|

The problem with saying "everyone over $250k get hosed" is the second the Fed actually does that, every company and everyone with more than $250k is going to pull it's cash out of any bank that's not a G-SIB because those are effectively zero risk, and the most well- funded and well- hedged bank out there still dies if you remove a big enough chunk of deposits. Outside of guaranteeing all deposits I'm not sure how the Fed stops every bank and credit union from being absorbed by JPM and Citi if this keeps going.

|

|

|

|

|

| # ? Jun 6, 2024 19:47 |

|

ranbo das posted:The problem with saying "everyone over $250k get hosed" is the second the Fed actually does that, every company and everyone with more than $250k is going to pull it's cash out of any bank that's not a G-SIB because those are effectively zero risk, and the most well- funded and well- hedged bank out there still dies if you remove a big enough chunk of deposits. you say that "too big to fail" was a loving mistake and make it clear that if JPM fucks up bad enough that, yeah, the billion and a half you have on deposit there isn't protected either. Alternatively you make all banks go through routine and actually thorough audits and stress tests to ensure their health, and anyone given the "too big to fail" label gets a whole set of extra regulations that basically turn it into a utility. Frankly they should be stringent enough and focused enough on stability vs. profitability that your average investor will want to split the business themselves long before that, which is good because too big to fail is some bullshit that should never happen.

|

|

|

|

Cyrano4747 posted:Alternatively you make all banks go through routine and actually thorough audits and stress tests to ensure their health, and anyone given the "too big to fail" label gets a whole set of extra regulations that basically turn it into a utility. this is exactly what a SIFI/GSIB is. The Dodd-Frank stress tests that got unpassed for mid-tier banks like SVB are still in place for the eight largest US banks. Also JPMC isn’t considered the safest bank right now because people expect the government to bail it out, it’s because it’s sitting on enough cash to bail out the government.

|

|

|

|

hypnophant posted:this is exactly what a SIFI/GSIB is. The Dodd-Frank stress tests that got unpassed for mid-tier banks like SVB are still in place for the eight largest US banks. Also JPMC isn’t considered the safest bank right now because people expect the government to bail it out, it’s because it’s sitting on enough cash to bail out the government. dodd-frank should never have been repealed for mid-tier stuff.

|

|

|

|

Ya'll do know that the regulators already auctioned First Republic bank off to JP Morgan, right? https://www.reuters.com/business/finance/california-financial-regulator-takes-possession-first-republic-bank-2023-05-01/Cyrano4747 posted:dodd-frank should never have been repealed for mid-tier stuff. Agreed.

|

|

|

|

Cyrano4747 posted:dodd-frank should never have been repealed for mid-tier stuff. plainly. but to be precise, large parts of dodd-frank remain in place even for small banks; it’s only the asset requirements to be considered “too big to fail” that got raised. I’ll also point out there’s some debate whether having these stress tests in place would have saved SVB, since they allegedly don’t consider interest rate risk as part of the stress testing regime. I don’t know enough about the stress tests to comment about that. I do know, from watching hours of senate testimony for a class on the Fed this semester, that the SF Fed had found SVB to be deficient on a number of risk measures and had given them notice they needed to clean up their poo poo, but they hadn’t reached the “actual consequences” phase yet and anyway it’s not obvious what SVB could have done differently once interest rates started climbing and a big chunk of their asset book was suddenly underwater.

|

|

|

|

I wonder about the FDIC upper limit sometimes. Using this history: https://americandeposits.com/history-and-timeline-of-changes-to-fdic-coverage-limits/ And this inflation calculator: https://www.usinflationcalculator.com/ We can see these limits expressed in the form of 2023 dollars. 1934: 2.5K = 56,312.69, new 5K = 112,625.37 1950: 5K = 62,621.58, new 10K = 125,243.15 1966: 10K = 93,159.26, new 15K = 139,738.89 1969: 10K = 123,366.21, new 20K = 164,488.28 1974: 20K = 122,448.68, new 40K = 244,897.36 1980: 40K = 146,522.33, new 100K = 366,305.83 2008: 100K = 140,191.27, new 250K = 350,478.16 Not sure what this says, except everyone got loving hammered in the late 70s. I think we'd also need to know this in proportion to household wealth or income.

|

|

|

|

hypnophant posted:it’s not obvious what SVB could have done differently once interest rates started climbing and a big chunk of their asset book was suddenly underwater. As rates rose in 2022, SVB actually reduced their hedging, increasing the effective duration of their portfolio. This was effectively doubling down on a bet that interest rates would quickly return to lower levels. They could've done... not that FT posted:And at the end of 2021, SVB’s financial accounts indicate that on the AfS side it held $15.26bn of interest rate swaps to hedge against the impact of rising rates on its big bond portfolio. So what happened?

|

|

|

|

NYTimes on the latest fed rate raise...quote:What to know about the Fed’s latest move.

|

|

|

|

LanceHunter posted:seizure and sale of First Republic Bank to JPMorgan Chase Narrowly avoided further run on banks this weekend/week Hopefully(?) this sweeps the mortgage interest rate losses under the rug and OH LOOK A BLIMP

|

|

|

|

uh oh LostCosmonaut fucked around with this message at 23:07 on May 3, 2023 |

|

|

|

I said, OH LOOK, A BLIMP

|

|

|

|

LostCosmonaut posted:

Fed Chair Jerome Powell today: "Banking system sound and resilient"

|

|

|

|

Really we should have seen this coming edit: my bad LostCosmonaut fucked around with this message at 13:46 on May 4, 2023 |

|

|

|

LostCosmonaut posted:Really we should have seen this coming I enjoy the joke here, but let's remember the thread rules...

|

|

|

|

LostCosmonaut posted:

pacwest says about 73% of their deposits are under the fdic limit (svb was 6.2% for comparison). if they really do go down that seems like a pretty big warning sign that this panic is just starting to bring down large regional banks all together

|

|

|

|

Good news everybody, housing is back, for the handful of distressed sales still happening anywaysquote:93 major housing markets saw home price gains in March while 7 declined https://fortune.com/2023/05/03/housing-markets-where-home-prices-rose-and-fell-in-march-according-to-black-knight/

|

|

|

|

LostCosmonaut posted:Really we should have seen this coming LanceHunter posted:I enjoy the joke here, but let's remember the thread rules... yup, post was rightfully reported by someone. as LC has made several good posts in this thread and previously been good about the rules I'll let this one go with a warning, but next rule-breaking tweet in this thread (edit: from ANYONE, to be clear) gets a sixer or more. LC if you meant to perhaps post that tweet in stocks thread instead just delete it please, thanks pmchem fucked around with this message at 12:34 on May 4, 2023 |

|

|

|

hypnophant posted:it’s not obvious what SVB could have done differently once interest rates started climbing and a big chunk of their asset book was suddenly underwater. Liquidated some of those assets once the fed clearly signaled they were going to raise rates a lot, eaten a small loss, and used those funds to buy assets whose value is positively correlated with the interest rate? You know, like, been bankers? Done their job?

|

|

|

|

Hadlock posted:Good news everybody, housing is back, for the handful of distressed sales still happening anyways that article is paywalled; are these seasonally-adjusted numbers? Because if not, well, price rises in May as compared to the winter don't necessarily translate to a recovery in prices "this year".

|

|

|

|

Leperflesh posted:that article is paywalled; are these seasonally-adjusted numbers? Because if not, well, price rises in May as compared to the winter don't necessarily translate to a recovery in prices "this year". In my area, Denver metro, nominal prices from March to April appreciated about 2.5%. 6% off the highs of Spring/Summer 2022 but those were real goldrush highs. There's just no inventory.

|

|

|

|

Wasn't paywalled last night, try archive.is

|

|

|

|

ok yup not seasonally adjusted, but the numbers are still significant and the article compares vs. peak 2022 prices which is about as useful as seasonally-adjusted anyway:quote:Among the 100 largest markets tracked by Black Knight, 53 housing markets ended March at a price that remains below their 2022 peak price. Meanwhile 47 markets are back—or above—their 2022 peak. However, even that metric marks an improvement from February, when 75 major housing markets were below their 2022 peak price and just 25 markets were back—or above—their 2022 peak.

|

|

|

|

hobbez posted:There's just no inventory. This is the key here, and what I was going for The numbers don't mean much when total sales per month are in the tens in each local market It is interesting that it's an almost universal trend country-wide though

|

|

|

|

Leperflesh posted:that article is paywalled; are these seasonally-adjusted numbers? Because if not, well, price rises in May as compared to the winter don't necessarily translate to a recovery in prices "this year". I had the same question and after not getting the answer directly from reading the article I saw that it was answered in the extremely faint footnote in the picture of the chart - they are seasonally adjusted. I don't know if it's a fair assumption that historical seasonality patterns used for adjustment are applicable to the current environment, but they at least attempted to adjust.

|

|

|

|

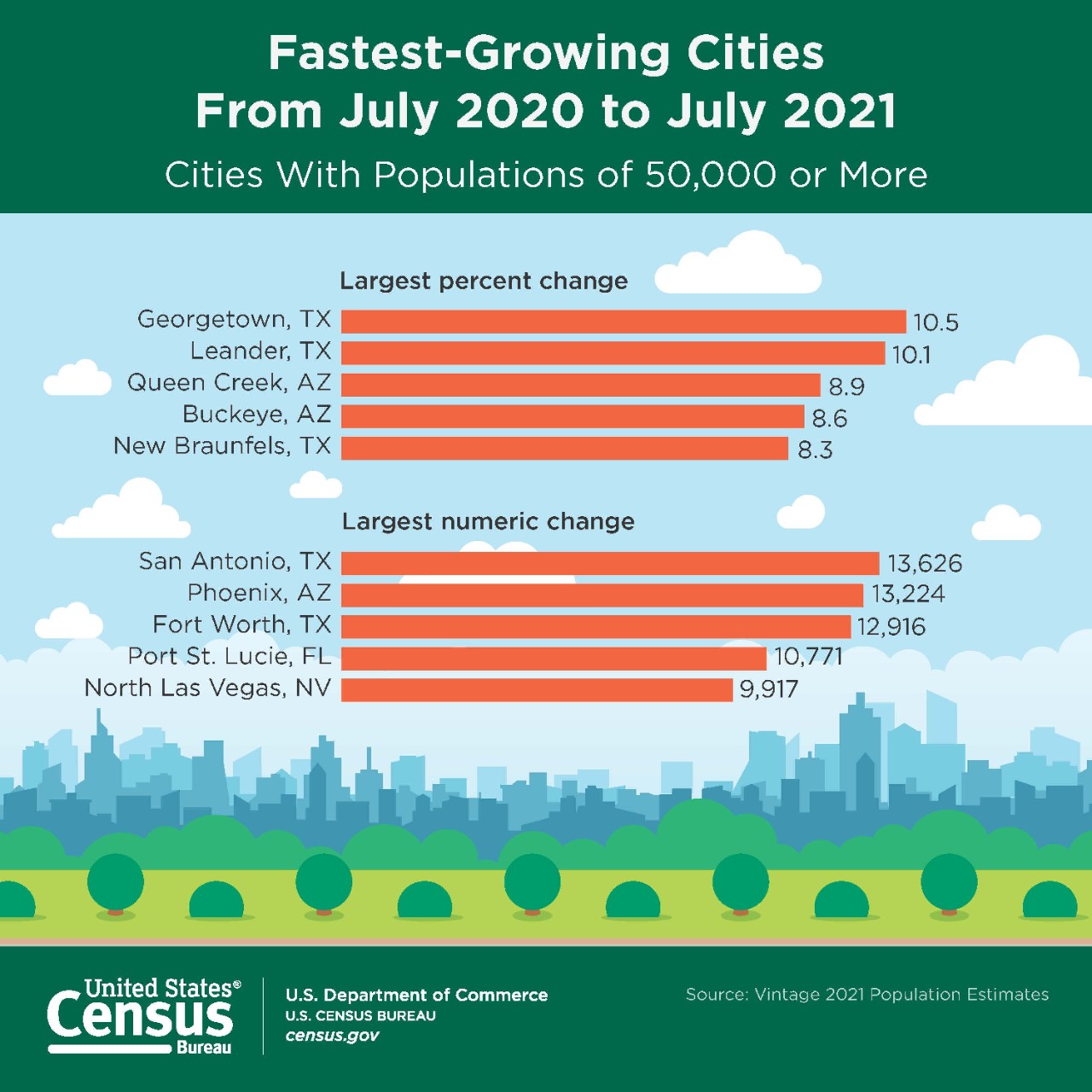

This is a good indicator that Austin's pro-building policy is actually paying dividends, even as we've had to absorb some of the biggest population growth in the country for over a decade. Check out this graph from the Census department... Three out of the five largest percentage growth cities are in the greater Austin area, and two of them are outright suburbs of Austin. For over a decade now we've been building like crazy, but housing costs were still rising faster-than-average because of the sheer number of people moving here. It resulted in some NIMBY backlash, as people saw these towers going up and also saw their rents rising and decided that the two phenomenon were related. It was hard to explain that the new towers meant those rent raises were lower than they might have been otherwise.

|

|

|

|

odd lots has an episode today about spiraling childcare costs (stream available here): https://www.bloomberg.com/oddlots ep description: quote:Disruptions caused by the pandemic have revealed deep flaws in our supply chain for physical goods. Certain market failures that have been left to fester for years were suddenly exposed. But some parts of the economy were broken long before the pandemic, particularly anything having to do with care work. Various forms of childcare, daycare, eldercare and healthcare have seen costs explode, with services unevenly distributed, even as those working in the care economy often remain poorly compensated. On this episode, we speak to economist Nancy Folbre, professor emerita of economics at UMass-Amherst and director of the Program on Gender and Care Work at the Political Economy Research Institute, about why such crucial services are so broken in America. looking forward to listening. that particular labor market has been totally broken since the pandemic (even worse than before pandemic). I know of local childcares that have been actively trying to hire, money available to do it, but unable to reach anywhere near fully staffed for literally 2 years straight now

|

|

|

|

What is working well these days?

|

|

|

|

ultrafilter posted:What is working well these days? I hear that being a billionaire is very profitable!

|

|

|

|

pmchem posted:looking forward to listening. that particular labor market has been totally broken since the pandemic (even worse than before pandemic). I know of local childcares that have been actively trying to hire, money available to do it, but unable to reach anywhere near fully staffed for literally 2 years straight now We briefly relocated to a city of 100k and hired a In our new town we lucked out and three spots opened up a week before, is a 3 minute drive and next to the neighborhood market, thank God

|

|

|

|

Here's a non-paywall/gift link to the NYTimes coverage of today's jobs report. Just way too much stuff to all copy over here, but some highlights... quote:U.S. employers added 253,000 jobs in April.  quote:Wages climb rapidly, defying the Fed’s hopes for a slowdown. Doomers in absolute shambles.

|

|

|

|

We clearly have outstanding issues (debt crisis, Ukraine, china trade war, oil supply, chip production) but they don't seem to be limiting the metrics used to measure the markets or the market's status. What that says for inflation may be an open question. Considering china is the biggest doomer pushing "America is going to fail" this should be of significant spite to them.

|

|

|

|

I feel like we need some new term to describe a kind of anti-stagflation. In the same way that term was coined to try and capture the seemingly-paradoxical economic state of a slow economy with high inflation, we need something to capture this state of the economy running super-hot in terms of full (or near-full) employment and rising wages that isn't getting knocked back by rising interest rates. The "radiator economy?"

|

|

|

|

LanceHunter posted:I feel like we need some new term to describe a kind of anti-stagflation. In the same way that term was coined to try and capture the seemingly-paradoxical economic state of a slow economy with high inflation, we need something to capture this state of the economy running super-hot in terms of full (or near-full) employment and rising wages that isn't getting knocked back by rising interest rates. The "radiator economy?" Part of the problem is Keynesian economics was developed under a heavy manufacturing economy where capital investment drove productivity through purchases of PPE but in a switch to an information/service economy there’s less need for large capital investment to drive growth.

|

|

|

|

I'd say certain sectors that were particularly juiced by zero interest rates, like tech and commercial real estate, are definitely in a chill right now. I'd think residential real estate would be too, with mortgage rates tripling, but I guess it's having roughly balancing effects of "we are never moving" killing inventory vs. "a 2% ask price is unaffordable at 7%" killing demand.

|

|

|

|

also it is not actually good news that wages continue to not rise as fast as prices, and a booming economy in which that continues can't last, right, because at some point people can't afford to buy things any more

|

|

|

|

Leperflesh posted:also it is not actually good news that wages continue to not rise as fast as prices, and a booming economy in which that continues can't last, right, because at some point people can't afford to buy things any more Yes, but it seems to indicate that we are one side of that equilibrium still which is not good.

|

|

|

|

Oh, for sure, and I think most of us agree that the inflation was and perhaps still is being driven by supply shortages, not (or not only) by demand, which is why rising rates is predicted to have less of an impact. But wage growth lagging price growth probably will, IMO, in that at some point there will be a new equilibrium between supply and demand that fixes prices in place. No?

|

|

|

|

Leperflesh posted:Oh, for sure, and I think most of us agree that the inflation was and perhaps still is being driven by supply shortages, not (or not only) by demand, which is why rising rates is predicted to have less of an impact. But wage growth lagging price growth probably will, IMO, in that at some point there will be a new equilibrium between supply and demand that fixes prices in place. No? Part of the issue is also that consumer spending is very unevenly distributed. It's surprisingly hard to find good data broken out by income bracket, but here's a WaPo chart I found that shows at least the big trends:  Basically your highest quintile in the economy is spending 3x-4X what the lowest quintile is in general. If you're just talking discretionary spending it's more like 10x. I suspect that if this was broken out by deciles it would be even starker. The people who have come out the best from wage growth have been on the very bottom (e.g. servers actually beginning to get half way decent pay as a result of labor shortages in part due to more of them moving out of the industry because of covid) and at the very top (something obscene like 70% of the increase in savings during covid happened in the top 10%). So if you're talking about the median earner it's very possible to find someone who hasn't seen that wage growth, but is still getting squeezed by inflation. So, yeah, we're in a situation where a few groups have more disposable income than before and can afford higher prices on luxury items, but at the same time a lot of other people aren't seeing that wage growth and are feeling squeezed by rising prices on daily goods.

|

|

|

|

|

| # ? Jun 6, 2024 19:47 |

|

Leperflesh posted:also it is not actually good news that wages continue to not rise as fast as prices, and a booming economy in which that continues can't last, right, because at some point people can't afford to buy things any more Is that changing? I'm just googling but it looks like seasonally adjusted wage growth for the 3 months December 22-March 23 was 1.2%. It looks like CPI increase for those three months was... 1.1% Well, okay, so they're basically tied at this point, but at least inflation is no longer clearly outpacing wage growth. If inflation doesn't spike back up (big if) this might be a good sign wage growth will start to steadily outpace it, though.

|

|

|