|

Lexicon posted:Hmm, ok. But the vacancy rate is still pretty low, unless things have changed since I was last in Vancouver. Vacancy rates are kind of a high-noise (i.e. garbage-esque) stat, because they are based on CMHC's "core rental stock" numbers, which are derived from all those old purpose-built rental buildings. They don't count condos being rented by individual landlords, basement suites, etc. The lack of real information about vacancy rates is just one of the ten thousand total abject failures of the CMHC in the last 20 years. They stopped doing anything related to their core mandate so they could underwrite more mortgages, period, full stop. Also, anecdotally, the rental market is soft as gently caress right now. Nobody I know is getting increase notices at their anniversary, stuff like that.

|

|

|

|

|

| # ¿ May 10, 2024 11:58 |

|

Cultural Imperial posted:Yeah, the 'affordable' stuff like wooden low rises built in the 70s are extremely hard to get into. The market is hosed at all segments. In the last three years, I moved back to Vancouver, got a salary increase, my wife got a job, then she got a salary increase. The net effect was that in that time we've gone from looking for stuff around the $1600-1700 price point, to the $1800-1900 price point, and finally to the $2000-2400 point. Honestly the $1700 to $1800 area is most reflective of reality (in that you don't have poo poo from those idiots at RentItFurnished.com polluting your search pool), and I was able to find some good stuff there. So naturally, I figured that adding another $800 a month to my rental budget would make things a lot easier, right? The units over $2000 in this city are hilarious. The aforementioned RentItFurnished garbage is part of it, in that you'll see a LOT of ludicrous 400 square foot shitboxes full of Ikea furniture asking $2400 a month, but it's more than that. You will find entire houses for rent in one neighborhood (Marpole usually), then maybe a horribly constructed early 90's 1000-sqft townhouse in Fairview, and then some optimistic idiot looking for $2300 for his 800 square foot two 'bedroom' condo in the Olympic Village. All of these are driven simply by the cost of ownership for the landlord, and don't reflect the actual competitive nature of the market- the dude renting his old house in East Van has no carrying costs, so he can price it around market rate, but the dude with the condo needs to ask the same rent despite being hilariously out of step. So his listing sits, and waits, and waits, and never moves. The stuff that moves is the stuff like what we ended up finding- a beautiful huge unit (1400 square foot) in a nice low-rise building right by Main Street. It sticks out like a sore thumb in all of the poo poo floating around out there, and so it goes pretty quickly to the best tenants available. Everything else sits and rots, and since it's sitting empty it basically causes the market distortion all the way down the line that makes it hard for people with a smaller budget to find ANYTHING, because it's all a game of dominoes.

|

|

|

|

Lexicon posted:^ Why are supposedly profit-maximizing individuals apparently wont to let their properties remain empty rather than accept a [market] rental price that may be far lower than their carrying costs? This is a widely reported meme, not only in the residential rental market, but also commercial (hence the many empty shopfronts on Robson and elsewhere). It's one thing to occupy a place yourself until you get the rental rate you want, but to leave it empty.... http://en.wikipedia.org/wiki/Commitment_bias Cultural Imperial posted:Cool, I live practically next to you. I'm paying $1500/month (700sq ft 1br) for one of those new places behind the Mt Pleasant community center, how bout you? I live a block away from the Cascade Room, and I pay $2400 for the aforementioned 1400 square foot unicorn.

|

|

|

|

JawKnee posted:I've gotten an increase 2 times in the last 3 years, but I live in a purpose-built rental apartment building that had it's roof replaced last year, so I guess that's not unreasonable. The purpose-built units usually do their automatic increases every year, because they're owned by REITs and they need to pace inflation. The benefit there, though, is that you get a professional management company and not some batshit amateur landlord loving everything up and not understanding the RTA. I'm really happy with my current situation despite having a non-pro landlord who's a bit... colourful, but if given the choice I'll take pros every day.

|

|

|

|

Cultural Imperial posted:Fineable offence, do you follow Ben Rabidoux? If so, what do you think of his analysis? He's pretty good, in my opinion. Like anybody else you have to add a certain fuzzy-math error due to working with lovely data (because that's all there is to work with), but he definitely digs up whatever he can.

|

|

|

|

Your mom will also have to find X thousand dollars to repay the bank when the term of her mortgage comes due and she's lost all that equity she spent.

|

|

|

|

Lexicon posted:Or alternatively, spend half an hour studying the relevant price-to-rents ratio in the area, and very likely conclude it would be insanity to buy. It all seems very impressive and logical... if you predicate your departure point on the idea that banks and mortgage brokers know what the gently caress they're doing, and that it's not a GIGO information system they're using. Ask Lehman investors about that, if you can find one who didn't jump out of a building on 09/15/2008.

|

|

|

|

rrrrrrrrrrrt posted:Those seem like pretty tall orders for a condo, but I'm not that up on the market. There isn't a market in Canada* where a price/rent analysis doesn't spit out a big fat fuckin' "no buy", so this is all angels on the head of a pin level stuff. Also, housing stock in Canada has been skewed towards the demands of our current massive speculative bubble for like 5-8 years, so naturally if you have actual normal human requirements for your housing, you won't find anything good that's a new build. Like, duh. 350 to 500 square foot condos are like half the stock coming online in Canada right now (thanks to Toronto and Vancouver largely, but no exclusively). If you really want to buy that condo, just loving do it already so the rest of us can piss down the well. Either you are financially literate enough to recognize what a terrible idea this is, and feel it in your gut (and are therefore not tempted to even CONSIDER it for another two years), or you're not. No amount of messageboard advice is going to change that. *I think Fort Mac might still be the exception to this rule, but if you want to buy property in a resource boomtown on that basis by all means go juggle those grenades.

|

|

|

|

rrrrrrrrrrrt posted:Genuinely curious, is there a better rent vs. buy calculator than the NYT one? When I play around with it, even with very, very conservative numbers I can get the break-even point to be around 5 years. That calculator doesn't take into account a lot of stuff, the biggest being that it auto-calculates mortgage deductability from the carrying costs, which drops the cost of ownership considerably. It also assumes a marginal tax rate of 20% and a "lost" RoI on the downpayment of only 4%. You're better off spreadsheeting it yourself in Excel and seeing how close the number is to the 15-20x sweet spot for price to rent. Edit: it also leaves out the PTT and GST, for instance. Seriously, do the costs yourself, it's flat out impossible to get them to meet. Franks Happy Place fucked around with this message at 21:33 on Jul 11, 2013 |

|

|

|

Demon_Corsair posted:What do you tell people that keep saying that renting is just throwing your money away vs investing in a house. You tell them a) a mortgage is just renting money from a bank, you're still "losing" money, and b) it's not "paying a bit more", it's probably paying twice as much per month for the same size and location when you factor in all the other elements (taxes, condo fees, closing costs, opportunity costs, etc). "Renting is just throwing money away" is a piece of conventional wisdom so stupid that it is barely worth responding to. It's like saying 'beer before liquor, never been sicker' and then making the largest purchase of your life based on that.

|

|

|

|

Baronjutter posted:Where are you getting "twice as much" in renting vs buying. Since you apparently can't do math without somebody holding your hand, here you go: Let's take this property as a proxy because I'm not going to be arsed to work on your behalf and will instead settle for the first place I can find in Victoria that's got the rental price explicitly listed. Let's assume the price/rent ratio is roughly equivalent for condos, and then we'll tack on a monthly strata fee. So, it's selling for $530,000, and rents for $2600 a month. Let's assume a down payment for $100,000 for easy math's sake, giving us a mortgage of $430,000. At 5.2% interest (which I think is a reasonable figure for the full 25 year duration, even perhaps a bit generous), we end up with a monthly mortgage of... right around $2600 a month. Fancy that. So, now we get on with the fees. Let's assume that on a property of this value (a high-end condo), the fees would be $400 a month, which honestly isn't even that bad. Property tax is usually 1/12th of your mortgage payments (roughly), so that's another $200-250 a month. Since you are the owner and not renter, you are solely responsible for repairs, including special assessments, you need to save the standard 1-1.5% a year. Let's be super generous and say that it'll be only $300 a month and pray that your strata is well-managed (it won't be); in reality you should be closer to $400 for when those roofing and envelope and boiler assessments come due, which they will. So let's see where we are: $2600 a month mortgage; $400 a month condo fees; $200 a month property tax; $300 a month repair costs; So we're up to $3500 a month and we haven't even touched transaction costs. This is where it gets fun. Statistically speaking, you're likely to sell your condo after around five years, especially since a condo is not a long-term solution for a young couple. So now we have to calculate these costs on a five-year horizon, and amortize those into your monthly payments. If that sounds like it's unfair to the homebuyer vs. the renter, bear in mind it's also sparing the homebuyer the cost of renewing the mortgage at the end of the five-year fixed term we're working with; if interest rates have changed, or the principle has been written down, those costs can be substantial. So we'll act like the statistical likelyhood of moving is a given. So now we add on these and amortize over five years: PTT of $8600; GST of $26500; Misc. fees (appraisal etc.) of $2000; ...which adds up to roughly $600 a month over five years. So now we're at $4100 a month based on some reasonable, fairly conservative ballparky numbers. And we aren't done yet! Next, we have our friend Mr. Opportunity Cost, aka that $100,000 down payment you made. Even at a fairly conservative 5% RoI, you're passing up on $400 a month in interest, bringing the total cost of ownership + opportunity cost to a whopping $4500 a month. So yeah, it's not quite 'twice', you sure got me there! Maybe you can spot me the difference in recognition that none of these stats take into account loss of principle.

|

|

|

|

Lexicon posted:You're clearly absolutely chomping at the bit to buy into this risky, illiquid and overpriced asset class, despite copious advice to the contrary and your own admission of innumeracy. So why not just go ahead and pull the trigger, and you can serve as the thread's resident 'cautionary tale' in a few years. Yeah, I've got to say, my bladder is full and this well looks mighty appealing right now.

|

|

|

|

Oh man I forgot home insurance! Which is pretty much the dictionary definition of home ownership: "Oh man, I forgot to account for X cost!"

|

|

|

|

Lexicon posted:This whole thing is a very 'Anglo' phenomenon (a bit less so these days in the USA, perhaps). I just visited Switzerland where the social norm is to rent and property is frequently owned by large pension funds and REITs and the like. Walking around the streets of Zurich, it was rather difficult to argue that they're worse off than we are... Most Berliners rent. But I guess Berlin isn't a world-class city like Vancouver.

|

|

|

|

Good man. Pay it forward the next time you hear a Gen Y person you know about to commit financial suicide.

|

|

|

|

Winnipeg... ...is not immune.

|

|

|

|

Its below the ten year average but above recent months on a seasonally adjusted basis. Likely a combination bear trap and the last few idiots with preapproved mortgages at the old lower rates desperate to "lock in the savings" before they expire.

|

|

|

|

Baronjutter posted:In terms of government policy how do you encourage affordability vs ownership? You 'encourage affordability' by ensuring there is an adequate supply of good rental stock that covers all sectors (i.e., three bedroom units, etc.), and then you get the gently caress out of the securitization business entirely.

|

|

|

|

That's a pretty bog standard "delusional landlord wanting to rent a furnished apartment" listing. For instance, this.

|

|

|

|

Zeitgueist posted:If one of those windows doesn't open a time-space portal to NYC, that's pretty nuts. Blade_of_tyshalle posted:That's an apartment? The pictures make it look like a hotel room. That company (https://www.rentitfurnished.com) is my own personal chuckle factory.

|

|

|

|

Throatwarbler posted:That's not a terribly compelling argument. Land isn't a fungible commodity, just because there's plenty of land in Fort Nelson doesn't mean land in downtown Vancouver should never get expensive? Half of Vancouver is empty lots full of tumbleweeds, or single-story commercial that could easily be rezoned to five-story mixed use. The bullshit about 'running out of land' applies to literally every city in this country, no exceptions.

|

|

|

|

Well of COURSE they need to blow up more greenfield for their developments! Everyone knows there's no room left to densify in Canadian urban cores. Honestly, Main Street from 7th down to Terminal is either vacant lots or single-story commercial buildings. This is the heart of Vancouver, a few blocks from the Skytrain, and there's loving used car lots and vacant strips of scrub. It's a loving disgrace.

|

|

|

|

Having met Tsur a few times, I am fairly comfortable in stating that he is, in the immortal words of General Tommy Franks, the loving stupedist guy on the face of the earth.

|

|

|

|

Winnipeg has a housing bubble because CMHC stands for Canadian Mortgage and Housing Corporation, not Vancouver and Toronto Mortgage and Housing Corporation.

|

|

|

|

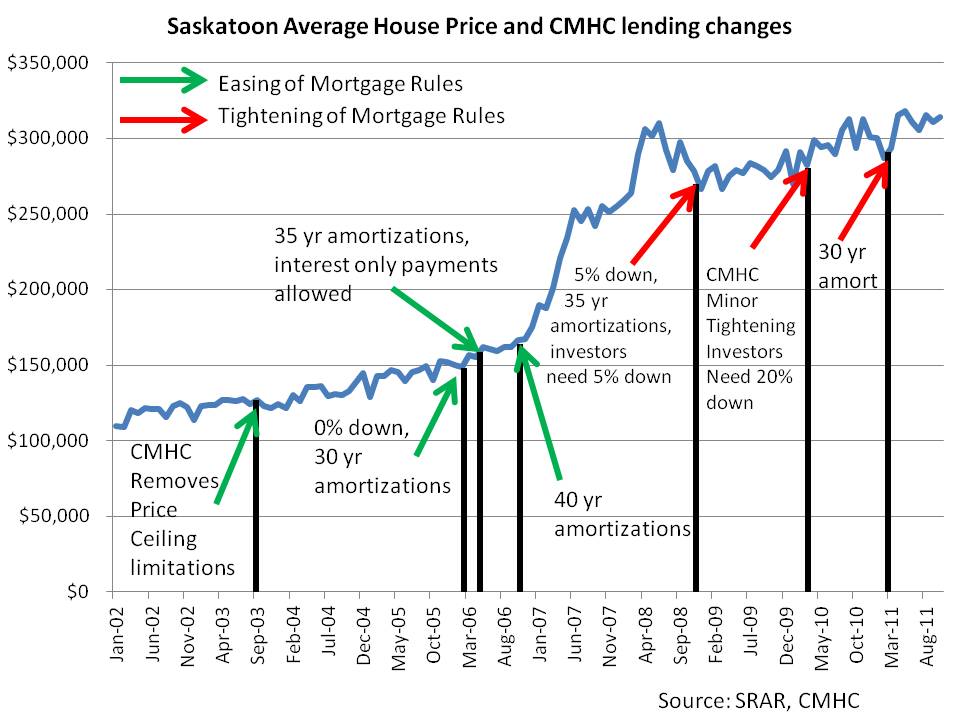

Lexicon posted:I'm all for heaping opprobrium on the CMHC, but they've been around since the end of WW2* - the housing bubble has not. From this awesome blog:  Saskatoon Housing Bubble posted:Pre-2003 – CMHC: 5% down with price limit depending on area, 25 yr amortizations, no price limit if 10% or more down In short: there is a timeliness component to the relevancy of discussing CMHC behavior in relation to the market.

|

|

|

|

Back when I was at the real estate board I looked up the numbers on mortgages by classification. In the 18 months or so that the 0-down, 40-year mortgages were allowed, so many of them were written that when I checked in 2010, 9% of all mortgages in Canada were of this type. Think about that the next time tells you Canada has no subprime problem.

|

|

|

|

Cultural Imperial posted:Is this on public record? Is there a way we can get this info? Here's a source from 2010 showing it at 6%. (Edit: page 23). Two caveats: 1) The percentage they show is almost certainly lower than it actually was, because CAAMP generally obfuscates these problems. Also they don't cover the seedier ends of the industry in these surveys (because they like to obfuscate!). 2) That said, the percentage of 40-years in the total portfolio has almost certainly dropped since 2010, though only because so many mortgages have been written since there. Yay for securitization and portfolio churn, right? Take it as mostly a data point that is illustrative of how bad it got by 2008, and of course remember that this garbage is still floating around in the system waiting to give us the economic shits.

|

|

|

|

enbot posted:0 down long term mortgages are bad, but how common are ARM's? In particular pay-option ARM's- the US crash followed very closely to those "resets". Canada doesn't really have ARMs as such, but the way our mortgage market works creates similar pressures. See, in Canada you can get a 25 year (or even 40 at one point, as we've discussed) amortization, but practically nobody offers a long-term mortgage. The mortgage terms are usually 5-year at most, with most people opting for lesser terms, or even floating-rate mortgages. Now, most people will tell you that the biggest problem with this setup is that people will come back at renewal time and find out that posted rates are much higher than they were when they originally set up the mortgage. While that's certainly a problem and creates somewhat of a similar situation to the U.S. ARM crisis, the real punch is here: Coylter posted:Now she might face a situation where her house is worth less than the mortgage and where there is 0 demand for houses at that price. I mean low interest rates pretty much enabled those economically dying community to stay afloat and keep their house. Now this all seems ripe for ending. What happens in this scenario, which is going to be increasingly common, is that when Coylter's mom goes into the bank to renew her term, the bank will run the numbers on comparable properties in her neighborhood, tell her the house is worth $40,000 less than the mortgage outstanding, and demand the cash balance before they'll renew. If she tries to go to another bank (and this stands for the people with the rate-shock problem I mentioned above, too), the bank will impose a penalty on her, the new bank will demand a fee for porting the mortgage, and she'll still be out tens of thousands of dollars. Not to mention, the new interest rate will be prohibitively high, since she has zero leverage and is a comparatively large balance-sheet risk due to her nonexistent equity. So, not quite ARMs, but a similar crisis.

|

|

|

|

Paper Mac posted:She should just rent out her basement!! I believe CMHC takes possession to liquidate the property. The bank gets the full insured value unless the CMHC finds something dubious with the paperwork, i.e. the EMILI numbers were prima facie pants-on-head retarded, due diligence wasn't done, whatever. In that case CMHC may deny insurance coverage, which is something they've been warning banks lately is a real possibility. Edit: Coincidentally, this is why I avoid Canadian bank stocks like they were made of polonium.

|

|

|

|

Paper Mac posted:How exposed is this decision making process to direct political influence? Well, ask yourself which of these scenarios is more likely: the Federal government happily accepts tens of billions of dollars in Crown agency debt due to CMHC being a bunch of profligate morons, or Harper playing the populist anti-banker card and sticking as much of the losses on the Big 5's shareholders as possible without blowing up the banking sector entirely? CMHC isn't the Bank of Canada or CRA or something like that with a purpose-built firewall, so it's as political as the Department of Finance and Treasury Board want/need it to be. And boy howdy, will they lean on it to scrape every last free penny out of the big banks when it comes to that point.

|

|

|

|

Oh, they'll never touch the CDIC stuff, not when the banks have so much cash and assets in their uninsured portfolios. Given how profitable Canada's banking sector is, I suspect they'd just reinstate the bank tax or something like that. You could probably make back all the money owed to the Feds without destabilizing the financial sector, and the only people who would suffer would be the bankers and their shareholders, which everyone could live with. Just, you know, don't be a shareholder when that happens.

|

|

|

|

Binton posted:Ah I guess, I always thought real estate fees were about 5 or 6k on a house like that. I just looked around I guess they're on average 7% on the first 100,000 and 3% on the remaining. So thats about 15k, so yeah you'd have to stay for a few years. Once you add up all the other hard expenses of ownership you're looking at a minimum stay of anywhere from five to ten years just to recoup those costs, nevermind all the other benefits of renting.

|

|

|

|

Cultural Imperial posted:If you're going to complain about high realtor's fees, get busy writing to your MP to wrest control of the MLS from the CREA. Good loving luck, realtors probably donate more money to politicians of every ilk than any other 'professional' association in Canada.

|

|

|

|

Baronjutter posted:Guys ALWAYS type "REALTOR®". It must be all in caps and have the registered trade mark symbol, otherwise you are diluting the brand and hurting the image of these elite professionals. They are ordered by the Boards to do so. Which is why I refuse to do it whenever I type it out. One last gently caress you to my former employers.

|

|

|

|

I don't mind a tiny village pub on a cold day, but then again I am an incurable

|

|

|

|

Lead out in cuffs posted:You build equity faster by renting and putting the remainder away. The first few years of mortgage payments are mostly interest and build you almost zero equity. You're forgetting a bunch of other expenses. Repairs and maintenance, for instance, run about 3-5% of the value of the home per year.

|

|

|

|

blah_blah posted:Well, 5% of a $400k condo is $20k, so you need a lot of $1700 pump repairs in a year to get to that point. Unless something goes catastrophically wrong in your building every year, 5% is a pretty crazy amount for a new-ish condo. That being said, I got pretty lucky in my old building (less than $200 in repairs over a 4 year period). When somebody says "about 3-5%", it is pretty dumb to immediately run out and cite the best-case edge scenario (a well-built new condo) and then pick the highest number in the range (5% instead of 3%) and then say "wow, that's too high!!1!". There is not a single condo in Greater Vancouver whose strata has been properly assessing future expenses and building a fund to match. If you don't believe me, all you need to do is look at why the government changed the rules for mandatory depreciation reports to force them to confront the matter. And of course they can still ignore those reports with a 3/4ths vote, so nothing has changed. If you want to count on your piddly $300 a month covering something like a new roof when all it can do is barely keep up with elevator servicing and the gardener and somebody to hose out the parkade once a year, you're loving delusional. -Boilers go, on average, every 15-20 years, at a 90% confidence interval (so figure yours could easily go at the ten-year mark) -Same range for roofs. -Envelopes fail no later than around the 20-year mark. Etc. etc.

|

|

|

|

Italy's Chicken posted:My strata fees went up 40% this year because we just had a 10 year depreciation report which showed the previous fee structure wasn't going to cover squat. We're now pegged to cover almost everything for the next 30 years (not including a catastrophe). I'm paying just over half of what the strata average costs are for the lower mainland. I stand corrected, there's ONE place that has a proper strata fee. :iamafag:

|

|

|

|

Baronjutter posted:If short-sighted idiot voters weren't an issue, what's the best thing government could do right now? Anything super drastic would hurt a lot of people and 'the economy' but clearly this whole bubble is just a ridiculous hot potato people just hope the next generation will have to deal with. Would there be a way to just slowly deflate prices to a reasonable norm and then keep the market there? -Cut off the banks' access to sweet sweet CMHC gravy, and force them to actually insure their own portfolios. -Cancel the Homebuyers' Plan, and make sure anybody who used it has repaid their RRSPs. -Create a punitive tax on unoccupied real estate in urban areas where the vacancy rate is below a certain percentage (say 2%). -Return the conditional capital gains exemption on selling multi-family dwellings, so that people who own old apartment buildings can sell them to redevelopers without getting anus-loved by the taxman. -A national housing strategy with funding and support for purpose-built rental and cooperative housing, as well as new funding for targeted social housing.

|

|

|

|

|

| # ¿ May 10, 2024 11:58 |

|

Mr. Wynand posted:I don't see how this wouldn't effectively pop the bubble. Once mortgages are actually "difficult" (i.e. not irresponsibly easy) to get, buyers dry the gently caress up and the the best possible scenario would be that everyone just sort of decides to leave their property on the market for ever without dropping their asking price. Of course as soon as a handful of people can no longer afford their mortgage payments because the economy sucks poo poo or because their interest rate went up or both they will have no choice but to cut their price, and then it's a race to the bottom. If an economic transaction depends on a ready supply of "free" money, it's not an economic transaction that is sustainable, full stop. Take your medicine now, or take it later when it's too late, there's not really a choice in the matter. The best you can hope for is that all of that misallocated money stimulates more productive economic activity, and that a healthier rental sector + national housing strategy takes care of young people/the poor/people who need social housing.

|

|

|