|

Wouldn't a lower expected CAD$, result in a higher yield on Canadian 10-year bonds? * bonds

|

|

|

|

|

| # ? Jun 4, 2024 20:36 |

|

Best explanation I've found all morning. http://www.economist.com/blogs/buttonwood/2010/07/bond_markets_keynesianism_and_debt quote:ONE hesitates to step into an argument in which Nobel-prize winning economists are involved but I have been dragged in anyway. Last week's editorial on austerity provoked a response from Paul Krugman; this in turn cited the blog of Brad De Long which quoted this humble hack in evidence against our leader line. (Hi, Brad, and thanks for reading.) namaste friends fucked around with this message at 17:28 on Aug 5, 2014 |

|

|

|

ocrumsprug posted:Wouldn't a lower expected CAD$, result in a higher yield on Canadian 10-year bonds? That's what I was thinking, too. Bonds, man. They're hard.

|

|

|

|

ocrumsprug posted:Wouldn't a lower expected CAD$, result in a higher yield on Canadian 10-year bonds? staaaaaaaaaaagflaaaaaaaaaaaaaaaaaaaaaaaation

|

|

|

|

Rick Rickshaw posted:I can't believe I didn't think of posting about it back when we were talking about people living in containers in Saskatchewan. It never surprises me any more when the world becomes more and more like Snowcrash.

|

|

|

|

Another good explanation about interest rates + bond yields. http://www.investopedia.com/articles/forex/05/041305.asp

|

|

|

|

Lexicon posted:^ Bonds and the bond market mystify me. Anyone care to explain why Canadian bonds would have a lower yield than American ones? Some sort of elaborate forex arbitrage reason I'm guessing? It's because the CDN government is seen as less risky than the US by bond investors. No crazy stuff. Certain large holders of US bonds / currency have also been moving to other securities / currencies like Canada or gold, etc. in the short term this can have a strengthening effect on C$ but rates are generally seen to drive forex over the medium to long term rather than the other way around (low rates => weak FX)

|

|

|

|

Kalenn Istarion posted:It's because the CDN government is seen as less risky than the US by bond investors. No crazy stuff. Certain large holders of US bonds / currency have also been moving to other securities / currencies like Canada or gold, etc. in the short term this can have a strengthening effect on C$ but rates are generally seen to drive forex over the medium to long term rather than the other way around (low rates => weak FX) We just saw the GDP numbers for the US come out indicating the recovery is well under way. Why do investors see the US as more risky than Canada?

|

|

|

|

Rick Rickshaw posted:I can't believe I didn't think of posting about it back when we were talking about people living in containers in Saskatchewan. I think I kind of blocked the whole charade from my mind. I'm going to take a bike down there at lunch to see if they've even started. Would you be willing to say that they're appropriating the counter-culture of living in storage containers?

|

|

|

|

Cultural Imperial posted:http://business.financialpost.com/2014/07/30/albertans-piling-on-debt-faster-than-rest-of-country-as-housing-market-heats-up/ Anecdote time: I went on vacation in Banff in 2012 and one of my friends was working in Calgary and came up for a few days to meet us for some skiing. He was from Ireland and had never owned a pair of skiis in his life. Hed' scooped up a pair of super high-end Salomon's with boots and a Burton board for $200 from a coworker. I hardly ever buy anything new but I asked him how he'd gotten such a great deal. He said it was pretty typical; Albertans buy near gear almost every season and practically give away the last season's, lest someone see them on the hill without the best and newest equipment. Professor Shark posted:Would you be willing to say that they're appropriating the counter-culture of living in storage containers? maybe tiny houses will become more popular in Canada?

|

|

|

|

Kalenn Istarion posted:It's because the CDN government is seen as less risky than the US by bond investors. No crazy stuff. Certain large holders of US bonds / currency have also been moving to other securities / currencies like Canada or gold, etc. in the short term this can have a strengthening effect on C$ but rates are generally seen to drive forex over the medium to long term rather than the other way around (low rates => weak FX) That makes objectively no sense to me, but whatever.

|

|

|

|

Cultural Imperial posted:We just saw the GDP numbers for the US come out indicating the recovery is well under way. Why do investors see the US as more risky than Canada? More to do with government funding policy than anything although my day to day access to bond market intel is not as good as it used to be so might be a bit stale. The US government has had several debt cap crises the last couple years. It would be suicide for this to happen but if the deadlock ever lasted long enough it could cause a missed or delayed payment which would be a default. Canada's government doesn't have the same issues on top of (rightly or not, I'm not starting that debate again) being viewed as more conservative. It's also reflected in sovereign credit ratings. The US now has one (maybe two?) AA ratings while Canada remains AAA.

|

|

|

|

Wasting posted:Yep, no dangerous asset bubble here. Just plain old jealousy and dumb renters. Just wait until valuations are 100% higher in five years - - that'll shut up all those envious renters at the IMF. I completely agree with you. Too bad half this thread isn't discussing that issue, and is just bitching about how terrible people who live in the city are, and how unethical it is to own a home. You see for the glory of the people's revolution it is normal to expect every leftist to take a vow of poverty. See you all on the DTES.

|

|

|

|

Cultural Imperial posted:We just saw the GDP numbers for the US come out indicating the recovery is well under way. Why do investors see the US as more risky than Canada? Because they keep playing ridiculous political games with their debt? I'm sure waiting to the last second, pretending to default, and government shutdowns to make Obama look bad doesn't exactly inspire confidence. That nonsense doesn't happen in Canada; if a party is in power they are in power full stop.

|

|

|

|

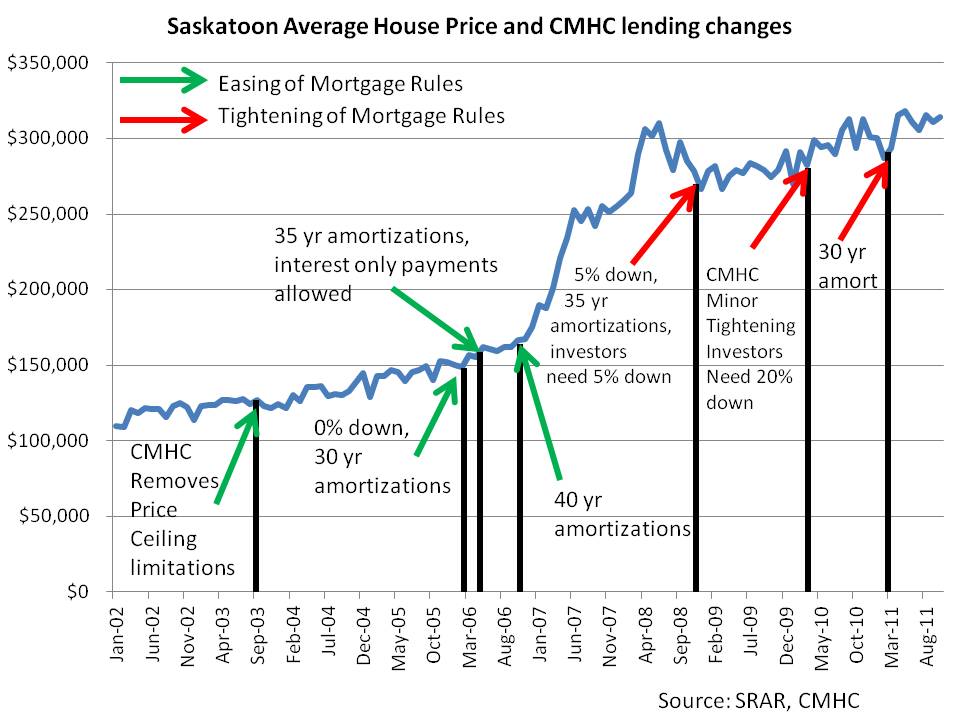

Franks Happy Place posted:From this awesome blog: So, here's another historical chart (lots of funny arrows, but it's the best chart I found with both long term historical data and up to date figures past 2010):  What's sort of troubling there is that you see the price flattening out only in 2007-2008 and then picking right back up at around 2009 - i.e. after both CMHC restrictions tight up again and the 2008 recession. Which makes no sense - it's the opposite of what you'd expect. What slowed down Vancouver around 2007? Moreover, why aren't the CMHC post-2008 restrictions making a dent in the rate of price increases? I could understand if most of the growth happened before before them and just stayed there, but that just isn't the case - growth continues at the exact same rate. Further, if you look at the long term trend in national house pricing:  There are some bubbles there yes, but we are are basically back on the trend-line now. Whatever happened, already happened before 2010. That trend line does not at all seem out of whack with population growth:  Or disposable personal income:  Or any other of the obvious indicators of a real long term rise in the demand for housing. As for the blips divgering from the trendline, here's something that does seem to coincide with them (sort of):  So basically what I am seeing here is that whatever is happening now is not at all "weird" in the context of Canada's housing price history from 1980 onward. There have been some very clear-cut bubbles but it is very obvious to see where they started and where they ended, and currently they have ended. I mean I do wonder why housing prices never actually seem to go down for any great length of time - you'd think supply should always eventually catch up with demand, and although housing starts tend to be all over the place, they should, over the long term, catch up, no? Is it maybe a reflection of the fact that although sure, land isn't limited, the marginal cost of a housing unit over ever-increasing density does keep going up? Other countries certainly seem to experience a much higher range of fluctuations (though notably the UK does not, and arguably we have much in common with them in terms of urbanization and immigration). Either way, my faith is shaken Canada Housing Thread. Vancouver is still expensive relative to the rest of Canada yes, but it's still moving in the same general direction as it. If some all-consuming economic cataclysm is imminent, it would have to do with the trend starting in the early 90s and before, because nothing really stands out for just the past decade or so. Mrs. Wynand fucked around with this message at 20:55 on Aug 5, 2014 |

|

|

|

Anecdotes from Black Creek: My aunt and uncle bought a nice five acres here with a natural spring, for about $120k about twelve years ago. It's now valued at well over $500k A few years beforehand, they were looking at 20 acres just up the street. At the time, it was on the market at $45k with full harvestable timber. Flash forward to 2014 and the owners have profited $100,000 by selling the timber, and the lot is now valued at just over $3 Million.

|

|

|

|

Rutibex posted:Because they keep playing ridiculous political games with their debt? I'm sure waiting to the last second, pretending to default, and government shutdowns to make Obama look bad doesn't exactly inspire confidence. That nonsense doesn't happen in Canada; if a party is in power they are in power full stop. Can you cite any sources? I'm not saying you're wrong. I think your view is interesting but I think you place too much faith in a rational market.

|

|

|

|

Cultural Imperial posted:Can you cite any sources? I'm not saying you're wrong. I think your view is interesting but I think you place too much faith in a rational market. No sources or anything, just seems like it would work that way. You're likely right though the markets are quite myopic. Traders don't think about something like a political deadlock making the US government default. You can't quantify politics and feed it into a risk model so it's just ignored.

|

|

|

|

Vancouver market is HOT HOT HOT http://www.biv.com/article/20140805/BIV0111/140809980/metro-vancouver-home-prices-rise-44-in-july quote:Metro Vancouver home prices rose 4.4% to $628,600 in July compared with the same month a year ago, according to Real Estate Board of Greater Vancouver (REBGV) statistics released August 5.

|

|

|

|

Okay, is it at all possible that Toronto and Vancouver will crash but leave the wider FIRE sector alone?

|

|

|

|

Kafka Esq. posted:Okay, is it at all possible that Toronto and Vancouver will crash but leave the wider FIRE sector alone? Absolutely. If the footprint of the FIRE industry in Vancouver and Toronto are localized. The TORONTO dominion bank and the ROYAL BANK OF CANADA IN VANCOUVER are totally isolated! e: and everyone knows that CDOs, ABCP and CDSs are well documented and understood by the completely rational actors that buy and sell them!

|

|

|

|

Cultural Imperial posted:Can you cite any sources? I'm not saying you're wrong. I think your view is interesting but I think you place too much faith in a rational market. No, this is exactly what I was referring to - the debt ceiling thing has happened several times now in the last couple months. Congress and the white house basically play chicken with each other to try to achieve political objectives until they get to the edge of default and then pass a cap raise just in time. The most recent iteration saw US government services mostly shut down for a month or so. Rutibex posted:No sources or anything, just seems like it would work that way. You're likely right though the markets are quite myopic. Traders don't think about something like a political deadlock making the US government default. You can't quantify politics and feed it into a risk model so it's just ignored. Actually that's not true at all; as I noted it's a big part of why the US government lost its AAA rating and is trading at a discount to Canada. Traders are very aware of and take account of large binary risks. I know the debt desk at the place I used to work spent a great deal of time figuring out what default scenarios might look like and how they would impact price.

|

|

|

|

Kafka Esq. posted:Okay, is it at all possible that Toronto and Vancouver will crash but leave the wider FIRE sector alone? Metro Vancouver is more than half the population of the province of BC, so I am sure it will be fine. Fake edit: Presumably, the rapid growth in the FIRE sector was likely in the metro areas. However good luck to you getting bank financing to build your townhouse development in Pemberton, after Vancouver goes down. VVV Real edit Cultural Imperial posted:To quote @ac_eco, There is some evidence to that effect. ocrumsprug fucked around with this message at 23:42 on Aug 5, 2014 |

|

|

|

http://www.bloomberg.com/news/2014-08-05/consumer-outlook-about-canadian-economy-falls-again.htmlquote:

To quote @ac_eco, quote:Canadians bearish about the economy but bullish on housing. How does that make any sense? https://twitter.com/ac_eco/status/496781176166973441 This just in, Canadians are dumb as gently caress.

|

|

|

|

Here I am thinking that lovely jobs are a Vancouver calamity. http://www.macleans.ca/economy/economicanalysis/canada-is-the-best-job-creator-in-the-g7-not-so-fast/ quote:For the first time since 1997, today saw the release of the sixth consecutive U.S. jobs market report with a net monthly employment gain of over 200,000 persons. But are they doing better than Canada, and if so, by how much?  quote:The U.S. employment market was dreadful in 2010, but has improved steadily since then. The scale required to show the 2010 numbers makes it difficult to see the relative differences in the last few years, so here is the same data starting at January 2011:  quote:By this metric, U.S. employment growth outpaced Canadian growth in 2012 and 2014. The two countries were relatively even in 2013 outside of two bad months (February and October) for the United States.  quote:The United States has outperformed Canada by this metric in 23 of the 30 months from January 2012 to June 2014 (the Canadian July 2014 data has yet to be released), with the U.S. averaging 1.34 per cent growth relative to Canada’s 0.97 per cent. Full-time employment has grown by 2.3 million in the last year—64 times Canada’s paltry 35,600 net gain. Given Canada’s performance gap over the past two-and-a-half years, it is getting more and more difficult to claim that Canada “strongest job-creation record in the G7.”

|

|

|

|

If this is the same HPI created and cultivated by the CREA, the same real estate cartel who fight to keep housing data secret from consumers, that's why. Its stated purpose was to smooth the data (obscure evidence of a bubble). Nm I see this is "House" not "Home." Would be curious to see what your data is tracking, but I am phone posting. Conjecture, but increases in price could be offset by increases in starts of smaller houses (i. e., condos) at what are still too high prices. Wasting fucked around with this message at 00:47 on Aug 6, 2014 |

|

|

|

Kalenn Istarion posted:

|

|

|

|

Mr. Wynand posted:That trend line does not at all seem out of whack with population growth: Why should housing prices track population growth? That doesn't make any sense. It should track surplus or shortages in the housing supply, not the number of people in the country. Also is this housing price index inflation indexed or what? Mr. Wynand posted:Or disposable personal income: Again - is this real or nominal income? It looks like a total, not a median or average. And why should the price of housing track incomes either? If there's no discernible increase in the quality of the housing then doesn't that say exactly that we're spending ever larger proportions of our income on housing because reasons?

|

|

|

|

eXXon posted:And why should the price of housing track incomes either? It would make some sense if housing prices tracked incomes because that would imply that housing prices are tracking inflation, which makes sense (thanks to Robert Shiller, is an unequivocal fact).

|

|

|

|

tagesschau posted:Actually that's not true at all; as I noted it's a big part of why the US government lost its AAA rating and is trading at a discount to Canada. Traders are very aware of and take account of large binary risks. I know the debt desk at the place I used to work spent a great deal of time figuring out what default scenarios might look like and how they would impact price. [/quote] Not sure that I agree it was more than partially political but it's true that the market only considers ratings as one of many factors when pricing debt. In addition, the US ratings change had been telegraphed for months and so was priced in well before it was made fact.

|

|

|

|

That personal income graph graph is hilariously deceptive and dishonest.

|

|

|

|

Maybe the population figures are inflation-adjusted and nothing else is.

|

|

|

|

http://www.chpc.biz/vancouver-housing.html

|

|

|

|

Mr. Wynand posted:

Well that's just the thing, you picked a very convenient time to start looking at trends considering up till 1980 houses hardly moved at all over the previous century (assuming Canadian housing followed a similar trend as the states, which is reasonable to think). Housing has only "always increased" if you are considering the late 80s till now, it's not some historical rule. This is easy to see in the case shiller index that is often referenced. Of course the late 80s is when easy credit became a normal thing, which is really the primary drive of bubbles. You have to ask, if wages aren't increasing, how is an increase in a basic necessity supported? The money has to come from somewhere, and it has been the increase of consumer credit (debt).

|

|

|

|

http://www.advisoranalyst.com/glablog/2014/07/31/canadian-real-estate-a-crack-in-the-tree.htmlquote:“It’s like if the tree in the e: This is a really good article to give to friends and family who lust after the pride of ownership. A better formatted pdf is in the above link. namaste friends fucked around with this message at 04:22 on Aug 6, 2014 |

|

|

|

http://business.financialpost.com/2014/07/30/canadas-most-expensive-housing-market-not-headed-for-crash-says-credit-agency-dbrs/quote:A leading credit rating agency says Canada’s most expensive housing market may not be all that affordable for the average family, but despite that no major correction is coming Vancouver’s way. Time to man up and buy motherfuckers e: to say that there isn't a problem with the housing market in Montreal is just staggering

|

|

|

|

Financial Post posted:“Based on historical data, the Vancouver market does not appear to be significantly overheated,” said DBRS, in the report. “Therefore, a correction of any magnitude may not be justified given the strong fundamentals in the market.” I would love to see that historical data, but I wouldn't be so rude as to ask them to make it up just on my account. That Montreal line pretty much tells you what you need to know about their analysis.

|

|

|

|

Hypothetically, what happens if this bubble never pops? Or if it flattens out and stays steady, never crashes?

|

|

|

|

Brannock posted:Hypothetically, what happens if this bubble never pops? Or if it flattens out and stays steady, never crashes? A bubble can't steady itself; when speculators start seeing a slow down in the growth rate, they'll start selling. As they start selling, growth slows down and level off, more bullish speculators start selling, and the sudden supply causes a drop in prices. Then it cascades.

|

|

|

|

|

| # ? Jun 4, 2024 20:36 |

|

Brannock posted:Hypothetically, what happens if this bubble never pops? Or if it flattens out and stays steady, never crashes? Then anybody with half a brain happily rents forever, German-style.

|

|

|