|

EasternBronze posted:The implication was that people who live overseas are exempt from taxes, that wasn't an accurate statement. A statement no one made. quote:Even the Foreign Earned Income Exclusion doesn't always apply, even if 100% of your income was earned overseas. To a vanishingly small subset of people subject to rare rules such as to make it a point of distraction away from the discussion. Deflection. quote:Of course, you'd have to actually understand the topic to know that. Have you ever actually filed a tax return, overseas or otherwise? Whether I answer in the affirmative or negative does not change the fact that this is a logical fallacy.

|

|

|

|

|

| # ? Jun 3, 2024 22:14 |

EasternBronze posted:Noone is sinking the discussion, its an issue that is relevant to a sizable portion of the posters here Nope, just two morons who don't understand that whether or not expats receive the mincome is a nonissue. The fact that you're sitting here pretending like me and archangel have never done taxes before (I own my own business) is comical. Just give up on your little crusade and shut the hell up, you're just making yourself sound more stupid at this point.

|

|

|

|

|

down with slavery posted:We can tax wealth. We call it a "property tax". hth This is correct, and according to well known socialist magazine business insider: business insider posted:Last week's annual CapGemini/RBC survey of investors worldwide showed the number of households with more than $1 million in investable wealth rose almost 15 percent to 13.7 million in the year through 2013. Their total wealth rose almost 14 percent to $53 trillion, it estimated. My previously posted figure of 117 trillion was incorrect and based on a different article I read a few weeks ago, so my bad on that. However, as you can see the wealthy have plenty of wealth to redistribute yet still remain insanely rich.

|

|

|

|

Nobody cares about property tax because wealthy people don't keep a large portion of their wealth in property, and it's typically a small tax.

|

|

|

on the left posted:Nobody cares about property tax because wealthy people don't keep a large portion of their wealth in property, and it's typically a small tax. Property doesn't mean what you think it does Just because property tax has been horrifically underutilized (generally we really only tax land/buildings) is just another mistake in our tax system. You should pay property tax on your bank accounts, assets, etc.

|

|

|

|

|

EasternBronze posted:Its not, the reason why these tax deductions exist is to prevent people not making extremely high incomes from facing an onerous tax burden overseas just because of their residency outside the United States. You can go make 15K a year in some other country and that might be totally livable, but not if you don't get those deductions for living outside the U.S. Dude, the fact that you keep talking about poverty and 15k/year in reference to a $95k deduction is just loving weird.

|

|

|

|

archangelwar posted:A statement no one made. Yeah they did. My Imaginary GF posted:gently caress expat tax dodgers. Pay your loving taxes or burn your passport and renounce your citizenship. Don't be a gently caress'n hypocritical rear end in a top hat. Expats don't count for minimim guaranteed income because the policy is designed to boost domestic consumption, not your ability to purchase melamine-laced milk and ground tiger dick. It seems the implication is pretty clear here, people who live overseas should just pay taxes for living in two countries and like it, because FYGM. Why you than decided to jump in and claim that citizens living overseas don't have taxable income is beyond me. quote:To a vanishingly small subset of people subject to rare rules such as to make it a point of distraction away from the discussion. Deflection. Have I anywhere actually argued against the GMI or are you just tilting at right-wing windmills again? You do realize that you can talk about multiple aspects of the GMI at once right? quote:Whether I answer in the affirmative or negative does not change the fact that this is a logical fallacy. It might reveal the reason why you think people who live overseas are somehow exempt from federal taxes. down with slavery posted:Nope, just two morons who don't understand that whether or not expats receive the mincome is a nonissue. Well its an issue to me and someone else, thats why it got brought up. If its so unimportant than why even address it? Is it so upsetting to you that not everyone is a monolingual who could easily be bankrupted by a preventable illness that you absolutely must post about it?

|

|

|

EasternBronze posted:Well its an issue to me and someone else, thats why it got brought up. If its so unimportant than why even address it? It's been addressed. Quite a few times. Feel free to go back to page 4 and stop posting about it. quote:Is it so upsetting to you that not everyone is a monolingual who could easily be bankrupted by a preventable illness that you absolutely must post about it? How adorable, more lovely concern trolling.

|

|

|

|

|

Have I mentioned in this post how many languages I speak? I don't want to leave my bilingualism out of a single post.

|

|

|

|

down with slavery posted:Property doesn't mean what you think it does What is the property tax rate that the ultra-rich would have to pay on their investments?

|

|

|

|

down with slavery posted:No, I'm sorry, expats like yourself who are trying to avoid paying their fair share back to society won't be receiving the mincome. Your snide insinuation that overseas citizens don't "pay their fair share" is not only wrong but irrelevant to the issue at hand. Why should a working class person who lives overseas pay for infrastructure and programs they have no possibility of using and also be expected to pay taxes in their own resident country? How are you supposed to live paying full taxes in two developed countries? It makes no sense. I would happily live in the U.S. for the 31 days required to not attain foreign residency in exchange for 15K. What are you going to do about it? Is this too specific for the thread, are we only supposed to be saying how good the GMI is? EasternBronze fucked around with this message at 04:55 on Nov 4, 2014 |

|

|

EasternBronze posted:Your snide insinuation that overseas citizens don't "pay their fair share" is not only wrong but irrelevant to the issue at hand. Why should a working class person who lives overseas pay for infrastructure and programs they have no possibility of using and also be expected to pay taxes in their own resident country? How are you supposed to live paying full taxes in two developed countries? It makes no sense. So again, this is about double taxation on expats, not about mincome, and again, not an issue due to the US tax policy regarding expats. Nobody making working class wages is being crushed by double taxation, it's specifically set up to target those who make over a certain amount of money, which has already been explained to you but you seem unwilling to accept it. quote:I would happily live in the U.S. for the 31 days required to not attain foreign residency in exchange for 15K. What are you going to do about it? Nothing, feel free. Oh, by the way, mincome requires you to be a resident for at least 6 months of the year. Sorry about that slugger. Believe it or not, we can legislate around your grade 2 "what if I do <x>" games. Can you at least try to create a realistic hypothetical where what you're arguing for makes any sense. down with slavery fucked around with this message at 04:57 on Nov 4, 2014 |

|

|

|

|

down with slavery posted:Property doesn't mean what you think it does Voters will love to hear that their bank accounts will be taxed, and that government inspectors will come to their house to suss out hidden wealth. Be prepared to answer questions about the artwork on your wall citizen!

|

|

|

on the left posted:Voters will love to hear that their bank accounts will be taxed, and that government inspectors will come to their house to suss out hidden wealth. Be prepared to answer questions about the artwork on your wall citizen! Voters will be fine with it. The ultrawealthy are a very small portion of the population. The only bank accounts (and other assets) we need to tax are the ones that belong to the 1%. Such is the beauty of how bad our wealth inequality has become. edit. And yes, all the shenanigans that go on with taxes and expensive artwork should be seriously looked at. down with slavery fucked around with this message at 04:58 on Nov 4, 2014 |

|

|

|

|

down with slavery posted:Voters will be fine with it. The ultrawealthy are a very small portion of the population. The only bank accounts (and other assets) we need to tax are the ones that belong to the 1%. How will you know if someone is in the 1%? And will it sort of be just a continual purge of whoever is in the top 1%, as opposed to a hard cutoff point?

|

|

|

|

Nintendo Kid posted:Ok so you admit that your idea to make peppers cheaper by wasting a bunch of money on government farms for them is stupid? Great! Again, another what the gently caress are you talking about moment here, unless you spend your time high-fiving yourself for correcting peoples' opinions and then calling them assholes for thinking things, but in light of the information you've provided it would seem that the simple solution to the unaffordable vegetable problem and the knock on effect of obesity being a symptom of poverty (a problem I feel is paramount in discussing, because we're all going to end up as fat poors if the robots take over and we haven't sorted this out yet) is to make sure we fully automate farming first right? If dwindling numbers of farmers are causing the farmers' voice to get louder than those suffering from their wants, replacing them with emotionless machines should usher in a new era of dietary health increases for so many who cannot justify $50 on fresh produce. i am harry fucked around with this message at 05:09 on Nov 4, 2014 |

|

|

on the left posted:How will you know if someone is in the 1%? And will it sort of be just a continual purge of whoever is in the top 1%, as opposed to a hard cutoff point? Hard cutoff point. We can start at $10 million of personal wealth. All property owned past a reasonable point (hint: less than 8 figures, probably less than 7 but I don't want to get you too excited) should be taxed every year.

|

|

|

|

|

If I used incorrect verbiage in a post that is perfectly understood, then I apologize, but that does not mean you get to invent your own strawman. I have never once said that citizens overseas were exempt from all federal taxes.

|

|

|

|

on the left posted:Voters will love to hear that their bank accounts will be taxed, and that government inspectors will come to their house to suss out hidden wealth. Be prepared to answer questions about the artwork on your wall citizen! The Austin Independent School District gestapo is oppressing me. My property taxes are an excuse for them to send

|

|

|

|

down with slavery posted:Voters will be fine with it. The ultrawealthy are a very small portion of the population. The only bank accounts (and other assets) we need to tax are the ones that belong to the 1%. Such is the beauty of how bad our wealth inequality has become. To be more precise, we already intercept all data that goes to and from their banks. We know when they send money because all that poo poo is done digitally these days, and America created digital data management and collects everything binary transmitted between nations (and also potentially trinary, that's not my department to know) and especially any data going in and coming from known tax havens. So you're getting the global superrich moving from currency into assets as a way to dodge taxes. For the vast majority of individuals, this won't have an impact. For the sub-superrich expat, you're going to pay your goddam taxes, you're going to pay them when we want, and you should really quit loving around when it comes tax time. So yeah, MGI won't impact the superrich. If anything, it'd be the ultimate test of trickle-up economics.

|

|

|

|

down with slavery posted:So again, this is about double taxation on expats, not about mincome, and again, not an issue due to the US tax policy regarding expats. Nobody making working class wages is being crushed by double taxation, it's specifically set up to target those who make over a certain amount of money, which has already been explained to you but you seem unwilling to accept it. Specifically because of the tax credit they receive. That's why its there and your implication that its "unfair" is wrong-headed. quote:Nothing, feel free. Oh, by the way, mincome requires you to be a resident for at least 6 months of the year. Sorry about that slugger. Believe it or not, we can legislate around your grade 2 "what if I do <x>" games. Can you at least try to create a realistic hypothetical where what you're arguing for makes any sense. Actually plenty of people hold residency in states that they don't actually live in. How is this requirement going to actually be enforced? My choice to choose an overseas residency is purely at my discretion and for my own benefit, I could easily just claim residency back at my parent's house and than be subjected to regular income tax just the same as if I stayed in the states. Can't you see how its a little unjust to exclude working people from federal benefits that they are on the hook for tax-wise? Edit: You know what I think America needs? More sweeping electronic surveillance! EasternBronze fucked around with this message at 05:11 on Nov 4, 2014 |

|

|

|

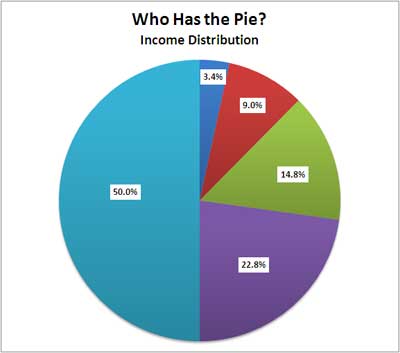

down with slavery posted:We can tax wealth. We call it a "property tax". hth And then it runs out. Not a solution for an ongoing policy. So posting the wealth chart over and over because it looks better is almost entirely useless  http://www.economicpopulist.org/content/rich-and-rest-us-united-states In terms of income, as discussed earlier, GMI would require increasing taxes to more like 40-50% of GDP. 50% of GDP is 100% of the income of the top 20%. The top 20% begins at about $115k a year. This is the chart we should be working with.

|

|

|

asdf32 posted:And then it runs out. When? I don't think you grasp just how large the wealth held by the 1% is. When the bottom 20% has 10% of the wealth we can talk about how we can't afford to keep actively redistributing wealth (on top of restoring income tax rates, which should be done as well). asdf32 posted:This is the chart we should be working with. Why? Why can't we touch the wealth inequality? Scared your inheritance might get hit? down with slavery fucked around with this message at 05:12 on Nov 4, 2014 |

|

|

|

|

EasternBronze posted:Can't you see how its a little unjust to exclude working people from federal benefits that they are on the hook for tax-wise? That's the entire point of having centralized banking. gently caress your sense of justice; pay me. Justice is subjective; taxes are not. "Taxes are unjust" - Everyone, from loving forever. gently caress yes they will be unfair to you. They're also necessary if you want to have organized nation-states and avoid even higher taxes from entrenched nobility who give even less a poo poo about your survival. down with slavery posted:When? I don't think you grasp just how large the wealth held by the 1% is. Capital has higher rate of return than wages. Ergo, provision of minimum capital to all individuals as a supplement to any independent wages they earn will allow individuals to accrue capital with the rate of capital's return on investment. What about this economic concept is so loving hard for individuals to understand? What I'm asking for is a quantification of these facts so I can better sell the issue. My Imaginary GF fucked around with this message at 05:14 on Nov 4, 2014 |

|

|

|

EasternBronze posted:Can't you see how its a little unjust to exclude working people from federal benefits that they are on the hook for tax-wise? Do you believe you are now entitled to section 8 housing and food stamps regardless of income or location? Like, this is not how benefits work in the current world. You are entitled to what the law entitles you to.

|

|

|

|

down with slavery posted:Property doesn't mean what you think it does Uh, If we paid property tax on those things it would accumulate very little money, due to the rates it works at. It would also interestingly enough result in a strange imbalance in taxes by having a lot more of them paid to municipalities, counties, and states versus federal level, plus many places have 0 property tax.

|

|

|

Nintendo Kid posted:Uh, If we paid property tax on those things it would accumulate very little money, due to the rates it works at. What do you mean by the rates it works at? All wealth is property. A property tax is a wealth tax. Property taxes need to be utilized in order to rectify wealth inequality. Income taxes will not fix that problem, the sad truth is that even with a 90% marginal tax rate on the top bracket the ultrawealthy are still woefully undertaxed.

|

|

|

|

|

down with slavery posted:When? I don't think you grasp just how large the wealth held by the 1% is. But most of the 100-whatever trillion held by the wealthy is businesses. Liquidating that is going to cause lots of problems very quickly. Redistributing it to the employees would work better but that's a completely different policy

|

|

|

|

down with slavery posted:What do you mean by the rates it works at? All wealth is property. A property tax is a wealth tax. Property taxes need to be utilized in order to rectify wealth inequality. Income taxes will not fix that problem, the sad truth is that even with a 90% marginal tax rate on the top bracket the ultrawealthy are still woefully undertaxed. You're a loving idiot. Property, specifically, refers to land. For most of history, the world operated on Malthusian dynamics where property ownership guaranteed food surplus and allowed individuals to accumulate capital.

|

|

|

My Imaginary GF posted:You're a loving idiot. Property, specifically, refers to land. For most of history, the world operated on Malthusian dynamics where property ownership guaranteed food surplus and allowed individuals to accumulate capital. No it doesn't. http://en.wikipedia.org/wiki/Property http://en.wikipedia.org/wiki/Property_tax Property tax is colloquially known as land only in the US because that's what we're brought up to believe, probably because the rich have a vested interest in creating this idea that property other than land can be taxed. I'm a loving idiot? Really? Quite the tone to take with me.

|

|

|

|

|

down with slavery posted:When? I don't think you grasp just how large the wealth held by the 1% is. You can touch it but funding permanent policy on a fixed sum of money isn't terribly smart? The policy is bounded by income. Plus that wealth isn't just dollars in the bank, it's businesses and properties etc. You can't just tax it all. My father is dead and my mother doesn't have any money. So not really?

|

|

|

asdf32 posted:You can touch it but funding permanent policy on a fixed sum of money isn't terribly smart? The policy is bounded by income. Doesn't need to be permanent. quote:Plus that wealth isn't just dollars in the bank, it's businesses and properties etc. You can't just tax it all. Yes, you can appraise assets and pay taxes on the value. quote:My father is dead and my mother doesn't have any money. So not really? Your family has money and a wealth tax goes explicitly against your interest. Sorry I messed up the details.

|

|

|

|

|

asdf32 posted:And then it runs out. Not a solution for an ongoing policy. Your problem with taxing wealth and redistributing it...is that it will work and then there won't be large collections of wealth to tax or poor people lacking capital to pay? Uh...okay...

|

|

|

|

quote:Do you believe you are now entitled to section 8 housing and food stamps regardless of income or location? Like, this is not how benefits work in the current world. You are entitled to what the law entitles you to. There are logistical reasons why those can't be given out to people living overseas. How are you going to get a SNAP card to work in China? Is the government going to give me a housing voucher to use in downtown Seoul? Of course, a good leftist answer would be that residency shouldn't effect your right to food, shelter, medical care etc so why even bring this up? If it makes you feel any better just refer to us as "undocumented Americans" instead of "expat". Of course, if you want to play the "this is the way it works" card (A bit rich in a thread about a GMI, something that is NOT GOING TO loving HAPPEN IN AMERICA) than its pretty easy to see that GMI being a federal entitlement would, like social security, not end at the American border, any means test notwithstanding. My Imaginary GF posted:That's the entire point of having centralized banking. gently caress your sense of justice; pay me. Justice is subjective; taxes are not. You haven't actually provided a good reason as to why people who live overseas shouldn't receive the GMI beyond your own ignorant stereotype about overseas citizens. Have you ever actually left the country and met one of us out there? You might be surprised alot of us have student loans and work everyday just like other people trying to get by. I mean, when we aren't busy liquidating our vast fortunes into hidden assets and acting out deviant barbarisms.

|

|

|

EasternBronze posted:You haven't actually provided a good reason as to why people who live overseas shouldn't receive the GMI beyond your own ignorant stereotype about overseas citizens. Because the GMI is intended to help out those least fortunate in society. Expats who have chosen to work overseas are not a part of that group, sorry. It's a minor concern and continuing to pretend like "working class expats" (which basically don't exist in the US, if you're contracted to work overseas, you're probably well above the poverty line). Again, if you want to show us some real examples of the people you're worried about, feel free. Until then, can you just stop posting about it?

|

|

|

|

|

down with slavery posted:Because the GMI is intended to help out those least fortunate in society. Expats who have chosen to work overseas are not a part of that group, sorry. It's a minor concern. So it will be means tested at what income level exactly?

|

|

|

EasternBronze posted:So it will be means tested at what income level exactly? We can start at the poverty line.

|

|

|

|

|

down with slavery posted:We can start at the poverty line. That's great because I worked in China for a year in 2012 and I made under the poverty line and my networth was less than zero thanks to student loans. I'll collect my 15K now, thanks alot! Why do you care if working overseas is a choice or not? Go out to rural Wisconsin and tell me that speaking four languages will get you a job.

|

|

|

|

down with slavery posted:Because the GMI is intended to help out those least fortunate in society Wow, that's a good idea, I wonder if anyone else has ever thought of a government program that sends money to people who need it, while excluding people who make over some amount of money. Such a program might be cheaper and more effective than a blanket money handout!

|

|

|

|

|

| # ? Jun 3, 2024 22:14 |

|

down with slavery posted:Because the GMI is intended to help out those least fortunate in society. Expats who have chosen to work overseas are not a part of that group, sorry. It's a minor concern and continuing to pretend like "working class expats" (which basically don't exist in the US, if you're contracted to work overseas, you're probably well above the poverty line). Specifically, a GMI is intended to induce domestic consumption subject to multiplier effects. Expats do not deal with American domestic multiplier effects in their consumption habits, and therefore are not worth consideration. If you want a GMI and have student loans to pay, you're free to work in America. Or not; accumulate your capital in America and do with it what you want, in a system with the highest return on GMI's investment. EasternBronze posted:That's great because I worked in China for a year in 2012 and I made under the poverty line and my networth was less than zero thanks to student loans. I'll collect my 15K now, thanks alot! gently caress you; work in America if you want a GMI. I don't give a poo poo how many whores you buy in China. I give a poo poo that the whores you buy in Nevada pay their taxes. You're free to work overseas. You're also free to disqualify yourself from GMI by doing so. The purpose of GMI is for you to go to rural washington speaking 4 languages and being able to create your own business from doing so. My Imaginary GF fucked around with this message at 05:35 on Nov 4, 2014 |

|

|