|

punk rebel ecks posted:Everywhere said it was stupid to buy SAVE yet I didn't listen due to my gut. Friend, it is 2021. It is never stupid to buy

|

|

|

|

|

| # ? Jun 8, 2024 03:25 |

|

punk rebel ecks posted:Everywhere said it was stupid to buy SAVE yet I didn't listen due to my gut. And now it's one of the best performing airlines. most of them suck really bad and some of them are probably astroturfed by institutions so that they actually say the opposite of what the institution actually does. analysts' price targets and performance expectations are so often bullshit that i've just started ignoring all of them

|

|

|

|

double post

|

|

|

|

punk rebel ecks posted:Everywhere said it was stupid to buy SAVE yet I didn't listen due to my gut. And now it's one of the best performing airlines. I keep telling you guys about my twitter list https://twitter.com/HedgeyeDDale/status/1356374802647445508?s=20 https://twitter.com/realwillmeade/status/1314665331147837441?s=20

|

|

|

|

I canít figure out how to report that dumb rear end go fund me. Nobody should subsidize your idiocy and youíll fuckin do it again.

|

|

|

|

He needs to declare bankruptcy and never touch anything regarding stocks ever again.

|

|

|

|

Yeah, I feel sympathy because he was uneducated but would you operate a $500K wrecking crane if you didn't know how to use it?

|

|

|

|

DOPE FIEND KILLA G posted:it might take a while but i have faith it will bounce back eventually. golf is going to have some good growth overall in the coming years i think What's the reasoning there, more rich people from memestocks?

|

|

|

|

Surprisingly Dope posted:What's the reasoning there, more rich people from memestocks? Seems like a good brand and they also acquired Top Golf which I think will get bigger from here and I think will come back quicker than some other crowded activities stuff. Maybe they can do other stuff with the technology there, too. They used to be litigious when it comes to IP. Disclaimer: I hate golf and am dumb, so might be totally off here. But I'm in this for a few thousand.

|

|

|

|

would there be any reason to have large allocations of VTI, VOO, and VUG at the same time or should you just pick one

|

|

|

|

Kunabomber posted:You guys see this? So he would have sold like 20+ calls naked? On a meme stock. And didn't even know you can't trade options outside normal market hours? Man.

|

|

|

|

does no one offer something like this where the user chooses the tickers?

|

|

|

|

|

|

|

|

There needs to be a higher barrier to entry on poo poo like derivatives. Most people have no business getting involved in those markets. Even fundamentally they're of extremely questionable utility, honestly. In securities and commodities markets having all these people participating at least provides liquidity. But all this other stuff, it's even more nakedly gambling. On credit. And there's definitely no good reason some rear end in a top hat who doesn't know his way around that stuff should be able to expose himself to that much financial loss simply because he had the ability to download an app. Also derivative markets did 2008, so there's that. I really don't see any reason for them to exist aside from rich assholes who should be in line for the guillotines going "b-b-b-b-but are money..."

|

|

|

|

ReidRansom posted:There needs to be a higher barrier to entry on poo poo like derivatives. Most people have no business getting involved in those markets. Even fundamentally they're of extremely questionable utility, honestly. In securities and commodities markets having all these people participating at least provides liquidity. But all this other stuff, it's even more nakedly gambling. On credit. And there's definitely no good reason some rear end in a top hat who doesn't know his way around that stuff should be able to expose himself to that much financial loss simply because he had the ability to download an app. There does need to be greater stringency for allowing retail investors to trade options but this won't happen because it's easy money for the casino

|

|

|

|

ReidRansom posted:There needs to be a higher barrier to entry on poo poo like derivatives I want to see a breakdown of GME money losers in shares vs options. my hunch devoid of anything but anecdotal reddit browsing suggests shares lost people more money than options.

|

|

|

|

ReidRansom posted:There needs to be a higher barrier to entry on poo poo like derivatives. Most people have no business getting involved in those markets. Even fundamentally they're of extremely questionable utility, honestly. In securities and commodities markets having all these people participating at least provides liquidity. But all this other stuff, it's even more nakedly gambling. On credit. And there's definitely no good reason some rear end in a top hat who doesn't know his way around that stuff should be able to expose himself to that much financial loss simply because he had the ability to download an app. They are actually there to reduce risk, options came from farmers needing to lock in the prices for their next crop. But yah, someone has to be on the other side, taking on that risk. The issue comes when uneducated people are like yah I'll loving buy soybeans at 100 next year, woooo. Or like this guy "I'll sell a shitload of soybeans next year for 100 (without having any idea how to grow soybeans myself)" He definitely lied about his options experience btw. I went through etrades thing honestly, they still won't give me the ability to sell naked calls.

|

|

|

|

Jalumibnkrayal posted:NDRA has a liver scanning device in phase 2 or 3 trials I believe. That's why we're in it. Better yet, it's already approved in China and Europe. Just a matter of time in Los Estados Unidos.

|

|

|

|

lmao

|

|

|

|

help I gained my life savings in weed stocks

|

|

|

|

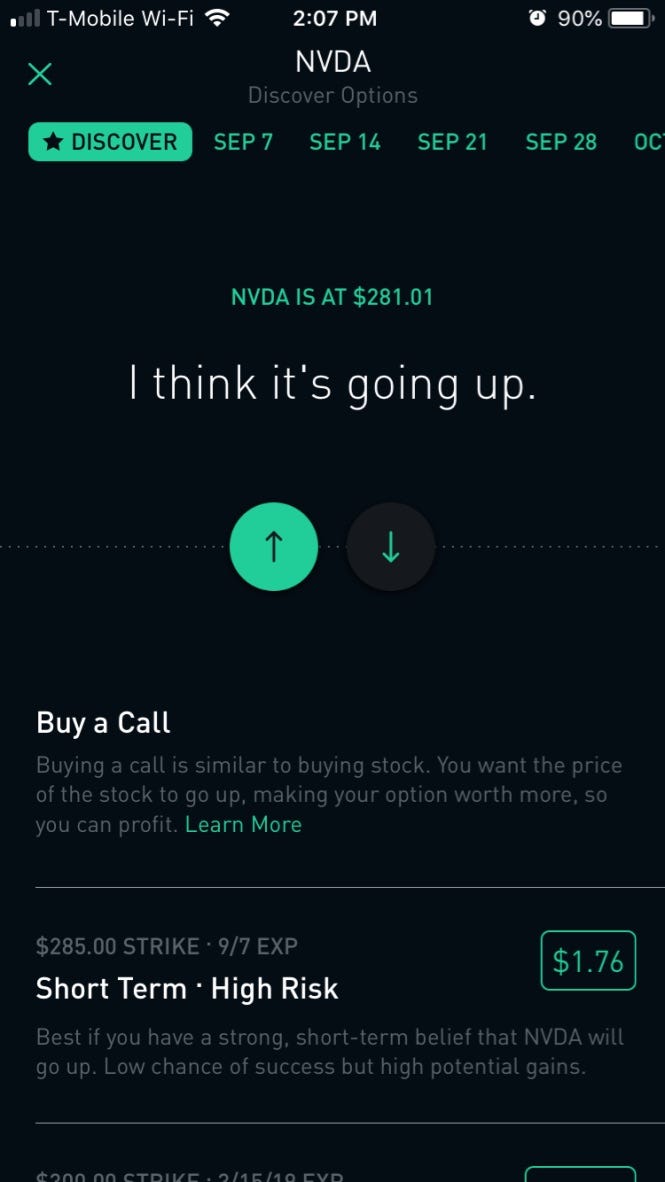

ReidRansom posted:There needs to be a higher barrier to entry on poo poo like derivatives. Most people have no business getting involved in those markets. Even fundamentally they're of extremely questionable utility, honestly. In securities and commodities markets having all these people participating at least provides liquidity. But all this other stuff, it's even more nakedly gambling. On credit. And there's definitely no good reason some rear end in a top hat who doesn't know his way around that stuff should be able to expose himself to that much financial loss simply because he had the ability to download an app. Robinhood's business model is in making risky things like options look less scary than they are. when you sign up you get given a margin account automatically. the options trading screen looks like this:  people were talking about how the app looks nicer and simpler and more web 4.0 or whatever than other places. that's also to ease people into trading who might otherwise be cautious

|

|

|

|

I made $170 selling weed today. Suck my dick, D.A.R.E. program.

|

|

|

|

pmchem posted:I keep telling you guys about my twitter list I tried looking back in your posts but couldn't find any link to your list. What's your twitter?

|

|

|

|

Shear Modulus posted:Robinhood's business model is in making risky things like options look less scary than they are. when you sign up you get given a margin account automatically. Iíve been plugging along for almost a year now, still have almost no idea what I am doing at all, and yet have not lost more money than I can A) afford to spend on the entertainment or 2)a single penny more than I consciously deposited. Buying options isnít the risky part, itís selling naked.

|

|

|

|

Normy posted:I tried looking back in your posts but couldn't find any link to your list. What's your twitter? https://forums.somethingawful.com/showthread.php?threadid=3259986&userid=160125&perpage=40&pagenumber=33#post511916011

|

|

|

|

Kal Torak posted:So he would have sold like 20+ calls naked? On a meme stock. And didn't even know you can't trade options outside normal market hours? Man. What I don't understand is how the brokerage didn't close his positions faster. We made margin calls much faster when inwas working. Granted, we didn't have GME volatility problems, but one of our main jobs was to maintain awareness of client margin. We'd get fired for something like this.

|

|

|

|

Shear Modulus posted:Robinhood's business model is in making risky things like options look less scary than they are. when you sign up you get given a margin account automatically. Itís pretty gross how little people are talking about the fact that robinhood just gives everyone a margin account. This little ďgrowth hackĒ causes all of these other problems, including the issue with collateral and T+2 the other week. I had to pass certain hurdles to get different levels of options cleared with my broker and when I had a bad year they even called me up and asked me if I knew wtf I was doing. If I ended up losing everything they would be able to sleep well and easy knowing they gave me plenty of outs to admit Iím an idiot.

|

|

|

|

Shear Modulus posted:Robinhood's business model is in making risky things like options look less scary than they are. when you sign up you get given a margin account automatically. Compare against the brightly colored frog that is E-Trade's  It's trying to warn you away.

|

|

|

|

gonna check out CNSX:OWLI tomorrow and might buy some holding TSXV:QMC (up 49%!  ) and TSXV:SUPR (down 67% ) and TSXV:SUPR (down 67%  ) )seems with these resource extraction companies you sometimes gotta sit on em for a looooong time numberoneposter fucked around with this message at 01:51 on Feb 11, 2021 |

|

|

|

Robinhood gives users a lot of power to get in trouble just by hitting a big "I AGREE" button. Schwab would make you pass an options exam before selling naked calls, probably with a human being on the phone.

|

|

|

|

Surprisingly Dope posted:What's the reasoning there, more rich people from memestocks? I'll try and keep it short here. Its mostly conjecture, and 'gut feeling' (please note tho: i am a loving idiot). Golf has been losing popularity since 2003, but that decline sort of leveled off around 2018. I think that, while the sport was still in an overall decline, it was beginning to find a new audience. That's partially anecdotal from a lot of friends of mine getting into it the last couple years (I'm pretty young for a goon and definitely not in a high income bracket), but its also based on certain statistics, like the fact that in 2019 golf had its best viewership numbers in the 13-34 demographic since 2009 (also, 2019 was up 75% in this demographic from 2018). I think that there have been a variety of changes over the years in the way golf is broadcasted and marketed that have lead to this shift, (plus Tiger coming back, baby!) and I think within the next decade or so we could have kind of a drastic paradigm shift in who is watching and playing golf. Plus, golf is one of the few sports that is pretty much pandemic proof. Through 2020 this has shown to lead to another major surge in the sports popularity. None of this is specific to Callaway per se, but it is a strong brand in and of itself.

|

|

|

|

Robinhood should definitely, at minimum, have like half a dozen warnings that you gotta read and a quiz you gotta take and pass before it lets you sell naked calls. Goddamn.

|

|

|

|

Shear Modulus posted:Robinhood's business model is in making risky things like options look less scary than they are. when you sign up you get given a margin account automatically. That's bullshit. Merrill Edge at least had a few days vetting/application process to even get to mess with covered options. I'm still too stupid to even mess with options but at least they weren't encouraging me to play with up and down arrows that can gently caress you that hard. Jesus.

|

|

|

|

ReidRansom posted:Compare against the brightly colored frog that is E-Trade's drat that Etrade app is looking a hell of a lot better than last time I logged on, old one looked like an excel sheet from the ninties

|

|

|

|

So is SNDL still worth buying right now even though it spiked today, or will it go back down?

|

|

|

|

where are people getting the idea that robinhood lets you sell naked calls

|

|

|

|

Does robinhood let you write contracts? Because if so that's gonna setup a ton of people for a bad time.

|

|

|

|

robinhood lets you go up to level 3 but not box spreads. they do not allow for naked calls (level 4)

|

|

|

|

strange feelings re Daisy posted:Robinhood gives users a lot of power to get in trouble just by hitting a big "I AGREE" button. Schwab would make you pass an options exam before selling naked calls, probably with a human being on the phone. I see the value in letting the average person trade options, you just have to not be an idiot, which is difficult for most people.

|

|

|

|

|

| # ? Jun 8, 2024 03:25 |

|

Gaius Marius posted:drat that Etrade app is looking a hell of a lot better than last time I logged on, old one looked like an excel sheet from the ninties They have a couple of different platforms. Power E-Trade is pretty alright; E-Trade Pro is steaming rear end that looks like the 90s, yeah. Guess some people prefer that, because they still support it.

|

|

|