|

Veskit posted:To help offset the rate cuts, Carson said he would “get rid of all the deductions and all the loopholes.” That’s a bold proposal, considering how popular many tax breaks are, including deductions for interest on home mortgages and charitable contributions, as well as exemptions for health insurance and retirement savings. If there was ever any serious attempt to get rid of the mortgage interest deduction there will be riots in the suburbs. (Not to mention the enormous fight that the banks would put up.)

|

|

|

|

|

| # ? Apr 29, 2024 13:45 |

|

e_angst posted:If there was ever any serious attempt to get rid of the mortgage interest deduction there will be riots in the suburbs. (Not to mention the enormous fight that the banks would put up.) It's so well deserved though what a horrible policy.

|

|

|

|

Veskit posted:It's so well deserved though what a horrible policy. I think encouraging home ownership isn't a bad thing. But the amount they let you deduct is kind of crazy and probably skews things too far. Combine it with other policies that incentivize home ownership (like California's Proposition 13) and you end up with a really hosed up market. Also, there are definitely a lot of middle-class people who don't realize (or at least don't admit) that they are paying the same tax rate as the working poor because of that deduction. Hell, I'm single and pulled around $60k last year. My effective tax rate should have been a little over 18%, but I ended up barely paying 12% (and the refund check I got was much, much bigger than anything I ever got a decade ago, when I was living near the poverty line on two part-time jobs).

|

|

|

|

e_angst posted:I think encouraging home ownership isn't a bad thing. But the amount they let you deduct is kind of crazy and probably skews things too far. Combine it with other policies that incentivize home ownership (like California's Proposition 13) and you end up with a really hosed up market. Most middle and upper class people won't admit what their effective tax rate because doing so would undermine all the reasons to poo poo on the poor and talk about how they are paying for the poor, etc. The progressiveness of our tax structure is assumed in all political discussions (as a reason to lower taxes on the rich/business) but doesn't exist anymore in reality, except for very specific circumstances. And then add in poo poo like this (everyone that I know at a startup or who was at a startup, all regular low/mid-level employees did the same trick to get options in to a Roth free and clear): http://www.forbes.com/sites/deborahljacobs/2012/03/20/how-facebook-billionaires-dodge-mega-millions-in-taxes/ But yes, removing the mortgage interest deduction would restore some of the progressive nature the tax system is supposed to have. It'd also cause an instant an immediate backlash against whoever did it, and would be something only to do after treating capital gains like regular income instead of special bullshit (or worse, tax free at the federal level), actually taxing corporations, and ending the more insane tax shelters that cause real effective tax rates on the rich to be vastly lower than people who make normal amounts of income. About the only way I could see it happening is much like what I've said for removing Prop 13 - a phase out at a time of known housing price increases (as a result of massive lowering of interest rates or something). Even then the political attack ads write themselves.

|

|

|

|

e_angst posted:I think encouraging home ownership isn't a bad thing. But the amount they let you deduct is kind of crazy and probably skews things too far. Combine it with other policies that incentivize home ownership (like California's Proposition 13) and you end up with a really hosed up market. It's the amounts you can deduct as you said that are loving dumb absurd. I don't know why people get more than a one time deduction. There would be a literal war however if you took that away. Pervis posted:Most middle and upper class people won't admit what their effective tax rate because doing so would undermine all the reasons to poo poo on the poor and talk about how they are paying for the poor, etc. The progressiveness of our tax structure is assumed in all political discussions (as a reason to lower taxes on the rich/business) but doesn't exist anymore in reality, except for very specific circumstances. And then add in poo poo like this (everyone that I know at a startup or who was at a startup, all regular low/mid-level employees did the same trick to get options in to a Roth free and clear): Wait you can dogpile a bunch of cheap rear end shares from a start up into a roth ira? Am I understanding that correctly? Also yes on everything else yes it's impossible to remove but gently caress if we could it'd certainly help clarify our progressive tax system.

|

|

|

|

Also somewhat related, if I wanted to keep up with the news, should I go with the economist weekly subscription or is there something better? Lets say it needs to be a 5/10 on the readability scale, and a 8/10 on the informative scale if at all possible.

|

|

|

|

I think the economist is better than any other large weekly news magazine, but that's not saying too much, necessarily.

|

|

|

|

Veskit posted:Also somewhat related, if I wanted to keep up with the news, should I go with the economist weekly subscription or is there something better? Lets say it needs to be a 5/10 on the readability scale, and a 8/10 on the informative scale if at all possible. That depends on if you want to know the Very Serious Person angle on events. If you do then The Economist is what you're looking for.

|

|

|

|

Veskit posted:Wait you can dogpile a bunch of cheap rear end shares from a start up into a roth ira? Am I understanding that correctly? Options, not shares. I haven't done it myself (and am not a lawyer nor is this advice, but if you are in a startup I'd inquire with the right people), but as explained to me, startups have a set valuation schedule of sorts - share price and thus option value is not bound by any sort of market so reported worth of said securities is more what's declared by the company rather than a market. You can take stock options worth 'nothing' or close to it, and transfer said securities in to a Roth or other vehicle rather than cash, or something to that effect but the end result is getting out of the income tax and lots of money in to tax-advantaged account. Then later they are worth a shitload more money, which you can build on after that. There's some other method where you fill out some IRS form where you basically pay taxes on the options that are worth nothing (now), and then later when you sell them it's long-term capital gains rather than normal income (note that CA doesn't recognize the distinction, so they still pay the 9-13%). It's something similar to what Romney did to make at most 30k a year in contributions turn in to way the gently caress more than that: http://www.theatlantic.com/politics/archive/2012/09/whats-really-going-on-with-mitt-romneys-102-million-ira/261500/

|

|

|

|

|

| # ? Apr 29, 2024 13:45 |

|

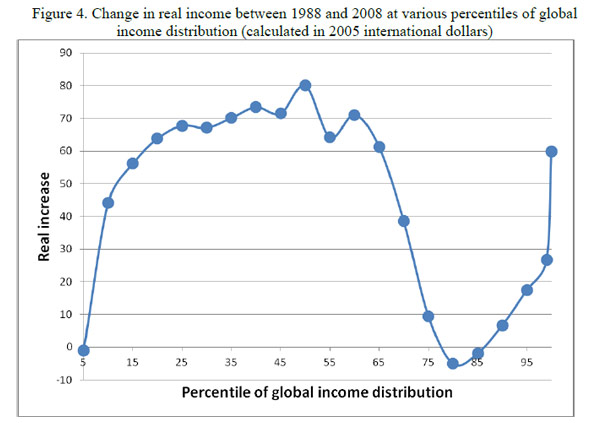

I feel a bit weird necromancing a thread to reply to a post from almost a month ago but I got caught up in election related crap and then got kind of distracted. Also this discussion wasn't exactly leading to an exchange of ideas. That having been said I did want to address a couple things before moving on.asdf32 posted:Umm, why? We're probably coming off the best 2 decades or so in worldwide economic history with high growth and probably no increase in inequality. That means on average everyone has benefitted (and the notable losers are ~80th percentile). Even though I can anticipate how you would wiggle out of this claim it's still a really stupid thing to say. quote:So what do you want? The 1920s was followed by the 1930s. Japan in the 1970s and 1980s was followed by Japan in the 1990s and 2000s. Rapid growth is, if anything, historically correlated with dramatic and painful crashes. quote:Well we can but it's less likely with inflation hovering near zero and less likely to have a large impact if it does pop. Ok then why did a period of relatively low inflation in the 2000s result in an epic asset bubble pop in 2008? By the way, one of the guys widely recognized as having predicted the 2008 crash is not exactly feeling bullish about the US economy right now. quote:I don't really agree. Generally increasing the money supply increases demand for everything which doesn't impact the most important aspect of prices - relative value. The exact values of QE are public and the impact of printing money isn't exactly a mystery and consistent with Keynesian policy. The history of capitalism is also riddled with long and ruinous periods of deflation or economic depression which exactly what I'm warning about. Yeah I guess if you're comfortable with the idea of a repeat of the Long Depression from the 19th century or the Great Depression from the 20th then everything is hunky dory. Your argument about economic fundamentals is also, frankly, dumb. Productive assets are irrelevant under capitalism [i]unless they can produce a profit for their owner.[/url] There are plenty of historical examples of productive assets being allowed to waste away because the demand for their use wasn't sufficient. quote:Well besides noting that Japan is near the top of the GDP per capita list and therefore I'm not terribly concerned about them I'll say that they are a really interesting exception. Clearly there are no fundamental economic problems preventing them from growing so the problem is financial or political. Beyond that I don't know what to say except that yes, it's possible that any country could stop growing like Japan. I just don't see why I should think that will happen. For example China is decades away from that type of GDP per capita. If there is a hard upper limit on GDP growth then that's probably a good thing for long term inequality. quote:If you say so... That's how capitalism works? Just look at Japan (or America after 1929). You can have a skilled labour force and lots of capital and still end up with resources laying idle if there's no way to profitably employ those resources. quote:I'm still not convinced you have a coherent definition for bubble. The countries sitting at the top of the GDP per capita list that have almost all been there for decades aren't bubbles. They have experienced bubbles but their economies aren't explained by bubbles. Instead of just repeating the things you already believe give me some evidence. What would propel growth in the US economy over the last couple decades if you take away the housing bubble? And why hasn't growth returned to its historical average? quote:I already noted how China has grown through U.S. recessions and overall, developing economies were far less affected by the crisis and bounced back to pre-crisis growth quickly. The mechanics of trade and comparative advantage that are the basic drivers of export growth continue to work even when the rich countries stall out (which is basically what's happened in the last 7 years). Comparative advantage is not the basis for trade between advanced economies, Chinese growth estimates are unreliable, and China's growth since the crash has relied in large part upon a massive internal stimulus, as well as selling to countries that also have unstable or crisis prone economies right now. quote:China continued growing through the crisis and so did India: This doesn't address what I'm arguing. quote:The idea that Japan represents the future of the first world is possible. I just see no reason to think it is at this point. But comparing Japan to China makes no sense given the massive wealth disparity between them. China hasn't hit the middle income trap, let alone the upper income trap Japan occupies. Even if the entire first world stagnates it's another leap to decide that 1) that matters much to the rest of the world or 2) is a bad thing in the big picture (they've already been growing slower for decades).

|

|

|