|

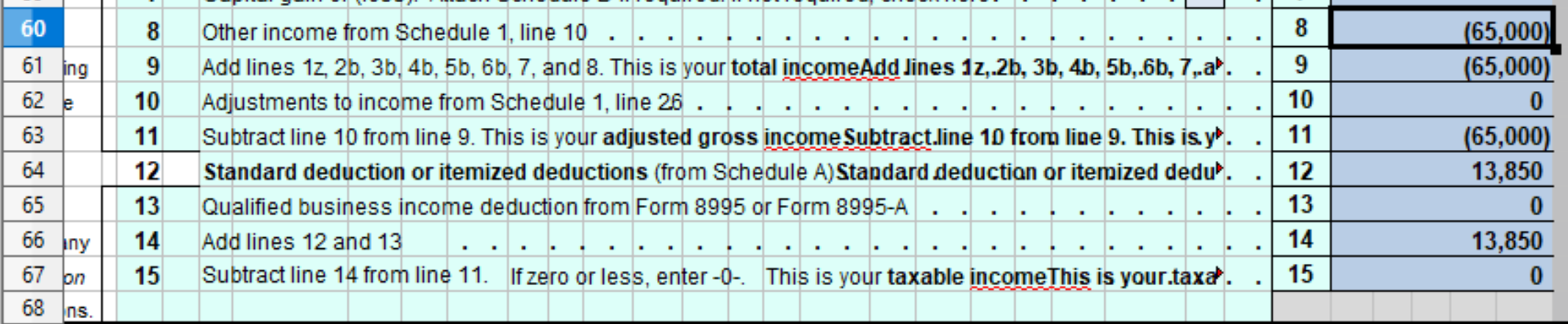

I've been working abroad 100% of last year. I tried filling out the million forms and sheets, and I'm 99% sure it's supposed to come to $0 since I make far less than $120,000. But it's not. And I'm not seeing the exclusion even doing anything. It seems to be working in the opposite direction if anything. I think 1040 posted:10 Adjustments to income from Schedule 1, line 26 1040 posted:8 Additional income from Schedule 1, line 10 I'm very confused where on the 1040 or some other sheet the exclusion is supposed to work. I don't want to pay $110 to have some software do it for me, but when I use free software, it doesn't even ask me for my foreign income, then it gets mad at me for having $0 in income. Sorry, I don't know how much you can help, but I thought it might be worth a shot. It feels super scummy that I might have to pay to file taxes in a country I don't even live in just to (probably) tell them it was $0 just because they made it soooooooo complicated.

|

|

|

|

|

| # ¿ May 16, 2024 21:35 |

|

PatMarshall posted:Use form 2555, the instructions should explain how it works. I did exactly that, but then line 44 wants my income from 1040 line 11. But line 11 is dependent on line 44... It's a circle. 2555 posted:44 Deductions allowed in figuring your adjusted gross income (Form 1040 or 1040-SR, line 11) that are 1040 posted:11 Subtract line 10 from line 9. This is your adjusted gross income dpkg chopra posted:Are you self employed? If so, you’ll still owe self employment taxes. No, I'm just a regular employee with nothing economically fancy or interesting at all in my life. Shadow0 fucked around with this message at 03:13 on Apr 13, 2024 |

|

|

|

Boris Galerkin posted:Try running the numbers in this excel spreadsheet: https://sites.google.com/view/incometaxspreadsheet/home Potentially dumb question, but do things in parenthesis mean negative?  As I thought, it is totaling to 0, but only if the () means negative.

|

|

|

|

H110Hawk posted:Yes. Oh wow, I just noticed one of the fields has parenthesis baked in! It all makes sense now! I thought that was weird, but didn't know if I should interpret it as anything. It all came together and worked how I expected it to. I can finally file! Thank you so much!

|

|

|