|

Sorgrid posted:Japan had one of the worse (if not the worst) levels of productivity per hour worked per capita in the world Here's a source for this statement. Also here's a link to hours worked, though it appears self-reported. There's no way Japan's average is at ~1700, though it does fall nicely in line with the government's official line that the average Japanese worker does 33 hours a week - just about what you'd wind up with if everyone was doing 40 hours a week with ~5 hours of mandatory breaks as required by the labor standards law. Sheep fucked around with this message at 23:10 on Jun 12, 2013 |

|

|

|

|

| # ? May 10, 2024 10:56 |

|

pentyne posted:Isn't a fair amount of time for the average Japanese office worker not even getting anything done but being seen at the office for those hours? Like to them its more important that they be seen as physically present for 10-12 hours every day and only doing 5-6 hours of work. Another thing about this (and this is anecdotal, if with a whole bunch of anecdotes) is that people are expected to be available in case a client calls to request anything, even until late in the evening. It's like, yeah all the work for today is done, but what if someone calls and needs something??? For some reason it can't wait until the next day, even if the request comes in at 8:30 pm or something. This is more likely a symptom than a cause, but it certainly isn't helping matters. And then banks close at 3pm, I just don't even know what the gently caress about this country.

|

|

|

|

z0glin Warchief posted:

What? Are bank employees sitting around doing nothing starting from 3 pm?

|

|

|

|

Lucy Heartfilia posted:What? Are bank employees sitting around doing nothing starting from 3 pm? Does that really surprise you in a country where ATMs are often closed from 8pm to 9am, and also on holidays? Also in tales_of_Japanese_banking.txt, this girl I know got an entry job at a regional bank here. Part of the interview involved being tested on abacus usage. She actually had an abacus she carried around and practiced on when waiting for the bus and what not. I guess Japan's financial backbone is so outdated that it is still operable even in the event of a blackout by just busting out the abacuses (abaci?) and faxing poo poo by candlelight. Edit: almost forgot, I can't even do internet banking on holidays because they shut that down too for some reason. Sheep fucked around with this message at 00:48 on Jun 13, 2013 |

|

|

|

Lucy Heartfilia posted:What? Are bank employees sitting around doing nothing starting from 3 pm? My guess is mandatory 'meetings' about how you'll do your best to ~ganbaru~ the next day and then cleaning. Cleaning is... a thing much like radio calisthenics are.

|

|

|

|

That sounds like American grade school.

|

|

|

|

Sheep posted:Edit: almost forgot, I can't even do internet banking on holidays because they shut that down too for some reason. I'd never thought about it before, but based on the ATMs I suppose it shouldn't surprise me. That still takes the loving cake though

|

|

|

|

I had to go in to a bank after hours for something once and it was a madhouse, people running everywhere, counting money, filling out paperwork. I suppose there may have been some cleaning going on.

|

|

|

|

Lemmi Caution posted:I had to go in to a bank after hours for something once and it was a madhouse, people running everywhere, counting money, filling out paperwork. I suppose there may have been some cleaning going on. This is basically why depopulation isn't really an issue. A WHOLE lot of slack could be taken up by proper computerization.

|

|

|

|

Shouldn't the work day logically be 9-6 if it's 40 hours a week, including an hour lunch break? That's pretty much what I've got in Hong Kong and I thought it's pretty standard everywhere. The crazy poo poo is when they hang out until 9 or later, totally unpaid.

|

|

|

|

Stringent posted:This is basically why depopulation isn't really an issue. A WHOLE lot of slack could be taken up by proper computerization. But but but think of the poor fax and copy machine makers!!

|

|

|

|

Bloodnose posted:Shouldn't the work day logically be 9-6 if it's 40 hours a week, including an hour lunch break? That's pretty much what I've got in Hong Kong and I thought it's pretty standard everywhere. The crazy poo poo is when they hang out until 9 or later, totally unpaid. There's your problem. Never expect logic to be used if it clashes with "the Japanese way". Sheep fucked around with this message at 03:14 on Jun 13, 2013 |

|

|

|

Stringent posted:This is basically why depopulation isn't really an issue. A WHOLE lot of slack could be taken up by proper computerization. Eh, depopulation is still an issue from an economic/consumer spending point of view even if productivity went up (I doubt worker wages would rise with productivity).

|

|

|

|

Ardennes posted:I doubt worker wages would rise with productivity. Have you tried to hire a programmer recently?

|

|

|

|

Sheep posted:Does that really surprise you in a country where ATMs are often closed from 8pm to 9am, and also on holidays? I'm not going to deny that this is crazy, but some people might not know a key part to this. Abacus is actually one of the de facto officially-sanctioned Japanese hobbies for children. It's common for kids to go to abacus lessons the way some go to piano lessons. So it is, indeed, real crazy that she would need that for her job. However, the fact that she can use or was practicing the abacus is less of an insane thing in Japan where it's a lot more common. Stringent posted:This is basically why depopulation isn't really an issue. A WHOLE lot of slack could be taken up by proper computerization. This is basically the key, but the problem is that vast swathes of the population are actually actively disinterested in anything related to efficiency. They treat it almost like a slippery-slope of productivity. Suggestions for better ways to do things will be met with, "Well why would we want it to take less time? What would we do with that extra time? What do you mean go home earlier? If I go home before my boss does they'll think I'm lazy." It's a weird thing because I do sympathize with some of the logic. It would be nice if productivity increases didn't lead to layoffs. It just sucks to see everyone's lives being absolutely ruined in the same style as that planet in Hitchhiker's Guide that was nothing but middle-managers. ErIog fucked around with this message at 06:31 on Jun 13, 2013 |

|

|

|

ErIog posted:The fact that she can use or was practicing the abacus is less of an insane thing in Japan where it's a lot more common. Even this part isn't too crazy, given that you can do some pretty crazy mental calculation by visualizing an abacus. Called "暗算" I think. Then again Excel or even a calculator works just as well...

|

|

|

|

zmcnulty posted:Called "暗算" I think. For bonus hilarity, this means something like "to scheme maliciously in the shadows" in Chinese.

|

|

|

|

Sheep posted:There's your problem. Never expect logic to be used if it clashes with "the Japanese way". In Tokyo Vice Jake Adelstein mentioned how he was astonished that they had no computers at the newspaper office and had no plans to introduce them in the mid/late 90s. One person's job just in the crime reporting department was to maintain a filing system of notecards with contact details. Literally the entire person's job could've been replaced with a single computer and a Microsoft excel spreadsheet. Another guy at the sports department was the one in charge of doing the same for player statistics. There were quite a lot of problems getting information in a timely manner from those people.

|

|

|

|

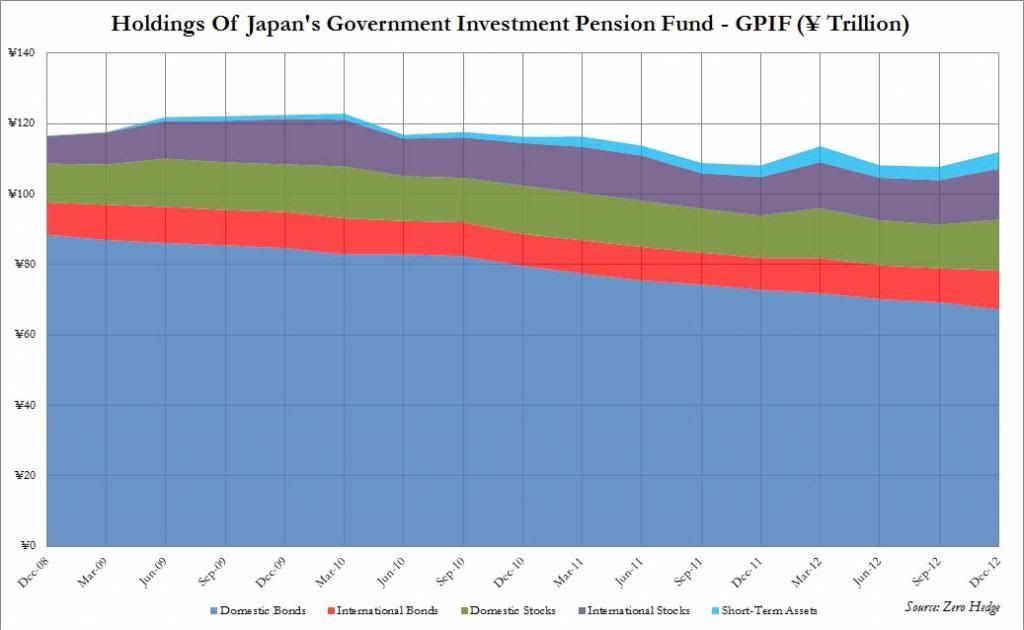

Samuelthebold posted:One bit of information I'd really like to know is how much leeway the big institutions currently have to buy bonds. The graph at 3:02 shows how enormously they are invested in bonds already, but it doesn't give a good idea of future buying capacity. If anyone's interested, I found something that served to me as a bit of an answer for this from the Financial Times on June 3rd: quote:According to the BIS, Japanese banks hold 90% of their tier 1 capital in JGBs. So for buying capacity, I'm going to assume "not much". quote:Japan’s largest bank, Bank of Tokyo-Mitsubishi, has already acknowledged that reducing its USD485bn holdings of JGBs would be disruptive for the markets...Nobuyuki Hirano, chief executive of Bank of Tokyo-Mitsubishi, admitted that the bank’s Y40tn ($485bn) holdings of Japanese government bonds were a major risk but said he was powerless to do much about it.... There's the home bias, I suppose. Nobody wants to be the first to rock the boat. Between this and the fact that the big pension fund (GPIF) wants sell bonds from here forward, I think it's going to be really hard for the government to turn off QE. It looks like they may have to increase it, actually. The yen is rising in value today, but I'm going to keep hanging on to other currencies.

|

|

|

|

Samuelthebold posted:There's the home bias, I suppose. Nobody wants to be the first to rock the boat. I don't know if the big banks can break away even if they wanted to, the Japanese government can't pay that debt so if they stop buying the entire dance comes to an end. I don't think an endless inflation spiral can happen, but because of the theoretical financial points but that either Japanese banks or the US/IMF won't allow it to happen because the consequences are to great.

|

|

|

|

The banks definitely can't and won't move that giant lump away from JGBs. But right now the BoJ is using QE money to automatically buy 70% of new bonds, and to buy god-knows how many more in open trading in an attempt to keep rates low. If the banks and pensions literally can't buy more bonds because they have no more money and are facing de-saving, then who buys the bonds when QE stops? I'm starting to look at Japan's QE less like it was a radical new idea and more like something they just had to start doing.

|

|

|

|

Samuelthebold posted:The banks definitely can't and won't move that giant lump away from JGBs. But right now the BoJ is using QE money to automatically buy 70% of new bonds, and to buy god-knows how many more in open trading in an attempt to keep rates low. Goes back to the US/IMF, funding will keep on being pumped in to keep the game going, because the US (and the West) does need Japan for economic and strategic regions but it might be a little rough in the future.

|

|

|

|

ErIog posted:I'm not going to deny that this is crazy, but some people might not know a key part to this. Abacus is actually one of the de facto officially-sanctioned Japanese hobbies for children. It's common for kids to go to abacus lessons the way some go to piano lessons. Bloodnose posted:For bonus hilarity, this means something like "to scheme maliciously in the shadows" in Chinese. Wooden Abacus is for sissies. Real Abacus is using one hand and segments of your fingers to denote different units.

|

|

|

|

Ardennes posted:Goes back to the US/IMF, funding will keep on being pumped in to keep the game going, because the US (and the West) does need Japan for economic and strategic regions but it might be a little rough in the future. Eh, I don't know. Bailing out Japan is mighty expensive. Japan's government budget for this year alone needed about US$500 billion of new debt (now covered by QE), which by the way was slightly more than their tax revenues. That's way, way beyond the scope what the IMF is set up to deal with, and if asked how about handing that many billions to Japan, I think I know what US taxpayers would say. At the same time, how would Japanese people respond to foreigners insisting that they slash their government budget by double digits?

|

|

|

|

Samuelthebold posted:Eh, I don't know. Bailing out Japan is mighty expensive. Japan's government budget for this year alone needed about US$500 billion of new debt (now covered by QE), which by the way was slightly more than their tax revenues. That's way, way beyond the scope what the IMF is set up to deal with, and if asked how about handing that many billions to Japan, I think I know what US taxpayers would say. At the same time, how would Japanese people respond to foreigners insisting that they slash their government budget by double digits? That would be be the rough part, and there is going to be plenty of acrimony but ultimately Japan's trade partners won't accept very high inflation for a variety but ultimately the Fed isn't directly answerable to anyone (and neither is the IMF really) and it may become a situation where Japan becomes Greece to America's Germany. Obviously it isn't a solution, but the US wants the yen to remain relatively stable and the US has the political and military power to make Japan answerable to their debt. It will just be a even more gloomy and eventually austere existence. Also, Japan does have a considerable amount of US debt itself. Also, part of that future is more of the budget than before will go to the military, especially the air force and the navy. Ardennes fucked around with this message at 07:57 on Jun 13, 2013 |

|

|

|

Wonder how realistic it would be to gut Japan of its useful technologies/capabilities (i.e. companies), rather than ask the US taxpayer to fund every Hanako and Taro's pension. edit: I say this because a lot of people will ask why Japan should be bailed out zmcnulty fucked around with this message at 08:23 on Jun 13, 2013 |

|

|

|

zmcnulty posted:Wonder how realistic it would be to gut Japan of its useful technologies/capabilities (i.e. companies), rather than ask the US taxpayer to fund every Hanako and Taro's pension. Eh doubtful, Japanese banks/its government doesn't control those assets, we would probably just make Japan in debt to the IMF/US for the rest of the 21st century (if nothing seriously changes).

|

|

|

|

Ardennes posted:That would be be the rough part, and there is going to be plenty of acrimony but ultimately Japan's trade partners won't accept very high inflation for a variety but ultimately the Fed isn't directly answerable to anyone (and neither is the IMF really) and it may become a situation where Japan becomes Greece to America's Germany. Fair enough. I'll keep intervention in mind as a real possibility, but I still lean toward Japan being too big a problem for other countries to solve. The US is four times the size of Germany, but Japan is 11 times the size of Greece. Similarly, Germany's GDP is about 10 times Greece's GDP while the US's is only 3 times Japan's. EDIT: Not to mention, if I were loaning money, a country with a rapidly shrinking population would look like a pretty bad investment. Samuelthebold fucked around with this message at 08:33 on Jun 13, 2013 |

|

|

|

Samuelthebold posted:Fair enough. I'll keep intervention in mind as a real possibility, but I still lean toward Japan being too big a problem for other countries to solve. The US is four times the size of Germany, but Japan is 11 times the size of Greece. Similarly, Germany's GDP is about 10 times Greece's GDP while the US's is only 3 times Japan's. Keep in mind that the IMF might be taking a serious amount of the weight at the same time, which splits the load and the IMF has quite a bit of lending power. Also, the way it traditionally works is the lending parties make sure they will get "their cut" at any cost which probably will be most of the budget will be taken over by interest and there will be massive austerity measures and likely a prolonged depression. Obviously will make everything worse, but Japan will be kept in a similar "zombie" state to Greece even though there will no feasible way for it to growth its way out of debt and will just have to sell every asset the government has to keep the process going on. They will probably let the Emperor keep the palace though.

|

|

|

|

zmcnulty posted:Wonder how realistic it would be to gut Japan of its useful technologies/capabilities (i.e. companies), rather than ask the US taxpayer to fund every Hanako and Taro's pension. As long as they keep the Chinese out of the onsen/ski resorts I'm fine with this.

|

|

|

|

Ardennes posted:Eh doubtful, Japanese banks/its government doesn't control those assets, we would probably just make Japan in debt to the IMF/US for the rest of the 21st century (if nothing seriously changes). I meant via acquisitions, so completely private. If you look at what aspects of Japan are attractive -- from a global competitiveness standpoint -- what do you see? A shitload of R&D and technical capabilities is my guess. Definitely going further and further up the value chain in recent years. If keeping the economy itself afloat isn't realistic, it would be up to the private sector to keep certain companies afloat. And if that's not realistic, maybe keeping specific departments/capabilities afloat is? Check out Samsung buying a piece of Sharp. Wonder what drove that decision? zmcnulty fucked around with this message at 08:57 on Jun 13, 2013 |

|

|

|

zmcnulty posted:I meant via acquisitions, so completely private. I guess depends on the company, and their assets. It would really depend on exports falling apart while there are worthwhile assets still worth poaching. It is hard to say, because so many Japanese corporations seem to be exposed to a global market. If Japan falls apart, they may still make money overseas. I am sure Ford would love a piece of Toyota if they could. But, inflation will probably be a good thing for them for a while at least, their goods will be priced cheap for a global market. Japanese good are generally known to be pretty high quality though, so it help subsidize them at least a while. Of course the issue is that the government itself will have a real revenue issue soon and its banks are tapped out, it can't just print money. While very high inflation may improve their exports, but it would enrage everyone else especially tens of millions of Japanese savers. Eventually they would have to find someone to prop them up and the US and its buddy the IMF would be there to "help." Ardennes fucked around with this message at 09:03 on Jun 13, 2013 |

|

|

|

Ardennes posted:Keep in mind that the IMF might be taking a serious amount of the weight at the same time, which splits the load and the IMF has quite a bit of lending power. Well, I'm still skeptical. I think they'd have to get pretty far gone to allow other countries to tell them what to do. Greece is in the EU, so it didn't have as much choice. Anyway, here's an interesting chart that shows the GPIF's holdings. They would actually have some serious room to buy more JGBs if they were willing to dump their other stuff. On the other hand, you can see how they're shrinking, too.

|

|

|

|

Samuelthebold posted:Well, I'm still skeptical. I think they'd have to get pretty far gone to allow other countries to tell them what to do. Greece is in the EU, so it didn't have as much choice. It looks like the GPIF has very modestly diversified because of what we are talking about, and it doesn't look like it has too much of a margin (domestic bonds are yen bonds I assume). I guess they could force the pension to hold almost 100% of its holdings in Japanese bonds, but it wouldn't help them that much. Japan has assets to utilize but they may very soon reach the point where they have to actively sell them off to maintain their balance. Edit: The Nikkei just took another 6%+ dip at the moment, supposedly because of recent strengthening of the yen. Basically, the dollar is staying weak even though theoretically it shouldn't. Ardennes fucked around with this message at 02:58 on Jun 14, 2013 |

|

|

|

What the gently caress, Japan.quote:To get an idea of how Japan's prime minister, Shinzo Abe, is faring in his quest to lift his country out of two decades of stagnation, look no further than the skirts of the girl group Machikado Keiki Japan. https://www.youtube.com/watch?v=SlBk_TwWX0k

|

|

|

|

Samuelthebold posted:What the gently caress, Japan. I think we've talked before about media taking weird fringe bullshit and portraying it as mainstream Japanese.

|

|

|

|

LimburgLimbo posted:I think we've talked before about media taking weird fringe bullshit and portraying it as mainstream Japanese. Oh, this is totally weird fringe bullshit, and I wouldn't mean to present it as mainstream, but the fact that this even exists is fascinating. And creepy and a little alarming.

|

|

|

|

Still better than AKB and its myriad offshoots.

|

|

|

|

http://www.cbsnews.com/8301-204_162-57589423/japanese-eyeball-licking-trend-carries-blindness-risk/quote:A strange trend among Japanese school-aged children and teens -- licking a friend or lover's eyeballs -- may be perplexing, but experts are more worried about the germs they are potentially spreading. Is this just the Japanese equivalent of rainbow bracelets, i.e a nearly nonexistent youth phenomena that the media treats like a major threat to the moral fabric of their country?

|

|

|

|

|

| # ? May 10, 2024 10:56 |

|

pentyne posted:http://www.cbsnews.com/8301-204_162-57589423/japanese-eyeball-licking-trend-carries-blindness-risk/ And a similar kind of thing just came up three posts ago. Is this the general Japanese culture thread now?

|

|

|