|

BigDave posted:Is there a point to having more then one credit card? having too few lines of credit open can prevent you from reaching your highest possible FICO credit score. it helps to have a few cards, use them sparingly but regularly, and pay them off in full each month.

|

|

|

|

|

| # ¿ May 3, 2024 07:04 |

|

Shibawanko posted:i don't really have any financial problems but i'm just a teacher and i have no investments or experience with them, i can afford to spend some money on something like this but since i am a complete rube when it comes to financial stuff i figured it might be really stupid for some reason i don't clearly perceive If you have no investments or experience with them, your first investment should probably be something boring and reliable like a retirement target date index fund. Not bitcoin. Unless you're also a degenerate gambler.

|

|

|

|

Valicious posted:Iím looking for some investing advice.  or  re: specific ETFs or IRAs, that's a whole long discussion but the one-line boring newbie advice is to buy a target date index fund or total market index ETF in your IRA

|

|

|

|

I Like Jell-O posted:This is why people say that owning a home is a lifestyle choice: if you don't care to deal with all the bullshit that comes with owning a home, buying a home noticably lowers you quality of life. Compare that to stocks or bonds where you just put the money in, and returns magically come out. I just hate renting more than owning a home.

|

|

|

|

SlapActionJackson posted:No issues with putting gifted money in a 529, but you should be aware that grandmother-owned 529 vs parent-owned 529 vs grandma-held-non-529 investments will all get different treatment for financial aid. Interesting. Details?

|

|

|

|

just make sure whatever official Loan Estimate you get is stamped July 17 or later and to close August 1 or later, because there's a 50 bps bonus for that (refis just got cheaper): http://www.mortgagenewsdaily.com/consumer_rates/980720.aspx older quotes will be worse

|

|

|

|

Dross posted:You should absolutely build up a minimal emergency fund as a priority over paying off debt, because without it your emergency plan is more debt. related, from /r/personalfinance (this supports your point)

|

|

|

|

Magnetic North posted:It's still 4x the cost and adding presumably little value over the S&P index fund or a Vanguard Target Date at 1.5. Vanguard target date funds are 15 bps, not 1.5.

|

|

|

|

sofi: theyíre burning shareholder/investor money as fast as they can in order to hit revenue and user targets (which theyíre not) in order to hope their stock price stays vaguely propped up because they pay a ton of compensation in stock not cash. and their fingers are crossed that their growth is good enough to get them acquired by a company that makes money like fidelity or vanguard or schwab or some big bank they lose huge amounts of money and itís in part due to deals like the one theyíre offering you! and also in part due to sending me an endless flood of snail mail refi offers that I instantly trash https://finviz.com/quote.ashx?t=SOFI

|

|

|

|

Dear newbies thread, Much like for the long-term thread, I intend to update the newbies OP in coming hours/days. This will not be a full thread reboot; it will just be an edit of the OP which is untouched since 2016, contains some dead links, etc. If anyone would like to advocate for specific new information / links / books / FAQs / whatever to be put in the OP, please post in reply. Same for stuff they think should be removed from the OP because it's bad advice / out of date / sucks / etc. The OP is pretty long so I really think it needs simplifying, as most people will be wanting to post anyway for advice. Moana is pretty busy and said he's unable to do the update personally at the moment, hence the solicitation of comments from the thread. Thanks!

|

|

|

|

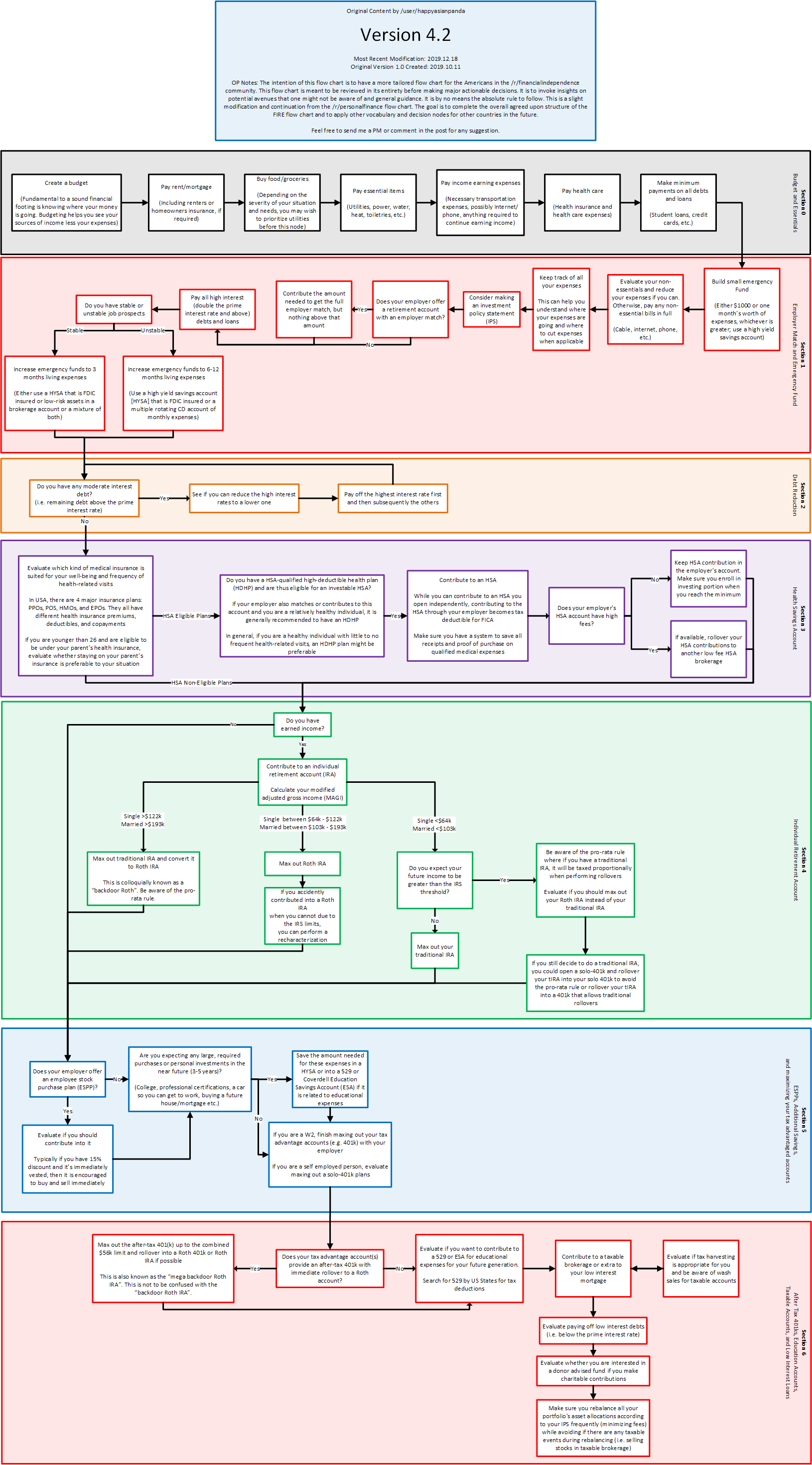

I have edited updates into the OP: Deleted some old/dead/redundant links. Updated some BFC megathread links. Simplified some sections, including cutting the Canadian advice and adding a link to the Canadian Investing megathread and fixing the Aussie links to where they now forward. Added the reddit personalfinance and FIRE flowchart image links. If there are other special requests, feel free.

|

|

|

|

Medullah posted:Could post links to some of the success stories in the thread or subreddit... Or some of the "Look I know I'm $75,000 in debt but I NEED all three of my cars" ones The newbies thread is a positive place. You may be thinking of the BWM thread. Regardless, I'm not doing extra work to dig up stories.

|

|

|

|

Famethrowa posted:Hi thread--big newbie here and I'm hoping for a sanity check on my plan. the flowcharts at the bottom of the thread's OP were basically made to help people such as yourself wrap your head around what to do next

|

|

|

|

there's nothing perfectly safe to do with money you need in 3-6 months that is not also associated with small and unexciting returns. depending on your level of sophistication, you can: (a) put it in a high-yield savings account with a bank such as Ally (better interest rates than some other big banks) (b) buy treasury bills of 13-week duration or less (c) buy a treasury bill fund such as SGOV since you're asking in the newbie thread the answer is probably (a)

|

|

|

|

we tried freetaxusa and the free (edit: well, gimped and cost some money to file but mostly free?) online turbotax last year and turbotax gave us a better refund... so we went with that. no IRS objections so far

|

|

|

|

Motronic posted:And not to start a tipping derail but I don't tip on credit cards. I leave cash. People who work jobs where tipping is part of their actual income can decide if they want to report that and/or how much. hell, that's a fair point. here's another example of cash's utility: https://www.youtube.com/watch?v=M2_SjB016e4

|

|

|

|

Ham Equity posted:You have to buy them through the worst website in the world, but I would suggest looking at iBonds instead: careful on your terms, there. "I Bonds" are the treasury inflation linked bonds. that's what you were recommending. "I Bonds" or "I-Bonds" "iBonds" are a registered trademark of Blackrock, and are ETFs used to build (non-inflation-linked) bond ladders: https://www.ishares.com/us/strategies/bond-etfs/build-better-bond-ladders

|

|

|

|

PerniciousKnid posted:The approval process is what confused me. If approval is easy I guess I just need to swallow a handful of Motrin and dive in to the paperwork. after the approval process your broker should send you a document like this https://www.theocc.com/getmedia/a151a9ae-d784-4a15-bdeb-23a029f50b70/riskstoc.pdf most people wonít read it, but, they should

|

|

|

|

in soviet russia, bills pay you

|

|

|

|

Busy Bee posted:What I am searching for: the other replies and your original understanding are good (there are some bond links in the long-term thread's OP you may be interested in, you're way ahead of most people on bond stuff), but there are some complications in your list here. you want it to have 3.5-4.5% yield over 5-10+ years, but also be low risk and liquid. something like BND or GOVT or MBB would probably do it over the next 5-10 years, but the 5-10 years after that? completely unknown, as it depends on interest rates a decade from now. so just realize you may be changing your list's desires or selling the bond fund in 5-10 years (if not sooner). probably no big deal, but, realize that going in. if you're in a low income bracket and the 3.5-4.5% yield from the bond fund will also be small compared to your income (just guessing here), then you might just consider keeping life simple and buying a target date fund in your IRA/401k and focusing on increasing income bracket instead. in general, see flowcharts in OP.

|

|

|

|

Guinness posted:HSA contributions made through payroll deductions avoid both federal income tax and FICA (Medicare/OASDI) tax. huh, I did not realize this, or it's somehow weirdly different for my employment situation. I'll have to check past statements. neat

|

|

|

|

pay off your credit card statement balances on time, folks https://twitter.com/charliebilello/status/1685273972114706432?s=20

|

|

|

|

Arkhamina posted:Before this whole thing happened, she was a paycheck to paycheck, tons of medical debt, zero assets person. focusing on two key sentences here -- this person, in better times, had poor personal finances. and now keeps having security breaches of a financial account? there is no way I'd share a credit line with that person. if something goes awry it will tank you both and then you won't be able to support her further. the basics need to get fixed on their end, especially security issues ASAP. you're doing your best.

|

|

|

|

Jenkl posted:Check out the OP in the long term investing thread for a handy flowchart that's reasonably up to date, iirc. I believe the short answer is no not really. I put the same flowcharts in the OP of this thread back at the same general time!

|

|

|

|

i'm a big fan of budget.ods, budget.xlsx, or sheets.google.com

|

|

|

|

definitely check out and try to understand and execute the first flowchart in the OP. itís good. early on in it, youíll see a step about paying down high interest debt such as your credit cards. if youíre only bringing in <= $1000/mo before expenses thatís a difficult thing the flowchart does not address. thatís less than federal minimum wage. it sounds like youíve been job hunting but goons might ask for more info there to figure out useful suggestions or feedback for you; potentially including a radical career change. we also have a resume megathread for detailed feedback on resumes. also an interviewing megathread. just being cash flow positive and trying to improve is half the battle though! youíve got this! e: typo pmchem fucked around with this message at 03:56 on Jan 6, 2024 |

|

|

|

Do you have access to another vehicle or how did you intend to uber/dash? Do you have any assets such as collectibles, retirement accounts, or other things that could be liquidated for a mortgage payment? Do you have family who are aware of the situation and perhaps able to help in either cash or job hunting? And yeah, what Hawk said. You have an immediate cash flow problem and need to look outside your industry to any available above board job in order to begin satisfying the bank or your mortgage lender. Anxiety can be paralyzing but big problems are solved one small step at a time. Do the small steps, ASAP.

|

|

|

|

Pipistrelle posted:Yep, itís registered as a 501c3 in Washington (I think thatís where they registered?) for anyone hesitant after the last goonfund in CSPAM. Thereís an elected board and everything to be clear, that thread has nothing to do with BFC and any questions/concerns about it should be directed toward its own thread and subforum.

|

|

|

|

Busy Bee, you might also consider just buying some treasury ETFs to make things easier. blackrock / ishares even has term treasury ETFs that are liquidated at defined dates for ladder construction, since you seem to be trying to control interest rate risk.

|

|

|

|

Busy Bee posted:Thank you everyone. I have a few more questions: probably not any real benefit of the term ETFs vs buying treasuries, some people just don't wanna deal with treasurydirect or their broker's treasury interface. or like tracking everything via exchange tradable symbols instead of CUSIPs, etc. you say that "I'm still trying to have a proper allocation on my end since I only started seriously a year ago. Since I'm still relatively young, I'm also considering putting more towards stocks since my time horizon is decades." given that info, I'd probably not worry about bond ladders at all tbh. you probably don't even need a bond allocation. but if you want a bond allocation, since you have time, you could just park that % in $bnd or some other intermediate to short term fund. makes life easier and never know, might benefit from interest rate drops. people in the long term thread may have additional suggestions.

|

|

|

|

drk posted:You're probably looking for an ACATS transfer yeah. the key phrase when talking to your broker or asset custodian is that you want the assets transferred "in kind"

|

|

|

|

Lawyer time?

|

|

|

|

TooMuchAbstraction posted:I'm trying to figure out what the tax implications would be for an investment sale, which requires knowing the cost basis for a given sale. I can't find that information anywhere on my Vanguard accounts. Does anyone know if it's possible to know this in advance? Obviously it'd be a somewhat rough estimate, since the actual value of the transaction will depend on the market price at the time the sale goes through; I'm just trying to get a rough sense of whether it'd be worth cashing out investments to pay for something, vs. pursuing other methods. it's there somewhere. https://investor.vanguard.com/search#q=cost%20basis when VG redid their web design a few years back, cost basis became a pain in the rear end to find hidden between layers of unintuitive clicks and eventually leading back to the old design site. I remember dealing with it before I left them. don't know where it is today. you can call support but they're not open on weekends and probably not open tomorrow due to the holiday (?). my current broker has all that stuff in an up-front, obvious place and 24/7/365 support.

|

|

|

|

i just use a spreadsheet?

|

|

|

|

whatever you do, pay off the credit cards first. easy win. thereís a car buying thread in A/T that someone here will link (iím phone posting) which can help on that front. the choice to take a loan from your retirement savings and spend it in part on a vacation is something iíd probably try to avoid repeating

|

|

|

|

Hughmoris posted:A scenario and a rookie question: $200/day, as you define it, 20 days/month, would be 200*20*12 = $48,000/year. or 48% annual return on $100k. if you can find a consistent, reliable low risk way to get 48% annualized returns, be sure to tell the rest of us. it will not come from any advice you will find in the newbies thread.

|

|

|

|

this politician insider trading discussion has run its course for the BFC Newbies thread. take it to a politics subforum, the stocks thread, the BWM thread, basically anywhere but here. thanks

|

|

|

|

Head Bee Guy posted:Is there a small/home business thread or place where that's discussed on here? I'm starting a lil ol' sportswear brand, and I've got a lot of questions: When should I form the LLC (before I sell anything?)? When and where should I open a business bank account? What bookeeping software do folks recommend? Any other software/excel templates that folks like for tracking various metrics? I'm also curious about advertising on instagram (e.g. how much I should budget for that, how to make it more impactful, etc). every now and then someone asks if we have a startup or small biz owner thread and the answer is basically no. some exist in the archives but are not active. if our community has aged into the range of wanting such a thread, i highly support someone stepping up and a posting a new thread about it.

|

|

|

|

Medullah posted:... I know it's an election season, but please keep random, strictly political (ESPECIALLY electoral politics), low effort, hot takes in the political subforums where they belong. Not in the generally apolitical, widely helpful BFC megathreads***. Like, SA already has multiple forums dedicated to this poo poo and even other non-politics forums with their own political news-saturated chat threads. I'm gonna make this my one broad warning to all BFC readers and just point at our rules thread when I probe people in the future. ***(I'll exempt stock thread people trading on news) Somebody fucked around with this message at 23:53 on Apr 16, 2024 |

|

|

|

|

| # ¿ May 3, 2024 07:04 |

|

I'm reviewing the OP of this thread. Does anyone have freely accessible content to add that they'd recommend for newbies? e.g. websites or PDFs or videos that would be useful to people in their 20s getting their first real job, or people that may be middle aged but are trying to "do things right" for the first time: fix their finances, or take out a car/home loan, or learn about saving/investing?

|

|

|