|

I did. It's a very old roof and needs replacing.

|

|

|

|

|

| # ? May 11, 2024 12:30 |

|

TheReverend posted:A roofer came to my house to give me an estimate on a roof. Any claim has the possibility of increasing your premiums. No one can tell you if it definitely will or by how much if it does. The loss would likely be covered but without seeing your contract, there is no way to know. Standard homeowner policies should have a list of perils. Look for Coverage A, Perils Insured Against or something like that. Damage caused by these perils would be covered less any deductible. However, you need to read them fully because there are always exceptions.

|

|

|

|

Right. I guess what I was asking for isn't really a list of definite consequences but rather some possible ones that maybe I haven't thought up. For example, would it make switching to a different insurance company more difficult? Will I become locked in to AllState for a great long while?

|

|

|

|

Hed posted:We're trying to rebid the standard basket of insurance policies (Health/Vision/Dental) for our small 10-person firm. Does any good here broker that? We're incorporated in Colorado. I should be able to help. Messaging you now.

|

|

|

|

Kung Fu Jesus posted:Any claim has the possibility of increasing your premiums. No one can tell you if it definitely will or by how much if it does. TheReverend posted:Right. If you were to switch to another company, they will run a report that shows all the losses and claims attached to you and anyone else named on your policy. Depending on what your company has paid out, different companies will rate you differently. Certain types of claims are immediate red flags for a lot of the more preferred companies, like fire or water damage. Roof damage can sometimes be overlooked and impact the rate slightly less, but will often still impact future premiums. If you want to stay on top of this, file your claim and get it done, and then wait for your renewal. See what the company does with your rate. A company may say something to the tune of "Ok, now he has a new roof and we've had it redone. The old one was old anyways, so we aren't going to ding him since its safer now". Or they can just raise your rate at renewal. If that is the case, you can always shop around, but remember; if you're bundling all your stuff with your existing company, you'll want to do it wherever you shop too to make sure its a fair shop. I just saw the posts before that that say you were going to replace it because its old, not because of any specific damage. Definitely call your company on this. What you'd be doing is tying the need to replace the roof to a covered peril like wind or hail. It'd be a claim, but could save money in the long run if you get a nice roof. Talk to an agent and find out!

|

|

|

|

It is odd that insurance will cover if a tree falls on a fence, but not when a fence falls on a tree.

|

|

|

|

West SAAB Story posted:It is odd that insurance will cover if a tree falls on a fence, but not when a fence falls on a tree.

|

|

|

|

West SAAB Story posted:It is odd that insurance will cover if a tree falls on a fence, but not when a fence falls on a tree. Oddly enough, insurance policies often DO cover this (they have a "trees and shrubbery" sublimit). The Knights who say Ni would be pleased.

|

|

|

|

I've updated the OP with some more relevant information. Is there anything in particular that folks feel need to be added that I didn't cover?

|

|

|

|

Stupid luck. I hit some debris on the freeway today. Probably a muffler. I'm going to need a new radiator installed and cosmetically a new front bumper cover. Probably $1000-$1500 total. I'm wondering if I should just pay it out of pocket or claim it. My deductible is probably $500 but I'll have to check in the morning. loving asshats dropping poo poo on the highway.

|

|

|

|

Shaocaholica posted:Stupid luck. That is mega crappy. Unfortunately that is likely going to be considered an at fault collision claim with your insurance company. These are the ones that raise your rates and stuff like that. It won't pay out a lot, but it will be a hit if its over a certain threshold dollar amount. Do you have something like accident forgiveness or some such? Otherwise, yeah, consider making a claim just know it'll likely raise your premiums in the near future.

|

|

|

|

Jastiger posted:That is mega crappy. Unfortunately that is likely going to be considered an at fault collision claim with your insurance company. These are the ones that raise your rates and stuff like that. It won't pay out a lot, but it will be a hit if its over a certain threshold dollar amount. Do you have something like accident forgiveness or some such? Otherwise, yeah, consider making a claim just know it'll likely raise your premiums in the near future.

|

|

|

|

SiGmA_X posted:You think it'll be collision? Flying rocks that caused $3-4k in damage was comp for my dad on my first car. Isn't this basically the same thing? There's nothing to stop me from saying it was a rock. I quite frankly don't know what it was. It was at night and I barely saw what it was. Could have been a rock that fell out of a truck.

|

|

|

|

Is a good general rule of thumb for auto insurance that you insure your car for the value of your house? I know the OP says that I should get as much insurance as I can afford but that's a really vague amount of money. Currently I'm only paying $200 twice a year for $15,000 (BI coverage), $30k per accident, and $15k property damage liability. My insurance agent recommends I spend about $400 twice a year for $250,000 for BI coverage, $500,000 per accident, and $100,000 for property damage liability. I own a home that is worth about $180,000. Is it true that I want a policy that exceeds or meets that cost so I don't lose my house in an accident lawsuit of some sort? Is there any "better" halfway point between doubling my premiums and what I currently pay? My wife and I make around $60k jointly a year and we have zero accidents on our record at age 29.

|

|

|

|

Jastiger posted:That is mega crappy. Unfortunately that is likely going to be considered an at fault collision claim with your insurance company. These are the ones that raise your rates and stuff like that. It won't pay out a lot, but it will be a hit if its over a certain threshold dollar amount. Do you have something like accident forgiveness or some such? Otherwise, yeah, consider making a claim just know it'll likely raise your premiums in the near future. Well as it turns out its a 'comp loss' and not collision. $500 deductible. So my next question is, are there thresholds for how much my premium goes up based on the repair amount? Is there any difference between a $1k repair and a $3k repair? $5k? $10k? Seems like its in my best interests to go right up the threshold and not surpass it if its a step system. Conversely its in the best interests of the repair shop to claim the maximum amount of work within reason.

|

|

|

|

As a general rule if you hit something while moving, while that thing is not mobile, its collision. Rocks flying up and hitting your car? Comprehensive. You hit a bunch of rocks sitting in the road and screw up the axles? Collision. I'm actually really glad to hear you're getting it filed as a comp claim though, that will not cause your rates to go up as much. Collision ae the big ones that can cost you. Its a good idea to cover any assets you may possibly lose with liability limits. I would just hesitate to stop there because you may often need more. Also, once you have a good track record of insurance, the cost difference between 100/300 and 250/500 isn't that great and certainly not as great as the price difference in 30/60/ and 100/300. Remember, you're not insuring the car, you're insuring YOURSELF. If you have 15/30/15 you have like, no insurance. You're legal, but if you're involved in any kind of significant accident or liability issue you're going to exhaust that in no time. You'll note that your agent has doubled your premium but increased your coverage by more than a factor of 10. It sounds like you have some significant assets, both you and your wife are wage earners, and you have a good record,you should definitely increase your insurance limits to at least 100/300 in my opinion. Have you been with your company long? Is it one of the major companies? The jump will be a little bit from 15/30, but for someone in your situation, you're sounding very underinsured. Make sure you have uninsured and underinsured motorist for you and your wife too! As far as the thresholds for damage, every company views them differently. As far as I know they DO have a tiered system where they may or may not overlook a certain dollar amount. You'd really have to check with your company, and remember, if you ever do change that separate company may view it more or less favorably than your existing one. If you feel that the repair shop isn't being on the level you can always request a separate shops quote.

|

|

|

|

Shaocaholica posted:Well as it turns out its a 'comp loss' and not collision. $500 deductible. Insane Totoro posted:Is a good general rule of thumb for auto insurance that you insure your car for the value of your house? I know the OP says that I should get as much insurance as I can afford but that's a really vague amount of money. I'd recommend at least 100/300/100, if not 250/500/250. VVVVV Whoops on the dollar amounts, you have that right. SiGmA_X fucked around with this message at 02:57 on Feb 22, 2014 |

|

|

|

SiGmA_X posted:Same exact rate increase regardless of value - despite what some agents say. Their commission changes levels based on claim value from what a friend who is a producer said (could vary by company, he was with State Farm, and his dad owned the agency for 3+ decades, I tend to believe him). I don't think I've ever had a rate increase from comp, either, FWIW. That is probably true for loss ratios and agents that are responsible for their entire book of business. For a State Farm Agent that is directly responsible to State Farm for their book, the costs of any claims can be passed on the agent as a way to spread the pain when SF has to pay out on a claim. I can tell you though, as an agent that writes new business, that a claim CAN be "under threshold" and be ignored for rating purposes. quote:Youre taking on far too much risk with your low coverage. Small accidents can sometimes result in many tens of thousands in damages. You would absolutely be bankrupt if you got in a reasonably bad accident, and that's just foolish. Do you mean 100/300/100?

|

|

|

|

Err...Hmm. I'm with SF. If I'm reading your posts right I should just go for it and get everything fixed up 100% since I have a flawless record.

|

|

|

|

Shaocaholica posted:Err...Hmm. I'm with SF. If I'm reading your posts right I should just go for it and get everything fixed up 100% since I have a flawless record. Well if its going to be a comprehensive claim, then yeah it impacts your rates less. It can still impact them, though. But yeah, I mean, get your car fixed if its all screwed up. Don't drive an unsafe vehicle:)

|

|

|

|

Thanks for the help!

|

|

|

|

Jastiger posted:Well if its going to be a comprehensive claim, then yeah it impacts your rates less. It can still impact them, though. But yeah, I mean, get your car fixed if its all screwed up. Don't drive an unsafe vehicle:) Oh yeah I'd never drive unsafe. Just meant about all the nit picky cosmetic stuff. But its done. Car is dropped off at the body shop, told them to make it perfect. Really sucks that something as innocuous as some poo poo on the road at night can impact my work life, social life, finances, guh. I missed most of work today although I worked from home. I'm not going to have my car for about a week and so I have to drive a rental. All because someone lost their exhaust on their beater that probably costs way less than what the insurance machine is going to spend to fix. But I guess it could be so disproportionate as a 1 cent nail that kills a million dollar exotic car in addition to bodily injury because someone didn't close up a box of nails in the bed of their truck.

|

|

|

|

Shaocaholica posted:Oh yeah I'd never drive unsafe. Just meant about all the nit picky cosmetic stuff. But its done. Car is dropped off at the body shop, told them to make it perfect. Hey, this is why it pays to have good insurance. poo poo happens, no one is going to doubt that. But at least you know with all the stress you're experiencing, paying a ton out of pocket isn't on top of it, compounding the issue. A lot of people that do not have insurance would be screwed in your position. Good thing you're covered, I'm glad its going well for you.

|

|

|

|

The kind of insurance I do is very large energy risks like oil & gas wells, pipelines, petrochemical plants, and power companies. I'm finishing up a $1.4 billion policy that has about 20 insurance companies on it. I actually like my job most of the time.EugeneJ posted:When is the best time to purchase long-term care insurance if you have no major health problems? I've heard if you're not already enrolled by your 60s, you can't get coverage I purchased LTC coverage in my mid thirties because the industry was changing the rules and getting rid of the unlimited coverage model. I'm not a health insurance expert by any stretch, but I'd guess mid-40s would make sense. People who are younger need long-term disability coverage more than long-term care. Speaking generally, for Auto, try to a combined single limit (CSL). a $350,000 CSL protects better than a $100k/$350k/$100k split limits.

|

|

|

|

MoraleHazard posted:The kind of insurance I do is very large energy risks like oil & gas wells, pipelines, petrochemical plants, and power companies. I'm finishing up a $1.4 billion policy that has about 20 insurance companies on it. I actually like my job most of the time. I want to know more about this. I did a $15mm cyber liability policy that had three carriers stack limits and that was an ordeal. I can't fathom working with 20. What's the premium on something like that? Please tell me you get paid commissions. I had a friend that scored a trucking account that was $1.6mm in premium but her contract was salary only. quote:I purchased LTC coverage in my mid thirties because the industry was changing the rules and getting rid of the unlimited coverage model. I'm not a health insurance expert by any stretch, but I'd guess mid-40s would make sense. Quoted for truth. Mid to late 40's is the best time for LTC. Premiums spike at age 50. They become ridiculous at age 60. Technically you CAN get LTC up into your 70's but either you likely have some health condition that disqualifies you or your premiums are so high you should probably think about offing yourself if you break a hip. A big shift in the industry is the availability of hybrid policies -- life insurance that has an amended Accelerated Benefit wording allowing you to disburse policy funds as if it was an LTC contract. This may obsolesce LTC as we know it.

|

|

|

|

I know costs could vary greatly, but what's a ballpark of cost per month for a healthy 50YO vs coverage amounts for LTC? I'm years away from that point, and ATM I just have great STD/LTD[&/Term/health/auto/renters] coverage.

|

|

|

|

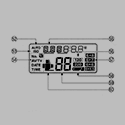

The Jizzer posted:I want to know more about this. I did a $15mm cyber liability policy that had three carriers stack limits and that was an ordeal. I can't fathom working with 20. What's the premium on something like that? Please tell me you get paid commissions. I had a friend that scored a trucking account that was $1.6mm in premium but her contract was salary only. I do a $1.2 billion excess liability tower that has over fifty markets on it. It's a nightmare. The property risks have both layers (stacked limits) and quota share participation where each market takes a percentage of the total limits. Premiums can, depending on limits, deductibles, and total insured values (TIV) can run between $5 and $15 million (what I've worked on). My employer get a fee, usually a healthy one, but a few accounts are on commission. I work on a ~$10M property risk that's full commission, but the large risks have commissions in the 7.5% to 12.5% range. Here's a very scrubbed graphic of one type of property policy. Each colored block represents one insurance company. However, a couple are Lloyds slips so they'll have somewhere between 3 and 10 markets on each slip. So one block may really be 6 markets. Limits and deductibles are standard for this type of risk, but don't correspond to any actual client.  What makes these kinds of placements difficult, I think, is the differential terms. Some markets have sticking points about various coverage extension so one block may have an extension curtailed or not cover natural catastrophe hazards like named windstorm. We do our best to get concurrent terms, but it's not always possible. One fun type of risk I work on is coverage for the anti-piracy security teams that operate in the Indian Ocean. Some London markets pay 30% commission on those risk. If I bring in new business, I get a cut of that new business whether its fee or commission. I don't get anything on renewal income, but I do get a bonus. If anyone really wants me to Moral_Hazard fucked around with this message at 16:49 on Feb 28, 2014 |

|

|

|

MoraleHazard posted:I do a $1.2 billion excess liability tower that has over fifty markets on it. It's a nightmare. The property risks have both layers (stacked limits) and quota share participation where each market takes a percentage of the total limits. Premiums can, depending on limits, deductibles, and total insured values (TIV) can run between $5 and $15 million (what I've worked on). My employer get a fee, usually a healthy one, but a few accounts are on commission. I work on a ~$10M property risk that's full commission, but the large risks have commissions in the 7.5% to 12.5% range. This all sounds like a mega SiGmA_X posted:I know costs could vary greatly, but what's a ballpark of cost per month for a healthy 50YO vs coverage amounts for LTC? I'm years away from that point, and ATM I just have great STD/LTD[&/Term/health/auto/renters] coverage. Well, I did LTC for a couple that were in their mid 50's and they had a pretty solid plan. If I remember right the premium as about $300 a month for both of them. I think that particular policy was with Genworth which generally offers a solid policy to their customers. It was about 4 years ago though and the industry changes a lot, so take that for what it is.

|

|

|

|

Jastiger posted:Well, I did LTC for a couple that were in their mid 50's and they had a pretty solid plan. If I remember right the premium as about $300 a month for both of them. I think that particular policy was with Genworth which generally offers a solid policy to their customers. It was about 4 years ago though and the industry changes a lot, so take that for what it is. It's a bit higher now, but not that far off. I just ran a plan with the following: Married couple, 50 years old, preferred $250/day 3% compound 90 day eilmination 5 year benefit Lifetime pay Came to about $420 / month. Not sure how things look in other states but it's a coverage wasteland in CA. Most carriers have bolted from the market or have stripped down their coverages. There's really only 2-3 viable options right now.

|

|

|

|

I rent a room in a house from the guy that owns it. He also rents rooms to two other people but none of us have a lease or anything, we're just friends of the homeowner and pay him cash every month for rent. There's no separate entrances or kitchens or anything for each renter, it's just a (large) house. I've been thinking of getting renter's insurance because I have a feeling that my poo poo might not be covered under his homeowner's insurance if the house burns down or something. Can I do so even though I don't have a lease?

|

|

|

|

100 HOGS AGREE posted:I rent a room in a house from the guy that owns it. He also rents rooms to two other people but none of us have a lease or anything, we're just friends of the homeowner and pay him cash every month for rent. There's no separate entrances or kitchens or anything for each renter, it's just a (large) house. Your stuff is not. If the place burned down his homeowners policy would cover all of his property and the home. He could claim your stuff as his in order to get paid out, but of course, if the company knew they probably wouldn't allow that. Plus, its doubtful he has limits extra high to account for you and your room mates stuff. You also have no liability protection in the event that there is some kind of injury due to your actions. Snag a policy for your stuff!

|

|

|

|

Yeah I just talked to him about it and he said since they'd cut him a check if that happen it'd basically be up to him if he wanted to compensate me for my losses, so if I was worried about it he'd write me up a lease or something if I needed it to get insurance. So I'm going to look into it and see if it's worth buying, thanks. Edit: Ok, Progressive is like $240-300 a year depending on what deductible I get. My yearly insurance will still be cheaper than I was paying just for my car last year but I need to think about this a bit. Now for the deductible in this policy, that'll apply on any claim right? From like a roof leak or burst pipe that damages, say, my bed, all the way up to the house burning down and taking out everything I own? 100 HOGS AGREE fucked around with this message at 15:58 on Mar 1, 2014 |

|

|

|

Jastiger posted:This all sounds like a mega As big companies are buying higher and higher limits they start buying up all the available world-wide insurance which makes things interesting too. The biggest ones though, the BP's and the Exxon-Mobil's just self-insure (at least large chunks of their risks, if not everything). They have so much money they don't need insurance. 100 HOGS AGREE posted:Yeah I just talked to him about it and he said since they'd cut him a check if that happen it'd basically be up to him if he wanted to compensate me for my losses, so if I was worried about it he'd write me up a lease or something if I needed it to get insurance. Yes, it applies once to each claim. It's likely called "per occurrence" or "per accident" in your policy. Also, you want to ask if your policy is "actual cash value" or "replacement cost". Replacement cost will give you enough money to replace something that's damaged or destroyed. Actual Cash Value (ACV) will just give what an item is worth right now, so if it's old you'll get less money than you need to replace it. ACV valuated policies cost less in premium, but sometimes the difference is very small. You should also see if the policy Progressive is quoting has a personal liability component. It's probably not super necessary unless you have guests in your room regularly and depending on how your landlord's homeowners is worded, that might cover third-party liability (i.e. other people getting hurt or having their stuff broken) in your room and/or landlord's house. Moral_Hazard fucked around with this message at 16:37 on Mar 1, 2014 |

|

|

|

100 HOGS AGREE posted:Yeah I just talked to him about it and he said since they'd cut him a check if that happen it'd basically be up to him if he wanted to compensate me for my losses, so if I was worried about it he'd write me up a lease or something if I needed it to get insurance. Should get a quote from me at my company But seriously, its still a good idea to have it if you can afford it. It gives you a line of insurance history to get lower rates if/when you are on your own and looks good in general. I know my company gives a discount on auto if you have renters insurance, even if its not with us. As Morale said, make sure its Replacement Cost. I do not sell or quote anyone any kind of property policy without it being Replacement Cost. It just doesn't make sense for you to buy ACV policies at any point in time. To answer the deductible question its a generic yes. its often per claim, so if all that stuff happens at once, you'd pay one deductible. A good way to think about it is one deductible per claim, unless different claims are from the same event in which it'd likely still be one deductible. Like for example a pipe burst and you got a new bed because it ruined it, then you find out a day or two later that it ruined your stereo too. Likely one deductible because its from one event. As far as liability, any decent renters policy is going to have it and medical payments in it at a minimum of $100K liability and $1k med. Its inexpensive and ought to be in the same price range as to what you're seeing with a policy without it. I've literally seen a policy go from $304 to $306 with the only difference being $100K liability and $300K liability. Get liability.

|

|

|

|

I parallel park on public streets, this morning I came to my car and saw another car had backed into mine, the other car was still touching mine. I took photos, then moved my car, and took photos of the damage to my car's bumper (scuffs, scratches, paint transfer). Police will not issue a report unless the damage was significant or there was bodily harm, so I didn't bother calling them. No witnesses, I don't know who the other driver was, I just have the vehicle's plate. Should I bother filing a claim with my insurer or the other person's insurer? What typically happens when fault is hard to determine in a situation like this (no witnesses, static photos)? My deductible is $500 and I have a pristine driving record. I'm willing to let the issue go if there is a good chance 50-50 fault is determined and my premium go up as a result. State is MA and my insurer is Geico.

|

|

|

|

Melting Eggs posted:I parallel park on public streets, this morning I came to my car and saw another car had backed into mine, the other car was still touching mine. I took photos, then moved my car, and took photos of the damage to my car's bumper (scuffs, scratches, paint transfer). Well remember the rule, your rates may always increase with a claim. However, its pretty clear that it was his fault and if you were serious about making a claim, you should have called the police to file a proper report. That way 100% fault can be established against the other driver. I know with my company if you had a not-at-fault claim, we wouldn't ding you for it. If you want your car fixed, file a claim, and give Geico all of the information you have. I'm pretty sure they'll go after the other guy, but it'll be a bit tougher since you don't have a police report. Good job on the photos though, and if they tell a good story, you should be able to have the other guys insurance pay for it. If you're ever in doubt, get a third party to confirm your story to make claims go easier.

|

|

|

|

I'm trying to decide if I want to enroll in the HDHP at work or not. I did the math and basically if my total medical bill charged (not including dental/vision as those are separate plans) is expected to be under $1000 give or take then the HDHP is cheaper in terms of premiums and out of pocket costs. I'm 25, in good shape I think, and am physically active in my spare time 7 days a week though I work at a desk job. I run, bike, and lift weights, so I guess my primary concerns are going to be hurting my feet/legs from running or getting hit by a car while biking (in which case their insurance SHOULD cover me right?). Is it reasonable to assume on average that someone in my category is going to be billed more than/less than $1000 per year in medical costs? I have no prior data to compare to because my adult life up to now has been covered by socialist healthcare. I haven't factored in the HSA and employer contribution to it yet because I'm still waiting for HR to get back to me.

|

|

|

|

Boris Galerkin posted:getting hit by a car while biking (in which case their insurance SHOULD cover me right?). If it's their fault, and they have insurance (agents correct me if I am wrong here, but I believe certain types of coverage on his policy may cover him in the case of no insurance (UM/UIM) or when he is at fault/no-fault (MED/PIP)). I know some state (VA I think) doesn't have a law about "Dooring" a bicyclist so the officer can't assign fault and there can be insurance issues. On the HDHP in general, unless you use a lot of medical services, it's generally a good idea (if you have an emergency fund) because you have access to an HSA, which a great way to save tax free for medical expenses (including dental, vision, prescriptions and other stuff not normally covered by insurance). Some states still tax HSA contributions, though, so keep that in mind when doing the calculations.

|

|

|

|

Boris Galerkin posted:I'm trying to decide if I want to enroll in the HDHP at work or not. I did the math and basically if my total medical bill charged (not including dental/vision as those are separate plans) is expected to be under $1000 give or take then the HDHP is cheaper in terms of premiums and out of pocket costs. I'm 25, in good shape I think, and am physically active in my spare time 7 days a week though I work at a desk job. I run, bike, and lift weights, so I guess my primary concerns are going to be hurting my feet/legs from running or getting hit by a car while biking (in which case their insurance SHOULD cover me right?). Is it reasonable to assume on average that someone in my category is going to be billed more than/less than $1000 per year in medical costs? If you are single, you'll probably pay less than $1000 a year in premiums. A healthy 25 year old in a HDHP will probably pay something like $30-$80 a month which at the high end, puts you at the cusp of your limit. Of course, if there is a catastrophic incident then yeah, you're going to want to have the coverage. Factor in the amount your company will chip in, it becomes better to have the insurance, right? last laugh posted:If it's their fault, and they have insurance (agents correct me if I am wrong here, but I believe certain types of coverage on his policy may cover him in the case of no insurance (UM/UIM) or when he is at fault/no-fault (MED/PIP)). I know some state (VA I think) doesn't have a law about "Dooring" a bicyclist so the officer can't assign fault and there can be insurance issues. Boris is right to cite tax issues. Be sure to factor those in too! As far as someone else hitting you, your auto insurance may help pay some of your costs if you're hit by another driver, regardless of fault. That'd be that Medical Payments/PIP coverage. Theirs should be primary though if they have it. If they have NO insurance or not enough, then your UIM/UM coverage should be kicking in.

|

|

|

|

|

| # ? May 11, 2024 12:30 |

|

I don't think you understand. I ran the numbers for the health plans offered to me, and already factoring in premiums, if I'm billed less than $1000/year then the HDHP is cheaper for me. I.e., I goto a doctor right now and walk out with a bill for $2000 for whatever reason. The HDHP is already costing me more than a regular plan with a lower deductible. Again that's the amount billed, not the amount I'll pay (if I had a $300 deductible plan for example I know I'll pay much less annually, even with the higher premiums). I'll have to go home and run the numbers through my other spreadsheet to see how the HSA and free HSA contributions factor into. Another thing I just realized, if I had the HDHP then all my bills are pre-tax dollars right? I.e., that $300 deductible health plan would cost me $300 of post-tax money whereas that $3000 deductible HDHP costs me $3000 pre-tax money.

|

|

|