|

I will say this year has demonstrated the virtues of paying into your retirement progressively throughout the year instead of in a lump sum in January.

|

|

|

|

|

| # ? May 30, 2024 15:32 |

|

I haven't contributed to my IRA yet because I had less cash on hand than I wanted, but my bonus comes in on the 15th and you can bet your rear end I'm going to be smiling when I do that transfer.

|

|

|

|

laxbro posted:Sounds like you're in great shape. What you should do next depends on your age, salary, short/medium term goals (home ownership), and retirement goals (retiring at 55/62/67 etc.). Thanks for this! I'm 32. I made ~120k last year but I'm quasi-freelance, working on 2-3 separate productions each year plus smaller gigs to fill in gaps, so it's not guaranteed I'll make that every year. I would say I still have room to grow in terms of what I can make yearly doing my current job. I don't have any short-term financial goals aside from "don't leave cash sitting around doing nothing", and my medium-term goal is home ownership (within 10 years ideally). My Roth IRA is in a target date 2060 fund so that's pretty much my goal for retirement (age 70). My current savings account is .03% APY so I definitely have to upgrade that. Can you suggest anything I should read to understand CDs and treasury bills? I looked into my pension details and it's fully employer-funded. I'm not permitted to contribute and there's no 401k. Basically I have to work 400 hours per year for a qualifying year, and I have to have 20 qualifying years to get the best rate on my bank of hours for determining my payments after retirement. Right now (5 years, 4000 hours) I'm eligible for $151 monthly. My years keep getting busier so chances are good I will end up with at least $2000/mo payments from this. Maybe this will get better with more militant union negotiations (seems to be moving that direction), maybe it will get worse for a million other reasons.

|

|

|

|

The Puppy Bowl posted:I will say this year has demonstrated the virtues of paying into your retirement progressively throughout the year instead of in a lump sum in January. Me doing that in 2022: Ha ha, yes, yessss Me doing that in 2021: Well this sucks

|

|

|

|

Duckman2008 posted:Not to get too political , but The Fed is raising interest rates and basically putting the economy in a recession to lower inflation and wage growth. Yeah I mean I was just posting for fun. I know number go up and number go down but over the long haul number go up up up.

|

|

|

|

The Puppy Bowl posted:I will say this year has demonstrated the virtues of paying into your retirement progressively throughout the year instead of in a lump sum in January. This was the first year I have been in a position to max one of our Roths for the year , so I was like ďhell yeahĒ and maxed it back in January. Like, I donít regret because thereís just no way to know, but itís def a damnit on the timing.

|

|

|

|

Duckman2008 posted:This was the first year I have been in a position to max one of our Roths for the year , so I was like ďhell yeahĒ and maxed it back in January.

|

|

|

|

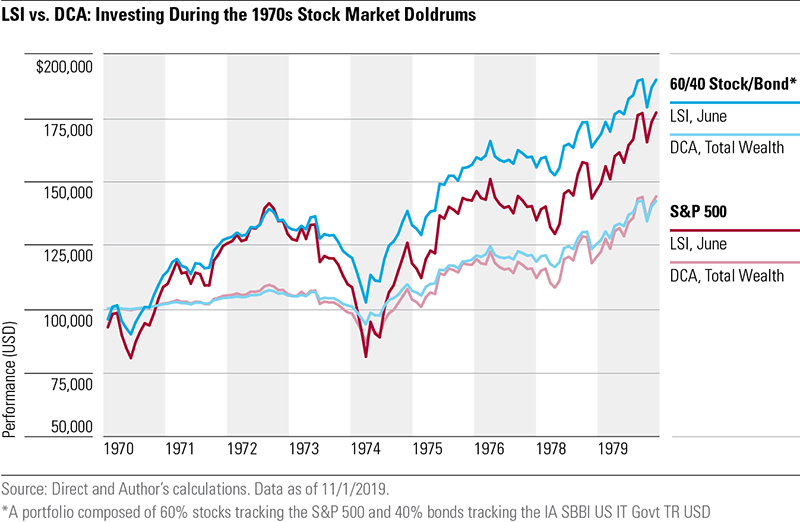

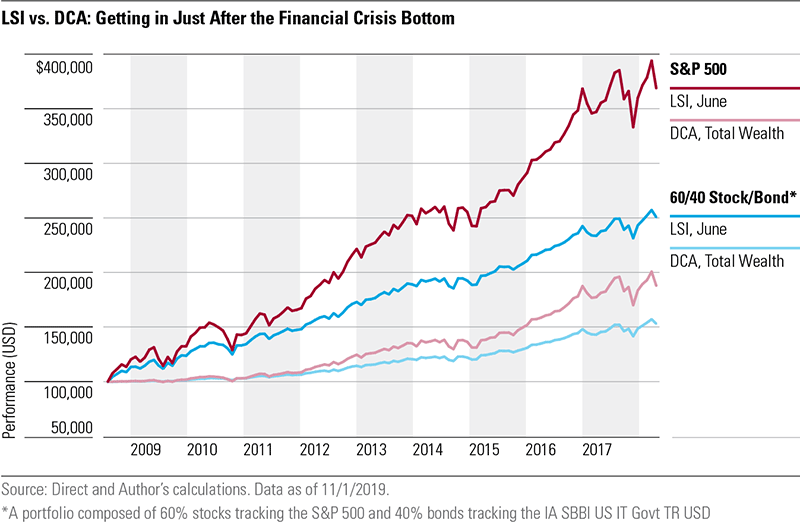

The Puppy Bowl posted:I will say this year has demonstrated the virtues of paying into your retirement progressively throughout the year instead of in a lump sum in January. You're likely going to come out ahead with lump sum investing instead of dollar cost averaging though. But dollar cost averaging can be better for you emotionally in times like this. Like if putting all your money in at exactly the wrong time may discourage you from investing in the future, then DCA would be the better choice.

|

|

|

|

That doesn't apply if you are acquiring the lump sum throughout the year and investing it all at once because you are losing the growth of those small individual investments. Investing money as you earn it isn't dollar cost averaging.

|

|

|

|

If you don't have the money you can't invest it but it is still effectively DCA.

|

|

|

|

I bought a lot of VTSAX at 108 because I had a large lump sum sitting in cash for ~reasons~, and although I know it is more likely to go up than not over the long term it still hurts to look at market performance. Itís an extremely good problem to have though and I really shouldnít whine about it. Reasonably sure my retirement will be spent either in comfort or battling post-apocalyptic warlords depending upon which way things go. At least I wonít have to work at Wal*Mart.

|

|

|

|

Salami Surgeon posted:That doesn't apply if you are acquiring the lump sum throughout the year and investing it all at once because you are losing the growth of those small individual investments. Investing money as you earn it isn't dollar cost averaging. Distinction without a difference, if I've ever heard one. DCA is a strategy in which you divide a total amount to be invested across periodic purchases, regardless of the asset's price, and at regular intervals If your "total amount to be invested" is a $6,000 IRA contribution, but can only afford to contribute $1,000 per month, then yes the 6x contributions of $1,000 are a DCA of a $6,000 investment If your "total amount to be invested" is the $1,000 you can afford to contribute to an IRA each month, then sure, each $1,000 is a lump sum investment of $1,000 and not DCA ... but you have still divided a total amount to be invested across periodic purchases and thus committed a DCA. You just didn't have an alternative!

|

|

|

|

Oh yeah, I was going to mention itt that my new accountant freaked out and fired me because I pushed back on the legitimacy of my nondeductible IRA contributions + Roth conversions (backdoor Roth) and asked him to complete IRS form 8606. Never expect competence from anyone.

|

|

|

|

GoGoGadgetChris posted:Distinction without a difference, if I've ever heard one. I think the distinction is intentionally saving up to invest a lump sum later. When people compare "lump sum" and "dollar cost averaging" the assumption is that you have the money now and the question is how to invest it. In that case, lump sum now has the higher expected value. But it would be entirely reasonable to hear "lump sum is better" and misunderstand that to mean "save up every month until you have a lump sum", which has a lower expected value. But there's probably a better way to word it?

|

|

|

|

Yeah, that's what I meant to say. I interpreted The Puppy Bowl as saying "paying into your 2022 retirement progressively throughout the year 2022 instead of in a lump sum in January 2023".

|

|

|

|

Doesn't DCA involve buying when the market dips and holding cash in between dip events? Seems bad, like timing the market bad. Regular scheduled buys that coincide with your cash flow are essentially doing lump sum every time and that seems like a pretty optimal strat. SamDabbers fucked around with this message at 20:52 on May 11, 2022 |

|

|

|

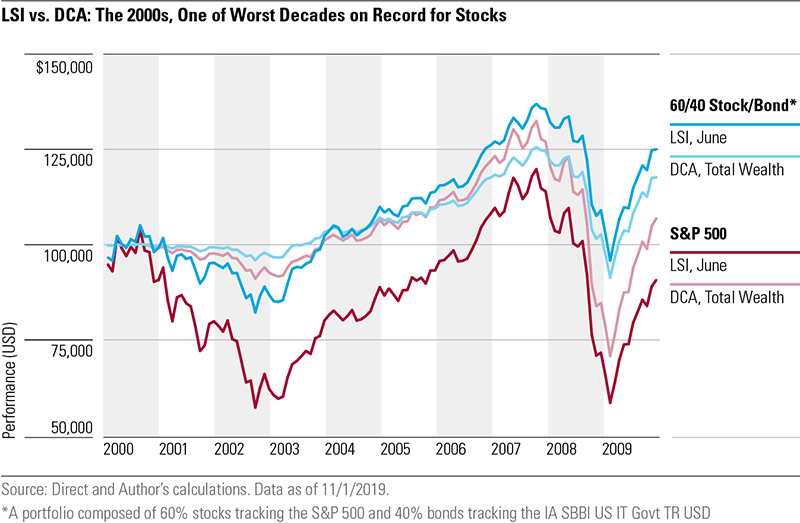

pokeyman posted:But it would be entirely reasonable to hear "lump sum is better" and misunderstand that to mean "save up every month until you have a lump sum", which has a lower expected value. To be honest I've never seen someone interpret it that way until this page of this thread... SamDabbers posted:Doesn't DCA involve buying when the market dips and holding cash in between dip events? Seems bad, like timing the market bad. No, DCA is usually at regular intervals. It's historically less profitable than lump sum, but is perfectly reasonable (and obviously better this year so far, in hindsight).

|

|

|

|

runawayturtles posted:No, DCA is usually at regular intervals. It's historically less profitable than lump sum, but is perfectly reasonable (and obviously better this year so far, in hindsight). Ah, interesting. I suppose the comparison assumes you have a lump sum available to invest at a particular point in time. My strategy has been to cap the amount of cash I hold at any time (taking into account planned expenses and emergency fund) and invest any surplus into the highest priority/most advantaged space available on a monthly basis. When my cash reserves aren't at the cap, then any budget surplus just stays cash. On the surface it looks like DCA given that definition because of the regular interval, but I'm avoiding having a lump sum sitting around uninvested in the first place. Retirement saving is built into the budget and comes off the top, of course. SamDabbers fucked around with this message at 21:40 on May 11, 2022 |

|

|

|

Dollar Cost Averaging was originally a strategy for easing into a stock as a way of hedging against volatility. It makes sense if you are investing in a thing with low confidence that it will go up during some period, and intend to sell it once it does firmly go up, because it prevents you from putting all your money in right before a dip that you could otherwise have bought into as it dipped. There are other ways to hedge against volatility, but this one is pretty easy to understand. We invest for decades in the overall market as a retirement investment strategy because we believe it pretty much always goes up over that time frame. If we believe that, we do not need to DCA to soften short-term volatility which will not affect the final number at all. If we do not believe that the market will rise over decades, we should not be investing in it at all. If we're uncertain about that prospect, we should be reducing exposure to the long-term market trend via diversification and other hedging strategies. DCA does not reduce exposure to the long-term market trend. Which, again, if that was your intent, just... put some small amount of your overall allocation into cash or a safer asset like bonds, rather than doing DCA. The reason two of those charts show DCA underperforming is because DCA is holding some money back from a market which, in both cases, rose over the full period shown. The chart that showed "The 2000s" showed DCA outperforming in the S&P500 because over the period shown, the S&P500 went down. Bonds are a volatility hedge, so the portfolio with 40% bonds was net positive, and as expected, lump sum beat DCA. Note that it's difficult to find 10-year periods that were that bad. In that period of high volatility, it was the hedge that used bonds that won out even over the DCA approach with pure stocks. I think this further highlights that if you're very worried about volatility, there's better hedging strategies than DCA available. tl;dr, DCA is a fine tool to use in certain cases, mostly ones commonly discussed in the stonks/gambling thread; it's a bad idea for your multi-decadal retirement investing.

|

|

|

|

Leperflesh posted:Dollar Cost Averaging was originally a strategy for easing into a stock as a way of hedging against volatility. It makes sense if you are investing in a thing with low confidence that it will go up during some period, and intend to sell it once it does firmly go up, because it prevents you from putting all your money in right before a dip that you could otherwise have bought into as it dipped. There are other ways to hedge against volatility, but this one is pretty easy to understand. Posts like this are why I follow this thread. Thanks!

|

|

|

|

Duckman2008 posted:This was the first year I have been in a position to max one of our Roths for the year , so I was like ďhell yeahĒ and maxed it back in January. Yep. I did this with my Roth IRA, buying $6k of VTI on January 1st when it was ~240 and then with like $28k of VXUS last summer for my brokerage account when it was at 67 So I am very much the hypothetical man in the OP who invests at the worst times (and still comes out ahead by retirement? we'll see, apocalypse pending!)

|

|

|

|

The Puppy Bowl posted:I will say this year has demonstrated the virtues of paying into your retirement progressively throughout the year instead of in a lump sum in January. remember the smart thing to do is whatever thing works out best using the accurate knowledge of the future that you've obtained by drinking too much coffee

|

|

|

|

Coffee is for scrubs. Real players get their foreknowledge by using the geriatric spice melange. That or being elected to Congress, whichever.

|

|

|

|

My overall portfolio is up 11% since I started investing in 2015 but Fidelity is telling me it's a few points behind the Russell 1000 Index. Ironically, I'm still up on tech stocks I purchased in 2018 but everything else is in the red.

|

|

|

|

Question for people here. I have my 457b and 403b through TIAA, since they're the ones my work uses. I have my 457 entirely in a TIAA target date, TTFRX, and my 403 is in TLFRX. No access to vanguard funds through my school's choices. I'm working on it. We did just get access to some different target date funds from TIAA, and the expense ratio is lower. It's TLLIX. I did the mutual fund compare on them and it looks good from where I'm sitting but I want goon financial opinions. I won't be retiring until 2050. Thoughts on switching both 457 and 403 to this fund instead? We literally just got access to them yesterday.

|

|

|

|

I think I'm going to harvest a couple grand of tax losses tomorrow. Silver lining I guess.

|

|

|

|

Crosby B. Alfred posted:My overall portfolio is up 11% since I started investing in 2015 but Fidelity is telling me it's a few points behind the Russell 1000 Index. I finally dumped the tech fund I bought in 2011. I had been thinking for like 2 years I needed to stop gambling, take my profits, and put it all in my TDF. Oh well, it was still WAY up overall, just a shame I didn't do it in the fall when I was last giving it a hard thought. Coulda shoulda woulda though. Retirement is now all in boring TDF, as it should be.

|

|

|

|

Realistically, what are growth options aside from the stock market, esp. with the current state of bonds. I-Bonds only keep you up with inflation. Should I become a landlord?

|

|

|

|

Smashing Link posted:Realistically, what are growth options aside from the stock market, esp. with the current state of bonds. I-Bonds only keep you up with inflation. Should I become a landlord? Itís a massacre out there You could do some weirdo poo poo like throw some money at gold and cross your fingers but at this time its about wealth conservation or minimizing losses, not really wealth growth

|

|

|

|

Smashing Link posted:Realistically, what are growth options aside from the stock market, esp. with the current state of bonds. I-Bonds only keep you up with inflation. Should I become a landlord? Being a landlord works out unless your tenant doesn't pay rent and drags out eviction 12 months while trashing the place. Also you will be a landlord which has extreme risk for your soul.

|

|

|

|

Smashing Link posted:Realistically, what are growth options aside from the stock market, esp. with the current state of bonds. I-Bonds only keep you up with inflation. Should I become a landlord? This is kind of my deal too... like in one aspect my whole side gig/hobby of investing and trading stocks is completely over? I guess the only thing now to focus on now is just my day job and keep investing in my traditional retirement fund (401k/Roth IRA/HSA/etc.). If it only wasn't so boring

|

|

|

|

If you're ever tempted to dabble in gambling then check out all the suicide stuff in this crypto subreddit https://www.reddit.com/r/terraluna/

|

|

|

|

So what would be the sane person's choice of long-term investments with savings that are losing value each day? My employer allows after tax 401k contributions with in-plan Roth conversion. I'm already maxed on pretax and have nearly as much going into the post-tax bucket too. I thought I could increase the contributions from each paycheck to increase the Roth part (still wouldn't get close to the combined $60k limit) while using a portion of my savings for living expenses instead. Ordinarily I wouldn't consider this repurposing of savings, but at this point we have two years' worth of spending gathering dust in a savings account. At least some of that should be doing work, even if it's effectively just replacing the paychecks. Edit: the issue of liquidity isn't a big one, but I should prob think a little harder about it too. Trabant fucked around with this message at 05:53 on May 12, 2022 |

|

|

|

A well-diversified basket of domestic and international total market index stock funds, optionally with a small allocation to a total market bond fund. Assuming you mean long term when you say long term. BFC usually advises people to have 6 months living costs in cash. Your actual need for cash savings could be very different depending on your resources, risk factors, potential expenses (for example, do you own a home with a lot of deferred maintenance or very big ticket possible costs?), etc. But if you're asking what to do with extra cash you want to save in the long term, the answer is still the three-fund portfolio.

|

|

|

|

Mu Zeta posted:If you're ever tempted to dabble in gambling then check out all the suicide stuff in this crypto subreddit Jesus, thatís sad. But also, come on, dude. quote:

|

|

|

|

I have no idea what most of the terms in the vid link below mean but I guess things are rather turbulent in the crypto market right now? https://twitter.com/i/status/1524344875575291904

|

|

|

|

Leperflesh posted:A well-diversified basket of domestic and international total market index stock funds, optionally with a small allocation to a total market bond fund. Assuming you mean long term when you say long term. Maybe this is reductive but if you actually have cash right now, isnít this actually a good time to invest? Buy low sell high and all that?

|

|

|

|

Mons Hubris posted:Maybe this is reductive but if you actually have cash right now, isnít this actually a good time to invest? Buy low sell high and all that? for long term investing you should generally be investing based on a strategy that will meet your desired long term goals rather than reacting to short term market movements there is macro risk with this but you can't really control for like, a serious transformation of the global economic order

|

|

|

|

Trabant posted:So what would be the sane person's choice of long-term investments with savings that are losing value each day? Reminder you can put $10k into I Bonds a year if you have not done that yet.

|

|

|

|

|

| # ? May 30, 2024 15:32 |

|

Does anyone have a reliable guide to tax loss harvesting with Vanguard? I haven't bothered to do this in the past, but I'm looking at some rather sizeable losses on my primarily VTSAX investments, and it occurs to me that I really ought to take advantage of the opportunity. At the same time, I really don't want to mess up any part of the process. Edit: answering my own question, it looks like PoF has a Vanguard-specific guide: https://www.physicianonfire.com/tax-loss-harvesting-vanguard/ Ersatz fucked around with this message at 15:46 on May 12, 2022 |

|

|