|

jaete posted:Germany has been weird about the whole austerity and schwarze null thing for about a hundred years, it's not caused by the Euro or anything. The US also have debt ceiling laws for the states. It's the only way a single currency can work on a large scale like the US, the EU, China, India or Russia. Otherwise you're going to end up with states, oblasts, regions or whatever occasionally going bankrupt which tends to be both unpopular and harmful. China is currently grappling with unsustainable regional debt loads and it appears the Chinese government has little interest in either bailing them out or allowing them to default. There is nothing unique about restricting regional debt in a federal system and there is nothing unique about very different regions with very different needs sharing a single currency. West Virginia, Hawaii and New York are very different. Moscow and Ingushetia are different and Beijing and Gansu are different. Frequently this is also true on a regional level - Rome and Sicily are very different and Copenhagen and Bornholm are different. What is different in the EU is that regional wealth transfers are quite small relative to for instance the US where the feds run medicare, social security schemes and of course the military. The US federal budget is 6 trillion USD while the EU budget is roughly 1 trillion EUR. The Euro reduces the cost of debt which is good and it eliminates currency exchange costs which is also good. No, you can't take on a lot of debt. This is obvious and it is obvious that regional politicians would do it anyway if not legally prevented from doing it. To balance that EU wealth transfers ought to be much higher.

|

|

|

|

|

| # ? May 23, 2024 08:00 |

|

As long as member states control the overwhelming volume of fiscal policy, the eurozone will never ever work as an economic zone.

|

|

|

|

Dismantle all states, got it

|

|

|

|

Fiscal union would stabilize eurozone. But these days it carries a massive risk of igniting intra European political fighting about budgets to totally new level where Covid support packages and euro bailouts will seem like child's play. And frankly I'd be among those bitching and whining because it would most likely mean restructuring/destruction of the vestiges of welfare state we still have in Finland and I'd very much like to see it saved and expanded rather than be "rationalized" into more technocratic mould acceptable to majority neoliberal views in EU. So in short, we're hosed.

|

|

|

|

fiscal union would require a complete reworking of how the Commission is put together, which at the present is through a highly intricate series of formal negotiations, balancing performances, gentlemen's agreements and smoke-filled rooms; this is flatly not workable if the Commission's budget and power increases in the way such a union would entail, and reforming the selection procedure would be a major undertaking in itself. i think this could probably be done with enough will behind it, but it would be a highly delicate affair, especially with EPP as a sort of permanently dominant party in the european parliament but far from being able to command an actual majority.

|

|

|

|

Owling Howl posted:The Euro reduces the cost of debt which is good and it eliminates currency exchange costs which is also good. No, you can't take on a lot of debt. This is obvious and it is obvious that regional politicians would do it anyway if not legally prevented from doing it. To balance that EU wealth transfers ought to be much higher. You don't actually need debt limit laws to prevent that, you just need a more coherent system. After all, not every US state has a debt limit law in either state law or the state constitution. And there are plenty of cities and other smaller units that don't have debt limit laws. The key is that investors did not delude themselves into thinking that county and city debt are the same as state/region/province debt, and assume the state/region/province will always pay out the county/city's obligations in full. Likewise, investors understand that while the federal government won't let any state/region/province implode, that doesn't mean they will cover all of their bad debt. For states it is a very rare occurrence, but it has happened in the past, in the 1933 Arkansas default. For cities and counties, it happens just often enough that capitalists right reports on how often US municipalities default on their debt, like this one from Fidelity (https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/fixed-income/moodys-investors-service-data-report-us-municipal-bond.pdf). But during the 90s and 00s, everyone deluded themselves into thinking any national debt in the EU is exactly the same as EU debt. That's was always a delusion.

|

|

|

|

iirc yanis varoufakis' big idea during the standoff with schäuble (RIP) was that greece default without leaving the euro, which would've made this issue abundantly clear it would've created Moral Hazard and Higher Interest Rates for Responsible Countries, though, so instead greece just got completely crushed

|

|

|

|

Lol, lmao https://www.ineteconomics.org/perspectives/blog/unhappy-new-year-how-austerity-is-making-a-comeback-in-berlin-and-brussels quote:Unhappy New Year: How Austerity is Making a Comeback in Berlin and Brussels

|

|

|

|

I for one am super excited about another popularity surge for the populist fascists all over Europe. What could possibly go wrong?

|

|

|

|

So, the German left party recently split off an anti-immigrant "left, but with right-wing characteristics" party under Sahra Wagenknecht(as a poster itt wanted to see). They now have presented some initial basic political positions https://www.dw.com/en/germany-sahra-wagenknecht-presents-left-wing-conservative-party/a-67923808 Some highlights: - end of most decarbonization efforts, instead climate change must be solved through new technologies(only example they mention are new types of e-fuels for combustion engines that are "climate compatible") - higher pensions & unemployment benefits - end of sanctions against Russia and trying to convince them to restart gas exports to Germany - immediate end of weapons deliveries to Ukraine, pressure to negotiate and accept Russia's "legitimate interests" in the country and eastern europe - end of "cancel culture", specifically people shouldn't be "defamed" just for saying what they think about the pandemic(she's an anti-vaxxer) or support for Ukraine - political purges in public broadcasters and instead hiring people with more "diverse opinions" Interestingly there is absolutely zero mention of anything related to immigration, despite this being their main dispute with the Left party. They are very, very careful on that one. Overall, it seems like a huge pile of garbage. Nothing about their social policies is significantly different from the main Left party and all the right-wing crap is damaging to the working class in the mid and long term. What a great benefit for our political landscape.

|

|

|

|

you forgot the remigration crap of the right-wing afd (and other) this week; it might explain why they didn't say anything about immigration.

|

|

|

|

His Divine Shadow posted:Lol, lmao idgi, why the gently caress does anyone even care about state debt, it literally doesn't have direct effect on people's lives (unlike nice things which could be bought by issuing more state debt)

|

|

|

|

suck my woke dick posted:idgi, why the gently caress does anyone even care about state debt, it literally doesn't have direct effect on people's lives (unlike nice things which could be bought by issuing more state debt) It's usually worth it but it's not like it just free money (MMT nerds need not apply)

|

|

|

|

counterpoint: make mmt a real thing state should borrow until inflation becomes relevant, then just tax the poo poo out of everything till it's not, goto 1

|

|

|

|

suck my woke dick posted:idgi, why the gently caress does anyone even care about state debt, it literally doesn't have direct effect on people's lives (unlike nice things which could be bought by issuing more state debt) suck my woke dick posted:counterpoint: make mmt a real thing I mean, it'd be nice if the EU were less dysfunctional, but it seems difficult to see a pathway for that kind of political project. Only slightly satirically hyperbolizing, the EU is held captive to German brainworms and traumas, and the original function of the EEC was to keep the Germans and French from trying to murder each other every 20 years, dragging the rest of us with them over and over. That part seems to have worked out. It's all the other stuff piled on top that's unfortunate. As the quoted article says, the EU is constructed to obsess over state debt, for ideological reasons (ultimately), and there simply isn't a political will across the continent to change that. Even when it is plainly visible that the emperor has no clothes!

|

|

|

|

suck my woke dick posted:counterpoint: make mmt a real thing

|

|

|

|

I mean, it helps if your economy does stuff besides corruption and building presidential palaces in the first place

|

|

|

|

mawarannahr posted:add low interest rates and you've got Turkey We'd need much more kebab for that

|

|

|

|

https://www.euractiv.com/section/justice-home-affairs/news/eu-parliament-wants-commission-in-court-hungary-stripped-of-voting-rights/quote:Most political groups in the European Parliament want a probe into the European Commission’s decision to unfreeze EU funds for Hungary, followed by a lawsuit in the EU’s top court and a possible motion of censure, while also urging the Council to strip Hungary’s voting rights over its rule of law deficiencies.

|

|

|

|

golden bubble posted:https://www.euractiv.com/section/justice-home-affairs/news/eu-parliament-wants-commission-in-court-hungary-stripped-of-voting-rights/ so basically the suspend membership in all but name option, yes please, viktator orban can go eat a dick

|

|

|

|

Hasn't Slovakia already said that they will block any censure against Hungary?

|

|

|

|

szary posted:Hasn't Slovakia already said that they will block any censure against Hungary? If it's not going to be them it's definitely going to be someone else.

|

|

|

|

TearsOfPirates posted:If it's not going to be them it's definitely going to be someone else. Orban's only other buddies were in Poland and they're not in power now so I'm cautiously optimistic this might actually go somewhere this time

|

|

|

|

TearsOfPirates posted:If it's not going to be them it's definitely going to be someone else.

|

|

|

|

Regarding eurochat: here in Spain the whole switchover to the Euro in 2002 has had some pretty far-reaching consequences, most notably in housing accessibility. Anecdotally, over the holidays I was talking to the in-laws of my in-laws and one bragged that they sold a 3 bedroom apartment in the same neighborhood where my mother-in-law lives to the tune of over 200k Euros. Out of curiosity I asked my mother-in-law how much she paid for her apartment back in 1983 (also a 3 bedroom) and her response was 2 million pesetas. Now I'm no economist, in fact i hate math, but plugging in the data into an online calculator got me these results: https://www.measuringworth.com/calculators/spaincompare/result.php?year_source=1983&amount=2000000&year_result=2022. However, if I plug in 2 million PTAs into a regular currency convertor, back in 2002 that amount was worth just over 12k Euros. So If I'm reading this right, a real estate investment made in 1983 for the equivalent of 12k Euros in 2002 has paid off for over 200k Euros in 2023. Does that sound right? Because if so, that's quite the payoff for a 40 year investment. Maybe I'm coming to the wrong conclusion numbers-wise but the vibe felt in Spain for a while now has been that if you bought property in pesetas then congratulations, you can conceivably live off of that until you die, but if you entered the labor market after 2002 (and especially after 2010) then you're pretty much locked out of buying a house for the rest of your life. It seems that the lot in life for many young Spaniards is patiently waiting for a loved one to pass away in order to either sell off remaining property to buy their own house, or just straight up move into the deceased's domicile, because Spanish banks went from giving mortgages to randos off the street in 2007 to asking for two indefinite contracts with salaries above 1.5k Euros minimum each (which the majority of the population doesn't make monthly) and a 20-30% down payment in cash a year later. Either way, it's a depressing prospect, especially when the Spanish constitution guarantees dignified housing as the right of all Spaniards. More and more it feels like that the pre-Euro generations with 2-3 properties to their name are parasitizing off of younger generations with their rent-seeking behavior. And of course this doesn't consider real estate companies buying up entire blocks and turning them into vacation rentals or whatever. Whenever the subject comes up in my classes I can taste the bitterness in the air and more than once I have heard "How could we have sold off our children's futures to German finance ministers" but that's the thing, seems like everyone assumed that monetary policy was gonna be paired with fiscal policy instead of what we have now.

|

|

|

|

Yeah but it wasn't and there were even economists raising warnings about that. Though nobody cared or noticed.

|

|

|

|

DXH posted:Regarding eurochat: here in Spain the whole switchover to the Euro in 2002 has had some pretty far-reaching consequences, most notably in housing accessibility. Anecdotally, over the holidays I was talking to the in-laws of my in-laws and one bragged that they sold a 3 bedroom apartment in the same neighborhood where my mother-in-law lives to the tune of over 200k Euros. Out of curiosity I asked my mother-in-law how much she paid for her apartment back in 1983 (also a 3 bedroom) and her response was 2 million pesetas. Mainly the conclusion that the Euro has anything to do with it. Housing is hosed everywhere. A Buttery Pastry posted:Just do the same to them too.

|

|

|

|

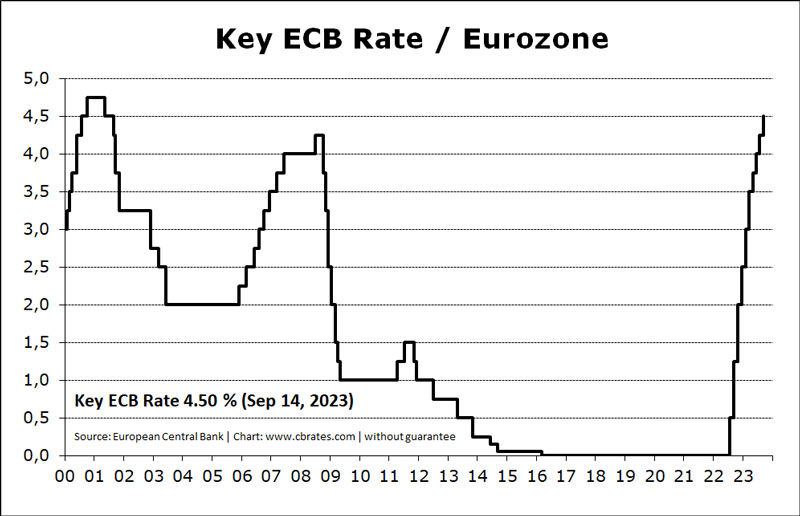

The euro likely had a hand in cheap loans being so abundant up until 2007, with it's low interest rates. Though not solely responsible.

|

|

|

|

His Divine Shadow posted:The euro likely had a hand in cheap loans being so abundant up until 2007, with it's low interest rates. Though not solely responsible. It absolutely did; but then also didn’t Spain have an absolutely massive construction boom that was fueled by German savings being funneled into that low interest credit? My employer shifted the order consolidation center for our construction-adjacent product to Spain of all places, because it burned through more units than the rest of Europe combined.

|

|

|

|

DXH posted:Now I'm no economist, in fact i hate math, but plugging in the data into an online calculator got me these results: https://www.measuringworth.com/calculators/spaincompare/result.php?year_source=1983&amount=2000000&year_result=2022. However, if I plug in 2 million PTAs into a regular currency convertor, back in 2002 that amount was worth just over 12k Euros. So If I'm reading this right, a real estate investment made in 1983 for the equivalent of 12k Euros in 2002 has paid off for over 200k Euros in 2023. Does that sound right? Because if so, that's quite the payoff for a 40 year investment. This is how house prices have gone in the Anglosphere too, particularly the US and UK. People who bought a house in the 20th century are now insanely wealthy based off the real estate bubble and the rest of us can eat poo poo.

|

|

|

|

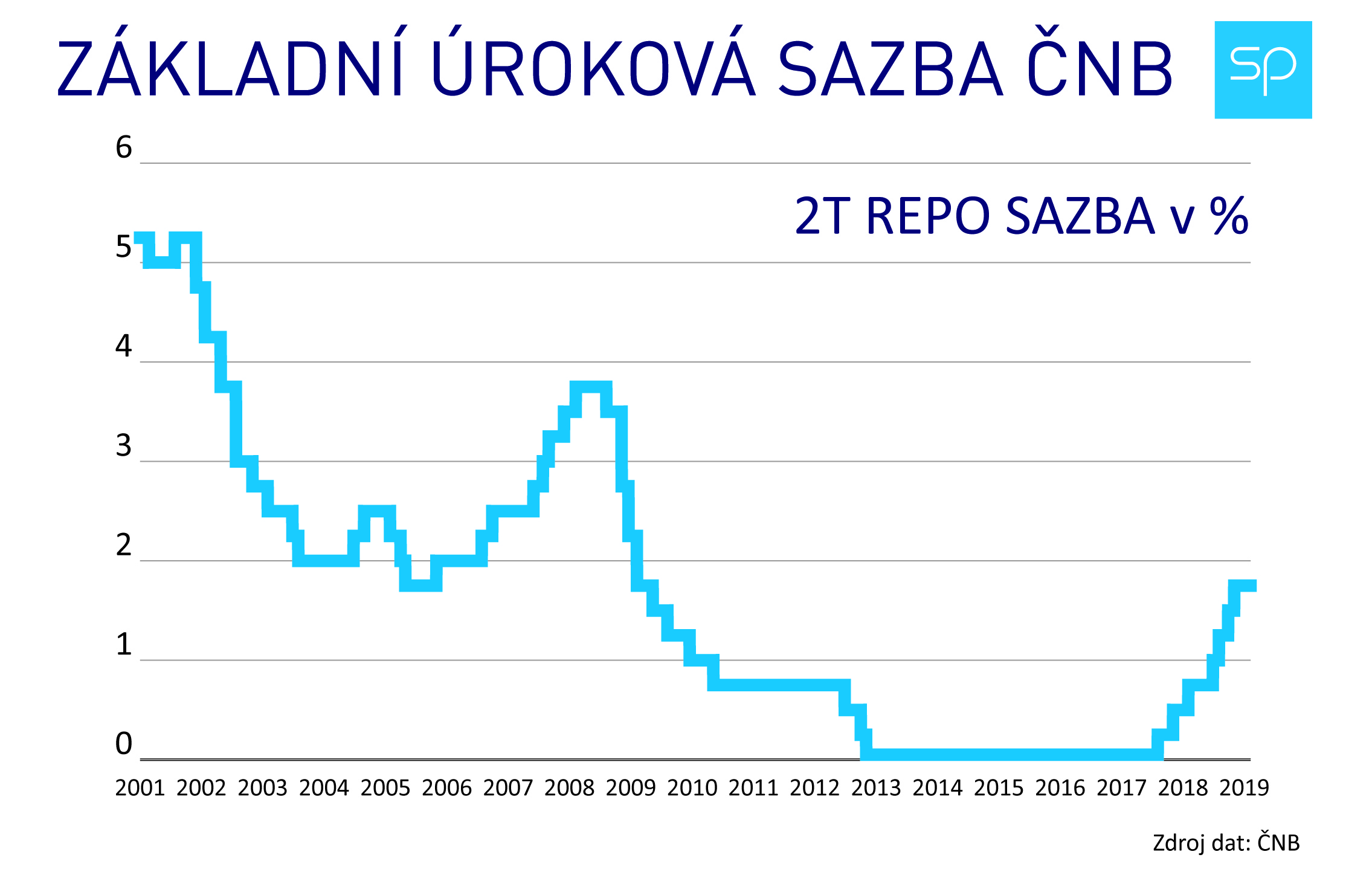

Loans were cheap everywhere (in the "west" at least), in europe outside the eurozone, US, UK, etc. Here's CZK for comparison:

|

|

|

|

szary posted:Hasn't Slovakia already said that they will block any censure against Hungary? Fico says a lot of things that he contradicts shortly after.

|

|

|

|

mobby_6kl posted:The problem is that the assholes can veto to protect each other. Poland got better but instead we have to deal with Slovakia now

|

|

|

|

His Divine Shadow posted:Yeah but it wasn't and there were even economists raising warnings about that. Though nobody cared or noticed. Sometimes if I read the room correctly I do bring up how Julio Anguita (mayor of Cordoba for decades and head of the Spanish Communist party back in the 90s) basically predicted all of the woes of the Eurozone and how its negative consequences would be inordinately felt by the southern European countries, and he was saying so on Spanish TV in 1991. https://www.youtube.com/watch?v=i38sVjEK9fI It tends to fall on deaf ears however; at this point it's basically impossible to do anything about it. Tesseraction posted:This is how house prices have gone in the Anglosphere too, particularly the US and UK. People who bought a house in the 20th century are now insanely wealthy based off the real estate bubble and the rest of us can eat poo poo. Oh I'm well aware, as I'm originally from the states and in Orlando what I paid to rent an entire 4 bedroom house in 2010-2011 ($1.2k) is now not enough to cover monthly rent for a studio apartment in the same area. mobby_6kl posted:Mainly the conclusion that the Euro has anything to do with it. Housing is hosed everywhere. Yeah sure, because neoliberalism being the default policy preference in the West at the end of history. My question was that if the change to the Euro exacerbated the general trend, especially in Southern/Eastern European countries with considerably less purchasing power compared to France, Germany, or the UK before the Euro.

|

|

|

|

DXH posted:Yeah sure, because neoliberalism being the default policy preference in the West at the end of history. My question was that if the change to the Euro exacerbated the general trend, especially in Southern/Eastern European countries with considerably less purchasing power compared to France, Germany, or the UK before the Euro. quote:in Spain the whole switchover to the Euro in 2002 has had some pretty far-reaching consequences, most notably in housing accessibility. Anecdotally, over the holidays I was talking to the in-laws of my in-laws and one bragged that they sold a 3 bedroom apartment in the same neighborhood where my mother-in-law lives to the tune of over 200k Euros. Out of curiosity I asked my mother-in-law how much she paid for her apartment back in 1983 (also a 3 bedroom) and her response was 2 million pesetas. That's not really a question that I think can be definitely answered without doing some actual research and serious stats but on the surface I'm not seeing anything to suggest that it did.  You can see that some of the least affordable places are outside the Eurozone: Poland, Czech Republic, Croata are all some of the worst in Europe and less affordable than Spain, for example. None of those countries are in the Eurozone (other than Croatia and they only joined in 2023). Hungary isn't super cheap either. vvvv mobby_6kl fucked around with this message at 16:06 on Jan 17, 2024 |

|

|

|

mobby_6kl posted:That seems like an assertion that the adoption of Euro did make it worse: Notably, e.g. PL also not even part of the Eurozone. Ireland is the main place I can think of that has joined the Euro and has incredibly unaffordable housing (where people want to live, housing in the rural parts is dirt cheap), despite having a massive boom in the early 2000s. But Ireland’s population is also almost 40% higher than in 2000, so it’s hard to see how that wouldn’t put pressure on housing.

|

|

|

|

Ireland's population may be growing but it's still down over a million from what it was before the Great Famine. The unaffordability is primarily driven by location and speculation, rather than raw number of butts needing beds.

|

|

|

|

The famine was like 180 years ago I kind of doubt there's just usable surplus housing still standing around from back then. Especially in places where people want to be, i.e., Dublin.

|

|

|

|

mobby_6kl posted:That seems like an assertion that the adoption of Euro did make it worse: Assuming this graph is correct, Spain does seem to have been hit hard by the Euro:  Average wages meanwhile are basically flat 2000-2022. That said, I would echo your assumption that you need a lot more stats to try to tease out what has happened in Spain, and whether the cause is the Euro or something more complex. Greater European integration also means more competition for apartments, which means comparatively wealthy Northern Europeans are now potential buyers for Spanish property. At which point you'd be kind of an idiot to sell to another Spaniard, if some Danish pensioner is willing to pay twice as much. Looking up apartment prices in Spain, they seem insanely affordable to my Danish eyes. Tesseraction posted:Ireland's population may be growing but it's still down over a million from what it was before the Great Famine. The unaffordability is primarily driven by location and speculation, rather than raw number of butts needing beds.

|

|

|

|

|

| # ? May 23, 2024 08:00 |

|

Absolutely, my point was more that it's where you want a roof that's driving the price not how many heads need a roof.

|

|

|

I CANNOT EJACULATE WITHOUT SEEING NATIVE AMERICANS BRUTALISED!

I CANNOT EJACULATE WITHOUT SEEING NATIVE AMERICANS BRUTALISED!