|

Motronic posted:Friendlier how? Like interface? i use vanguard for my IRA, it's just fine, i've probably spent 20 minutes total on the site in my life

|

|

|

|

|

| # ? May 16, 2024 09:09 |

|

Mostly focusing about the ease of rebalancing quarterly when you have a dozen different assets or are doing tax loss harvesting when the time is right.

|

|

|

|

I use a broker because I have both vanguard and blackrock etfs as well as some stocks but it's like whatever

|

|

|

|

Doctors gonna doctor

|

|

|

|

Trabant posted:Even if I were to agree with that theory, uncontrolled inflation alone is a horrid thing. I lived through a period of hyperinflation ( Yeah hyperinfalation is bad and so it's still important that taxes are collected, that's why I put the word all in quotes

|

|

|

|

Yond Cassius posted:There's a small meltdown going on over at the Wall Street Journal comments section (paywall warning), because, in some ways, this is already starting. Nobody's coming for a second go at Roth IRA funds, but they're taking some wind out of the dynastic wealth-building potential of really big IRAs. Most of the article is guillotine bait, but the short form is that, if the SECURE Act becomes law, it'll adjust the rules on payouts for non-spousal inheritance of IRAs.

|

|

|

|

After "The Incident" they'll just take all the 401Ks and redistribute it to pay for the dome wall.

|

|

|

|

A small price to pay

|

|

|

|

In general is there any reason to wait until the end of the year to max out an IRA contribution or should I just do it as early as possible to get it out of the way? Like if I have the 5500 available at the start of the year should I put it all in or make deposits over time?

|

|

|

|

Statistically, the best strategy is to invest lump sums as early and as often as you can.

|

|

|

|

mmj posted:In general is there any reason to wait until the end of the year to max out an IRA contribution or should I just do it as early as possible to get it out of the way? Like if I have the 5500 available at the start of the year should I put it all in or make deposits over time? The sooner the better! By investing you are stating that it should go up over time. More time in the market = more time spent going up. There may be some exceptions, like if that $5,500 is all the savings you've got, or if you would gain a significant amount of peace of mine from contributing monthly.

|

|

|

|

Thanks that's what I needed to know. This would just be shifting funds from an existing vanguard investment account so no emptying my emergency fund

|

|

|

|

mmj posted:In general is there any reason to wait until the end of the year to max out an IRA contribution or should I just do it as early as possible to get it out of the way? Like if I have the 5500 available at the start of the year should I put it all in or make deposits over time?

|

|

|

|

Small White Dragon posted:If you were planning to do a pre-tax/Roth IRA and there's the possibility that you could get a bonus or something that might put you over the contribution thresholds? I've heard it can do a PITA to undo. I had to take $800 back out of a Roth a year later when I earned into the phase out limit. It was ~5 minutes of paperwork but I think I had to mail it to Vanguard? I'd assume you can upload PDFs now, but it wasn't bad at all.

|

|

|

|

Weird question but Iíll go for it, if any goons here work for Fidelity or similar, Iím looking to explore 401(k) options for my company (setting one up, started last year and now we have employees). We are very small, so not a lot of negotiating power but getting the basic low cost index funds for people would be awesome. I figure having an internal referral would be nice, so PM me if so! Also feel free to share here who I should not bother looking at.

|

|

|

|

movax posted:Weird question but I’ll go for it, if any goons here work for Fidelity or similar, I’m looking to explore 401(k) options for my company (setting one up, started last year and now we have employees). We are very small, so not a lot of negotiating power but getting the basic low cost index funds for people would be awesome. How many employees? My GF has 8 and uses guideline since she uses gusto for payroll. Seems pretty good so far. There were some posts about this awhile back with a guy who looked into the various options and costs more.

|

|

|

|

mmj posted:In general is there any reason to wait until the end of the year to max out an IRA contribution or should I just do it as early as possible to get it out of the way? Like if I have the 5500 available at the start of the year should I put it all in or make deposits over time? The limit is $6,000 now. You can't go wrong either way, but I would contribute $115 a week just because I like dollar cost averaging. It makes me feel less bad if the market goes down in the short term, and if it only goes up, well darn, guess I'll wipe my tears with positive returns on every dollar I invested.

|

|

|

|

Volkerball posted:The limit is $6,000 now. You can't go wrong either way, but I would contribute $115 a week just because I like dollar cost averaging. It makes me feel less bad if the market goes down in the short term, and if it only goes up, well darn, guess I'll wipe my tears with positive returns on every dollar I invested. https://money.cnn.com/2016/03/23/retirement/dollar-cost-averaging/index.html https://www.kiplinger.com/article/investing/T023-C032-S014-the-problem-with-dollar-cost-averaging.html DCA does not work. Please stop suggesting it.

|

|

|

|

I think it's fair to do some sort of automatic deduction or transfer if you're not disciplined or courageous enough to save it all up and then pull the trigger. Lots of people do better with saving when the money just kind of automatically disappears. But yeah, do not do this for DCA reasons - at most you should be doing it on a per-paycheck basis.

|

|

|

|

Motronic posted:https://money.cnn.com/2016/03/23/retirement/dollar-cost-averaging/index.html The first link is discussing rebalancing your stock to bond ratio by DCA instead of just rebalancing right now and then investing in line with your new allocation. The seconds conclusion is quote:Yes, dollar cost averaging is a sound principal, especially in the beginning, but don't be lulled into ignoring its diminishing impact over time. Buffett recommends DCA because people can get discouraged if they put a bunch of money down immediately and then the market goes down, and it's an easy way to set and forget an investment. There's nothing wrong with either strategy that I've seen. Selecting between lump and DCA is infinitely less important than just ensuring you invest the money.

|

|

|

|

DCA is trading money for peace of mind. Here in BFC we try to maximize money and explain why the peace of mind is an illusion. DCA is far less harmful than Not Investing, but it's still ideal to do neither.

|

|

|

|

movax posted:Weird question but Iíll go for it, if any goons here work for Fidelity or similar, Iím looking to explore 401(k) options for my company (setting one up, started last year and now we have employees). We are very small, so not a lot of negotiating power but getting the basic low cost index funds for people would be awesome. You probably want a "SIMPLE IRA" plan - it's made just for folks like you assuming you have some small business number of employees. https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan https://www.fidelity.com/retirement-ira/small-business/simple-ira/overview https://investor.vanguard.com/small-business-retirement-plans/simple-ira Unless you're dead set on 401k - I seem to recall there is some small business focused 401k company out there.

|

|

|

|

GoGoGadgetChris posted:DCA is trading money for peace of mind. You could argue the same thing about adding bonds to your portfolio later in life. Statistically over the long term, the market goes up 8% annually and returns far more than bonds, so in the world where we ignore risk tolerance, there's no point to ever have any other allocation than 100% stocks. But your risk profile changes over time, and everyone's tolerance is different to begin with. I mean me personally, it's not really a matter of choice. I would never end up in a situation where I have a $6,000 surplus I could throw at my Roth on the first day of the year, because that $6k would've already been invested incrementally over the previous year as soon as I got it, which is effectively dollar cost averaging, even though it could be argued that it's just frequent lump sum investments of every dollar I have available that is earmarked for investing. But whatever the case, when things like December 2018 come around, I get excited rather than feeling like I'm missing out like I would've if I dropped $6k into my IRA in July 2018, which helps me stay the course. If you're just starting investing and you have $6k sitting in the bank and you want to put it all in a Roth IRA tomorrow, I'm not going to argue against that. That's a perfectly reasonable thing to do. But over the long term dollar cost averaging in the form of investing every dollar you make that is earmarked for investing as soon as you get it is the way to go unless you get to the point that you are maxing out both your 401k and your IRA and still have enough left over to invest in other things. But even in that situation I think I would DCA the surplus in a taxable brokerage account rather than set it aside for a lump sum buy in my IRA the next year, because I wouldn't give a gently caress about retirement moneys at that point and I'd rather look at medium term savings for things in my 40's and 50's that I'd save through taxable accounts. Volkerball fucked around with this message at 23:11 on Jul 12, 2019 |

|

|

|

My former employer did matching 401k contributions, but I was only there long enough for 75% of their contributions to have vested. When I login to check my balance, my total reflects the vested and non-vested contributions, but they also give you a breakdown and I have ~$4k that's not vested. The information on the vesting page says:quote:If you leave the Company after completing four or more years of service, you will receive the entire value of the funds in your Plan accounts. You also become automatically 100% vested in Company contributions when you reach age 65, become totally and permanently disabled, die, or the Company terminates the Plan. Does this mean I've already forfeited the 25%, despite it showing up in my balance, or is that only if I transfer the money to another fund? I'm wondering if the 100% vested when you reach 65 only applies if you're still working there when you hit 65, or if I leave this account alone for another almost 30 years that will finally vest. I'd like to transfer it over to my new employer, but if it would one day vest it may be worth the hassle of leaving it where it is now. May being the key term, it doesn't seem like $4k is going to make or break my retirement, but that number will obviously grow with time.

|

|

|

|

H110Hawk posted:You probably want a "SIMPLE IRA" plan - it's made just for folks like you assuming you have some small business number of employees. I want to offer a post-tax option as well and my understanding of SIMPLE is that it's only pre-tax. In my ideal world (I think), we'd try to get Fidelity and offer up no-fee trades on their mutual funds and the iShares ETFs they allow. spwrozek posted:How many employees? My GF has 8 and uses guideline since she uses gusto for payroll. Seems pretty good so far. There were some posts about this awhile back with a guy who looked into the various options and costs more. 18 right now, should be at 25 by end of the year.

|

|

|

|

H110Hawk posted:You probably want a "SIMPLE IRA" plan - it's made just for folks like you assuming you have some small business number of employees. This is correct, a SIMPLE IRA is much easier administratively than a 401k. However, it does have a few minor disadvantages, which you may or may not care about : * The cap is lower ($12k instead of $19k) * the match rates are fixed * there's no Roth option * it will complicate backdoor Roths.

|

|

|

|

MomJeans420 posted:Does this mean I've already forfeited the 25%, despite it showing up in my balance, or is that only if I transfer the money to another fund? I'm wondering if the 100% vested when you reach 65 only applies if you're still working there when you hit 65, or if I leave this account alone for another almost 30 years that will finally vest. I don't think it'll vest when you hit 65 unless you're then working with the company. My last company had a provision where if you returned to the company within a certain amount of time (about 5 years, plus or minus a few months based on when the quarter boundaries landed), you could "pick up where you left off" in your 401k vesting, so they left my unvested balance around until I crossed the threshold and reclaimed it then. It might be that your old company has something similar buried in the fine print.

|

|

|

|

I had a feeling that was the case, which means I can simplify my life and just transfer it over, thanks!

|

|

|

|

DACK FAYDEN posted:I have a 401(k) from my previous employer at Fidelity, filled entirely with pre-tax contributions and employer matches. I'd like to move it to Vanguard because they have all my other savings. I was in your exact situation and did this last year (out of work for 1.5 years, transferred a mix of pre-tax and after-tax non-Roth 401(k)s over to my Roth IRA). No contribution limits because you're not contributing (adding money) to a retirement account, you're converting. Just pay income tax. Just be aware that, even though you've done the math and think you can stomach the income tax, it still hurts and is a huge punch in the gut once the tax numbers come out. Just be mentally prepared for it. Don't forget state taxes as well. One other thing to be aware of: my tax guy told me was that since I was on Covered CA (California's health... thing related to Obamacare) while unemployed, I was paying my premiums as if my income were 0. There is going to be a chance that I might have to pay back some of my health care premiums -- we'll see. DACK FAYDEN posted:Doesn't appear that I have to use any fancy backdoor strats, since I don't hit income limits or anything. Just straight up transfers, plus tax on the rollover. Am I missing anything here, whether factually or just a reason this wouldn't be as good an idea as it seems? On whether it's a good idea or not, I guess it depends on the tax bracket now when you're converting, vs. your tax bracket when you retire. Assuming 100k, 20% overall tax rate now, 15% tax when you retire: Pre-tax (no tax now; 15% tax rate when you retire, so take-home is 85%): Net pay = (100k * (1 + growth)^(number of years)) * .85 Roth (you're paying 20% in taxes now so you're only investing 80k; take home 100% when you retire) Net pay = (100k * .8) * (1 + growth)^(number of years) Comparing both sides, the 100k and the (1 + growth)^(number of years) actually cancel out. So you're actually comparing a pre-tax of .85 vs. a Roth of .80. You're actually better off going with pre-tax for the same gross 100k. Because a lot of variables cancel out, you actually only need to do a simple straightforward comparison between tax rate now vs. future tax rate. (In practice, when you'd be withdrawing portions of your investment in pieces, but you could split this out piecemeal into a sum of multiple years and the math turns out to be the same.) (I personally made this mistake, and I probably would've been better off NOT converting my pre-tax to Roth.) facepalmolive fucked around with this message at 03:09 on Jul 13, 2019 |

|

|

|

Question of my own: My previous (large, with lots of negotiating power) employer's 401(k) plan allowed for mega backdoors, so I in fact did do that very bougie thing. I now work for a much smaller company. It offers pre-tax and Roth, but it doesn't appear as if after-tax 401(k) is an option. If I just went up to my plan administrator and just asked, how likely is it for them to add after-tax + in-service withdrawals as a choice? In other words, does it 'cost' the company anything to add it as a choice? Is Fidelity less incentivized to offer my company the choice?

|

|

|

|

facepalmolive posted:Question of my own: My previous (large, with lots of negotiating power) employer's 401(k) plan allowed for mega backdoors, so I in fact did do that very bougie thing. It's not a default feature of 401ks, it specifically has to be added into the plan document. It supposedly adds overhead as there is required means testing, and (potentially) refunds of some of the after-tax contributions if the benefit too heavily favors HCEs (highly compensated employees). However, no harm in asking. Most people, I think, aren't even aware of it.

|

|

|

|

Mine explicitly has an after-tax option which facilitates eventual Mega backdoor Roth, but no in-service rollovers to facilitate the Mega backdoor as I go. So I can only take advantage of it if I leave the company and rollover after-tax to Roth IRA. Since I'm not near the Roth IRA cutoff yet, I recently choose to switch from traditional 401k to Roth 401k to virtually increase my tax advantage space within my means. This was after maxing my traditional 401k for the last 5 years or so once I learned about index investing and such. The rest of my 401k from the last 11.5 years is traditional, and now only the last two months have been Roth. But now if I leave, that latter portion (sans employer match, which is always put in as traditional contributions) can at least roll directly to a Roth IRA.

|

|

|

|

KYOON GRIFFEY JR posted:I think it's fair to do some sort of automatic deduction or transfer if you're not disciplined or courageous enough to save it all up and then pull the trigger. Lots of people do better with saving when the money just kind of automatically disappears. But yeah, do not do this for DCA reasons - at most you should be doing it on a per-paycheck basis. GoGoGadgetChris posted:DCA is trading money for peace of mind. One more question on this topic. If IRA is already maxed and you're trying to get 401k maxed for 2019, which is the smarter option? a) balance the remaining 12 pay periods in the year to an even 401k contribution percentage to hit the 19k limit by end of year b) crank up the 401k contribution percentage as high as possible now to max out the annual 19k limit asap (would take 4 pay periods) and sustain monthly expenses using available savings Based on what I've read on this page, option (b) is better as far as long-term growth?

|

|

|

|

zaurg posted:One more question on this topic. If IRA is already maxed and you're trying to get 401k maxed for 2019, which is the smarter option? B, but make sure your employer match (if you have one) isn't per pay period or you could end up leaving money on the table. I.e. if I were to crank my contributions way up and max before end of year my employer would not match my contributions after I've maxed out, but your plan may not work that way.

|

|

|

|

Your employer might also do a true-up, so that even if you front-load your contributions you'll still get their full match. It'll probably be at the end of the year, but at least you won't miss out on it.

|

|

|

|

Eldred posted:B, but make sure your employer match (if you have one) isn't per pay period or you could end up leaving money on the table. I.e. if I were to crank my contributions way up and max before end of year my employer would not match my contributions after I've maxed out, but your plan may not work that way. Yup this is what my employer does.

|

|

|

|

Shower thought: given that "past performance is no guarantee of future results", how is it that all of USA's retirement plans rely on the market going up and to the right in perpetuity, with swings and all? Is that normal for every country out there? Is it theoretically plausible that the economy goes to total poo poo for 20 years and people have nothing to live on when they retire?

|

|

|

|

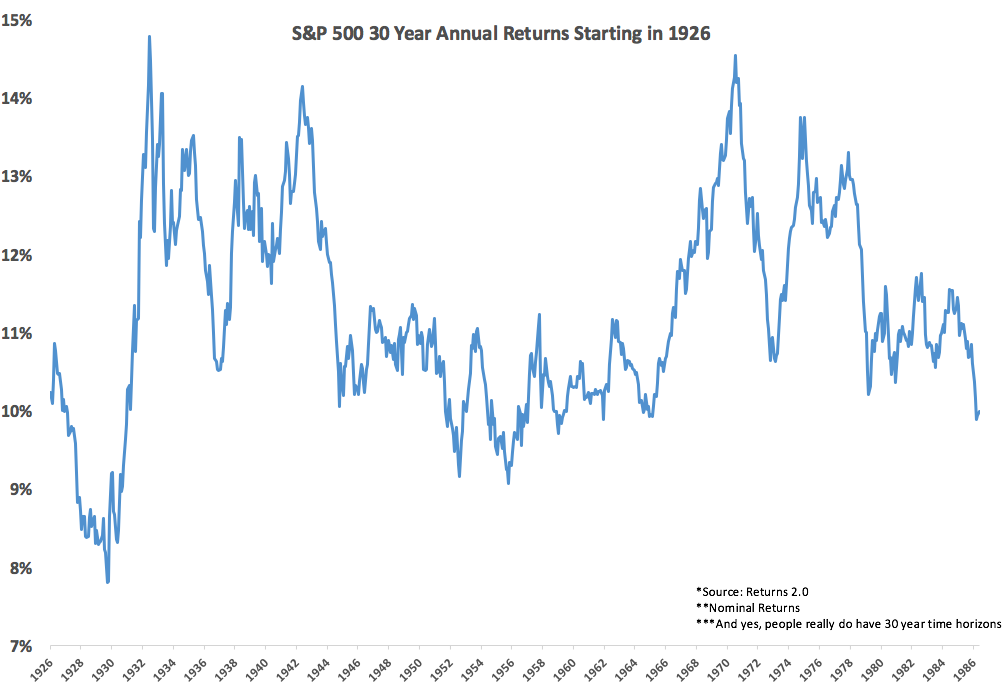

DreadCthulhu posted:Shower thought: given that "past performance is no guarantee of future results", how is it that all of USA's retirement plans rely on the market going up and to the right in perpetuity, with swings and all? Is that normal for every country out there? Is it theoretically plausible that the economy goes to total poo poo for 20 years and people have nothing to live on when they retire? Past performance isn't a guarantee, but at the same time, a 100 year track record is a 100 year track record. This is looking at 30 year spans rather than 20 year spans, but it still says a lot. The worst time in US history to invest was right before the great depression, and even then you still got over 7% annually. And if you were investing throughout the crash, all that money had outstanding returns as the market rebounded. To have the sort of affect you're discussing, you'd almost have to be talking about a collapse of the financial system, in which case, not having enough money to retire on when you get old is the least of your worries.

|

|

|

|

DreadCthulhu posted:Shower thought: given that "past performance is no guarantee of future results", how is it that all of USA's retirement plans rely on the market going up and to the right in perpetuity, with swings and all? Is that normal for every country out there? Is it theoretically plausible that the economy goes to total poo poo for 20 years and people have nothing to live on when they retire? In short, even if it was theoretically plausible, it doesn't radically change your decision calculus at all.

|

|

|

|

|

| # ? May 16, 2024 09:09 |

|

Trabant posted:Your employer might also do a true-up, so that even if you front-load your contributions you'll still get their full match. It'll probably be at the end of the year, but at least you won't miss out on it. My employer just sent out an email making sure people knew they will true up front loaders.

|

|

|