|

Strong Sauce posted:Meh, not sure how tweets encourage doomscrolling. Tweets are easier, especially since it has the direct clipped video. Exact video is much clearer than articles. Having these rules just seems weird to me. And just seems to derail it more talking about these restrictions. Tweets encourage doomscrolling because tweets are such small tidbits of information that it is extremely easy to build false narratives just using lots and lots of short clips and small quotes that can be devoid of context. (For example, see how LibsofTikTok has used Twitter to convince thousands of morons that doctors are trying to force kids to be trans or how public school teachers will happily give their students porn or whatever.) And while it can be easy to recognize this pattern when done by rear end in a top hat conservatives and Bitcoin maximalists and other people whose positions are far removed from your own, a lot of folks don't recognize this same pattern when done by accounts like Doomberg or others who share some of their politics.

|

|

|

|

|

| # ¿ May 22, 2024 17:32 |

|

Anyways, given the developments we've just heard about First Republic, I think it's interesting to see Levine's take on them from yesterday..."Matt Levine posted:SVB’s current share price is a mystery — the stock hasn’t traded since Thursday — but it is probably zero. The deal was launched with a stock price of $267.83, it was about to price at $95, but then the lawyers decided it couldn’t price without revealing more details about the bank run, which would presumably lead to a much lower price. The next day, the value of the stock was zero.

|

|

|

|

thekeeshman posted:It seems to me the issue is that the gov and financial system is having to make moves to calm things in the short term but hasn't had the ability or willingness or time to figure out what those moves mean in the long term. As the clip pointed out, there's a special assessment on all banks now, big or small, to ensure that the bailout insurance system is solvent, but that insurance only applies to big depositors if they are at systemically important banks. At least based on current actions and Yellen's testimony. If this remains the case, any large depositor would be negligent in staying at a small bank. I mean, the main fix would just be having FDIC insurance cover all deposits with no limit. This is entirely possible solution, it's not very desirable for the banks because they don't want to pay the extra amount for their FDIC insurance premiums under such a system.

|

|

|

|

drk posted:FDIC rates are already tiered by risk: https://www.fdic.gov/deposit/insurance/assessments/proposed.html At this point FDIC (and other fed actions) basically mean that deposits in effect have unlimited coverage. The only difference that would come from making it official is that 1) there would be a reduced anxiety and 2) banks would have to actually pay out higher premiums for the higher coverage. EDIT: (Also, it looks like we made it less than a page before the brigading started...)

|

|

|

|

pmchem posted:I think there are legal hurdles in making any sort of unlimited FDIC coverage "official". I'm sure it will come up on weekend talk shows. Whether or not the FDIC could do it entirely as a regulatory change or if they would need a law passed is an interesting question. If it did come down to passing a law, then the whole thing is likely off the table. Small-to-mid-sized banks have car dealership-levels of political influence, in that they are often one of the biggest concerns that any individual congressional representative will have in their district. And, of course, those are the banks that would least like their FDIC premiums to go up.

|

|

|

|

I've heard some compelling arguments for the Fed offering checking and savings accounts (in particular, that they then have a more direct lever for cooling demand by just increasing the interest rates in those accounts, causing more people to want to spend less and save more). One big issue with that is trying to find a way to make this available without causing massive runs on all the other banks as people pulled their money and put it into the new Fed accounts.

|

|

|

|

Federal Reserve raises benchmark rate by 0.25 point despite bank turmoil (non-paywall link)quote:The Federal Reserve raised interest rates by a quarter of a percentage point on Wednesday, moving forward with its fight against high inflation despite concern that its rate hikes may be fueling instability in the banking system.

|

|

|

|

Borscht posted:Wait the fed said today that his target for I location is just 2%. That seems incredibly low. The Fed's inflation target has been 2% for decades. It has low inflation/steady prices as part of its responsibilities, and it hit upon 2% as the official number that meets that definition a while back. It became official policy in 2012. quote:The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve's statutory mandate. The Committee judges that longer-term inflation expectations that are well anchored at 2 percent foster price stability and moderate long-term interest rates and enhance the Committee's ability to promote maximum employment in the face of significant economic disturbances. In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time. They also have a helpful guide that shows the difference in their original 2012 statement and the revised edition they put out in 2020. EDIT: Here's another interesting read, on the New Zealand inflation-targeting policies in the 1990s that ended up making 2% the defacto "right" amount of inflation in the minds of most economists. LanceHunter fucked around with this message at 01:56 on Mar 23, 2023 |

|

|

|

Leperflesh posted:Regardless, in addition to covid deaths there's a far larger number of people who have or had long-term health effects from lingering covid that didn't die and many of them have had to leave the workforce. This does not get much press. True, but they are counted against the labor force participation rate, and that number has been rising steadily and is only about 0.8% lower than it was pre-pandemic. https://fred.stlouisfed.org/series/CIVPART It has been a bit low compared to the post-1970s trend, but that has been the case since the mid-2010s as the boomers retire. EDIT: Another interesting chart is the US Working Age Population, which did take a dip during the pandemic but has now fully recovered and it at a historical high. https://fred.stlouisfed.org/series/LFWA64TTUSM647S I think the "too few workers" thesis doesn't really hold up to the data. I do think that there are still some kinks being worked out due to workers relocating, shifts in demand, and more experienced workers being replaced by less experienced ones who are still settling into their roles. But that alone isn't enough to cover the entire inflation story. There was a lot of really stupid money out there in the days of effectively-0% interest, and while increasing interest rates have shrank the dumb money pool, the fact that things like crypto haven't completely collapsed means that there's still too much of it out there. LanceHunter fucked around with this message at 17:35 on Mar 23, 2023 |

|

|

|

I think all of the excess mortality discussion doesn't actually explain the inflation story, though. As the charts previously posted show, we have an all-time high number of working age adults in the US and labor force participation is nearly as high as it was pre-pandemic. Also, increased demand has definitely been a factor in this current wave of inflation, and there is no way that a rise in excess deaths could be responsible for that (since, you know, dead people aren't know for buying things).

|

|

|

|

drk posted:Wow, they weren't kidding about low vacancy rates: Most of that was likely supply-side, as there were a poo poo-ton of housing starts up until the first rumblings of the global financial crisis started to hit...  ...then once it did hit, housing starts hit their lowest point since they started keeping records in 1959, and (worst of all) they stayed at those record-low levels for 4 years. Of course, the population was continuing to grow during that time. Thus leading to the situation we are in now.

|

|

|

|

Unless there are major code changes in most cities to allow bedrooms without windows, then a lot of commercial-to-residential conversions won't be economical to pull off. And yeah, it would kinda suck to have a bedroom with no windows, but that's better than waiting until someone finally puts up the money to tear down a huge tower and replace it. (Especially since the units in the brand-new tower would almost certainly be significantly more expensive than converted units.) Also, it's not like windows in tower apartments are always that beneficial or even aesthetically pleasing. Look at this video walk-through of a 2/2 in one of the towers in my city. Starting at 0:29 it shows the second bedroom, which has one tiny window in a little divot at the end of the room. And looking out the window, you see how they had to build in a cut-out in the whole building to give that bedroom that tiny, ineffectual window. https://cdn.realync.com/transcoded-videos-s/8DD64F54-211D-44FE-ADCF-60350AAA2CE3/8DD64F54-211D-44FE-ADCF-60350AAA2CE3mc.mp4

|

|

|

|

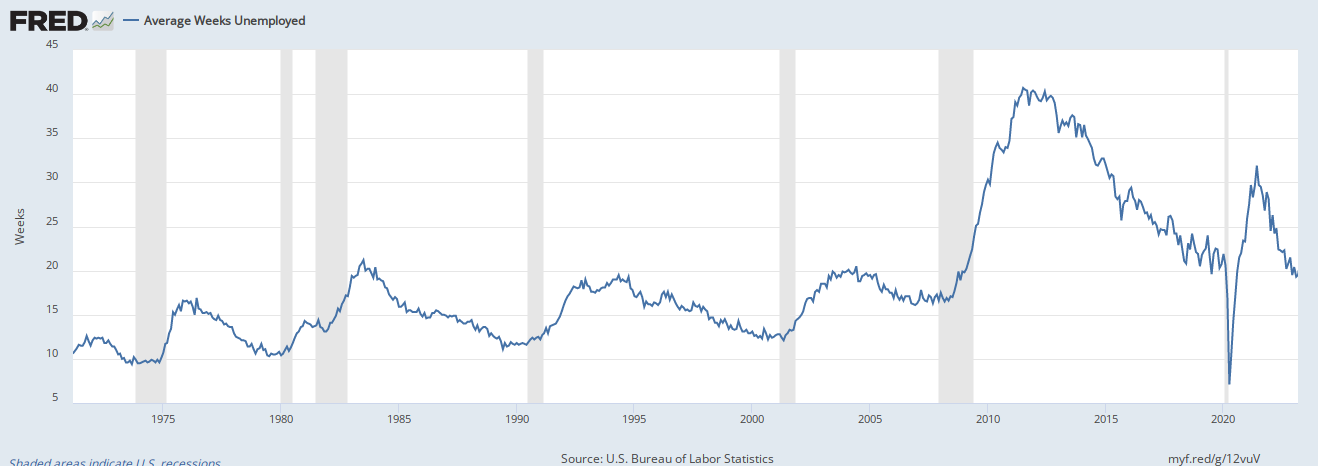

err posted:The media keeps trying to compare it to the GFC, especially with the banking crisis, but I feel like circumstances are so much different now compared to then. Can someone explain what a "mild" recession would look like? I think it's hard to conceive of what a mild recession would look like today. Especially when considering the last two "mild" recessions in the US. The post-S&L Crisis recession in the early 90s and the post-DotCom Crash recession of the early 00s. In both cases the overall effect on the economy was mild because it was really just a couple of specific industries that got walloped. If you weren't involved in a Savings & Loan/commercial real estate during the 90s recession or working tech/telecom in the 00s recession then the economy wasn't really bad, just kinda sluggish. If you were involved in those industries during that time, poo poo was dire. I don't know that I see that same type of pattern repeating again, though. So if we are actually seeing a mild recession, it probably won't look like anything in recent history. That isn't to say that any potential recession wouldn't be mild, more that it will probably be weird and unexpected in how it happens. One chart I was looking at while thinking about the early 90s recession was this. The average number of weeks that unemployed people had been unemployed each year. It's amazing that we spent over a decade (before the pandemic even hit!) with people unemployed for longer than the absolute peak of the 90s (a time when Gen X was being called "the Slacker Generation" because they were seen as not working enough).

LanceHunter fucked around with this message at 02:42 on Apr 15, 2023 |

|

|

|

There’s a very compelling piece in The Atlantic by Jean M. Twenge, called The Myth of the Broke Millennial (Apple News link to get around paywall.) Some interesting selections: quote:Impressions of generations tend to form early, and they often get cast in amber. As a scholar of generations, I’m well aware of that. But even I was surprised when I returned to my study of Millennials to look at the generation as it enters middle age. quote:By 2019, households headed by Millennials were making considerably more money than those headed by the Silent Generation, Baby Boomers, and Generation X at the same age, after adjusting for inflation. That year, according to the Current Population Survey, administered by the U.S. Census Bureau, income for the median Millennial household was about $9,000 higher than that of the median Gen X household at the same age, and about $10,000 more than the median Boomer household, in 2019 dollars. The coronavirus pandemic didn’t meaningfully change this story: Household incomes of 25-to-44-year-olds were at historic highs in 2021, the most recent year for which data are available. Median incomes for these households have generally risen since 1967, albeit with some significant dips and plateaus. And like each generation that came before, Millennials have benefited from that upward trend. quote:A house is perhaps the most tangible embodiment of the American dream. Millennials’ housing woes have featured prominently in media accounts of the generation’s economic (and life) problems. “There should be a Millennial edition of Monopoly where you just walk around the board paying rent, never able to buy anything,” a Twitter comedian who goes by “Mutable Joe” joked in 2016. BuzzFeed ran a story last year on 24 “ways Millennials became homeowners,” filled with decidedly sui generis anecdotes. One described someone who’d been hit by a truck and won a lawsuit, covering their down payment. Short of getting concussed by a semi, the article suggested, Millennials had little chance of becoming homeowners.

|

|

|

|

laxbro posted:Are they comparing HHI? If so then I don't think it is any surprise the dual-income millennial households are outearning their single-income households of older generations. Individual income is mentioned in the piece as well... The Atlantic posted:Household income is only one lens, but individual income shows largely the same thing. Booms and recessions push incomes up and down, but although many media stories have tended to associate Millennials almost exclusively with the latter, they’ve now experienced both, and in a big way: Increases in income since 2014 have been steep. Also, while there are more dual-income households now than a generation ago, there are also more one-person and single-parent households as well.

|

|

|

|

golden bubble posted:Think about how many news articles there are about understanding the "real American." It doesn't matter there's less of them proportionally than there have ever been before. So much of the media still thinks they matter more than other americans. And if a writer fervently believes the average american millennial is a white man with moderate education, that really changes the reporting on millennial economics. I'd argue that much of the "millennials are permanently economically doomed" pieces aren't from writers who think the average American millennial is a white man with moderate education. Probably the exact opposite. It's coming from highly-educated journalists in places like New York City who are extrapolating their experience (astronomical student loans from j-school, working in a industry where pay has been falling, surrounded by an absolutely insane real estate market) onto the rest of their generation around the country. Decades from now I think we're going to look back and be able to better recognize just how weird it was for society when the people who are professionally responsible for reporting on the world had their economic situation go from being generally better-than-average to generally worse-than-average. It used to be that, when a local reporter for the Daily WhereverTheFuck newspaper wrote a piece, they were probably making a bit more money than a majority of the people who would eventually read it. Today, when a freelancer churning out content for Vice or Vox or wherever writes something up, it is very likely that they are making less money than the majority of the people who will eventually read that piece. LanceHunter fucked around with this message at 21:11 on Apr 18, 2023 |

|

|

|

More details on First Republic.New York Times posted:First Republic Bank Lost $102 Billion in Customer Deposits So I guess the question here is if we should read this as "over a hundred billion in deposits were withdrawn, they're on their death-bed" or read it as "over a hundred billion in deposits were withdrawn and they managed to survive, so it's looking up from here". (I feel like the NYT headline writer feels pretty strongly in the later, especially because when I got the push notification that read "First Republic Bank Lost $102 Billion..." I thought the story was going to be something significantly more dire.) LanceHunter fucked around with this message at 22:08 on Apr 24, 2023 |

|

|

|

NYTimes on the latest fed rate raise...quote:What to know about the Fed’s latest move.

|

|

|

|

LostCosmonaut posted:Really we should have seen this coming I enjoy the joke here, but let's remember the thread rules...

|

|

|

|

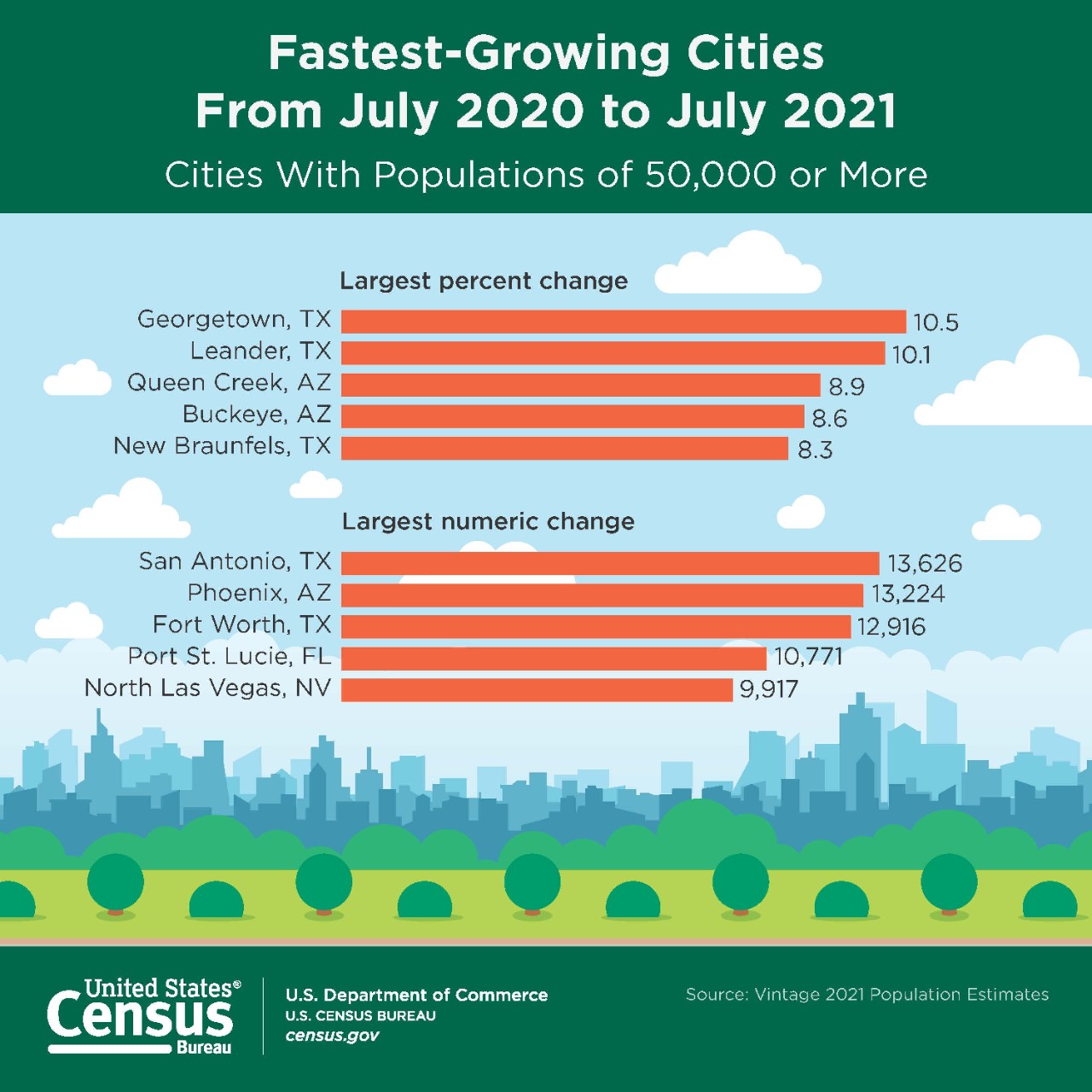

This is a good indicator that Austin's pro-building policy is actually paying dividends, even as we've had to absorb some of the biggest population growth in the country for over a decade. Check out this graph from the Census department... Three out of the five largest percentage growth cities are in the greater Austin area, and two of them are outright suburbs of Austin. For over a decade now we've been building like crazy, but housing costs were still rising faster-than-average because of the sheer number of people moving here. It resulted in some NIMBY backlash, as people saw these towers going up and also saw their rents rising and decided that the two phenomenon were related. It was hard to explain that the new towers meant those rent raises were lower than they might have been otherwise.

|

|

|

|

Here's a non-paywall/gift link to the NYTimes coverage of today's jobs report. Just way too much stuff to all copy over here, but some highlights... quote:U.S. employers added 253,000 jobs in April.  quote:Wages climb rapidly, defying the Fed’s hopes for a slowdown. Doomers in absolute shambles.

|

|

|

|

I feel like we need some new term to describe a kind of anti-stagflation. In the same way that term was coined to try and capture the seemingly-paradoxical economic state of a slow economy with high inflation, we need something to capture this state of the economy running super-hot in terms of full (or near-full) employment and rising wages that isn't getting knocked back by rising interest rates. The "radiator economy?"

|

|

|

|

LLSix posted:Maybe something like the-inevitable-consequences-of-a-deeply-dishonest-definition-of-unemployment? Pretending people who haven't been able to find a job for 12 months cease to exist is ridiculous. This topic came up in the thread before: Trying to hand-wave away the continued fall in unemployment as fake doesn't stand up to scrutiny when labor force participation is just 0.7% lower than it was immediately before the pandemic hit, and basically in-line with the rate for the last ten years.

|

|

|

|

Lockback posted:Corporations have always tried to price their products as high as the market would allow, they never needed excuses. Normally if a company goes too high a competitor can swoop in and take their profit by lowering their margin but having a higher volume. That can't happen now because.... supply chain issues including labor shortages. The entire "greedflation" narrative took off among the Jacobin crowd for the same reason the election fraud narrative took off among the Fox News crowd. It reinforced strongly-held priors ("Trump couldn't lose an election!" / "Rising wages could never cause rising prices!") that had until recently had held basically true (Trump technically won in 2016 and wage increases above the far-below-equilibrium $7.25 an hour legitimately have negligible effects on prices) and upon which were a lot of the more extreme elements had based their wildest fantasies (after Trump won 2020 all the seal indictments Q talked about were going to be opened / the minimum wage should be $33 an hour).

|

|

|

|

pmchem posted:also state capitals for two of the largest states. I’m more that surprised AA didn’t already have a direct flight The direct flight situation in Austin is very frustrating. Up until 1999 we only had a municipal airport and the vast majority of flights went to other Texas cities (mostly Houston and Dallas) to then connect out. Our current airport opened just two years before 9/11, and it had about the worst possible architecture for handling things afterwards. For example, every single shop/restaurant/cafe/etc was behind the security checkpoint, since they never imagined a world where people without tickets wouldn't be able to go through security to be able to wait for their arrivals. The airport has been trying its hardest to keep up with the insane amount of growth, but it's been a poo poo-show the entire time.

|

|

|

|

Inflation report is out...New York Times posted:What to know about the latest inflation report.

|

|

|

|

Also, some discussion on the sources of this inflation...New York Times posted:How the drivers of inflation have changed. Which is most interesting for this graph:

|

|

|

|

street doc posted:There is no real debate. After decades of consolidation companies had Yes, the highly monopolistic, corporatized industry of *checks notes* day care centers are only raising prices because of corporate greed and not at all because of rising labor costs.

|

|

|

|

One advantage of being at full/near-full employment: Job satisfaction is rising.Wall Street Journal posted:Workers Are Happier Than They’ve Been in Decades Highlighted the one catch in there. That said, the full survey report is here and it is worth a look. In particular, this chart is a beauty... (Also, as an aside - where are people hosting images now that imgur has hosed off? I'm just attaching things but obviously that is pretty limited.)

|

|

|

|

St. Louis Fed president James Bullard gave an interesting presentation on how monetary and fiscal policy affected inflation. (That link is to the press release. This is to the presentation PDF.)James Bullard posted:The Monetary-Fiscal Response This chart in particular paints a hell of a picture...

|

|

|

|

SpartanIvy posted:I think the 1,400 number may be of all inventory which includes a lot of older homes which trend way smaller. I don't think so, because... GlyphGryph posted:If I recall correctly from last time I dug through the numbers, we were down from 40% of new housing construction being in the started home size range (<1400 sq ft) to about 5% in the late 2010s. I do wonder what those numbers look like now.

|

|

|

|

LLSix posted:Does that mean that commuting costs each employee more than $4,600 a year? Because they seem to be claiming that's how much they spend at city business, so add on gas, vehicle maintenance and other transportation costs to start getting close to how much people save by working from home? That math only works if you assume that the person who is now working from home is spending $0 on things like lunch, drinks after work, etc. Companies like DoorDash are thriving now because they are picking up a lot of this spending that would otherwise go to urban businesses. Commuting costs are entirely separate, and while there are places that claim the average cost is much higher (like this article claiming the average cost is $8466 a year), if you break down the numbers you see that the majority of their calculation ($5,190 of the $8,466) relies on opportunity cost from lost time rather than actual money spent on gas/vehicle maintenance/etc.

|

|

|

|

For some extremely tenuous definition of "gets its due". Aside from being a barely coherent list of bullet points, even the article's own summary is just the biggest wet fart... quote:The bottom line: Though there's nothing like consensus on the topic, "the discussion has widened," Claudia Sahm, a former Fed economist, tells Axios.

|

|

|

|

GhostofJohnMuir posted:yeah i've seen a fair number of republican house members publicly stating that they don't trust yellen's x-date and think there's either more time or more extreme extraordinary measures like preferential coupon payments that can be done. probably biden gives before this is an issue, but i worry that familiarity breeds carelessness. one of these days we're going to accidently dance off this cliff even though almost no one actually wants to If Yellen had come out and said "We cannot legally send the June 1 social security checks if the debt ceiling has not been raised before that date", it would properly light a fire under people's asses. Familiarity breeding carelessness definitely seems to be the big issue here. I think Biden was relying on the markets and the business community to properly freak out and starting to push their weight around. Unfortunately, too many people are convinced that it will never happen and so there is no freak out.

|

|

|

|

An interesting possibility I've heard, and easily the sloppiest possible solution (outside of the actual global nukes-are-flying economic crash), is that people holding US debt sue for damages. They would very clearly have standing and motivation to do so. Then the courts can decide if the debt ceiling violates the 14th amendment (it definitely does) and can order Treasury to keep selling debt to make its payments.

|

|

|

|

ultrafilter posted:It's not a matter of whether the debt ceiling violates the constitution, though. It's a matter of whether the current SCOTUS will say that. I guess it depends on how many T-Bills are in Harlan Crow's portfolio...

|

|

|

|

May jobs report is out... The New York Times posted:U.S. employers added 339,000 jobs in May.

|

|

|

|

Very brief piece at Bloomberg where Marc Rowan of Apollo is coining the term "non-recession recession" to describe the coming time of a strong main economy while the financial sector takes a loving bath. I still prefer Matt Yglesias's term for it, "the liquidation of the rentier".

|

|

|

|

I think that San Francisco in particular is going to be a more extreme example of this effect, so they probably shouldn't be taken as the exemplar of what is coming for everyone. They're basically being hoisted on their own petard here, being hurt by the fact that their economy is so heavily tech-focused (when that was what made them so rich for the last few decades).

|

|

|

|

|

| # ¿ May 22, 2024 17:32 |

|

Hadlock posted:I'm curious, an old roommate of mine was an EE from turkey working at a semiconductor company and send most of his paycheck home for his dad to buy properties in Istanbul. Before he moved out he said he had something like 10 properties. World bank inflation calculator says that since he and I had that conversation about a decade ago, inflation has gone up 595% Wasn't it earlier in this thread were a lot of people were discussing how fixed-rate mortgages were pretty rare outside the US? I'd assume that the bank resolves this by adjusting the interest rate to match/beat inflation when the interest rate on the mortgage adjusts.

|

|

|