- Halo14

- Sep 11, 2001

-

|

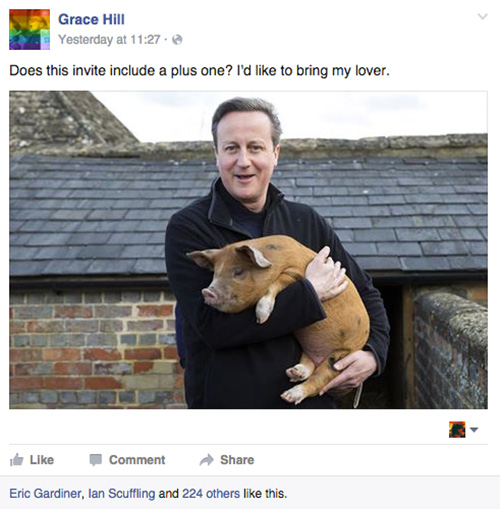

Yay. Social media once again proves its worth.

|

#

¿

Dec 1, 2015 05:58

#

¿

Dec 1, 2015 05:58

|

|

- Adbot

-

ADBOT LOVES YOU

|

|

|

#

¿

May 10, 2024 12:25

|

|

- Halo14

- Sep 11, 2001

-

|

So glad that politicians lifelong retirement payments will be removed as well.

|

#

¿

Dec 1, 2015 23:27

#

¿

Dec 1, 2015 23:27

|

|

- Halo14

- Sep 11, 2001

-

|

Never gets old that one.

|

#

¿

Dec 1, 2015 23:51

#

¿

Dec 1, 2015 23:51

|

|

- Halo14

- Sep 11, 2001

-

|

Turns out copper phone lines are poo poo? Who would have guessed...

$641 million: NBN copper remediation costs blows out ten times

https://delimiter.com.au/2015/12/03/641-million-nbn-copper-remediation-costs-blows-out-ten-times/

quote:A new set of leaked documents have revealed that the NBN company underestimated the cost of remediating Telstra’s copper network by a factor of ten in its November 2013 Strategic Review, with the actual cost ballooning out by a factor of ten times to cost the NBN company about $641 million.

|

#

¿

Dec 3, 2015 02:19

#

¿

Dec 3, 2015 02:19

|

|

- Halo14

- Sep 11, 2001

-

|

What's this about?

https://au.news.yahoo.com/qld/a/30262639/kids-in-detention-sit-in-at-dutton-office/

quote:Peaceful protesters say they won't move from outside Immigration Minister Peter Dutton's Brisbane office until the government releases all children from detention.

Multi-denominational Christian group Love Makes a Way is calling on the government to adopt Senate amendments to free all children from Australian detention centres.

"Minister Dutton can decide today to release all 112 children, including babies, currently in Australian detention centres and the 95 held on Nauru," Anglican priest Fr Nicholas Whereat said.

"Imagine what a Christmas present that would be."

It was disappointing the government had refused to openly communicate about the issue, forcing groups to adopt such protest measures, Anglican Dean of Brisbane Peter Catt said.

The group - which includes Anglican, Baptist, Catholic and Quaker members - wants mandatory reporting for abuse and broader media access to detention centres.

Greater protection for whistleblowers reporting abuse is also a priority.

Protesters on Thursday gathered outside Mr Dutton's Strathpine office brandishing signs reading "Jesus was an asylum seeker" and attacking Australia's "callous" policies.

It comes after six members were forcibly removed after camping out at Prime Minister Malcolm Turnbull's Edgecliff office.

The group intends to remain at the Immigration Minister's office, or outside, until children are released from detention.

|

#

¿

Dec 3, 2015 08:30

#

¿

Dec 3, 2015 08:30

|

|

- Halo14

- Sep 11, 2001

-

|

How appropriate is the 2GB logo there.

|

#

¿

Dec 11, 2015 03:18

#

¿

Dec 11, 2015 03:18

|

|

- Halo14

- Sep 11, 2001

-

|

http://www.afr.com/news/policy/tax/ato-prepares-to-reveal-tax-secrets-of-1500-companies-20151206-glgikw

ATO prepares to reveal tax secrets of 1500 companies

Oh it's been released in a searchable format:

http://www.afr.com/news/policy/interactive--ato-reveals-corporate-australias-tax-secrets-20151217-glpmsg

quote:Senior executives are bracing for the release of tax details for more than 1500 companies on Thursday, with the figures expected to show more than a third of large corporates paid no tax in 2014.

That's the aggregate figure for 2013, and the position was even worse for foreign companies operating in Australia, half of which had no taxable income last year, on revenue totalling $21 billion.

While the aggregate figures are no surprise, the Tax Transparency report that Tax Commissioner Chris Jordan will release on Thursday, for the first time, will identify how much tax individual companies pay.

But the selective information is confusing and companies may struggle to explain how the ATO numbers differ from their own reported tax payments.

Public attention inevitably wil fix on any discrepancies between Thursday's figures with statements that a string of major corporates including Google, Apple, BHP Billiton, News Corporation, Rio Tinto and Chevron made to the Senate tax inquiry earlier this year on how much tax they pay.

The data may include James Packer's companies, which would be regarded as foreign because the ownership through Cairnton Holdings is held by Bahamas companies, while Mr Packer himself recently moved to Israel.

But investors may battle to understand what the figures to be released on Thursday mean.

Two years of bitter political battles have produced a reporting regimen under which the ATO will detail total revenue, taxable income and tax paid for foreign owned corporates and Australian public companies with more than $100 million of sales.

The Tax Transparency report will provide no details of the quite legitimate reasons that most companies paid less than the statutory 30 per cent tax rate—and in some cases less than the amount reported in their accounts—and accounting firms are encouraging companies to be proactive in explaining their tax positions.

Preparations include seminars, one-on-one coaching and suggested question-and-answer briefings for senior executives to handle media inquiries.

Amendments that the government agreed to with the Greens on December 3 will extend the tax disclosures to Australian private companies with turnover of more than $200 million, but this information is not expected to be ready before March, when it will be released separately.

The delay is to enable the ATO to provide the private companies with the opportunity to comment on the figures to be released.

The challenge will be to understand how the figures that the ATO releases for international companies in particular relate to the special purpose accounts that they file with the Australian Securities and Investments Commission.

"Income tax expense is a vastly different amount to the total taxes paid," a spokeswoman for a major multinational told The Australian Financial Review earlier this year.

"An income tax expense is purely an accounting tax cost or expense for accounting purposes only."

Apple's Australian company reported income tax expense of $80.35 million in 2014, while its cashflow statement showed income tax paid as $101.1 million.

WHAT THE NUMBERS MEAN

Aggregate tax data published by the ATO for 2013 offers several different measures of revenue, and list "Taxable income", as well as "Taxable income (Calculation statement)".

The ATO also details "Tax on taxable income", "Gross tax", "Tax payable" and "Net tax". It appears that the cash tax paid is the net tax figure which will be supplied for each company.

To add to the confusion, the figures will be for tax consolidated entities or in some cases individual companies rather than what is the consolidated group under accounting principles.

BP's major holding company, BP Australia Investments, reported income tax expense of $84 million in 2014. But bizarrely, tax is consolidated in the previous holding company, BP Regional Australasia Holdings.

Xstrata until recently has held most of its mining investments in separate companies without an umbrella parent in Australia (though it has said it is moving to this model).

It's possible that not all of the separate companies reach the $100 million a year in revenue and thus would not be included in the report.

It may be possible for Australian large private companies to game the system by restructuring to ensure different taxable entities have less than the $200 million revenue cut-off. But the late Greens amendment covers the 2014 tax year, before any such moves would have been taken.

Foreign companies are defined as groups with a foreign ultimate holding company, though if the foreign shareholding is less than 50 per cent they will be regarded as private Australian companies and excluded from next week's list.

Cairnton Pty Ltd, a subsidiary of the Packer family's Cairnton Holdings, files accounts with ASIC under the category, "Small proprietary company that is controlled by a foreign company", suggesting that the entire group may be treated as foreign owned and thus caught by the Tax Transparency provisions.

The ATO has already published aggregate figures for corporate tax paid in 2013, which show that 2,840 non-resident companies of all sizes operating in Australia reported $42.3 billion in sales.

But 1,375 of these foreign companies—or nearly half—with total revenue of $21.2 billion, had a total taxable income of only $17.9 million and after other allowances each paid zero tax.

In comparison, 2,210 large and very large Australian companies (with revenue above $100 million and $250 million respectively) reported sales of $1.85 trillion, and taxable income of $168 billion.

Of these, 705 companies (almost a third) with revenue of $434 billion, had a taxable income of $5.7 billion. While this indicated tax payable of $1.7 billion, after various allowances none of these companies paid tax, and five of the very large firms were paid tax refunds totalling $1 million.

Australian resident companies carried less debt, with average debt/assets ratio of 31 per cent, against 56 per cent for foreign companies. Halo14 fucked around with this message at 04:15 on Dec 17, 2015

|

#

¿

Dec 17, 2015 04:11

#

¿

Dec 17, 2015 04:11

|

|

- Adbot

-

ADBOT LOVES YOU

|

|

|

#

¿

May 10, 2024 12:25

|

|

- Halo14

- Sep 11, 2001

-

|

http://www.smh.com.au/federal-politics/political-news/jamie-briggs-an-ambitious-mp-who-overstepped-the-mark-20151229-glwgt3.html

quote:"He's always been very sure of himself," says one colleague - perhaps too sure of himself.

When ABC radio host Rafael Epstein described him as a "junior minister" - a common term in Canberra - he shot back by calling Epstein "a junior radio presenter" and accused him of not showing his position respect.

quote:A passionate free marketeer, Briggs helped design Work Choices while working in John Howard's office. He has recently called for cuts to penalty rates on Sundays and public holidays.

quote:A former flatmate and political ally of Joe Hockey, Briggs publicly said he voted for Abbott against Turnbull in September. quote:

In September, the day after Malcolm Turnbull rolled Tony Abbott as leader, Briggs was filmed being pushed into a party room meeting in a wheelchair. When rumours emerged that Briggs had injured himself dancing on a marble table in a ministerial suite, his spokesman said he had "seriously injured his leg while on a run this morning".

Briggs, 38, later conceded he hurt his leg during "high jinks with the former prime minister" on the night of the spill.

"Look, I went to tackle him; I ran at him and missed and the rest is history," he said. "I then limped back to my office and licked my wounds."

Christ.

|

#

¿

Dec 29, 2015 11:08

#

¿

Dec 29, 2015 11:08

|

|