|

Scuffy_1989 posted:The murder rate was already on the rise prior to the 2004 expiration of the assault weapons ban. And they jumped even more rapidly once it ended. The mass shooting graph from your own link also shows that (with the exception of the year Columbine skyrocketed the amount of people killed) mass shootings fell right after it went into effect and rose sharply right after it expired. Strong correlation between the two, but no proven causation.

|

|

|

|

|

| # ? May 24, 2024 23:43 |

|

Leon Trotsky 2012 posted:They actually got Sinema to agree to a new revenue raiser. The article actually doesn't mention anything about the 20% deduction for pass-through entities, it relates to the Net Investment Income Tax, an obamacare era surcharge on certain investment income that is already designated to shore up various federal health accounts. I don't know where you got the idea that it was the 199A isue, but it's not.

|

|

|

|

Leon Trotsky 2012 posted:The mass shooting graph from your own link also shows that (with the exception of the year Columbine skyrocketed the amount of people killed) mass shootings fell right after it went into effect and rose sharply right after it expired. And yours does exactly the opposite for mass shootings. It shows that it fell rapidly shortly before it went into effect, and rose slightly afterwards until it spiked for obvious reasons in 1999 [At least I'm assuming that's Columbine, the math would seem to hold up], then it started to drop rapidly. Like graphs aren't that complicated, and that one is color coded for ease of use. There's the line going down before it, and the line starting to go up during it. The first half of the AWB is a complete wash as far as mass shootings go, as the average low wasn't lower than the last few decades and the high was higher. It's only in the later half of the bill that things really drop. Before that the lowest point in 6 years was directly before the bill happened. Which is not quite irrelevant, but certainly niche. Mass shootings of the sort that chart is tracking are as important as any deaths, but the majority of homicides committed with guns aren't going to be on that list. Tracking the effectiveness of any given law strictly by it's impact on that chart is neither fair nor useful. I'd say the evidence is that the AWB meant gently caress all to mass shootings, on account of all the mass shootings that happened with pistols even after it was gone. Virginia Tech is still the third deadliest shooting in US history. It's only in the last decade or so that it's been rifles used in a lot of these things, and that's well after the AWB was over. If that's all you care about, then I don't think there's particularly strong evidence the AWB helped.

|

|

|

|

Mulva posted:And yours does exactly the opposite for mass shootings. It doesn't. If you actually run a regression on the data, you can see that the relationship between the period it was in effect has a strong correlation to reduced gun deaths. The 1994 to 2004 period saw lower average annual rates of both mass shootings and deaths resulting from such incidents than before the ban's inception. The average number of annualized deaths during mass shootings (according to the FBI counts) was 5.3 during the ban, 7.2 prior to the ban, and 25.0 after the ban expired. The CRC and FBI released a study that showed the same thing: https://sgp.fas.org/crs/misc/R44126.pdf Other studies found the same thing: https://ohiocapitaljournal.com/2022/06/15/did-the-assault-weapons-ban-of-1994-bring-down-mass-shootings-heres-what-the-data-tells-us/ Mulva posted:If that's all you care about, then I don't think there's particularly strong evidence the AWB helped. Again, I was not saying the AWB caused it. I repeated several times: Leon Trotsky 2012 posted:Strong correlation between the two, but no proven causation. Leon Trotsky 2012 fucked around with this message at 22:12 on Jul 7, 2022 |

|

|

|

Didn't most of the 8 billion companies making AR's and nerdy bits for them not start until like 2005?

|

|

|

|

Leon Trotsky 2012 posted:The argument that crime in general dropped because it was a period of economic growth and stability seemed like a tried and tested truth, but after 2009 we had the worst economic crisis since the Great Depression and crime kept going down for years. Then, when the average savings of the bottom 50% of Americans tripled in the back half of 2020 and first half of 2021, we had the highest percentage increase in violent crime alongside a small decrease in property crime. You've already been called out by others on a couple of your claims, but I wanted to address the bolded part above. Given that, prior to the Trump/Biden pandemic relief, around 63 percent of Americans said they were unable to handle a $500 emergency car repair or a $1000 emergency-room bill, I'm not sure that "the average savings of the bottom 50% of Americans tripled" is a very valuable stat in context of pandemic-era violent crime. I realize that link is from a 2016 study, and I'm sure that Americans were helped by the $1800 they got under Trump & the additional $1200 they got under Biden (I know I was!), but it's not as if $3k was life-changing on a permanent basis. I also think it'd be a mistake to handwave off the incredible emotional effects of the pandemic, especially for those who lived alone or were otherwise isolated, and the ensuing mental-health crises for which studies are only now emerging. (The notable recent ones had to do with the effects on teens, and they've been pretty sobering.) Your 2009 factoid would be a more solid foundation for your contention that violent crime doesn't correlate with financial stability (or, more specifically, mass shootings don't have that correlation).

|

|

|

|

Willa Rogers posted:You've already been called out by others on a couple of your claims, but I wanted to address the bolded part above. What are you disagreeing with? You are agreeing that everything I said is a fact, but pointing out that there are outside factors - which I don't disagree with? It's not "hand waiving away the incredible emotional effects of the pandemic." That was the point of the comparison. That economic change has not had a 1:1 correlation with crime since 2008.

|

|

|

|

Here's a factcheck.org answer about the Assault Weapons Ban & its effects:quote:President Joe Biden claims the 10-year assault weapons ban that he helped shepherd through the Senate as part of the 1994 crime bill “brought down these mass killings.” But the raw numbers, when adjusted for population and other factors, aren’t so clear on that. https://www.factcheck.org/2021/03/factchecking-bidens-claim-that-assault-weapons-ban-worked/

|

|

|

|

I don't know that the broad statistics around where American median and lower are really show the whole picture. It is astonishingly expensive to live in the US in so many ways, and with so much fewer benefits.

|

|

|

|

Leon Trotsky 2012 posted:What are you disagreeing with? That the economic boon of the pandemic stimuli proves that violent crimes doesn't correlate with economic well-being, if I interpreted your post correctly, and in context of the post you were answering. this: quote:The argument that crime in general dropped because it was a period of economic growth and stability seemed like a tried and tested truth, but after 2009 we had the worst economic crisis since the Great Depression and crime kept going down for years. Then, when the average savings of the bottom 50% of Americans tripled in the back half of 2020 and first half of 2021, we had the highest percentage increase in violent crime alongside a small decrease in property crime. As I said, you were on surer footing using 2009 as an example than the recent pandemic relief. Willa Rogers fucked around with this message at 22:24 on Jul 7, 2022 |

|

|

|

Willa Rogers posted:I also think it'd be a mistake to handwave off the incredible emotional effects of the pandemic, especially for those who lived alone or were otherwise isolated, and the ensuing mental-health crises for which studies are only now emerging. (The notable recent ones had to do with the effects on teens, and they've been pretty sobering.) Do you have these handy? I haven't read anything about it yet and am very curious.

|

|

|

|

DeadlyMuffin posted:Do you have these handy? I haven't read anything about it yet and am very curious. This is the most recent one I recall: quote:In the survey, more than half – 55 percent – of high school students said they experienced emotional abuse from an adult in their home. In addition, 11 percent saying they experienced physical abuse. I recall another recent survey in which something like 50-60 percent of teens said they'd thought of suicide or self-harm, but I'll have to go digging for it. Here's a KFF survey analysis on the effects of the pandemic on adults, including young adults. Willa Rogers fucked around with this message at 22:34 on Jul 7, 2022 |

|

|

|

Willa Rogers posted:That the economic boon of the pandemic stimuli proves that violent crimes doesn't correlate with economic well-being, if I interpreted your post correctly, and in context of the post you were answering. That was the point of the comparison. I never said it didn't correlate. It does correlate. If it was a 1:1 direct correlation with no influence from outside factors, then an immediate short term change for 12 months should have correlated with the 12 month crime rate. Prior to 2009, it was assumed to be an almost direct correlation. Since 2009, the data has shown that it is an important factor, but not the sole decisive factor and that other factors (like the social ones from the pandemic) can have a large enough impact to disrupt the correlation. A direct correlation, strong correlation, weak correlation, and inverse correlation are all correlational relationships, but not the same thing. Prior to 2009, it was assumed (and backed up largely by the data) that it was a direct correlation. Since 2009, the data has shown a correlation between violent crime, but not a direct one. Leon Trotsky 2012 fucked around with this message at 22:35 on Jul 7, 2022 |

|

|

|

Willa Rogers posted:I recall another recent survey in which something like 50-60 percent of teens said they'd thought of suicide or self-harm, but I'll have to go digging for it. Might be these periodic studies from Harvard; I'm pretty sure I remember you being the one to bring them to the attention of one of these threads. I know I found the mental health numbers there pretty jarring the first time I saw them.

|

|

|

|

Do Americans Know What a Massive Ripoff American Life Really Is? https://eand.co/do-americans-know-what-a-massive-ripoff-american-life-really-is-8804aa6b65fa quote:I’ve recently moved to the States — shudder — for a year or two. And I’m shocked at how expensive just life is. For no good reason at all. Gets a bit opiniony but the links to sources are in the original post.

|

|

|

|

Thanks, eviltastic; that was the study!Leon Trotsky 2012 posted:That was the point of the comparison. Thanks for the explanation. The way you phrased the pandemic relief was what caused a raised eyebrow, as if the $3000 one-offs & "tripling" the savings of those who couldn't afford a $500 emergency bill prior to the pandemic somehow proved that violent crime doesn't correlate with economic hardship.

|

|

|

|

E: nvm, not worth it

|

|

|

|

Jaxyon posted:Do Americans Know What a Massive Ripoff American Life Really Is? They really shouldn't have started this bragging about European TV

|

|

|

|

Jaxyon posted:Do Americans Know What a Massive Ripoff American Life Really Is? Wow, this is a great, if depressing, response to the claims that Americans are better off than citizens of most other countries. It's also something I've notice change gradually (and not so gradually) over the past few decades, as neoliberalism & its ensuing austerity took hold over various sectors of our economy. It's especially notable with social programs like Medicare, which have increasingly privatized & enriched its profiteers at the expense of Americans. It's also notable in the extent to which government services have been farmed out to consultants & NGOs, which became apparent during the pandemic with everything from fubar'd unemployment-comp systems in states to the rent relief to landlords & tenants.

|

|

|

|

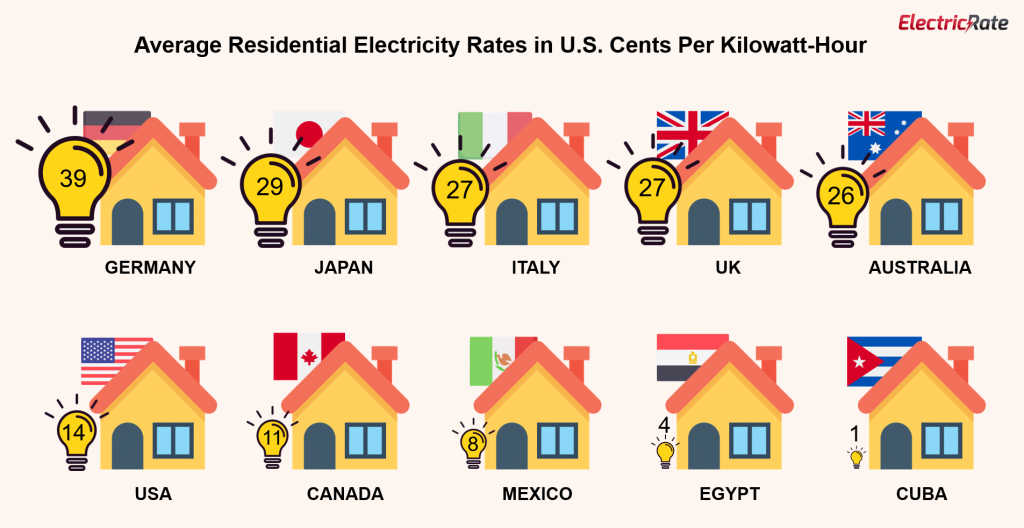

Jaxyon posted:Do Americans Know What a Massive Ripoff American Life Really Is? Lots of his overall points about things being a ripoff are right, but he is completely wrong on many many claims. Sometimes, wildly wildly off. #1 He's confusing rental costs by just converting the currency difference and not factoring in the income difference or purchasing price parity. #2 As someone who lived in the U.K. for a while, the idea that there are far fewer channels in the U.S. than Europe and that the TV quality/value is much better is an insane claim. #3 He thinks that people are regularly paying more than $1,000 a month in electric and utility bills in the U.S. That is insane. The average is about 2k per year ($166 per month). #4 He thinks that the U.S. is the only country with TV provider monopolies. #5 He thinks the average American has less than $100 for food, childcare, medicine, and recreation per week. #6 He is calculating total American healthcare costs per capita and assuming it is the out of pocket cost average. The average American isn't spending $7.5k to $12k per year out of pocket on healthcare. #7 Weirdly, after making some ridiculously high assumptions about American bills, he actually dramatically underestimates the average credit card interest rate and thinks it is about half of what it actually is. He guesses it is around 10%, but it is closer to 23%. He also thinks hedge funds and credit card companies are the same thing. #8 He says that since the average non-mortage debt load is around $6.5k per person, that the average family of 4 must have close to 25k in debt. Which is assuming that two children are going to have $6.5k in credit card debt. #9 He's making some completely wild claims like, "Americans have a true tax rate of more than 100%" because of the existence of healthcare co-pays and college tuition. I agree with many of his overall points, but he is ridiculously off on his estimates and using very bad math. Not to mention the wild opinion stuff about how all Americans crave blood and churches use bake sales and babysitting to brainwash people into violent barbarians. Or stuff like: quote:Aggression and hostility are now norms — nobody expects anyone to be kind or gentle or nice, the way Canadians and Europeans are. Edit: Tiny Timbs posted:They really shouldn't have started this bragging about European TV You beat me to it. But, I also found that immediately hilarious. Willa Rogers posted:Wow, this is a great, if depressing, response to the claims that Americans are better off than citizens of most other countries. I really hope you didn't read the whole thing. I'm not sure how anyone can somehow read through the claims that using a church daycare is "how Weimar fascism started," that American children have $6.5k in credit card debt, and that many people pay over $1,000 per month in electric bills without pausing. Leon Trotsky 2012 fucked around with this message at 23:29 on Jul 7, 2022 |

|

|

|

what do you even have to do to hit a 1k utility bill? are you running an aluminum recycling operation in your back yard?

|

|

|

|

Herstory Begins Now posted:what do you even have to do to hit a 1k utility bill? Crypto.

|

|

|

|

Mulva posted:And yours does exactly the opposite for mass shootings. (USER WAS PUT ON PROBATION FOR THIS POST)

|

|

|

|

If UK TV is so bad why does America keep ripping it off?

|

|

|

|

Leon Trotsky 2012 posted:I really hope you didn't read the whole thing. I'm not sure how anyone can somehow read through the claims that using a church daycare is "how Weimar fascism started," that American children have $6.5k in credit card debt, and that many people pay over $1,000 per month in electric bills without pausing. He doesn't say $1000 in electric bills, he says 500-1000 for all utilities, and depending on where you are and if you own vs rent, that can be true. I have a smaller ($1300sq ft) house in LA and with not very serious usage and including all my utilities(internet, tv streaming, water electric gas garbage sewage), I'd say $500 is about right. In cold parts of the country you can break $500 for heating alone during winter. I don't agree with everything in that blog, but I do think the larger argument that the US is quite a bit more expensive to live in than we give it credit for is correct. Average household consumer debt in the US around $90k Jaxyon fucked around with this message at 00:05 on Jul 8, 2022 |

|

|

|

Jaxyon posted:Do Americans Know What a Massive Ripoff American Life Really Is? Nice opinions indeed. quote:Let’s take utility bills. They’re astronomical in America compared to the rest of the rich world, and even much of the rest of the world period. Heating, electricity, gas, water? These things can easily add up to $500 to $1000 dollars per month. Electricity in Seattle is $0.1056-$0.1307 per kwh today: https://www.seattle.gov/city-light/residential-services/billing-information/rates At the end of December 2021, statista reported: https://www.statista.com/statistics/263492/electricity-prices-in-selected-countries/ posted:Denmark and Germany had one of the highest electricity prices worldwide, as of September 2021. At the time, Danish households were charged around 0.36 U.S. dollars per kilowatt hour, while in Germany the price stood at 0.35 dollars per kWh. By comparison, in neighboring Poland, residents paid about half as much, while households in the United States were charged even less. I can’t find a good source in English for more recent consumer electricity prices in Germany right away, but this source from July 2022 reports an average of USD 0.39: https://www.electricrate.com/data-center/electricity-prices-by-country/#Countries_With_Most_Expensive_Electricity_Prices The USA is not even in the top 20 countries for electricity prices, of which 11 are in Europe.

|

|

|

|

Jaxyon posted:He doesn't say $1000 in electric bills, he says 500-1000 for all utilities, and depending on where you are and if you own vs rent, that can be true. He specifies that utilities means water, gas and electric. TV and internet are covered as another cost.

|

|

|

|

I remain unconvinced that people are regularly (or even almost ever) hitting 1000/mo utility bills while living on minimum wage livelihoods.

|

|

|

|

mawarannahr posted:Nice opinions indeed. In general Germany has higher per kwh costs than the US, but lower actual utility bills. I'm not sure how the current energy crisis has changed that. Also Los Angeles metro has twice as many people as the entire state of Washington and also is at 0.25/kwh Herstory Begins Now posted:I remain unconvinced that people are regularly (or even almost ever) hitting 1000/mo utility bills while living on minimum wage livelihoods. I agree

|

|

|

|

Herstory Begins Now posted:I remain unconvinced that people are regularly (or even almost ever) hitting 1000/mo utility bills while living on minimum wage livelihoods.

|

|

|

|

mawarannahr posted:Nice opinions indeed. You're comparing Seattle City Light, a taxpayer subsidized municipal utility, with privatized electric. Look up the rates for Georgia Power and get back to me. I am a Seattleite, I know how this works. SCL is billed bimonthly and routinely 50-60% less than the average cost of a non-municipal utility. More Americans are served by private electric utilities than aren't. SCL specifically receives taxpayer and state funding subsidies to keep costs of utilities low for those who are covered under it. SCL also ONLY covers Seattle city limits, which covers less than half of the Seattle-Tacoma metro population. Much more is covered by Puget Sound Energy than not, which is substantially more expensive than SCL. HonorableTB fucked around with this message at 00:23 on Jul 8, 2022 |

|

|

|

Jaxyon posted:He doesn't say $1000 in electric bills, he says 500-1000 for all utilities, and depending on where you are and if you own vs rent, that can be true. As mentioned, he specifies that the $500 to $1,000 figure is for water and power and says many people "easily" pay $1k per month. I tried to use a calculator to find some way to pay $1k in water and power anywhere in the U.S. and the closest I could find was to be in Hawaii, with a larger than average house, running central air 24/7, with above average electrical appliance use and I could only get to around $600. That consumer debt count includes mortgages. It's around $6k when you exclude those. And that number is skewed by a few people with very large debts. More than half of Americans have between $0 and $2,000 of credit card debt. He is grossly overestimating utility costs in the U.S. and underestimating them in Europe. Leon Trotsky 2012 fucked around with this message at 00:31 on Jul 8, 2022 |

|

|

|

Jaxyon posted:He doesn't say $1000 in electric bills, he says 500-1000 for all utilities, and depending on where you are and if you own vs rent, that can be true. As far as the utilities go, he's counting internet and tv streaming as separate from utilities; the article has it at $150 on those then a further $500 - $1000 per month on water/electric/gas/sewer/garbage, so you're still below his claimed utility bills. I don't know what average utility costs are like in other places, but I've had a larger house than 1300 sq ft in a much colder part of the USA than Louisiana and my utilities in the winter got to about $250 at most. I'm just a single data point, but unless he's got a source for that, it sounds very off. His overall point I think stands, but it stands on the ridiculously insane costs of certain things like healthcare and education. Most of the rest of that doesn't seem to be harder to get here than anywhere else. Except of course for the incredible European tv shows that everyone raves about so much.

|

|

|

|

HonorableTB posted:You're comparing Seattle City Light, a taxpayer subsidized municipal utility, with privatized electric. Look up the rates for Georgia Power and get back to me. Electric rates in Germany are almost 3x the kw/h of the U.S. The U.K. has about 2x. The E.U. has fairly high electric and gas prices. Canada is the only OECD country with cheaper electricity than the U.S.

Leon Trotsky 2012 fucked around with this message at 00:29 on Jul 8, 2022 |

|

|

|

Crows Turn Off posted:You are able to see the graph, yes? Not sure you actually understand the data points and trends here. Oh by all means go off, I'm sure this isn't going to blow up in your face at all. I also deleted a much longer post about how his CRS report link was sappy bullshit that also didn't show what he said it did because I am frankly tired of running in this circle, and also more interesting discussions were happening, but if you want to call me out we can go. e: I'd rather you didn't, it's not an interesting conversation and there's nothing meaningful to say about it. But again, if you want to.... (USER WAS PUT ON PROBATION FOR THIS POST) Mulva fucked around with this message at 00:30 on Jul 8, 2022 |

|

|

|

Leon Trotsky 2012 posted:That consumer debt count includes mortgages. It's around $6k when you exclude those. And that number is skewed by a few people with very large debts. More than half of Americans have between $0 and $2,000 of credit card debt. When you include mortgages, the worst country in Europe is Switzerland with 50k to the US's 90k. https://www.statista.com/statistics/1073009/debt-per-adult-europe-by-country/ Dopilsya posted:Except of course for the incredible European tv shows that everyone raves about so much. To be fair, you can't praise the US version of The Office without someone teleporting into the room and saying "But the UK version was so much better!" Jaxyon fucked around with this message at 00:33 on Jul 8, 2022 |

|

|

|

Why would you include mortgages? If you're making an argument for how poor Americans are versus those in other countries you'd use unsecured debt.

|

|

|

|

Jaxyon posted:When you include mortgages, the worst country in Europe is Switzerland with 50k to the US's 90k. The mortgage is tied to an asset, though. If someone has $50k in credit card debt and another person has a $150k mortgage, the person with $150k in debt is not the person with bigger financial problems.

|

|

|

|

HonorableTB posted:You're comparing Seattle City Light, a taxpayer subsidized municipal utility, with privatized electric. Look up the rates for Georgia Power and get back to me. https://www.georgiapower.com/residential/billing-and-rate-plans/pricing-and-rate-plans/residential-service.html According to Georgia Power's website, electricity costs are cheaper there than the quoted costs in Seattle.

|

|

|

|

|

| # ? May 24, 2024 23:43 |

|

https://www.cleanenergywire.org/factsheets/what-german-households-pay-power Most sources i've found say that despite a much higher price/kwh in Germany, for instance, the actual utility bill tends to be less than US$100, while the average US monthly bill is about 20% higher than that. I'm sure the current increases have blown both of those numbers up.

|

|

|