|

No good chairs for under $5K? You can get a down-filled LC3 for $4,900 if you wait until DWR has a 15% off sale. Come on, Ben! Just gotta be patient. On topic, I saw Herman Miller trying to pitch their Embody ($1k) office chair to gamers. Gamers buy $300 - $500 pieces of garbage fake race car chairs and equally expensive water-cooled neon light cases, but yeah, no gamer is going to buy an Embody until Summit1g is sitting in one or something. GWM but still BWM.

|

|

|

|

|

| # ? May 14, 2024 01:50 |

|

AreWeDrunkYet posted:https://www.theguardian.com/us-news/2018/feb/27/ben-carson-spokesman-falsely-denied-expensive-table-bought Bring back the guillotines.

|

|

|

|

Krispy Wafer posted:balloon-baron Man, I wish username changes weren’t so expensive.

|

|

|

|

Hoodwinker posted:John Smith you are not allowed to quote or respond to this post, thanks Moneyball posted:i don't automatically hate everything you post JS, just the pointless derails it causes

|

|

|

|

Blinkman987 posted:No good chairs for under $5K? You can get a down-filled LC3 for $4,900 if you wait until DWR has a 15% off sale. Come on, Ben! Just gotta be patient. What's the point of those racing chairs anyway? I see so many people using them. I hit reply just as I noticed a "Bitcoin Academy" ad at the top of the page. Stock photo of confident businessman saying how he trades bitcoin for a living. If someone sees it again could they screenshot it?

|

|

|

|

22 Eargesplitten posted:What's the point of those racing chairs anyway? I see so many people using them. There is no point other than looks, they are all terrible garbage chairs. They were smart enough to give them out to popular twitch streamers, and now every dumbass thinks they need one.

|

|

|

|

Enos Cabell posted:There is no point other than looks, they are all terrible garbage chairs. They were smart enough to give them out to popular twitch streamers, and now every dumbass thinks they need one. Something like an Aeron would probably be more comfortable for most gamers. I mean I consider them to be expensive, but they are much more comfortable than a racing chair. HFX fucked around with this message at 15:30 on Mar 1, 2018 |

|

|

|

How do you deal with the guilt/shame of losing a massive amount of money making stupid bets on the market?quote:About a month ago I went on sabbatical. While traveling around the country I started day trading (worst financial decision of my life). I've lost 30% of my total net worth (46% of my liquid capital) over the last 3 weeks making incredibly stupid bets in 3x leveraged inverse ETFs. I had a "come-to-jesus" moment and closed everything out 2 days ago after losing Portfolio Margin status. Of course as soon as I did the market immediately went my way (down). I lost 3 years of hard earned savings in 21 days.

|

|

|

|

HFX posted:Something like an Aeron would probably be more comfortable for most gamers. I mean I consider them to be expensive, but they are much more comfortable than a racing chair. And much cheaper than spinal surgery. I bought a Steelcase Leap for $1000 a few years back, and that is one of the smartest purchases I've made.

|

|

|

|

Propaniac posted:How do you deal with the guilt/shame of losing a massive amount of money making stupid bets on the market? Oo boy that's the good stuff. I thought we were all out of leveraged bagholder quotes after everyone got loving de-ci-ma-ted with the VXY family but NO! Luv 2 watch tha world burn

|

|

|

|

Enos Cabell posted:And much cheaper than spinal surgery. I bought a Steelcase Leap for $1000 a few years back, and that is one of the smartest purchases I've made. If you’re patient you can find them for dirt cheap on Craigslist. Like $100 cheap.

|

|

|

|

My "minor" gambling problem was resolved by tracking all my spending religiously, although even then it took a few years to fully get it out of my system. I wasn't necessarily living paycheck to paycheck or going into serious debt but I wasn't saving monies and was carrying CC balances. I still do Powerball and maybe a scratcher once a week, but it doesn't have the same impact on me as blackjack or the casino. Content: https://www.reddit.com/r/legaladvice/comments/813ung/ca_grandmother_gave_my_brother_and_me_an_equal/ quote:When my brother was 16 and I was 4 my grandmother set aside a share portfolio for us. As soon as we were old enough it was transfered into our own accounts, and it was only four years later that my brother dipped heavily into his and bought a new honda. Comments range from commending dad for not spending his kid's inheritance, to the GF being in serious trouble for pretending to be a lawyer.

|

|

|

|

Propaniac posted:How do you deal with the guilt/shame of losing a massive amount of money making stupid bets on the market? Another r/wallstreetbets poster is born.

|

|

|

|

Jake Mustache posted:Content: Holy poo poo, it’s Fargo season 3 in real life

|

|

|

|

quote:While traveling around the country I started day trading This should be the thread title forever.

|

|

|

|

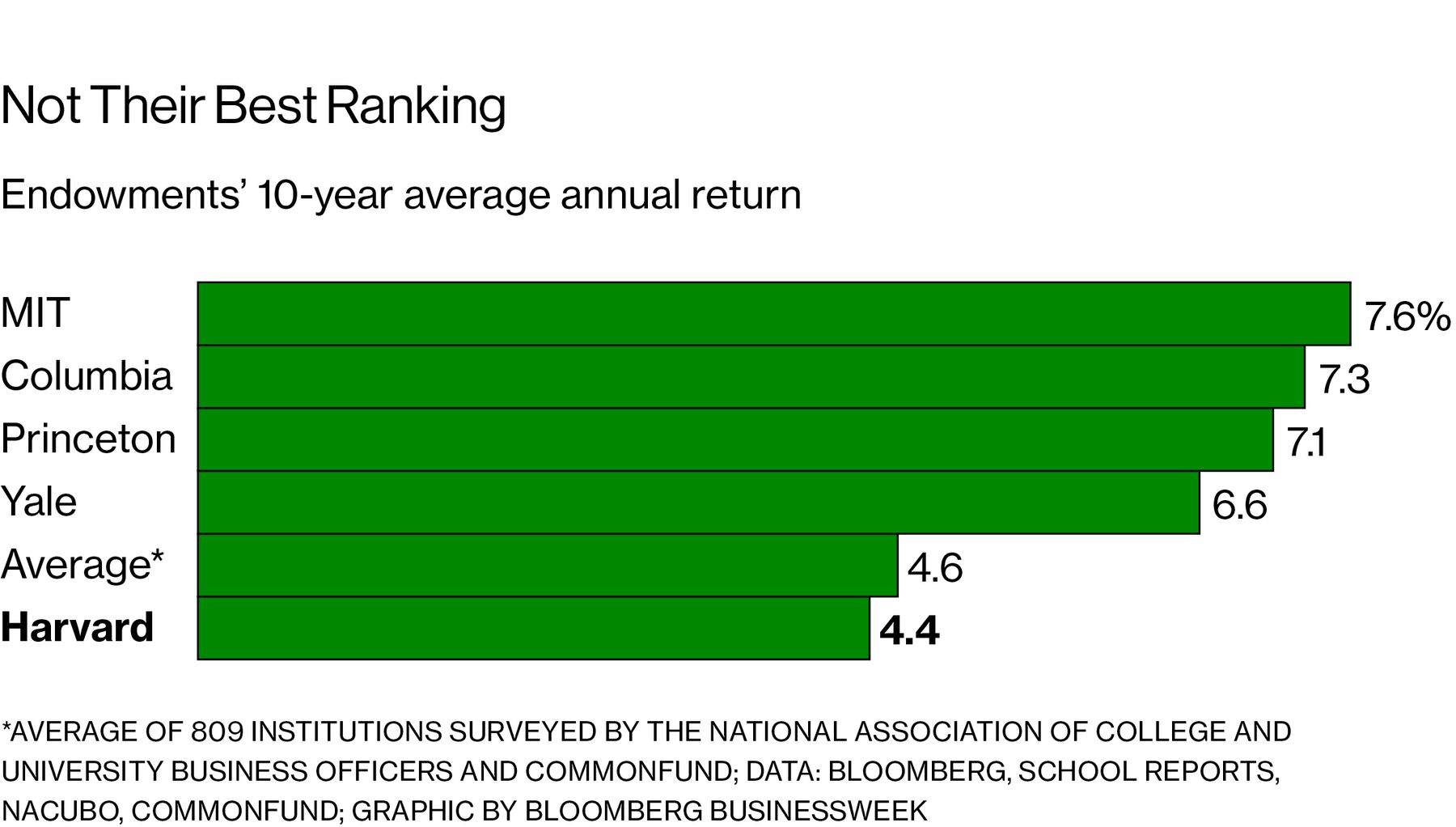

Here's some tasty institutional schadenfreude. Harvard attempts to invest its endowment in some neo-colonial Brazilian adventure, with predictable results: https://www.bloomberg.com/news/articles/2018-03-01/harvard-blew-1-billion-in-bet-on-tomatoes-sugar-and-eucalyptus Harvard Blew $1 Billion in Bet on Tomatoes, Sugar, and Eucalyptus *The university’s highly paid money managers thought they could manage risks other schools avoided. Six years ago, Jane Mendillo, then head of Harvard’s endowment, spent a week in Brazil, flying in a turboprop plane to survey some of the university’s growing holdings of forest and farmland. That year, Harvard began one of its most daring foreign adventures: an investment in a sprawling agricultural development in Brazil’s remote and impoverished northeast. There, workers would produce tomato paste, sugar, and ethanol, as well as energy after processing crops. The profits, in theory, could outstrip those of conventional stocks and bonds and keep the world’s richest university a step ahead of its peers. Harvard bet the farm in Brazil and lost. The university, which invested at least $150 million in the development, is now exiting, according to people familiar with the matter who requested anonymity because they aren’t authorized to discuss the investment. The venture contributed to the decision by its current endowment chief, N.P. “Narv” Narvekar, to write down the value of its globe-spanning natural resources portfolio last year by $1.1 billion, to $2.9 billion. Harvard, which manages $37.1 billion, has said those investments produced strong returns but now face “significant challenges.” Current and former officials otherwise declined to comment. Harvard made many mistakes over the last decade, according to Thomas Gilbert, a finance professor at the University of Washington, but almost all of them boiled down to a single miscalculation: the belief that its top money managers—who were paid $242 million from 2010 through 2014—were smarter than everyone else and could handle the risks almost all other endowments avoided. “They became loose cannons,” Gilbert says. “When you’re managing donor money, it’s appalling.”  (Cue sad trombone) Harvard over the past decade posted a 4.4 percent average annual return, among the worst of its peers. It even lagged the simplest approach: Investing in a market-tracking index fund holding 60 percent stocks and 40 percent bonds, which earned an annual 6.4 percent. Some of Harvard’s blunders have been well-chronicled. Facing heavy losses after the financial crisis in 2008, Mendillo sold private equity stakes at deep discounts before they could recover. Her successor, Stephen Blyth, experimented with expanding the endowment’s in-house team of stock traders before retreating in the face of tens of millions of dollars of portfolio losses. Blyth stepped down in 2016. But perhaps no bet damaged Harvard more than its foray into natural resources. The university invested in central California vineyards, Central American teak forests, a cotton farm in Australia, a eucalyptus plantation in Uruguay, and timberland in Romania. Harvard has been reevaluating and selling some of those investments, such as part of the Uruguayan plantation it sold to insurer Liberty Mutual last year. “The natural resources portfolio was supposed to be the crown jewel,” says Joshua Humphreys, president of the Croatan Institute, a nonprofit that focuses on sustainable capitalism. “But they were known for taking outsize risks, and those can cut both ways.” Such investments haven’t always lost. Mendillo took the lead flipping U.S. timberland in the 1990s, delivering substantial profits when she worked for then-endowment chief Jack Meyer. Harvard similarly scored big gains when it bought and sold timberland in New Zealand in 2003. When Mendillo returned to Harvard after managing Wellesley College’s endowment, she tried for a reprise. This time she thought U.S. timber was expensive. Instead, Harvard could tap forestry Ph.D.s and other sharp minds to find opportunities in emerging markets, taking advantage of growing demand for scarce resources around the globe, she said in a 2012 Bloomberg interview. Mendillo saw these investments as decades-long wagers, which her board embraced. “Natural resources is our favorite area,” she told a July 2012 investor conference. At the time, Brazil’s economy was booming, and the government was pouring development money into the impoverished, rugged, semi-arid northeast. The university, working with Brazilian private equity firm Gordian BioEnergy, established a company called Terracal Alimentos e Bioenergia, according to tax filings and people familiar with the matter. Terracal planned to spend more than 5 billion Brazilian reals ($1.5 billion) on the agricultural complexes. The first development would transform thousands of acres around the remote town of Guadalupe on the Parnaiba River using modern irrigation technologies. By the time Mendillo stepped down as endowment chief executive officer in 2014, the economy in Brazil was slowing, and a government corruption scandal was deepening, spooking Harvard and other foreign investors. The strategy paid off for one constituency: Harvard’s money managers. Alvaro Aguirre, who oversaw natural resources investments, made $25 million over four years, tax records show. His boss, Andrew Wiltshire, was paid $38 million over five years. Both have since left Harvard. Mendillo earned as much as $13.8 million in a single year. Vox Nihili fucked around with this message at 20:05 on Mar 1, 2018 |

|

|

|

Vox Nihili posted:Here's some tasty institutional schadenfreude. Harvard attempts to invest it's endowment in some neo-colonial Brazilian adventure, with predictable results: Poor Harvard, only $38B left for them to watch lazily roll around at the roulette wheel. For the record, this princely sum would cover almost 5% of the cost to pay for college for every American forever.

|

|

|

|

I, for one, am shocked that "sustainable capitalism" fails in competition with regular old "exploit-and-export another country's non-renewable resources" capitalism.

|

|

|

|

EAT FASTER!!!!!! posted:For the record, this princely sum would cover almost 5% of the cost to pay for college for every American forever. I'm not really sure what to make of that stat. That it's 5% of the money needed to make dividends that would pay for every incoming class?

|

|

|

|

EAT FASTER!!!!!! posted:Poor Harvard, only $38B left for them to watch lazily roll around at the roulette wheel. harvard is need blind at least unlike my alma mater with our measley 1.8bn endowment

|

|

|

|

EAT FASTER!!!!!! posted:Poor Harvard, only $38B left for them to watch lazily roll around at the roulette wheel. Uh, $38B divided by 20 million students (source: https://nces.ed.gov/programs/digest/d16/tables/dt16_105.20.asp?current=yes) is $1900 to subsidize students in perpetuity if there is no student growth. That $1900 at a 4% rate of withdrawal is... $75/yr per student.

|

|

|

|

KYOON GRIFFEY JR posted:harvard is need blind at least unlike my alma mater with our measley 1.8bn endowment They know full well their endowment is enormous and their cultural cachet is as well

|

|

|

|

kimbo305 posted:I'm not really sure what to make of that stat. That it's 5% of the money needed to make dividends that would pay for every incoming class? Yes, basically the cost to provide free college to every American forever would be like $40B a year. To pay for this in perpetuity, assuming an r of 0.05 you'd need like $800B. You'd have to make a couple of assumptions though: one would be that higher education costs stop going up (they have exceeded inflation for like 25 straight years - it's a loving racket) and the other is that you can achieve an r of 0.05. Anyway, Harvard has only managed an r of 0.04, despite an average somewhat conservative portfolio earning nominally 6.1%. Still, $40 billion dollars held in cash for an organization whose only stated mission is educating students seems wildly irresponsible. KYOON GRIFFEY JR posted:harvard is need blind at least unlike my alma mater with our measley 1.8bn endowment The reason I doubt these numbers is that my liberal arts school with 2.25 billion was looking into how much of the endowment we'd have to dedicate to just make college free, forever, for everyone and it was like 1B for maybe 2000 students. Ultimately we (the trustees, faculty and students discussing this as a college) decided it wasn't worth it, and just committed to need blind admissions instead, so that college tuition would be treated like a progressive tax (some students were EXCEEDINGLY wealthy). I know despite coming from relatively modest means that we were able to pay for my college rather easily. Many of my friends attended school for free because of financial need. EAT FASTER!!!!!! fucked around with this message at 21:02 on Mar 1, 2018 |

|

|

|

EAT FASTER!!!!!! posted:Yes, basically the cost to provide free college to every American forever would be like $40B a year. To pay for this in perpetuity, assuming an r of 0.05 you'd need like $800B. You'd have to make a couple of assumptions though: one would be that higher education costs stop going up (they have exceeded inflation for like 25 straight years - it's a loving racket) and the other is that you can achieve an r of 0.05. Uh... again, $40B/yr is going to give you $2000/yr/student. College is a fuckton more expensive than that.

|

|

|

|

baquerd posted:Uh... again, $40B/yr is going to give you $2000/yr/student. College is a fuckton more expensive than that. Yeah I went back and looked at your numbers, and that is far more students than I had seen quoted as participating in undergraduate education. Various think tanks came to summary numbers on this, which is where I found my "40B annually" number, but yours certainly seems more in line with reality, especially if those student numbers are accurate (and I have no reason to doubt them).

|

|

|

|

EAT FASTER!!!!!! posted:Yeah I went back and looked at your numbers, and that is far more students than I had seen quoted as participating in graduate education. Yeah, assuming an average of $10k/yr for tuition alone (average at just state schools), college in-perpetuity becomes a ~$4 trillion cost if you can administer such a fund like a college trust. Add in private schools and/or board and now we're talking $10 trillion easy unless we slash expenditure through fiat or something.

|

|

|

|

Yeah if you treat the TRUE cost to the college to provide degree granting education $15,000 to provide - which is already a very generous assumption based on data available from the UK where costs have not run out of control - it would still require $300B annually. I have no idea where these loving think tanks came up with a cost of 1/6 that.

|

|

|

|

EAT FASTER!!!!!! posted:Yeah I went back and looked at your numbers, and that is far more students than I had seen quoted as participating in undergraduate education. Different figures account for public/private, community college/four-year, and full-time/part-time differently. 20 million is the figure if you include everything, I believe. Presumably the part-time students/community college students are cheaper to pay for.

|

|

|

|

Vox Nihili posted:Different figures account for public/private, community college/four-year, and full-time/part-time differently. 20 million is the figure if you include everything, I believe. Presumably the part-time students would be cheaper to pay for. I've tried to slice it in such a way as to come up with anything APPROACHING the absurdity of the $40B number I originally quoted and I'm faced with the realization that it is (and I was) just flatly wrong.

|

|

|

|

EAT FASTER!!!!!! posted:I've tried to slice it in such a way as to come up with anything APPROACHING the absurdity of the $40B number I originally quoted and I'm faced with the realization that it is (and I was) just flatly wrong. $40B is probably approximately the yearly price of tuition for full-time, four-year program students at public schools (or some similarly diced figure).

|

|

|

|

Of course once everyone has a degree we'll need to have Better College to differentiate yourself from the hoards of other job applicants with degrees. Better College will be a lot like Regular College except it costs $20k per year. OH! You thought college was just about education?

|

|

|

|

Y’all missed the part where $40B was like 5%:EAT FASTER!!!!!! posted:Poor Harvard, only $38B left for them to watch lazily roll around at the roulette wheel.

|

|

|

|

Krispy Wafer posted:Of course once everyone has a degree we'll need to have Better College to differentiate yourself from the hoards of other job applicants with degrees. Better College will be a lot like Regular College except it costs $20k per year. That's what my Masters degree is for. Only I got it for free with the GI Bill. Of course that just means in the near future only PhDs will get a good job.

|

|

|

|

How much would it cost to send every horse to college forever?

|

|

|

|

Volmarias posted:How much would it cost to send every horse to college forever? Depends on the mix of equestrities and stable income

|

|

|

|

Crazy Mike posted:Of course that just means in the near future only PhDs will get a good job.

|

|

|

|

quote:I was wondering about the idea of a first time home buyers loan and the feasability of using that offer as more of an investment tool than a future home. 3% of 200k is 6k. 6k! Thats my yearly IRA contribution which I'm heavily considering throwing towards a "home" instead this year. 200k can get me a decent single bedroom apt or townhouse in my area. If I scrimp and save I could even put 9/10k together which puts me in the 300k property range assuming someone actually gives me a 3% loan. My credit score is firmly over 700 and climbing and I'm in my mid 20s, making roughly 50k a year.. My longtime girlfriend is a bit more financially stable, with a 740 credit and more liquid savings. I dont nessecarily intend on involving her other than slipping living expenses as we've always done, but if an opportunity presented itself that I needed to, we are more than stable enough for me to consider involving her. I'm not japanese but they keep calling me a ninja for some reason~

|

|

|

|

Guest2553 posted:I'm not japanese but they keep calling me a ninja for some reason~ Owning a $300k home on $50k yearly salary seems like a disaster waiting to happen. Now if this was 2006, he’d have banks lining out the door to give him loans.

|

|

|

|

Bird in a Blender posted:Owning a $300k home on $50k yearly salary seems like a disaster waiting to happen. Now if this was 2006, he’d have banks lining out the door to give him loans. Pretty bad spot to be in. $240k loan at 4.5% is $1,216 a month, and his monthly take-home is probably about $2,900 HUD considers you to be "Rent Burdened" and at high risk of financial disaster if ALL housing costs (rent, utilities, taxes, HOA) exceed 30% of your take-home, and this would be 42% on the mortgage alone. It's crazy what pre-2007 lenders considered reasonable.

|

|

|

|

|

| # ? May 14, 2024 01:50 |

|

GoGoGadgetChris posted:It's crazy what pre-2007 lenders considered reasonable. Forgot to source, but it's from like 60 minutes ago.

|

|

|