(Thread IKs:

fart simpson)

|

Cao Ni Ma posted:Whoa it took this long for the guy to realize this when japan got run over in the 80s already Japan managed it's decline pitch perfectly with a massive cultural boost and slow sinking into dotage.

|

|

|

|

|

| # ? May 26, 2024 05:37 |

|

Cao Ni Ma posted:Whoa it took this long for the guy to realize this when japan got run over in the 80s already i mean like even china's nascent DRAM industry is light years ahead now of japan with zero shouldn't have sold elpida to america, cucksters

|

|

|

|

Jeb Zemin

|

|

|

|

I don't know if this is funny but it's been stuck in my head for a while now: the cultist scene from hot fuzz except the cultists chant "rules-based global order" over and over

|

|

|

|

Tankbuster posted:Japan managed it's decline pitch perfectly with a massive cultural boost and slow sinking into dotage. what decline? it's still the third largest economy by gdp in the world?

|

|

|

|

what decline? the US is still the largest economy by gdp in the world?

|

|

|

|

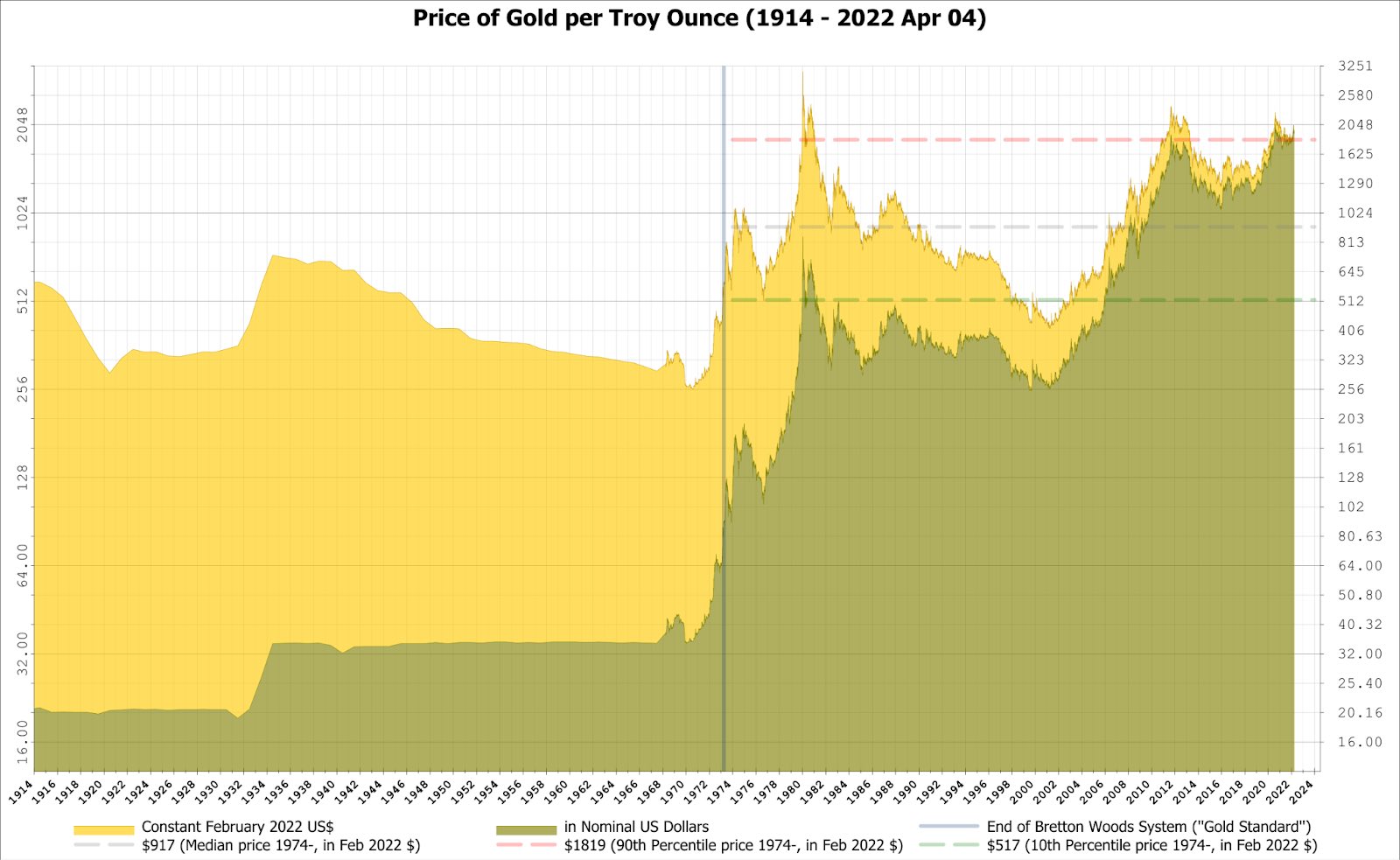

Gdp, that famously valid number that gets boosted by productive things like real estate value and financial speculation

|

|

|

|

|

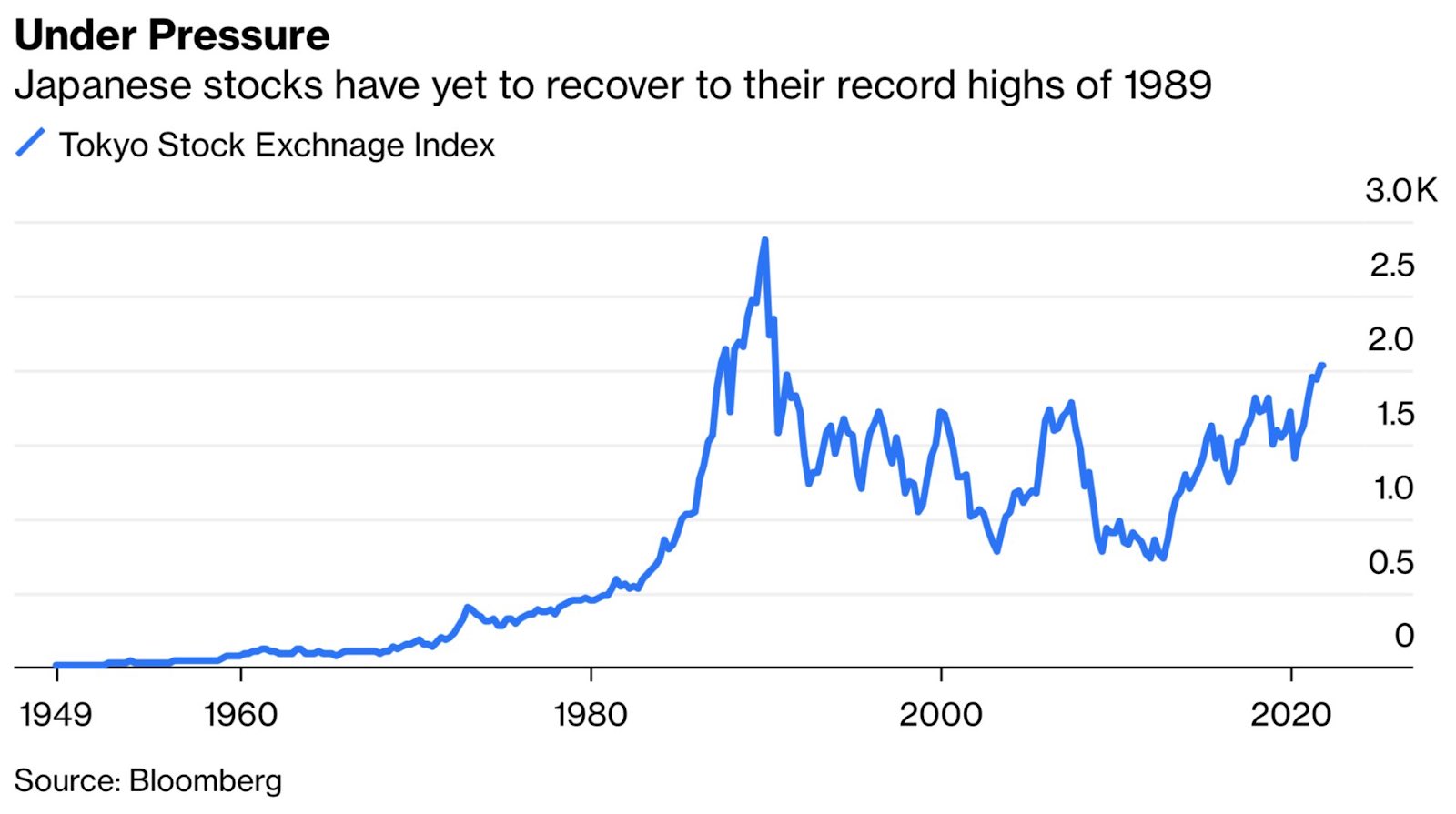

ok, but every time i read about japan's decline it's in reference to the bubble. like the current state of affairs is the aberration and the bubble wasn't. seems backwards to me, but iunno i just live here.

|

|

|

|

unwantedplatypus posted:Thank you Xi Jinping for eliminating sexual poverty in China Unironically a fan of Marxism—Leninism—Jinpingism

|

|

|

|

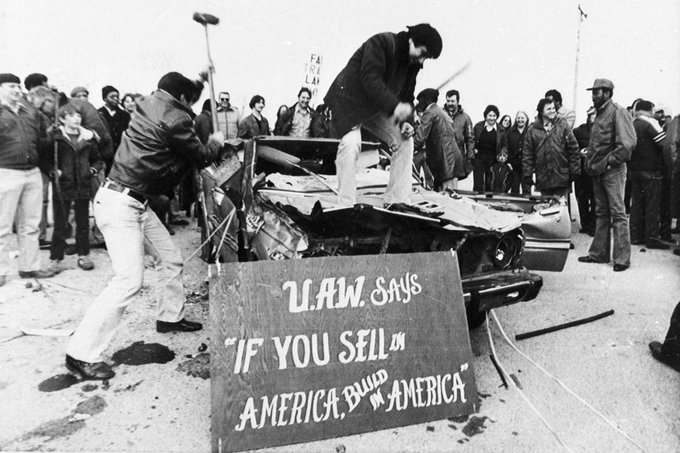

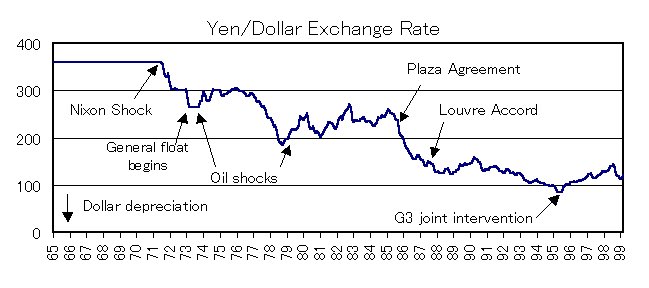

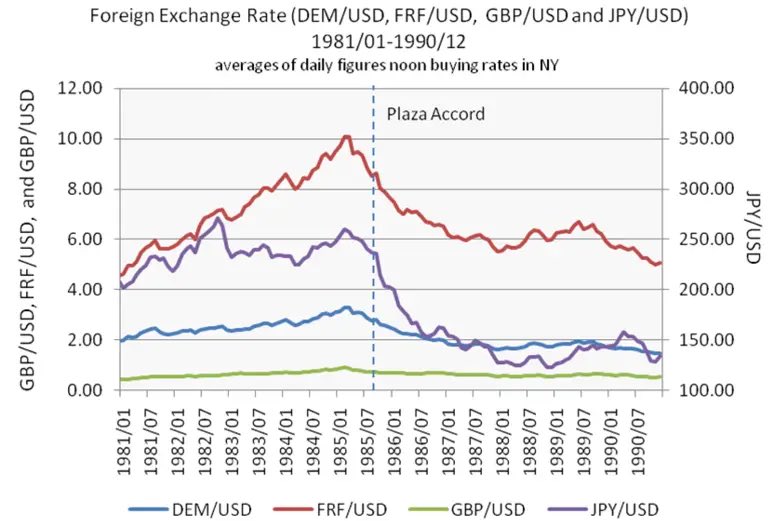

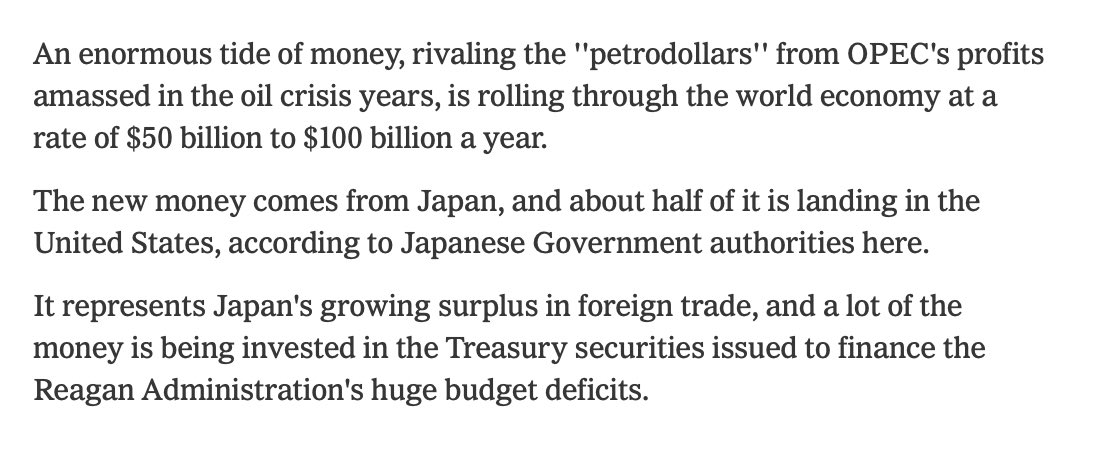

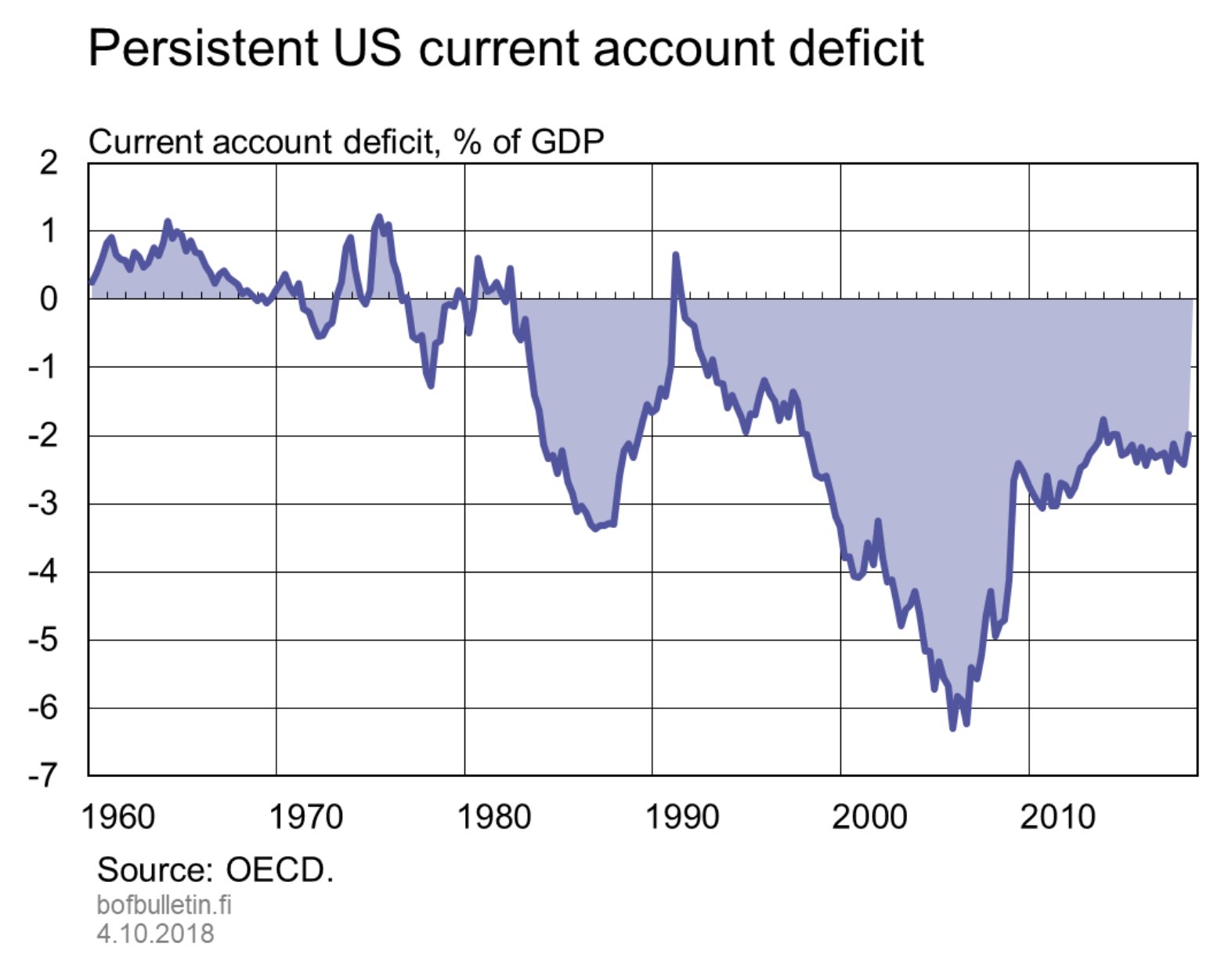

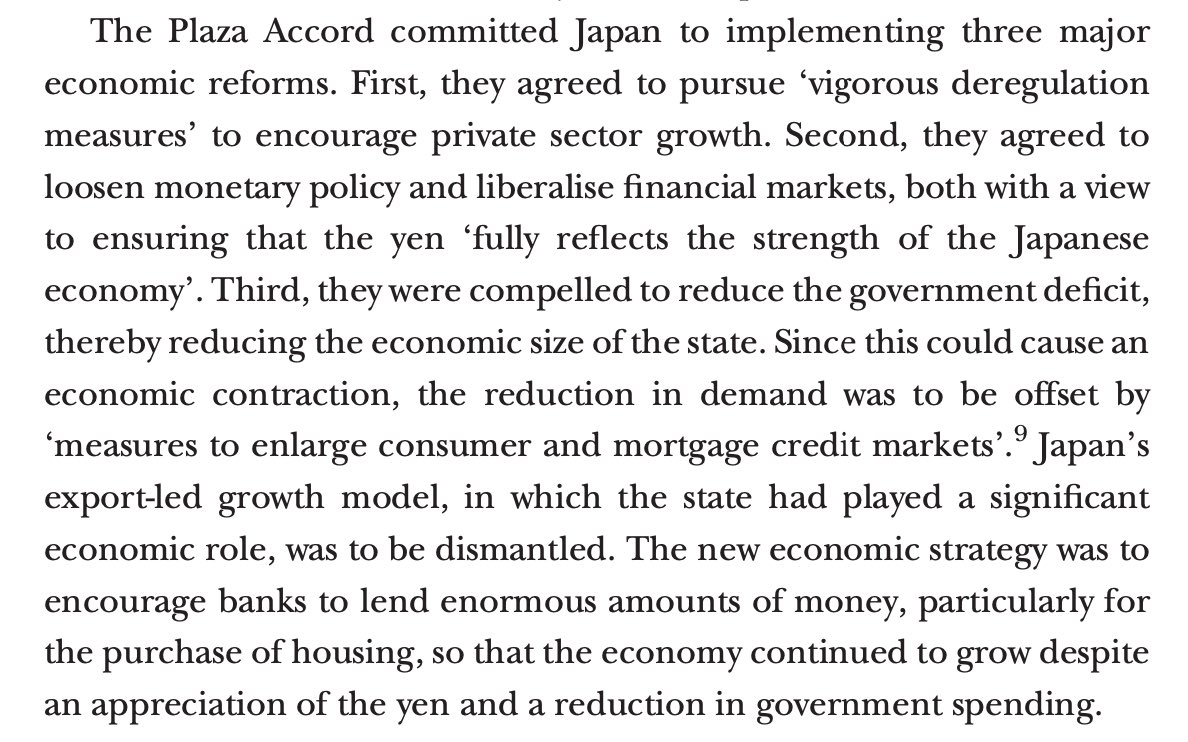

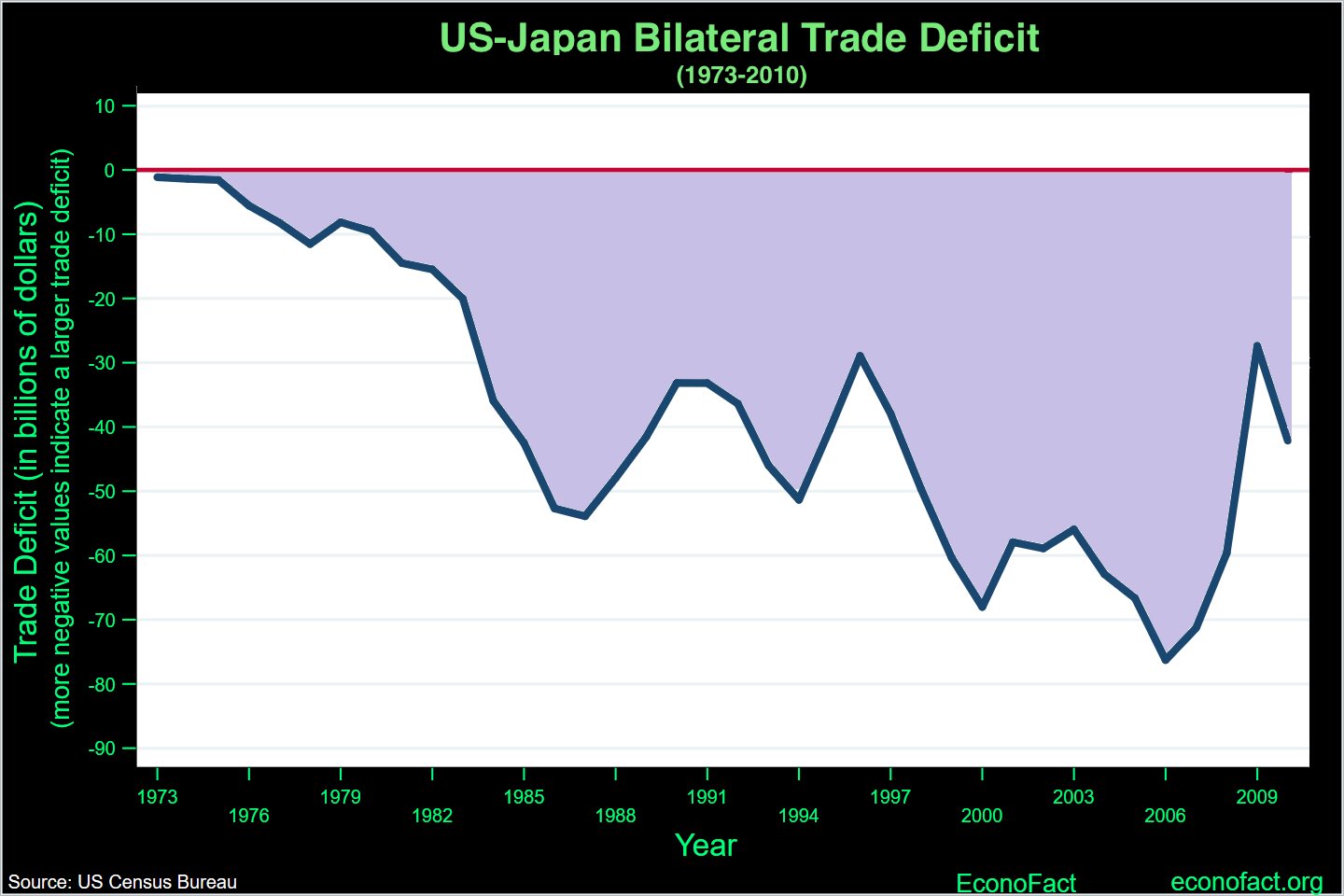

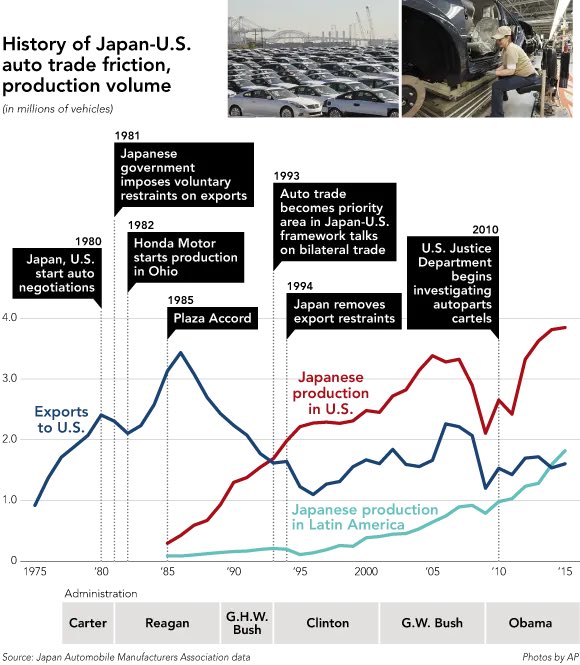

Stringent posted:ok, but every time i read about japan's decline it's in reference to the bubble. like the current state of affairs is the aberration and the bubble wasn't. Japan basically got its prized manufacturing sector ripped up by the US: https://twitter.com/bidetmarxman/status/1564267348017938434 quote:It is impossible to understand the current existential threat the US feels from China without first understanding what happened to Japan 37 years ago.

|

|

|

|

Stringent posted:ok, but every time i read about japan's decline it's in reference to the bubble. like the current state of affairs is the aberration and the bubble wasn't. You live in a country that managed finish the video game called Capitalism.

|

|

|

|

Some Guy TT posted:so anyway im in quarantine now and im wondering if theres any way to get a chinese sim card and phone number while im stuck here ill probably need a whole new phone too while im at it since i cant open this one and replace the card Presumably you're in China quarantine. Unless you picked up a prepaid or dual number SIM in HK, you might have to wait until you're out and visit any of the major telcos to buy a new SIM. This is because they usually require an ID/passport to get your SIM. You can also pick up a cheap burner at these places, and although there's cheaper options it'll mean going to another shop. Another option would be contacting the school to see if they can courier you a SIM+burner in quarantine. Most hotels allow delivery, but whether the school can arrange the SIM is another question. With a Chinese number you can sign up for WeChat but you'll eventually need to add ID verification and stuff. Once you have the set up, I hope you have a working US credit card so you can set up an Alipay tourist pass and load it with some RMB. Almost everything gets done cashless these days. The tourist pass is good for 30 days which would be enough for you to get your residence permit (if you're on a work visa?) and then you can set up a local bank account and link it to WeChat/Alipay. Make sure you're getting monthly pay slips with the tax paid listed on them, or that the HR keeps those records in an easy to access place. If you ever want to convert RMB to foreign currency, you'll need those records because they basically need to do the matching of your take-home pay against the currency conversion.

|

|

|

|

Danann posted:Japan basically got its prized manufacturing sector ripped up by the US: right, that's what i was saying. there's this narrative in the west at least that japan is in some terminal state of decline since the 90s, but the facts as i see them aren't that japan is in decline so much as it's no longer experiencing explosive growth. and yeah, the fact that the US state dept runs the japanese government and the dollar being the world's reserve currency had a big effect on how that growth was stopped, but i'm p sure it was going to stop one way or another at some point.

|

|

|

|

Telluric Whistler posted:Make sure you're getting monthly pay slips with the tax paid listed on them, or that the HR keeps those records in an easy to access place. If you ever want to convert RMB to foreign currency, you'll need those records because they basically need to do the matching of your take-home pay against the currency conversion. i dont think you need to keep paper records for this. you can just go to the tax office and request a copy of their records, it takes like 10 minutes and it's free

|

|

|

|

besides, Japan already developed the Fumo. Any people can rest after making something so sublime.

|

|

|

|

fart simpson posted:i dont think you need to keep paper records for this. you can just go to the tax office and request a copy of their records, it takes like 10 minutes and it's free My god. Xi Jinping please save us my people yearn for efficient local bureaucracy

|

|

|

|

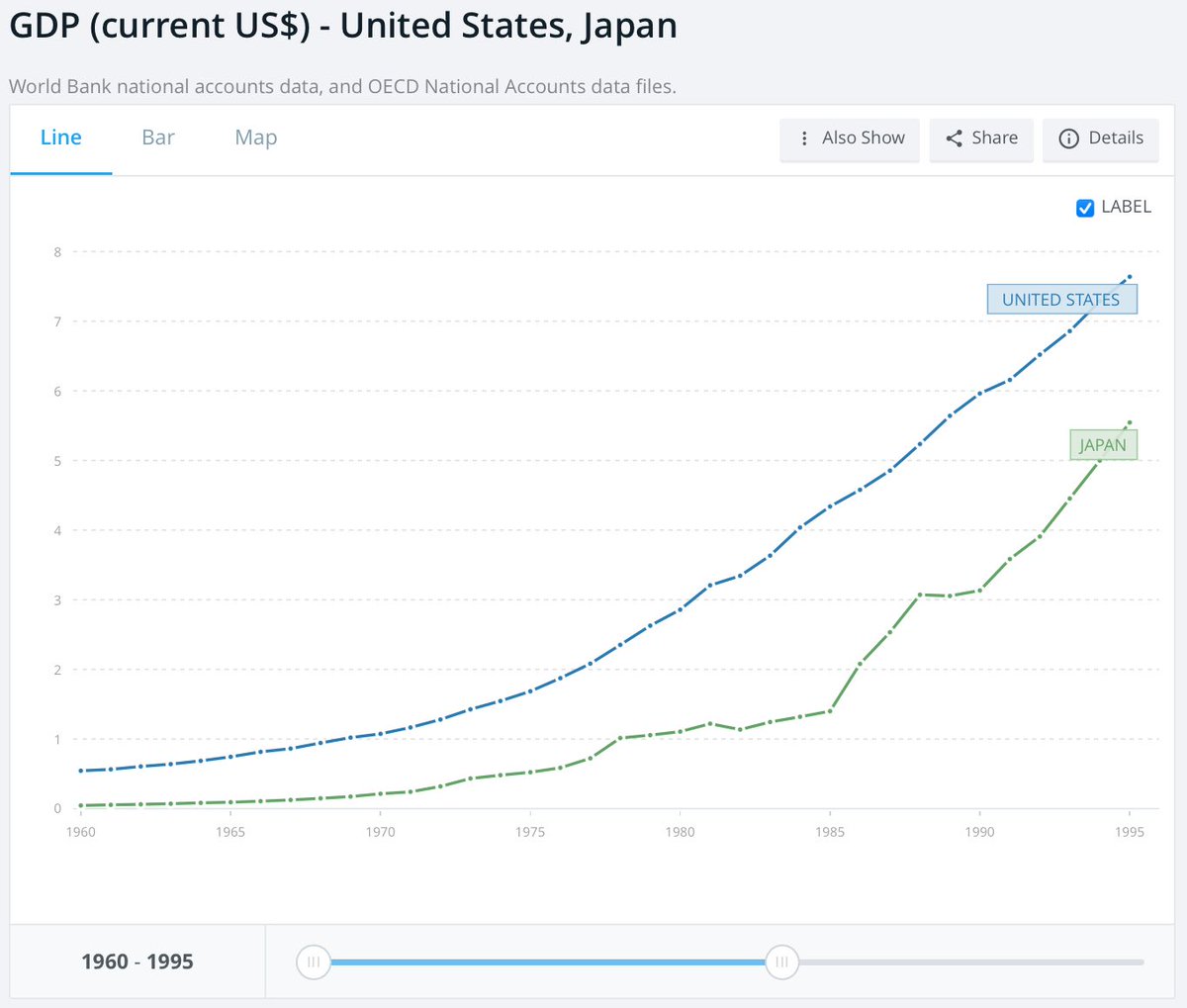

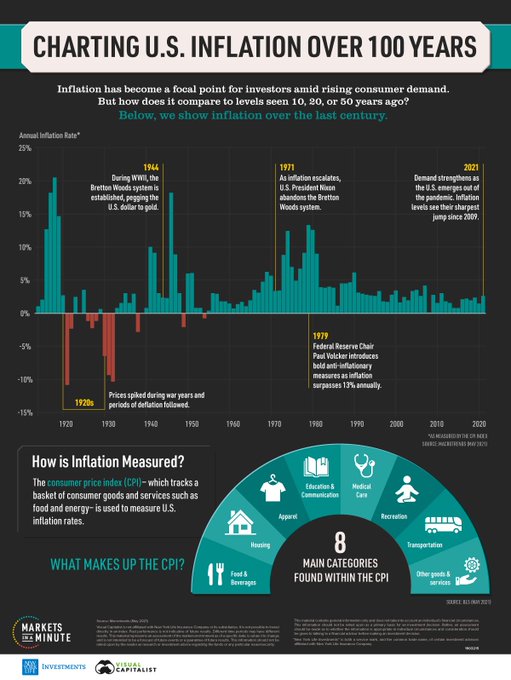

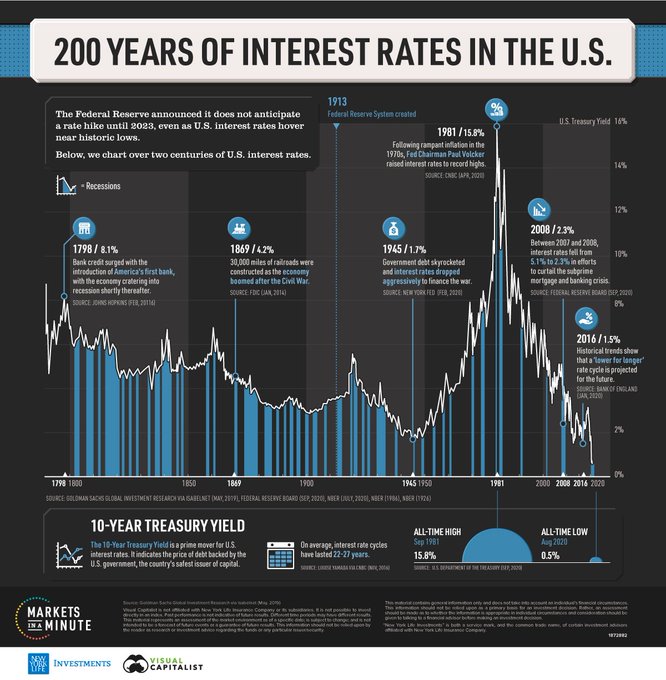

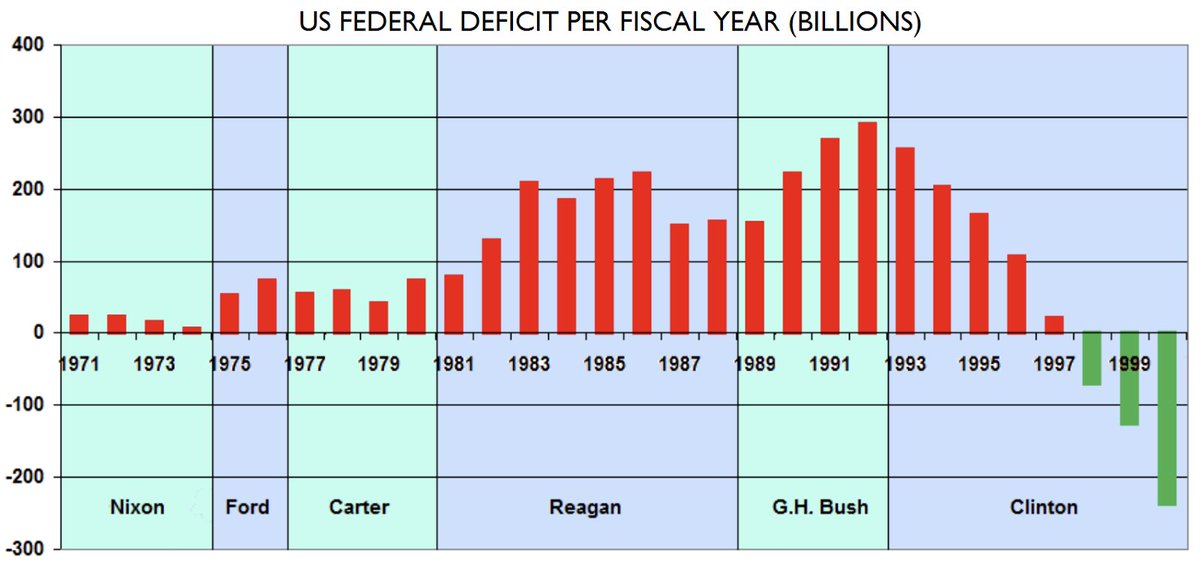

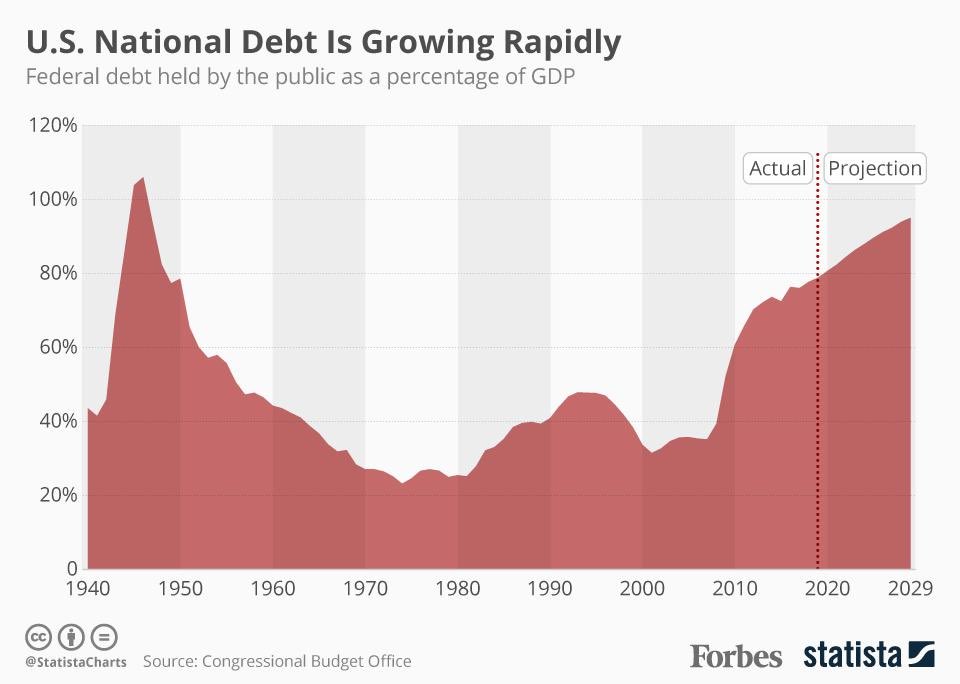

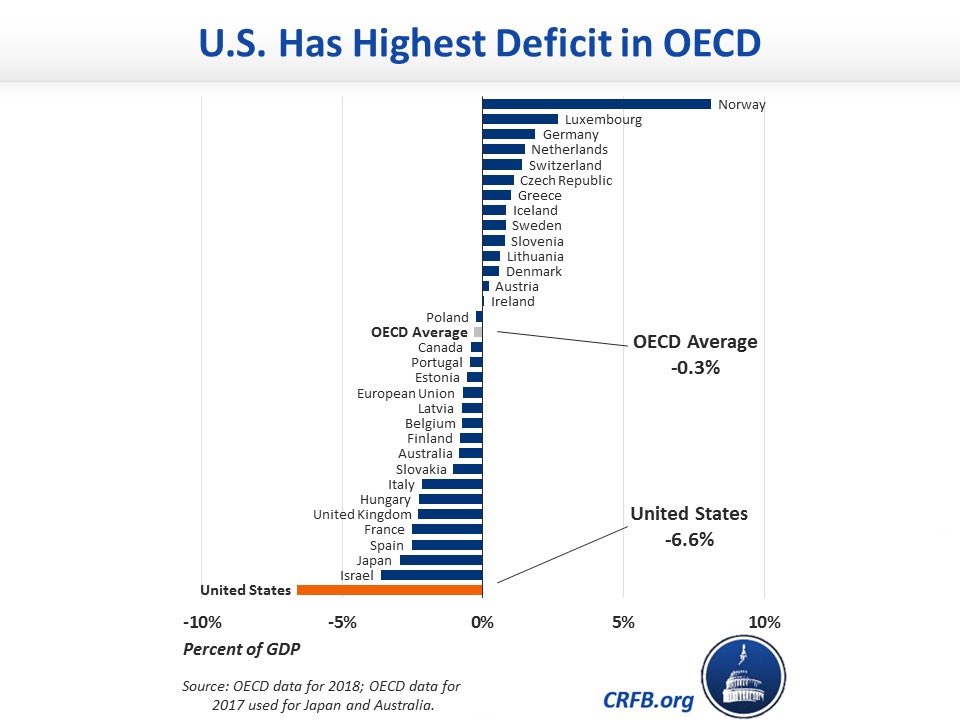

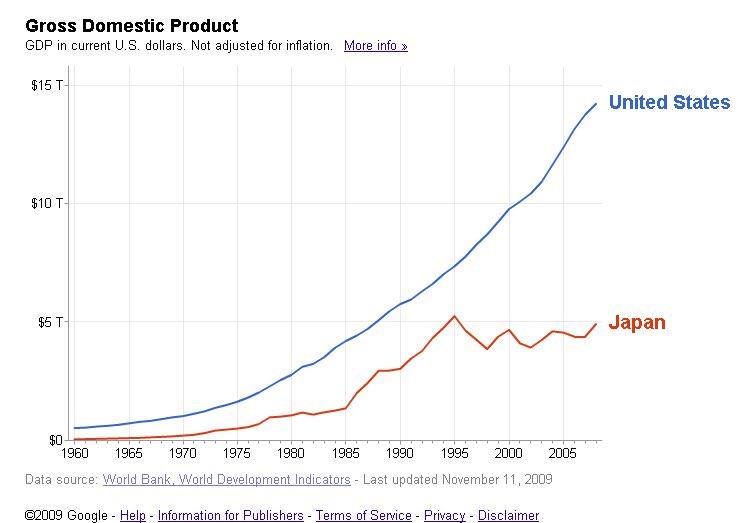

Stringent posted:what decline? it's still the third largest economy by gdp in the world? Stringent posted:right, that's what i was saying. there's this narrative in the west at least that japan is in some terminal state of decline since the 90s, but the facts as i see them aren't that japan is in decline so much as it's no longer experiencing explosive growth. I would disagree with your opinion that it was only explosive growth that stopped. Growth has stopped. The economy has stagnated. The country is poorer relative to other nations than it was. Japanese people are poorer now then they were 30 years ago. Sure it's the third largest economy by GDP in the world, but that's a result of things that predate most of my lifespan. Let's take a look at GDP and per capita. We'll make the start year 1995, because that's the last year before Japan's GDP growth dives and flat lines.  We see Japan is sitting at $5.5T GDP and a per capita of $44k in 1995. It takes 15 years for it to get back to these numbers again and it does not stay there for long. It sits at $4.9T GDP and a per capita $39k in 2021. That's bad, real loving bad. Especially the last five years. Where the line is for all intent and purposes a flat line. Even if we measure from 1998. The year that the GPD tanks to $4.0T. The country has barely climbed upward. Let us compare with the country that sits right behind Japan in the rankings, both then and now: Germany. In 1995 it sat at $2.5T GDP and a per capita of $31k. In 2021 it sits at $4.2T GDP and a per capita $50k.

|

|

|

|

droll posted:My god. Xi Jinping please save us my people yearn for efficient local bureaucracy muh privacy as i give everything to and fear the irs

|

|

|

|

OhFunny posted:I would disagree with your opinion that it was only explosive growth that stopped. Growth has stopped. The economy has stagnated. The country is poorer relative to other nations than it was. Japanese people are poorer now then they were 30 years ago. i'm not an economist so i don't know what any of that actually means. like, it's valued in usd, so is it accounting for fluctuations in exchange rates? does it take into account changes (or the lack thereof) of prices of things? i get that number isn't going up, but what are the practical ramifications of that supposed to be?

|

|

|

|

Stringent posted:i'm not an economist so i don't know what any of that actually means. i think the point is that america stepped in to engineer all of this to keep japan's economy from rising up too high, despite being a pretty close ally

|

|

|

|

fart simpson posted:i think the point is that america stepped in to engineer all of this to keep japan's economy from rising up too high, despite being a pretty close ally well, no argument there

|

|

|

|

fart simpson posted:ally Not a very good choice of words

|

|

|

|

Vassal state.

|

|

|

|

Danann posted:Japan basically got its prized manufacturing sector ripped up by the US: Mandoric also had some good posts on this topic from the econ thread Mandoric posted:And there are political considerations as well. Keeping a currency low encourages exports in a competitive market, and can be used to encourage spending domestically rather than on imports; keeping a currency high makes imports cheap but leaves exporters unable to compete. The US famously stomped its feet in the '80s and threatened to just ban imports from Japan unless it pushed the yen from around \300=$1 to \100=$1; Japan complied and turbofucked itself, with costs of labor and domestic commodities essentially tripling, and the creation of a bifurcated economy where those who had suddenly had 3x more when spending as long as they did it overseas while those who didn't and had to spend more of their paycheck to begin with on domestic goods suddenly couldn't find manufacturing work because real export prices had dropped by 67% but also weren't paying any less at the supermarket. Mandoric posted:Yes, IMO. It's not a universal opinion, but it's not an uncommon one; the result of a drastic upward revaluation "doubling a currency's value" is essentially deflation, which means huge unearned rewards for those already sitting on actual or locked-in future money and a big crunch for those with big cash flows but not a hoard. Very much in the short-term interest of bankers, poor for processing industry whose domestic labor becomes more expensive, and terrible for extraction industry whose expenses remain the same but whose export prices halve and for younger and more marginal laborers who are now costing the company twice as much but who still have to spend most of it on purely domestic goods that haven't gone down. Encourages financialization and speculative bubbles heavily as the bankers now have twice the weight to throw around, also encourages foreign rather than domestic investment as foreign things are ~so cheap now~. Mandoric posted:

|

|

|

|

strange feelings re Daisy posted:brb, immersing myself in the Xi Jinping thought map 🧠🧠🧠🧠🧠🧠🧠🧠👍👍👍👍👍👍👏👏👏👏👏👏👏👏🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

|

|

|

|

would love to see biden thought map

|

|

|

|

Corn |-| |-| |-| |-| |-| |-| |-| |-| |-| Pop

|

|

|

|

Mantis42 posted:would love to see biden thought map one of those images that make you feel like you’re having a stroke with the twist of actually giving you one

|

|

|

|

Mantis42 posted:would love to see biden thought map young mouths all the way down?

|

|

|

|

|

|

|

|

Sniff -> grope

|

|

|

|

|

|

|

|

lmao

|

|

|

|

Stringent posted:i'm not an economist so i don't know what any of that actually means. There's a thing called Purchasing Power Parity which basically does what you say. If you earn $15/hr but a burger meal is $15 and in another country you earn $5 and a burger meal is $5... we can say $5 in that other country's PPP is $15 Here's Japan, but like any human derived "unskewing" of the data it's not 100% accurate.  https://tradingeconomics.com/japan/gdp-per-capita-ppp#:~:text=GDP%20per%20capita%20PPP%20in,of%2032846.39%20USD%20in%201990. Antonymous has issued a correction as of 10:35 on Oct 17, 2022 |

|

|

|

What kind of ailment causes a man to thirst while speaking for two hours

|

|

|

|

that might look OK but that puts it around the PPP of Spain, Czech Republic and Puerto Rico according to the IMF. GDP Per capita also doesn't take into account income distribution and that's a big part of how wealthy a place might feel. Here's 3 different groups measures of countries by GDP per capita in PPP https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita

|

|

|

|

loving hell

|

|

|

|

Antonymous posted:that might look OK but that puts it around the PPP of Spain, Czech Republic and Puerto Rico according to the IMF. that's interesting. i've actually got a couple friends from spain that have lived here for quite a while and, at least according to them, economic prospects are a lot better in japan than in spain. i'm definitely too dumb to understand this stuff tho.

|

|

|

|

|

|

|

|

|

| # ? May 26, 2024 05:37 |

|

Stringent posted:that's interesting. i've actually got a couple friends from spain that have lived here for quite a while and, at least according to them, economic prospects are a lot better in japan than in spain. Japan has a lot of poverty and the countryside of japan is really poor. if you just go to tokyo b/c you got a job offer I guess you can avoid a lot of it idk "The OECD reported in July 2006 that Japan suffers high rates of relative poverty. Another OECD report stated that Japan was second worst in poverty among the OECD member nations, in the mid 2000s" https://en.wikipedia.org/wiki/Poverty_in_Japan OECD includes spain edit: Japan is pretty low on here (low meaning having high poverty rate), still lower than spain in the 2021 data, but lol usa is almost dead last, below bulgaria, for poverty rates https://data.oecd.org/inequality/poverty-rate.htm gently caress this place Antonymous has issued a correction as of 11:06 on Oct 17, 2022 |

|

|