|

My wife nd I have been fighting for the entire week and I am throwing in the towel: I guess I'll buy a riding mower. Which one should I buy and what's a good price? We're looking at this one: https://www.lowes.com/pd/John-Deere...tely/5001418905 but I really have no idea.

|

|

|

|

|

| # ? May 9, 2024 11:32 |

|

Throatwarbler posted:My wife nd I have been fighting for the entire week and I am throwing in the towel: I guess I'll buy a riding mower. Which one should I buy and what's a good price? Excellent condition used can save a lot. I have the old version of that JD and it is super easy to get parts for. Reliability is�riding lawnmower standards. Riding lawn mowers are notoriously maintenance heavy after some years and mines from ~2007. I desperately wish I had a bagger. I have a tow behind sweeper and it�s not nearly as good. Who wouldn�t want free compost right?

|

|

|

|

CarForumPoster posted:I desperately wish I had a bagger. I have a tow behind sweeper and it�s not nearly as good. Who wouldn�t want free compost right? Yeah we get a lot of leaves in the fall and I�ve grown to hate the sweeper.

|

|

|

|

The Dave posted:Yeah we get a lot of leaves in the fall and I�ve grown to hate the sweeper. I still like that its way cheaper than a new mower with a bagger but...I loved it at the start but my yard has cypress knees, divots, etc. The metal front lip catches on everything and the drive wheels are tiny and the spanish moss wraps around the axle constantly to the point of seizing it. So cutting moss and percussive maintenance are getting rather annoying. Its not very effective at the high settings. Works great on the low settings but gets constantly damaged. No way to win. Sure does eat pine needles though, which are so thick from my 20+ 50+ft pine trees that they kill the grass. CarForumPoster fucked around with this message at 13:38 on May 25, 2022 |

|

|

|

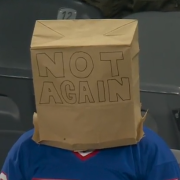

Aaand because I thought I would sleep on it for a night, it's now OOS. Apparently there's some kind of run on everything that has an engine and wheels these days?

|

|

|

|

Throatwarbler posted:Aaand because I thought I would sleep on it for a night, it's now OOS. Apparently there's some kind of run on everything that has an engine and wheels these days? Does your local HD not have them sitting out front? But yes, they order parts from overseas. The things they domestic parts are made from are from overseas. Things from overseas are still delayed.

|

|

|

|

I went to Lowes the other day and they had none sitting outside, only a few Craftsmans in the back ( I understand these are the bad ones). What made me pause was going to the JD website and seeing the MSRP is actually $1999? So I'm paying ADM on lawn mowers now? Also lol the reviews. https://www.deere.com/en/mowers/lawn-tractors/100-series/s100-lawn-tractor/ Throatwarbler fucked around with this message at 17:19 on May 25, 2022 |

|

|

|

tater_salad posted:Edit: ^^ they MIGHT update your appraised value so when you hit 22% LTV you'll drop PMI but that's 100% a question to ask your lender, as it probably varies by laws and servicer. Guess what my mortgage servicer just did?  Rocket Mortgage just informed me that they are not entertaining any PMI removals on the basis of escalating property values. There must be a major renovation associated, which would increase the value by a percentage relative to your initial cost/value to greater than 20% equity relative to the starting value. This was "due to unstable real estate market conditions" and was a repeated statement from two different sets of calls (I tried twice in case I got a weirdo the first time). Rocket Mortgage just informed me that they are not entertaining any PMI removals on the basis of escalating property values. There must be a major renovation associated, which would increase the value by a percentage relative to your initial cost/value to greater than 20% equity relative to the starting value. This was "due to unstable real estate market conditions" and was a repeated statement from two different sets of calls (I tried twice in case I got a weirdo the first time).They literally went with "We don't believe current appraisals. Gut your kitchen if you want to remove PMI."

|

|

|

|

Sundae posted:Guess what my mortgage servicer just did? "I just spent 20k remodeling my kitchen to look exactly the same. Please send out an appraiser"

|

|

|

|

Depending on who you talk to, and what market you're in, we're about to dip into a four year recession where home mortgage interest rates will hit 9% and push housing prices way down I don't necessarily agree with that but wouldn't surprise me if the risk management guys at RM have an agenda they're pushing

|

|

|

|

Great, now I get the schizophrenic luxury of having bought at peak pricing and a low interest rate so I can simultaneously love and hate my house

|

|

|

|

In the 1 year we've owned our home in Seattle, the estimated value has increased about $150k. My neighbor is about to sell his identical house so I'm curious to see how it goes. Due to this, I asked my lender about our PMI and having it removed. We put 10% down so with that rise in value I thought maybe we could get it taken off. He told me the company the loan was secured through has a 2 year holding period for PMI before it can be removed or the other option was to refinance but given the current rates, it doesn't make sense for us.

|

|

|

|

Oh boy, this loving house... On our front porch, we have a crack in the concrete, and I thought my mind was playing tricks on me for thinking there was a drop from one side to the other. Sure enough, using my level there's a change in pitch. Who do I even call about this

|

|

|

|

How old is the house, what region/soil do you live in, when was the last time you had foundation work done, how aggressive is your lawn watering schedule

|

|

|

|

Hadlock posted:How old is the house, what region/soil do you live in, when was the last time you had foundation work done, how aggressive is your lawn watering schedule House was built in 2019, central Florida area. Lawn is watered 2-3x a week. Never had foundation work done as the house is pretty new

|

|

|

|

Mud jack, Mud Jack, MUD JACK

|

|

|

|

PainterofCrap posted:Well, if you have a public adjuster, they'll just take a percentage of your estimate as their fee. oh we are well past that, and yeah it was on his form. like, i'm actively in litigation, hence vaguery.

|

|

|

|

Not a Children posted:Great, now I get the schizophrenic luxury of having bought at peak pricing and a low interest rate so I can simultaneously love and hate my house Unless you plan on selling in 5 years or less who gives a gently caress. Enjoy your likely once in a lifetime low interest rate. Unless you need some kind of equity loan, your homes value means jack poo poo other than dick waving. On a separate note, most of my house is set up with Lutron Casetas. Does anyone know of a Pico mount that works similar to the Philips hue mount for their switch? https://www.bestbuy.com/site/philips-hue-dimmer-switch-white/6454394.p?skuId=6454394&ref=app_ios&loc=pdpShare I basically want a wall mount for the Pico remote where I can take the Pico out easily when I want. Pilfered Pallbearers fucked around with this message at 04:47 on May 26, 2022 |

|

|

|

Hadlock posted:I also need to manhandle the device in and out of the Usually they will help you load it at Harbor Freight, and what you want to do to get them out of the bed is gently tip them on their backs so they are laying king wise on the bed, and pull them out until gravity helps you slide it gently to the ground. You could also make a cut an inch from the bottom all the way around once you have it pulled out a good amount and just slide it out of the box from there onto the ground. From there you use a hand truck. These things really aren�t that heavy but I�ve done it with washing machines and refrigerators before without injuring myself. You need it to be in the box for this to work though, otherwise you scratch the poo poo out of the truck and whatever you are unloading.

|

|

|

|

Hadlock posted:Depending on who you talk to, and what market you're in, we're about to dip into a four year recession where home mortgage interest rates will hit 9% and push housing prices way down Can you source anything on this? I�m set to close tomorrow and this kind of poo poo is giving me hives. To try and set my mind at ease, I ran some calcs. I compared my current purchase price and interest rate (4.25) to a hypothetical crash price - 20% off of purchase price, which is what I understand to be the average rough order of magnitude from The Great Recession - and ran that at 9%. The lower home price and higher interest rate is PITI costs are roughly 20% higher than my current payment. At 7% interest the payments are still about 10% higher than our current price. That�s all assuming a substantial drop in price, which seems unlikely in our highly desirable area of central San Diego, which is undergoing a little San Francisco-ization right now, but who knows. This makes me feel a little better. Sort of. Do never buy, I guess

|

|

|

|

Anza Borrego posted:Can you source anything on this? Just ignore it. There's a million people in Colorado predicting the entire state economy is going to crash because things being expensive means they HAVE to become cheap again and it's all built on weed maaaan

|

|

|

|

Anza Borrego posted:Can you source anything on this? I'm going to close in about a week and this also made me feel a little better. Do never buy, of course.

|

|

|

|

Anza Borrego posted:Can you source anything on this? If it makes you feel any better, on the timespan of 20 years we're still at historically low rates. Looks like rates in '00 were right around 7-8% for a 30Y fixed rate. And that's just straight up ignoring the 70s when poo poo got really crazy (15+%) Mark my words, the couple of years where rates bottomed out around the 2-3% rate are going to be a once in a lifetime wealth transfer. People who got in on it are incredibly fortunate to have been loaned such a significant amount of money at an interest rate that likely won't even match inflation. I'm not even talking about high inflation making the headlines, I'm talking about actual fed targets of ~3%. Plus, if rates somehow tank below 4% again in the future (and hoo boy if they do did we gently caress something up - keep in mind the hyper-low rates of today are a direct result of post-2008 monetary policy designed to goose the gently caress out of the economy) you can still refinance.

|

|

|

|

Is there any meaningful difference between N95 vs P2 masks when used as ppe for cleaning mould?

|

|

|

|

Cyrano4747 posted:If it makes you feel any better, on the timespan of 20 years we're still at historically low rates. Looks like rates in '00 were right around 7-8% for a 30Y fixed rate. And that's just straight up ignoring the 70s when poo poo got really crazy (15+%) Yeah this Goes double if you live in California* where your property tax increases are capped at 2% annually, and can not be retroactively applied in years like this one *And apparently in parts of Oregon, but I think theirs is more conservatively set to like 3.5% Not building new housing is one thing but locking in a 2020 property tax rate at 1.1% for life, then riding out 3-4 years of 7% inflation, hoo boy good luck getting those people to sell, bonus points if their mortgage rate was anywhere near 2%. You'd be crazy as a property owner to sell something bought/refinanced in the last three years and lose out on the very probable* long term gains *Past results do not guarantee future results, but there's an awful lot of retired blue collar boomers riding around on a $50,000 Harley Davidson and a paid off house; ref: anybody that bought a house pre-1972

|

|

|

|

Hadlock posted:Yeah this Oregon is 3% assessed value increase unless you do improvements (not repairs) that increase the value more than 10% in one year. If you gently caress that up you get re-assessed but a lot of contractors around here only get permits for mechanical and electrical.

|

|

|

|

therobit posted:Oregon is 3% assessed value increase unless you do improvements (not repairs) that increase the value more than 10% in one year. If you gently caress that up you get re-assessed but a lot of contractors around here only get permits for mechanical and electrical. How much of a pain in the rear end are unpermitted renovations when you try to sell? If there are obvious renovations do buyers try to look at old pulled permits? It is wild to me that it�s the norm for big deal GCs to do work orders with no permits and put their license at risk, yet it seems that is exactly the norm in many areas (where permits are required by law)

|

|

|

|

If you remodel one room per year shouldn't be a problem? I'm sure if the value of your kitchen increased by $16,000 on a $100k house the appraiser isn't going to nail your rear end Adding a second story and four more bedrooms and two bath? Sure

|

|

|

|

I'm out here trying to be the model PO. As you may know I'm remodeling a bedroom, so pretty small stuff. I did decide to replace the three plugs and faceplates as well. It was very satisfying to just cut off a backstabbed outlet and put the replacement in using the screws. You know, properly. One of them also was a splice location that was backstabbed with one on the screws, which got spliced with Wagos and a jumper wire to the outlet. And they are all level, with the grounds up like I like them, with screwless faceplates.

|

|

|

|

I just moved to my very first home. I really can�t believe I�m sitting here typing this in my house. There are a million things I need to do but all in good time. Feels good.

|

|

|

|

Harriet Carker posted:I just moved to my very first home. I really can’t believe I’m sitting here typing this in my house. There are a million things I need to do but all in good time. Feels good. It's a really good feeling on your first year anniversary in your home not to have to sign a new lease.

|

|

|

|

Inner Light posted:How much of a pain in the rear end are unpermitted renovations when you try to sell? If there are obvious renovations do buyers try to look at old pulled permits? It�s pretty hard to tell unless you add square footage or have brand new mechanicals or a new electrical panel.

|

|

|

|

Inner Light posted:How much of a pain in the rear end are unpermitted renovations when you try to sell? If there are obvious renovations do buyers try to look at old pulled permits? I dunno about "most buyers," but I would absolutely look up permits for any obvious renovations/additions/etc. If you add a light fixture or something that probably won't get caught, but if you do major work then don't assume it'll go unnoticed... a modern kitchen or bathroom in a 30 year old house is pretty obvious. Lots of places have online permit search systems, so it's pretty drat easy to figure out if a house got permits or not. There's a reason you need permits to do certain work, and it's not so the tax collector gets their share (though that is part of it). Also around here, the disclosure form asks if any un-permitted work has been done on the house. Don't lie on the disclosure form.

|

|

|

|

In complete First World problems Costco delivery folks dropped a TV on my wood floor and damaged 3 planks that need to be replaced in the middle of the room. It�s veneer that interlocks. The delivery people offered to �settle� for $485.xx, our flooring company who installed it said their crews are �only doing big jobs right now�. I guess I�ll keep calling different floor places, we have the plank stock in the basement for at least these 3. Any ideas how to proceed and close this out? Of course I�m tempted to say sorry we have to get all new floors like PainterOfCarp said for roofs.

|

|

|

|

Hed posted:In complete First World problems Costco delivery folks dropped a TV on my wood floor and damaged 3 planks that need to be replaced in the middle of the room. It�s veneer that interlocks. I would get a flooring company to come and give you an estimate. Some flooring types don't really come apart easily and you end up having to replace more than "just those 3" so I'd get some estimates from anyone willing to come out (3 ppl is always recommended) and then say: "here's the estimates for the job, what say you" then if they are still offering only 400 bux when your estimates are 2k, get a a lawyer.

|

|

|

|

If it�s three planks, what makes it so difficult to do yourself? Legit question because I don�t know what goes into it.

|

|

|

|

Most flooring planks are "tongue and groove", so they're locked together. Sometimes you can break them apart, sometimes you can't. Often you need to basically disassemble the floor to the point where the bad boards are, and then put it back together, so if it's in the middle of a room, it's a big job.

|

|

|

|

unknown posted:Most flooring planks are "tongue and groove", so they're locked together. Sometimes you can break them apart, sometimes you can't. Often you need to basically disassemble the floor to the point where the bad boards are, and then put it back together, so if it's in the middle of a room, it's a big job. Which is why you should let someone else deal with this poo poo because I'm not going to give up a weekend kuz geek-squad hosed up your floor. It's unfortunate but if they did this to my floor I'd want to pay someone to fix it. If I did it, I'd fix it on my own.

|

|

|

|

Harriet Carker posted:I just moved to my very first home. I really can�t believe I�m sitting here typing this in my house. There are a million things I need to do but all in good time. Feels good. Awww. Congratulations!

|

|

|

|

|

| # ? May 9, 2024 11:32 |

|

Also if the floor is older, the wood may be difficult or impossible to match, the stain may be difficult or impossible to match, the thickness of the planks may be wrong so they have to be sanded down, etc. One trick to deal with several of those issues is to steal boards from an inconspicuous area (a closet for example) and then just replace the boards in the closet with whatever. This is, of course, more labor.

|

|

|