|

Leperflesh posted:More broadly, I've discussed in other posts, and I know others have too, that long-term investing is largely about risk management. Understanding the risk profiles of the investments you hold in your profile is important, as is understanding your own tolerance for risk, and re-evaluating your risk tolerance regularly. If you want to decrease volatility risk in a long-term account, using covered options is not ideal because they expire, on top of their costs. Why not sell some of your stock position and increase your bond position, to get a similar trade-off between volatility and performance, but without the rolling cost/expiration problem with options? That's the approach advocated in Berenstein etc., and the current crisis is not a repudiation of that strategy whatsoever.

|

|

|

|

|

| # ? May 18, 2024 02:12 |

|

Cheesemaster200 posted:In other words if you don't have a risk tolerance for equities, then put your money in aggregated bond funds because they don't drop due to irrational market panic.  This is a cheap way to hedge volatility, yes. Much less expensive than buying puts. e. And let's show a bigger picture, too:  You don't make a lot of money with bonds in the long run. Probably nobody should be 100% bonds in a long-term portfolio, even very risk-averse investors should have some exposure to equities. But look at the difference in volatility there! Leperflesh fucked around with this message at 23:08 on Mar 19, 2020 |

|

|

|

Leperflesh posted:

Well yes, options have no place in a long term portfolio. That was a more tongue and cheek comment about how sometimes safe investments aren't so safe.

|

|

|

|

Leperflesh posted:Yeah the issue here is that Baddog is advocating timing the market with puts because everyone knew the corona virus was gonna be bad/the market is currently plunging; he was not saying "hedge your index funds in your retirement account by buying rolling puts" which as you point out is also pretty bad because you're just incurring ongoing costs in order to effectively reduce your volatility risk, which you could instead do with... less volatile investment options, for much lower cost. SlyFrog posted:Yeah. This all really seems excessively complex for longer term planning. Picking up option instruments that have expiry dates measured in weeks or months as a hedge against risk for long term investing is, simply put, silly. Cheesemaster200 posted:Well yes, options have no place in a long term portfolio. That was a more tongue and cheek comment about how sometimes safe investments aren't so safe. While I understand the points you were trying to make, people can do really creative things to hedge long-term risk with options, too! Not just the short-term examples I've been discussing. Check this out: https://amplifyetfs.com/swan.html https://finance.yahoo.com/quote/SWAN Dudes created an ETF that is ~90% treasuries, ~10% SPY LEAP calls. As a result, their ETF gets ~70% the gain of the S&P500, but, is hedged against black swan events where the market quickly crashes. Amazingly, since they just had a field test of the whole drat idea, we can see how it did! https://stockcharts.com/freecharts/perf.php?SWAN%2C%20SPY It mostly tracked SPY since last June, falling a little behind in the huge run-up to peak SPY. It's still in the green since last June, up ~5%, while SPY is down -14%. It held value very well, giving whoever owns it the desired hedge and time to take other actions instead of just having their portfolio get creamed. But, why not just use bonds? Check out SWAN vs VBINX, the Vanguard Balanced fund (60/40 stocks/bonds) https://stockcharts.com/freecharts/perf.php?SWAN,VBINX The Balanced fund trails SWAN every step of the way since June, by a fair margin. I'm honestly impressed. I don't know how SWAN will hold up in the new zero fed rate environment, since their holdings are ~90% treasury. But loving amazing that it performs so well, and as advertised. I'm half tempted to suggest it to some family members who need more conservative retirement holdings. If anyone has analysis/thoughts on SWAN I'd love to hear them.

|

|

|

|

pmchem posted:their ETF gets ~70% the gain of the S&P500 Ouch! That's pretty bad.

|

|

|

|

That's fascinating pmchem. It's got a .49% ER, and it's brand new, so I agree with definitely not recommending that until we understand it a lot better. I also don't see how an ETF can effectively use rolling chains of ITM options while not incurring the same costs and drag that an individual would have doing the same thing. But I defeitely don't fully understand what they're doing. e. Also wondering about taxes, distributions, and note in the prospectus that they reserve the right to invest in substantially different stocks than the S&P. It's an actively-managed fund, with all that entails. oh and it only has $200M of assets, and there's always a question of scalability/liquidity with small funds. Can their strategy work if they grow to 5x or 10x or 50x their current size? Leperflesh fucked around with this message at 23:36 on Mar 19, 2020 |

|

|

|

GoGoGadgetChris posted:Ouch! That's pretty bad. Well, it's not the S&P500, but, bad compared to what? What if you wanted to retire in 2030 and began investing heavily in Vanguard's target date 2030 fund in 2006, getting a bit of a late start on things? https://stockcharts.com/freecharts/perf.php?SPY,VTHRX At the start of 2020, SPY was up ~240% and VTHRX was up ~150%, or about 63% of the S&P. So, I guess 70% doesn't look so bad if your goal is to grow wealth while mitigating risk?

|

|

|

|

Over 20+ years the S&P is almost certainly going to outperform, so why introduce stuff to reduce volatility when it's just going to end up with you having lower returns over the long run? To make the line less squiggly?

|

|

|

|

18cpr case of 9mm to my door. Maybe I'll print some stock charts and see if I can land some good groupings on the dips.

|

|

|

|

acidx posted:Over 20+ years the S&P is almost certainly going to outperform, so why introduce stuff to reduce volatility when it's just going to end up with you having lower returns over the long run? To make the line less squiggly? Same reason you hold bonds, yeah: you'd gradually increase your volatility hedges as you approach retirement; or, for other long-but-not-as-long investing goals (saving money for your kids' college, say), where volatility risk is high enough on that time scale that you don't want to be 100% equities.

|

|

|

|

pmchem posted:I'm honestly impressed. I don't know how SWAN will hold up in the new zero fed rate environment, since their holdings are ~90% treasury. But loving amazing that it performs so well, and as advertised. I'm half tempted to suggest it to some family members who need more conservative retirement holdings. If anyone has analysis/thoughts on SWAN I'd love to hear them.

|

|

|

|

moana posted:Has it been tested across any other date ranges? What do backdated runs look like versus a balanced fund? How much volatility does it have compared to the 60/40? I think the guy in the video on their page discussed backdated testing, but, all I know about it is in my post. If anyone can answer those questions I’d love to hear it. Being the internet the quickest way to get an answer would be to claim nobody can possibly know the answer to those questions.

|

|

|

|

acidx posted:Over 20+ years the S&P is almost certainly going to outperform, so why introduce stuff to reduce volatility when it's just going to end up with you having lower returns over the long run? To make the line less squiggly? There is sequence risk. Volatility matters a lot at key moments in your investment life. And there is non trivial risk that stocks underperform even in long periods. Fama & French found a 4% chance that equities underperform treasuries over a 30 year period in a simulation they ran. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3081101 I think we do a bad job of talking about risk in this thread. Expected returns are important but they are averages. The band of possible returns is quite wide. The risk of the market is real and we are being compensated for taking that risk, and doing everything we can through diversification and discipline to ensure we’re only exposing ourselves to the compensated risks. BUT IT IS STILL A RISK. It is not a guarantee that the future return of the stock market will resemble past returns. It is not a guarantee that equities will outperform treasuries in the long run. It’s just very likely. It’s similar to dollar cost averaging discussion we had earlier. The expected return for DCA a large chunk of money is lower than lump sum investing. But the volatility is lower. 66% of the time, lump sum outperforms DCA. The rest of the time IT DOESN’T. If you are a robot, then sure, you take the bet. If you are a robot, you’d take a coin flip that paid out $100,005 or lost you $100,000. Higher expected return than not taking it. But people tend to feel loses more than they feel gains and I think almost no humans would take that bet unless they were desperate or really rich (or a thrill seeker). DCA vs Lump Sum is not so extreme but I think a similar principle applies. For most of us, the question of retirement is “will I have enough?” mixed with “what’s the most I can have?” And it may very well make sense to choose the less risky option if it seems to guarantee “enough” even if it cuts you off from “the most I could have, perhaps”. Luck still plays a big role in the stock market, even in the long run. (A fun extra wrinkle is that in the long run, bonds carry an inflation risk, meaning they might not gain money fast enough, making the less risky asset the more risky asset. Christ this is hard and scary.)

|

|

|

|

Hi. I'm looking to invest in the stock market now that it seems to be crashing and stocks are (maybe) cheap, and I am looking for some advice. As I'm Scandinavian, a lot of the terms thrown around are a bit unfamiliar or unapplicable, so forgive me if I ask questions that are answered in the OP, I am writing this partially to pick your brains and partially to check my thinking. I have previously owned both stock funds and stocks, with varied success. I left the market around 2014ish I think, and figured I'd go back in when a crash happened. All in all, I have maybe about 10-15k euros to invest, and I am looking to invest for the medium term, ie minimum 4 -10 years. My thinking is that I buy relatively cheap now and when this recession or crash is over the stock market will go up again and I'll earn a tidy profit. I do know timing the markets (buying at the lowest point and selling at the highest) is folly and there's no point in trying. My aim here is also to buy and keep for the specified time period then selling stock off, hopefully to buy an appartment if things go well, but that's neither here nor there. So I'm not keen on daytrading, just buy and check in once in a while. I also want to minimise risk, with the understanding that this will also blunt the rewards. I am also operating on the assumption here that the stock market will improve over the course of 4 years, that we probably have not hit the bottom yet, and that I initially might see the stocks lose a lot of value. My first question then, is if it's better to invest in individual stocks, in stock funds, or a mix of the two? If so, which proportions? And what kind of stocks and or funds would be the preferred for my goals? Is it better to invest in an index EFT instead of an index fund or does it not really matter for my purposes? My thinking is that it might be best to have a mix of funds and stocks. Since my plan basically relies on the general value of the market, I'd assume it'd be best to invest in a low cost index fund. But regarding stock picks, I'm not sure which industries it'd be wisest to invest in. Do I go for construction, real estate, banking or pharma, or other industries? Thoughts, ideas, suggestions, comments about what a dumb babby idiot I am and I don't know what I am doing?

|

|

|

|

Planning on harvesting some losses next week once I am able to avoid the wash sale. I just want to make sure that people generally agree these are not substantially the same: VTIAX (taxable account)and VDIPX (401k) VTSAX (taxable account) and S&P500 Index trust (401k) I don't quite have $3K of losses in VTSAX but say I sold all of it I pretty much see the option buying VTIAX or VFIAX. If I did VTIAX it would push me to about 56% US Stock and 28% international stock. Then a month later I can start purchasing VTSAX again. If I did VFIAX I could sell some VTIAX as well to get to 3K in losses. I would be at 67%/17% US/Int. I could then start buying VTSAX And VTIAX in a month. I would also look to sell VFIAX and be back in VTSAX/VTIAX soonish (but with constant 401k contributions I would need at least a slight gain). Any thoughts? I can't do any of this until the 27th and I don't want to screw it up. I will most likely be in the 25% bracket.

|

|

|

|

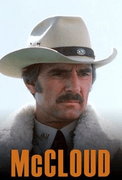

McCloud posted:Hi. Hi. Your statement that you know timing the markets is folly, is in direct competition with your statement that you went to cash in 2014, and your idea that now is a good time to buy into the market because there's been a crash. Both of those decisions are market-timing decisions. And the first one probably cost you money - we have not yet fallen back to the point the market was at in 2014, even with the latest massive drops! If you'd left your money in the market then, you'd still be ahead today. My suggestion is to check out the reading material in the OP and peruse one or two of the top picks. Then: for a medium-term medium-risk investment horizon, you'll need to figure out what your risk tolerance really is. I doubt anyone in this thread will suggest picking individual stocks, but a plan that includes some exposure to stocks via index funds might make sense. Most likely by the time you're a handful of years away from when you want cash, you'd need to be entirely or nearly entirely in cash to preserve that cash, unless you're flexibile (on the order of years) on when you want the cash.

|

|

|

|

spwrozek posted:Planning on harvesting some losses next week once I am able to avoid the wash sale. I just want to make sure that people generally agree these are not substantially the same: "Substantially identical" is the wording of the wash sale rule, and "identical" is a high bar to meet. So I wouldn't worry about it unless you're, for example, trading VTSAX for VTI, since they're literally different share classes of the same fund. VTSAX and VFIAX are absolutely not identical despite their very similar performance, same with VTIAX and VDIPX (VDIPX does at a glance appear to be identical to VTMGX, though, different share classes of the same fund). There has never been a ruling from the IRS about whether the wash sale rule even applies to 401k accounts (although there has been for IRAs, apparently), so odds are you can just ignore whatever's in your 401k when figuring out wash sale stuff. However, I'm not sure I'm fully understanding your planned trades. Trading VTSAX to VFIAX seems reasonable to me, they have a very close correlation with each other. Trading VTSAX to VTIAX does not make sense to me as this could dramatically alter your domestic/international asset allocation. I would give further feedback if you clarify your current holdings and intended holdings.

|

|

|

|

Kylaer posted:"Substantially identical" is the wording of the wash sale rule, and "identical" is a high bar to meet. So I wouldn't worry about it unless you're, for example, trading VTSAX for VTI, since they're literally different share classes of the same fund. VTSAX and VFIAX are absolutely not identical despite their very similar performance, same with VTIAX and VDIPX (VDIPX does at a glance appear to be identical to VTMGX, though, different share classes of the same fund). There has never been a ruling from the IRS about whether the wash sale rule even applies to 401k accounts (although there has been for IRAs, apparently), so odds are you can just ignore whatever's in your 401k when figuring out wash sale stuff. Thanks on the first part, that was my reading of everything on the net but wanted the sanity check. Yes I was not very clear on my allocations. Here is my current allocation percentage: US Stock - 67.2% INT Stock - 17.5% US Bond - 9.3% INT Bond - 1.3% Cash - 1.1% Alternatives - 3.6% If I go with the VFIAX it basically stays the same, maybe a small uptick in US stock if I see some international stock. If I go with VTIAX my allocation ends up at about : US Stock - 56% INT Stock - 28% US Bond - 9.3% INT Bond - 1.3% Cash - 1.1% Alternatives - 3.6% I don't think it is bad per say but I would say a bit heavier in international stock than I would like. I think around 20% international and 65% US is where I want to be based on being 33 and a long way from retirement. Maybe I answered my own question and should go with VFIAX and keep buying international to get my rebalance where I would like it. If you have more though let me know.

|

|

|

|

What exactly are you trying to sell? Is your 67.2% U.S stock all VTSAX? Are you intending to sell all of it?

|

|

|

|

Kylaer posted:What exactly are you trying to sell? Is your 67.2% U.S stock all VTSAX? Are you intending to sell all of it? In my taxable account I have VTSAX (about $20K) and VTIAX (about $10K). My Roth IRA is 2060 target fund. My HSA is VFIAX. My 401k is S&P500, mid cap, and small cap (all with vanguard). I intend to sell my VTSAX in my taxable account. If I sell it all it is about 15% of my US stock holding. currently it is about $2600 in losses. I started my taxable in 2018 as a supplement to my retirement since I have no more tax advantaged space. So yeah, all lots in the red but all the money in it is for use in about 20 years if I retire early, 30 if I don't. Seems like the best thing is to just sell and buy VFIAX assuming things haven't changed much in a week.

|

|

|

|

That seems like a perfectly reasonable plan, VTSAX to VFIAX is a good conversion choice.

|

|

|

|

Need some talking off the ledge. Have my 401k and Roths invested in Vanguard targeted retirement funds (age appropriate). I'm fighting the urge to convert to straight money market or something similarly low-risk. This should be a "stay the course", right?

|

|

|

|

Yes. Don’t be the moron that buys high and sells low.

|

|

|

|

Crackbone posted:Need some talking off the ledge.

|

|

|

|

Leperflesh posted:

Just look at how sexy DCA and having something to rebalance into looks in those equity dips

|

|

|

|

withak posted:Yes. Don’t be the moron that buys high and sells low. To add to this, don't change your retirement plan before it's finished because of short-term market performance. There is no 35-year period in American history that doesn't also include at least one major drop.

|

|

|

|

Crackbone posted:Need some talking off the ledge. When would you know when to get back in the market exactly? Would you be monitoring the market hourly for the next year to make sure you get back in at the right time?

|

|

|

|

Crackbone posted:Need some talking off the ledge. The best part about target date funds is that you literally pay people smarter than you and hopefully with a steadier hand to make these decisions for you. Let them.

|

|

|

|

H110Hawk posted:The best part about target date funds is that you literally pay people smarter than you and hopefully with a steadier hand to make these decisions for you. Let them. well no, they're funds-of-funds and the underlying funds are index funds, which are in turn pegged to their index; the beauty here is that human decision-making is removed from the process. That's fundamentally the advantage, because people suck at this.

|

|

|

|

Leperflesh posted:the beauty here is that human decision-making is removed from the process Everything other than asset allocation - which was pre-planned from the beginning and not subject to market forces and emotions.

|

|

|

|

Motronic posted:Everything other than asset allocation - which was pre-planned from the beginning and not subject to market forces and emotions. Yup, and since they're offered in multiple target dates, each of which follows a particular allocation path, it's you who chooses your balance really when you choose which target date(s) to buy, not some fund manager.

|

|

|

|

moana posted:Yeah, this is my feeling right now, after the past couple weeks I realize I don't care about volatility or losing money nearly as much as I thought I would. I'm selling off my bonds in chunks as we go, hopefully able to buy all the way to the bottom. I guess I should have been at a more aggressive allocation all along but my first crash was 2008 when I had all of maybe 10k invested so I wasn't sure how I would react to something like this.

|

|

|

|

This too is my first crash. I started investing for real in February 2020. Should've warned you guys.

|

|

|

|

I created a Vanguard brokerage account in February and jumped into an index fund right at the end of the month. Currently down 28% on the position and it's frustrating, but anything other than sticking to the plan seems like a panic response. If I had started sooner and been in the market deeper I might feel differently.

|

|

|

|

Gazpacho posted:I created a Vanguard brokerage account in February and jumped into an index fund right at the end of the month. Currently down 28% on the position and it's frustrating, but anything other than sticking to the plan seems like a panic response. If I had started sooner and been in the market deeper I might feel differently. You'd actually have a green number and instead of being +400% you'd be I think +328% and that is much easier to look at and go oh I'm fine. Stick with it, but it gets better mentally. If you are sitting at -28% and fine you are probably good with your risk tolerance and wont do anything stupid. Stick with the plan.

|

|

|

|

I have been putting money into my Roth account for years, never really did anything with it except add to it. Finally decided to start investing Jan 2019. I officially have less than what i put in total over all the years. Started my kids 529 last summer and contributed Jan 1st as well. That's down even more than what I put in. You are not alone. At least I have 25 years and my kid has 15 years for it to bounce back somewhat.

|

|

|

|

Ignoring reinvested dividends and employer contributions I am in the red on every account. But I am a robot as well so I am not really worried. I started investing in '09 but really didn't have the income/lack of student loans to go full in until 2014. I am just staying the course and believe it will all work out on my timeline.

|

|

|

|

I just don't know what to think right now. I'm 32 and have a pretty significant chunk of change in investments. I got hit pretty hard in 08 and I'm getting hit hard again now. I don't want to retire or anything, so I'm planning on sticking in for another 20 years or so. Work full time, good income for where I live and happy with what I do for a living. This poo poo sucks. I need to stop looking at my accounts and marketwatch and such. I have money with cfp who works for wells fargo. Some of it is in their tracked funds and some of it is privately managed by her for a lower percentage. This poo poo just fuckin sucks. Anyone else in a similar boat? For what it's worth I'm down about 15% right now on paper across my accounts.

|

|

|

|

vandalism posted:I just don't know what to think right now. I'm 32 and have a pretty significant chunk of change in investments. I got hit pretty hard in 08 and I'm getting hit hard again now. I don't want to retire or anything, so I'm planning on sticking in for another 20 years or so. Work full time, good income for where I live and happy with what I do for a living. This poo poo sucks. I need to stop looking at my accounts and marketwatch and such. I have money with cfp who works for wells fargo. Some of it is in their tracked funds and some of it is privately managed by her for a lower percentage. This poo poo just fuckin sucks. Down from what, the peak? Who cares? It doesn't matter. You aren't taking the money out and aren't using it. If anything you weekly or monthly contribution is now worth more. Just ignore it and keep plugging away. That's my attitude at least. I'm 31.

|

|

|

|

|

| # ? May 18, 2024 02:12 |

|

Why would you pay a wells fargo analyst a fee to put you into not-index-funds? Why would you bother with wells-fargo index funds when vanguard and fidelity funds track the same indexes for cheaper? But aside from that, if you had money int he market in 2008, and kept it there, you maid gains that you absolutely haven't given up yet despite the current crash. We're nowhere near bottom-of-2008 levels and are unlikely to get there. Holding steady from them to now was the right move and it continues to probably be the right move. There's some risk that it's not, but the risk is small.

|

|

|