|

Nintendo Kid posted:Our GDP would be quite a bit higher if we didn't have so many people who couldn't afford to buy anything but the bare basics. Or do you not understand late capitalist economies? Demand talks. Umm you don't understand economics if you think taking money from one person and giving it to another person as part of a system which might plausibly decrease working hours will boost GDP in any real terms. The only hope for boosting the economy is to create an overall healthier social situation where education and human capital increase. However, this is long term.

|

|

|

|

|

| # ¿ May 15, 2024 23:38 |

|

chairface posted:That depends on if the person getting the money is going to spend it in a way that increases aggregate demand more than leaving it with the first person or not. No it doesn't depend on that. It depends on whether more stuff gets produced or not which is a very unlikely effect of policy that probably won't boost working hours. What you described can happen in a 100% inflationary scenario where no new wealth is created at all. Helsing posted:Actually unless you're talking about Austrian economics or something then "economics" doesn't really have anything to say about what would happen in that situation until you add in a lot of context, such as each person's propensity to spend. Same.

|

|

|

|

Helsing posted:In our current economic climate an increase in aggregate demand would lead to more production. If you combined that with a a German style "work-sharing" scheme then you could easily have a situation where wealth is redistributed, hours worked goes down and production increases. Increased aggregate demand increases real GDP if and only if it causes an increase in 1) productivity or 2) working hours. It's just arithmetic. So which one of the above is going to increase due to GMI and why? Increased working hours isn't likely at all. It will probably decrease working hours and workforce participation. The only argument for a productivity increase is that decreased employment will spur increased automation. In a scenario where aggregate demand increases and employment decreases this is very possible, but not likely to actually increase production, it will just offset some of what's lost. Like I said, over the long term there is the hope that increased education and human capital might cause an increase in both of the above. That's possible but certainly not immediate.

|

|

|

|

Helsing posted:The mistake you're making is that you're assuming that the economy is already working at full capacity, which it isn't. There are already idle resources that could be put to use if the demand for them existed. No I'm not. If it's already at full capacity then increased demand won't cause any growth. Case closed. But if it's not at full capacity a policy still has to do 1 or 2 above to actually increase output. There are literally no exceptions to this. Keynesian stimulus for example typically works by boosting employment in a situation when employment is low. The increased GDP comes from the employment. But in the case of GMI we have a policy that may boost aggregate demand, but probably simultaneously discourages an increase in employment. Hence no growth. chairface posted:Because we produce things for magical fairy reasons and not because there is demand for the products to be met. Riiiiiiight. By over-reacting to him, you've let Reagan sabotage your understanding of economics. asdf32 fucked around with this message at 00:50 on Nov 3, 2014 |

|

|

|

on the left posted:You need to talk about productivity because what is money if there is nothing to buy? Though just to be clear as a wealth transfer policy GMI will absolutely work. It's just that increased GDP isn't likely to be an immediate result. And there is a chance that inflation will be somewhat significant as a result (if not in general, then in housing or other areas where people will inevitably compete to spend their new money) archangelwar posted:Why? People with more money buying more things would not result in an increase in providers of those things? Because all of the potential providers are now getting $15k and feel less need to work? Am I wrong that part of the point is that old people, single mothers etc won't feel as much pressure to work?

|

|

|

|

Helsing posted:As demand increases more idle workers are hired. Also people currently performing low productivity work may be attracted by better wages to move into higher productivity occupations. In addition to this you'll have people who can now afford to do things like hire a nanny (creating one job) and then enter the labour force (increasing hours worked). It also raises the price of labour, which puts pressure on companies to automoate, which in turn raises productivity (and thanks to the GMI job killing automation presumably won't carry the risk of sucking aggregate demand out of the middle class). Increased aggregate demand will certainly create a pull in the labor market for more production which will show up as increased wages. But whether this leads to more production or inflation depends entirely on whether it succeeds at getting more people into the workforce and/or increasing productivity. Simultaneously every potential new employee is getting $15k from a policy that's deliberately trying to prevent some of them from feeling a need to work. Remember that money for GMI came from someone who was also going to spend most of it. The aggregate demand increase comes from the different propensities to spend. It's not the entire GMI amount or close too it. So yes some of what you're saying is possible, it depends on 1) how much aggregate demand increases and 2) how much less interested will people be in working. Helsing posted:If a bunch of elderly Wal Mart greeters and single moms waiting tables suddenly withdraw their labour from the economy while simultaneously a bunch of car dealerships, construction firms, marketers and factories get new customers then do you really think the final effect on the economy will be nil? I think the economic effects are nil unless those car dealerships, construction firms and factories get more workers! archangelwar posted:Minimum wage policy supposedly has the exact same effect of pushing out certain sections of the labor force, yet somehow increased unemployment is not a guaranteed consequence of raising minimum wage. Minimum wage has never been significant. Hence it never has significant effects positive or negative. You can't offset the removal or people from the workforce with increased consumption. Those things are actually contradictory.

|

|

|

|

My Lil Parachute posted:So humor me. What exactly is wrong with my scenario? Yeah, everything. You made up numbers with no basis in reality. GMI will probably create some inflation due to dis employment, and/or at least in the specific areas where people will inevitably compete to spend their "new" money (like housing). But there is no reason to assume that this effect will be that large, unless you literally think everyone will quit their jobs to live off 15k. GMI is absolutely effective as wealth transfer policy.

|

|

|

|

Cnidaria posted:I don't see why people are still debating this since it was answered on the first page. Just from a moral perspective alone we should have basic income and disagreeing is pretty hosed up considering the current state of wealth inequality and the fact that there are millions of people in the year 2014 with food insecurity in the US alone. Also why do we care if there are people who aren't employed? There currently not enough jobs to employ everyone in the country and this problem will likely get worse as more jobs are automated. If production could increase without costing anyone anything it would have already happened*. Automation takes people to design build and maintain the equipment. How much automation is optimal depends on the relative costs of the skills needed to produce the machines and the skills which the machines replace. If manual labor becomes comparatively more expensive relative to skilled automation producing labor (because GMI causes low wage people to work less) then yes automation will fill in some of the gap. But under no circumstance will it increase output outright. Because again, if that was possible it would already happen. *I already know that someone is going to say "But the economy isn't at 100%!" - that still doesn't mean that increased production is free for producers. Slack production comes about because of unemployment primarily, not because businesses are paying people to twiddle their thumbs.

|

|

|

|

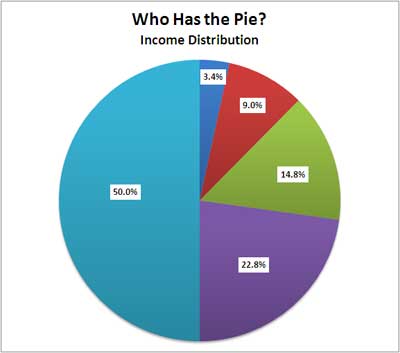

down with slavery posted:We can tax wealth. We call it a "property tax". hth And then it runs out. Not a solution for an ongoing policy. So posting the wealth chart over and over because it looks better is almost entirely useless  http://www.economicpopulist.org/content/rich-and-rest-us-united-states In terms of income, as discussed earlier, GMI would require increasing taxes to more like 40-50% of GDP. 50% of GDP is 100% of the income of the top 20%. The top 20% begins at about $115k a year. This is the chart we should be working with.

|

|

|

|

down with slavery posted:When? I don't think you grasp just how large the wealth held by the 1% is. You can touch it but funding permanent policy on a fixed sum of money isn't terribly smart? The policy is bounded by income. Plus that wealth isn't just dollars in the bank, it's businesses and properties etc. You can't just tax it all. My father is dead and my mother doesn't have any money. So not really?

|

|

|

|

Helsing posted:It's unlikely that real estate prices would increase in exactly the proportion necessary to eliminate the gains enjoyed by working class people. Anyway the solution there is probably a mixture of greater public housing construction and rent control. It's not unlikely it's impossible. Some inflation is likely but it's impossible for it to erase the gains entirely. You literally can't construct better wealth transfer policy than taking money from the rich and giving it to the poor. So there are no questions as to whether this would work at transferring wealth. asdf32 fucked around with this message at 06:01 on Nov 5, 2014 |

|

|

|

Helsing posted:Well, you could always change the relations of production. As far as financial policy aimed at addressing financial inequality, it's the best. Separate is whether solving financial inequality gets you everything you want.

|

|

|

|

down with slavery posted:Wealth too honey For reference assuming 40 trillion of "hoarded wealth" (first number I found) that's something like 2-5 years of GMI. Though you can't come close to taxing that much because as you force the liquidation of the assets underlying it you devalue them. So it's effectively less.

|

|

|

|

VitalSigns posted:We don't really need to posit science fiction. The last few decades have seen incredible productivity leaps with the owners and the rich sucking up not only the entire amount of gains, but managing to shove compensation even lower and gulp down, vampire-like, some of what labor had received in earlier times. These are significantly offset if healthcare and taxes are accounted for and correlate to the floodgates of globalization opening up. Not just technology by any means. (Healthcare is literally a societal cancer) I'm on the record agreeing that both technology and globalization pose challenges for the future (though primarily the first world) but HappyHippo is correct. The idea that technology is de-valuing labor, if true, would be a new development. Not a continuation of an existing trend.

|

|

|

|

VitalSigns posted:Wait are you saying that healthcare costs...reverse the trend of worker pay stagnating or regressing? Because healthcare costs have been increasing faster than inflation for years. Yes because employers deduct healthcare from the wages in that chart.

|

|

|

|

Helsing posted:Labour is not on the verge of being made obsolete by machines. However, automation, outsourcing and the global mobility of capital have massively shifted the balance of power between labour and capital (and this is without even going into political developments that have reinforced this trend). As such the returns to labour are decreasing and the returns to capital are increasing. That leads to greater inequality of wealth and a nasty "winner-take-all" social ethos. You're essentially advocating wealth redistribution to push the savings rate down further to spur demand. The U.S. for example already has a very very low savings rate. So that's not what's needed.

|

|

|

|

Redistributing from people with higher rates of savings to lower rates of savings. That's what Helsing was talking about. It increases aggregate demand by reducing savings rates overall.

|

|

|

|

Helsing posted:Yeah, because clearly what I was saying in that post is that we should redistribute income in whatever way will best maximize iPhone sales Well not much changes does it. Here is something you can probably understand: I don't like short term issues being intertwined with long term policy. Whether GMI is good or bad should have little to do with current economic conditions (either way). "We need stimulus now lets just enact this permanent policy!" sets off alarm bells that get my attention every time. Current events get used to justify bad policy all the time, and it's a problem. So I'm not disagreeing with the argument, I'm disagreeing that our short term need for stimulus should should dictate permanent policy. Especially when we have a well established Keynesian toolkit including borrow and spend, print money and lower interest rates. In fact we're doing all of these things and could just do them more (my favorite would be infrastructure projects) to deal with short term issues. (Beyond the short term, demand, like all financial policy, can't create growth on its own). Besides that there are actually a lot of really good fundamental arguments for GMI: Kaal posted:Basic income is all about improving the efficiency of society, by allowing citizens the fiscal stability to pursue long-term projects. It's about ensuring that most people can afford a basic room to rent rather than living on the street and constantly needing intervention from emergency services; it's about being able to regularly buy toothpaste so they don't need a $25,000 dental surgery; it's about ensuring that most people can afford to live a decent life, so they aren't forced to turn to crime and drugs to make ends meet; it's about having a refrigerator and a cooking unit available rather than having to shell out for unhealthy prepared meals; it's about raising kids in a secure environment so they're able to take advantage of education and become productive citizens. And overall it's about creating a good society that isn't so blinded with short-term gains that it ends up bleeding money to pay for all the quick-fixes. This principle of efficiency has been proven over and over again. Disputing the policy of basic income is also a refutation of basic economics. Basically everything here is a sound long term argument for GMI and reduction in inequality and poverty in general. Having a low education, poor health, high crime self perpetuating underclass is fundamentally bad for the economy for reasons anyone can see (even ignoring fairness). Accretionist posted:Are there other angles on how it induces domestic consumption? That's basically it for financial arguments. If money is borrowed to pay for it that would also increase demand. But I'd categorize that borrowing as independent policy. GMI is wealth transfer policy. The increased demand comes from the different rates of savings of the groups involved in the transfer.

|

|

|

|

mistake

asdf32 fucked around with this message at 17:05 on Dec 20, 2014 |

|

|

|

Accretionist posted:Can you provide numbers for your point? Here are some:   Compensation has continued to go up (no not as fast as productivity), it's just that it's been eaten primarily by healthcare (and taxes and other benefits). According to the second chart, of the 107% divergence 37% is accounted for by this. It's a big piece of the puzzle. Helsing posted:What you're saying is far as far as it goes - we shouldn't implement permanent solutions if the problems are short term - but it's highly questionable whether declining returns to labour or weak aggregate demand is a "short term" problem. We're talking about a phenomenon that's been going on for four decades. Declining returns to labor and weak aggregate demand are entirely different subjects, we can have high local demand that still doesn't touch certain worker segments (for some of the reasons you acknowledge below). quote:Until now households have been able to work more hours (partially by having men work more hours of the week, partially by pushing women into the workforce), take on more credit, or finance consumption through various forms of credits, in particular by relying on the increasing equity in their homes. But unless you think we're going to suddenly discover more hours in the day or unless you think it would be good to keep our domestic consumption reliant on inflating asset bubbles then something has got to give here. This is why I think these discussions are important - [I think] you're missing all the primary reasons people are working harder for less: the societal cancers known as healthcare, housing and education and global competition. They don't relate primarily to narratives involving the elite (particularly the part where hospitals and academia are screwing society). They relate to people missing the primary problems directly in front of them. quote:Keynesian policy is hard to sustain when you've got globally mobile capital, floating exchange rates and a government that has been captured by financial interests. Everyone tolerates Keynesian fiscal policy because it's the dominant economic policy? We're engaged in large amounts of keynesian policy at this moment and have been particularly since the financial crisis. Starting with George Bush mailing out stimulus checks to everyone in the country and continuing with 0% interest rates, quantitative easing (printing money) and record deficits. One thing that sometimes gets lost is that deficits are stimulus. It doesn't matter what the name of the bill is. The stimulus part comes from the government spending more than it takes in, regardless of what that spending is on. Will republicans fight a new "stimulus" bill? Yes, but that's basically a publicity stunt by both sides compared to the massive [keynesian] stimulus the current deficits represent. Well like I mentioned above there is a point here with the capital controls in that stimulus spending or higher demand can leak outside the borders and might miss some groups altogether. I don't think we know for sure. But that's one reason why my preferred policy would be local spending first on things like infrastructure which stay here. Implement capital controls? Absolutely not. I'm not convinced it's needed and it would be a massive FYGM to the rest of the world.

|

|

|

|

|

| # ¿ May 15, 2024 23:38 |

|

Helsing posted:Don't you think you should be disaggregating those statistics a lot more than you are? How are you distinguishing between the stock options paid to CEOs vs. the healthcare provided for workers, and why are you using average wages instead of median wages? You're chart is at such a high level of abstraction that it is impossible to verify whether the numbers are showing what you claim they are showing. The graph is the same level of abstraction as the one I originally replied too. Certainly the heritage foundation graph is not the be all end all here. But it's capturing an obviously important point that's often lost - a significant chunk of wage stagnation is explained by healthcare costs. Unions? I continue to fail to see how you can look at titanic shifts in the global economy that coincided with wage stagnation and conclude: "Nope, mostly unions". But we've had this discussion. Note that this point about healthcare is important for comparing wages between the U.S. and other countries which have national healthcare. quote:I'm not entirely sure what you're trying to say here but it certainly doesn't follow that stagnating wages and salaries are disconnected from weak aggregate demand. Households are underpaid and over leveraged and that is depressing the demand for goods and services in an economy where roughly 70% of GDP is composed of consumption. Increased aggregate demand should generally help everyone if the economy is depressed. But not evenly. And as we've basically seen the economy can grow while leaving certain segments behind. So increased demand can still leave some labor segments out. Whether it does and who it leaves behind are entirely separate variables from demand itself. I'd also caution you again on putting too much emphasis on demand. Aggregate demand matters mostly in terms of changes (quick decline = recession, quick increase = bubble) but not in absolutes. Different economies function just fine with wildly varying rates of savings for example (Norway 39, US 17). The financial system does a good job of balancing these things out over time and shifting supply to wherever the demand may be. If we wanted permanent policy to increase aggregate demand we'd just print money and mail it out as checks. We know that doesn't work and it doesn't work because increasing aggregate demand isn't universally good policy. quote:You cannot talk coherently about any of the sectors you just mentioned without discussing how the government has been captured by monied interests. I'm honestly a bit shocked that you could type that list of sectors out without somehow recognizing that. Yes I can because none of these things primarily have to do with that. Healthcare is a problem of market supply with non-market demand but it's also intertwined with culture (fight to the end), exacerbated by things like too much liability and privacy but most importantly: a lack of interest in reform. Americans haven't really ever wanted a national healthcare system and have lived the consequences. The elites haven't foisted this upon them. And, lo and behold, it's currently changing. Housing prices have been on their way up since the 90's well before mortgage backed securities were relevant at a time when Fannie and Freddie dominated the market with a mandate to subsidize middle class home ownership rates (in tandem with tax credits and other incentives). That's driven the longer term housing increase. The bubble was a temporary side show in that story. And, given that the bubble popped spectacularly, it's not clear housing prices would be lower today if none of it had happened. Increased housing prices are part of a large trend, not simply "deregulation". Separately, the idea that the financial industry loves market crushing bubbles is absurd.  The red line below is Fannie and Freddie. Asset backed securities are barely a thing until 2003.  And as for education, right, a major part is well meaning subsidies for education. Reminder of the point: Housing, healthcare and higher ed are huge pieces of the puzzle for why middle class economic gains have stagnated. And they don't easily tie to any single narrative. The market is a big problem in healthcare but less so in housing and education where well intended government policy has helped cause long term problems. quote:This is a former chief economist at the IMF, who not exactly a socialist firebrand: I'm not sure at this point how we got on the financial crisis but like I said, it and the potential oligarchs that caused it are not the primary causes of the things above. Healthcare is literally an economic cancer in my opinion but I'd caution you against declaring any category within it "deadweight". If the government took over healthcare the entire industry would be subsumed within it and all categories of jobs would continue to exist in some form (certainly the government shouldn't rubber stamp every claim for example). The financial industry, well, lets agree that I think rich people and rich corporations don't like giving money away for nothing yet seem to pay quite a bit for finance. That, and finance plays a roll in capital allocation and investment choice. Not an easy case for "dead-weight" quote:Keynesianism tends to refer to a cluster of policies that goes beyond just deficit spending and includes controls on capital and an emphasis on fiscal policy rather than monetary policy, which generally means a larger role for government. Well austerity in Europe is primarily the result of the Euro tying the hands of all the nations involved. When any normal country faces a debt crisis it can devalue it's currency. Greece, Spain etc couldn't do that, hence Austerity. Yeah it was a huge mistake and everyone gets that now. But the Euro created a unique set of circumstances that hadn't really been encountered before. Beyond that I'm not really going to quibble. Certainly there is room for more aggressive government stimulus. But to suggest that we're not deep in the middle of an era of Keynesian economic policy is sort of ridiculous. quote:Simply running up deficits is a totally inadequate policy for addressing the problem's we're facing. Obviously if the economy is in recession then the government should run deficits but that doesn't mean that this policy on its own is going to accomplish much. There's a big difference between, say, cutting the capital gains tax vs. building a bunch of roads and bridges. Well again borrowing is stimulus and the scale at which we're borrowing far exceeds the size of any real or proposed "stimulus" bill. Some of it may not be directed but that borrowing goes to pay for government employees who would otherwise be laid off and programs like unemployment which are every bit as good as as any "stimulus" bill. quote:

It hasn't created unbalanced growth it's created growth across the board with the first world middle class as the only major exception. Not perfect, but I'll take it. The countries you list grew with significant amounts of trade with a first world willing to outsource industries and directly invest in them. Japan wouldn't grow for example if the U.S. wasn't willing to import huge amounts of steel, cars and electronics starting the 70's - exactly the things capital controls, which you're calling for, prevent. asdf32 fucked around with this message at 17:41 on Dec 21, 2014 |

|

|