|

literally this big posted:It's probably a loss-leader for them. Get you in to FZROX for free and then get you to 'diversify'/over-weight certain sectors a bit with some of their other funds. It also allows them to say that they're special by offering a 0ER fund. They don't exactly match the standard indices to avoid paying the fees to do so and they tend to have a lower number of holdings. There also was a minor issue that the total AUM was low which can cause a minor drag though this might have changed. None of these are necessarily deal breakers, but given that ERs for the standard choices are 0.015% - 0.05% it's probably a wash. I hold FZILX because the comparible fund both seemed to perform worse and had a higher ER, but it does have like half the holdings and that could easily be a short term artifact given that it doesn't have a long term track record. asur fucked around with this message at 00:58 on Jan 10, 2021 |

|

|

|

|

| # ? Jun 6, 2024 02:10 |

|

It's not my first criterion, but "will this fund still exist in 30 years" is somewhere on my list. Not sure 0% fee funds are sustainable on that scale, though I guess they could add a fee later if they become unwilling to eat the expense?

|

|

|

|

Assuming these 0ER funds are broker issued and contain *only* high volume stocks that are otherwise traded on the platform it's possible they cost next to nothing or they may still break even in some way. Like when the fund needs to buy or sell they just capture some of the retail (?) trades going on in their platform anyway and so run essentially zero transaction costs, or they even earn fees on the trades. The fund i'm familiar with here in sweden works like this. That one has been around for ages. As said earlier though they will probably perform worse than a proper all stock fund due to low diversification ratio as they only do high volume stocks. Threadkiller Dog fucked around with this message at 10:43 on Jan 10, 2021 |

|

|

|

So my husband just started a new job, and we're moving the 401k over to the new company, but honestly we're going to have to keep about 3k of it (we've both been unemployed since June) as an emergency cushion since his new job covers exactly everything assuming nothing bad ever happens...mostly. Is there a way to do that without taking a tax penalty on anything but the 3k?

|

|

|

|

Guildenstern Mother posted:So my husband just started a new job, and we're moving the 401k over to the new company, but honestly we're going to have to keep about 3k of it (we've both been unemployed since June) as an emergency cushion since his new job covers exactly everything assuming nothing bad ever happens...mostly. Is there a way to do that without taking a tax penalty on anything but the 3k? Unfortunately, I believe that the penalty-free withdrawal option under the Cares Act expired at the end of 2020. If we're talking about an emergency fund. Best option is probably to put it on a credit card and then pay it off after his first paycheck. Can you open an interest-free credit card for the move and only use it for true emergencies? Even letting interest accrue for 1 billing cycle would likely be better than taking the tax+penalty (and lost earnings potential) on the 401k money. Do you have a Roth IRA? You can withdraw your contributions from a Roth IRA penalty and tax free. The penalty for withdrawing early from a 401(k) is 10% which is in addition to any taxes you would have to pay on that money if it is a traditional account. So if you withdraw $3,000 you could be on the hook for over $1,000. If you do it, do it only because there are no other options. I get it. Starting a new job, especially without any savings, is really really hard. Make sure you know exactly when his first paycheck will be deposited. Try have a good idea of exactly how much the net pay will be and try to figure how much you will have to spend those first few months.

|

|

|

|

And skip the 401k+ira contributions if you are making them. Build your cushion. At maximum do the matched amount.

|

|

|

|

laxbro posted:Unfortunately, I believe that the penalty-free withdrawal option under the Cares Act expired at the end of 2020. Its less about the paycheck not hitting, he's already 2 in, its that he had to take a 15k pay cut, and I'm still unemployed. Its almost enough to live on, so we'll need the 3k for random expenses that we just don't have the money for at the moment. We're not going to be homeless certainly, nothings going to get repossessed, but I'm 100% sure that we'll have to pull out 2-300 a month from it, especially starting in March when health insurance takes a big chunk of his pay if I'm not employed by then. Savings are pretty much gone at this point aside from that. Anything we could have pulled out tax free at this point has been done. I think we're just going to have to take the hit on it and once I get a job (fingers crossed on this one) or he finds another (still looking) go hard on IRAs, which will be easier since we've gotten used to living broke rear end lifestyle anyways. Sucks we just barely missed the withdrawal window.

|

|

|

|

First off - Iím sorry youíre in this situation. I know itís scary, and I can tell youíre really trying to exhaust all options. If you told me that you are good at not carrying debt and good at paying it off timely... I would second what the poster said above - donít steal from your future selves, instead, get a 0% APR card for 12-18 months as a bridge. Put only the bare essentials on the card, and once you both get your heads above water, follow the chart below which involves building a $1000 emergency savings, then getting employer match, then paying off high interest cards (note: the card with 0% interest is only high interest once the APR runs out...), then getting savings back up to 3-6 months, etc., etc.

|

|

|

|

I'm curious, what would people consider "a conservative mix of stock and bonds" for the last box?

|

|

|

|

Guildenstern Mother posted:Its less about the paycheck not hitting, he's already 2 in, its that he had to take a 15k pay cut, and I'm still unemployed. Its almost enough to live on, so we'll need the 3k for random expenses that we just don't have the money for at the moment. We're not going to be homeless certainly, nothings going to get repossessed, but I'm 100% sure that we'll have to pull out 2-300 a month from it, especially starting in March when health insurance takes a big chunk of his pay if I'm not employed by then. Savings are pretty much gone at this point aside from that. Anything we could have pulled out tax free at this point has been done. I think we're just going to have to take the hit on it and once I get a job (fingers crossed on this one) or he finds another (still looking) go hard on IRAs, which will be easier since we've gotten used to living broke rear end lifestyle anyways. Sucks we just barely missed the withdrawal window. Then you have to cut expenses. You guys are spending more than you earn. Beans and rice. Cheap housing. Consider getting rid of the car if possible. Iíve been there and Iím sure lots of other BFC people have been too. If things are dire then of course tap the 401k but in that case also look into food banks and other govt/nonprofit assistance programs.

|

|

|

|

laxbro posted:Then you have to cut expenses. You guys are spending more than you earn. Beans and rice. Cheap housing. Consider getting rid of the car if possible. Iíve been there and Iím sure lots of other BFC people have been too. ďAssuming you guys are already down to the rice and beans / PB+J diet and all non-criticism expenses are cut...Ē But yes, good point. If youíre actually that bad that youíre willing to steal from your future selves and pay a penalty, then you better be living the most minimum life possible.

|

|

|

|

Small White Dragon posted:I'm curious, what would people consider "a conservative mix of stock and bonds" for the last box?

|

|

|

|

I'm not sure if people are literally saying to go on beans and rice diet but don't do that. Buy whole chickens and broccoli. It's boring but nutritious.

|

|

|

|

I mean, DO buy rice and beans, but only insofar as that they are a cheap option to meet your dietary needs for their category.

|

|

|

|

Goons really can make any thread about food.

|

|

|

|

lol I just made a pot of beans last night, even saved the bean broth for soup. One nice thing about being unemployed is I can use the time to be frugal with food, and fortunately I already have giant amounts of bulk spices, so cheap ingredients can be made to taste amazing easily. We'll figure it out, it was more a question of whether we could use a bit of the IRA to float the emergency expenses like the car keys deciding not to work last week without taking the tax hit.

|

|

|

|

GoGoGadgetChris posted:Employers like to have life insurance policies on their employees not because they have a revenue center of Killing You, but because they will experience financial loss if you croak A (well off) relative of mine had a non-profit she supported take out a life insurance policy in her name (which she paid for.) I thought it was a pretty ingenious fundraising strategy.

|

|

|

|

laxbro posted:Beans and rice. Also, pro-tip: Restaurant Supply ^^Classy 'Old Poor' trick. Examples from my local:

|

|

|

|

I only recently found out you can shave a cabbage with a veggie peeler and have perfect coleslaw-esque shredded cabbage. Don't buy pre shredded anything ever. Even if you're rich.

|

|

|

|

Accretionist posted:Also, pro-tip: Restaurant Supply I felt this post in my bones.

|

|

|

|

UncleGuito posted:I'm in the process of executing a reverse rollover of a traditional IRA (Vanguard) into my employer sponsored 401K, because as I understand it, I'm not able to conduct a backdoor roth IRA conversion if I hold any funds in traditional IRAs. Bump just in case anyone has any insight here - thanks!

|

|

|

|

UncleGuito posted:Bump just in case anyone has any insight here - thanks!

|

|

|

|

UncleGuito posted:I'm in the process of executing a reverse rollover of a traditional IRA (Vanguard) into my employer sponsored 401K, because as I understand it, I'm not able to conduct a backdoor roth IRA conversion if I hold any funds in traditional IRAs. It's not so much that you can't do a backdoor Roth, it's that the appeal is less because the IRS apportionment rule means some of your conversion will be taxable. Since your new 401k lets you do a reverse rollover, that's clearly the way to go. UncleGuito posted:My employer 401K is also with Vanguard and they said they allow it but I'm still confused on a few things. There's such a thing as non-deductible traditional IRA contributions - they're after tax money sitting in a traditional IRA. They're step 1 of the backdoor Roth contribution, so you will be making these in the future and need to keep track of them. It does not sound like you currently have any non-deductible contributions. You've never filed form 8606 with your taxes and in 2019 and 2020 you took the tax deduction for those contributions you made? The old 401k was similarly all pre-tax contributions, right? You never made after-tax (but non-Roth) contributions to that plan?

|

|

|

|

Residency Evil posted:Is there a better way of funding a backdoor Roth than transferring the money over from my bank account? I funded the IRAs on 1/1 and it looks like the funds won't actually be available for Roth converting until 1/11, which I'll surely forget. Should next year should I just transfer the cash to my brokerage account ahead of 1/1?  Hey Residency Evil don't forget to to hit the convert button today. Hey Residency Evil don't forget to to hit the convert button today.

|

|

|

|

withak posted:

For some weird dumb reason, Vanguard let me convert to Roth/buy funds using the money last week, even though they weren't listed as "available" until today. But thank you.

|

|

|

|

spf3million posted:My understanding is the same as yours. You should be able to roll all of your pre-tax dollars from your traditional IRA into your 401k (assuming your work's plan allows for it which it sounds like it does). The traditional IRA contributions you've made since the initial rollover from previous 401k (the $600 or so) should also be eligible for rollover to your new 401k. Maybe ask whoever indicated that some funds were ineligible for an itemized breakdown? It's not clear why some would be eligible and some not. SlapActionJackson posted:It's not so much that you can't do a backdoor Roth, it's that the appeal is less because the IRS apportionment rule means some of your conversion will be taxable. Thanks! My MAGI is over 75K so it sounds like anything I put into the traditional that didn't get rolled into a roth was a nondeductible contribution? The old 401K that rolled into the traditional IRA was split between traditional and roth contributions. Edit: just took a look at my 2018 and 2019 returns and I think I messed something up once my MAGI exceeded the roth contirbution threshold (I didn't know about backdoor conversions until recently). Looks like I contributed the full $5500 to the traditional IRA in 2018 but not really following what my CPA filed for 2019. I don't remember doing a rollover but my return seems to imply that? Here are two screens of the relevant 8606 sections: 2019: https://i.imgur.com/ICtv8p8.png 2018: https://i.imgur.com/8k720Qd.png Regardless, looks like I do have nondeductible contributions that I won't be able to reverse rollover? If that's the case, I'm not sure how I'm supposed to do a backdoor roth if those 2018 contributions are still in the traditional IRA. UncleGuito fucked around with this message at 18:20 on Jan 11, 2021 |

|

|

|

UncleGuito posted:Thanks! My MAGI is over 75K so it sounds like the $600 was a nondeductible contribution? Looks like I put in $600 for both 2019 and 2020 but will have to see if my CPA submitted any 8606 forms. Yeah, if you're single, MAGI > $75k and you had access to a 401k in '19 and '20, then those $600 contributions are non-deductible and your CPA should've filed 8606. I'm not sure what the rules are for reverse-rollovers with mixed-deductibility like this. Can they just take the deductible portion and leave the non-deductible assets behind? Hopefully Vanguard/ your CPA knows. This could get complicated. UncleGuito posted:The old 401K that rolled into the traditional IRA was split between traditional and roth contributions. But the Roth part of your old 401k ended up in a Roth rollover IRA, not the one your are trying to move into your new 401k, right?

|

|

|

|

SlapActionJackson posted:Yeah, if you're single, MAGI > $75k and you had access to a 401k in '19 and '20, then those $600 contributions are non-deductible and your CPA should've filed 8606. Yeah - the old 401k was split properly between traditional & Roth IRA. I edited my above post after doing some digging in my old returns. Seems like I did the full $5500 contribution to the traditional IRA In 2018 without doing any backdoors (didn't know at the time). Sounds like the proper way of doing this is reverse rolling over the entire traditional IRA balance minus the $5500 to my 401k, then doing a backdoor roth on the $5500 from 2018 (plus anything I want to backdoor for 2021)? Here's the prior year 8606's: 2019: https://i.imgur.com/ICtv8p8.png 2018: https://i.imgur.com/8k720Qd.png UncleGuito fucked around with this message at 23:13 on Jan 11, 2021 |

|

|

|

Yeah, that 2019 8606 implies that 1. You did a Roth conversion of $5424 in 2019 2. You didn't have any rollover IRA at all. (Maybe statement 7 sheds some light on WTF is going on there?) I think at this point you need to ask your CPA what the hell is going on with those accounts.

|

|

|

|

SlapActionJackson posted:Yeah, that 2019 8606 implies that Thanks! Figured something was fishy lol. I moved and got a new local CPA for this year - the guy who did it last year has been really slow to respond, probably since I'm not paying him this year. Here's the 2019 statement 7, if anyone's able to understand it. Section 15 on the 8606 is all empty, but line 16 also says $5424 ("If you completed Part I, enter the amount from line 8. Otherwise, enter the net amount you converted from traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2019") https://imgur.com/a/P5w0j1Z I guess what I just need to confirm, based on the above, is if $5500 is the total nondeductible amount, or whether it's $10,924. UncleGuito fucked around with this message at 23:18 on Jan 11, 2021 |

|

|

|

Guildenstern Mother posted:lol I just made a pot of beans last night, even saved the bean broth for soup. One nice thing about being unemployed is I can use the time to be frugal with food, and fortunately I already have giant amounts of bulk spices, so cheap ingredients can be made to taste amazing easily. We'll figure it out, it was more a question of whether we could use a bit of the IRA to float the emergency expenses like the car keys deciding not to work last week without taking the tax hit. So speaking of IRA, do you have a Roth IRA? you can take the principle out without a penalty. I would still try to float it on a CC but maybe that is an option.

|

|

|

|

Ed D Jones secretary called me yesterday, putting on her most sweet southern charm voice asking when I want to make an appointment. I was saying no, I already made my deposit in Vanguard instead, she started getting pushy. I told her I was going to sell it all and reinvest with Vanguard. I thought she was going to cry. "tfw when an idiot you fooled gets wisened up" This is I'd say one of the best lessons I've learned from SA. I'm not totally sure what to do with the money in my savings. I never take out, only make deposits. It would be nice to get about 4% interest or so, but not sure what to do with it.

|

|

|

|

Cheese Thief posted:Ed D Jones secretary called me yesterday, putting on her most sweet southern charm voice asking when I want to make an appointment. I was saying no, I already made my deposit in Vanguard instead, she started getting pushy. I told her I was going to sell it all and reinvest with Vanguard. I thought she was going to cry. Are you talking about cash savings? You arenít going to get a 4% return on cash anywhere. There isnít any really good place to stash short/medium term cash right now so youíre gonna feel the siren call of stocks. For medium term cash I like to do 6 month treasuries. Fidelity has an auto-roll feature that automatically rolls your money into new treasuries of the same duration. I think vanguard has the same feature. You can obviously do any duration you want but 6 months seemed to be the sweet spot last I checked. Makes it easy to access your money when you want to buy that new car or put a down payment. Treasuries are also exempt from state and local tax and obviously super safe. If youíre talking about long term retirement savings then jam that money into a vanguard target date fund and forget about it. All you should worry about is how to earn/save more money to put into retirement. Let vanguard do the heavy lifting on determining the allocation.

|

|

|

|

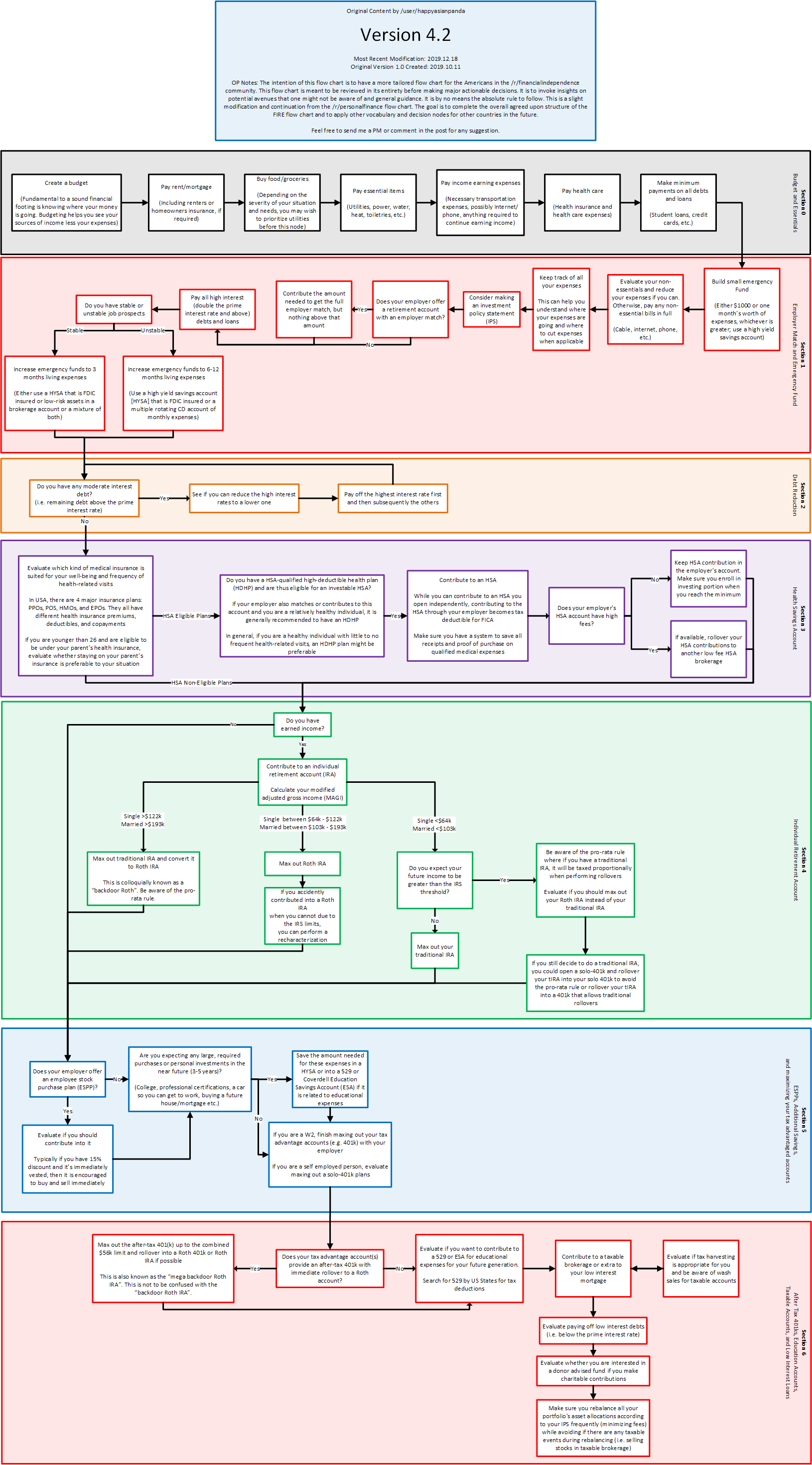

Cheese Thief posted:This is I'd say one of the best lessons I've learned from SA. I'm not totally sure what to do with the money in my savings. I never take out, only make deposits. It would be nice to get about 4% interest or so, but not sure what to do with it. not sure what to do with cash? maybe check this out from /r/personalfinance,

|

|

|

|

pmchem posted:not sure what to do with cash? maybe check this out from /r/personalfinance, This is great! Should go in the OP.

|

|

|

|

laxbro posted:This is great! Should go in the OP. there is also a variant from /r/financialindependence if you find the /r/personalfinance chart doesn't quite fit your needs:

|

|

|

|

what do you guys think about putting half my portfolio in vbms? it has an extremely low expense ratio and has been around for a while

|

|

|

|

fart simpson posted:what do you guys think about putting half my portfolio in vbms? it has an extremely low expense ratio and has been around for a while Seems a little dumb. Vanguard total bond fund has exposure to mortgage backed securities. Iím not sure why you would want to focus 100% on mbs. Also why are you 50% fixed income? Is that your standard asset allocation or are you timing the market? Finally, a good rule of thumb is to keep your bond allocations very simple. Take your risk on stocks not bonds. The riskiest bonds have limited upside while unlimited downside. Really no reason not to do the total bond fund in a retirement account.

|

|

|

|

So my plan here is to 1) move the rest of my Ed Jones money to Vanguard. 2) They want to keep it invested as is, but I need to submit to have the funds re-invested into VTSAX? -- I think I'm mostly in Mutual Funds right now. Should i 100% go in on VSTAX? I don't even know what the means really. I tried to read the Pillars of Investment, or whatever it's called, as suggested in the OP. But I just don't have time for all that, it's interesting though.

|

|

|

|

|

| # ? Jun 6, 2024 02:10 |

|

laxbro posted:Seems a little dumb. Vanguard total bond fund has exposure to mortgage backed securities. Iím not sure why you would want to focus 100% on mbs. I generally agree with the sentiment of your post and also do not use VMBS in my retirement accounts, but, your post implies that VMBS has a higher risk for loss of principle than a total bond fund such as BND. That is not the case. VMBS contains, on average, bonds with a higher credit rating as it entirely contains USGOV backed bonds; if those default, so does the US government. It has bonds with a lower average duration. It also has a lower realized volatility over the years. As a natural consequence of all that, it also has lower total return over the years. https://investor.vanguard.com/etf/profile/portfolio/vmbs https://investor.vanguard.com/etf/profile/portfolio/bnd https://stockcharts.com/freecharts/perf.php?VMBS,BND&n=2803&O=011000 Of course, this could all change in the future if fannie/freddie come out of conservatorship and VMBS starts accepting non-gov backed bonds somehow. But that's another story.

|

|

|