|

I agree, the government is at fault for the housing crisis, by not banning the practice of landlording.

|

|

|

|

|

| # ? Jun 8, 2024 06:30 |

|

Oakland Martini posted:renters who refuse to pay rent should be swiftly evicted Why?

|

|

|

|

qhat posted:Sounds like itís really difficult to pay for housing. We should probably fix that. Stop helping people spend beyond their means to buy unproductive assets, problem solved.

|

|

|

|

COPE 27 posted:I wonder why the people who can't afford a home aren't having kids 1st world countries without housing crisis has had sub-replacement fertility rate for decades even in Canada it's not something which only began in the last 5 yrs

|

|

|

|

Could a city like Toronto mandate that new buildings be co-ops, or would that fall under the purview of the province?

|

|

|

|

tagesschau posted:Stop helping people spend beyond their means to buy unproductive assets, problem solved. Letís say, for the sake of argument, I bought 100k worth of dividend paying ETFs. It pays 3%, or $3000, a year. Not bad! But Iím a greedy geezer and I want a lot more, so I take out a loan for a million bucks and get a nice $30k coupon each year, which is pretty much the cost of a 1 bedroom. Letís now say the ETF stops paying dividends suddenly. Well gosh, I donít really want to sell because the market is bad, but I have interest payments to make, and that was basically all of my savings, I think Iím somehow being hard done by, can I find any sympathy from anyone here? Anyone? No? What do you mean youíre laughing at my bad decisions? I think itís perfectly sane to laugh at someone who goes bankrupt for making a really stupid investment like that that relied on some cash flow that was never guaranteed. Apparently though, we have to find some sympathy for idiots that take out a HELOC to fund a mortgage to buy a rental property that stops paying rent after a couple years. Itís almost like leveraged investing has consequences when the market sours, and we should also be laughing at broke leveraged real estate investors, rather than giving them air time.

|

|

|

|

qhat posted:Letís say, for the sake of argument, I bought 100k worth of dividend paying ETFs. It pays 3%, or $3000, a year. Not bad! But Iím a greedy geezer and I want a lot more, so I take out a loan for a million bucks and get a nice $30k coupon each year, which is pretty much the cost of a 1 bedroom. The threads are melting together in my half awake state and I thought ďletís say, for the sake of argumentĒ meant you were doing a Ben Shapiro impression and that made this post extremely funny.

|

|

|

|

qhat posted:Letís say, for the sake of argument, I bought 100k worth of dividend paying ETFs. It pays 3%, or $3000, a year. Not bad! But Iím a greedy geezer and I want a lot more, so I take out a loan for a million bucks and get a nice $30k coupon each year, which is pretty much the cost of a 1 bedroom. There is a key difference here. When the ETFs stop paying dividends the richer entity (big companies) is taking from the poorer entity (you). Whereas, in the housing example the richer person (landlord, pbuh), is being not paid by the poorer person (sub-human renter). Hope that helps.

|

|

|

|

eXXon posted:Why? If mom and pop landlord are to exist let's at least do it in a way that protects everyone involved. melon cat fucked around with this message at 03:24 on Jan 29, 2024 |

|

|

|

qhat posted:I like to think what went through that landlordís head at that point is the realization that he didnít and never actually provided any value to these people other than the threat to kick them out if he wasnít paid his monthly tributes. The landlord provided the capital required to actually build the home the resident lived in, which is quite a bit of value I would think. Is your landlordless housing system fix just FULL COMMUNISM NOW the government builds all the housing or do you have a more elaborate idea here?

|

|

|

|

It would probably be good if we created a such a surplus of housing such that in weird disagreements between tenants and landlords that rose to the point of a tenant being evicted it wasn't an utterly existential threat to tenants lives and instead just a mild annoyance. But creating new housing is sadly just not possible.

|

|

|

|

a primate posted:Could a city like Toronto mandate that new buildings be co-ops, or would that fall under the purview of the province? Coops are basically enabled by relying on "free" land being rented long term, so the development of coops is only really possible when some organization decides that renting land for long terms for basically no yield is a good idea. As you would expect no one actually wants to do this, and so the only organizations that end up doing this are governments and so coops are effectively restricted to being developed in the limited lands that the government owns (they own less than you think). If the government mandated that new buildings had to be coops the most likely outcome would be that none of these new buildings would be viable to be created and so they wouldn't be, so it would in effect be the government restricting development of new housing. This would have terrible outcomes for renters as rental scarcity would continue to increase given a relatively fixed amount of housing stock combined with rapidly increasing population.

|

|

|

|

qhat posted:Letís say, for the sake of argument, I bought 100k worth of dividend paying ETFs. It pays 3%, or $3000, a year. Not bad! But Iím a greedy geezer and I want a lot more, so I take out a loan for a million bucks and get a nice $30k coupon each year, which is pretty much the cost of a 1 bedroom. I have no sympathy for landlords who are getting screwed by the current market conditions - it's a risky investment and they shouldn't have done it, the possibility of needing to evict a tenant is a risk they should have accounted for. I don't know why (yes I do it's greed) anyone would take the risk without being able to cover like 2 years of no income from the rental with whatever they've got set up for emergencies. I don't agree with the analogy though - a dividend paying ETF has language in it explaining when & how they'll pay out dividends generally, and in the majority of dividend paying ETF's I've seen, there's no guarantee a dividend will be paid - there's no language in there that requires them to issue a dividend. With a tenant, there's legal framework requiring them to pay rent - bit of a different case. I've got no issue with the LTB taking forever to actually evict anyone though - there should be a lot of steps / alternatives explored, with eviction as a last resort. Banks bend over backwards to work with mortgage holders specifically because foreclosure is a long, arduous, expensive procedure and they generally wind up in a worse position than renegotiating the mortgage. There's no reason renters shouldn't have the same protections / options before losing their home.

|

|

|

|

Femtosecond posted:The landlord provided the capital required to actually build the home the resident lived in, which is quite a bit of value I would think. No they didn't. The developer almost certainly borrowed money from a bank or other lender to finance construction and possibly the land cost too. The original buyer borrowed most if not all of the funds to buy the house, as did subsequent buyers. There is virtually limitless capital available to finance every stage and what you really mean is that each entity assumed some risk which our various governments have been working very hard to minimize, thereby driving up housing prices. As for the landlord question, I'm sure you know that there are plenty of intermediate alternatives besides abolishing private property because lots of people have posted them in this thread. As melon cat just said, why should property owners also be landlords? If landlords need to exist they should be a heavily regulated, licensed profession. Indeed you can also envision private ownership with an entirely public system of property management.

|

|

|

|

Femtosecond posted:The landlord provided the capital required to actually build the home the resident lived in, Good joke

|

|

|

|

TrueChaos posted:I have no sympathy for landlords who are getting screwed by the current market conditions - it's a risky investment and they shouldn't have done it, the possibility of needing to evict a tenant is a risk they should have accounted for. I don't know why (yes I do it's greed) anyone would take the risk without being able to cover like 2 years of no income from the rental with whatever they've got set up for emergencies. The point is that there's never a guarantee of receiving a cash flow. There's a legal framework yes, but that doesn't mean no risk, in fact there's no guarantee you'll even get your unpaid rent even if you're successful at the tribunal. I think we basically agree. Ultimately you're still relying on some money that may or may not be there, the fact that a minor blip such as not getting the rent for 6 months equates to going bankrupt is what makes the whole strategy outstandingly stupid, if not more stupid than levering up on stocks, and 100% deserves all the ridicule it does (or rather, should) receive. Having freedom to lever up like this and pull in an insane income relative to your assets in any situation, while also expecting help from the government/media when things go the other direction, is what's truly despicable. qhat fucked around with this message at 18:18 on Jun 14, 2023 |

|

|

|

melon cat posted:Not who you are replying to but many of the renter vs landlord problems you hear about would be solved if it ďmom and popĒ landlords were prohibited. It is completely insane to me than any Bob Dick and Jane with a HELOC can become a landlord, aka someone who wields a disproportionate amount of power over another working Canadiansí housing. Most ďmom and popĒ landlords donít have the professionalism, knowledge, or financial cushioning to deal with common tenant issues and it is loving wild to me that anyone can become a landlord without any additional certification, special insurance coverage, or tenant law expertise. Like what the gently caress. Lol technically in Vancouver you need a business license, which should be put up somewhere on the property, or at least shown to tenants. There are fines and everything. I have never actually seen one from a landlord. And just lol at the idea that tenants are going to be demanding them from prospective landlords, when the current advice for searching for housing includes "stand out from the pack by sending bank statements, credit reports, and your children's report cards".

|

|

|

|

Oakland Martini posted:Neither landlords nor renters should be able to get away with abusing their counterparts. Yes, some landlords absolutely do abuse their tenants and they should be punished severely for it, just as renters who refuse to pay rent should be swiftly evicted, but neither behavior excuses the other.* I think this kind of analysis is too superficial. Landlords and renters arenít abusing each other in a vacuum. They are doing it in the real world where their interests as individuals and classes have shaped the very same world. The same goes for the government and itís hand in the whole housing crisis. For many decades, homeowners and landlords have demanded that governments at all levels defend their interests. They have been quite successful and it has lead to a crushing housing crisis. In that context, Iím not fussed about renters scoring a win. I donít think the situation is good, either. It would be far superior if tenants who donít like their landlords could just leave for greener pastures or eviction wasnít life changing and devastating. But renters have no where else to go and eviction is devastating, so I am very much for any system that makes eviction difficult. Renters need that protection. If individual landlords feel abused by that fact, they can look to their class, the root cause of the problem, to change the underlying problem.

|

|

|

|

You do not, in fact, gotta hand it to them

|

|

|

|

These same landlords are getting basically exactly the system they have and probably will continue to vote for lol. gently caress em.

|

|

|

|

qhat posted:The point is that there's never a guarantee of receiving a cash flow. There's a legal framework yes, but that doesn't mean no risk, in fact there's no guarantee you'll even get your unpaid rent even if you're successful at the tribunal. I think we basically agree. Ultimately you're still relying on some money that may or may not be there, the fact that a minor blip such as not getting the rent for 6 months equates to going bankrupt is what makes the whole strategy outstandingly stupid, if not more stupid than levering up on stocks, and 100% deserves all the ridicule it does (or rather, should) receive. Having freedom to lever up like this and pull in an insane income relative to your assets in any situation, while also expecting help from the government/media when things go the other direction, is what's truly despicable. Yeah, we're in agreement. I would just generally put rental income as lower risk of being interrupted than dividends, but that's entirely irrelevant to the point.

|

|

|

|

TrueChaos posted:Yeah, we're in agreement. I would just generally put rental income as lower risk of being interrupted than dividends, but that's entirely irrelevant to the point. The people who decide to pay dividends also get dividend income from that decision, so thereís a lot of alignment around preserving that stream of income.

|

|

|

|

eXXon posted:No they didn't. The developer almost certainly borrowed money from a bank or other lender to finance construction and possibly the land cost too. The original buyer borrowed most if not all of the funds to buy the house, as did subsequent buyers. There is virtually limitless capital available to finance every stage and what you really mean is that each entity assumed some risk which our various governments have been working very hard to minimize, thereby driving up housing prices. Yes the builder borrowed money from the bank, but the bank would have only lent them the money if they had significant deposits, which is where the money from the landlords comes in. The reason why in this country purpose built apartment development disappeared for decades and was replaced by condo development, was because it was dramatically easier to finance the development of a condo, because it was dramatically easier to assemble deposits by crowd sourcing investment, and thus dramatically easier to get loans from the banks. I mean are we only concerned about banning Mom n' Pop landlords from financing condo buildings and instead only allowing giant rental companies to own and operate apartments? Sure fine though in such a case my point still stands in that they are indeed sadly bringing some value to the table in terms of actually providing the necessary guarantees to the lender in order to actually finance the construction of the building. The other alternative to privately owned purpose built rental housing would be that the government gets involved, and finances its own enormous amounts of publicly owned apartment housing, funding it from market rents. For the record, I absolutely think this is a good idea. eXXon posted:As for the landlord question, I'm sure you know that there are plenty of intermediate alternatives besides abolishing private property because lots of people have posted them in this thread. As melon cat just said, why should property owners also be landlords? If landlords need to exist they should be a heavily regulated, licensed profession. Indeed you can also envision private ownership with an entirely public system of property management. It sounds like we're saying that we're ok with corporations financing, building and operating rental housing? It may result in less shenanigans, but it probably won't get rid of the issue of constantly squeezing renters ever more as much as possible. Only more competition and surplus of housing can do that. I thought for a long time that a system with more presence of purpose built rental would be better, though maybe it's just shifting problems around as we can see an example of that in Seattle, where for a long while they practically only built rental, and it generated its own issues. The funny regulatory environment there resulted in an unviability of condos that resulted in them not being built at all, which pushed people who wanted to buy condos either into renting or having to stretch to buy a SFH.

|

|

|

|

What happened in Seattle with rental buildings?

|

|

|

|

Femtosecond posted:Yes the builder borrowed money from the bank, but the bank would have only lent them the money if they had significant deposits, which is where the money from the landlords comes in. I donít think that is quite true. HELOC-as-downpayment is just ridiculous double dipping and itís the bank providing capital. You might say ďoh, but the landlords bear the risk of that loan in the case that the rental business doesnít work outĒ but generations of government at all levels has worked hard to keep bearing that risk from actually having any danger to it. (I used a HELOC for the down payment on a condo for my sister last year after my financial advisor ran some numbers and determined that it was probably cheaper than selling investments to do so. Nobody in the whole process batted an eye. If it wasnít for the fact that I was putting a roof over my baby sisterís head it probably would have been too surreal for me to endure.)

|

|

|

|

A combination of things around the regulatory environment in Seattle has basically made it so that condos are unviable rarely build. quote:https://www.kuow.org/stories/why-are-condos-in-seattle-so-rare-and-expensive Its almost as if the deposits are helping getting the building get built... This other article is well worth a read and really really gets into the nitty gritty details of like 70s era tax code changes that made apartments unviable in Canada. Funny thing is there's a sort of grass is greener sort of thing going on here where the author is clearly looking at the dearth of condos in Seattle as a problem and the plenty in Vancouver as being something to strive for. quote:When it comes to condominium development, Cascadiaís two largest cities couldnít be more different. Last year nearly 60 percent of new housing starts in the city of Vancouver, BC, were condominiums; meanwhile, Seattle saw no new condominium buildings open. And thatís not changing anytime soon: less than 10 percent of all building slated for downtown Seattle in the next three years will be condos. Whatís the differenceówhy the blossoming of condominium construction in one city and the almost complete dearth in the other?

|

|

|

|

Subjunctive posted:(I used a HELOC for the down payment on a condo for my sister last year after my financial advisor ran some numbers and determined that it was probably cheaper than selling investments to do so. Nobody in the whole process batted an eye. If it wasnít for the fact that I was putting a roof over my baby sisterís head it probably would have been too surreal for me to endure.) This was absolutely a thing and I think this was absolutely a huuge issue in inflating housing prices all through the last several years. I've heard mixed things in recent years in terms of whether this move is still possible or whether regulators have slammed the door. Maybe now you have to go to the extra step of finding a really unscrupulus mortgage broker whereas before even at the big banks of TD, BMO etc they wouldn't ask questions.

|

|

|

|

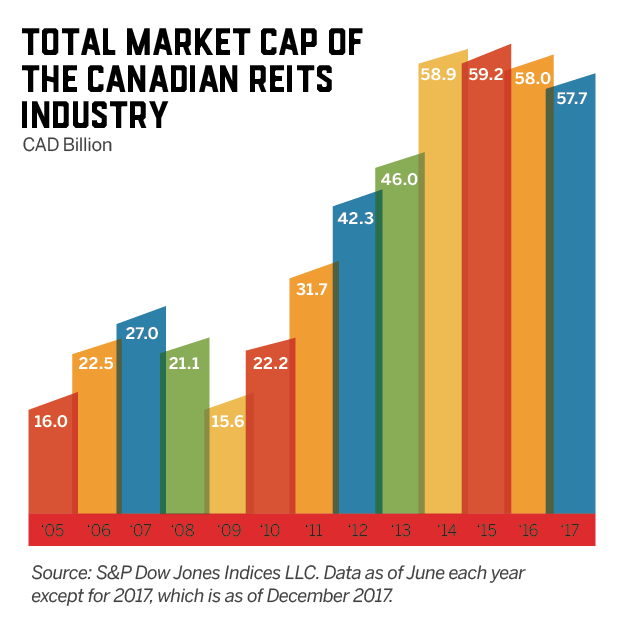

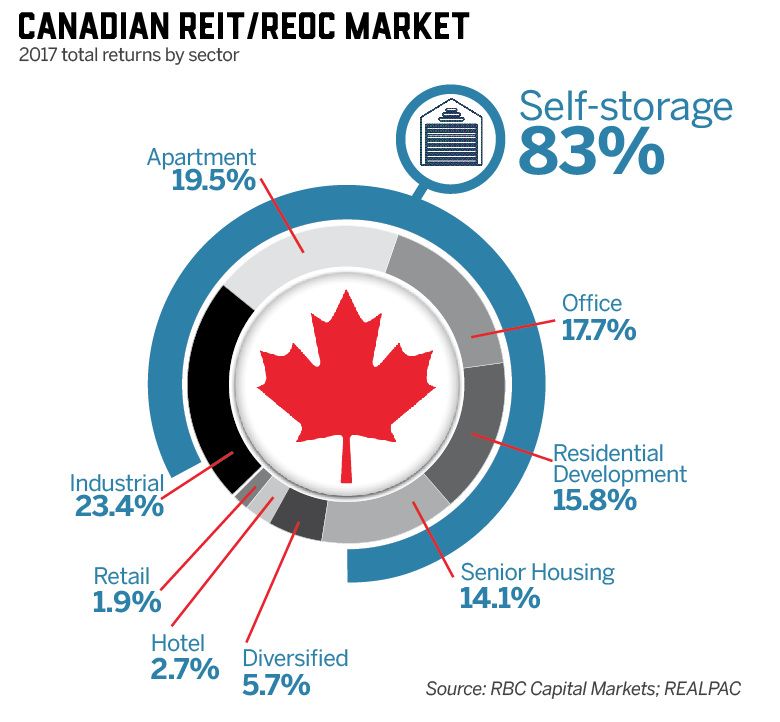

Femtosecond posted:Yes the builder borrowed money from the bank, but the bank would have only lent them the money if they had significant deposits, which is where the money from the landlords comes in. While purpose-built rental construction in Toronto is pathetic, it never quite completely died:  I would argue from that graph that condo construction cannibalized rental building, which was evidently still possible in the early 1970s with interest rates higher than today. Incidentally, it's from a BILD report on how to fill the need for new rentals. Of course a builder lobbyist doesn't care what they're building as long as they get paid, but for developers, yeah, I think there's enough lonely capital around to finance construction without having to appeal to mom & pop Heloc. There's some $80B stashed in REITs that didn't even exist 30 years ago and they can't all be buying up office towers that nobody wants to occupy anymore. Although, on that note, let me express disdain/despair at the rightmost figure from some REIT website (yeah they're old, I'm too lazy to find newer ones):   lol at smart money going to self-storage 6 years ago. Anyway, we already talked about how condos pivoting to marketing to investors has led to thousands of tiny, shoddily-built shitboxes that are inadequate for renters and owner-occupiers alike. That's a deliberate result of government policy, and if we're insisting on mostly free-market solutions to the problem, surely there are ways to shift incentives back to financing rental construction? All I know is that doubling down on supply-side policies like negative gearing in Australia didn't do a drat thing except get more mom & pop investors to borrow eye-bleeding sums to shuffle around ownership of a relatively small proportion of existing homes. Incidentally, this doesn't even necessarily work out for the investors considering the opportunity cost and risks from interest rate hikes, as this article half-argues: quote:More than a third of condos in Toronto are owned by investors, according to 2020 data, the most up-to-date figures from Statistics Canadaís Canadian Housing Statistics Program (CHSP), at 36 per cent (145,015). Thatís slightly below the Ontario figure of 42 per cent of all condos (233,860), according to the data published in February. All of that poo poo sucks!   This poo poo sucks too! (I'm the vacant land) But surely you can envision a regulatory structure that disincentivizes condos for investment but not for owner occupation? There's plenty of middle ground between the status quo and outright banning investment properties. Femtosecond posted:The other alternative to privately owned purpose built rental housing would be that the government gets involved, and finances its own enormous amounts of publicly owned apartment housing, funding it from market rents. For the record, I absolutely think this is a good idea. It doesn't even need to fund it from market rents if we're willing to raise some taxes here and there. But yes, sure, more public housing and co-ops, please. Femtosecond posted:It sounds like we're saying that we're ok with corporations financing, building and operating rental housing? It may result in less shenanigans, but it probably won't get rid of the issue of constantly squeezing renters ever more as much as possible. Only more competition and surplus of housing can do that. I wouldn't say I'm "ok with" that so much as I have no hope of any Canadian government pursuing alternatives in the next decade or two.

|

|

|

|

As others have said, it's just wild that your random citizen can use millions of dollars in leveraged loans to buy up real estate for investment purposes without an iota of oversight, licensing, or anything else. A random person can't just start trading options without proving to their brokerage and regulators that they know what they're doing and are financially able to handle losses. Similarly how many of these real estate investors would borrow a million dollars and dump it into a single stock? Or would even be allowed to borrow for investing like that? It's far too easy to have access to enormous amounts of capital when the asset is real estate.

|

|

|

|

Landlordism is effectively an ideology, and the dominant ideology of the western world at that. Countries cripple their economies and dispossess massive swathes of the population to sustain it, and treat the landlord class as vital pillars of society simply for existing and receiving money.

|

|

|

|

eXXon posted:

There are but no one here is going to like it. The second article about the difference between Seattle and Vancouver apartment construction gets into it, but in the 1970s era when lots of apartments were built, the federal government was giving huge amounts of wildly generous tax incentives to developers well, well beyond anything being done now. On twitter weeks ago there was a chart that got into the various components of condo vs rental financing and lined things up to show the "gap" and explain why condos are now so favoured. I'm never gonna find this thing again, but if I do I'll absolutely post it. Fidelitious posted:As others have said, it's just wild that your random citizen can use millions of dollars in leveraged loans to buy up real estate for investment purposes without an iota of oversight, licensing, or anything else. The big magic thing here is that with the collateral of land that people are recklessly borrowing against bankers think there is no real expectation that it can go to zero, and it has a high floor whereas with other things to borrow against, eg. your Shopify holdings, there is much more of an expectation that it could go to a zero valuation.

|

|

|

|

Good news Landlords! https://twitter.com/baystreetamber/status/1669334914582425600?s=46&t=ruJSzwqECRxfc3oePbtIng Higher interest rates having its effect. https://twitter.com/cmhc_ca/status/1669321239922442240?s=46&t=ruJSzwqECRxfc3oePbtIng

|

|

|

|

It feels bad that my retirement plan is starting to shape up as "move to another country". The housing in Canada is insane.

|

|

|

|

Indolent Bastard posted:It feels bad that my retirement plan is starting to shape up as "move to another country". The housing in Canada is insane. Beats mine of "walk out into the ocean"

|

|

|

|

Powershift posted:Beats mine of "walk out into the ocean" Says the man in landlocked Alberta.

|

|

|

|

Bajaha posted:Says the man in landlocked Alberta. So it will be a long walk

|

|

|

|

It would be quicker if you walk out into one of those toxic sludge lakes in the tar sands.

|

|

|

|

A decent article from MacLeans which goes more into the frustration and despair from younger generations, especially recently. The generational divide is so immense (I'm even thinking of uni students unable to rent now which was easy ten years ago). Optimism! https://macleans.ca/longforms/the-end-of-homeownership/amp/ MacLeans posted:Young voters have been key to electing the last two Liberal governments, but the current government has little credibility with that demographic on this file. That may have something to do with the fact that multiple-property owners, who have profited enormously from the past few years’ run-up in property values, are well-represented in government. More than 100 MPs, comprising more than one-third of Parliament, own multiple properties.

|

|

|

|

Maybe Ontario could consider spending some of its $22.6 billion in excess funds on something.

|

|

|

|

|

| # ? Jun 8, 2024 06:30 |

|

McGavin posted:Maybe Ontario could consider spending some of its $22.6 billion in excess funds on something. They could find 2 more car manufacturers that want free battery plants.

|

|

|