|

Randalor posted:So is Pence actively trying to get the lowest amount of votes in history? Because I'm pretty sure almost every one of those points will drive away a large chunk of people. He may be trying to beat ¡Jeb!'s all time high score of $5k per vote received in Iowa. Always wondered how he would have done if he just gave every Iowan registered voter $5k and asked them nicely to "please vote"

|

|

|

|

|

| # ? May 25, 2024 18:13 |

|

Failed Imagineer posted:He may be trying to beat ¡Jeb!'s all time high score of $5k per vote received in Iowa. I'm pretty sure Pence is not going to have anywhere near the amount of money that Jeb did. If he spent his entire campaign budget bribing Iowans right now, then he would only be able to give each of them a little over $7. So, even in the category of "embarrassing record-setting," Pence likely isn't going to do anything memorable.

|

|

|

|

Move over Jeb!, it's Pence! Is there some kind of financial reason for him to run or are a lot of staffers or w/e encouraging him for a paycheck?

|

|

|

|

Main Paineframe posted:Honestly, so what? That's politics. Nobody plays nice, and if your strategy requires your opponents to play nice, then it's a fantasy. There's no point in pissing and moaning about it. Lol. It's ok to cheat third parties from ever being able to mount a credible threat because if they were really good, then both major parties running an endless interference campaign wouldn't be able to stick.

|

|

|

|

the_steve posted:Lol. It's not okay, but it happens. Start cheating yourself. Or try a new approach.

|

|

|

|

the_steve posted:Lol. It's also incredibly ahistorical - most successful political movements have either involved some level of cooperation or negligence from the ruling parties in regards to their growth and empowerment. Mass public support requires time and fertile ground and space to grow in a way that enables alternative power structures to progress with minimal disruption. The US has developed a very effective multi-pronged method for disrupting nascent political movements, so the only ones you're like to see show up are ones astroturfed by the main parties but eventually break their chains, and that's more of something the Republicans do than the Dems.

|

|

|

|

Even if the Republican party did the morally correct thing and repeatedly, consistently condemned Trump in the strongest terms possible, it probably still wouldn't work because you can't simply kick someone out of a primary (as far as I know) so he would just use that resentment as fuel to win the primary anyway. I guess they could still deny him the nomination, but they'd obviously lose a crapload of voters and the election as a whole. They aren't going to be rid of him until he's dead. Or *shudder* completes a second term I guess, but even then he'll probably keep running anyway on a platform of "no more term limits" because why would that stop him? Regardless of whether he could actually be inaugurated.

|

|

|

|

Leon Trotsky 2012 posted:I'm pretty sure Pence is not going to have anywhere near the amount of money that Jeb did. If he spent his entire campaign budget bribing Iowans right now, then he would only be able to give each of them a little over $7. For sure. It's not impossible that as DeSantis farts his way out of contention the anti-Trump GOP money coalesces around Pence, but I don't realistically see his warchest ever being that impressive

|

|

|

|

Failed Imagineer posted:For sure. It's not impossible that as DeSantis farts his way out of contention the anti-Trump GOP money coalesces around Pence, but I don't realistically see his warchest ever being that impressive I give a hearty "lol" at money that tries to coalesce around Pence. Trump will roll him up and smoke him like a cheap cigar. Then probably have another crazed lunatic fascist assassinate him at CPAC or something that couldn't even be predicted right now.

|

|

|

|

bird food bathtub posted:I give a hearty "lol" at money that tries to coalesce around Pence. Trump will roll him up and smoke him like a cheap cigar. Then probably have another crazed lunatic fascist assassinate him at CPAC or something that couldn't even be predicted right now. "I could shoot Mike Pence on this stage and still win the primary. Watch!"

|

|

|

|

Executing your cuck opponent on stage is the new method of winning Republican primaries.

|

|

|

|

God told Mike Pence to run for President because He thinks it'll be funny and He's right.

|

|

|

|

I think that to some degree, each R competitor is setting up in case something happens that causes Trump to become nonviable- or to become his running mate.

|

|

|

|

The IRS has finished building the demo of the new free direct e-filing service for taxes that was mandated in the IRA. The IRA only mandated that a service be built, tested in a pilot program, and that the IRS produce a report on costs and potential challenges for implementation. Congress still needs to take an actual vote to make this a permanent feature for everyone. Some taxpayers will be selected in January 2024 to be part of the initial pilot program and have access to the new free IRS direct e-file software and customer service portal. The full report on the cost, timeline for full implementation, and recommendations on implementing a universal direct free filing system will be released later this week (no specific date, but either Thursday or Friday). The free filing system will include secure portals that users can log in to and chat with IRS customer service representatives for assistance in filing out forms or any questions they may have. Intuit has announced that they are opposed to such a system and that "a direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem" that will cost taxpayers billions. Even some people in favor of the system have worries that the $80 billion in IRS funding set aside in the IRA could be cut sometime in the next few years and if they start this project, that could leave them wasting millions of dollars and being unable to finish it. However, others say it would save time and a large percentage of the $14.4 billion collectively spent on tax prep each year for the nearly 70% of Americans who would qualify for the free filing system who currently pay to have someone else review or file their taxes. https://twitter.com/washingtonpost/status/1658480857043320844 quote:IRS tests free e-filing system that could compete with tax-prep giants

|

|

|

|

I hope the e-file pilot goes well; there are a lot of jagged edges such a setup could get caught up on, and it's going to be held to a higher standard than the notoriously lovely commercial products.

|

|

|

|

Wait didn't God tell Pence he was going to be president some day or am I mixing up christofascist pols?

|

|

|

|

the_steve posted:Lol. Credible threat? The Green Party has never won a single electoral vote, and the largest portion of the popular vote it ever got was 2.7%, which happened more than two decades ago. They currently have zero presence above the level of local politics, and only rarely even make an impact on state politics, let alone federal. It doesn't matter whether it's third parties or an insurgent faction within the party or anything else. If you're challenging an established political force, you should expect that established political force to fight back. Whining about how your political opponents are opposing your political movement is beyond naive. Of course, it's a different story if they're breaking laws or engaging in violence (though I can't think of many successful leftist movements that didn't have to overcome at least one of those things). But when your list of complaints are things like "the Dems might pretend to adopt parts of our campaign platform", you're not gonna win very much sympathy. If the Dems say that they're more electable than the Greens, they're not cheating the Greens out of the election, they're flaunting their track record of winning elections.

|

|

|

|

God tells a lot of people they're going to be president, he's just a prankster like that

|

|

|

|

Morrow posted:God told Mike Pence to run for President because He thinks it'll be funny and He's right. Yes and if he does not win God taught him a lesson in humility. Aren't God's lessons beautiful?

|

|

|

|

DarkCrawler posted:Yes and if he does not win God taught him a lesson in humility. Aren't God's lessons beautiful? Reminds me of an older SNL skit where they're interviewing some sports guys after a game and they're both praising Jesus. Except the loser keeps saying things like "yeah Jesus really dropped the ball on that one".

|

|

|

|

Leon Trotsky 2012 posted:Intuit has announced that they are opposed to such a system and that "a direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem" that will cost taxpayers billions. Intuit should be shot into the loving sun. "Oh no it will cost the taxpayers billions, unlike the billions it costs tax payers to buy our software and services." Fuckin' freeloading corporation.

|

|

|

|

Job was pranked by the Lord. Jonah went inside a large mammal for the Lord. Mike Pence outdid them both. Also why is taxes in the US so pants on head stupid Blew my mind come canadian tax season

|

|

|

|

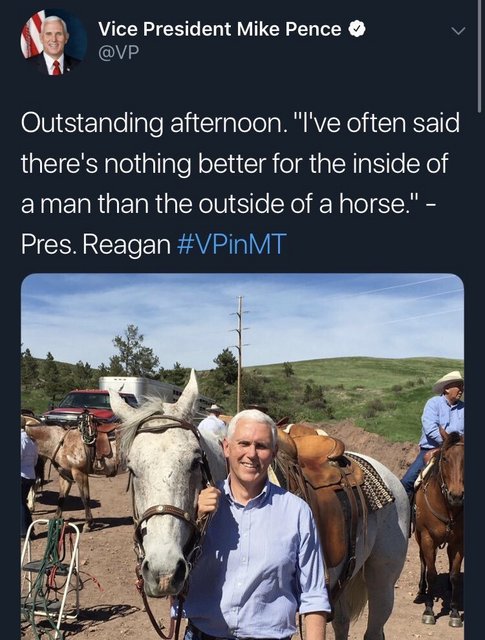

Leon Trotsky 2012 posted:

lmao It's really funny how "wasting taxpayer money" is something that only happens when the government spends money it already has to provide its citizens with free goods or services, and not when a company sets itself up as a middleman and charges money for something that should be free.

|

|

|

|

Edgar Allen Ho posted:Job was pranked by the Lord.

|

|

|

|

I'm my own man. Ok, well will call the man who tried to kill you bad? well, now wait a second there.

|

|

|

|

Still seems nuts to a non-American that you guys all have to file your own taxes instead of that burden being on your employers, but I guess not being gouged for the right to do the busywork is a step forward

|

|

|

|

Bird in a Blender posted:I get where you're coming from, but if we go back to the government shutdown of 2013 (which I know is not the same as what we're talking about now), the public generally blamed Republicans for it, even though Obama was president. So we do have some history of the public looking beyond just who the president is. I think Dems can possibly control the narrative enough that more people blame Republicans for a default. I'd rather not get to that point though. Yes but that was a government shutdown. Not a debt default. The vast majority of people weren't affected by the shutdown and it's not like it resulted in a massive recession and major job losses like a default would. So basically the only people that were even aware of it were those people who are at least a little plugged into politics news, hence why the blame was correctly placed on the Republicans. But average folks probably didn't even know there was a government shutdown. If you want to compare a default and it's resulting economic impact to anything, the great recession is probably the best example. Obama will always get the blame for it because a lot of people lost their jobs and homes while he was president. Nevermind the fact that it started when Bush was in office and the worst of it happened when Obama was brand new and couldn't really do much to stop it. People don't know that. They just think "Bad thing happened to me. President X is in office. It's his fault." It's really that simple. Keep in mind I'm talking about the type of people who's main priority in life is watching American idol and Sunday sportsball. Not goons on the internet.

|

|

|

|

the_steve posted:Problem is, as soon as a third party would manage to make any sort of meaningful headway, their platform either gets co-opted by the Dems (Oh yeah, we actually believe in all of that stuff they're saying too despite all visible evidence to the contrary, and we're the most "electable!"), Or it will suddenly be against the rules to win an election while third party (Oh, we don't like the font on their paperwork, or we just decided to abolish the position we're about to lose.) If the platform gets co-opted, why is that a bad thing? Having two big parties seems to be somewhat inevitable in a winner takes all first past the post system. That means that they effectively become coalitions formed before the election. My understanding is that this is what happened to the Progressive party. In US history political parties have either replaced one of the two existing ones or been absorbed. If the thing happens, why does it matter if Democrats do it or not?

|

|

|

|

Gort posted:Still seems nuts to a non-American that you guys all have to file your own taxes instead of that burden being on your employers, but I guess not being gouged for the right to do the busywork is a step forward Especially given the IRS already knows everything that goes into the vast majority of tax filings for people who don’t have dedicated tax people on staff

|

|

|

|

intuit posted:Intuit has announced that they are opposed to such a system and that "a direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem" that will cost taxpayers billions. Eat my entire rear end

|

|

|

|

DeadlyMuffin posted:If the thing happens, why does it matter if Democrats do it or not? Because coopting the message in the primary doesn't necessarily lead to it actually happening after they've been elected.

|

|

|

|

Fister Roboto posted:Because coopting the message in the primary doesn't necessarily lead to it actually happening after they've been elected. No, it doesn't. But if they co-opt the message and turn around and say the opposite once in power, they can't really credibly continue to co-opt it either.

|

|

|

|

DeadlyMuffin posted:If the platform gets co-opted, why is that a bad thing? Because the Dems won't do it and will even actively kill attempts to do it, but they say the words in a platform or speech to get votes from people who think they will and siphon off popular energy.

|

|

|

|

Edgar Allen Ho posted:Especially given the IRS already knows everything that goes into the vast majority of tax filings for people who don’t have dedicated tax people on staff Yeah, but the U.S. tax system has hundreds and hundreds of credits, deductions, and exemptions. The IRS doesn't know how much you spent on your home office, how much out of pocket healthcare expenses you had, how much you spent on supplies for your classroom if you're a teacher, how many miles you drove, how much you spent on state and local sales taxes/property taxes, how much you spent on moving costs, etc. etc. Countries with just one single tax jurisdiction are a lot easier to have the government "know" everything in advance. The IRS could do a lot of people's taxes for them, but it wouldn't be able to do everyone and it would likely overcount what is owed for some people (which will drive some people insane). That is why there are always calls to "simplify the tax code" and "remove tax loopholes and deductions," but it turns out that people who pay student loans, are self-employed, work as teachers, have moving expenses, have high state and local taxes, have high healthcare expenses, have a service animal, etc. like those tax breaks and don't want them to go away. And you will be accused of raising taxes on seniors, sick people, student loan-havers, the disabled, small business owners, self-employed people, or anyone else. They should just give you a pre-filled out tax return based on your witholdings and income and then let you modify it with deductions, credits, and exemptions. But, the tax prep industry has lobbied against stuff like that and the IRS doesn't have a lot of money, so they do a cost-benefit analysis and say, "If they are already inputting all the deductions and stuff manually, then is it really worth allocating our limited effort and money to pre-fill out their return when they can just look at their W-2 and fill out 5 extra boxes on the form they are already filling in?"

|

|

|

|

The main "problem" is that the U.S. has the most progressive income tax code in the world by far because they love to do "spending" through the tax code, but not directly. So, simplifying the tax code, removing all the deductions and credits, and just lowering the rates for lower income people to make it simpler would have the effect of basically ending the "cash assistance programs" that go to self-employed people, people with kids, teachers, etc. And only about half of Americans even have any federal income tax burden at all. So, by removing those refundable tax credits for people who already pay little or no tax, then you are basically eliminating a cash transfer program with no replacement compensation for all the specific groups and people the deductions and credits apply to. It makes much more sense to just pay out benefits directly and take a larger chunk of the money through taxes initially because you can create an incredibly simple tax system that will let the government do basically all of it for you and still get your targeted benefits to the people you want to target/universal benefits to everyone. That would require a sort of fundamental rewrite of U.S. law, the tax code, and welfare program administration, so that is why "simply the tax code" laws that don't address anything else always end up dying.

|

|

|

|

cat botherer posted:Pence has large mammals go inside of him for the Lord. Clearly he's talking about consuming the horse whole. Just dislocating the jaw and swallowing it all, in the typical red-blooded reptilian style.

|

|

|

|

Mike Pence might be one of the most confusing people in modern politics. He spent four years being the most spineless rear end-licking doormat he could possibly be, then threw all of that rear end-licking out in one go when he suddenly grew a spine on January 6th, and has spent every moment since trying to pretend that he never grew the spine in the first place. He's now running one of the most perplexing campaigns I've ever seen or read about - he's running against a man who fingered him as a traitor and tried to have him killed but refuses to say a single harsh word about that man. As far as the Republican base goes, he's the singular figure responsible for the dethroning of their god king. They wanted to hang him. How on earth does he think he can appeal to them? He would be much more understandable if he had used January 6th to pivot to be a "neutral" talking head and pick up a paycheck like Michael Steele or Scarborough, but instead he's trying to pretend nothing ever happened. So strange.

|

|

|

|

Gort posted:Still seems nuts to a non-American that you guys all have to file your own taxes instead of that burden being on your employers, but I guess not being gouged for the right to do the busywork is a step forward employers do collect that information and send it directly to you. for most people filing taxes is pretty easy, you just transpose the data from your form (called a w-2) into turbotax or whatever. does not take very long. the problem is that it costs money to do this, and also the information is also sent to the IRS so they could process it for you without the middleman or cost. like leon said the simplest reform here would just be for the IRS to send everyone a completed tax return and then give people the ability to amend it if they want to deduct stuff.

|

|

|

|

Kanos posted:Mike Pence might be one of the most confusing people in modern politics. He spent four years being the most spineless rear end-licking doormat he could possibly be, then threw all of that rear end-licking out in one go when he suddenly grew a spine on January 6th, and has spent every moment since trying to pretend that he never grew the spine in the first place. He's now running one of the most perplexing campaigns I've ever seen or read about - he's running against a man who fingered him as a traitor and tried to have him killed but refuses to say a single harsh word about that man. As far as the Republican base goes, he's the singular figure responsible for the dethroning of their god king. They wanted to hang him. How on earth does he think he can appeal to them? I feel this way about all the GOP primary contestants but about DeSantis most of all because he was the only one who seemed like he might actually have a chance. If you’re not going to challenge or attack Trump in any way you have zero chance to win. Auditioning for VP I get, but otherwise the only apparent strategy is hope he dies has a stroke or winds up in jail ahead of or during primaries.

|

|

|

|

|

| # ? May 25, 2024 18:13 |

|

Zwabu posted:I feel this way about all the GOP primary contestants but about DeSantis most of all because he was the only one who seemed like he might actually have a chance. DeSantis I feel like I can understand more - he had intended to slide into place unopposed once Trump was out of the way, but all of his performative chud bullshit has brought Florida to the brink of collapse and he's trying to escape the state before it all comes crashing down on him, so he had to move up the timetable and is now in the incredibly awkward position of trying to pitch himself as Trump Part Two while Trump Part One is still available.

|

|

|