|

Well if I am doing something wrong then I very much want to correct it. They explained it to me but it was three years ago, so tomorrow is a good time for a refresher and possibly a better explanation of how it's supposedly legal for us to do this.

|

|

|

|

|

| # ? Jun 5, 2024 07:59 |

|

You're going to get fired.

|

|

|

|

DarthJeebus posted:Well if I am doing something wrong then I very much want to correct it. They explained it to me but it was three years ago, so tomorrow is a good time for a refresher and possibly a better explanation of how it's supposedly legal for us to do this. It is super simple. The IRS expects you to accurately and honestly report all your income. If you make $2 and hour wage + tips, that say over the course of of a year averages out to $12 and hour, and your employer taxes you based on some number he picked, say $7.50 an hour, then you owe the IRS additional taxes on the difference, $4.50 per hour. $12/hr X 40hr/week x 52 weeks would be $24,960. Thats what you should pay taxes on (minus deductions etc) If your employer withholds taxes based on $7.5/hr x 40hr/week x 52 weeks your employer is only withholding taxes on $15,600. The IRS expects you to report and pay taxes on the full $24,960. You need to consult with a tax person and figure out if you owe taxes, how much you owe, and what the best way to correcting this error is before the IRS figures it out and gets mean. You will almost certainly pay some penalty (ignorance is not an excuse) but it is probably worse if they come to you rather you go to them.

|

|

|

|

edit; I'll make reparations

|

|

|

|

DarthJeebus posted:edit; I'll make reparations Get a better job where to don't have to worry about it, instead.

|

|

|

|

Don't worry about the IRS. There are millions of people who make income mostly on tips and don't report the full amount. I don't know how the loan is going to work out for you, but it's not a problem unless they deny you. If they do, I don't know, talk to a lawyer or something.

|

|

|

|

NancyPants posted:Uh yeah you're required to report your income, if someone is not reporting what was actually paid/earned then someone is cheating. Uh the government has no jurisdiction over my body and as a separate entity, what the free citizens choose to give me for my trade in wage labor cannot be demanded by foreign government.

|

|

|

|

xxEightxx posted:Uh the government has no jurisdiction over my body and as a separate entity, what the free citizens choose to give me for my trade in wage labor cannot be demanded by foreign government. False, he didn't let us know he was the PERSON not the entity known as what'shisface within the first 3 posts so that argument is null and void.

|

|

|

BgRdMchne posted:Don't worry about the IRS. There are millions of people who make income mostly on tips and don't report the full amount. Please don't encourage tax fraud in the legal questions thread.

|

|

|

|

|

Car loans and home loans, is that how most IRS audits hit people who don't report their full income? I've always wondered how the IRS picks someone; is it because they eventually gently caress up at some point and someone in their financial circle gets audited, so the net swoops wide? Like the initial poster's loan gets the attention of the IRS, and they do an audit on the business, and everyone working there? I always do cash tips, it just seemed easier.

|

|

|

|

Paying quarterly taxes is a total pain in the rear end and also complicates your 1040 and state return so you'll probably want hire a cpa at least the first time.

|

|

|

|

The two times I've seen a regular individual get audited, its been because a small business they were a part of had opened an account (one PayPal, one bank account) and their social was attached to it (nothing hanky) and there was a large amount of money passing through for business purposes. My CPA client said the IRS is getting aggressive as gently caress, over the last 5 years. THANKS OBAMA

|

|

|

|

blarzgh posted:The two times I've seen a regular individual get audited, its been because a small business they were a part of had opened an account (one PayPal, one bank account) and their social was attached to it (nothing hanky) and there was a large amount of money passing through for business purposes. They've been aggressive about begging for more money from Congress, everything else I've heard is that they're auditing fewer and fewer people. On the other hand, their computers are getting better about picking up unreported 1099s and sending out friendly correction letters, but those aren't terribly aggressive.

|

|

|

|

sullat posted:They've been aggressive about begging for more money from Congress, everything else I've heard is that they're auditing fewer and fewer people. On the other hand, their computers are getting better about picking up unreported 1099s and sending out friendly correction letters, but those aren't terribly aggressive. As someone who may or may not have created joinder with the Entity known as the IRS, we're auditing less people and focusing on preventative strategies. But you are never, ever doing yourself a favor when you lie to the IRS, and yes, failing to report your income is totally, definitely, absolutely lying to the IRS. If you hurt yourself, or when you retire, we're the ones who tell Social Security how much you made, not you. Do you want Social Security paying you a percentage of $15k, or a percentage of $60k? When you decide to buy a house, do you want your mortgage lender to think you're flat loving broke, or do you want them to know what you actually make, so you get approved for an amount and an interest rate you can use? And yes, if we find out, when we find out, there will be penalties and interest going back for years, and you will spend much more money digging out of that hole than you would have spent just being honest the first time. And that argument isn't even addressing the fact that it's your loving civic duty to pay the appropriate amount of taxes, and that servers are not too good to be chipping in for roads and schools just like the rest of us.

|

|

|

euphronius posted:Paying quarterly taxes is a total pain in the rear end and also complicates your 1040 and state return so you'll probably want hire a cpa at least the first time. That's crazy, I pay quarterly here in Canada (you have to if you have more than 3k in taxes to pay on your business in a year) and literally all it is is the CRA sends me a letter telling me how much to pay and on which dates, and then I pay it, and when my tax return comes around I fill it out and subtract the amount I've paid in quarterly from my total owing on the form. Magic, done.

|

|

|

|

|

|

|

|

|

HookShot posted:That's crazy, I pay quarterly here in Canada (you have to if you have more than 3k in taxes to pay on your business in a year) and literally all it is is the CRA sends me a letter telling me how much to pay and on which dates, and then I pay it, and when my tax return comes around I fill it out and subtract the amount I've paid in quarterly from my total owing on the form. Magic, done. As with most things, the U.S. tax code needs and overhaul. There is no reason that there should be an industry that exists for the average person to file their taxes. Our system is riddled with exceptions and deductions because we can't get the parties to sit down and compromise on a reasonable tax code. Mostly because people don't think they should pay any taxes and everyone who gets government services and subsidies should live off charity or bootstraps or just conveniently die or whatever, and of course the other side which whats taxation to be proportional to income, meaning rich people pay more. Then you always get some joker who throws out 'flat tax' and refuses to acknowledge how a flat tax is unfair to lower income people, or makes vague promises to not gently caress over the poor, which nobody believes. It is super fun! Also since most/all politicians are in the pockets of the uber rich, they basically don't fund the IRS for poo poo. Afterall if they don't have the resources and manpower to monitor the taxation of the citizens and businesses in the U.S. then you can cheat easier!

|

|

|

|

Paying quarterly is pretty simple in theory; the problem is that people don't do it and then are scrambling at the end of the year. Divide last year's tax bill by 4, recalculate if your income changes dramatically. Most tax software systems will print out quarterly vouchers (1040-ES) for you, or you can pay on the IRS website. If you've been keeping track of your expenses (an important part of any business) you then report that amount on your 1040 at the end of the year.

|

|

|

|

drat, I look good today.

|

|

|

|

HookShot posted:That's crazy, I pay quarterly here in Canada (you have to if you have more than 3k in taxes to pay on your business in a year) and literally all it is is the CRA sends me a letter telling me how much to pay and on which dates, and then I pay it, and when my tax return comes around I fill it out and subtract the amount I've paid in quarterly from my total owing on the form. Magic, done.

|

|

|

|

and a political party that cynically wants the same to make their tax plans more palatable

|

|

|

|

I live in the UK, a 1st world country and our taxes get deducted from wages before we see it hit our bank account. Only self employed people need to fill out tax forms. Lol America.

|

|

|

|

reformed bad troll posted:I live in the UK, a 1st world country and our taxes get deducted from wages before we see it hit our bank account. Only self employed people need to fill out tax forms. That happens for anyone who isn't self employed in America, too.

|

|

|

|

Sefer posted:That happens for anyone who isn't self employed in America, too. Does being a waiter/waitress and collecting tips count as self employed then?

|

|

|

|

reformed bad troll posted:I live in the UK, a 1st world country and our taxes get deducted from wages before we see it hit our bank account. Only self employed people need to fill out tax forms. So if you had something that should give you a tax break, such a childcare expenses or deductible charitable giving, how would you account for that at the end of the year without filing taxes?

|

|

|

|

Sefer posted:That happens for anyone who isn't self employed in America, too. Except you still have to file at least a 1040EZ. Most people's taxes should be a simple postcard, with a checkbox saying "that sounds right."

|

|

|

|

Thanatosian posted:Except you still have to file at least a 1040EZ. Most people's taxes should be a simple postcard, with a checkbox saying "that sounds right." Canada's taxes could be set up like that super easily. As it stands now, you send in your tax return at the end of the year and if you miss stuff that they have records for they just send you a friendly letter that says they fixed it and your actual owed/refunded taxes are whatever. They made sure I got extra money back once because I missed a month's worth of RRSP contributions from when I switched companies. I'm pretty sure someone with just the standard deductions could fill in random boxes and send their return in and it'd still work out fine.

|

|

|

|

NancyPants posted:So if you had something that should give you a tax break, such a childcare expenses or deductible charitable giving, how would you account for that at the end of the year without filing taxes? Someone can correct me if I'm wrong but for deductible charitable giving that can come through your wage slip and is tax free so there's no need to do a tax return as its already been dealt with at source by the employer and HMRC. Childcare is dealt with separately through the Child Tax Credit system. You apply via HMRC and based on your income you get paid X amount per month separate to the wage from your employer.

|

|

|

|

In America childcare is a very low limit credit or deduction I can't remember. Charitable giving is part of your itemized deductions which for most goons does not apply because you take the standard deduction. Itemized deductions mostly come into play when you have a mortgage.

|

|

|

euphronius posted:In America childcare is a very low limit credit or deduction I can't remember. $3000 per year, it's pretty laughable.

|

|

|

|

|

Bad Munki posted:$3000 per year, it's pretty laughable. Haha, I wish it were $3000. It is a percentage of up to $3000, depending on your income. $3000 per person, that is, so a married couple does get up to $6000 as long as both people work. For my wife and I, it is 20% of $6000, or $1200.

|

|

|

|

reformed bad troll posted:Someone can correct me if I'm wrong but for deductible charitable giving that can come through your wage slip and is tax free so there's no need to do a tax return as its already been dealt with at source by the employer and HMRC. That's interesting. So is there any tax-advantaged situation where someone would have to file taxes? Or is it just businesses that ever have to file?

|

|

|

Sweet Custom Van posted:Nice tie What can we as citizens (and me, as someone interested in policy work) do to help fix the IRS's completely hosed financial situation? I could like stick a fiver in with my 1040 EZ with "a little something to keep the lights on" written on it. Discendo Vox fucked around with this message at 08:21 on Nov 20, 2015 |

|

|

|

|

NancyPants posted:That's interesting. So is there any tax-advantaged situation where someone would have to file taxes? Not really. The system the HMRC uses is called PAYE (Pay As You Earn). It is what it says essentially, you pay what you're supposed to as you earn. It's up to you and your employer to make sure you are on the correct tax code though, otherwise you might get a friendly letter from HMRC a year later saying "You owe X amount but don't worry we'll just deduct it from your wage over Y amount of months". Or the other way round "You paid too much, here's a nice cheque." When you're eligible to repay your Student Loan this also comes out your wage and can be seen on your wage slip. The only difference recently is that a lot of companies are starting to hire people who previously would've been PAYE as self employed contractors. So the company pay less tax and Jim the delivery driver has to now do a tax return every year.

|

|

|

|

Discendo Vox posted:What can we as citizens (and me, as someone interested in policy work) do to help fix the IRS's completely hosed financial situation? Talk to your Congressman. Yes, it felt dumb as I was saying it. That said, all American citizens can make voluntary payments directly against the national debt.

|

|

|

|

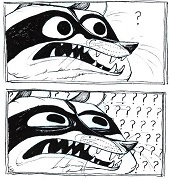

Guys is it true that if I pretend to not know I have to pay taxes that I don't have to pay them??

|

|

|

|

mastershakeman posted:Guys is it true that if I pretend to not know I have to pay taxes that I don't have to pay them?? Yes, Daywalker.

|

|

|

Sweet Custom Van posted:Talk to your Congressman. Yes, it felt dumb as I was saying it. I'll see what I can do- I am familiar with how meaningless voluntary payments agains the debt are.

|

|

|

|

|

Don't pay against the debt. America's debt is actually a really big asset right now because they're the world's reserve currency. The debt is actually advantageous. They still probably shouldn't have so much just in case someone else's currency becomes the de facto reserve, but if that were to happen, there'd be bigger problems than a 20 trillion dollar hole.

|

|

|

|

|

| # ? Jun 5, 2024 07:59 |

|

My mother died about 15 years ago with a will. Since then, I have become estranged from my father. Now he is now trying to sell their marital home, and has found a buyer. It turns out that the deed was originally written with no tenancy, therefore defaulting to tenants in common, which gives me an interest in the house. In the past 36 hours I have spoken to 4 real estate attorneys, and gotten a number of different opinions, but what it distills down to is this: 1) the deed was recorded that way intentionally, and not by negligence. It was likely intended to insure that I received some of the house as an inheritance (I am an only child), but that is supposition at this point. 2) I have some interest in the sale 3) The house will be foreclosed on if the sale does not go through 4) the house is in considerable disrepair 5) he wants me to sign a quit-claim deed to give up my interest in the home My questions are thus: 1) is there a way he can force me to give up my interest? Through litigation or other means? 2) If the home is foreclosed upon, would there be consequences to me beyond not getting any money? He called me Wednesday night at 8:30pm, and the sale is at 2:00pm this coming wednesday, so I received less than 7 days notice and had to do all my own leg work just to find out what the details were. The extent of information he gave me was that he needed a quit-claim deed signed. Luckily I work at a bank that owns a title company, so I have access to real estate attorneys from both the title research side and the foreclosure side. They could not advise me as a client, and could only give me casual conversational advice. I am looking for the same kind of advice here, before I retain an actual attorney of my own. I want to verify their advice was not tainted by the fact that they know me. He is the type of person who would forego his interest in the sale to prevent me from getting mine. I am not saying he will do that, but it is possible that he will just say gently caress it. In addition to answering my questions, any general advice would be appreciated. I am in Illinois as is the property in question.

|

|

|