|

Nitrousoxide posted:Current photovoltaics are designed to operate from around 400 nanometers to 1000 nm. That is in the visible light spectrum and a small amount of infrared, and that short range of wavelengths is half of the light energy that reaches the ground. This is fine but also a completely different point

|

|

|

|

|

| # ? May 20, 2024 01:26 |

|

Germany is doubling down on their Nuclear closure and renewables.... ...by building a Natural Gas plant in the parking lot of a closed nuclear plant https://twitter.com/CommieGIR/status/1328421273664360449?s=20

|

|

|

|

France gonna France:

|

|

|

|

MomJeans420 posted:France gonna France: France is doing fine. Ironically, its Germany pressuring France to shutter nuclear plants and replace them with an energy source France long pushed out: Coal.

|

|

|

|

Not in terms of CO2 emissions but in terms of encouraging business investment in your country.

|

|

|

|

MomJeans420 posted:Not in terms of CO2 emissions but in terms of encouraging business investment in your country. Business investment is always going to go the cheap route and that's a PROBLEM, and its why France is probably a better model, again. Overall, France's CO2 emissions are lower and they are further along addressing their emissions than Germany is.

|

|

|

|

https://twitter.com/CarbonBubble/status/1065617560006213635?s=20

|

|

|

|

MomJeans420 posted:Not in terms of CO2 emissions but in terms of encouraging business investment in your country. Am I wrong to think that the energy contractors grossly overbid these projects and then treated the savings as a windfall? Isn't this just the senate trimming the fat?

|

|

|

|

More likely solar costs fell more than expected during that time frame, but I wouldn't think it would be necessary to explain to this thread why the government unilaterally defaulting on existing contracts is a bad thing. Maybe their business models relied on that cash flow to finance another solar project they bid at a low price because they didn't have to be as concerned at making a profit on it. Think of it from the company's point of view - you bid on a government contract to build a solar plant for a fixed price. Many things can go wrong so you need to build a buffer into the price (and profits), but if you make your bid too high you won't get selected. If there are massive cost overruns that aren't covered by some exception, your company now has to eat the difference and may lose money on the project as a whole. If you are competent company with lots of experience, this should theoretically let you be efficient and have fewer problems, letting you bid lower but still make a profit. Maybe you hit it out of the ballpark on this project and make more money than expected. Unfortunately your next project has multiple delays and you take a huge loss. If you're not going to be saved by the government in the latter situation, why should you be penalized in the former?

|

|

|

|

A very interesting analysis was published about the drivers of cost increases in nuclear plants. Article in Joule: http://dx.doi.org/10.1016/j.joule.2020.10.001 (check scihub for free access) Ars writeup: https://arstechnica.com/science/2020/11/why-are-nuclear-plants-so-expensive-safetys-only-part-of-the-story/ Joule Abstract posted:Nuclear plant costs in the US have repeatedly exceeded projections. Here, we use data covering 5 decades and bottom-up cost modeling to identify the mechanisms behind this divergence. We observe that nth-of-a-kind plants have been more, not less, expensive than first-of-a-kind plants. “Soft” factors external to standardized reactor hardware, such as labor supervision, contributed over half of the cost rise from 1976 to 1987. Relatedly, containment building costs more than doubled from 1976 to 2017, due only in part to safety regulations. Labor productivity in recent plants is up to 13 times lower than industry expectations. Our results point to a gap between expected and realized costs stemming from low resilience to time- and site-dependent construction conditions. Prospective models suggest reducing commodity usage and automating construction to increase resilience. More generally, rethinking engineering design to relate design variables to cost change mechanisms could help deliver real-world cost reductions for technologies with demanding construction requirements. Ars posted:The analysis, done by a team of researchers at MIT, is remarkably comprehensive. For many nuclear plants, they have detailed construction records, broken out by which building different materials and labor went to, and how much each of them cost. There's also a detailed record of safety regulations and when they were instituted relative to construction. Finally, they've also brought in the patent applications filed by the companies who designed the reactors. The documents describe the motivations for design changes and the problems those changes were intended to solve. Nuclear generation stations actually being more expensive to build more of the same design instead of cheaper and construction costs accounting for 70% of the increase in costs are the two big conclusions that stick out to me. Those conclusions track with projects like Vogtle where there have been massive construction related delays.

|

|

|

|

https://twitter.com/sciam/status/1330988708204568577?s=20

|

|

|

|

How the hell does it still make financial sense to still drill in ANWR with oil prices this low? For those who aren't aware, the Trump Administration is trying to quickly sell oil leases before Biden takes over. But my question is... who is buying and why?

|

|

|

|

Probably buy now and hold til later strategy.

|

|

|

|

Dameius posted:Probably buy now and hold til later strategy. That make sense if we weren't forecasting peak oil in the next few years. Unless this type oil is easier to drill for vs. others.

|

|

|

|

Gabriel S. posted:That make sense if we weren't forecasting peak oil in the next few years. We've been forecasting peak oil in the next few years for over 100 years.

|

|

|

|

peak oil was 2 - 15 years ago depending on how nitpicky you get in defining 'oil' ANWR is much much easier to drill than deep sea, and much cheaper to produce than either fracking or tar sands. Its a juicy prize.

|

|

|

|

Gabriel S. posted:How the hell does it still make financial sense to still drill in ANWR with oil prices this low? For those who aren't aware, the Trump Administration is trying to quickly sell oil leases before Biden takes over. Btw, there are already signs of a recovery in energy and most likely in 2021/2022 you will see an upward swing in prices as the vaccines are applied and that the lag in investment in recent years (especially 2020) causes a supply constriction. This will eventually equalize as more production comes back online. That land is worth something.

|

|

|

Phanatic posted:We've been forecasting peak oil in the next few years for over 100 years. Peak oil is your toothpaste tube still producing toothpaste somehow even though you thought it was about to be empty 3 days ago.

|

|

|

|

|

Phanatic posted:We've been forecasting peak oil in the next few years for over 100 years. Who's we? Equinor just revised their latest estimates for peak oil in 2027.

|

|

|

|

not that i expect them to really bother, but are there powers to be used by a biden administration that could claw back that sort of fire sale leasing

|

|

|

|

Gabriel S. posted:Who's we? The oil and gas industry, prominent petroleum geologists, the US Department of Energy, among others.

|

|

|

|

mediaphage posted:not that i expect them to really bother, but are there powers to be used by a biden administration that could claw back that sort of fire sale leasing Executive order to expand natural preservations

|

|

|

|

Phanatic posted:The oil and gas industry, prominent petroleum geologists, the US Department of Energy, among others. Well, I don't know what they said but when Saudi Aramco is using the term "peak oil" in their presentations to investors it's not a joke. Nearly every oil company is showing the peak in less than a decade and this is a new development.

|

|

|

|

Gabriel S. posted:Well, I don't know what they said but when Saudi Aramco is using the term "peak oil" in their presentations to investors it's not a joke. Nearly every oil company is showing the peak in less than a decade and this is a new development. Well, it's gonna happen eventually, so this time they may of course be right , but the predictions of the peak being in "the next few years" have been pretty consistent across the timeline where humanity has been exploiting oil reserves. Let's go back to where this started. You asked how it makes sense to drill in ANWR with prices so low. Someone suggested that producers are buying the leases now to hold them for later exploitation. You say *that* doesn't make sense because peak oil is forecast to be right around the bend, and the producers are effectively unanimous in that forecast for the first time. So let's assume that peak oil is in fact just a few years away. 1. Producers think peak oil is coming in a few years and are buying leases in ANWR, even though current prices are very low. 2. Producers don't think peak oil is coming in a few years, and are buying leases in ANWR, even though current prices are very low. In the first case, why doesn't it make sense that they'd buy the lease now, and then only drill and produce oil in a few years once the price goes higher?

|

|

|

|

Phanatic posted:Well, it's gonna happen eventually, so this time they may of course be right , but the predictions of the peak being in "the next few years" have been pretty consistent across the timeline where humanity has been exploiting oil reserves. Of course, it's going to happen but that isn't the point. I would like to see credible forecasts - not predictions - that have continually showed peak oil. It sounds like watered down headlines. Citation needed. Phanatic posted:In the first case, why doesn't it make sense that they'd buy the lease now, and then only drill and produce oil in a few years once the price goes higher? My theory is that demand has taken such a significant hit that even with the geology of the area it's still uneconomical to drill. What's even more interesting is that oil producing countries like Saudi Arabia will be lowering their own prices in the future at lower margins which will complicate things even further. Their economy is dependent oil and they're going to keep that going as long as possible. Going further, I doubt the people doing the sales aspect of this need to care. Once the deal is signed, they get paid. Anything else is just details. And drilling operations aren't something that happen over a year or two. It's five or even a decade or more.

|

|

|

|

cool "theory"

|

|

|

|

Gabriel S. posted:Of course, it's going to happen but that isn't the point. I would like to see credible forecasts - not predictions - that have continually showed peak oil. It sounds like watered down headlines. Citation needed. I'm not sure what distinction you're making between "forecast" and "prediction" but contemporaneously credible experts have been predicting peak oil for as long as we have been producing oil . https://books.google.com/books?id=O...eers%2C&f=false Transactions of the Society of Automotive Engineers, Volume 14, Part 1, paper from the head geologist of the USGS: quote:How long the commercial production of natural petroleum will continue in this country is a question whose answer is no less speculative than the quantitative estimates. After the production peak is passed, be it 1 year or 5 ,the annual output of natural oil will decline gradually for a long time...the most significant feature of the prospect, however, is the probability that, although an estimated two-thirds of our reserve is still in the ground, with an annual drain of one-third of a billion barrels, the peak of production will soon be passed, possibly within three years. The date when the peak will be reached is a matter of individual opinion, in which predictions have wide range. There are many well-informed geologists and engineers who believe the peak in the production of natural petroleum in this country will be reached by 1921 and who present impressive evidence that it may come even before 1920. The USGS predicted in a bulletin (Bulletin 394:Papers on the conservation of mineral resources (reprinted from report of the National Conservation Commission, February, 1909) in 1909 that we'd run out of petroleum by 1939, natural gas by 1924, and coal by the middle of the 21st century. Hubbert predicted in 1957 that US production would peak in 10-15 years. The Hubbert Curve was basically the ur-prediction that all refinements/adjustments were based around for the next decades. World crude production in 2019 was about 30 billion barrels, Hubbert predicted that would peak at 12.5 billion barrels around roughly 2000, it hit that production value in 1967. In 1974 he predicted that it would peak in 1995. Phanatic fucked around with this message at 20:06 on Nov 25, 2020 |

|

|

|

MightyBigMinus posted:cool "theory" I guess? I mean, I'm putting it out there purposefully for it to be criticized. I'm finding it difficult to grasp that it's still economically viable to drill in Alaska while you have headlines like Exxon internally cut oil prices estimates and predicts the recession to hang on energy prices for the next decade. Not to mention - everything else. Phanatic posted:I'm not sure what distinction you're making between "forecast" and "prediction" but contemporaneously credible experts have been predicting peak oil for as long as we have been producing oil . drat. Good point. I wonder what those would have thought about modern drilling technology.

|

|

|

|

Gabriel S. posted:I mean, I'm putting it out there purposefully for it to be criticized. I'm finding it difficult to grasp that it's still economically viable to drill in Alaska while you have headlines like Exxon internally cut oil prices estimates and predicts the recession to hang on energy prices for the next decade. Not to mention - everything else. Even the north slope is almost certainly cheaper than offshore drilling. Offshore is just a whole ‘nother world of cost. Also, oil companies are playing a longer game than just about anyone else, particularly the government. Having those leases in their back pocket six years from now when some OPEC country gets terror bombed and cuts production and oil bounces back to $200/bbl could make them a lot of money.

|

|

|

|

MrYenko posted:Even the north slope is almost certainly cheaper than offshore drilling. Offshore is just a whole ‘nother world of cost. Also, oil companies are playing a longer game than just about anyone else, particularly the government. Having those leases in their back pocket six years from now when some OPEC country gets terror bombed and cuts production and oil bounces back to $200/bbl could make them a lot of money. Ah hah! Why is the North Slope cheaper? How does the geology here compare to say Saudi Arabi's?

|

|

|

|

The problem is most people assume peak oil to be literally the amount of oil left in the ground, but you should really think of it as the amount of oil remaining for which recovery is economically viable. As oil prices rise, more oil becomes recoverable. You also have to factor in politics - Los Angeles has a ton of oil beneath it, a lot of it under very expensive real estate (Beverly Hills, for example). If oil is cheap and available, you'll see more pushes to restrict local drilling and just import Saudi oil because out of sight, out of mind. Get oil over $100/barrel or something like the Arab oil embargo and those concerns will diminish.

|

|

|

|

Gabriel S. posted:Ah hah! No idea. I’d imagine it’s more expensive than Saudi Arabia just due to labor costs, since slavery is illegal in the US.

|

|

|

|

MrYenko posted:No idea. I’d imagine it’s more expensive than Saudi Arabia just due to labor costs, since slavery is illegal in the US. Not if we were to put prisoners to work in oil extraction!

|

|

|

|

MrYenko posted:No idea. I’d imagine it’s more expensive than Saudi Arabia just due to labor costs, since slavery is illegal in the US. I've got news for you  Offshore is silly expensive, though. Almost any oil extraction on dry land will be cheaper, except maybe tar sand poo poo, though I don't remember the exact figures on that and might well be wrong.

|

|

|

|

Considering that oil prices are already starting to recover just on vaccine news, I think hoping that oil will disappear...is a bit wishful. Those arctic lands will probably be profitable to whoever holds them.

|

|

|

|

MrYenko posted:No idea. I’d imagine it’s more expensive than Saudi Arabia just due to labor costs, since slavery is illegal in the US. Heh. From my understanding, the geology of Saudi Arabia is incredibly unique and they've got an advantage that they have a higher quality oil and it's much easier to extract. As for labor rights, I suspect that's true as well.

|

|

|

|

You also have to keep in mind the Saudis can just turn on the taps to produce more oil, and their current lifting costs are $3 per barrel (how much it costs them to produce a barrel after the wells have been drilled and the fields have been developed). They need oil at something like $80 per barrel to balance their national budget, but they're producing at a profit at pretty much any price. It hugely varies for other parts of the world, but $30 to $50 per barrel would cover a lot of the production, and even higher for a lot of the shale. Keep in mind this is costs AFTER the cost to develop the field, which can be expensive once you run 3D seismic surveys, drill wells, and pay for all the people/vendors. Mischievous Mink posted:Not if we were to put prisoners to work in oil extraction! Kamala is a huge fan of prison labor, but she'll put them to work mining lithium

|

|

|

|

Isn't that... almost like a bad thing? It sounds like they'll just keep slowly dropping prices to remain competitive with green energy and flood the market with cheap oil. Also, This is a pretty decent article, I hope they're right. The Peak Oil Era Is Suddenly Upon Us

|

|

|

|

Reminds me of a statement about oil I heard I think some 20 years ago - The stone age did not end because we ran out of stones.

|

|

|

|

|

| # ? May 20, 2024 01:26 |

|

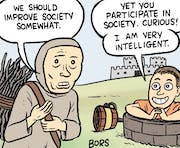

As long as we are appealing to the "cheapness" of energy, we'll never escape fossil fuels.

|

|

|