|

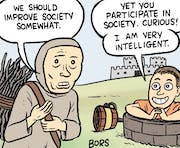

VictualSquid posted:I do not know anything about those Lazard guys, but from that statement they see themselves entirely in competition to wind and solar. So, presumably they run fossil and nuclear plants and feel threatened by their fossil plants getting protested by pro-w&s people. no you've completely misread that and just painted it with standard "internet argument brain" (assuming a conspiracy when you just don't know) lazzard is an electricity generation industry trade publication and consultancy. they're basically an accounting firm that specializes in electricity investments. they publish their yearly reports so that they get more clients for being the authoritative name. their LCOE analysis was standard before W&S even really came along, and so they applied it to W&S mostly as-is. that resulted in w&s "winning" the reports for something like 5 years running now. however critics have said that because its calculating the total generation irrespective of reliability, that in effect applying its old formulas to new w&s generation was giving w&s pricing an unfair advantage. the argument is that lazzard are biased in favor of wind and solar, because the LCOE analysis they carried forward does not account for "firmness". this argument primarily comes from argumentative nukelords on the internet, so it was easy to ignore for years and years, but eventually they got sick of hearing it and commissioned the report you see in that graph, with the goal of seeing "ok how much more would firming up w&s make it cost". their conclusion is "still less than nuke, except maybe sometimes in california but even then its very close". MightyBigMinus fucked around with this message at 14:01 on Apr 24, 2023 |

|

|

|

|

| # ? May 9, 2024 13:40 |

|

They're basing that on 4 hours of storage?  Yeah, no.

|

|

|

|

VictualSquid posted:I read the statement as: Nuclear is the one that has had for a long time externalities priced in far more robustly than other sources of power. Nuclear plants have to pay into insurances for waste disposal and land rehabilitation where especially coal didn't for example. I am not at all surprised that Lazard had to update their chart, I did a cursory analysis some time ago ITT that pointed out many areas that it favored S+W. I don't think intentionally, it just underestimated the costs with non-dispatchable power as well as some historical performance such as nuclear plants assumed to run for 30 years while a lot have long since operated for much longer.

|

|

|

|

Electric Wrigglies posted:Nuclear is the one that has had for a long time externalities priced in far more robustly than other sources of power. Nuclear plants have to pay into insurances for waste disposal and land rehabilitation where especially coal didn't for example. Yes and somehow those public pro-nuclear arguments always involve forcing w&s to price in their externalities as frontpage news. And the pro-nuclear arguments that compare it with coal only appear on page 20 of a report that nobody reads. And all those externality calculations are wrong, because they are pretty much impossible to accurately perform. So some 10:1 between coal and nuclear is probably true, but the small difference between w&s and nuclear are always more of a reflection of the author's bias. I just find it too be a pretty counterproductive argument, if you are pro-nuclear instead of anti-renewable. Not as dumb as the FDP recently trying to argue that subsidising bitcoin will somehow give us fusion power, but close. And that graph and post is just terrible. That one is FDP tier. VictualSquid fucked around with this message at 14:29 on Apr 24, 2023 |

|

|

|

VictualSquid posted:Yes and somehow those public pro-nuclear arguments always involve forcing w&s to price in their externalities as frontpage news. And the pro-nuclear arguments that compare it with coal only appear on page 20 of a report that nobody reads. If you are saying that the Lazard analysis can't give you the answer for the one true power for all your power needs, I completely agree. The technically optimal solution is going to be a blend of power sources taking into account local peculiarities and the pragmatically achievable is going to be a different mix blend inclusive of undesirables such as gas, etc. It is an interesting analysis and in time I believe it will only get more robust. To say that LCOE can't be estimated is to say that climate change can't be predicted - it's a far easier problem and climate predictions are getting better and better all the time. Even if at this stage it only informs that these are considerations that need to be taken into account and provides indicative scale of the costs involved, it has already been educational. I will say that I agree with a couple other posters that firming costs are still underestimated (although for understandable reasons - they are still hidden within the existing grids with a majority of dispatchable power which is completely understandable as this analysis is for new power installed into existing grids, not theoretical pure S+W grids).

|

|

|

|

Electric Wrigglies posted:If you are saying that the Lazard analysis can't give you the answer for the one true power for all your power needs, I completely agree. The technically optimal solution is going to be a blend of power sources taking into account local peculiarities and the pragmatically achievable is going to be a different mix blend inclusive of undesirables such as gas, etc. No, I am saying that that twitter post sucks. I am not talking about the whole analysis, that one looks fine. At least as fine as a study with this disclaimer can be: This analysis also does not address potential social and environmental externalities, including, for example, the social costs and rate consequences for those who cannot afford distributed generation solutions, as well as the long-term residual and societal consequences of various conventional generation technologies that are difficult to measure (e.g., nuclear waste disposal, airborne pollutants, greenhouse gases, etc.)

|

|

|

|

oh, I think you are just chucking a sad because LCOE would include firming power which will be a direct cost to the consumer if it is not inherently subsidised by existing grid dispatchable power. The tweet doesn't say much more than Lazzard has started to include higher firming power costs into its LCOE which has had the unsurprising result that a S+W grid is more expensive than the take or pay contracts within an existing grid currently signed would indicate. Ok, there is some inflammatory/snide remarks comparing it to the most expensive nuclear plant constructed in the US and more reasonable BAU costs if nuclear had the support it deserves (ie Chinese nuclear) but eh, it is good if everyone understands that end user power costs are going up, whichever way we slice it. I didn't think it was that controversial to say that as dispatchable and spinning reserve power goes the way of the dodo, the firming costs of un-dispatchable power will rise.

|

|

|

|

No, I am sad because pro-nuclear is entrenching itself even more as a synonym for anti-renewable and pro-fossil in public discourse here where I live and I think that that is the wrong attitude. I absolutely agree that we need massive amounts of grid infrastructure investments to operate a high-renwable grid, and we should include that in cost calculations.

|

|

|

|

https://twitter.com/energybants/status/1650337825399635969?s=20 In the US the Palo Verde plant is relatively young compared to other nuclear power plants, and its youngest reactor became operational in 1988, so that's 35 years. The LCOE assumes a project lifetime of 20 years

|

|

|

|

The oldest still operating went online in 1969 and the early 1970s, and those plants are all going for license renewal to try and make it to 80.

|

|

|

|

Jows posted:The oldest still operating went online in 1969 and the early 1970s, and those plants are all going for license renewal to try and make it to 80. Which on the face of it, it makes it seem Lazzard favours S+W but Lazzard targets providing guidance to energy investors. Promising returns over 50 year timeframes is the space of hardwood timber farms in Australia and government expenditure, not private sector infrastructure investment. So for Lazzard, it makes sense that it prices things in a 30 year timeframes at max.

|

|

|

|

Electric Wrigglies posted:Which on the face of it, it makes it seem Lazzard favours S+W but Lazzard targets providing guidance to energy investors. Promising returns over 50 year timeframes is the space of hardwood timber farms in Australia and government expenditure, not private sector infrastructure investment. So for Lazzard, it makes sense that it prices things in a 30 year timeframes at max. There's sort of a bifurcated market in wind and solar because in a lot of cases the companies building the plants don't want to own them for more than a couple years. The ideal scenario is the company constructs the plant while signing medium to long term power supply contracts with customers who will hopefully pay extra for green energy and then sells the fully functional plant and supply contracts at a premium to institutional investors who want low risk returns over the decades long life of the plant. It's a risky business model because construction & plant energisation delays are very common and can cause severe financial problems so a lot of these companies fail but if they can manage to keep flipping plants like they're remodelling houses on HGTV it is extremely profitable. It's one of the reasons nobody except governments are willing to fund nuclear, the investors that are willing to accept a high level of risk in utilities see higher potential returns in wind and solar.

|

|

|

|

slorb posted:There's sort of a bifurcated market in wind and solar because in a lot of cases the companies building the plants don't want to own them for more than a couple years. Very true, a very reputable multi-disciplinary company in Australia (RCR Tomlinson, made lots of very good stuff and delivered projects) bankrupted itself by getting into building renewable energy and scheduling the grid connection acceptance for a couple of wind farms at a few months when it took over 18 months for each, which because of the high cost of capital leveraged for the projects, just bled RCR dry. They had already committed and almost finished several before realizing the crazy risk they were dialing in on grid connection timelines. To be fair, they had normally been much quicker but because of the blackouts in SA partly caused by super self-protective settings on windfarms there dropping them out rather than trying to ride through grid instability (caused by a storm knocking over an interstate HV interconnector), the grid manager (AEMO) had put in place much more stringent connectivity permitting and acceptance trials/audits.

|

|

|

|

slorb posted:The ideal scenario is the company constructs the plant while signing medium to long term power supply contracts with customers who will hopefully pay extra for green energy and then sells the fully functional plant and supply contracts at a premium to institutional investors who want low risk returns over the decades long life of the plant. My experience with that is the plant is built with the worst parts they can get away with. The plant gets commissioned and there's zero preventative maintenance done until it's sold off. Hacks and band aid fixes get applied by the investment group's company before it's sold off again. I've seen this at several natural gas turbine/steam turbine power plants and I get to see it again at a wind farm now.

|

|

|

|

At least here in germany there are copious rules and regulations about maintenance, inspections, repairs and so on in place, often coupled to insurance or permits. As a result they are often in great shape and continue to produce electricity for longer than their 20 years predicted lifetime. Now that a bunch of turbines are reaching or have reached that age they either get used for longer or sold to other countries for another 20 years of generation. There's wear and tear but it appears that like with solar they can be used much longer than anticipated. 30 years is the current go to value for new planned turbines afaik.

|

|

|

|

|

This is absolutely true of most solar farms I get to see as well.

|

|

|

|

Son of Rodney posted:At least here in germany there are copious rules and regulations about maintenance, inspections, repairs and so on in place, often coupled to insurance or permits. As a result they are often in great shape and continue to produce electricity for longer than their 20 years predicted lifetime. Now that a bunch of turbines are reaching or have reached that age they either get used for longer or sold to other countries for another 20 years of generation. There's wear and tear but it appears that like with solar they can be used much longer than anticipated. 30 years is the current go to value for new planned turbines afaik. A bit of TLC goes a long way and especially now that they are understanding things like white etching bearing failures on wind turbine bearings - I expect that the ones being built now will be that much better. It is also a reason why proper infrastructure solar is worlds apart much cheaper than rooftop solar. As they age, they need little fixes, keep the dust off, maybe change a plane of glass here and there. On a roof is so much more dangerous than ground level. The major benefit of rooftop is that it hides the capital cost of expanding solar in another cost center (eg private housing).

|

|

|

|

Rooftop solar serves an important purpose in my part of the world (rural Colorado), it drives support for renewables among preppers and libertarians.

|

|

|

|

Apparently some energy companies are looking into using excess energy generated from plants for bitcoin mining. In theory the idea is that this energy would be lost, for example when excess natural gas is flared off, so with mining it can at least be used for an economically useful purpose. Does that sound like a good idea or do you think it's a distraction from investing in other things like battery tech?

|

|

|

|

Anything involving crypto is a waste, a scam, or both.

|

|

|

|

Dameius posted:Anything involving crypto is a waste, a scam, or both.

|

|

|

|

Thats an awful idea.

|

|

|

|

|

America Inc. posted:Apparently some energy companies are looking into using excess energy generated from plants for bitcoin mining. In theory the idea is that this energy would be lost, for example when excess natural gas is flared off, so with mining it can at least be used for an economically useful purpose. Does that sound like a good idea or do you think it's a distraction from investing in other things like battery tech? By definition bitcoin mining is a wasteful activity, like that's a core design goal for the protocol An economically useful activity would be running an electrolysis or desalination plant

|

|

|

|

Surely you could use that excess power for literally anything besides loving crypto mining that doesn't need to be staffed 24/7 by anything but a skeleton crew.

|

|

|

|

Do natural gas electricity plants regularly flare? I had mostly associated that with drilling operations. Also the idea of excess energy for natgas plant sounds ridiculous, aren't they one of the most dispatchable power sources. You spool them up when demand increases and when in drops they quickly spool down in a sub-minute schedule. "Demand dropped suddenly, quick, we have 30 seconds of mining to do. That article feels like there is enough production from renewables, nuclear and coal plants, and no one wants to buy their premium natural electricity. The facility is gathering dust and they want to find some use for it to recover their investment.

|

|

|

|

QuarkJets posted:By definition bitcoin mining is a wasteful activity, like that's a core design goal for the protocol Yeah, it's always worth repeating (because occassionly you come across someone who doesn't know) that Bitcoin mining is a competition. The amount generated doesn't scale up with more energy going on, it's just that the more energy you are putting in the more chance you have of winning the lottery every few minutes. For a plant operator it might be a profitable exercise depending on their generation costs, but in terms of the overall economy it's a complete waste of resources.

|

|

|

|

You can pump water uphill and generate power off it when it's needed. You need the right area for that, but it's been used for a long time effectively. It doesn't have to be as environmentally harmful as other hydro power because it can be a (relatively) closed loop with 2 reservoirs.

|

|

|

|

|

Doing production with “excess energy” turns out to be expensive because you’re building a system that normally has its upfront capital costs spread out over constant output and now you’re removing output when you don’t have the excess energy which just makes the output you do have more expensive. Also as more and more people add similar setups to your area the amount of excess energy drops and now your output falls even more and you’re jamming even more upfront capital costs into each unit of output. It’s a better idea to just setup someplace where there’s almost always clear skies or strong winds and just produce your output all the time. Alternatively you generate solar or wind and run off that when you can and pull from the grid when you need to. Also crypto is dumb and bad and the energy intensive versions should be illegal.

|

|

|

|

|

Having large amount of "excess production" that doesn't fit into your grid storage and power exports most means that you should build more export lines and grid storage. The actually useful usage of that cheap energy would be deferrable power usage. Like charging EVs and heating up water heaters. Or electrolytically extracting the rare earth metals from all those old crypto mining rigs.

|

|

|

|

Are we talking about the excess production on that gas plant? Seems like the best thing would be not to run it. Speaking of which, today is a pretty sunny day apparently so we've hit negative spot prices in some places  So it's pretty interesting to see how that's dealt with

I guess the negative prices would be great for encouraging storage solutions but I'm not sure it's that great for the market, Germany and Netherlands for example are still burning ~10GW worth of fossil fuels, which are definitely not free.

|

|

|

|

California experiences negative prices not too infrequently, typically cool sunny days in spring that followed wet winters (more hydro capability). Of course the price always recovers in the evening as the sun goes down.

|

|

|

|

Saukkis posted:Do natural gas electricity plants regularly flare? I had mostly associated that with drilling operations. But demand and supply must always be equal to maintain a stable grid. To make this happen, utilities will have some spare capacity that one could consider "excess production" that is being shunted into a dump load (basically a giant resistor). Passive and active power electronics are capable of redirecting this spare capacity as needed on the millisecond timescale, keeping the grid operating smoothly while the turbine catches up a few seconds later to the new load level. Some plants use their dump load for heating water or something to store the energy for later use, but the key thing is that whatever they are doing with the dump load needs to be able to handle sudden and large swings. I don't think computers can deal with sudden and huge power fluctuations, so if this is the "excess production" they are talking about to run these bitcoin operations, I don't know how it would actually work. But it could also just mean that they're running their generators a bit higher than needed, and skimming off the top to run their mining operation. The marginal cost to increase production some certain amount of kW on top of an already-running turbine for a power plant operator is much, much cheaper than retail prices for that same power. So I could see it being a profitable thing to do. It's just obviously a stupid thing to do on a societal scale. There are probably also regulations and laws in place in most areas to prevent utility operators from profiting off of their power production before putting it on the grid in this way, but this is just conjecture, and I'm sure it varies a lot by location.

|

|

|

|

Managing frequency and voltage across a grid us hugely complicated and generally called grid services when not inherently supplied by the properties of load or generators (in fact the value of inherent grid services might be separated and charged separately). A lot simpler with large spinning turbines because the inertia of the spinning mass mechanically resists a change in frequency that would normally result from a large increase or decrease in load. I actually find it hard to believe that anyone is achieving grid services by consuming power through resisters or other load dumping mechanism. I have been part of buying bulk power off grids before (think ~20 MW continuous) and you can get a real discount if you allow for yourself to be dropped off early in load shedding schemes. Frequency instability initiates dumping of load or generation (as required) and the programing is such that shedding is done in a specific order by program. Sign yourself up to be shed at the drop of a hat and boom, so many extra trips a year than your neighbour but cheaper power bills as well (ours was 4 c/kwhr at night, 8 c/kwhr by day in 2010 in WA).

|

|

|

|

Electric Wrigglies posted:Managing frequency and voltage across a grid us hugely complicated and generally called grid services when not inherently supplied by the properties of load or generators (in fact the value of inherent grid services might be separated and charged separately). A lot simpler with large spinning turbines because the inertia of the spinning mass mechanically resists a change in frequency that would normally result from a large increase or decrease in load. Obviously it made financial sense for y'all, but how much overbuilt was your onsite backup/generation compared to neighbors for when y'all got shed?

|

|

|

|

Electric Wrigglies posted:Managing frequency and voltage across a grid us hugely complicated and generally called grid services when not inherently supplied by the properties of load or generators (in fact the value of inherent grid services might be separated and charged separately). A lot simpler with large spinning turbines because the inertia of the spinning mass mechanically resists a change in frequency that would normally result from a large increase or decrease in load. Inertia helps keep frequency stable, big generators have a lot of rotating mass. I was told that during the last big Texas freeze they got really close, relatively speaking, to 59hz before tripping their power plant offline.

|

|

|

|

Electric Wrigglies posted:Managing frequency and voltage across a grid us hugely complicated and generally called grid services when not inherently supplied by the properties of load or generators (in fact the value of inherent grid services might be separated and charged separately). A lot simpler with large spinning turbines because the inertia of the spinning mass mechanically resists a change in frequency that would normally result from a large increase or decrease in load. Though it doesn't really matter, because it's likely the second thing I mentioned, where they're just running it at a slightly higher nominal output, and skimming off the top.

|

|

|

|

We successfully ran since 1890, prior to solid-state electronics able to react in milliseconds, thanks to the magical ancient negative feedback loop known as "droop". It works across any distance, with any number of generators and loads in parallel, and with no communication between the independent devices. Its not just inertia, but the inertia is part of that control scheme.

|

|

|

|

|

Dameius posted:Obviously it made financial sense for y'all, but how much overbuilt was your onsite backup/generation compared to neighbors for when y'all got shed? We had an ancient ~250 kva genset that theoretically would power some pumps to clear out some critical lines but while it got religiously load tested each week with a load bank, I never seen it fire a shot in anger. The Western Australian grid at that time was pretty solid and our circuit was relatively robust, maybe have to hire out a 160 t crane for a few things that gummed up after a few hours down during a rough lightning storm or something (and that we could start without). The Maranus Island (sp?) gas explosion was the only time we were load shed and that was a force majeure shut for weeks separate to the contract. So our discount was absolutely wonderful value and you wonder if the grid should have even had the discounts on offer but hey, public grid means a belt and braces approach.

|

|

|

|

This feels like a very dumb question but can solar panels be "shut off" if their power isn't needed? Like could there be a remote relay that just opens a breaker to stop their contribution to the grid? Same for wind turbines?

|

|

|

|

|

| # ? May 9, 2024 13:40 |

|

You can curtail solar pretty easily, but it requires some interaction between the grid and the inverter.

|

|

|