|

Epic High Five posted:Debt forgiveness and debt jubilees are as old as the concept of debt itself, and are in many cases religiously proscribed. All of these things predate capitalism AND socialism by thousands or tens of thousands of years. This is America, your right to your opinion is about the only one you've really got, but your qualms here are with something greater than the predominant economic modes of the last few centuries. Fair enough. Besides, I'm done debating this topic anyway. I've stated my opinion and I have nothing else to add.

|

|

|

|

|

| # ? May 21, 2024 09:34 |

|

Borlorg posted:I think the rich coprs who got bailed out should have taken responsibility instead. You don't need to construct the notion I was somehow in support of that. There are many things in the budget that I, as a registered voter, am not happy with. And I vote accordingly and suggest everyone does so as well. It certainly does not mean that I drew the line at the school loan bailouts and somehow ok with a hunded of other dumb things we pay for. Everything about this is intensely disingenuous. I had a long essay typed out against this, complete with numbers and sources, but you'd probably just shrug it off anyway, so why bother. Cope harder. Thanks for the approximate six-tenths of a cent that you'll be paying for my 10k forgiveness. Anyway, moving on from the very unwelcome half-baked libertarian derail. I've noticed that some of my loans seem younger (and thus I've made fewer payments on them) since they traded servicers. I can't find where I'd been making payments on those loans from before that time, so it looks as if I've only been paying on them for only a few years rather than nearly 10. I'm concerned that it would take longer to get them forgiven, regardless of IDR or PSLF. Especially if that is the case, I think the IDR would just be best. If I can consolidate all of my loans under one servicer, it'd still be capped to 5% of my discretionary income (or less? not sure how that works), and then it'll just be gone one day.

|

|

|

|

Framboise posted:If I request a refund for the payments I made to Navient and AES during the pause, will the balance I paid return to the account? I have an FFEL loan with AES and I contacted them about getting my money back for the payments I made during covid and they said I am SOL because its a bank owned loan and I am not eligible for the 20k relief either. This article: https://www.cnbc.com/2022/08/26/more-details-emerge-about-biden-federal-student-debt-forgiveness-plan.html Has this quote in it: "Even if your FFEL loan is with a private company, all hope may not be lost. An Education Department spokesperson said borrowers with those loans can call their servicer and consolidate them into the Direct Loan Program to become eligible for forgiveness." I am going to call AES about having my loans consolidated into that type. I really should have done it a year ago. A year and a half from now I will be eligible for the PSLF forgiveness. I held off on consolidating because I hate my job and I didn't know if I could stick it out for (then) 2 1/2 years. I'm still at the same job so I might as well go ahead and do it.

|

|

|

|

You don't even have to call them to consolidate it. You can do it yourself via studentaid.gov

|

|

|

|

One catch about consolidating (as they warn you on the student aid.gov page) is that it apparently wipes out prior payment history you had toward the loans with IDR. In other words if youíre already on IDR for FFEL loans, consolidate and get back on an IDR plan, youíre resetting the clock for those loans as far as IDR forgiveness. That said, this doesnít apply to the PSLF waiver if youíre consolidating your FFEL loans for that reason.

|

|

|

|

Also, if you're not on PSLF now but might be eligible for it, you want to apply for it by October, because there's a temporary waiver to some of the requirements right now that will let you get credit for times you might not get credit for. There's also, for a long time, been this threat hanging over people's heads that PSLF might get cancelled/closed to new applicant. I don't think that will happen as long as Biden is President, but still, it doesn't hurt to apply now and get on record that you're making eligible payments. See here for more info. https://studentaid.gov/announcements-events/pslf-limited-waiver

|

|

|

|

https://twitter.com/ArgoJournal/status/1563930389986660352

|

|

|

|

Honestly better for that 45-64 demo than Iíd expect.

|

|

|

|

FizFashizzle posted:Honestly better for that 45-64 demo than Iíd expect. They are the most likely demographic to currently have children with college debt.

|

|

|

|

I just consolidated (through studentaid.gov) to a Direct Loan. I have 3 possible outcomes: its true and this gets grandfathered into the forgiveness and I am good to go, I stick with my lovely job or I get this other job I applied for that is also at a non profit and I'll have them forgiven through PSLF in about a year and a half, or I get this much better paying job I applied for outside of academia and it wouldn't matter because I could easily pay the rest off myself.

|

|

|

|

I've got several Subsidized/Unsubsidized loans that I had been paying on with the standard plan 10-year repayment up until the Covid pause; I'm actually now working for local government (started 11/2019) - should I consolidate these into a single loan via StudentAid.gov for the PSLF? I asked in the GBS thread but they seemed to think no, but StudentAid.gov tentatively said it would lower my interest quite a bit to consolidate.

|

|

|

|

Read the FAQ and through the thread and couldnít find a clear answer for a weird question I have. We paid off my wifeís entire student loan in July 2020 and it was worth approximately $30k. From what I read since she had pell grants she would be eligible for a refund of $20k of what we paid. I reached out to Nelnet and they said they couldnít do a partial refund of my payment, and would have to reopen the loan and pay me back the entire $30k. Then I could apply to get the $20k forgiven, and after that could use $10k of the $30k I got back to fully wipe out the loan again before loan payments restart in December. My question is, if the loan is reopened today, do we even qualify for forgiveness? Since itís after the announcement was made I couldnít find how old the loans had to be to qualify. We qualify under the financial parts. My follow up question is, does this sound correct or should I call Nelnet for a second opinion? Thanks in advance everyone, this whole process is very confusing.

|

|

|

|

Kem Rixen posted:Read the FAQ and through the thread and couldnít find a clear answer for a weird question I have. We paid off my wifeís entire student loan in July 2020 and it was worth approximately $30k. From what I read since she had pell grants she would be eligible for a refund of $20k of what we paid. I reached out to Nelnet and they said they couldnít do a partial refund of my payment, and would have to reopen the loan and pay me back the entire $30k. You just needed to be making the payments in question DURING the payment freeze. No idea on the refund portion, that probably will be an institution thing so don't see why they'd lie BUT interest rates are still frozen till december so you'll have a window to deal with it all at least.

|

|

|

|

In addition to the blanket relief, it looks like we're still seeing full forgiveness for scam schools and defunct for-profit schools. https://www.washingtonpost.com/education/2022/08/30/westwood-college-debt-cancellation/ quote:The Education Department said Tuesday it will grant full, automatic cancellation of $1.5 billion in education debt held by former students of the defunct for-profit chain Westwood College.

|

|

|

|

Kangxi posted:In addition to the blanket relief, it looks like we're still seeing full forgiveness for scam schools and defunct for-profit schools. That's been happening for a while. It actually started under Obama, was cancelled by Trump, and started back up more aggressively under Biden. It's not related to the current student loan forgiveness/IDR reform/Student loan pause. It is a good policy, though.

|

|

|

|

When is the "snapshot" taken of the amount of debt that will be forgiven? As of a few days ago, my wife had a balance of ~$6500 remaining. We had continued paying during the payment pause because we could. We initiated the refund for payments made since March 2020, which will shoot her balance back up to ~$14k. My question is, will the $10k forgiveness hit that $14k number, dropping the balance to $4k? Or will it only apply to the $6500 she had outstanding when the announcement was made?

|

|

|

|

The Midniter posted:When is the "snapshot" taken of the amount of debt that will be forgiven? It will hit whatever the balance is when it is applied (most likely early 2023). There isn't a snapshot at the time of announcement. In your wife's situation, it will reduce the debt from ~$14k to ~$4k.

|

|

|

|

Kangxi posted:In addition to the blanket relief, it looks like we're still seeing full forgiveness for scam schools and defunct for-profit schools. oh poo poo that includes me for the one year I did at Westwood

|

|

|

|

Borlorg posted:2. I and any other law-abiding citizen like myself make our voices heard at the ballot box. We vote for the candidate whose views are more aligned with our own. Perfect candidates do not exist and a lot of times it feels like choosing a lesser evil. So, it's a tradeoff analysis that everyone does for themselves. Poor thing. Like his self-made hero Elon, Borlong is forced, with a heavy heart, to vote Republican. Pray for him as he makes his voice heard at the polls by punching a ticket for the party he was gonna vote for anyway, no matter what.

|

|

|

|

Sheesh. My head is spinning after spending half of today navigating my options for pursuing PSLF. I seriously begrudge anyone who claims that pursuing loan forgiveness is 'lazy'. Currently, I have 6 outstanding loans, two of which are FFEL and the other four are Direct (conveniently, I was in school right in the middle of the switch to direct lending). Both of my employers since Dec. 2013 are eligible for PSLF according to the studentaid.gov help tool, so in theory, if approved I'll only need to continue making payments through Dec. 2023. However, I need to consolidate the two FFEL loans to qualify. The catch (for me) is, consolidated loans must be on an IDR plan to qualify for PSLF - but if I only consolidate the two FFEL loans, then the balance of that 'new' loan limits which IDR plans I qualify for (whereas currently, all six of my loans are on the old 15% IBR plan). Meanwhile, if I consolidate *all* my loans, then the balance will qualify for any of the existing IDR plans, including the cheapest PAYE plan (and probably the new Biden IDR plan, I'm assuming). The downside is that my unpaid interest will be capitalized, which sucks - but I guess will ultimately be moot due to PSLF. For anyone else interested in consolidating for PSLF, my loan servicer advised me today that the application takes about 30-45 days to process, and you can't apply for PSLF until after the consolidation is complete. The current waiver expires on 10/31/22, so don't waste any time. Also of interest - normally, consolidating your loans will wipe out your prior IDR payment history toward forgiveness, but apparently that has been temporarily waived by the ED as part of this communication from April '22: https://www.ed.gov/news/press-releases/department-education-announces-actions-fix-longstanding-failures-student-loan-programs

|

|

|

|

If the Republicans try and sue to stop the loan relief will the money just be in limbo until the court case gets resolved? Would we have to pay back the $10k? I'm assuming worst case scenario because of the 6-3 Supreme Court.

|

|

|

|

Youth Decay posted:If the Republicans try and sue to stop the loan relief will the money just be in limbo until the court case gets resolved? Would we have to pay back the $10k? I'm assuming worst case scenario because of the 6-3 Supreme Court. Yeah Iím here with this too. Iím cynically imaging a scenario where they torpedo it somehow or just hold it up in court forever and ever until the Supreme Court axes it, but I have no idea how the mechanisms here work. Iím hesitant to celebrate my 15k being forgiven because they seeming get away with so much, but Iím also wondering if they would have sued already if they were gonna do it?

|

|

|

|

Mississippi is one of the 19 states whose laws require the Department of Revenue to determine if forgiven student loan debt is tax free or not. They are the only ones (so far) to confirm that they will. They also basically explicitly say they are doing it out of spite and to annoy people who benefit from it. Arkansas and Wisconsin are also considering it. The other 16 states have already ruled it out or not commented. https://twitter.com/matthewstoller/status/1565360834074873859

|

|

|

|

Leon Trotsky 2012 posted:Mississippi is one of the 19 states whose laws require the Department of Revenue to determine if forgiven student loan debt is tax free or not. So glad I left that loving hell hole of a state goddamn

|

|

|

|

From what I understand NC is going to tax it as well. gently caress me I guess

|

|

|

|

zimbomonkey posted:From what I understand NC is going to tax it as well. gently caress me I guess We'll Christ that's where I moved to! Womp womp

|

|

|

|

Some minor news, but DOE says the form for forgiveness (if they don't already have your information on file) will be going up sometime between 1 and 2 months from now and recommends subscribing to their notification page on the student loan website to be alerted. They also say that after you submit the form, the debt will be forgiven and your loan balance should update in within 4 weeks. zimbomonkey posted:From what I understand NC is going to tax it as well. gently caress me I guess BonoMan posted:We'll Christ that's where I moved to! To be fair, NC's Division of Revenue says that the NC General Assembly didn't include a provision they asked for in last year's budget to allow the Division of Revenue to decide if it was taxable or not. But, they will be asking them to address it in the upcoming budget. Doesn't mean that they will give the DOR discretion on how to handle it, but it isn't 100% definitive right now.

|

|

|

|

For those who forgiveness applies to automatically, when are the balances expected to update? I canít seem to find this anywhere.

|

|

|

|

hattersmad posted:For those who forgiveness applies to automatically, when are the balances expected to update? I canít seem to find this anywhere. The only thing they have said is that they expect to have everyone who is automatically having the forgiveness applied done "within 45 days" of starting the process. No info yet on when they are starting it.

|

|

|

|

Leon Trotsky 2012 posted:Arkansas and Wisconsin are also considering it. The other 16 states have already ruled it out or not commented. The article you posted is inaccurate. Not your fault, but the author was trying to make tax law understandable and in doing so, completely misrepresented the situation. When there is a change in the federal tax law definition of income ó like the student loan forgiveness being made nontaxable for the next few years ó every state has a law on their books that describes how federal changes will be reflected at the state level. Some states automatically accept federal changes into their state tax law, either immediately or on a regular basis. So in those states, student loan forgiveness will be tax-free unless the legislature makes a law to make them taxable. Other states do not automatically accept these federal changes. As such, in these states student loan forgiveness will be taxable unless the legislature passes a law to make them non-taxable. In practice that means that those tax codes are usually a couple years behind the federal, and sometimes have specific things that never get changed. For example, Wisconsin has several provisions that are more than 20 years out of date, and a couple which are more than 35. Mississippi is one of the 24 states that generally require the legislature to enact federal changes into its state income tax law. So the tweet is completely misleading and wrong ó Mississippi is not the first state to tax it; if theyíre first at anything itís just admitting out loud that itís taxable in their state.

|

|

|

|

Indiana apparently passed a law last year that decoupled the tax changes from the stimulus bill from state taxes and does not plan to undo the changes. Meaning that student loan forgiveness will be taxed as income in Indiana. https://www.wdrb.com/news/education/indiana-to-tax-student-debt-forgiveness/article_632f0ff2-2e08-11ed-981b-9bc3d9c4e2fb.html

|

|

|

|

Leon Trotsky 2012 posted:Indiana apparently passed a law last year that decoupled the tax changes from the stimulus bill from state taxes and does not plan to undo the changes. well this loving sucks my state literally can't do anything good, ever lmao Framboise fucked around with this message at 21:53 on Sep 6, 2022 |

|

|

|

My loan consolidation with MOHELA just went through. That was faster than expected, so thatís nice. Iíve already filed for PSLF but I am still anxious I didnít do something right, since there really is no clear, published order of operations.

|

|

|

|

The Cubelodyte posted:My loan consolidation with MOHELA just went through. That was faster than expected, so thatís nice. Iíve already filed for PSLF but I am still anxious I didnít do something right, since there really is no clear, published order of operations. How long did your consolidation process take? I submitted mine last week but was told 30-45 days.

|

|

|

|

Iím still waiting for Mohela to fully import my loan info. As of right now it just shows that Iím in good standing with a $0 balance. I get that theyíre probably overwhelmed with everything, but Iíd really like to see where Iím at with PSLF. I should be done, but the old loan servicer hadnít finished counting my old payments.

|

|

|

|

I have $4,000 left on my loan, its with Aidvantage, income less than $125k. When does it go away? What do I need to do?

|

|

|

|

Fozzy The Bear posted:I have $4,000 left on my loan, its with Aidvantage, income less than $125k. If the DOE has your income information for 2020 or 2021 on file, it will happen automatically. If not, then check the DOE student loan website. You can sign up to get notified when the form goes live.

|

|

|

|

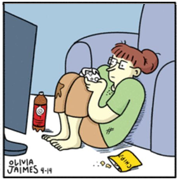

People who requested refunds for their student loan payments from post-March 2020 have been getting the money back in about 2 weeks after they put the request in. Interestingly, the DOE seems to be giving some people their refunds via ACH direct deposit, some people all of it in one check, and at least one person got 63 separate checks for every individual payment they made:

|

|

|

|

Leon Trotsky 2012 posted:If the DOE has your income information for 2020 or 2021 on file, it will happen automatically. If not, then check the DOE student loan website. You can sign up to get notified when the form goes live. They probably don't have my income on file. I signed up with my email a few weeks ago. Has anyone gotten an email from them?

|

|

|

|

|

| # ? May 21, 2024 09:34 |

|

Fozzy The Bear posted:They probably don't have my income on file. I signed up with my email a few weeks ago. Has anyone gotten an email from them? I don't think anyone has. The form hasn't gone live yet and they just say it will be before the end of the year with no specific date.

|

|

|