|

spain portugal and greece show that sovereign defaults are a get one get 7 sorta deal

|

|

|

|

|

| # ? Jun 3, 2024 16:05 |

|

Knew I was getting it wrong somehow

|

|

|

|

bob dobbs is dead posted:spain portugal and greece show that sovereign defaults are a get one get 7 sorta deal I knew Argentina had defaulted more than once just this century but some Wikipedia digging informed me it’s actually defaulted nine times since independence from Spain

|

|

|

|

https://www.nytimes.com/2023/08/10/business/russia-economy-ruble-inflation.htmlThe New York Times posted:After Russia’s ruble hit a 16-month low against the U.S. dollar, raising fears of rising inflation, even one of President Vladimir V. Putin’s top cheerleaders in state media lashed out at the country’s financial authorities on Thursday over an exchange rate that he said was a subject of global mockery.

|

|

|

|

What is the difference between a ruble and a dollar? About a dollar.

|

|

|

|

I was morbidly curious about the history of the ruble quote:1 United States Dollar equals

|

|

|

|

Clearly this means that the BRICS will be the dominant currency union of the 21st (and 22nd) century.

|

|

|

|

LanceHunter posted:Clearly this means that the BRICS will be the dominant currency union of the 21st (and 22nd) century. Yeah I mean there will have to be so many more BRICS bucks, like for every dollar in the world there will be 100 BRICS bucks

|

|

|

|

the dollar's days are numbered. all china and russia have to do is allow free movement of capital, and the whole rotten edifice will crumble into dust

|

|

|

|

Global economics and current events no+tweet megathread: R.I.P. the US dollar

|

|

|

|

I like the spirit but:Hadlock posted:Global economics and current events no-tweet megathread: R.I.P. U.S.D. Maybe that's not funnier, idk.

|

|

|

|

I will try harder on this dead gay comedy site, sorry

|

|

|

|

pseudanonymous posted:Yeah I mean there will have to be so many more BRICS bucks, like for every dollar in the world there will be 100 BRICS bucks Without doubt the funniest one is having to say that millions of dong are equal to like $300. Ugh speaking of which the Bank of Japan needs to get off its rear end and cool down the quantitative easing, the dollar is back over $1:140 yen. When I moved here it was as low as $1:75 at times.

|

|

|

|

ITT a bunch of goons who just found out Argentina might have bad finances predict the downfall of the US dollar.

|

|

|

|

Is Britain really as poor as Mississippi?

|

|

|

|

I feel like clocking in at Alabama's level even with London isn't something to be too proud of either.

|

|

|

|

That is some chart. Cities, states, regions and countries all being measured against each other in GDP is always going to give weird comparisons.

|

|

|

|

mrmcd posted:I feel like clocking in at Alabama's level even with London isn't something to be too proud of either. I was about to fire off a post about how we should remember that Mississippi, Alabama, and the rest of the Deep South is insanely agriculturally productive and how that probably accounts for their relative wealth compared to the UK. Then I was looking further into it and found that actually manufacturing, of all things, is the biggest part of Mississippi's economy. Nissan and Toyota have big plants there, there's Ingalls Shipbuilding doing a bunch of contracts for the Navy, and Ashley Furniture also has a big operation there. I was also about to post about how Mississippi is still poor, though, because of the income inequality issue there. Then I did more looking and saw that the median household income in Mississippi is $49,111 (£38,787.13), compared to £32,300 ($40,893.90) for the UK. The stats say that 19.4% of Mississippi is in poverty, but only 17% of the UK is, though. Though it's tough to get a lot out of those numbers, because the Mississippi figure is the US Census Bureau measure of poverty while the UK figure uses their "absolute poverty (AHC)" measure.

|

|

|

|

England has been coasting on their prewar imperial image for a long time yeah. Brexit probably isn't helping tremendously.

|

|

|

|

The median in the UK is lower but is seems like the bottom is less dire. Homelessness in the US is .18% vs. .004% in the UK, people without health insurance is close to 0% vs. 8.4% in the US. Social mobility is definitely worse but you're less likely to die starving in the street or in insulin shock. It's pretty hard to compare these things one-dimensionally.

|

|

|

|

Lockback posted:That is some chart. At least it’s PPP adjusted although I presume that’s at a national and not metro level.

|

|

|

|

WSJ - The Economic Losers in the New World OrderThe Wall Street Journal posted:The world’s biggest economies are offering huge subsidies in a cutthroat race to win the industries of the future. The losers: all the countries that can’t pay up.

|

|

|

|

How is the US solar panel import tariff system working so far Seems like China is producing them at half to a quarter the price of US factories

|

|

|

|

LanceHunter posted:I was about to fire off a post about how we should remember that Mississippi, Alabama, and the rest of the Deep South is insanely agriculturally productive and how that probably accounts for their relative wealth compared to the UK. Then I was looking further into it and found that actually manufacturing, of all things, is the biggest part of Mississippi's economy. Nissan and Toyota have big plants there, there's Ingalls Shipbuilding doing a bunch of contracts for the Navy, and Ashley Furniture also has a big operation there. To further agree with your post: people might not easily guess just how little agriculture contributes to GDP. In California, the most incredibly productive agricultural state in the country, ag contributes 1.25% to the state's economy. https://ajed.assembly.ca.gov/content/california-economy-0 Food production is hypercompetitive and extremely low margin, with technology having massively cut the labor cost over the last century (which is compounded by the exploitation of migrant, below-minimum-wage labor, of course). We enjoy very cheap food in America, and that means that like... making food doesn't make much money. This is also part of why agribusiness is so consolidated, with huge corps doing most of the growing: a small farm can't make enough money for its owners to survive unless it's specializing in one of the higher-margin (lower volume) products. However. Having a highly productive domestic agricultural industry has huge benefits to a country, so focusing on GDP can be reductionist. If you don't produce most of your own food - or at least, operate as a net exporter of food - you have to be a net importer, at much higher costs, which has its own follow-on economic impacts. As, uhhh, UK post-Brexit is realizing. https://www.trade.gov/country-comme...resh%20produce. quote:The UK imports around 46 percent of the total food it consumes and is reliant on both imports and its agricultural sector to feed its population and drive economic growth. The UK’s geography, climate, and relatively wealthy population mean it will always be a significant importer, especially of fresh produce. And the US is maybe flirting with: https://www.usda.gov/sites/default/files/documents/USDA-Agricultural-Projections-to-2031.pdf quote:

|

|

|

|

Hadlock posted:How is the US solar panel import tariff system working so far https://www.canarymedia.com/articles/clean-energy-manufacturing/the-us-climate-law-is-fueling-a-factory-frenzy-heres-the-latest-tally quote:In just 12 short months, Biden’s Inflation Reduction Act has spurred more than 100 new cleantech manufacturing announcements and nearly $80B in private investment.  quote:Solar manufacturing is headed for the South, too. Planned factories are concentrated in Alabama, Georgia and South Carolina, with some also coming to Ohio and solar giant Texas.  As I understand it, when they say "1GW solar panel plant" that means the factory will be able to produce 1GW worth of solar panels annually, in perpetuity. 1GW is equivalent to 2.5 million 400w solar panels or 3.33 million 300w solar panels which seems to be about the average size installed on roofs these days. There's about 82 million SFHs in the US Hadlock fucked around with this message at 22:02 on Aug 16, 2023 |

|

|

|

Hadlock posted:https://www.canarymedia.com/articles/clean-energy-manufacturing/the-us-climate-law-is-fueling-a-factory-frenzy-heres-the-latest-tally I wouldn't quite say "in perpetuity". The factories are certainly going to be operating long-term, but you're probably looking at something like a 30-50 year lifespan before they need to be updated/retrofitted to remain in operation. This is a very good sign, though. Total energy generation in the US in 2022 was 4.24 trillion kWh. Let's take a ballpark and assume that solar panels will produce at their capacity about 20% of the hours in a year (8760*0.2 = 1752) a plant that produces 1GW worth of solar panels would probably be making panels able to produce 1752 GWh (1.752 billion kWh) in a year. That ends up being about 0.04132% of total US energy generation. If the plant produces at capacity for 30 years, that's a respectable 1.24% of all US power on year 31 coming from panels it made. Since solar panels have a lifespan of about 30 years, if the plant continues producing at the same capacity beyond 30 years the work it would be doing would primarily be replacing previous capacity it made that has aged out. Things are definitely moving in the right direction since the IRA passed, but it's going to be a really long road ahead.

|

|

|

|

That also assumes zero advances in w/ft2 in the next 30 years. Much more realistically, every one of those factories will be retooling to produce denser/more efficient/cheaper panels on a continuous basis in order to remain competitive. The factory itself is the biggest capital investment, and then ongoing smaller capital investments to keep tooling up to date or react to market forces etc. have much shorter ROIs and therefore become much more feasible.

|

|

|

|

Yeah solar panels in 50 years will probably look vastly different from today I'm skeptical we'll see above 30% efficiency in our lifetime though. Most panels struggle to exceed 20% and the best panels you can buy today are 23% I think Car factories seem to do a re-tool every 6-8 years They're claiming 25 year warranty but I've been looking at second hand panels on Craigslist (there's an unused spot in my yard that gets awesome sunlight 8+ hours a day) and a lot of them are from 2015 and having trouble making 60% of their nameplate capacity Hadlock fucked around with this message at 05:33 on Aug 17, 2023 |

|

|

|

Hadlock posted:Car factories seem to do a re-tool every 6-8 years Depends on the tools and the details, there’s usually tooling cost for a given project (eg unless you’re 100% carrying over a car’s exterior design, you’ll need new body tooling) and sometimes there are improvements to the existing hardware for production that need to happen too (eg for the robots moving components around, etc). But that’s not a full refresh or redesign of a plant. Battery production also tends to be referred to by the annual production capability of the given factory, FWIW.

|

|

|

|

Hadlock posted:They're claiming 25 year warranty but I've been looking at second hand panels on Craigslist (there's an unused spot in my yard that gets awesome sunlight 8+ hours a day) and a lot of them are from 2015 and having trouble making 60% of their nameplate capacity I'm gonna bet that that 25 year warranty is against factory defects and absolutely not against the unavoidable decline in capacity that is an inherent part of current solar panel chemsitry. Some researchers recently broke the current theoretical limits of efficiency with some new cleverness: https://www.science.org/doi/10.1126/science.adf5872 Science posted:Two studies show how interfaces between perovskite layers and silicon cells in tandem solar cells can be modified to improve performance (see the Perspective by De Wolf and Aydin). Mariotti et al. showed that an ionic liquid, piperazinium iodide, improved band alignment and enhanced charge extraction at the interface of a trihalide perovskite and a C60 electron-transporting layer by creating a positive dipole. With these modifications, a 2.0-volt open circuit voltage was achieved in a silicon tandem cell. Chin et al. report the uniform deposition of the perovskite top cell on the micropyramids of crystalline silicon cells to achieve high photocurrents in tandem solar cells. Two different phosphonic acids improved the perovskite crystallization process and also minimized recombination losses. These modifications yielded perovskite/silicon tandem cells with certified power conversion efficiencies of more than 31% for active areas of at least 1 square centimeter. —PDS

|

|

|

|

Might. I think 30% efficiency with a warranty stretching decades is within the realm of possibility, but unlikelyLeperflesh posted:I'm gonna bet that that 25 year warranty is against factory defects and absolutely not against the unavoidable decline in capacity that is an inherent part of current solar panel chemsitry. From here https://na.panasonic.com/us/solar-panel-battery-storage-warranties https://na.panasonic.com/us/solar-panel-battery-storage-warranties/tripleguard-warranty Panasonic website posted:TripleGuard warranty covers your HIT® and EVERVOLT® Series standalone panels for performance output, parts, labor and shipping for 25 years. I think Panasonic didn't roll out their 25 year warranty until like 2018 or so. I'm not sure what the watershed moment was but warranties went way up around that time across the board  Edit: it was in May 2017 https://www.prnewswire.com/news-rel...-300454574.html URL says it all really Hadlock fucked around with this message at 03:00 on Aug 18, 2023 |

|

|

|

The job market in life science is brutal right now. Somehow none of this turmoil is being reflected in unemployment rates. Really confusing.

|

|

|

|

life sciences is not that big a sector

|

|

|

|

street doc posted:The job market in life science is brutal right now. Somehow none of this turmoil is being reflected in unemployment rates. In terms of private capital and the stock market, it seems like life sciences are always the first to drop and the last to recover.

|

|

|

|

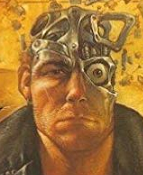

So two questions 1) what logical fallacy am I falling victim to when I look at the price shiller index since ~2019 and make this face   2. What fundamentals about the US economy have changed since 2022 that are somehow decreasing pressure on inflation? We still seem to have a ~2%* global labor shortage and I feel like prices need to go up way more than 10% before increased wages bring enough people back in to the market. *Permanent 2%

|

|

|

|

Hadlock posted:So two questions Try plotting it against the s&p... Or even just a 2% compound interest line. Hadlock posted:

Money supply has tightened. Business investment is way down, since it has to meet a much higher bar for expected returns now.

|

|

|

|

Hadlock posted:So two questions Fundamentals weren’t he fundamental driver of the inflation. The idea has been debunked repeatedly in this thread. One fundamental that has actually changed is the combination of housing prices and interest rate mean the velocity of housing sale is way down as people can’t afford to buy or sell.

|

|

|

|

pseudanonymous posted:Fundamentals weren’t he fundamental driver of the inflation. The idea has been debunked repeatedly in this thread. This is impacting the M&A market too, which is adjusting but looks different than it did in early 2022.

|

|

|

|

pseudanonymous posted:the velocity of housing sale is way down as people can’t afford to buy or sell. Really thought things were going to crack this spring and prices would come down considerably, but people (at least in general) just seem to be staying put, and the scarcity of homes is holding prices up even with mortgages through the roof. Just feels unsustainable at these levels of mortgage rates. I remember having a discussion with someone about 18 months ago where "8% mortgages would break everything!" was discussed. But we're almost there now, and attitudes have all been adjusted. Lockback posted:This is impacting the M&A market too, which is adjusting but looks different than it did in early 2022. way different. venture capital still feels pretty lifeless as well. Maybe a tiny bit recovered from flatline.

|

|

|

|

|

| # ? Jun 3, 2024 16:05 |

|

Price of global trade has dropped dramatically from the peak covid crisis.  They are still up since pre-covid, as mentioned in the source, an article from June: https://www.freightwaves.com/news/trans-pacific-spot-container-shipping-rates-are-inching-up This followup article from July 31st doesn't have that lovely chart above, but is useful for context https://www.freightwaves.com/news/trans-pacific-shipping-rates-rise-as-carriers-constrain-capacity quote:Linerlytica said trans-Pacific deployments are down 12.1% to date, while Asia-Europe capacity is up 7.6%, “with further divergence expected in the coming months as even more capacity is added to Europe while capacity is withdrawn from the trans-Pacific market.” Up 9% over 4 years seems to me, a guy who doesn't know much about this, like a pretty reasonable rate of growth if you ignore all the pandemic stuff. That transpacific and asia-europe shipping has returned to some semblance of normalcy is perhaps one indicator that the supply restriction driving much of the inflation in consumer goods over the last three years is basically done, although there may still be supply restrictions with specific commodities (ukranian wheat, lithium?). The shortage of labor is overstated because it ignores that inflation more or less completely wiped out wage increases in 2021-2 and businesses have effectively not raised wages - wage growth has outpaced inflation since March but has a ways to go before it'll counteract the degree to which inflation outpaced wage growth Mar 2021 to Mar 2023.  source I would guess that on an inflation-adjusted basis the restriction on business investment is coming from higher interest rates and not really a lack of labor, although again probably with key industry exceptions (especially health care?) and maybe local exceptions in specific job markets.

|

|

|