- leftist heap

- Feb 28, 2013

-

-

Fun Shoe

|

how do i get in on these strong fundamentals

|

#

?

Feb 21, 2017 21:42

#

?

Feb 21, 2017 21:42

|

|

- Adbot

-

ADBOT LOVES YOU

|

|

|

#

?

May 10, 2024 08:39

|

|

- leftist heap

- Feb 28, 2013

-

-

Fun Shoe

|

i wanna slice of the strong fundamentals pie

|

#

?

Feb 21, 2017 21:42

#

?

Feb 21, 2017 21:42

|

|

- Reince Penis

- Nov 15, 2007

-

by R. Guyovich

|

I'll see your strong fundamentals and raise you [borrows against equity] $250,000!

|

#

?

Feb 21, 2017 21:50

#

?

Feb 21, 2017 21:50

|

|

- James Baud

- May 24, 2015

-

by LITERALLY AN ADMIN

|

what the gently caress is brentwood college

Private boarding prep school on the island, one of the pricier ones around at ~50k/year. Used to be rather less "international" than Vancouver schools, dunno about now.

James Baud fucked around with this message at 22:29 on Feb 21, 2017

|

#

?

Feb 21, 2017 22:27

#

?

Feb 21, 2017 22:27

|

|

- Mozi

- Apr 4, 2004

-

Forms change so fast

Time is moving past

Memory is smoke

Gonna get wider when I die

-

Nap Ghost

|

how do i get in on these strong fundamentals

You would have to be mental to miss out on all da fun!

|

#

?

Feb 21, 2017 22:39

#

?

Feb 21, 2017 22:39

|

|

- HookShot

- Dec 26, 2005

-

|

Also any smart family transfers a lot of this stuff BEFORE they die to avoid a bunch of the taxes and lawyer fees and such. When my dad's dad was getting on he just personally gave out 75% of what everyone was going to get in his will anyways.

My husband's family is friends with one of the richest families in Finland, and the patriarch did this when he hit like 65 or something; he gave his kids like 90% of what he owned (his wife had already died at this point IIRC), bought himself two condos in a retirement home (I can't remember why he has two) and now has enough money left to live off until he dies, but not a ton more than that.

|

#

?

Feb 21, 2017 22:41

#

?

Feb 21, 2017 22:41

|

|

- ocrumsprug

- Sep 23, 2010

-

by LITERALLY AN ADMIN

|

It is amazing how quickly it becomes a bubble when all the bankers in Toronto can no longer afford a house either.

|

#

?

Feb 21, 2017 23:29

#

?

Feb 21, 2017 23:29

|

|

- Ccs

- Feb 25, 2011

-

|

Trump and Trudeau both come from 3+ generations of wealth and power and I'm gonna go out on a limb and say their children will, on a whole, live lives of extreme privilege, wealth, and most likely political influence.

Yes, but they are the exception.

http://www.theglobeandmail.com/globe-investor/globe-wealth/eroding-family-fortunes-how-the-cycle-can-be-broken/article33757468/

Of course, this article is talking about how to avoid eroding a fortune. But most people won't take that advice. It happened to my own ancestors. Some guy was wealthy on the scale of JP Morgan and his son burnt through most of it. Some still trickled down through the generations so that my parents are still upper middle class, but I'll probably be just barely middle class, and if I have kids they'll definitely be either middle or lower class unless I'm incredibly lucky. But I don't think I will be.

And that's not even considering Schumpeter's Gale and the cycle of new wealth creation, or the revolutions that have destroyed previous family fortunes. My girlfriend's parents both came from rich families whose wealth was destroyed during the Chinese cultural revolution. It was only because they were well educated before the revolution that they became the first generation able to go back to University. They then became doctors, but still rode bicycles their whole lives and lived in one apartment and never traveled.

|

#

?

Feb 22, 2017 00:29

#

?

Feb 22, 2017 00:29

|

|

- ductonius

- Apr 9, 2007

-

I heard there's a cream for that...

|

It is amazing how quickly it becomes a bubble when all the bankers in Toronto can no longer afford a house either.

I was just thinking to myself "I wonder when super-inflating house prices are going to become a problem now that Toronto is getting the reaming instead of Vancouver." Turns out the answer is "immediately".

|

#

?

Feb 22, 2017 01:33

#

?

Feb 22, 2017 01:33

|

|

- DariusLikewise

- Oct 4, 2008

-

You wore that on Halloween?

|

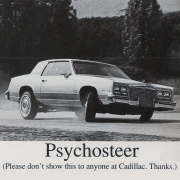

What the gently caress is wrong with realtors, don't they have anyone to tell them their self-bought advertising is poo poo???

|

#

?

Feb 22, 2017 02:00

#

?

Feb 22, 2017 02:00

|

|

- Mozi

- Apr 4, 2004

-

Forms change so fast

Time is moving past

Memory is smoke

Gonna get wider when I die

-

Nap Ghost

|

"Don't Kid Yourself - Get Lamb"

Alternate: stop kidding around/get lamb

Mozi fucked around with this message at 02:09 on Feb 22, 2017

|

#

?

Feb 22, 2017 02:07

#

?

Feb 22, 2017 02:07

|

|

- I would blow Dane Cook

- Dec 26, 2008

-

Can't post for 8 hours!

|

It's like Marvel vs Capcom but with Central Bankers:

quote:

Australia and Canada – Shared Experience

Thank you for inviting me to address this year’s Australia-Canada Leadership Forum. It is a real pleasure for me to be here.

The original plan for this session was to have Bank of Canada Governor, Steve Poloz, also speak. But the timing of the Bank of Canada’s next regular monetary policy meeting has meant that this wasn’t possible. Like us, the Bank of Canada has a blackout period around their policy meetings. So this means that I will need to wait for a future occasion to welcome Governor Poloz to Australia.

The Bank of Canada and the Reserve Bank of Australia enjoy a very warm relationship. Many of the issues we face are similar and our perspectives are often very close to one another. This is partly because of the similarities in our economies. But it is also because Australians and Canadians are both pragmatic and open-minded people and we don’t take ourselves too seriously. So, there is a natural affinity.

On the economic front, we are both medium-sized trading nations. We are both rich in natural resources. We have both had to come to terms with volatile prices for our key exports. We both have strong and resilient banking systems. We both have floating exchange rates and we operate flexible inflation targets. We are both attractive places for non-residents to invest their savings. We both have growing populations. And we both have had to deal with very large increases in housing prices in some of our cities. With all this in common, it is not surprising that we find much to talk about and experiences to share.

...

Housing and Borrowing

I would now like to turn to a second issue that I think will strike resonance with Canadians: housing prices and borrowing. This is an issue that is discussed a lot in both our countries. We have both had strong housing markets over recent years and there are concerns about the level of household indebtedness. There are some similarities in the factors at work.

One is that our populations have been growing quickly for advanced industrialised countries. In Australia, population growth has averaged 1.7 per cent over the past decade, while in Canada it has averaged 1.1 per cent. Over the past couple of years the growth rates have moved closer together.

Another similarity is that there has been strong demand from overseas residents for investments in residential property, particularly in our wonderful Pacific-rim cities. Not only are these cities attractive places to live, but we also offer investors security of property rights and economic and financial stability. Given the strong demand and its impact on prices in some areas, some state and provincial governments have recently levied additional taxes on foreign investors in residential property.

Our housing markets have also been affected by the global monetary environment. We both run independent monetary policies, but the level of our interest rates is influenced by what happens elsewhere in the world. With interest rates so low and our economies being resilient, it is not so surprising that people have found it an attractive time to borrow to buy housing.

Another characteristic that we have in common is that at a time of strong demand from both residents and non-residents, there are challenges on the supply side. I understand that zoning is an issue in Canada, just as in Australia. In some parts of Australia, there has also been underinvestment in transport infrastructure, which has limited the supply of well-located land at a time when demand for such land has been growing quickly. The result is higher prices.

We are also both experiencing large differences across the various sub-markets within our countries. The strength in housing markets in our major cities contrasts with marked weakness in the mining regions following the end of the mining investment boom (Graph 6).

The increase in overall housing prices in both our countries has gone hand in hand with a further pick-up in household indebtedness (Graph 7). In both countries the ratio of household debt to income is at a record high, although the low level of interest rates means that the debt-servicing burdens are not that high at the moment.

In Australia, the household sector is coping reasonably well with the high levels of debt. But there are some signs that debt levels are affecting household spending. In aggregate, households are carrying more debt than they have before and, at the same time, they are experiencing slower growth in their nominal incomes than they have for some decades. For many, this is a sobering combination.

Reflecting this, our latest forecasts were prepared on the basis that growth in consumption was unlikely to run ahead of growth in household income over the next couple of years; in other words the household saving rate was likely to remain constant. This is a bit different from recent years, over which the saving rate had trended down slowly (Graph 8).

This interaction between consumption, saving and borrowing for housing is a significant issue and one that I know both central banks are watching carefully. It is one of the key uncertainties around our central scenario for the Australian economy. It was also cited as one of the key risks for the inflation outlook in the Bank of Canada’s latest Monetary Policy Report. We are still learning how households respond to higher debt levels and lower nominal income growth.

http://www.macrobusiness.com.au/2017/02/australia-canada-compare-bubbles/

Australia wins again!

|

#

?

Feb 22, 2017 02:49

#

?

Feb 22, 2017 02:49

|

|

- leftist heap

- Feb 28, 2013

-

-

Fun Shoe

|

looks like the Irish really cleaned up their act!!

|

#

?

Feb 22, 2017 03:07

#

?

Feb 22, 2017 03:07

|

|

- leftist heap

- Feb 28, 2013

-

-

Fun Shoe

|

Yes, but they are the exception.

http://www.theglobeandmail.com/globe-investor/globe-wealth/eroding-family-fortunes-how-the-cycle-can-be-broken/article33757468/

Of course, this article is talking about how to avoid eroding a fortune. But most people won't take that advice. It happened to my own ancestors. Some guy was wealthy on the scale of JP Morgan and his son burnt through most of it. Some still trickled down through the generations so that my parents are still upper middle class, but I'll probably be just barely middle class, and if I have kids they'll definitely be either middle or lower class unless I'm incredibly lucky. But I don't think I will be.

And that's not even considering Schumpeter's Gale and the cycle of new wealth creation, or the revolutions that have destroyed previous family fortunes. My girlfriend's parents both came from rich families whose wealth was destroyed during the Chinese cultural revolution. It was only because they were well educated before the revolution that they became the first generation able to go back to University. They then became doctors, but still rode bicycles their whole lives and lived in one apartment and never traveled.

cool i'll take comfort in these anecdotes when i'm farming dirt in my 70s for Justin Trudeau III

|

#

?

Feb 22, 2017 03:10

#

?

Feb 22, 2017 03:10

|

|

- Rime

- Nov 2, 2011

-

by Games Forum

|

Today in "what is cheaper than real estate anywhere in British Columbia":

http://www.adirondackmountainestate.com/

quote:A 212 acre private estate built by Miss Lilly Schneeberger, who in 1956 co-founded the Max Daetwyler Co., a Swiss manufacturing company which originally produced components for civil and military aviation, and later developed machinery which would revolutionize the printing industry. The residence was built to resemble the homes she came to know so well in the mountainous hamlets in Switzerland. No expense was spared to create the magnificent Bernese Style Chalet that takes full advantage of the awe inspiring vistas of Lake Champlain, Vermont and the High Peaks. Three fireplaces and knotty pine walls throughout create a comfortable sophisticated interior. The main house has 6 bedrooms, 6 baths, multiple common sitting areas, an entertainment room, office and reading room; PLUS a caretaker's apartment on the top floor with a separate entrance. This luxury home is sold completely furnished including linens and china. The property features a five car garage, two barns (a 6-stall stock barn with running water and electricity, and a 6-stall horse barn) and a beautiful stocked spring-fed pond.

MAJOR PRICE REDUCTION TO $629,000.

Hmmm, yes, what can be had for that price here in our own hinterland...

Ahhh, perfect!

Terrace - Rural East

Quality finished family home located on 7 acres in Singlehurst subdivision. Main floor features living room & dining room with 11 ft ceilings, hardwood floors and high end Finnish wood stove, large open kitchen with Maple cabinets, island and breakfast area plus family room with wood stove. Upstairs you will find a spacious master bedroom with ensuite with soaker tub and separate shower plus 2 other bedrooms. Den/office. Full unfinished basement ready for your own ideas for finishing. This property is nicely landscaped and backs on to creek and Crown land offering maximum privacy. For the handyman is a 32 x 40 shop with loft. You really have to view this property to appreciate all its great feature and quality.

$649,000

gently caress this province.

|

#

?

Feb 22, 2017 05:36

#

?

Feb 22, 2017 05:36

|

|

- namaste friends

- Sep 18, 2004

-

by Smythe

|

http://www.theglobeandmail.com/glob...rticle34108191/

quote:

Many Canadians in the dark on minimum debt payments

Canadians who regularly make more than the minimum payments on their debt are less likely to fall into delinquency – but more than a third of consumers aren’t certain about the benefits of paying a greater amount, according to research released Wednesday by TransUnion.

The global survey included 1,010 responses from Canadians, 88 per cent of whom said they frequently pay more than their minimum monthly requirement for credit cards or similar revolving debts like lines of credit. But 39 per cent of the Canadians surveyed aren’t certain about the benefits that come with making more than the minimum monthly payments on their debt. In the U.S., this uncertain proportion of the population is lower at only 25 per cent.

TransUnion, a credit-monitoring agency based in Chicago, suggests that the trend-focused data could paint a more accurate picture of consumers for potential lenders than traditional credit reports, which capture consumers at a single moment in time. That is, it better recognizes a consumer’s ability to pay down debt rather than simply apply a number to what they owe.

If more Canadians follow recognize this and boost their minimum monthly payments, TransUnion says, it could open up more favourable rates and terms to a wider swath of the population.

“This may sound intuitive – consumers who are able to pay more usually have more liquidity and therefore are less likely to miss payments,” said Ezra Becker, Transunion’s senior vice-president and head of global research, in the press release. “But it is the quantification of this intuition that is important. This is an insight one can only derive from trended data that includes actual payment data, and it can be an important variable for lenders to use when assessing the risk of their credit portfolios.”

TransUnion has incorporated this real-time trended data into its Canadian credit-score offerings since 2015. Using a metric called “total payment ratio,” or TPR, it attempts to correlate payment amount and delinquency. It’s calculated by dividing consumer’s total monthly debt payments across their credit cards by the minimum required.

The higher the TPR, the less likelihood of delinquency: someone who pays $1,000 when the minimum that month is $200, for instance, has a TPR of 5. TransUnion’s study found that higher TPRs are correlated with lower delinquency rates, both for credit cards and auto loans across multiple markets.

As such, the company suggests, incorporating these metrics into credit-score calculations could increase the proportion of consumers in the high-end “super prime” category to 21 per cent, up from 12 per cent, opening up the opportunity for credit products with more favourable terms and rates.

Domestically, TransUnion Canada competes with Equifax Canada for credit reports. Equifax has also begun incorporating trended data into credit-score calculations; in January, its global parent company released a similar analysis suggesting that trended data could give 1.5 million consumers better access to credit each year.

Credit scores are mathematical formulas based on an individual’s credit report. A score can range from 300 to 900. Credit scores measure a consumer’s ability to pay down debt, assessing among other things their history with credit and current indebtedness. Lenders use credit scores and reports to assess the terms and rates they assign a person – or if they should lend the person money at all. This can affect everything from credit-card limits to the ability to mortgage a house.

Canadians are holding record amounts of debt. In the third quarter of 2016, Statistics Canada found that Canadian households owed $1.67 for every dollar of disposable income.

The secretary at my wife's work is in perpetual debt and only makes minimum payments on her 10k credit card bill. This is a woman who traded in her 2 year old car for a new one because 'she deserved it'.

It's been a while but I'm going to bring it up again; a bunch of you loving idiots told me I had no right to judge what people spent their money on and I should mind my own business, several pages back in this thread.

loving lol

|

#

?

Feb 22, 2017 16:08

#

?

Feb 22, 2017 16:08

|

|

- Evis

- Feb 28, 2007

-

Flying Spaghetti Monster

|

Is the argument really that the money we took away from billionaires wouldn't go to things that benefit everyone? Why else would we take it away? To blow it all on blackjack?

|

#

?

Feb 22, 2017 16:43

#

?

Feb 22, 2017 16:43

|

|

- Rime

- Nov 2, 2011

-

by Games Forum

|

There will always be those who chafe not at the yoke, but embrace their slavery with pleasure, and who will resist any who seek to trade the shackles for the fearful insecurity of freedom.

|

#

?

Feb 22, 2017 16:44

#

?

Feb 22, 2017 16:44

|

|

- namaste friends

- Sep 18, 2004

-

by Smythe

|

guys guys progressive taxation might work but

|

#

?

Feb 22, 2017 16:46

#

?

Feb 22, 2017 16:46

|

|

- Femtosecond

- Aug 2, 2003

-

|

CI is gonna love this one.

quote:

New budget does little to help B.C. home buyers

B.C.’s Liberal government says it is happy with how its foreign-buyers tax has helped cool Metro Vancouver’s real estate sector and could expand it to battle rising prices in the suburbs east and north of Vancouver and Victoria.

The sky-high cost of housing is expected to be a central theme in the provincial election that’s less than three months away, but Tuesday’s provincial budget provided almost nothing new to make homes more affordable.

Finance Minister Mike de Jong noted Tuesday that the 15-per-cent extra levy for international buyers in and around Vancouver has softened the market there and stopped the spike in prices. Now, the government is monitoring the extra pressure these buyers are putting on communities across the province, he said. The tax could be expanded to target the eastern Fraser Valley as well as Squamish and Victoria.

But he added there is more work to do.

“We have taken some very concrete steps to try to address affordability,” Mr. de Jong told reporters before addressing the legislature. “Where I don’t think we have done enough work collectively is on the supply side.”

After British Columbia introduced the levy on foreign buyers last August, the percentage of foreign buyers dropped from pre-tax average of 13 per cent down to 4 per cent in December.

Tuesday’s budget forecasts revenues from the property-transfer tax will fall to $1.5-billion next fiscal year, with $150-million coming from the foreign-buyers tax. This fiscal year, the property-transfer tax is forecast to bring $2-billion to provincial coffers, which surpasses the $1.8-billion in total direct revenues expected from the province’s main resource sectors.

Mr. de Jong also said he’d be open to approving a vacancy tax, similar to Vancouver’s, if any other community was interested, but he said the province has received no requests. Last summer, the province changed legislation to allow the City of Vancouver to levy a 1-per-cent tax on owners of properties that are not lived in by the owner full time or rented out at least six months of the year. The tax takes effect next year.

The only new housing measure announced in the budget was raising the threshold on a property-transfer tax exemption for first-time buyers to $500,000 from $475,000.

To make housing more affordable for local residents, the province will continue to meet with civic politicians to work toward increasing the density of B.C.’s cities and clearing permitting backlogs, Mr. de Jong said.

Kishone Roy, chief executive officer of the B.C. Non-Profit Housing Association, said little in the budget offers new help to the province’s more than 520,000 renters – many of whom dream of owning.

“[Home ownership] is getting further and further out of reach,” he said. “As rents go up, renters have less and less money they can save for that down payment.”

Late last year, the province announced a new interest-free loan program for first-time home buyers to secure a down payment on a property worth up to $750,000. In the first four weeks of the program, ending earlier this month, a little more than 515 applications were received, far below the rate needed to reach the 42,000 buyers the province wants to help over the next three years.

Genesis Rigor and her fiancé, Matthew Castillo, applied to the loan program after their offer on a two-bedroom, two-bathroom Richmond condo was recently accepted for roughly $475,000.

Ms. Rigor, a nurse, and Mr. Castillo, an architectural technologist, said that the market may have cooled, but getting a home is still a competitive and stressful process.

“It’s kind of deceiving what the price of the place is actually worth: We’ve seen a few places marked within our price range, but the market value is way over our budget,” Ms. Rigor said.

Maybe the BCNDP have an opportunity to outflank the Liberals by announcing an even bigger and dumber housing subsidy.

|

#

?

Feb 22, 2017 17:57

#

?

Feb 22, 2017 17:57

|

|

- namaste friends

- Sep 18, 2004

-

by Smythe

|

Genesis Rigor

what the gently caress is this enders game

|

#

?

Feb 22, 2017 18:01

#

?

Feb 22, 2017 18:01

|

|

- blah_blah

- Apr 15, 2006

-

|

Thanks, I clicked on this guy's LinkedIn profile and then he sent me an ~invitation to connect~

|

#

?

Feb 22, 2017 20:52

#

?

Feb 22, 2017 20:52

|

|

- namaste friends

- Sep 18, 2004

-

by Smythe

|

I think you should connect and seed his startup and document the ensuing comedy.

|

#

?

Feb 22, 2017 21:05

#

?

Feb 22, 2017 21:05

|

|

- ocrumsprug

- Sep 23, 2010

-

by LITERALLY AN ADMIN

|

You know, I can believe that Vancouver would be the place where getting a new identity would be some legit storefront business, instead of some shady guy at an ethnic looking coffee shop.

|

#

?

Feb 23, 2017 02:32

#

?

Feb 23, 2017 02:32

|

|

- namaste friends

- Sep 18, 2004

-

by Smythe

|

http://www.bnn.ca/toronto-housing-market-heading-off-a-cliff-sun-life-s-adatia-1.678530#_gus&_gucid=&_gup=Facebook&_gsc=GLKOC9Q

quote:

Toronto housing market heading 'off a cliff': Sun Life's Adatia

Canada’s hot housing markets are running out of steam, according to Sun Life Global Investments.

In an interview Wednesday with BNN, Sun Life’s Chief Investment Officer Sadiq Adatia said that there is a housing bubble in Toronto and Vancouver and that it’s already starting to burst.

“I think if you look at Vancouver, we’ve already seen the bubble burst there,” Adatia told BNN.

“A lot of people think it’s just the foreign players and that tax that came through, but it actually started before the tax actually got implemented. So, what we’re seeing is probably a further extension of that downturn as result of the foreign tax.”

For Toronto, meanwhile, Adatia says the trouble still lies ahead.

“Eventually we are going to see this market kind of stop and then come off a cliff,” he said. “The longer we stay in this run-up, the bigger the downturn is going to be.”

“Toronto for many years had been an under-valued real estate market. The difference is, though, that we’ve moved up so significantly in a short amount of time,” Adatia added. “And so, what will likely happen is that we’ll start seeing selling pressure down the road, we’ll see sales coming off. Right now demand is still there but demand is slowly coming off.”

huh. apart from madani i haven't heard of any economist saying anything this plainly about busting bubbles in Canada. I think this is quite something.

e: oh he's a CIO

|

#

?

Feb 23, 2017 03:37

#

?

Feb 23, 2017 03:37

|

|

- Adbot

-

ADBOT LOVES YOU

|

|

|

#

?

May 10, 2024 08:39

|

|

Yes, it's like a lava lamp.

Yes, it's like a lava lamp.