume (lol) your NHCEs are contributing up to the match, giving them an effective 10% ACP. This restricts your HCEs to 12.5% ACP. If your average HCE is making $200k, it means that your average HCE could not fully fund the 401(k) and receive the full match (9.75% deferral, +5% match) and to meet nondiscrimination tests you're reliant on HCEs being bad with money. If you add post tax dollar contributions in to this, HCEs can contribute large amounts to the 401(k) and further gently caress up your ACP.

|

|

|

|

That makes a lot of sense. The first HR person we talked to didn't even know that post tax contributions were a thing (that's why we are a bit skeptical) but when you lay it out like that makes sense.

|

|

|

|

It's backdoor Roth day! And for the first year I'm finally caught up with needing to fund prior years. It was only two years ago where I finally started making enough money to consider maxing out my retirement accounts, so I'm a little behind on even having a Roth, but this year I only needed to fund 2021 and not 2020, so I feel like I'm finally caught up in that regard and feels goodman.

|

|

|

|

Unsinkabear posted:How much emergency cash should I keep in the regular bank when dumping the rest into my new IRA? My e-fund would hold me for a year, maybe 16 months if I reaaaaly stretch it out. I'm constantly going back and forth between too much and not enough, which probably means it's the right amount. I was painfully unemployed and underemployed several times in my life, and a year of savings is a response to that. But I also grew it to that size over several years while still investing. It also depends on how hard it would be for you to bounce back from an emergency - how employable you are, what your safety nets look like, etc.

|

|

|

|

Itís just meant to tide you over during a down market, so I just went for 4ish months (but also have an easy time finding a new job, which is a luxury position)

|

|

|

|

I think I want to finally move away from a Vanguard Target Date fund to ...well basically the underlying funds that make it up to save money on the expense ratios. I can see the exchange vanguard option which is how I guess I'd do the initial change, but I am wondering 1) is there any downside to making the change away from a fund I've been using for the lifespan of the account? like fees or something? 2) How easy is it to rebalance down the line? 3) How often do people actually do a rebalance of their account? I think I'll be going with a 3 fund blend and not doing the international bond. Final decision will be US vs International percentages. I was kind of shocked to see 36% international in the target date fund.

|

|

|

|

1) There isn't any downside to changing funds provided this is in some tax advantaged space like an IRA, 401(k), 403(b), etc. If it's in taxable space, you will owe LTCG on any gains. 2) Rebalancing is easy. Most people, myself included, do the rebalancing based on contributions - so you weight your purchases differently based on the current makeup of your portfolio. Say you have 90% stocks and 10% bonds, but you want 20% bonds and 80% stocks. When you make your next contribution or purchase, maybe you buy a 50/50 instead of the 90/10 split to bring you back to an overall 80/20 ratio. 3) roughly annually I check my 401(k) allocation and move some percentages around for future buys. I wouldn't bother doing it more often than annually. My IRA is in target date because I'm lazy and seven bps or whatever isn't worth it to me.

|

|

|

|

Happiness Commando posted:My e-fund would hold me for a year, maybe 16 months if I reaaaaly stretch it out. I'm constantly going back and forth between too much and not enough, which probably means it's the right amount. I keep a year with no stretch as well but I'm a child of "graduated with a BA in 2009" so I'm paranoid and debt averse.

|

|

|

|

Unsinkabear posted:Thanks for the answer on this, but also... poo poo. That's going to make this tricky. If you want to be someone who is good at managing money it's not tricky at all. 3 months is a bare minimum emergency fund and is a lot more important in the immediate and mid term than investing.

|

|

|

|

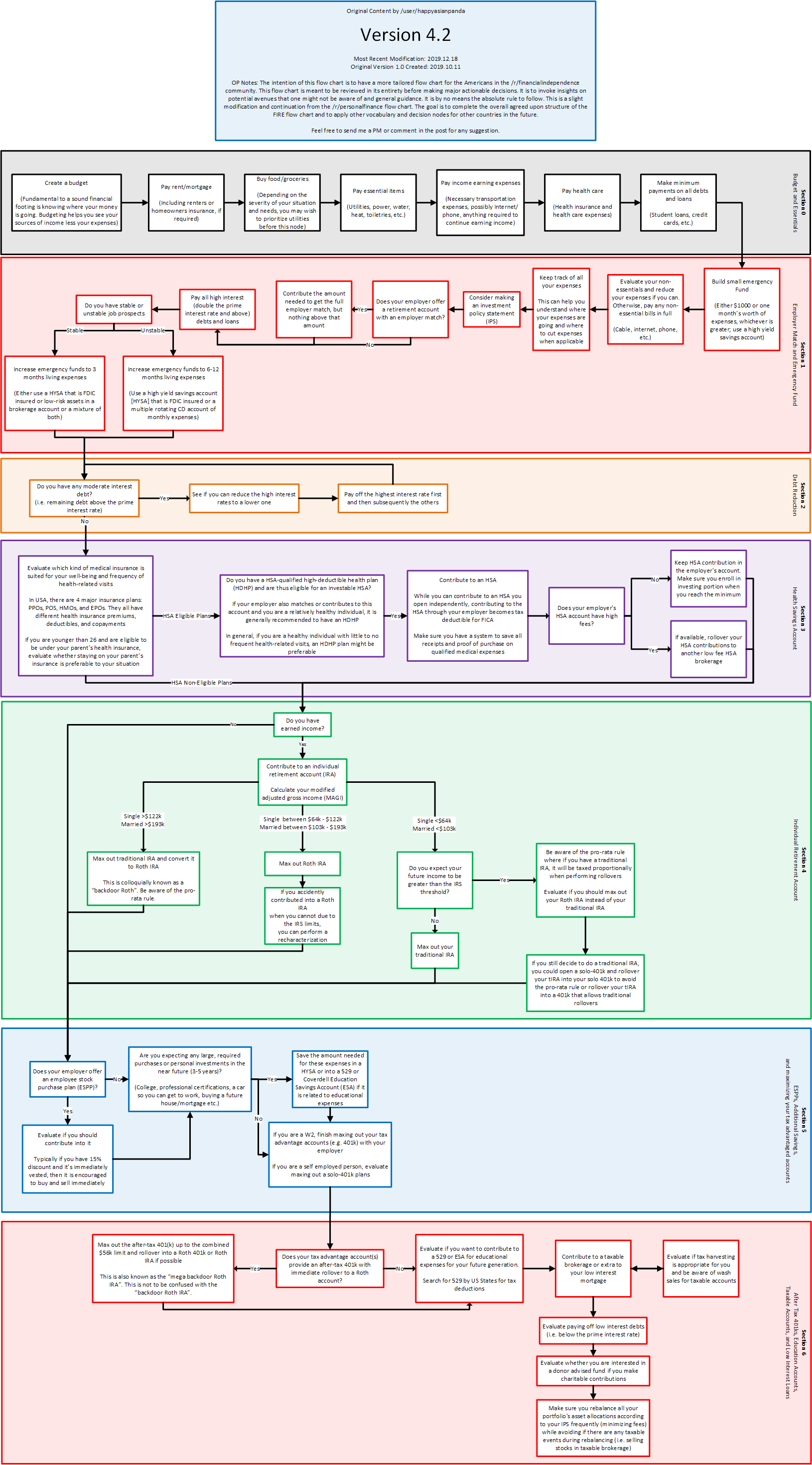

Weíve linked the flowchart, right? Follow that.

|

|

|

|

Pollyanna posted:We’ve linked the flowchart, right? Follow that. pmchem posted:https://www.reddit.com/r/financialindependence/comments/ecn2hk/fire_flow_chart_version_42/ I normally see the /r/personalfinance one linked, but itt all I see from the last few months is this FI/RE variant. My income doesn't at all allow for early retirement as a realistic option and I don't see that changing anytime soon, is this still the one I should be looking at?

|

|

|

|

Unsinkabear posted:I normally see the /r/personalfinance one linked, but itt all I see from the last few months is this FI/RE variant. My income doesn't at all allow for early retirement as a realistic option and I don't see that changing anytime soon, is this still the one I should be looking at? pmchem posted:not sure what to do with cash? maybe check this out from /r/personalfinance,

|

|

|

|

I work for a small business with no 401k. I max my Roth. I have just been putting retirement savings into index funds in a personal investor account, never sold a penny of it. Is there a better (tax advantaged) way to handle long term savings?

|

|

|

|

Unsinkabear posted:I normally see the /r/personalfinance one linked, but itt all I see from the last few months is this FI/RE variant. My income doesn't at all allow for early retirement as a realistic option and I don't see that changing anytime soon, is this still the one I should be looking at? I don't think there's any harm in going through the more detailed one, unless it looks too overwhelming and you won't actually do anything because of that.

|

|

|

|

|

| # ? May 29, 2024 17:27 |

|

The two flow charts are pretty similar until you get to the "congrats you have extra money" phase toward the bottom after filling out your retirement accounts. Which makes sense because there's really not a ton of objective difference in approaches until that point.

|

|

|