|

Albino Squirrel posted:Welp, the end is nigh.

|

|

|

|

|

| # ? May 10, 2024 00:29 |

|

My wife's printing that and bringing it to work tomorrow. The people she works with simply can't believe the housing market in Toronto is so insane. I also don't doubt this'll be sold to someone who is going to regret it as soon as the novelty wears off. I'm honestly still torn between renting and buying here. On one hand with rates going up prices might start coming down if we wait another few years but on the other hand prices around here are still very affordable for 2 income families. I'm seriously tired of living in apartment buildings so we're either going to be saddled with taking the risk on buying a house or dealing with putting the same amount of money or more each month towards rent but not paying maintenance or taxes. There's also the floodway issue. Winnipeg is now pretty well completely protected from river flooding and everything outside the floodway is pretty much set to get royally screwed up every few years thanks to all this wonderful climate change. It wouldn't surprise me if half the province living along the Red and Assiniboine start saying 'gently caress it' and leave for dryer pastures inside the perimeter. That's going to mean a run on houses over the next few decades.

|

|

|

|

If you scroll to the alley side of the building you can see there's still a garage door there. Makes moving a snap!

|

|

|

|

EvilJoven posted:My wife's printing that and bringing it to work tomorrow. The people she works with simply can't believe the housing market in Toronto is so insane. I also don't doubt this'll be sold to someone who is going to regret it as soon as the novelty wears off. Why is Winnipeg's housing market so crazy? For a place that is practically unliveable except for maybe 3 months of the year, all the canards that we hear about why prices are so high in Vancouver sure as hell don't apply.

|

|

|

|

Cultural Imperial posted:Why is Winnipeg's housing market so crazy? For a place that is practically unliveable except for maybe 3 months of the year, all the canards that we hear about why prices are so high in Vancouver sure as hell don't apply. Because the whole country is obsessed with property ownership, that's why.

|

|

|

|

It isn't that crazy compared to other places. It's also a rare city where there are jobs to be had AND a middle class person can still afford a house... for now.

|

|

|

|

EvilJoven posted:It isn't that crazy compared to other places. It's also a rare city where there are jobs to be had AND a middle class person can still afford a house... for now. Genuinely curious: presumably that was all true 15 or 20 years ago also?

|

|

|

|

It was, however, these days with that becoming rare across the country more people like me are starting to leave already over inflated markets for places like this. 15 years ago there simply wouldn't have been as much demand because other, more desirable cities were still somewhat affordable.

|

|

|

|

EvilJoven posted:It isn't that crazy compared to other places. It's also a rare city where there are jobs to be had AND a middle class person can still afford a house... for now. I just looked it up and my mind is blown that the unemployment rate in Manitoba is 5.4%.

|

|

|

|

Winnipeg has a housing bubble because CMHC stands for Canadian Mortgage and Housing Corporation, not Vancouver and Toronto Mortgage and Housing Corporation.

|

|

|

|

Fine-able Offense posted:Winnipeg has a housing bubble because CMHC stands for Canadian Mortgage and Housing Corporation, not Vancouver and Toronto Mortgage and Housing Corporation. I'm all for heaping opprobrium on the CMHC, but they've been around since the end of WW2* - the housing bubble has not. (* admittedly, with a tiny mandate back then of helping veterans purchase housing)

|

|

|

|

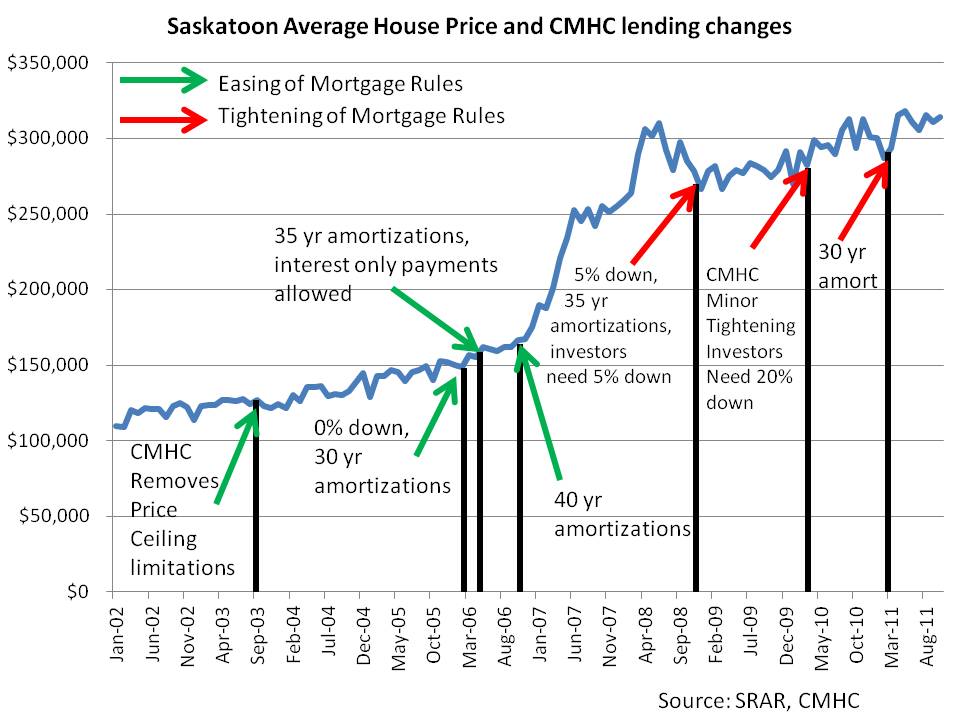

Lexicon posted:I'm all for heaping opprobrium on the CMHC, but they've been around since the end of WW2* - the housing bubble has not. From this awesome blog:  Saskatoon Housing Bubble posted:Pre-2003 – CMHC: 5% down with price limit depending on area, 25 yr amortizations, no price limit if 10% or more down In short: there is a timeliness component to the relevancy of discussing CMHC behavior in relation to the market.

|

|

|

|

^ Well that's all rather damning. That series of moves from 2003-2006 is borderline criminal-insanity.

|

|

|

|

Back when I was at the real estate board I looked up the numbers on mortgages by classification. In the 18 months or so that the 0-down, 40-year mortgages were allowed, so many of them were written that when I checked in 2010, 9% of all mortgages in Canada were of this type. Think about that the next time tells you Canada has no subprime problem.

|

|

|

|

Fine-able Offense posted:Back when I was at the real estate board I looked up the numbers on mortgages by classification. In the 18 months or so that the 0-down, 40-year mortgages were allowed, so many of them were written that when I checked in 2010, 9% of all mortgages in Canada were of this type. Anecdotes like that give me pause about ever thinking that we'll ever see the pre-2003 world again. That's a hell of a lot of the country whose interests are directly opposed to "housing is cheaper".

|

|

|

|

Fine-able Offense posted:Back when I was at the real estate board I looked up the numbers on mortgages by classification. In the 18 months or so that the 0-down, 40-year mortgages were allowed, so many of them were written that when I checked in 2010, 9% of all mortgages in Canada were of this type. Is this on public record? Is there a way we can get this info?

|

|

|

|

Wait, 0% down? Does that actually mean you don't have to put a downpayment on a house to get a mortgage for it? Please tell me I'm mistaken, because that sounds totally nuts.

|

|

|

|

Blade_of_tyshalle posted:Wait, 0% down? Does that actually mean you don't have to put a downpayment on a house to get a mortgage for it? Please tell me I'm mistaken, because that sounds totally nuts. Its what my sister in law has. Then she likes to hold it over our heads that she has a house and we don't.

|

|

|

|

Cultural Imperial posted:Is this on public record? Is there a way we can get this info? Here's a source from 2010 showing it at 6%. (Edit: page 23). Two caveats: 1) The percentage they show is almost certainly lower than it actually was, because CAAMP generally obfuscates these problems. Also they don't cover the seedier ends of the industry in these surveys (because they like to obfuscate!). 2) That said, the percentage of 40-years in the total portfolio has almost certainly dropped since 2010, though only because so many mortgages have been written since there. Yay for securitization and portfolio churn, right? Take it as mostly a data point that is illustrative of how bad it got by 2008, and of course remember that this garbage is still floating around in the system waiting to give us the economic shits.

|

|

|

|

Lexicon posted:Anecdotes like that give me pause about ever thinking that we'll ever see the pre-2003 world again. That's a hell of a lot of the country whose interests are directly opposed to "housing is cheaper". As home ownership is slightly under 70% of the population you can bet that there are a lot of people that don't want 2003 house prices again. Luckily they cannot hold it back forever so their interests at some point become immaterial. ie. The American and Irish home owners probably weren't terribly keen on the last 5-6 year either.

|

|

|

|

Blade_of_tyshalle posted:Wait, 0% down? Does that actually mean you don't have to put a downpayment on a house to get a mortgage for it? Please tell me I'm mistaken, because that sounds totally nuts. Yup we had the same craziness in the US, even though the companies have something called PMI which adds extra cost for no money down home loans. ocrumsprug posted:As home ownership is slightly under 70% of the population you can bet that there are a lot of people that don't want 2003 house prices again. Luckily they cannot hold it back forever so their interests at some point become immaterial. ie. The American and Irish home owners probably weren't terribly keen on the last 5-6 year either. Which is another interesting note vs. the US bubble, Canada already exceeded the US peak bubble numbers for home ownership. etalian fucked around with this message at 01:08 on Aug 24, 2013 |

|

|

|

etalian posted:Yup we had the same craziness in the US, even though the companies have something called PMI which adds extra cost for no money down home loans. Canada has similar CMHC insurance for high ratio mortgages.

|

|

|

|

Fine-able Offense posted:Back when I was at the real estate board I looked up the numbers on mortgages by classification. In the 18 months or so that the 0-down, 40-year mortgages were allowed, so many of them were written that when I checked in 2010, 9% of all mortgages in Canada were of this type. 0 down long term mortgages are bad, but how common are ARM's? In particular pay-option ARM's- the US crash followed very closely to those "resets". Blade_of_tyshalle posted:Wait, 0% down? Does that actually mean you don't have to put a downpayment on a house to get a mortgage for it? Please tell me I'm mistaken, because that sounds totally nuts. I remember 0% down "day out of bankruptcy" loans back in 07. Hell I remember 5% down (which could be covered with seller gifts) loans on ITIN numbers. enbot fucked around with this message at 17:08 on Aug 25, 2013 |

|

|

|

I realized the other day that the Canadian market will only crash when a significant enough volume of people with those mortgages start to die, their children cannot afford to pay them alongside their own, but the market becomes saturated and sales stagnate.

|

|

|

|

Rime posted:I realized the other day that the Canadian market will only crash when a significant enough volume of people with those mortgages start to die, their children cannot afford to pay them alongside their own, but the market becomes saturated and sales stagnate. These people don't have insurance in your scenario?

|

|

|

|

Good morning and welcome to Schadenfreude Monday! https://www.youtube.com/watch?v=7DH_4_wVNDM BBC segment on Netherlands property market bursting. "HOW COULD THIS HAPPEN?????"

|

|

|

|

""Property specialists blame overgenerous government tax breaks and overoptimistic lenders" Sounds familiar!

|

|

|

|

What's most amazing about this busting bubble is the proximity of the Netherlands to Ireland, Spain, Portugal, ground zero for the most precipitous busts in property in the last 5 years, and still everyone couldn't see this coming.

|

|

|

|

The most amazing thing is i have a few people around me who JUST bought houses. Like the bubble doesn't even exist.

|

|

|

|

Cultural Imperial posted:What's most amazing about this busting bubble is the proximity of the Netherlands to Ireland, Spain, Portugal, ground zero for the most precipitous busts in property in the last 5 years, and still everyone couldn't see this coming. Everyone thinks they are special. The Dutch undoubtedly thought they were different, and clearly superior to those profligate Mediterranean types. Hell, look at Canada's relatively-recent superiority-complex vis-a-vis the USA. I'm absolutely sick to death of hearing all around me how smart our regulators are, how prudent our banks are, how fantastic our economy is, and how everyone wants to live here. Not like those stupid Americans. Lexicon fucked around with this message at 15:52 on Aug 26, 2013 |

|

|

|

Lexicon posted:Everyone thinks they are special. The Dutch undoubtedly thought they were different, and clearly superior to those profligate Mediterranean types. I don't know if I'm just predisposed to be financially conservative or what but the lack of ability for people to assess risk is mind boggling. And I'm not even talking about real estate. Remember the SARS and bird flu problems we had in the last 6 years? There was an unlimited outpouring of rage that the pandemic never happened, with people in Canada bitching about how the risk was overwrought and it really wasn't necessary to get people vaccinated.

|

|

|

|

I mean we have an aging population that's moving into care houses and wee have declining population growth that's barely being kept afloat trough immigration. Yet we keep building more real estate and the prices keep going up. Something is going against the fundamental laws of physics here and its gonna catch up. Demand absolutely cannot keep up unless we start shipping rich Chinese expats en mass everywhere.

|

|

|

|

Coylter posted:I mean we have an aging population that's moving into care houses and wee have declining population growth that's barely being kept afloat trough immigration. I always tell people this in discussions when it comes up. I say "I can't predict the future. I can't predict how to make money in housing, either the upside or the downside. I can't predict any sort of timing. What I can say, with absolute certainty, is that the current situation of exponential price growth, and the average family unable to afford the average home, simply cannot persist. It can't persist anywhere in the world, and certainly not here."

|

|

|

|

Coylter posted:The most amazing thing is i have a few people around me who JUST bought houses. Like the bubble doesn't even exist. Prices can only get higher!

|

|

|

|

My situation for example. I live in Trois-rivieres. What used to run the economy here was the paper industry. Now its pretty much all gone and what remains is going away. There is almost quite literally nothing else produced for exporting here. When my father lost his factory job (30$ / hour), he simply could not find anything remotely close to that salary. It all began to wear down the family ending in a split. My mother kept the house and refinanced it with the help of low interest rates. Now she might face a situation where her house is worth less than the mortgage and where there is 0 demand for houses at that price. I mean low interest rates pretty much enabled those economically dying community to stay afloat and keep their house. Now this all seems ripe for ending.

|

|

|

|

Coylter posted:The most amazing thing is i have a few people around me who JUST bought houses. Like the bubble doesn't even exist. They aren't making land anymore!

|

|

|

|

God, watching history repeat itself is so loving depressing.

|

|

|

|

Paper Mac posted:They aren't making land anymore! I get that there's zoning, infrastructure, proximity, and even habitability issues to consider, but it's always struck me as particularly hilarious when this one is offered up in a country where land is so drat plentiful.

|

|

|

|

Coylter posted:My situation for example. I live in Trois-rivieres. What used to run the economy here was the paper industry. Now its pretty much all gone and what remains is going away. There is almost quite literally nothing else produced for exporting here. Jesus christ.

|

|

|

|

|

| # ? May 10, 2024 00:29 |

|

Coylter posted:I mean we have an aging population that's moving into care houses and wee have declining population growth that's barely being kept afloat trough immigration. I don't even know why anyone would bother having a single kid anymore, nevermind multiple children. Costs are outrageously high, growing higher all the time, and once again wages aren't climbing to compensate. My cousins are all single moms living on welfare, and they all want even more children than the ones they already can't support now. I wouldn't consider having a kid myself until I make at least $65k/yr, it doesn't make a lick of sense for me to do it any lower than that. And I certainly wouldn't think of buying a house at any wage lower than that, either. The entire spectrum of poo poo you're expected to do as an adult is a colossal web of lies and forced debts.

|

|

|