|

The individual sites don’t have access to any of your bank login info, they all use systems run in part by the banks to request all of that balance and transaction info.

|

|

|

|

|

| # ? Jun 5, 2024 08:17 |

|

Epitope posted:Are HDHP and coinsurance linked? Some posts here are implying that, but speaking anecdotally, I’ve seen coinsurance somewhere on every non-HDHP I’ve ever had. You’ve just gotta read your plan docs and do the math.

|

|

|

|

I'm helping my fiance manage her finances. She's eligible for PERA and we're trying to decide of she would be better served by their defined benefit plan or by a Roth 403b. I realize there probably isn't a simple answer to this but Ive never dealt with defined benefit plans, any pitfalls that might not be obvious or advice for what we should be comparing to make that decision?

|

|

|

|

I assumed (wrongly) that Schwab would prevent my wife from over contributing to her 401k. Between her employee and employer contributions, she's at $68,996 for the year, which rounds to $69k which is a nice number, but is above the $66k limit for 2023. 1. I'm not missing anything right? The limit is $66k? 2. How do I fix this?

|

|

|

|

Residency Evil posted:I assumed (wrongly) that Schwab would prevent my wife from over contributing to her 401k. Between her employee and employer contributions, she's at $68,996 for the year, which rounds to $69k which is a nice number, but is above the $66k limit for 2023. 1. Kinda. The mega backdoor portion is like per-plan, not per person. Which is pretty wild. So if you work at two different places during the year that both allow MBD, you can go over the top. https://www.bogleheads.org/forum/viewtopic.php?t=383925 Company should be the one preventing over contributions. 2. Contact HR or payroll or something. Is this all the same employer the whole year? HR might tell you to contact Schwab.

|

|

|

|

CubicalSucrose posted:1. Kinda. The mega backdoor portion is like per-plan, not per person. Which is pretty wild. So if you work at two different places during the year that both allow MBD, you can go over the top. Single employer all year for her. Thanks.

|

|

|

|

Do folks here with a value tilt also include international value in that? If so, any fund recommendations? The options I am seeing are more expensive than I'd like, but not insane (30 ± 5 bp).

|

|

|

|

Residency Evil posted:Single employer all year for her. Thanks. 2. Request a Return of Excess Contribution thru HR or Schwab, but probably HR.

|

|

|

|

drk posted:Do folks here with a value tilt also include international value in that? AVIV - Avantis International Large Cap Value ETF 0.25 ER AVDV - Avantis International Small Cap Value ETF 0.36 ER I'd love to hear superior/rival options. Dimensional and who else?

|

|

|

|

Yeah Avantis and Dimensional is what I came up with too. Avantis recently added some interesting fund of funds options too: AVNV: All-cap international value (AVIV + AVES + AVDV) AVGV: All-cap all-world value (AVLV + AVUV + AVIV + AVES + AVDV) All-cap value funds are fairly uncommon, so this is nice. Not sure how tax efficient that would be though since I assume the rebalancing could generate more taxable gains than would be ideal.

|

|

|

|

drk posted:Yeah Avantis and Dimensional is what I came up with too. Not endorsements but you wanna also look at tickers like EFV, FNDF, ICOW, IVLU, SCHY, VIGI International value typically ends up being huge overweight banks and energy unless there are sector caps.

|

|

|

|

Space Fish posted:AVIV - Avantis International Large Cap Value ETF 0.25 ER Ooh, thanks, looks like AVDV is exactly what I wanted. I didn't realize it existed. I've been using SCZ for a long time to approximate my small value tilt on the international side, but this fits it precisely and is 3 basis points cheaper.

|

|

|

|

Looking for some advice on how to evaluate and incorporate defined benefit pension into retirement planning. My partner and I both have access to a defined benefit pension. Mandatory contribution to the pension is ~11% of our salaries, but we are also exempt from social security payroll tax, and are subject to the windfall elimination provision for SS. We also have access to a 457 (pre-tax or Roth). I'm trying to figure out if we should toss more money towards the 457s, given we have access to defined benefit pensions, and whether or not we should make any Roth contributions. Right now we're putting about 5% additional into the 457s as pre-tax, but it doesn't have any match component. We're mid thirties, and not eligible to draw on the pension until 2049, but max pension benefit wouldn't be until 2054 for me, or 2055 for my partner.

|

|

|

|

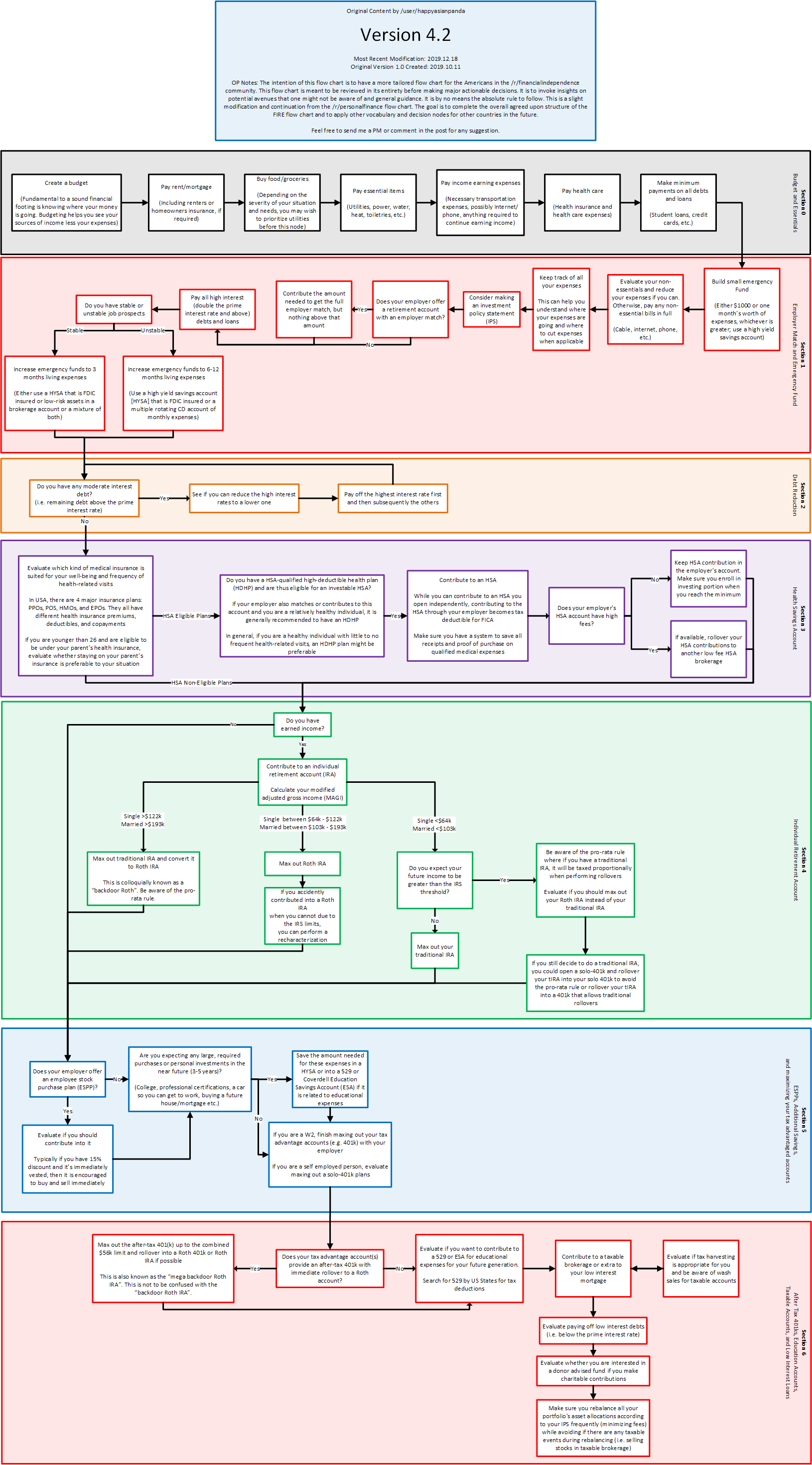

The Slack Lagoon posted:Looking for some advice on how to evaluate and incorporate defined benefit pension into retirement planning. My partner and I both have access to a defined benefit pension. Mandatory contribution to the pension is ~11% of our salaries, but we are also exempt from social security payroll tax, and are subject to the windfall elimination provision for SS. We also have access to a 457 (pre-tax or Roth). Follow the flowchart  , I think subbing in 457 for 401k? , I think subbing in 457 for 401k? What pensions do, basically, is reduce the amount of annual expenses you need to cover from elsewhere, with some variability in "how good" the pension actually is (funding/default risk, COLA component, and probably more factors not immediately coming to mind). So, take your expected annual expenses at the time you retire, subtract off the expected pension amount, and that's what you'll need to cover elsewhere.

|

|

|

|

The Slack Lagoon posted:Looking for some advice on how to evaluate and incorporate defined benefit pension into retirement planning. My partner and I both have access to a defined benefit pension. Mandatory contribution to the pension is ~11% of our salaries, but we are also exempt from social security payroll tax, and are subject to the windfall elimination provision for SS. We also have access to a 457 (pre-tax or Roth). Pension guy here. Contributory pensions don't work anything like a 401k, a 403b, or a 457. Your contributions are tracked, but the payout is really based on the plan formula and forms of payment available from the plan. Usually public pensions are worth making the contributions to if you plan to be there for a long time, but if you have the pension formula I can take a look.

|

|

|

|

Question about Fidelity brokerage accounts: I have one for myself. I'd like to set up some kind of sub-account for my special needs child. He has a joint savings account with me, and I'd like to invest his earnings without combining it into my own brokerage account. Any idea how I would go about doing that?

|

|

|

|

SouthShoreSamurai posted:Question about Fidelity brokerage accounts: Look into UTMA and UGMA accounts, but there's probably also something separate for special needs with some extra trustee stuff. This dude is a salesperson but actually has good content and is a parent of a special needs child himself. - https://disabledchildplanning.com/

|

|

|

|

CubicalSucrose posted:Follow the flowchart On that chart in section 6 why does it recommend maxing out your after tax contributions and the immediately rolling it to an IRA? Are we just trying to avoid 401k fees and/or bad investment options?

|

|

|

|

I asked a question about pensions a little further up, so this discussion has been pretty helpful. My main concern was with the long-term viability of a pension fund (especially since my fiance's is a state program), but from what I've been able to tell it's a pretty good deal, and since we'll both be contributing to Roth IRA's anyway that'll mitigate a lot of the risk.

|

|

|

|

CubicalSucrose posted:Look into UTMA and UGMA accounts, but there's probably also something separate for special needs with some extra trustee stuff. Thanks, I'll check that guy out. My son is about to turn 18, so the usual custodial accounts aren't going to work. eta: I just went ahead and opened a 2nd account under my own name for now. Not ideal for things like total net worth, but at least I can separate investing by accounts.

|

|

|

|

daslog posted:On that chart in section 6 why does it recommend maxing out your after tax contributions and the immediately rolling it to an IRA? Are we just trying to avoid 401k fees and/or bad investment options? It's specifically the Roth part not the IRA part that's important, it says Roth 401k or Roth IRA. Possible exceptions could be if you're retiring real soon, or your current taxes are absurdly higher than whatever your taxes end up being in retirement. IMO the tax free earnings still usually mean that part's outweighed but other people might disagree. surc fucked around with this message at 18:10 on Nov 9, 2023 |

|

|

|

Jabarto posted:I asked a question about pensions a little further up, so this discussion has been pretty helpful. My main concern was with the long-term viability of a pension fund (especially since my fiance's is a state program), but from what I've been able to tell it's a pretty good deal, and since we'll both be contributing to Roth IRA's anyway that'll mitigate a lot of the risk. This is probably the best place to look https://www.pbgc.gov/about/faq/pg/general-faqs-about-pbgc In practice, the PBGC insures private pensions to something call Actuarial Equivalence and if your employer adds sweeteners like an early retirement subsidy those don't get covered. When Delphi (GM parts spinoff company) went under is a good example.

|

|

|

|

daslog posted:Pension guy here. Contributory pensions don't work anything like a 401k, a 403b, or a 457. Your contributions are tracked, but the payout is really based on the plan formula and forms of payment available from the plan. Usually public pensions are worth making the contributions to if you plan to be there for a long time, but if you have the pension formula I can take a look. Assuming we don't get any promotions in the next 30 years to a higher grade, if we both retired at the maximum 80% payout in 2055, our annual pension would be around $320,000 (assuming 2% wage growth per year at max grade and step). As far as the chart goes, we're theoretically on "Max Roth IRA", which we can't do because we MFS for Student Loan/MFS purposes. Should we sub in Roth 457 contributions for Roth IRA? Increase the Pre-tax 457 contributions and make Roth IRA contributions once we can MFJ (2025 tax year)?

|

|

|

|

drat, I learned a new weird thing about Roth IRAs and MFS. Thanks! In your case I would treat the 457 in place of IRA contributions of either kind. 457s are great. I don't have strong preferences over Roth versus Traditional - at higher income levels and high tax rates Traditional contributions have nice tax benefits, and at lower income levels tax-free Roth growth is attractive if you can afford the contributions. Since you intend to eventually MFJ I would avoid doing any kind of traditional IRA contributions; you could be at an income point where you have to backdoor in to a Roth IRA and at that point having an existing traditional IRA is a pain.

|

|

|

|

The Slack Lagoon posted:Assuming we don't get any promotions in the next 30 years to a higher grade, if we both retired at the maximum 80% payout in 2055, our annual pension would be around $320,000 (assuming 2% wage growth per year at max grade and step). Are you not able to backdoor your Roth IRA contributions because you have significant funds in a Traditional IRA from before?

|

|

|

|

KYOON GRIFFEY JR posted:you could be at an income point where you have to backdoor in to a Roth IRA and at that point having an existing traditional IRA is a pain. Can you explain this a bit? I currently have a 401k, tradition, and Roth IRA. I won't be hitting the backdoor Roth threshold anytime soon but I only have a tiny about in my traditional at the moment; I could roll it over if doing so will keep more options open for me in the future.

|

|

|

|

Jabarto posted:Can you explain this a bit? I currently have a 401k, tradition, and Roth IRA. I won't be hitting the backdoor Roth threshold anytime soon but I only have a tiny about in my traditional at the moment; I could roll it over if doing so will keep more options open for me in the future. If you have any tIRA balance, then you can't execute a backdoor Roth without paying taxes, so even if you don't need to do one now you might want to keep your tIRA balance zeroed out to preserve your flexibility in the future. If your current tIRA balance is small then it might be worth paying the (small) conversion tax now to avoid a (larger) conversion tax later. But it might not - you might never need to backdoor Roth, or you might someday get access to an employer-sponsored retirement plan that permits IRA roll-ins (which is another tax-free way around the problem), or the laws might change, or whatever.

|

|

|

KYOON GRIFFEY JR posted:at higher income levels and high tax rates Traditional contributions have nice tax benefits, and at lower income levels tax-free Roth growth is attractive if you can afford the contributions. Since you intend to eventually MFJ I would avoid doing any kind of traditional IRA contributions; you could be at an income point where you have to backdoor in to a Roth IRA and at that point having an existing traditional IRA is a pain. I don't think your income level analysis is entirely correct. First, its worth noting that the only time you have an option is the 402g (elective deferral) limit, the 457 limit (same number as the 402g but accounted for separately) and the IRA annual limit. All other tax advantaged opportunities are Roth (through a mega-backdoor Roth, ESA, 529, or ABLE), triple-advantaged (for an HSA used for medical expenses), or deferred (HSA used after the age of 65 for non-medical purposes). Next, let's explore a world where all that exists are income taxes (and FICA taxes, which make no difference since they are always taxed anyways). We'll ignore all tax complexities here (and rules unique to roth IRAs), which we will look at later. Then, the only thing that matters is is the top marginal tax rate at deposit versus the top marginal at withdrawal. If they are the same, then traditional is just as good roth, and there is no tax advantage to either one. If it is higher at deposit, then traditional is better, and if it is higher at withdrawal, than roth is better. Thus, one could naively just think "I'll contribute deferred until the tax at withdrawal at my fixed rate will be the same as my current tax rate, then I'll invest in roth," but that would be suboptimal since that would make your taxable income unsmooth during your working years, resulting in higher taxes in roth paying years. Instead, under this model, you should from the beginning be putting into roth and traditional in a ratio such that in the end your top marginal tax rate will be exactly the same as what it was post-deferral in your working years. Of course, as I mentioned, this model is overly simplistic, because:

Note that most of these favor the wealthy. Those that have more money to invest after all of the tax advantaged accounts, those that would have an income over $97k for IRMAA, those that would have an income over $200,000 for the net investment tax, those with incomes large enough for AMT to matter (with the niche scenarios for it to trigger), early retirees, and those expecting to leave a large inherence. So, overall, I'd say the utility of traditional is parabolic. Those with ultra-low incomes (or low incomes with dependents) already have a 0% tax rate, so it should be a no-brainer to go for roths. Higher low income and lower middle incomes with dependents slightly favor roth, since while their tax rates aren't 0%, they might save themselves from having their social security being taxable, and the ability to withdraw the principal can help out with emergencies. This turns around with more solidly middle income and lower upper-middle incomes, where the tax deferral is allowing significant additional money to be invested, though prospective early retirees may choose a decent amount to roths still for the withdrawal ability. But once your income is high enough that you are throwing money into a brokerage account, this begins to turn around again, and for the particularly wealthy, the net investment tax is serious (along with the 20% capital gains tax threshold).

|

|

|

|

|

MegaZeroX posted:Capital gains is taxed after other income I was actually just thinking about this the other day - does that mean if you had say $100k in capital gains and $10k in normal income, the normal income would be taxed as if you only earned $10k?

|

|

|

drk posted:I was actually just thinking about this the other day - does that mean if you had say $100k in capital gains and $10k in normal income, the normal income would be taxed as if you only earned $10k? The first $10k would be taxed at normal income brackets, which after the standard deduction would be $0 in taxes. But then it doesn't effect capital gains at all, so let's pretend that the $10k is after deductions. This means the thresholds are $34.6k, or $79.2k if you are married, of long-term capital gains at a 0% tax rate after we subtract out the $10k from income. The rest would have 15% tax rate. Note that this is only on the gains portion though. For example, if you had a $100k value, and it doubled in value, and you withdrew all $200k, then only $100k in gains is what you pay taxes on. Then, in this scenario the first $34.6k/$79.2k of that 100k is at 0%, then the taxable amount would be $65.4k/20.8k, and you would be taxed $9,810/$3,120 for capital gains, respectively. MegaZeroX fucked around with this message at 02:09 on Nov 10, 2023 |

|

|

|

|

drk posted:I was actually just thinking about this the other day - does that mean if you had say $100k in capital gains and $10k in normal income, the normal income would be taxed as if you only earned $10k? This is why the really wealthy play tax games to not have “income” and lobby against high cap gains tax rates

|

|

|

|

Ancillary Character posted:Are you not able to backdoor your Roth IRA contributions because you have significant funds in a Traditional IRA from before? We both have Rollover IRAs from old 403(b)'s and I think the balances are high enough that I'd rather avoid paying the tax on it to convert. e: I think my take away is Roth 457 contributions might make sense, and once we are filling MFJ start up Roth IRA contributions. The Slack Lagoon fucked around with this message at 04:55 on Nov 10, 2023 |

|

|

|

The Slack Lagoon posted:Looking for some advice on how to evaluate and incorporate defined benefit pension into retirement planning. My partner and I both have access to a defined benefit pension. Mandatory contribution to the pension is ~11% of our salaries, but we are also exempt from social security payroll tax, and are subject to the windfall elimination provision for SS. We also have access to a 457 (pre-tax or Roth). My wife is a teacher (has a “defined” benefit, exempt from Social Security) and her pension is essentially a black box where the formula for calculating her payout is at the whim of whomever controls the Connecticut state legislature when she retires in 20+ years. Because of this I just assume she will get almost nothing and max out everything else.

|

|

|

|

I recently had a pow-wow with my 401(k) administrator (through Vanguard), a service offered for free through my employer. I've been lucky enough to be able to consistently max out my 403(b) and Roth IRA, and am trying to chart the best course for early retirement. Since I started my career I've been using pretax 401(k)/403(b)s, and ROTH IRAs as is the general wisdom. The advisor I spoke to was of the opinion that because I can afford it I should contribute to a Roth 403(b) rather than contribute with pre-tax income to reduce my taxable income in the future. I'm in my mid-30s, so it's not unreasonable that I'd be making more later on. My employer offers after-tax contributions with immediate rollover to a Roth - the mega backdoor, which is an amount of cap space I could make substantial use of but would not be able to max. Between a modest contribution to that and my Roth IRA, is that a good balance, or is there a reason to go full ROTH on all vehicles? My reckoning is that having access to the principal without penalty before I hit 59.5 years is a good hedge. Happy to provide more detail if that's helpful.

|

|

|

|

Not a Children posted:I recently had a pow-wow with my 401(k) administrator (through Vanguard), a service offered for free through my employer. I've been lucky enough to be able to consistently max out my 403(b) and Roth IRA, and am trying to chart the best course for early retirement. Since I started my career I've been using pretax 401(k)/403(b)s, and ROTH IRAs as is the general wisdom. The advisor I spoke to was of the opinion that because I can afford it I should contribute to a Roth 403(b) rather than contribute with pre-tax income to reduce my taxable income in the future. I'm in my mid-30s, so it's not unreasonable that I'd be making more later on. Trad vs Roth comes down to: A) Actual ability to contribute to one. B) Guesses about your personal future tax rates vs where you're at today. For the same tax rates (and a bunch of other related assumptions), it basically makes no difference. This is one question where there really isn't a good one-size answer. The best generic answer is "If you're asking this question, you're probably in a spot where you're going to be in really good financial shape no matter what." See the really good effortpost from the other day about parabolic benefits based on income. If you expect to have any sort of early retirement (say...55 or earlier, perhaps), you should be able to do some non-trivial Roth conversions in low/no income years. So that would nudge toward recommending maxing trad when for the tax break now. If you're going to cruise right through and work the whole time, it's less clear. Maybe that's an argument for more Roth stuff.

|

|

|

|

Does anyone here have experience with the Fidelity cash management account? I'm considering moving my primary checking to them, since my current credit union pays 0% unless you jump through a lot of hoops. If I am reading their page correctly, balances in the account currently earn 2.72%, with no minimum amounts, fees, or other requirements to earn that. And it includes a debit card, check writing, etc - most of the stuff I would use a more traditional bank or credit union for. If there aren't any big gotchas I'm missing, I am going to open an account. edit: there are a ton of threads over at bogleheads and this seems like a definite yes. i'll see about opening an account this weekend drk fucked around with this message at 19:00 on Nov 10, 2023 |

|

|

|

drk posted:Does anyone here have experience with the Fidelity cash management account? The only ones I can think of: There are no actual Fidelity banking branches if you need something like a cashier's check. The buttons for buying stocks and stuff are all right there so I guess if you had poor impulse control you could be tempted to YOLO all your checking account money meant for bills into meme stonks and 0dte options.

|

|

|

|

There actually is a fidelity "investor center" less than a mile from where I live but it's good to know not to expect any banking devices to be available. I honestly can't remember the last time I needed a cashier's check, so I'm not too worried about that. Normal checks, debit, ACH and wires should cover my banking needs for the foreseeable future, and I will leave my credit union acct open for a while as well.

|

|

|

|

I have a fidelity CMA account that's largely replaced traditional banks for me The yield you quoted is just for the FDIC sweep position, you can and should invest in government money market funds with a CMA. Fidelity will even auto liquidate MMF shares on demand to cover any withdrawals. Worth pointing out that the CMA is almost identical to a regular brokerage account. Which one you pick depends on whether you prefer ATM reimbursement (CMA only) or having SPAXX as a core position (brokerage only). It was an easy decision for me since my preferred MMF isn't an eligible core position so I have to buy it manually either way.

|

|

|

|

|

| # ? Jun 5, 2024 08:17 |

|

drk posted:Does anyone here have experience with the Fidelity cash management account? Mine isn't a cash management account, but I have what's listed as an "Individual" account at Fidelity. I just leave the money in cash and have it set to keep that in SPAXX, which is currently yielding about 5% and since SPAXX is also Fidelity they're fine with me drawing the money out as needed for same day payments. Actually you should listen to Jabarto about this, it sounds like they know it much better than I do. Doing some reading, it looks like the difference between my account and a CMA is that I don't get a debit card, checks, or free ATM use, though that works out for me since I also have a Fidelity credit card for the 2% cash back and it's set to automatically pay the balance each month out of the individual account so I use that instead of a debit card or checks for everything except ATMs. But I also have a small checking account at a local bank for that, so if you want it to be your only account I can understand the benefits of a CMA. All told I'm quite happy with it. I am a child of the internet generation so doing my banking through their webpage instead of a physical location is a solid plus for me, and earning $13.50 in interest this month off what amounts to a few thousand dollars I keep around to pay my bills is quite an improvement over what my checking account gets. Bremen fucked around with this message at 20:40 on Nov 10, 2023 |

|

|