|

RE: economic growth, medium-long term growth prospects for the US are actually remarkably good compared to places like Japan and Europe. The US won't face demographic issues for decades as things are right now. The lesson from China is that quickly catching up to the US as an impoverished third world country just isn't feasible

|

|

|

|

|

| # ¿ May 16, 2024 04:02 |

|

Typo posted:This is an actual economic concept known as convergence: This only works if you assume away the fact that poor countries have lovely institutions which prevent them from growing properly. Latin America has been stagnant relative to the top tier developed countries for decades and decades, for example

|

|

|

|

Typo posted:Poor countries with really awful institutions grow pretty fast too, India and Egypt pre-2011 are two examples. I mean more graduating from middle income to high income, which is what Latin America failed to do and has basically never been done outside of edge cases like South Korea, which is still at the poor end of developed countries And no, wiki has Argentina at $13,000 GDP/capita, it's nowhere near the US or Western Europe icantfindaname fucked around with this message at 04:15 on Sep 30, 2015 |

|

|

|

asdf32 posted:The other Asian tigers, Hong Kong, Singapore, Taiwan and then Japan before that are the primary examples. Japan shouldn't really be on that list, it started industrializing in the 1880s. You might as well put Germany on there too. The fact is that South Korea, Taiwan, and a handful of tax havens, oil baronies and city states don't really constitute a meaningful body of evidence that moving past the middle income trap is feasible for most developing countries

|

|

|

|

Veskit posted:What's the middle income trap? Basically the inability of a country, once it has progressed from a subsistence economy to a basic industrialized one, to continue increases in productivity and GDP https://en.wikipedia.org/wiki/Middle_income_trap quote:The middle income trap is a theorized economic development situation, where a country which attains a certain income (due to given advantages) will get stuck at that level.[1] icantfindaname fucked around with this message at 16:17 on Sep 30, 2015 |

|

|

|

Veskit posted:I think I learned about this back in school a while back in where countries try sending their bright students to foreign colleges to gain a ton of knowledge and then they never move back and waste a lot of money being unable to fund education themselves and get stuck in that cycle. India's not even at that point yet, middle income is usually around $10,000/capita/year GDP, while India according to Wikipedia is at $1800. Middle income countries are basically Latin America, China, Russia and Eastern Europe, along with the less hosed up parts of SE Asia and the ME like Turkey and Malaysia But the point is that even once you've gotten past the immediate barriers to development that face the poorest tier of countries, like civil war and political dysfunction, lack of capital to invest in basic industry and infrastructure, etc, there are still shitloads of very hard to fix institutional issues standing in the way of growth icantfindaname fucked around with this message at 16:31 on Sep 30, 2015 |

|

|

|

Arglebargle III posted:The classic middle income trap countries seem to all have monstrous inequality. It's because those countries either never had the postwar middle class phase, or had it forcibly dismantled by the IMF and friends. Applies to Latin America, possibly/probably Turkey, possibly Russia if you squint a bit, etc

|

|

|

|

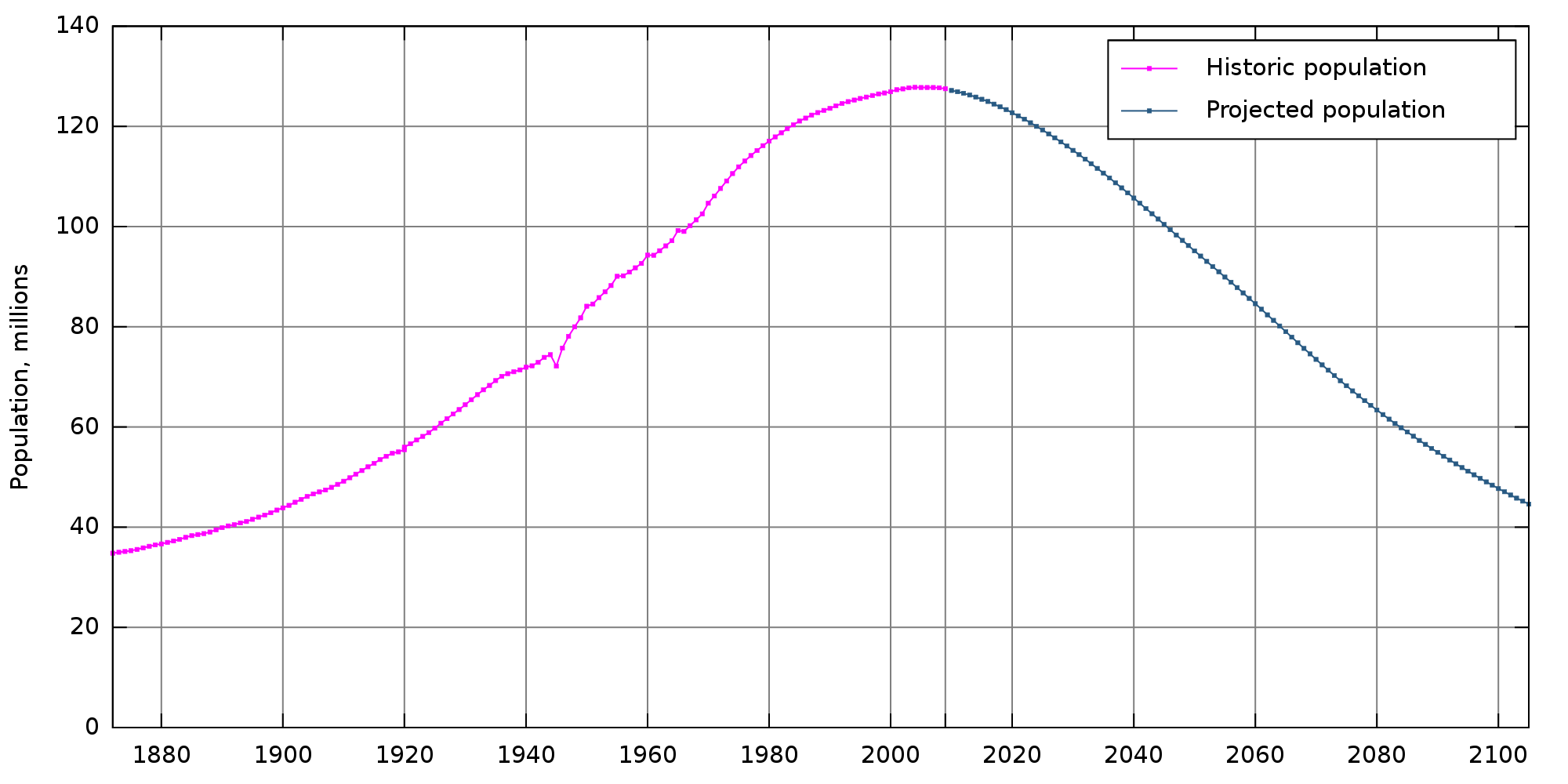

asdf32 posted:Well besides noting that Japan is near the top of the GDP per capita list and therefore I'm not terribly concerned about them I'll say that they are a really interesting exception. Clearly there are no fundamental economic problems preventing them from growing so the problem is financial or political. Beyond that I don't know what to say except that yes, it's possible that any country could stop growing like Japan. I just don't see why I should think that will happen. For example China is decades away from that type of GDP per capita. If there is a hard upper limit on GDP growth then that's probably a good thing for long term inequality. pictured: no fundamental economic problem preventing growth:  The idea is that long-term demographics for all countries not big enough and wealthy enough to attract human capital from abroad (basically everyone not named the US and possibly the UK) will kill off growth. And also, I'm sort of bemused by the idea that financial or political problems somehow aren't 'fundamental economic problems'? They have the same effect on the economy, why would they not be as serious? Take India or Latin America, for example. Their failure to grow could probably be described as political, but they're still not growing at the end of the day More generally though you still haven't really addressed the fact that almost all of the growth in the last few decades has been in China, whose export strategy is not generally repeatable by the rest of the developing world, and even with that export crutch Chinese growth still seems to be dying icantfindaname fucked around with this message at 16:03 on Oct 14, 2015 |

|

|

|

|

| # ¿ May 16, 2024 04:02 |

|

Guy DeBorgore posted:Japan's demographic crisis has definitely hurt its chances of recovery, but it doesn't explain the stagnation in the 1990s-early 2000s. I don't know what the explanation is, but I'm guessing it involves some political mistakes as well as economic fundamentals (more competition from Korea and China, for example). Japan hosed up its response to the early 90s bubble, IIRC. Even then it sort of recovered and had decent (2%-ish) growth for a while from the late 90s to 2008. The demographic impact is mostly being felt in its failure to recover from 2008 icantfindaname fucked around with this message at 18:00 on Oct 14, 2015 |

|

|