|

I've got a question about portfolio balancing: I've got a lot of cash in a Fidelity brokerage account in SPAXX, a Roth IRA, and a HSA. Should I pursue a consolidated strategy across all 3 account types (to keep age/risk informed ratios of a simple 3 portfolio fund, US market, world market, bonds), or should I be using my tax-advantaged space (Roth/HSA) for loading specific investments like my bond for tax-advantage? I don't foresee needing the either the cash or health fund in the near future (knock on wood). adnam fucked around with this message at 00:50 on Aug 30, 2023 |

|

|

|

|

| # ? May 18, 2024 08:17 |

|

It's usually recommended to think of your whole portfolio as one unified thing and then after determining your ideal asset allocations percentages trying to achieve that via placing less tax-efficient investments (bond funds and high dividend stocks for example) in tax advantaged accounts like the IRA/HSA first. You also want to include 410k investments if you have them in this grand portfolio. https://www.bogleheads.org/wiki/Tax-efficient_fund_placement - has some tips on what types of investments are more or less tax efficient. I do think it's important to consider time horizons though. If you might be taking some funds from the HSA in the near future, best to keep those anticipated funds in a less risky investment like MMFs. The remainder you could then put in more long-term investments. Time horizon is extra important for a brokerage account due to potential tax drag on dividends/interest vs more tax favorable treatment of long term capital gains in taxable accounts. If you might need those funds in the near future, don't sweat over taxes so much, keep investments in lower risk guaranteed yields like MMF/SGOV/t-bills. However if you're thinking very long-term in your horizon then you want a minimal turnover (and thus minimal tax drag) index ETF like VTI/VOO to maximize long term gains in a taxable brokerage space.

|

|

|

|

Josh Lyman posted:Should I just go ahead and open a Roth IRA with TDA and move over the 3% that's vested (around $4200)? Yes, but you should make sure you can actually do this without penalty. You may have to go [Weird savings account] -> [Trad IRA] -> [Roth IRA] using the backdoor to avoid taxes, and it might be advisable to do this in the first place given your income. If you do this make sure you clear the trad IRA balance completely. You can open the Trad IRA and the Roth IRA both with TDA. Josh Lyman posted:With respect to the contribution limit on a Roth IRA, if I'm over the MAGI limit, do I end up paying a penalty when I file my tax return? Seems like neither your employer nor IRA administrator would know whether you're over the MAGI limit, except if your wage alone is above it then your employer would know. But even then it's not clear to me that HR would bother blocking you from withholding into a Roth 401k. Yes, you can functionally do whatever you want with an IRA regardless of whether it's allowed or not. You'll just get hit at tax time. To clarify another point: there are no income limits on Roth 401(k) contributions. So HR would never block you from contributing to a Roth 401(k) if you are offered one.

|

|

|

|

So my workplace transitioned to a new employer and therefore a new 401k plan. It seems like a no brainer to roll the old trad 401k into a new trad IRA account? Then I can put the money in any fund I want. Any drawbacks or pitfalls, or reasons to roll the 401k forward to my new employer I should be aware of?

|

|

|

|

hobbez posted:So my workplace transitioned to a new employer and therefore a new 401k plan. The main reason not to is that having a pre-tax tIRA balance locks yourself out of performing a tax-free backdoor Roth in the future. e: There is one potential way around this, but it requires eventually working for an employer that offers a 401k plan that allows IRA roll-ins (which is unusual), so you'd be rolling the dice on whether you'll ever be able to take advantage of it. raminasi fucked around with this message at 15:02 on Aug 30, 2023 |

|

|

|

The main reason not to do it is that if you have a big trad IRA balance you cannot backdoor Roth IRA contributions. e:f,b

|

|

|

|

hobbez posted:So my workplace transitioned to a new employer and therefore a new 401k plan. Is everything in the old 401k plan fully vested as part of the transition? If there's still unvested dollars in there, you'll want to figure out how that gets treated when moving to a new 401k. Almost certainly unvested amounts would go away if you close and move it all to an IRA.

|

|

|

|

esquilax posted:Is everything in the old 401k plan fully vested as part of the transition? If there's still unvested dollars in there, you'll want to figure out how that gets treated when moving to a new 401k. Almost certainly unvested amounts would go away if you close and move it all to an IRA. For the first time ever I am 100% vested! Feels good man. The point about the back door is very valid! Iíll probably keep it in the 401k/roll it forward then. Thanks all

|

|

|

|

hobbez posted:So my workplace transitioned to a new employer and therefore a new 401k plan. What are the new plan's fund options and fees? "Any fund you want" sounds nice from a flexibility standpoint but in many cases you'll already have access to what you'd probably want (low cost broad index fund or target date fund).

|

|

|

|

KYOON GRIFFEY JR posted:Yes, but you should make sure you can actually do this without penalty. You may have to go [Weird savings account] -> [Trad IRA] -> [Roth IRA] using the backdoor to avoid taxes, and it might be advisable to do this in the first place given your income. If you do this make sure you clear the trad IRA balance completely. You can open the Trad IRA and the Roth IRA both with TDA I am pretty sure the Trad to Roth conversion will be taxed. If I followed along he gets a weird savings account match via the 401k (TSP?) and it is pre tax, then you move it to a trad IRA and still pre tax, then you convert to Roth IRA and it has to be taxed then. Also no back door needed I believe since back door is for new trad money converted to Roth ID you are over the income limit. But maybe I am not understanding the 401k/TSP weird savings account thing.

|

|

|

|

Yeah the whole thing is weird.

|

|

|

|

KYOON GRIFFEY JR posted:The main reason not to do it is that if you have a big trad IRA balance you cannot backdoor Roth IRA contributions. Sure you can, it's just that it's proportionally accounted for during the backdoor process. And you may be paying more in tax at that time than you wanted.

|

|

|

|

SpelledBackwards posted:Sure you can, it's just that it's proportionally accounted for during the backdoor process. And you may be paying more in tax at that time than you wanted. once you're paying a bunch of taxes on conversions it becomes a lot less attractive imo

|

|

|

|

I usually just sneak an extra $5k-$10k over to the Roth along with the non-taxed $7k conversion each year and pay the taxes on the extra "income" during filing.

|

|

|

|

One weird trick, IRS agents hate it!

|

|

|

|

Subvisual Haze posted:It's usually recommended to think of your whole portfolio as one unified thing and then after determining your ideal asset allocations percentages trying to achieve that via placing less tax-efficient investments (bond funds and high dividend stocks for example) in tax advantaged accounts like the IRA/HSA first. You also want to include 410k investments if you have them in this grand portfolio. https://www.bogleheads.org/wiki/Tax-efficient_fund_placement - has some tips on what types of investments are more or less tax efficient. Thanks, this makes more sense than what I was trying to do, and I really appreciate the link. Gives a good idea of next steps for my rebalancing. Keyser_Soze posted:I usually just sneak an extra $5k-$10k over to the Roth along with the non-taxed $7k conversion each year and pay the taxes on the extra "income" during filing. Can you clarify this? I understand the backdoor Roth if above limits, but how do I add that extra 5-10k?

|

|

|

|

Keyser_Soze posted:I usually just sneak an extra $5k-$10k over to the Roth along with the non-taxed $7k conversion each year and pay the taxes on the extra "income" during filing. The way you describe it, it sounds like you are doing Roth conversions as last-in-first-out rather than pro rata. If that's the case, you are doing your taxes incorrectly. esquilax fucked around with this message at 21:22 on Aug 30, 2023 |

|

|

|

So HSA, Iíve read that some of you are actually putting money into one and treating it like any other retirement account. I have a HDHP with I think a $1500 deductible so Iíve set my HSA contribution to put in that same amount. I do plan on having to pay the entire deductible over a year in healthcare and pharmacy costs so it made sense to me. Is this still a sensible thing to do?

|

|

|

|

Boris Galerkin posted:So HSA, I’ve read that some of you are actually putting money into one and treating it like any other retirement account. I have a HDHP with I think a $1500 deductible so I’ve set my HSA contribution to put in that same amount. I do plan on having to pay the entire deductible over a year in healthcare and pharmacy costs so it made sense to me. Is this still a sensible thing to do?

|

|

|

|

Boris Galerkin posted:So HSA, Iíve read that some of you are actually putting money into one and treating it like any other retirement account. I have a HDHP with I think a $1500 deductible so Iíve set my HSA contribution to put in that same amount. I do plan on having to pay the entire deductible over a year in healthcare and pharmacy costs so it made sense to me. Is this still a sensible thing to do? If you expect to have to pay that out over the year then you may have chosen the wrong healthcare plan. Given that you're locked in, then "Max out HSA contributions, never ever spend money from that account, and save receipts." is going to be "optimal." And the closer you get to that, the better.

|

|

|

|

Cugel the Clever posted:The HSA space is triple tax-advantaged, so might as well leave that money invested for the long-term, paying out of pocket for the medical expenses where possible. What do you mean by triple tax advantaged? I know that putting money into it now lowers my taxable income, so thatís 1 I guess? Whereís the other 2 coming from? Iíve never thought of an HSA as anything other than for medical bills.

|

|

|

|

Boris Galerkin posted:What do you mean by triple tax advantaged? I know that putting money into it now lowers my taxable income, so thatís 1 I guess? Whereís the other 2 coming from? Iíve never thought of an HSA as anything other than for medical bills. No tax on the contributions, no tax on growth, no tax when you take the money out (assuming used for qualifying medical expenses). It's the best retirement account ever.

|

|

|

|

CubicalSucrose posted:If you expect to have to pay that out over the year then you may have chosen the wrong healthcare plan. I didnít really have a choice. I take expensive meds so I needed the plan with the lowest deductible, which was this one.

|

|

|

|

Boris Galerkin posted:I didnít really have a choice. I take expensive meds so I needed the plan with the lowest deductible, which was this one. I meant "maybe a non-HDHP would've been better" but yeah if that wasn't an option (or would've been worse due to whatever your circumstances are), sucks.

|

|

|

|

CubicalSucrose posted:No tax on the contributions, no tax on growth, no tax when you take the money out (assuming used for qualifying medical expenses). It doesn't even have a penalty for using it immediately.

|

|

|

|

Boris Galerkin posted:What do you mean by triple tax advantaged? I know that putting money into it now lowers my taxable income, so that’s 1 I guess? Where’s the other 2 coming from? I’ve never thought of an HSA as anything other than for medical bills. e: f;b Additionally, and though this may change, you can withdraw for any purpose after 65, leaving it just another retirement account. Cugel the Clever fucked around with this message at 21:59 on Aug 30, 2023 |

|

|

|

CubicalSucrose posted:I meant "maybe a non-HDHP would've been better" but yeah if that wasn't an option (or would've been worse due to whatever your circumstances are), sucks. Yeah I understood what you meant. Unfortunately my employer does not offer a non-HDHP.

|

|

|

|

Boris Galerkin posted:So HSA, Iíve read that some of you are actually putting money into one and treating it like any other retirement account. I have a HDHP with I think a $1500 deductible so Iíve set my HSA contribution to put in that same amount. I do plan on having to pay the entire deductible over a year in healthcare and pharmacy costs so it made sense to me. Is this still a sensible thing to do? The worst thing to do is not contribute to your HSA at all. A better thing to do is to put money into your HSA and use that money to pay your deductible/out-of-pocket expenses when they come up. A different thing to do that can be better than either of those options in the long-term, is to put money into your HSA, and instead of using that money to pay your health care expenses, just pay those out of normal cash and let your account grow. This requires having the cash on hand to pay those expenses, and potentially saving healthcare receipts for 20 years so that you can pull out your money later. So this is more a strategy for rich people to maximize tax advantages for the future, than it is to manage your health expenses. Cugel the Clever posted:Additionally, investment growth and withdrawals are tax-free. They are penalty free for any purpose after age 65 but not tax free (i.e. if you don't use it on medical expenses, it is like a traditional IRA distribution).

|

|

|

|

OK so what I'm seeing is that the standard rule of thumb of "401(k) up to employer match, then max your IRA, then dump the rest into the 401(k)" should actually be "401(k) to employer match, then max HSA, then max IRA, then dump the rest into 401(k)" if I have the option to contribute to an HSA? And then just pay my deductibles/pharma bills with cash? e: jokes posted:It doesn't even have a penalty for using it immediately. It seriously never occurred to me to treat an HSA like anything other than a fund to pay for healthcare in the moment. I mean my HSA provider even sends me a "debit" card to use to pay the bills with. Boris Galerkin fucked around with this message at 22:17 on Aug 30, 2023 |

|

|

|

esquilax posted:The way you describe it, it sounds like you are doing Roth conversions as last-in-first-out rather than pro rata. If that's the case, you are doing your taxes incorrectly. I understood it to be just filling out the Form 8606 accurately and including the taxable amount on line 18 of 8606 as income on 1040 line 4b?

|

|

|

|

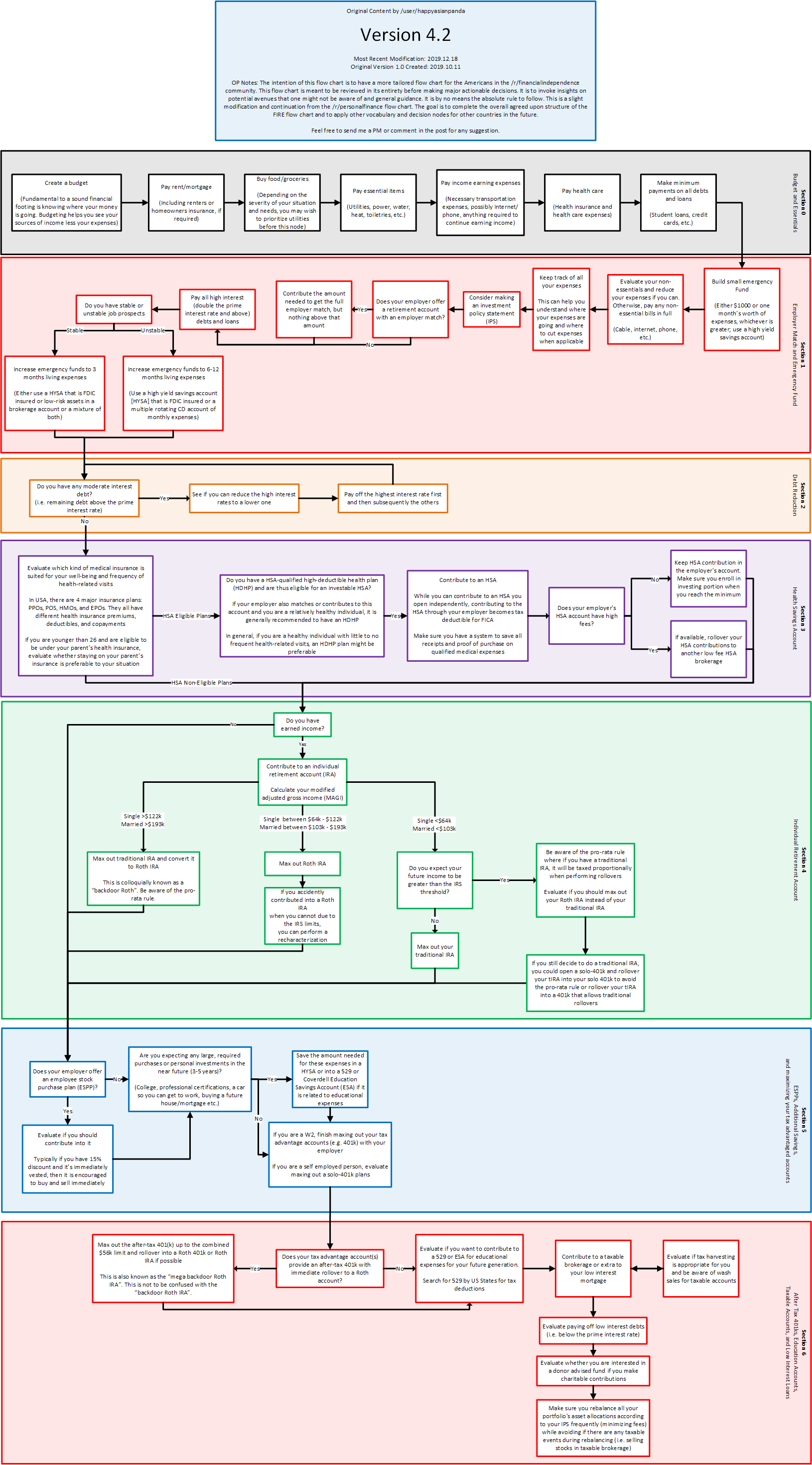

Boris Galerkin posted:OK so what I'm seeing is that the standard rule of thumb of "401(k) up to employer match, then max your IRA, then dump the rest into the 401(k)" should actually be "401(k) to employer match, then max HSA, then max IRA, then dump the rest into 401(k)" if I have the option to contribute to an HSA? And then just pay my deductibles/pharma bills with cash? Follow the flowchart, but that sounds right.

|

|

|

|

Boris Galerkin posted:e: Yeah, but if you're really smart you can do all your other retirement contributions then also max out contributions into an HSA and invest it into the same poo poo so that you get hundreds of thousands of dollars to spend on retirement healthcare. Fresh teeth!

|

|

|

|

Keyser_Soze posted:I understood it to be just filling out the Form 8606 accurately and including the taxable amount on line 18 of 8606 as income on 1040 line 4b? I'm not a tax expert and am not giving tax advice. If you're filling out the forms accurately then great. But if you (1) have an existing pre-tax traditional IRA balance, and (2) put in a $7k post-tax contribution into the traditional IRA each year, and (3) only convert a portion of your total Pre+Post tax traditional IRA balance into Roth, then you should not be getting $7k of non-taxed conversion each year. It would be a portion of that. If your tax forms are saying that your taxable amount is $7k less than your total conversion, you'll want to double check that you have completed them all accurately.

|

|

|

|

esquilax posted:I'm not a tax expert and am not giving tax advice. If you're filling out the forms accurately then great. But if you (1) have an existing pre-tax traditional IRA balance, and (2) put in a $7k post-tax contribution into the traditional IRA each year, and (3) only convert a portion of your total Pre+Post tax traditional IRA balance into Roth, then you should not be getting $7k of non-taxed conversion each year. It would be a portion of that. If your tax forms are saying that your taxable amount is $7k less than your total conversion, you'll want to double check that you have completed them all accurately. If you fill the form out correctly you really can't screw it up. It will do the pro rata correctly as you do the math. They even bold the word ALL in line 6 to help you not screw it up.

|

|

|

|

spwrozek posted:If you fill the form out correctly you really can't screw it up. It will do the pro rata correctly as you do the math. They even bold the word ALL in line 6 to help you not screw it up. Right, if you fill out the form correctly then the form is filled out correctly. But that's not a given, people constantly misread or misinterpret. I personally managed to screw up form 8606 a few times to my own detriment (until I fixed it), so I speak from experience.

|

|

|

|

CubicalSucrose posted:No tax on the contributions, no tax on growth, no tax when you take the money out (assuming used for qualifying medical expenses).

|

|

|

|

CubicalSucrose posted:Follow the flowchart, but that sounds right. I was going through this and have a question about section 4. It says something about creating a solo-401k due to the pro-rata rule. In a situation where an employer does not offer a 401k, could you create/open a solo 401k (e.g., register a company but not "use" it) and then use earned income from the job that does not offer a 401k to fund it? Or does it only work if you have actual self-employed income? Magic City Monday fucked around with this message at 11:41 on Aug 31, 2023 |

|

|

|

Magic City Monday posted:Or does it only work if you have actual self-employed income? This. You can only fund a Solo 401k with self employed money.

|

|

|

|

Salami Surgeon posted:This. You can only fund a Solo 401k with self employed money. It's absurd that retirement savings vehicles are tied to employment. gently caress you if your employer doesn't offer a 401k I guess.

|

|

|

|

|

| # ? May 18, 2024 08:17 |

|

SamDabbers posted:It's absurd that retirement savings vehicles are tied to employment. gently caress you if your employer doesn't offer a 401k I guess. this is america - obviously your access to health care and ability to stop working are tied to your job

|

|

|