|

tagesschau posted:The ability to make objectively stupid decisions and still make money hand over fist is the surest sign that you're in an inflating bubble, isn't it? I agree with your premise, but I'll point out that it's not objectively stupid. Risky is different from stupid; it's always risky, and as a result, it may also be stupid, but those two aren't directly connected. Every investment involves some degree of risk. Everyone's saying "well, the developer is offloading all the risk to the purchasers!" Yes, of course they loving are! That's the whole point of the contract: the developer doesn't reap the full reward if the property is worth more than they sold it for, but they're protected in the event that the thing that's currently happening, happens. And if it doesn't happen, the buyer gets a great return in exchange for doing literally nothing beyond providing a deposit. Now, would I leverage myself to do it? No, that's asking for trouble. At that point, your downside risk is far too high, unless you hedge it somehow. Take a loan under guaranteed but unfavourable terms, and now you've offloaded that risk to a lender, who is willing to take the risk based on the fact they can make a lot of money off it. Now you've cut off some of your potential upside, but you've limited your downside. It's not rocket science, it's just that something about real estate purchases jumbles people's minds.

|

|

|

|

|

| # ? May 18, 2024 05:22 |

|

T.C. posted:The people that we actually want to support in this situation are not at all sophisticated actors on average and it's not reasonable to expect them to be. It is reasonable to consult a lawyer (another lawyer, your own lawyer, if you are yourself a lawyer) if you're making a 5-figure or above deal, and unlike realtors they can actually face consequences for giving negligent advice.

|

|

|

|

PT6A posted:Risky is different from stupid; it's always risky, and as a result, it may also be stupid, but those two aren't directly connected. I guess it depends on how many of your eggs you're putting in one basket. The difference in foolhardiness between borrowing to go all in on Oakville pre-con home futures, borrowing to go all in on AAPL, and betting it all on black at the wheel is small enough that it's not really worth ranking them in order from smart to dumb. T.C. posted:Part of why real estate is overpriced is because the downside risk is treated like it's zero, so people price profitability based on the 40 percent return minus debt costs. People treat the cost of holding the asset as though it's zero, too. That fuels the perception largely in our parents' generation that it's basically impossible for a home purchase to be a bad financial decision in the long run.

|

|

|

|

I was advised by a financial advisor in 1999 to not buy property in Toronto because it was overpriced and near a peak. Sadly, 22-year-old me listened.

|

|

|

|

What is remarkable about our (assuming we're mostly millennials here) parents' generation is that in the 1980s they experienced an interest spike that was so severe it makes the recent climb in interest rates look like nothing, and this combined with the ensuing recession nearly bankrupted anyone that was exposed to real estate and yet even having gone through all that, the appreciation of real estate since that trauma has been so good that they're committed real estate bulls.

|

|

|

|

We got a protest now, 1 day a week for 2 hours, until demands are met. Also, this poor guy went from buying 5 million in real estate to struggling to put food on the table. https://v.redd.it/qe04brkh3nga1

|

|

|

|

Femtosecond posted:What is remarkable about our (assuming we're mostly millennials here) parents' generation is that in the 1980s they experienced an interest spike that was so severe it makes the recent climb in interest rates look like nothing, and this combined with the ensuing recession nearly bankrupted anyone that was exposed to real estate and yet even having gone through all that, the appreciation of real estate since that trauma has been so good that they're committed real estate bulls. I find people's memory realistically go back maybe like 5 years

|

|

|

|

PT6A posted:It is reasonable to consult a lawyer (another lawyer, your own lawyer, if you are yourself a lawyer) if you're making a 5-figure or above deal, and unlike realtors they can actually face consequences for giving negligent advice. I think the only point that people are trying to make is that these kind of high-risk contracts need to be regulated so that only idiots like that real estate lawyer get burned who should've known better. Buying presales is extremely common-place for "normal" people who would never be allowed to do, say, high-risk options trading or whatever. Regulations exist to protect unqualified or oppressed people from burdensome contracts and I see no reason why real estate contracts should be exempt. As another example, regulations should exist to prevent the existence of unconditional purchase agreements to protect people from their own idiotic decisions in FOMO markets.

|

|

|

|

Boot and Rally posted:My reading of the thread is that most people want protections for people who want a place to live. The speculators will either need much tighter restrictions or to be excluded through other means like taxing it so much to not make it worth it. Exactly. Speculators can get hosed but people trying to buy homes to live in shouldn't have to face a gauntlet of traps designed to funnel their life savings away into the coffers of shady developers. It's not the same as losing your shirt buying the latest GriftCoin (NotAScam), which, to be clear, should also be regulated out of existence.

|

|

|

|

I was wondering when Toronto was going to release any information about the vacant home tax and welp:Toronto’s vacant home tax deadline extended as many homeowners fail to respond posted:The deadline for Toronto’s new vacant home tax has been extended to the end of the month, Mayor Tory said Thursday, with about 84.5 per cent of homeowners completing the required form to declare whether their home is empty. Head of government professes to not wanting revenue, announces that predicted wet fart is going to be even wetter than ever imagined from the standpoint of pant making GBS threads. Anyway, I guess some non-zero amount of people are going to pay it instead of taking the obvious step of lying or ignoring the notice and daring the city to actually do something.

|

|

|

|

What we've seen in BC/Vancouver is that pretty much everyone is exempt from these taxes as all but the extrordinarily wealthy sell off their pied-a-terre condos they were keeping around to small time investors that rent them out. BC government says 99% of British Columbians are exempt from the Speculation Tax. Similarly the amount of actual empty homes impacted by Vancouvers' empty home tax keeps plunging. quote:https://storeys.com/city-of-vancouver-empty-homes-tax-report-2021-year/ This was the goal of the tax really to pretty much actually tax no one but to force units on to the market. Seems like it's working. Any revenue being generated is just like a nice to have. quote:By neighbourhood, Shaughnessy, West Point Grey, and the West End had the highest proportions of vacant homes, at 5% (but not the highest amount). Most the neighbourhoods on the eastern side of Vancouver had the lowest proportions of empty homes. Where the empty homes are are pretty much the mansion districts of the city. Femtosecond fucked around with this message at 19:33 on Feb 8, 2023 |

|

|

|

Femtosecond posted:What we've seen in BC/Vancouver is that pretty much everyone is exempt from these taxes ... and on that note: Builders seek extension on Toronto’s new vacant homes tax posted:Toronto region homebuilders are asking the city to extend the time they have to start paying the new vacant home tax on unsold housing units. Shocking that the guy from BILD can't come up with a plausible reason why they should be allowed to let unsold units sit vacant until ~market conditions improve~ and the price is right for them.

|

|

|

|

Isn’t “allowing people to sit on empty property until they can get more money for it” literally the exact thing the tax is supposed to discourage, and the one and only thing it can plausibly accomplish? IMHO, charge the developers double, and also force them to open a booth where you can pay to Spank a Condo Developer until all units are sold.

|

|

|

|

eXXon posted:... and on that note: quote:it’s not clear how many unsold units are sitting empty but it could take a year or longer in current real estate market conditions to sell those empty homes Yeah lol, it's not in "current real estate market conditions", it's "at the current unsellable listed price". I assure this guy, they will sell if you lower the price tag no problem. Maybe BILD should rent them out while they're waiting for "market conditions". You know, the exact purpose of the tax.

|

|

|

|

boom quote:Many new homes at risk, as major Vancouver developer files for insolvency Looking around twitter, looks like a lot of vancouver developers smugly making mock surprise comments. Seems like folks knew this company was on a shaky foundation for a long time and were expecting this.

|

|

|

|

Femtosecond posted:boom That's the sentiment on reddit as well.

|

|

|

|

Femtosecond posted:boom 👀

|

|

|

|

We just didn't free market hard enough. Time to double down on deregulation imo.

|

|

|

|

Guest2553 posted:We just didn't free market hard enough. Time to double down on deregulation imo. Non-homeowners should pay a resource usage fee as they take up resources but contribute nothing to the local economy. That money can be sent to current owners to help them weather these dark times. The fee is counted as income for the purposes of mortgage applications.

|

|

|

|

MickeyFinn posted:Non-homeowners should pay a resource usage fee as they take up resources but contribute nothing to the local economy. That money can be sent to current owners to help them weather these dark times. The fee is counted as income for the purposes of mortgage applications. I believe that this is called the Home Owner Grant.

|

|

|

|

Hubbert posted:I believe that this is called the Home Owner Grant. Yeah, but now renters get a list of names and amounts in the mail and they have to go to those people in person, apologize for leeching, and pay them in cash.

|

|

|

|

MickeyFinn posted:Yeah, but now renters get a list of names and amounts in the mail and they have to go to those people in person, apologize for leeching, and pay them in cash. Finally.

|

|

|

|

MickeyFinn posted:Non-homeowners should pay a resource usage fee as they take up resources but contribute nothing to the local economy. That money can be sent to current owners to help them weather these dark times. The fee is counted as income for the purposes of mortgage applications. Okay okay that’s enough of the BC Landlords FB Group/Deep Space 9 cross posting.

|

|

|

|

Gonna be hard for the housing market to implode when like 50% of homeowners have zero loans whatsoever https://twitter.com/ayan604/status/1624204736445681665?s=46&t=0m-7b1VzStwtZXwa5SCL_A

|

|

|

|

https://twitter.com/LeoSpalteholz/status/1624083269770956802?s=20&t=sAtplLA3nMC6kzL16mNR_w Bringing some "are investors the problem?" conversation here from the Canada D&D thread, seems like there's not much correlation one can discern between investors and real estate prices. The biggest takeaway for me is that the big university towns of London (Western) and Kingston (Queens) have a lot of investors to supply the housing for all the students that can't possibly be expected to be buyers.

|

|

|

|

Femtosecond posted:Gonna be hard for the housing market to implode when like 50% of homeowners have zero loans whatsoever What fraction of houses are sold every year? That is what matters. I’m guessing it is one percent or less. So a small fraction of homeowners needing to sell can be very large compared to the market.

|

|

|

|

What is the net worth of houses that are currently financed?

|

|

|

|

Or should I say, current total outstanding finance relative to cumulative most recent sale price of all houses that are free of finance.

|

|

|

|

MickeyFinn posted:What fraction of houses are sold every year? That is what matters. I’m guessing it is one percent or less. So a small fraction of homeowners needing to sell can be very large compared to the market. That would imply that the average residential property, including condos, is held for a hundred years or more. Don't know the number and a two second Google didn't tell me but you are likely off by an order of magnitude

|

|

|

|

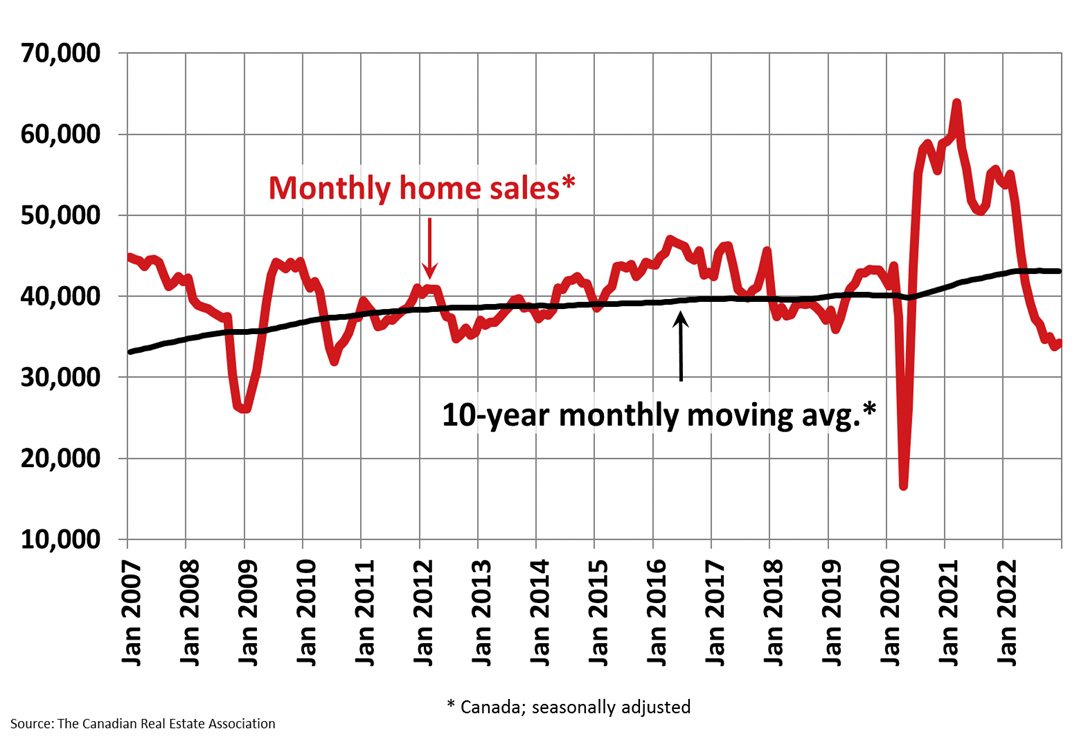

~40k sales/month = 480k/year = ~3.5% of the ~14M homes in the country, some ~2M of which are purpose-built rental and not really eligible to be sold (so more like 4% of those that can be sold).

|

|

|

|

eXXon posted:

Nice. Thanks for looking that up. So 1% more of all houses going on the market sounds like an increase in “supply” of 25%. I don’t think the 50% who don’t owe anything matters to a market crash.

|

|

|

|

Femtosecond posted:Gonna be hard for the housing market to implode when like 50% of homeowners have zero loans whatsoever Yeah, it's not like price discovery occurs entirely at the margins or anything.  Femtosecond posted:seems like there's not much correlation one can discern between investors and real estate prices Cool, now adjust it for median household incomes so it might actually be possible to draw the claimed conclusion. I'm not sure why you're pushing the number-go-up narrative increasingly hard despite the lack of evidence for it. I just wanted to note explicitly that you're doing so.

|

|

|

|

tagesschau posted:Yeah, it's not like price discovery occurs entirely at the margins or anything. shut up tagesschau (USER WAS PUT ON PROBATION FOR THIS POST)

|

|

|

|

Arivia posted:shut up tagesschau gently caress off, bigot. (USER WAS PUT ON PROBATION FOR THIS POST)

|

|

|

|

This article on investor-owned houses in Canada has a bunch of colourful charts. https://www.cbc.ca/news/canada/british-columbia/housing-investors-canada-bc-1.6743083 I'm starting to think there may be a problem.

|

|

|

|

I wish houses existing on the rental market was a thing so I could rent something bigger than 800 sq feet

|

|

|

|

MickeyFinn posted:I don’t think the 50% who don’t owe anything matters to a market crash. I think it matters only so much as a broader discussion around the broader economy-wide impacts of further interest rate hikes. We've been reading all these alarming articles about new buyers stretched to the limit who are getting utterly destroyed by variable interest rates, but meanwhile a huge chunk of the population's only concern right now is that the price of eggs is up. Basically if variable rates keep rising and blow up a bunch people at the margins, that can send prices tumbling, but if it's a relatively small amount of people does that mean the impacts on the greater economy are contained? When I said earlier "Gonna be hard for the housing market to implode" I should have been more precise in what I was saying here, because like absolutely prices can sink sure, I expect them to in the short term, but like is Canada in a position to avoid sinking prices inducing broader recessionary problems? Just having a look and it seems like the USA broadly here is more indebted than Vancouver which maybe sort of makes sense given that it's a pretty good deal to be a mortgage holder in the USA so why not. quote:...the share of owner-occupied households with no mortgage has climbed to 37.1 percent over the same nine-year period. Maybe none of this really matters and it's not a metric that means much.

|

|

|

|

tagesschau posted:Yeah, it's not like price discovery occurs entirely at the margins or anything. There's no need for the snark, even if the fact that half of homeowners have their mortgages paid off doesn't really seem to say a lot about the odds of a housing price crash or not. The "claimed conclusion" is that there isn't much correlation between investor ownership percentage and housing price, which is apparently true, but if you have an obvious explanation for why this doesn't matter or what the causation is here, do share. To some extent, it makes sense that even investors would be priced out of expensive markets and resort to cheaper cities if they're that set on becoming landlords. On the other hand, I don't really see how "there are more investors in London, Ontario so they're not a problem in Toronto" is a slam dunk. Easy debt fueled price increases nearly everywhere, even if they're most dramatic in CMA Vancouver/Toronto.

|

|

|

|

eXXon posted:There's no need for the snark, even if the fact that half of homeowners have their mortgages paid off doesn't really seem to say a lot about the odds of a housing price crash or not. The reason the scatterplot isn't very useful is that it doesn't show prices relative to the CMAs' median household income, which would give you some clue as to whether the homes are overpriced or not, and how far the debt-fueled speculative mania has driven them up beyond their sustainable value. It's not particularly helpful to drop it into the thread in an attempt to prove that number is not being propped up artificially by forces that will necessarily disappear under more normal interest rates.

|

|

|

|

|

| # ? May 18, 2024 05:22 |

|

Powershift posted:This article on investor-owned houses in Canada has a bunch of colourful charts. This article is another example of what I was talking about in the D&D thread in like how this issue around Investors in housing is weirdly framed by the media as this issue wholly around denying first time homeowners their rightful homes. (I mean this is pretty much the underlying premise of this whole thread too) There is a clear core underlying problem here in that there's not enough good purpose built rental housing, whether market or non-market, private or government owned being built in this country, but that is not the problem that is being expressed by the media. The problem seems to only be that Other People Are Trying To Buy The Home I Want To Buy. quote:Experts say the figures raise questions about whom new houses are being built for, and how capital may be distorting the housing market across a country in the grips of an affordable housing crisis. Um the homes are built for renters. There is a huge amount of people that cannot afford to buy a home that also need somewhere to live. Here we see the notion raised that renters having homes to live in is "distorting" the market apparently, which is presumably naturally wholly homeowners. If it weren't for those darn renters existing I'd be able to buy that house for a few thousand less. *shakes fist* quote:"What this dataset does is that it shows a competition to get on that [housing] ladder," said Andy Yan, director of Simon Fraser University's City Program. Where are those that have no hope in hell at ever getting on the ladder supposed to live? Are they allowed to have housing? You could find and replace "Investors" and replace them with "Renters" and the tone of the article changes remarkably and becomes rather dull. Because of course there's renters because renters need somewhere to live as well? quote:Statistics Canada data shows that more than a fifth of all houses in British Columbia, New Brunswick, Nova Scotia and Ontario were [occupied by renters] in 2020. Wow ur telling me that there's lots of renters in condos, the only sort of new housing that's been viable to build for decades on decades? Wow shocking. Ostensibly the point being driven at here is that if the Investors went away then the price of homes would go down. Sure. But where are those without an enormous gifted down payment supposed to live? Who knows who cares apparently. Mark Lee almost touches on the actual issue here, which is that Canada's tax code has apparently made it such that it's only profitable to make condos, thus the only housing product that is viable to build at all for renters is one where people can also owner occupy. quote:Marc Lee, senior economist at the Canadian Centre for Policy Alternatives, says changes in tax codes in the late 1980s and early '90s incentivized developers to build condos over detached homes. Very briefly mentioned as well is something that that the pool of investors is necessarily growing because housing is becoming so incredibly expensive that the only way people can afford to buy a SFH at all is if they rent out part of it quote:B.C. has the highest rate of "investor occupants" which refers to someone who lives in a single property with multiple residential units — such as "mortgage helpers" or Vancouver specials. Would be very nice if we had a huge amount of purpose built rentals being built and renters didn't have to live under the thumb of mom n' pop small business tyrant landlords. I think I've read somewhere that typical rents are a bit less in dedicated PBRs too. There would still be the same amount of Investor money flowing into housing, and renter housing would still be owned by investors, but I guess if it's off to the side and not visibly competing with the upper middle class it wouldn't be a problem for the Star/Globe/CBC and not worth writing an article about.

|

|

|