|

Since this will probably keep the news busy for the coming few weeks, I thought it might be useful to have a central overview and discussion place, otherwise there's 4-6 megathreads to keep on reading: General Welp, 2016 started hasn't so much started with a bang as with an (awaited) implosion:

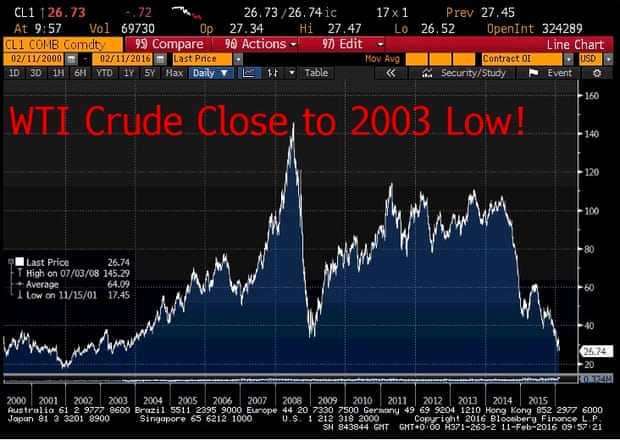

NON-EXHAUSTIVE List of Issues and/or problems:  OIL OIL   Oil has been skidding downwards for a long while now, at first fueled by the growth of shale gas/fracking and then by the Saudis et al. opening the pump as fast and hard as they can. The Saudis are flooding the market in order to drown the shale gas industry. This appears to be working as US fracking etc needs very high initial investment to get the wells going, which means borrowing lots of money from commercial banks. Currently, the oil price (at 28$ per barrel) is too low to support the investment and US fracking companies have been going bust at a fairly impressive rate, with estimates of one half to to one third in danger of fading before 2017. The problem for the US is that all the fracking financing, which seemed like a dream-come-true a few years ago, may now turn sour in a big way. The default risk in the US energy sector is the highest since the Great Depression. Already banks are putting money aside to deal with collapsing investments. Depending on how big they are, those banks may be in trouble. In the Middle east meanwhile, the collapsing oil prices mean that IMF has estimated that state could go bankrupt by 2020 if oil prices do not recover. Right now, the riyal is pegged to the dollar, but that might not last. In order to plug the current gap, the Saudi's are even considering selling shares in Aramco, the state oil company, which is their equivalent to selling the family silver on the cheap. Not to mention that the Iranians, fresh from getting out from a lot of sanctions, are back in the global oil market in a big way. This could, of course, see oil prices go even lower as they join a massive global oversupply. The upside of all of this is that consumers will see lower prices at the pump, leaving them with more disposable income etc. which can increase consumption in the West - the 'traditional' motor of global of economic growth. The downside is that the collapse in price of commodities like oil, gas , iron and copper ore are no good at all for developing countries and others (looking at you, Canada and Australia) who depend on bulk commodities in order to make their budgets and economies move.  EUROPE EUROPE   Austerity is bad, and Europe continues to prove it. If you thought that Greece was settled, think again: quote:Farmers’ roadblocks, ferries immobilised in ports, pensioners taking to the streets: protest has returned to Greece in what many fear could be the beginning of the crisis-plagued country’s most confrontational winter yet. While it's no longer the threat it posed in 2010, a collapse in Greece would still be very nasty for the EU economy, the Euro project and the EU as a political/civic union, especially if you look at how many refugees they are processing. The Italian banking system is still in a bad way and any bail-in or out will be very expensive indeed if it goes on the slide. There are rumours that the 3rd largest bank is suffering from a bank run, and its shares are taking a nosedive. In Portugal meanwhile, there is a new left-wing coalition and the Presidential elections are expected to be won by the right. Austerity is the name of the game here and more uncertainty, in possible combination with Greece, could make things interesting again. New election results in Spain meanwhile mean that their Parliament will be in a jam for a while to come, with reversal of austerity rules possible, depending on the outcome. France, with only 0.3% growth in Q3 2015 is saddled with persistent high unemployment at 10.6% and 25.7% youth unemployment and is currently led by the go-nowhere government of Francois Hollande, who is still stuck at 30% approval ratings even after the Paris attacks. The Front National, under Marine le Pen, is a serious contender now, and they are no good news for anyone. Germany is still doing well. with higher wages, economic output and all kinds of indicators doing well. However, 1.7% GDP growth isn't exactly a star.. What happens to Volkswagen (either the largest or second-largest company in Germany) after their revolting cheating is still to be seen. Plus, with the current migrant crisis, their politics could take a large wobble, especially if another Cologne-like event takes place. In short, Europe's definitely not out of the weeds yet, may be pulled back into them, and what happens when they are is anyone's guess. Plus, the current EU refugee crisis continues to roil the continent, costing much more than expected, the Schengen common border area may collapse, and it's causing more problems everywhere. The joint EU-Turkey solution is a joke. Also, Brexit.  CHINA CHINA  https://www.youtube.com/watch?v=rPILhiTJv7E Hurling down the economic cliff as we speak,, the once-great hope of the global economy is cracking very badly. A hugely inflated market, with over 28 TRILLION $ in debt, with probably even more in the super opaque shadow banking system, and literal ghost cities full of empty buildings could be on the edge of some pretty horrid shocks. With so much (western) capital now inside the Chinese market (due to lack of returns anywhere else), a collapse in China would be very bad for the global banking system. Plus, who would be left to export to? Mars? Improving / making matters much worse is the Chinese state, which does everything from forcing shareholders to buy in a crashing market to injecting capital to fluffing numbers. The official growth figures for the last quarter are 6.7%, but who really knows at this point.  THE STOCK MARKET THE STOCK MARKET  https://twitter.com/Schuldensuehner/status/690062595668209669/photo/1?ref_src=twsrc%5Etfw Global markets have been taking a bath for the last few days due to the abovementioned reasons and more. quote:Shares in Asia experienced further turmoil after an earlier rally petered out, extending the rout on global stock markets prompted by growing fears over the global economy.  INEQUALITY INEQUALITY   Richest 62 people as wealthy as half of world's population, says Oxfam quote:The vast and growing gap between rich and poor has been laid bare in a new Oxfam report showing that the 62 richest billionaires own as much wealth as the poorer half of the world’s population. One address in the Cayman Islands houses 20.000 companies quote:When Barack Obama criticised tax havens, he singled out one building on Cayman, Ugland House, which he claimed housed “12,000 corporations. Now, that’s either the biggest building or the biggest tax scam on record.” But Obama got it wrong – there are closer to 20,000 companies registered there, and 100,000 companies in Cayman as a whole. They include ones linked – or that have been linked in the past – to a bewildering array of British household names: Tesco, Sainsbury’s, BP, Manchester United – even the National Grid. In total, Cayman is home to nearly twice as many companies as people. Which is odd, because when I went to find them, there wasn’t much physical evidence of their presence. But they’re here all right, on paper. There might be as much as 21 Trillion Dollar hidden offshore quote:A global super-rich elite has exploited gaps in cross-border tax rules to hide an extraordinary £13 trillion ($21tn) of wealth offshore – as much as the American and Japanese GDPs put together – according to research commissioned by the campaign group Tax Justice Network. The burden of bailing out the last crisis has already fallen on the poorest, both globally and in western societies. How much more do they have to give? Or are willing to take it up the rear end? Their lack of consumption isn't doing the global economy any good and another hammer blow could see significant numbers of people pushed out of the middle class.  So what now? So what now?   Is this a crisis? Are we hosed? The consensus seems to be that it's not one .... yet .... but all the ingredients for a second Great Blowout are in place. However, the Royal Bank of Scotland gives the following advice quote:Sell everything except high quality bonds. This is about return of capital, not return on capital. In a crowded hall, exit doors are small. The only thing that we can already say is that the tools to get out of the next crisis will need to be invented, probably by our paralysed political systems (with US elections on the horizon). Any further crisis could put a whole host of unpleasant people (Le Pen, Trump, Wilders et al) in power and essentially turn the page towards nationalism and economic competition through tariffs and whatnot. Even without them, the Western Central Banks have very little ammunition left, with interest rates already through the floor.  Resources Resources  Austerity is entirely self-defeating and cannot work https://www.youtube.com/watch?v=JQuHSQXxsjM Why the American Housing Bubble led to the Eurocrisis led to the China Crisis: https://www.youtube.com/watch?v=V3FPmu2_J_0 (Yes, I happen to like Mark Blyth) If you need one, this site doesn't do a terrible job at providing a daily smorgasbord of economic news links. Don't read their opinion pieces as they are often vague. Junior G-man fucked around with this message at 16:13 on Jan 21, 2016 |

|

|

|

|

| # ¿ Apr 27, 2024 07:38 |

|

7c Nickel posted:I would like to add the caveat that my "We'll Coast Along" vote is very America centric. Other sections of the world may be hosed. This is very true, but I'm assuming that whoever reads 'we' in that sentence will apply that to his/her own country/region.

|

|

|

|

Shao821 posted:A lot of large corporations are starting layoff proceedings - I think they've already seen where this road leads and are dropping excess weight Transporter style. Well, we can create more debt-driven demand, but uhhhh .... even that's now reaching its limits. Household debt is still ballooning everywhere, and especially the UK is trying to cover it by inflating another housing bubble (can't go wrong, that!).

|

|

|

|

Dead Cosmonaut posted:Cohan wrote this piece back in 2012 on why the Dodd Frank and the Volcker Rule couldn't theoretically protect us from another banking crisis: Yeah, I don't entirely disagree with that reading about incentives vs. leverage, but my answer to this would be that even if you got incentives under (better) control, allowing leverage of 30-35 to one would still be irresponsible (and should be illegal) for systematically important (i.e. too-big-to-fail) banks; even when the incentives are right even a small black swan event can crash such a bank, needing bailouts. He's wrong to pose it as an either-or proposition; it should certainly be both. Or you know, we need to unwind all banks that are capable of causing systemic risk. That would be the real answer.

|

|

|

|

LeoMarr posted:So Recession and fascism is on the rise throughout europe and most of the west. Welp Woah can you resize that? And it's not necessarily fascism that follows recession. Although traditionally speaking, closed borders and pointing fingers at 'other' people has been really popular. To be frank, I don't even know what would happen to the European social democratic model; it could go hard left, hard right, or mutate into something else entirely.

|

|

|

|

Good piece by Ha-Joong Chang this morning in the paper about China. quote:Don’t blame China for these global economic jitters

|

|

|

|

European banks are taking another massive hit today:  And oil prices just keep on keepin' on:  Another good day on the stock market. Everybody's running for the hills (i.e. gilts, treasuries, yen and gold). And the southern EU is getting hammered again, Greece and Portugal in particular: quote:Investors are ditching Portuguese government bonds this morning, as the financial turmoil grows. Junior G-man fucked around with this message at 13:16 on Feb 11, 2016 |

|

|

|

ukle posted:As its probably over the heads of most posters here. And that was necessary or helpful why? quote:Honestly stinks of Lehman all over again, very similar setup as well and exactly the same kind of noises; got another dodgy debt instrument that is slightly related to the issues as well, really is 2008 déjà vu. Its not just Deutsche in a bad position, its many banks in Europe and the US, just Deutsche were kind of in trouble already with struggling to generate new business weakening their position and with the Asia markets going tits up, which it is very exposed to, and it really doesn't look good. The dodgy debt instruments are Contingent Controvertible bonds (or CoCo's), and there's a decent writeup of them here. Besides, I think the bigger problem is that if Deutsche Bank goes it has something like 2 or 3 times the GDP of Germany as its total capital footprint, so Germany couldn't even save it if it wanted to (and even if it wanted to, it's not allowed under EU rules which they strongly supported).

|

|

|

|

shrike82 posted:nah CoCos have been actually pushed onto the markets by regulatory bodies as a way of injecting capital during bad times. So that would potentially make them as safe and not-dodgy as all those AAA-rated MBS and derivates of those before 2008 then?

|

|

|

|

ukle posted:That wasn't a snipe, it was explaining why there wasn't any discussion on the topic as most people on here wont read the FT, work in finance, etc. Maybe you mean well, but this sounds incredibly pedantic. As if reading the FT endows you with supreme financial intelligence. quote:Deutsche's issue isn't one that's going to cause it to go out of business though its just a liquidity issue worst case its broken up ala Lehmans, No, I can't imagine a break-up along the line of Lehman's having any terrible knock-on effects on the European/global economy. I mean, Lehman's fall didn't precipitate anything else . quote:it only needs a relatively negligible amount to be raised over the year to keep its ratio in legal levels - hence why a German bailout is possible. Would be very similar to what the UK did with RBS, a bank of similar size. If you don't think a state rescue of Deutsche Bank, of any 'negligible amount', wouldn't lead to a bank run of epic proportions in Europe you need to read the FT more.

|

|

|

|

|

| # ¿ Apr 27, 2024 07:38 |

|

call to action posted:The opponents of neoliberalism should probably develop a compelling vision for the future, first, because I haven't seen one. The compelling vision here is PAY YOUR F*CKING TAXES (both individually and as corporations) and restore a proper tax system with increased marginal rates. With all the wealth sitting in the Cayman Islands alone, you could fund US & EU welfare systems to Scandinavian levels for the next 50 years. You don't need neo-Trotskyism or Baathism or whatever. You need a population that doesn't accept tax avoidance, evasion or whatever, and a government/global institutions to reinforce that.

|

|

|