|

That only worked because he's a loving White Male (tm). If he was a woman or minority they would have shot him in the head and dumped his body off the loading dock.

|

|

|

|

|

| # ¿ May 5, 2024 09:50 |

|

I know a guy that subscribes to one of those pre-made meal services. He pays something like $10/meal for a fancy TV dinner. You could literally go out to eat at a local deli or chinese place for every single meal and it would cost less than that.

|

|

|

|

DarkHorse posted:You get experience preparing, cutting, and cooking ingredients, everything is pre-measured so you can't screw that up, and you get to try lots of different flavors without worry what you're doing to do with this big jar of spice that you hate. Aint nobody got time for that. I just stuff all the ingredients in my Juicero and microwave the resulting paste.

|

|

|

|

Doctors' offices are very bad with other people's money. Actually almost everything about health care is BWM. Wife went in with knee pain from running. They say "We really want to give you an MRI, but the insurance companies usually want you to get an x-ray before they authorize that. We'll give you an x-ray even though there is basically no chance it will show us what the problem is" so they send her down the hall to get an x-ray. I asked how much the x-rays would cost and nobody had any idea. I called the insurance company and they said "nope, no need for an x-ray, you can get the MRI". So we cancel the x-ray and they schedule an MRI at a nearby hospital. After an hour on the phone somebody at the hospital is finally able to tell us the MRI will be $800. Call a clinic in the suburbs and they agree to do the same drat thing for $300. So office is basically screwing everyone who they refer for an MRI out of $500 for no reason because they don't check the prices. And nobody in the entire industry will ever tell you the sticker price of anything without a fight.

|

|

|

|

Going on /r/personalfinance and filtering with the "Auto" tag to find BWM almost feels like cheatinghttps://www.reddit.com/r/personalfinance/comments/6c5hg4/refinancing_a_car_bought_at_carmax/ posted:I bought a car for my wife last year in June, mostly out of need. Unfortunately just recently buying a house we didnt have much downpayment money so we went with Carmax. The principal balance is still about $15k. We round up from $360/mo to $400/$450. And our APR is 12.95%. How are you paying 13% on an auto loan? Why would you agree to that?! Also, how could we have ever predicted that we would need to buy a $15,000 car right after buying a house? https://www.reddit.com/r/personalfinance/comments/6a72ej/gf_lost_job_and_cant_pay_for_car_lease_what_to_do/ posted:Recently my GF quit her job without having another one lined up, and did so with very little saved. We've been trying to cut back on expenses as much as possible but she still has a car lease (~400/month, 2 years left and currently underwater) and car insurance (130/month) that is holding her back. She also has about 20k in federal student loans on IBR right now which her monthly payments are currently zero. She lost her ACA health insurance and also has a financed phone and phone bill, ~80/month. She's just about to run out of money and tensions are at an all time high. Despite this, we both have a lot of credit available. $400/month for a car you don't even own, and now I'll just quit my job lol

|

|

|

|

From that articlequote:Julian had just finished his PhD in education and was teaching part-time at Humber; I was an editor for the Food Network’s website and preparing to go on maternity leave. lol Then they paid 480,000 for a literal crackhouse with drug addicts passed out on the floor OctaviusBeaver fucked around with this message at 05:36 on May 30, 2017 |

|

|

|

The way I see it, if they get into a top tier school like Harvard or MIT then the savings don't matter too much, because those schools have tons of financial aid and the kid is going to make way more than I ever will anyway so some debt won't hurt. If you don't get into a school like that then you may as well go to a state school where the costs are manageable and scholarships are common. If they insist on going to a private college then that's on them and I wouldn't blame any parent for not contributing to that boondoggle.

|

|

|

|

DarkHorse posted:I got accepted to MIT but they didn't immediately offer me any scholarships, so I decided to go to a state university for my engineering degree. I eventually graduated with more money than I started with. GWM, BWL? If you're smart enough to get into MIT you're probably going to do pretty well no matter what school you go to. tbh anyone born in a first world country with a marketable skill has already won the lottery in life, just don't gently caress it up by buying a horse

|

|

|

|

Should I buy a brand new truck at 9% interest when I already have a working one and $20k in student loans? https://www.reddit.com/r/personalfinance/comments/6ebtm2/college_student_thinking_of_new_truck/ quote:To make this short, I am 2 years out of college for construction management degree. I am currently working with a very large popular GC that is well known and trusted in this field, but it is just an internship. I wish someone would invent a type of vehicle that was smaller, cheaper and more fuel efficient than a truck. But that's not the world we live in. If you want to drive to work, it has to be in a truck. At least if he borrows the money early, before he graduates, he can definitely count on getting a job in construction which isn't highly cyclical and dependent on local realestate prices. OctaviusBeaver fucked around with this message at 18:30 on Jun 2, 2017 |

|

|

|

the talent deficit posted:people leading miserable lives make poor romantic and spending decisions and abuse drugs. nobody knew! Eh, maybe. My grandparents grew up during the great depression and were way worse off than these people, I doubt divorce rates were that high then though.

|

|

|

|

https://www.reddit.com/r/personalfinance/comments/6fsb9b/dad_has_almost_a_quarter_million_in_stocks_is/quote:My dad ran a succesful business and sold it when he was 40. The past few years he's been investing his money in a brokers account, mainly because he wanted his money to make himself money, and because he enjoyed following the markets and reading about markets. Guy loses $85,000 in a bull market. Shorts the S&P 500 with 2x leverage. lol

|

|

|

|

canyoneer posted:Don't you dare call yourself an engineer when filing a complaint to the city unless you have a license to practice math. $500 fine in Beaverton, OR I thought this was going to be one of those stories where the headline is insane, but you read the article and it turns out there's a reasonable explanation. It wasn't one of those times.

|

|

|

|

Ixian posted:Meanwhile, in BWM news... From the comments quote:Having said that, someone at my work just financed a new Dodge Caravan... over 96 months. An 8 year car loan.

|

|

|

|

https://www.reddit.com/r/personalfinance/comments/6hu70b/would_it_be_wise_to_sell_my_car_for_a_cheaper_one/quote:I bought a 2015 SUV. Whhhyyyyyy would you buy a car worth 80% of your annual salary?!

|

|

|

|

If you have a job making $40k you almost certainly have health insurance, or could afford it with the Obamacare subsidies.

|

|

|

|

https://www.reddit.com/r/personalfinance/comments/6ilujy/the_family_dog_surgery_or_alternatives/quote:My 12 year old cat was diagnosed with cancer, a localized case of ocular lymphoma. Between the surgery to remove the tumor, the radiation therapy, and all the tests, it cost over $5000 and there's no guarantee the cancer won't return or she'll have a longer life. I barely make enough to live, i have other debts, and this would be a burden on me. I know it's hard to put a pet down, but borrowing $5k for a cat that's going to die of old age in 6 months anyway is just not a good decision

|

|

|

|

Dillbag posted:Wasn't sure whether to post this in this thread or the schadenfreude thread... Sweet, time be GWM and pick up a used graphics card on the cheap

|

|

|

|

NancyPants posted:What can you do to lose your license from a car accident? Uninsured, DUI/DWI? He now needs an SR22 so he did something. When I hear a story where someone accuses everyone they interact with of being unreasonable and malicious, I usually assume the story teller is actually the one causing all the problems and so far it's been a pretty safe bet.

|

|

|

|

A cruise ship doesn't have people on call 24/7 to help you go to the bathroom or give you a sponge bath so yeah, obviously that's gonna be cheaper. If you can take care of yourself on a cruise ship you don't need to be in a nursing home.

|

|

|

|

Couple buys a car, then has a "personal and financial crisis" that they solve by abandoning the car at the airport and leaving the country. They called the dealership on their way and told them where to pick it up, assuming that would solve everything and they wouldn't owe any more money.quote:So my wife and I purchased a Nissan from one of our local dealerships. At that time we did not know what we got ourselves into. The car was purchased in August of 2015. Long story short this car was a piece of poo poo from day one. Transmission crapped out after just 30k miles, but this is not my gripe today. And yes, we tried to get it replaced by the dealer - they did nothing. https://www.reddit.com/r/legaladvice/comments/6k8m4b/i_think_we_broke_the_auto_repossession_system/

|

|

|

|

https://www.reddit.com/r/personalfinance/comments/6n16rm/jobless_nearly_broke_2_houses_2_cars_with/quote:So almost a year ago, I left my 64k a year job to work for a start-up, I withdrew my 50k 401k (after taxes and fees) and loaned it to the business owner with the assumption that it would be paid back by Christmas plus he would cover taxes and penalties for withdrawing, and I would be making nearly double what I was making. That has completely fallen through, the owner proved to be a deceptive snake oil salesman, and while he is paying back the loan, it is over a much longer period, and I am no longer working for him, and suing him is not an option. I am charging him interest, but my immediate situation is rather dire. I have no job but am actively applying to places, my wife works but only makes $9 or $10 an hour and usually works ~30hrs, I own a rental house that isn't making money, but have only owned it for a couple years so don't have much equity (I am going to sell this one but have to notify tenants and it will take time to sell), I own the home I am living in and paying 750 a month on a land contract with 0% interest, but have owned for less than a year. I have two cars with significant loans on them (each one is around 15k-17k) and I am underwater by about 6 or 8k total between the two (one had my prior car's remaining balance rolled into it, and they have both depreciated significantly). I owe the IRS 13k from the withdrawal, and am on a $230/month payment plan with them. On top of all that, I have racked up about 10k in credit card debt over the last year, my credit score is shot, and my wife has student loans that are about $400 a month. I am less than a month away from being completely broke. Do I have any options besides bankruptcy? I'm feeling pretty hopeless, and I obviously regret my decision to leave the stability of my last job, but I don't know where to begin to fix this.

|

|

|

|

quote:the government deposits $630,000 in a hidden bank account linked to the newborn American and administered by a Jewish cabal Delegating your finances to a Jewish cabal is actually GWM.

|

|

|

|

monster on a stick posted:Whoever mentioned the financial independence subreddit found a goldmine One of the comments: quote:Clean up your resume and find a new office job. There's going to be so many places out there that are interested in your skills and background with both soc and art. When I think of in demand careers my mind immediately goes to "sociology + art".

|

|

|

|

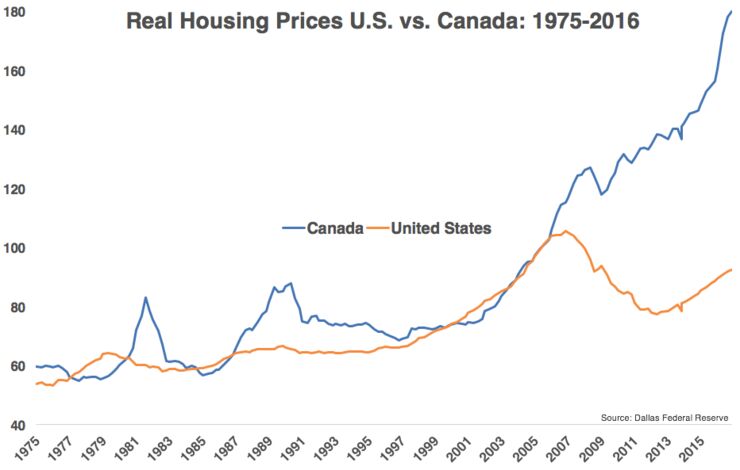

BWM: buying a house in Canada

|

|

|

|

Space Gopher posted:(also, the article really tries to gloss over the guy who owns two Jaguars, and spent his super-valuable time to mock a disabled panhandler for not working) The guy begging isn't on disability, he just got fired from his McDonalds job for skipping work. The mom is on disability for "anxiety". And it's super easy to get on disability on appeal. You go in front of a judge and you hire a lawyer who argues in favor of you getting disability. But the state doesn't have an advocate who argues you shouldn't be, so the judge only hears one side. The only missing piece is getting a doctor to say you have some sort of disability, and I bet that's about as hard to find as a doctor who says you need medical marijuana. e: actually this family is a quote:He was studying the paint stains on his jeans and boots. They were left over from some community service he had done a few days before as punishment for stealing two items worth less than $200 at a Walmart, one of which was some ear buds, and returning one for money. quote:She knew what they must say about her disability: It’s only anxiety, only depression. Why couldn’t she work? Why did she buy soda and cigarettes when they needed food? How could she afford the Internet and cable TV bills on a $500 monthly disability check? skipping community service to beg, that's gonna end well: quote:“I was supposed to go work off my fines today,” he said. quote:Why couldn’t he get a job? Was he to blame? Maybe people were right when they told him tattoos would turn off employers. He also could have walked through the snow that day McDonald’s had fired him — it was less than a mile from his house — but he hadn’t done that, either. OctaviusBeaver fucked around with this message at 15:00 on Jul 22, 2017 |

|

|

|

https://www.reddit.com/r/personalfinance/comments/6p05rk/23_year_old_senior_in_college_getting_a_divorce/ This one is way too long but the highlights are: - Married at 20, divorcing at 23 while still in school - Making$14,000/yr - Doesn't own a car but borrowed $6k to buy a camper at 20% interest - $2000 in unexplained credit card debt - Complains he can't get on food stamps but owns a dog and pays $40/month in pet insurance - Wife pays 2/3 of the rent but he wants to get divorced as quickly as possible so he will qualify for food stamps - Spends almost $100/month on pizza quote:Hi all, first time poster - I read through the sidebar info and hopefully I'm doing everything right. Thanks in advance for reading.

|

|

|

|

I listened to a Planet Money podcast talking about a startup in Atlanta that was working on automating sewing. The said the big problem with using automation to work with cloth is that it has a tendency to twist or wrinkle which messes up the machine, unlike a sheet of metal or plastic that you can hold down and it stays where you put it. That's why clothes are expensive, because instead of machines they are mostly made by hand. They solved that by having really fast, high resolution cameras that would count the threads as it went through the machine to keep it on track. They said it sewed a pair of jeans in about 90 seconds. It still couldn't do zippers or buttons but they are working on that. I imagine a clothes folding robot would have similar problems. Anyway, it was an entertaining episode and worth a listen: http://www.npr.org/sections/money/2016/08/03/488611449/episode-715-the-sewing-robot

|

|

|

|

curufinor posted:sewing is a much happier control problem than having arbitrary clothes and folding em I agree it's harder to fold, but if the folding robot screws up you get a slightly misfolded shirt. If the sewing robot screws up it sews to sleeves together. The folder has a lot more room for error.

|

|

|

|

If the government wants translators, paying for a 4 year degree sounds like just about the least efficient way you could possibly do that because you spend half your time on fluff classes. Would be much better off paying for intensive classes that focus on the language and culture they need translators for. I bet they could learn more with 1 year of that than 4 years of college.

|

|

|

|

I like how they think there's going to be a "profit" on a house they owned for 8 months.

|

|

|

|

monster on a stick posted:So she gets scholarships which may have even been need based because she describes herself as growing up poor. I have a hard time believing that someone named "J.P. Livingston" grew up poor.

|

|

|

|

SCA Enthusiast posted:She didn't grow up poor if her families savings plus scholarships could send her to Harvard with no debt. Anyone who's filled out the FAFSA and received any amount of financial aid should understand this. Harvard isn't like other schools. Their endowment is so large that tuition is basically gravy for them. If you get accepted into Harvard and your parents aren't rich they will make it work. Tons of aid available at that school.

|

|

|

|

Only need the title for this one: https://www.reddit.com/r/legaladvice/comments/6rhv98/i_gave_my_friend_6000_to_invest_in_stocks_and_now/ quote:I gave my friend $6000 to invest in stocks and now they are not responding to me and blocked me from social media

|

|

|

|

BWM: Taking giant student loans and then being shocked and indignant that you have to pay it back.

|

|

|

|

https://www.reddit.com/r/personalfinance/comments/74e4yv/i_have_two_cars_that_i_cant_afford_advice_needed/quote:24 M 2017 started off great, I started a new job and was making more than I ever before had. I went part time over the summer (cutting my income almost in half) so that I could go to school again. That was working up until I decided I want a truck. I went for kicks and giggles to dealerships getting an idea of what I could afford and what I couldn’t. I didn’t want to do a trade in and was planning on selling my 2008 Passat with ~170,000 miles, then getting a loan on a truck roughly $10,000 so that my payments would be about the same. Somehow I gave into the pressure of the salesman and manager and ended up coming home with a 2011 Frontier. After a few days I realized I can’t afford the truck and filled with desperation pleased with the finance guy to help me get out of the truck and into something cheaper. The “only car” that they could get me into was a 2014 Altima. It’s a nice car but now I realize it’s only $100 cheaper per month. So now I’m stuck with two car payments. I owe $3,500 on the Passat. I would love to get that car sold however I’m not entirely sure how that works with the loan. The bank obviously won’t give me the title until they are paid so if s buyer hears that I don’t have the title and have to have money first I wouldn’t blame them for running away. My 2 big questions are this: 1) how do I go about selling the Passat while having a loan still. Is there a form that they can sign showing the bank will give them the title? 2) the Altima is worth ~8,000 and it ended up costing me ~16,000. What are my best options? Keep it and just keep paying (roughly $270/mo)? Trade it in and get a truck around $5,000 and roll over the loan into that then actually have a truck like I originally wanted? I love the attitude of "I realized I want a truck, therefore I will buy a truck" and "somehow I spent twice as much as I intended". Like he has no control over his/her/its own actions. Also, how do you still owe $3500 on a car with 170,000 miles on it? The best part is he decides the solution is to get a second truck.

|

|

|

|

Krispy Wafer posted:Goons sometimes help goons, like that Vegas homeless guy we helped ship off to Detroit. That doesn't sound like helping.

|

|

|

|

Saving up enough money in your checking account to buy a house definitely isn't optimal, but it's still so much better than most people that I have a hard time calling it bad with money in an absolute sense.

|

|

|

|

Moneyball posted:Like, saving for a down payment? High interest savings account. If you invest it in something and you plan to buy at a certain time, you're exposed to a crash. Another option would be a short term, investment grade bond fund like VFSTX, it's returning ~2% right now. That said I think just keeping it in a checking account for a few years is fine also. If you can afford to buy a house in cash then trying to squeeze out an extra few thousand while you save up is just gravy.

|

|

|

|

Fuzzy Mammal posted:When I bought my engagement stone it was for $4k and came with a certificate saying it was worth $10k for insurance purposes. All that stuff is bullshit. Sure would be a shame if it was lost or damaged.

|

|

|

|

|

| # ¿ May 5, 2024 09:50 |

|

potatoducks posted:https://forums.somethingawful.com/showthread.php?threadid=3837987 I'm the guy who thinks they should register as 501(c) to handle $200 worth of donations.

|

|

|