|

Up until now I just use turbotax to handle my taxes. Other than knowing how to use that program, I do not know anything about taxes in general. I used the Direct File from the IRS in order to do my taxes this year because I wanted to encourage that sort of thing and it went fairly well, but then I already had an ID.me account so I bypassed that painpoint. I still need to do CA taxes though, so I wanted to use CalFile (https://www.ftb.ca.gov/file/ways-to-file/online/calfile/index.asp). Unfortunately, I do not have an account with them so I needed to register. Right now, I am stuck at the final step, where they either mail me (as in, actual paper mail) a PIN so I can finish, or they connect to TransUnion so I can answer some credit questions and get it verified right away. For the former, they say it takes 5-7 days which at worst means there is a chance I won't get it by the time the deadline rolls around, but for the latter currently it tells me they are not able to connect, and it is the weekend so all their support is closed so until Monday it is just me and my anxiety. So looking into it as much as I could I thought I saw that if I do not owe California any taxes, then I automatically get an extension on my return which allows plenty of time to get that CalFile working, if I do need to resort to getting the PIN by mail. Given my situation and that I got a return from California last year, that makes it not as urgent. So I look into the forms to see if it is the same case and I think I am getting a return from them this year, but I am slightly uncertain about the Alternative Minimum Tax in California. Apparently, my AGI is over the point where I should be calculating that to see if I do owe it. I am single and not self-employed, I am living in an apartment, I do not make any itemized deductions and I have no stock options or make any other particular extra deductions or credits, and LOL if I own any businesses to worry about operating costs on. I tried calculating AMT myself (though it was on a form that was from last year, as it was the only thing online), and as I understand it: 1. I add together my AGI plus the standard deduction. 2. Subtract any credits (which AFAIK is zero) 3. Subtract the cutoff, whatever they say it is, from that amount 4. Multiply it by the AMT tax rate, which is 7% in CA, so 0.07 5. Compare it to the income tax rate that I normally have. If it is greater than that, then I owe the difference. If the income tax is greater than that, then I do not owe anything more than that. Does that all sound about right? As far as I know, for my situation I do not owe any extra AMT and I should be good for getting a return from CA. Are there any online tools for calculating AMT? While I am at it, are there any decent online tools out there for filing state income tax? My only other alternative is to go back to paying for turbotax, fill out everything, then just mail the state return, which is not preferable. Sorry for all the words! Unlucky7 fucked around with this message at 21:57 on Apr 6, 2024 |

|

|

|

|

| # ? Apr 29, 2024 19:52 |

|

If I know my effective tax rate is 11% should I aim to make sure my paycheck withholding is 12% Both my wife and I have enough that it pushes us into the next tier and I think since we got married a couple years ago we've always owed mid four figure money because the default withholding thing just assumes you're a single earner family from 1952 How do I tell HR to withhold more money from my paycheck

|

|

|

|

Hadlock posted:How do I tell HR to withhold more money from my paycheck W-4

|

|

|

|

Hadlock posted:How do I tell HR to withhold more money from my paycheck If you have just one job each and no other significant income sources: Read the directions to the W-4 form or use the IRSí website tool and fill it out the way they tell you to (hard, may require reading or math) - OR - Both you and your wife just fill out W-4s as single (easy, does not actually require a divorce)

|

|

|

|

anyone who has used both have a personal opinion about turbotax online vs. standalone download? https://thefinancebuff.com/tax-software-online-or-desktop.html

|

|

|

|

RCarr posted:I sent my amendment in about 2 months ago and itís still not showing as received. Should I be worried?

|

|

|

|

Subvisual Haze posted:Personally I'd assume it's lost in the mail if they haven't received it within a couple weeks. Hmmm, I have a tracking number somewhere from when I sent it, Iíll have to look it up.

|

|

|

|

In 2023, I started a consulting business as a single member LLC electing to be taxed as an S Corp. This is my first time filing a tax return for any entity besides my own household. Recently, I realized one of my clients made out their 1099 form to my personal SSN rather than my LLC's EIN. I have been unable to get them to amend their 1099 to include the LLC's EIN. What's the easiest course of action here: claim income and business expense deductions from this client on my personal tax return, or do something (?) on my end to associate this income with my LLC? I'd prefer to do the latter, FWIW. Wish I had realized this earlier...that's what I get for not getting the taxes done before our second child was born.

|

|

|

|

My apologies if this is the wrong thread, but I have a FBAR question. I will be spending a significant amount of time outside the country for the rest of the year. From what I've been reading online, the easiest way to move money from me here to me there is through one of these borderless accounts like wise has. From reading online, these sorts of accounts trigger the FBAR reporting requirement if they go over 10k. The amounts involved will likely involve more than 10k but less than, say, 30k (so nowhere near close triggering Form 8938 ). So I will need to file a FBAR. So first question is: do I file the FBAR when I open the account this year or when I file my taxes next year? Also, this account will only be above 10k this year. For 2025 do I still have to report on it if its lower than 10k? (mostly thinking of keeping it open but inactive just in case) How would I report that I either closed it or that its balance was below 10k for all times of the year?

|

|

|

|

joepinetree posted:My apologies if this is the wrong thread, but I have a FBAR question. I will be spending a significant amount of time outside the country for the rest of the year. From what I've been reading online, the easiest way to move money from me here to me there is through one of these borderless accounts like wise has. From reading online, these sorts of accounts trigger the FBAR reporting requirement if they go over 10k. The amounts involved will likely involve more than 10k but less than, say, 30k (so nowhere near close triggering Form 8938 ). So I will need to file a FBAR. So first question is: do I file the FBAR when I open the account this year or when I file my taxes next year? Also, this account will only be above 10k this year. For 2025 do I still have to report on it if its lower than 10k? (mostly thinking of keeping it open but inactive just in case) How would I report that I either closed it or that its balance was below 10k for all times of the year? For 2024 balances the FBAR will be due April 15, 2025, with an automatic extension to October 15, 2025. You submit an FBAR for every year in which the total in aggregate of the highest balance in each of your non-US financial accounts exceeds $10,000. This means that if next year the Wise account has $6,000 in it and you move that to a local bank, your FBAR total is $12,000 and you still have to report.

|

|

|

|

Gabriel Grub posted:For 2024 balances the FBAR will be due April 15, 2025, with an automatic extension to October 15, 2025. Thank you. I probably would leave virtually nothing in the account after this year, or even close it outright. Would I need to report the account closed, or simply not fill out a FBAR for 2025?

|

|

|

|

I feel like my taxes should be pretty simple, considering I have one (1) salary job, don't own a house or anything. Anyway I've started trying to use TurboTax, but it seems convinced that I received a refund last year, when in fact I owed money (and yes I finally just submitted a W-4 which is apparently why I have owed taxes the last few years  ) )I live in NYC, so I'm assuming that's why there's some fuckery (federal, state, local?) I can't find any proof that I was given a refund, but TurboTax seems to think I did. Not sure if it matters. Should I just continue and pay the amount it says I owe?

|

|

|

|

AnonymousNarcotics posted:I can't find any proof that I was given a refund Do you not have a copy of last year's tax return?

|

|

|

|

joepinetree posted:Thank you. I probably would leave virtually nothing in the account after this year, or even close it outright. Would I need to report the account closed, or simply not fill out a FBAR for 2025? You don't have to file anything if you're under the $10k.

|

|

|

|

pig slut lisa posted:In 2023, I started a consulting business as a single member LLC electing to be taxed as an S Corp. This is my first time filing a tax return for any entity besides my own household. Recently, I realized one of my clients made out their 1099 form to my personal SSN rather than my LLC's EIN. I have been unable to get them to amend their 1099 to include the LLC's EIN. What's the easiest course of action here: claim income and business expense deductions from this client on my personal tax return, or do something (?) on my end to associate this income with my LLC? I'd prefer to do the latter, FWIW. File your own 1099 redirecting the money from yourself to the business. List your SSN as the payer and the business's EIN as the recipient. On your individual tax return, report the money as miscellaneous income, then show an equivalent negative amount as "income received as nominee" so that it nets to zero. On your business tax return, report the income as if it had been received by the business.

|

|

|

|

drk posted:Do you not have a copy of last year's tax return? I do. It says that I owed money last year. Not get a refund

|

|

|

|

Telegnostic posted:File your own 1099 redirecting the money from yourself to the business. List your SSN as the payer and the business's EIN as the recipient. That sounds straightforward. Thank you!

|

|

|

|

Gabriel Grub posted:You don't have to file anything if you're under the $10k. Yes, at any time during the year, so if it never reached 10k (or equivalent in foreign currency) and you had no other foreign accounts during the year, then you may not need to file an FBAR.

|

|

|

|

PatMarshall posted:Yes, at any time during the year, so if it never reached 10k (or equivalent in foreign currency) and you had no other foreign accounts during the year, then you may not need to file an FBAR. These are exactly the facts he described. Also, if you end up closing the account, there's a box you can check to indicate that.

|

|

|

|

Gabriel Grub posted:This means that if next year the Wise account has $6,000 in it and you move that to a local bank, your FBAR total is $12,000 and you still have to report. I don't believe that's correct. There's no point in this scenario where the aggregate value of the two accounts exceeds $6,000. Gabriel Grub posted:Also, if you end up closing the account, there's a box you can check to indicate that. There isn't one on the PDF FBAR, so you just stop reporting it after the year it was closed.

|

|

|

|

AnonymousNarcotics posted:I do. It says that I owed money last year. Not get a refund Go to the IRS website and pull a transcript. Compare it to your copy and what TurboTax thinks.

|

|

|

|

.

Gabriel Grub fucked around with this message at 07:35 on Apr 11, 2024 |

|

|

|

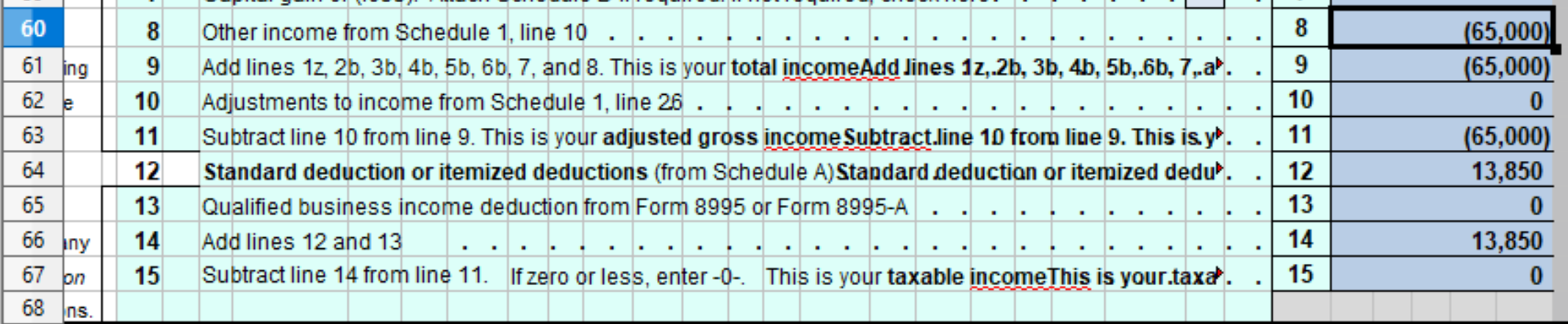

I've been working abroad 100% of last year. I tried filling out the million forms and sheets, and I'm 99% sure it's supposed to come to $0 since I make far less than $120,000. But it's not. And I'm not seeing the exclusion even doing anything. It seems to be working in the opposite direction if anything. I think 1040 posted:10 Adjustments to income from Schedule 1, line 26 1040 posted:8 Additional income from Schedule 1, line 10 I'm very confused where on the 1040 or some other sheet the exclusion is supposed to work. I don't want to pay $110 to have some software do it for me, but when I use free software, it doesn't even ask me for my foreign income, then it gets mad at me for having $0 in income. Sorry, I don't know how much you can help, but I thought it might be worth a shot. It feels super scummy that I might have to pay to file taxes in a country I don't even live in just to (probably) tell them it was $0 just because they made it soooooooo complicated.

|

|

|

|

Use form 2555, the instructions should explain how it works.

|

|

|

|

Are you self employed? If so, youíll still owe self employment taxes.

|

|

|

|

PatMarshall posted:Use form 2555, the instructions should explain how it works. I did exactly that, but then line 44 wants my income from 1040 line 11. But line 11 is dependent on line 44... It's a circle. 2555 posted:44 Deductions allowed in figuring your adjusted gross income (Form 1040 or 1040-SR, line 11) that are 1040 posted:11 Subtract line 10 from line 9. This is your adjusted gross income dpkg chopra posted:Are you self employed? If so, youíll still owe self employment taxes. No, I'm just a regular employee with nothing economically fancy or interesting at all in my life. Shadow0 fucked around with this message at 03:13 on Apr 13, 2024 |

|

|

|

Try running the numbers in this excel spreadsheet: https://sites.google.com/view/incometaxspreadsheet/home All the cells and dependencies are linked and automatically update. Might help you resolve your issues. (If you don't have excel it works in Google sheets too.)

|

|

|

|

dpkg chopra posted:Are you self employed? If so, you’ll still owe self employment taxes. That's good to know, since my wife will likely qualify for FEIE next year as a 1099. Thanks.

|

|

|

|

Boris Galerkin posted:Try running the numbers in this excel spreadsheet: https://sites.google.com/view/incometaxspreadsheet/home Potentially dumb question, but do things in parenthesis mean negative?  As I thought, it is totaling to 0, but only if the () means negative.

|

|

|

|

Shadow0 posted:Potentially dumb question, but do things in parenthesis mean negative? Yes.

|

|

|

|

Im running into an issue thats driving me loving insane. Trying to file our return via free file as married filling jointly. We had a tax preparer file our return last year and it looks like he made PIN codes for us to file electronically. Im filling it myself this year. Regardless of if I put in my and my spouses PIN or the correct AGI from last year I get rejected with this error: https://www.irs.gov/filing/free-file-fillable-forms/ind-032-04 Ive tried all the stupid tricks and permutations of Ď0í for spouses AGI, or PIN or leaving blank. Im confident the AGI and PIN are being entered correctly since I have our last years return here but it gets rejected every time. FML. Anyone know the correct way to resolve this?

|

|

|

|

Try making an account at irs.gov and downloading your tax transcripts just in case the return doesnít match what the irs has on file?

|

|

|

|

File an extension, paper and a stamp if necessary, if you owe money. Otherwise it should be printed on the bottom of the return packet from the preparer from last year.

|

|

|

|

Wow what the gently caress! I signed up for ID.me (and probably consented to sell my biometric data to anyone online, forever) and tried to pull my transcript for last year and it sure looks like my loving tax guy never loving filed a return for 2022. I have his copy of the completed return, but the IRS transcript only shows that he filed an extension. I can see from previous years the completed returns being submitted. What the gently caress!!! Should I try and file an extension to try and sort out this poo poo first? Can I do that online ASAP? Should I just print out the 2023 return and pray? I was already not on speaking terms with this rear end in a top hat and now I'm just livid. gently caress this poo poo.

|

|

|

|

H110Hawk posted:Yes. Oh wow, I just noticed one of the fields has parenthesis baked in! It all makes sense now! I thought that was weird, but didn't know if I should interpret it as anything. It all came together and worked how I expected it to. I can finally file! Thank you so much!

|

|

|

|

Ne Cede Malis posted:Wow what the gently caress! I signed up for ID.me (and probably consented to sell my biometric data to anyone online, forever) and tried to pull my transcript for last year and it sure looks like my loving tax guy never loving filed a return for 2022. I have his copy of the completed return, but the IRS transcript only shows that he filed an extension. I can see from previous years the completed returns being submitted. What the gently caress!!! For the PIN/AGI e-filing issue, since you currently don't have a 2022 return on file, just enter 0 for your's and your spouse's prior year AGIs. The system is comparing it to what is actually on file, not what it was supposed to be. Some e-file vendors will let you file prior year returns electronically. Were you expecting to owe money for 2022, get a refund, or were you breaking even? Late penalties for filing are based on a percentage of what you owe, so if you don't owe anything there shouldn't be any penalties charged. If your preparer said they filed the return and didn't, you can submit a complaint against them via Form 14157: https://www.irs.gov/tax-professionals/make-a-complaint-about-a-tax-return-preparer.

|

|

|

|

Peyote Panda continues to be the model IRS employee, and I'd like him to replace the officer working on my client's audit who is not.

|

|

|

|

Peyote Panda posted:Each year's return is generally treated separately for processing purposes, so if you have your 2023 return ready now there's no reason not to file and then go back and get 2022 sorted out. Thank you for helping me remain sane through this last minute BS. I owed a pretty big amount for 2022, which I paid using the voucher the preparer gave me a year ago. I was able to file and get the 2023 accepted doing what you said so the immediate fire is out. I guess you can just write the US treasury a check and they'll cash it without a return? So I guess the next step is to call this dude up and ask him what happened and tell him to file our 2022 return. We're trying to buy a house this year and I assume not having 2022 filed will gently caress up trying to get a mortgage approved? Part of me wants to rake this guy over the coals and demand a refund from the $1600 bucks I paid him for preparing this poo poo. I guess being charitable maybe he just forgot to hit send or something? This whole situation seems crazy to me but maybe it's just an honest mistake.

|

|

|

|

Ne Cede Malis posted:Thank you for helping me remain sane through this last minute BS. I owed a pretty big amount for 2022, which I paid using the voucher the preparer gave me a year ago. I was able to file and get the 2023 accepted doing what you said so the immediate fire is out. I guess you can just write the US treasury a check and they'll cash it without a return? Yes the government will cash your check and just hold it and apply it eventually when the return is filed. Or never apply it to anything I saw that once where they acknowledged that money was received but dindn't actually apply it to my client's balance until we called them. It was just very dumb. Your CPA may have been a jerk, he may have thought he filed it, he may have had a situation like me earlier this year where I'm supposed to get email alerts if a return is not accepted electronically but I had a bunch from when e-filing reopened this year that didn't go through for some reason but weren't specifically rejected and I was not aware that it happened.

|

|

|

|

|

| # ? Apr 29, 2024 19:52 |

|

Epi Lepi posted:Yes the government will cash your check and just hold it and apply it eventually when the return is filed. Or never apply it to anything I saw that once where they acknowledged that money was received but dindn't actually apply it to my client's balance until we called them. It was just very dumb. He's not a CPA, AFAIK, but an MBA  . I checked our previous year's correspondence and he mentioned filling 250 extensions the same day as he filled mine, so I am just assuming he filed an extension and just forgot to file the actual return before october. I'll email him and ask him to fix this poo poo. As much as I would like to attribute malice to this it's probably just a stupid mistake. . I checked our previous year's correspondence and he mentioned filling 250 extensions the same day as he filled mine, so I am just assuming he filed an extension and just forgot to file the actual return before october. I'll email him and ask him to fix this poo poo. As much as I would like to attribute malice to this it's probably just a stupid mistake.

|

|

|