|

Shifty Pony posted:I'm having a hard time envisioning how a just-slightly-deflationary environment would affect the median US family. Jus tot start with personal debt would become an even worse idea, correct? Well unemployment and underemployment would start going back up, while labor participation rates would take another hit. Consumer spending would go down again and likely stay depressed, while personal debt would continue to get worse. I see the future crisis being a long, slow and very stubborn recession, and when growth happens afterward it very well be extremely borderline (and likely continually revised downward). I could see whomever winning the 2016 election being a one-term president (sort of like Bush 1). Ardennes fucked around with this message at 22:05 on Jan 31, 2016 |

|

|

|

|

| # ? Apr 19, 2024 22:53 |

|

Ardennes posted:I see the future crisis a long, slow and very stubborn recession, and when growth happens afterward it very well be extremely borderline (and likely continually revised downward). e: No one will be able to afford them though. A Buttery Pastry fucked around with this message at 22:10 on Jan 31, 2016 |

|

|

|

Ardennes posted:Well unemployment and underemployment would start going back up, while labor participation rates would take another hit. Consumer spending would go down again and likely stay depressed, while personal debt would continue to get worse. Unless it's Trump, who has an actionable plan to engage in a multi-trillion infrastructure spending program. While Sanders also presents a spending plan, his is not one which could pass Congress. The TrumpWall is, and it offers the possibility of territorial addition through a foreign policy designed to force Mexico to pay for it. I'm certain that if Mexico is unwilling to pay for the TrumpWall is USD, that the United States would be willing to consider territory and permanent economic concessions.

|

|

|

|

My Imaginary GF posted:I'm certain that if Mexico is unwilling to pay for the TrumpWall is USD, that the United States would be willing to consider territory and permanent economic concessions. You're literally advocating for Mexican-American War 2 here. If it was anyone else but MIGF I would be surprised.

|

|

|

|

Cantorsdust posted:You're literally advocating for Mexican-American War 2 here. If it was anyone else but MIGF I would be surprised. The ecological disaster that the wall would produce is just a fun super bonus too!

|

|

|

|

Anubis posted:The ecological disaster that the wall would produce is just a fun super bonus too! Hey now those land management processes to link up isolated habitats to create continuous corridors so as to promote sustainable ecological sanctuaries, a process that's soaked up more than $80mm and exceeding 90,000 acres of aggregation - spanning both countries - is the exact kinda hippie talk that's Making America Not Drastically Improved Nor Greatly Optimized. Trump will fix these MANDINGO problems.

|

|

|

|

Dead Cosmonaut posted:I'm arguing that most identify as being French, not citizens of the Third Republic or some poo poo. People don't view their nationalities by whatever their current government is. That's a uniquely American thing going. Most 'French' people didn't identify as French before the Third Republic

|

|

|

|

icantfindaname posted:Most 'French' people didn't identify as French before the Third Republic It only took the loss of 3/4th the French population of the previous Republics for French identity to emerge.

|

|

|

|

From the today in history section on the front page of wikipedia:quote:On this day...

|

|

|

|

So is tech collapsing now too?

|

|

|

|

tekz posted:So is tech collapsing now too? Maybe. Probably.

|

|

|

|

tekz posted:So is tech collapsing now too? all the companies with giant valuations and weak eps are gonna crater yeah. people are willing to put up with that poo poo from amazon but everyone else has got to pay to play starting now

|

|

|

|

tekz posted:So is tech collapsing now too? Uber redesigned their logo!

|

|

|

|

http://www.cnbc.com/2016/02/05/citi-world-economy-trapped-in-death-spiral.htmlquote:The global economy seems trapped in a "death spiral" that could lead to further weakness in oil prices, recession and a serious equity bear market, Citi strategists have warned. Mainstream media starting to take notice... "Death spiral" is a rather dramatic way to put it.

|

|

|

|

Looks like a buy signal from where I'm sitting. (Well not QUITE yet, but nosing into one)

|

|

|

|

"Rational behaviour, most likely, will prevail."

|

|

|

|

Human beings: always rational actors

|

|

|

|

Depends what kind of rational. People rationally acting for self interest may actually prevail in making massive profits even while the system burns (might even be rational to encourage it if in the right places).

|

|

|

|

Brannock posted:Mainstream media starting to take notice... "Death spiral" is a rather dramatic way to put it. The way bulk commodities are deflating it could end up being that scary. You can charter bulk carriers for a

|

|

|

|

With global exports contracting hard over the last months and the baltic dry index in free fall, global manufacturing really looks like poo poo. Any economists here that could shed some light on the connection between such symptoms and a possible global crash?

|

|

|

|

|

SavageGentleman posted:With global exports contracting hard over the last months and the baltic dry index in free fall, global manufacturing really looks like poo poo. Any economists here that could shed some light on the connection between such symptoms and a possible global crash? I dunno. This dude says the BDI isn't that big of a deal -- shipping is just getting cheaper, but trading volumes have held. http://www.forbes.com/sites/timworstall/2016/02/09/whatever-the-baltic-dry-index-says-global-trade-is-not-collapsing/#7c2e38eb7cd2 The only other thing I found about the BDI was Lew Rockwell stuff, but I don't know enough on whether to trust the Gorbes article I posted.

|

|

|

|

Some conflation between the shipment of bulk commodities and containers in that article. Container rates he's partially correct about, there is an over capacity of container liners on some services. This is because there is a arms race in vessel size. The larger the vessel the cheaper per container cost in fuel. Bulk carriers are a different story. There is definitely a drop in bulk trade particularly in iron ore and coal headed to China.

|

|

|

|

Is there any chance real-estate prices will see a contraction the way oil prices have? That's something I tell myself I want to see happen, but just like cheap gas I imagine there would some very undesirable consequences that would come with that.

|

|

|

|

BrandorKP posted:Some conflation between the shipment of bulk commodities and containers in that article. Container rates he's partially correct about, there is an over capacity of container liners on some services. This is because there is a arms race in vessel size. The larger the vessel the cheaper per container cost in fuel. Bulk carriers are a different story. There is definitely a drop in bulk trade particularly in iron ore and coal headed to China. Yep. Here's an article where Maersk admits that conditions are not great for bulk goods. Forbes guy is more or less right, but he's probably being too optimistic. We're pretty obviously not in a global recession right at this moment, but it's not a great sign that growth in global trade is slowing or that carriers overestimated growth so badly that there's now an extreme excess of transport capacity.

|

|

|

|

BrandorKP posted:There is definitely a drop in bulk trade particularly in iron ore and coal headed to China. In related news the scrap yards now want to charge the company I work for to take away full steel bins because steel scrap prices have collapsed so bad.

|

|

|

|

side_burned posted:Is there any chance real-estate prices will see a contraction the way oil prices have? That's something I tell myself I want to see happen, but just like cheap gas I imagine there would some very undesirable consequences that would come with that. What is even your mechanism for that to happen?

|

|

|

|

side_burned posted:Is there any chance real-estate prices will see a contraction the way oil prices have? That's something I tell myself I want to see happen, but just like cheap gas I imagine there would some very undesirable consequences that would come with that. Probably. Real estate is a bubble again. Everybody wants the price of their land to go higher and higher all the time and people are opposing high-density development to drive their home values up.

|

|

|

|

Bip Roberts posted:What is even your mechanism for that to happen? side_burned fucked around with this message at 06:14 on Feb 11, 2016 |

|

|

|

ductonius posted:In related news the scrap yards now want to charge the company I work for to take away full steel bins because steel scrap prices have collapsed so bad. I used to do a lot of scrap work. Always getting loving leaking tires when one has to go into scrap yards. Prolerizers are a hell of thing to see work. Anyway scrap prices are function of steel demand. It's usually cheaper to make steel from scrap than ore. Even when steel is being made from ore scrap can play a role in the process. God I'm glad I don't board scrap barges or ships anymore. Lotta bullshit in scrap work. But that's a bad sign. Normally one can just put metals out on the street in most big cities and they'll just disappear because random guy with a truck grabs it and takes it to the scrap yard.

|

|

|

|

Another factor to take into account (after reading the OP) is that Turkey, too, has a massive real state bubble going on. It's just one article, but that's the most pro-Erdogan newspaper there is, the opposition paper warned about the same things back in May. And if that wasn't enough, the political situation is, to my mind, a ticking bomb, mostly because Erdogan depends on the army to fight the kurds and the gülenists, but the army loving hates his guts because of how much he went after them. It's just that they hate the kurds more, at least for the moment. Oh and Siria and the IS are there too. Anyway how come there isn't more talk about the Deutsche bank? that's what brought me to this thread.

|

|

|

|

ToxicSlurpee posted:Probably. Real estate is a bubble again. Everybody wants the price of their land to go higher and higher all the time and people are opposing high-density development to drive their home values up. Trouble is, when the housing market does crash a lot of people will just deny reality and refuse to sell rather than allow their homes to ~drop in value~. It's not like most people (baby boomers/retirees especially) need to move house so they can just hang on indefinitely.

|

|

|

|

feedmegin posted:Trouble is, when the housing market does crash a lot of people will just deny reality and refuse to sell rather than allow their homes to ~drop in value~. It's not like most people (baby boomers/retirees especially) need to move house so they can just hang on indefinitely. Then when pappap dies and the kids have to figure out what to do with the house...then what? The housing situation in America is just completely loving insane. A lot of banks just really, really don't want to sign home loans anymore and millenials are too buried in student debt and lovely wages to buy. There are also several empty houses for every person who doesn't own a house. A poo poo load of houses are just owned by somebody but nobody is using them because nobody is buying/they ask too high a price so they don't lose money/it's in a place nobody wants to live anyway. Plus if a person gets a new job in a far off land they want but they have a house to get rid of...then what?

|

|

|

|

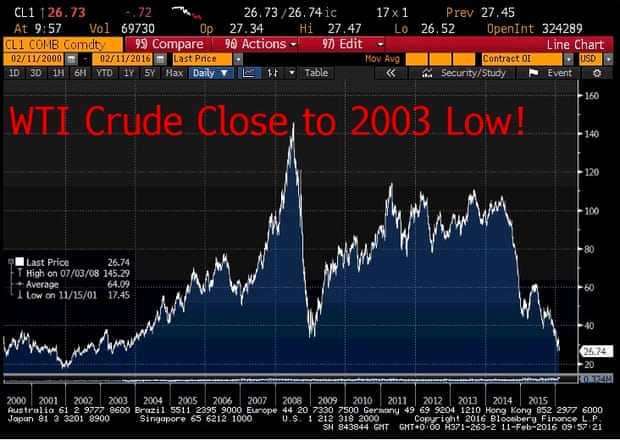

European banks are taking another massive hit today:  And oil prices just keep on keepin' on:  Another good day on the stock market. Everybody's running for the hills (i.e. gilts, treasuries, yen and gold). And the southern EU is getting hammered again, Greece and Portugal in particular: quote:Investors are ditching Portuguese government bonds this morning, as the financial turmoil grows. Junior G-man fucked around with this message at 13:16 on Feb 11, 2016 |

|

|

side_burned posted:Stein's law mainly. I have not read anything that is predicting a drop in prices anytime soon but rent and house prices are out pacing wages and that literal can not go on forever. On personal level I would love to see urban rents drop since I hate living in small towns but I am certain that the economic conditions were rents in SF and NYC would go down would be pretty goddamn horrific in many ways. Then again non-owner-occupied and speculative real estate is swimming in money (again) because there aren't enough mid to long term investments elsewhere. There is also an indication that some markets in North America and Australia are being used by foreign buyers to park money out of reach of their governments and out of the fallout zone of their country's economic troubles or again simply because there isn't much in the way of not already bubbling local investment available. The latter is primarily limited to luxury units in a few cities but is having a spillover effect as local residents or investors who would have bought those properties seek another place to purchase.

|

|

|

|

|

ToxicSlurpee posted:Then when pappap dies and the kids have to figure out what to do with the house...then what? The housing situation in America is just completely loving insane. A lot of banks just really, really don't want to sign home loans anymore and millenials are too buried in student debt and lovely wages to buy. Well, that's just the chickens coming home to roost, isn't it? Turns out that if you create a generation of underpaid debtors with no sense of job/economic security, they will be hesitant to take 30 year gambles on overpriced assets.

|

|

|

|

Dawncloack posted:Anyway how come there isn't more talk about the Deutsche bank? that's what brought me to this thread. As its probably over the heads of most posters here. Honestly stinks of Lehman all over again, very similar setup as well and exactly the same kind of noises; got another dodgy debt instrument that is slightly related to the issues as well, really is 2008 déjà vu. Its not just Deutsche in a bad position, its many banks in Europe and the US, just Deutsche were kind of in trouble already with struggling to generate new business weakening their position and with the Asia markets going tits up, which it is very exposed to, and it really doesn't look good. Assume this time it wont go the way of Lehman's though and the Germans will be forced to bail it out even though it will costs them short term maybe 100 Billion euros.

|

|

|

|

ToxicSlurpee posted:Then when pappap dies and the kids have to figure out what to do with the house...then what? Then it'll get interesting, but the boomers aren't yet at the stage where they're all rapidly dying off. Give it a decade or so and that could trigger a fall in house prices, though.

|

|

|

|

As always, the US(D) is always the best place to be in when there's turmoil. Kinda crazy how the major currencies have nose-dived against the dollar over the past 6 months

|

|

|

|

ukle posted:As its probably over the heads of most posters here. And that was necessary or helpful why? quote:Honestly stinks of Lehman all over again, very similar setup as well and exactly the same kind of noises; got another dodgy debt instrument that is slightly related to the issues as well, really is 2008 déjà vu. Its not just Deutsche in a bad position, its many banks in Europe and the US, just Deutsche were kind of in trouble already with struggling to generate new business weakening their position and with the Asia markets going tits up, which it is very exposed to, and it really doesn't look good. The dodgy debt instruments are Contingent Controvertible bonds (or CoCo's), and there's a decent writeup of them here. Besides, I think the bigger problem is that if Deutsche Bank goes it has something like 2 or 3 times the GDP of Germany as its total capital footprint, so Germany couldn't even save it if it wanted to (and even if it wanted to, it's not allowed under EU rules which they strongly supported).

|

|

|

|

|

| # ? Apr 19, 2024 22:53 |

|

nah CoCos have been actually pushed onto the markets by regulatory bodies as a way of injecting capital during bad times. there's nothing dodgy about that. the problem is that they've never been tested (triggered).

|

|

|