- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

After 9 years together Bitcoin has cost me my marriage. (self.Bitcoin)

quote:Or was it the weak hands selling their bitcoins driving down the price? If we had all just bought more bitcoins this wouldn't have happened. Reddit posted:180,000 student loan debt, unemployed

https://www.reddit.com/r/personalfinance/comments/7ruvb5/180000_student_loan_debt_unemployed/

I am going to make this short. I recently went to grad school at a prestigious school (Ivy League) to get my MA. The bill was steep; I studied the humanities. I know I am going to get backlash for the course I chose. I did not walk away from my course thinking it was going to land me into an automatic job.

But I would never take it back. I learned so much, and I'm hopeful to start working again. I took a teaching job last year that paid around 80K. I have 5-years experience. I was doing fine, until I lost my job. Rather than give the reasons, I'm jobless right now and want a career switch.

I recently defaulted on a private loan; the lender was not willing to work with me at all and was quite unpleasant to deal with. Eventually I just pushed it aside because the stress from the situation was actually keeping me from finding a job. I understand my options, but as I'm unemployed right now, I cannot do rehabilitation or consolidation. Or can I? I have spoken to my other lenders and they have been amazing. The default on the loan is only for 5,000. It's my smallest loan. I'm still very embarrassed about the default and the entire situation. My credit is in the tank, but I have a long-term apartment lease and I have enough savings to ride out the unemployment period. I do not have money to pay for my loans at the moment.

Now I'm in a better head space and looking aggressively for employment.

Anyone else in a similar situation? How many years did it take you to become debt free? How did you rebound from a default?

I feel slightly doomed right now and I know it's not the right attitude. quote:Wife wants to buy a house in 2 years, we have debt to income ratio of 25% currently

https://www.reddit.com/r/personalfinance/comments/7rr594/wife_wants_to_buy_a_house_in_2_years_we_have_debt/

We make about $150k combined per year, and calculated our debt to income ratio to be about 24%. She wants to buy a house desperately, but Iím leaning more towards paying off our debt.

She has figured, if we start saving now and pay our minimums on the debt instead, we could have about $30k saved which is plenty for a down payment where I live.

I want a house, but I hate our debt, we have been tackling it quite successfully over the last year and if we continued we could have everything paid off in 2-3 years or so. We have consolidated a lot of it into loans so our apr is 9% or lower on most of it but we do have a couple credit cards with higher apr

Just looking for advice, I personally want to convince her to put her dream of buying a house on hold. Her fear is that home prices are going to skyrocket in our area because itís booming with tech industries, we live in Denver and want to stay here SiGmA_X fucked around with this message at 08:06 on Jan 21, 2018

|

#

¿

Jan 21, 2018 07:42

#

¿

Jan 21, 2018 07:42

|

|

- Adbot

-

ADBOT LOVES YOU

|

|

|

#

¿

May 5, 2024 17:30

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Listening to people bitch about pensions, there's a big difference between 25 years of service and 30 years. I imagine a handful of 5 to 10 year service pensions would be miserable. As for company 401k vesting, most do it in 5 years or less.

I get it, defined benefit is generally better than defined contribution in that it requires zero effort and if you want more you can save more. But it also means you have to work at the same job forever in order to make a decent retirement.

Doctors are the best.quote:Gross pay on W-2 is $34K less than my salary. Did I get shortchanged?

https://www.reddit.com/r/personalfinance/comments/7t1er9/gross_pay_on_w2_is_34k_less_than_my_salary_did_i/

The issue is: just got my W-2 today. I work as an employed physician, with a contract salary of $150K. I worked the whole year without a raise or change in schedule so I was expecting my gross pay to be right around $150K. Instead, the gross pay they listed as "from my final pay stub" on my W-2 (I don't get any real pay stubs) was $116,634.80, and the "reported W-2 wages" (box 1) were $115,904.98. I don't pay into an FSA for work and just started paying into the 401K in November (total $729.82 for the year listed in box 12a). I don't get health insurance from work either. When I add up the total taxes (box 2,4,6,17) it comes to $36,912.08 in taxes. I added all of the deposits made to my checking accounts from work over 2017, and they paid me $102,822.13.

I am unfortunately really low in the knowledge department when it comes to this stuff, but I thought that salary minus employer deductions (like 401K, FSA etc) should equal gross pay for the year. It's off by a mile! And when I add up the $36.9K in taxes listed on the W-2 with the $102.8K I got deposited to my checking account (total of $139,734.21, and no I don't know if that math is valid), there is still 10K unaccounted for.

I'd really appreciate any insights you all might have. If I've made a huge oversight, I'd like to know before contacting payroll and making a fuss, and if they underpaid me, well... I'd like to be paid! code:medicare 2,175.00

social security 7,960.80

tax 36,912.08

cash 102,822.13

401k 729.82

150,599.83

|

#

¿

Jan 26, 2018 06:24

#

¿

Jan 26, 2018 06:24

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

OOo god drat that's the good stuff. I love the parenthetical revealing that she is unsure if she added two numbers correctly or not.

I find it hard to imagine working and NEVER looking at a pay stub... It must be because I'm a poor (or an accountant, either way) vs. a doctor. Aren't pay summaries usually located at the same place you setup direct deposit? My various companies sites have always had them on the same pages/sub-sites...

I would not bet on an Oregon pension if you are not already in the tier 1 or tier 2 group. Anyone younger is not going to get as good of a deal and every year the state has large budget shortfalls. The legislature has tried repeatedly to take away benefits from people who are already retired and keeps getting slapped down by the courts. The schools had the largest ever increase in funding this last year but still had to implement across the board cuts so they can meet thier pension obligations. The legislature still doesn't have the courage to try to reform it in a way that won't land them in court again.

quote:http://www.oregonlive.com/business/index.ssf/2017/03/johnny_delashaw_prolific_surge.html

The Feb. 10 report found that in his first 16 months at Swedish, Delashaw became the most prolific brain and spine surgeon in Washington, handling 661 inpatient cases that generated $86 million in charges for the hospital.

<snip>

Delashaw is the highest grossing recipient of the Oregon Public Employees Retirement System. He retired in 2015 with an annualized benefit of $663,354 - or $55,280 a month. That eclipsed the former leading PERS recipient, former University of Oregon football coach Mike Bellotti, whose annual benefit was $536,995.

Delashaw earned nearly $1.8 million at OHSU in Portland in 2011 and nearly $2 million in 2010, according to records released to The Oregonian/OregonLive by OHSU.

|

#

¿

Jan 27, 2018 02:36

#

¿

Jan 27, 2018 02:36

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I don't quite grasp your anecdote. Do you think the other surgery might have beat 98%? Would you have wanted the surgery if it could do 100%?

In your case, he didn't get more money from your case, right? Or was the PT going to pay him, too?

Is your case an indictment of his "on the up-and-up" status? I couldn't figure that out.

He got dramatically less money - whatever the office appointments were worth from insurance, maybe $300/ea, vs many tens of thousands. PT was a referral to a non-associated clinic. Maybe he gave me "special treatment" and decided to not perform a reasonably profitable surgery on me because I was related to one of his operating room nurses? Or OHSU had different standards for him to follow? From the stories of his ~2012+ quality of care, I'm glad I didn't have a case that interested him.

The real story here is lol Oregon PERS is hosed. ~20bn+ unfunded liability woohoo!! http://www.statesmanjournal.com/story/news/politics/2017/11/01/oregon-pers-unfunded-liability-task-force-final-report/823159001/

|

#

¿

Jan 27, 2018 08:09

#

¿

Jan 27, 2018 08:09

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I love that story. Comments in the thread were good too.

|

#

¿

Feb 2, 2018 04:59

#

¿

Feb 2, 2018 04:59

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I'm leaning towards "the poors should not breed" myself, especially in this age of wealth inequality, environmental stress, and technological birth control. After all, I don't want to take sex away from poor people. It's one of the things they can enjoy almost as well as the rich.

I'm also not a fan of this push for government mandated paid family leave. If you can not finance your 12 weeks of FMLA, perhaps that's a clue you should be on birth control until your finances improve.

I would also take it one step further and like to see those on TANF/SNAP benefits on mandatory birth control.

Because I do have some compassion, and a soft spot for children, I would support an increase in the cash value of TANF/SNAP benefits, but I would want that contingent on accountability measures such as mandatory birth control more so than able bodied work requirements or drug testing.

I understand this is a controversial opinion but do not understand why it is so controversial that it is rarely spoken aloud. Is there room for debate on whether and by how much should government and society discourage poor people from conceiving more poor people?

quote: https://www.reddit.com/r/personalfinance/comments/7upf7o/my_former_place_of_employment_shut_down_without/

My former place of employment shut down without notice, still owes me money. How do I do my taxes?

I had a serving job this past year at a restaurant that went bankrupt. The government seized the business, deemed it not profitable, and the place was shut down without notice. Aside from the fact that they owe me over $1000, I havenít heard anything and have no idea how to file my taxes this year. Iím in King County, Washington. Help! SiGmA_X fucked around with this message at 08:34 on Feb 2, 2018

|

#

¿

Feb 2, 2018 08:30

#

¿

Feb 2, 2018 08:30

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Chasing your dreams is BWM.

Get better dreams.

|

#

¿

Feb 2, 2018 16:25

#

¿

Feb 2, 2018 16:25

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

To be fair, there are significant differences between pieces of equity in actual companies and internet pogs, and you of all people should know that.

|

#

¿

Feb 6, 2018 03:50

#

¿

Feb 6, 2018 03:50

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I can't figure it out either. It sounds like its literally gambling on the volatility in the market which might as well just be gambling on the weather in Bosnia. It can't be that can it? And then who is taking the other side of these bets? Are any assets held at all?

|

#

¿

Feb 7, 2018 06:41

#

¿

Feb 7, 2018 06:41

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

What? Run aground at moderate speed, keelbolts will definitely snap, and then the keel goes away. Most people don't maintain / replace their keelbolts as frequently as the should, and this was a saltwater boat from the late 60's they bought for 5k. Of course the keelbolts weren't in good shape.

Either way that story is excellent. Compounding BWM makes the schadenfreude better.

|

#

¿

Feb 10, 2018 23:41

#

¿

Feb 10, 2018 23:41

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I would be in a constant state of terror if my whole livelihood depended on the fleeting generosity of a free social media platform.

Note to all people with joint finances: budget meetings are a thing, do it! Same with people who are married but have mostly separate finances!

SiGmA_X fucked around with this message at 23:47 on Feb 11, 2018

|

#

¿

Feb 11, 2018 23:42

#

¿

Feb 11, 2018 23:42

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Man, cash gifts from family are always a bad idea unless they're 100% no strings attached, no power granted to the giver.

My grandparents left me a $40k trust when I was born, and my parents said I could use it as a down-payment on a house some 12 years ago. I've since paid off the 80% that was financed, but technically it's owned outright by the trust and so I need my parents to sign off on a sale.

They're refusing to sign because I'm being "unappreciative" by wanting to sell and buy something else.

OH well! At least when I'm 40 I become the owner, unless my parents get mad at me one day between now and then? I'm considering that money gone because I refuse to be controlled in any way for any sum of money, but the whole thing is very gross and not doing our relationship any favors.

Yeah, I got owned pretty thoroughly on this one. I was 22 and had no clue what I was doing.

My parents are legitimately mentally ill and try to control their children with money. They were very opposed to me taking the high paying job that I got out of college and I think this was a plan to try and siphon as much of my net worth away as possible to try and maintain control.

Family!

|

#

¿

Feb 20, 2018 04:18

#

¿

Feb 20, 2018 04:18

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

can't do better than 17% a month in your investments (assuming 200 is the interest... which is, like, wtf, so prolly not the case), so sure, pay debt, unless you have liquidity probs

dunno if you should start a new portfolio or whatever, just pay that debt

(2400 / 14000 = 0.17)

Hey GWM goons

an uncle passed and in the will I inherited a small investment account he had. It has roughly 22k in long stock (ARRY, FB, SHOP) and performing well.

My question is, I have some student debt around 14k total. I am paying $200 a month and about to refinance. Would the GWM option be to sell whatever I can and pay that off and use whatever left over to start a new portfolio? I work in real estate so money is good but sporadic.

|

#

¿

Feb 20, 2018 07:41

#

¿

Feb 20, 2018 07:41

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

yah you're right

serves me for not sleeping for 2 days

thanks to your advice goons I opened a margin account with my credit card and maxed the limit on a 3x leveraged fund on SE Asian horse hay futures!

Living all the way to 70? THAT'S INCONVEIVABLE WHAT KIND OF SCAM IS THIS!!!!!

|

#

¿

Feb 21, 2018 08:08

#

¿

Feb 21, 2018 08:08

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

quote:Boss ghosting me after my auto-pay stops going through.

https://www.reddit.com/r/personalfinance/comments/7z8426/boss_ghosting_me_after_my_autopay_stops_going/

I have been employed doing IT at a company for over 2 years now with the same salary stating 40 hours a week on call.

Most the work is done from home and my checks stopped going through about 4 weeks ago. I contacted our office and the office manager told me it was an issue with payroll.

I have tried to contact my boss about it many times from going to the office in person, calling, and texting him. The only reply is that he will call me back.

There has been no notice that I am not employed by them anymore and continue to be the primary contact for everything involved with the transfer of the website and all internet marketing, so I get constant phone calls and emails.

I am still putting in work and hoping it is all a misunderstanding, but are there any actions I can take to ensure that I will receive payment for the work I am still doing? quote:I just spent all day looking at my simple IRA statements and called the investment company to get help understanding my statement. The company I work for hasn't put in my contributions or its in over 4 years. Help...

https://www.reddit.com/r/personalfinance/comments/7zb0ah/i_just_spent_all_day_looking_at_my_simple_ira/

I just spent all day looking at my simple IRA statements trying to understand why my retirement hasn't been growing like it should and thinking that maybe I should reallocate funds or whatever it takes to get it back on track.

There isn't a set "contribution" column just "additions" and it's split up between all the different funds and is just really difficult to look at and to make heads or tails of. There's been additions to the plan over the years but they were changes from the different funds changing and rectifying its self so I had a hard time trying to find my personal contributions in the mess when it's broken up between so many funds in different percentiles. Even looking at my pay stubs and W2 forms which said I was contributing I still couldn't find how they were applying my funds.

I called customer support. We figure out that there hasn't been any contributions in years and that I need to contact my employer or the companies financial adviser that started and manages the plan and can't help me any further. They gave me the number to the adviser and when I called they said he wouldn't be in until next week and to leave a message. I left a message for him to contact me when he got back.

I know my next step is to contact my employer. I work for a small company and know the owner well and I'm positive he will want to fix this but how does someone even begin to know how to fix this? Am I out the interest I would have made on the missing principle or is there a way to figure that out? Should I seek legal advice? Should I say anything to the rest of the employees?

Should I be worried about protecting my interests or will there be someone set in place (once I figure out who that is) who will guide me through this? It seems I have a lot of questions and feel vulnerable and mad and hope I'm not being taken advantage. SiGmA_X fucked around with this message at 06:18 on Feb 22, 2018

|

#

¿

Feb 22, 2018 06:13

#

¿

Feb 22, 2018 06:13

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

yes, you are indeed the goon gooning all over the thread lately

https://www.reddit.com/r/IAmA/comments/7zozg0/hello_reddit_we_are_lucyd_an_ar_smartglass/ posted:Blatant ICO scam unravels during Reddit AMA

ATTENTION: The AMA has concluded. Please forward all inquiries to info@lucyd.co, or join our telegram community at t.me/lucyd_en for prompt support.

Hello Reddit! We are Harrison Gross and Konrad Dabrowski, cofounders of Lucyd PTE Ltd! We are an AR smartglass developer based in Singapore. Our mission is to create a user friendly smartglass with a decentralized app store, that makes it easy to create, share and experience AR content.

A bit of information about our company:

We have 7 PhD's on staff who are all specialists in optics, AR or ergonomics.

We have the rights to 13 optics patents that we'll use to create our smartglass.

Our parent company, Tekcapital, is a publicly traded company on the London Stock Exchange (LON: TEK)

We have 11 signed alliances with app developers and other AR and security blockchain projects.

Our team has collective decades of experience at Fortune 500 companies, in technology commercialization, and in optical research labs.

We are one of the only token events facing the general market instead of just the crypto community.

We've already raised nearly $4m in our public TGE with only 5 days to go. For more information, you can visit our website here.

So if you guys have any questions about AR, smartglasses, or our planned blockchain app store, feel free to fire away!

-The Lucyd Team

ATTENTION: The AMA has concluded. Please forward all inquiries to info@lucyd.co, or join our telegram community at t.me/lucyd_en for prompt support.

<<From the comments>>

LucydLtd posted:Hello, our technology actually addresses several of the problems in Google Glass, which was really just a first foray into AR not a complete product, to be fair.

Our tech enables an ultra wide 120 degree AR-supported field of view, a form factor like normal glasses with flush LCD microdisplays, low light leakage for solid-seeming AR objects even in direct sunlight, and native Rx compatibility.

Furthermore, our decentralized, tokenized app store is very dev and community facing, enabling us to grow/scale the native content ecosystem extremely rapidly.

Take a look at our optics team. They are global leaders in AR and mechanical optics.quote:Do you actually HAVE this tech, or this is what you want to design? How far along are you in the design and production process? How much of this promised design will make it in to production?LucydLtd posted:We are owned by a public investment firm in the UK, and are accountable to shareholders for everything. To be honest you have a very shortsighted view. We stand to gain a LOT more careerwise AND financially by being successful in this endeavor.quote:You still haven't answered my question. What kind of fiduciary responsibility does a company have to its shareholders if the shareholders don't own any shares? Cryptocurrency is not the same as equity. quote:Do you have a prototype or a proof of concept?LucydLtd posted:The purpose of our ICO is to get to the hardware beta. quote:1) Where is the $4 million dollars youíve raised right now, at this very moment?

2) If you donít create a successful platform, where do those $4 million dollars go?LucydLtd posted:Everything we collect in the ICO is being deployed into our R&D efforts, and used to pay back our original seed funding from Tekcapital plc.quote:Quoted and bolded for when the SEC or FTC or any number of governmental agencies worldwide pursue a case against you. Also....lawsuits.LucydLtd posted:We're fully compliant in every jurisdiction we operate in. quote:What are some of your plans for the glasses and Augmented Reality?LucydLtd posted:To make it easier for everyone to access information and stay connected to friends, work and family.

Speaking of goons getting all goony...

https://www.reddit.com/r/relationships/comments/7xuq9f/my_28m_girlfriend_of_10_months_29f_got_really/ posted:My [28M] girlfriend of 10 months [29F] got really upset because we disagreed whether it was inappropriate that my friend jumped into the hot tub in just a see-through shirt and thong. She says she doesn't trust me being around that stuff "because I'm a guy"...I think shes being uptight.

tl;dr: My girlfriend got upset because my friend got in the hot tub in her thong & a white t shirt. Not sure if she's being irrational, or if this is a bigger red flag in the relationship

|

#

¿

Feb 24, 2018 03:02

#

¿

Feb 24, 2018 03:02

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I love the tldr that doubles the post length.

|

#

¿

Feb 25, 2018 07:47

#

¿

Feb 25, 2018 07:47

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Another refinancing application denied. We've done everything; moved to China to avoid high taxes and dedicate more than 50% of our limited teacher salary to my partner's student loans of $80k. Not seeing the light. Needing encouragement.

https://www.reddit.com/r/personalfinance/comments/84xsob/another_refinancing_application_denied_weve_done/

The insufferable posing style can probably be chalked up to "non-certified english teacher". But I have no idea what this guy is expecting for "encouragement." He married a boat anchor. Because he was isolated in a foreign country and it was the first familiar thing he found. Great basis for a relationship.

Also isn't 76+24=100? Or did I bad with reading?

|

#

¿

Mar 16, 2018 20:18

#

¿

Mar 16, 2018 20:18

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

If I were to read that charitably I assume he isn't counting the 24k federal loan as real yet. Given how he described it, it seems that he feels the federal loan itself was fraudulently taken out.

I'm confused by why he didn't do steps 2&3 before he met this woman, if he was so unhappy with China...

|

#

¿

Mar 17, 2018 02:10

#

¿

Mar 17, 2018 02:10

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Not quite South China Seas, but This couple contributed their anchor recently.

A few people have pointed out that those are some slave wages by people who could pay better. BWM more on the doctors imo because that $40 a month they're trying to save in under-the-table payments will result in them losing their mark and having to pay a better wage.

|

#

¿

Mar 17, 2018 08:01

#

¿

Mar 17, 2018 08:01

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I want to open a BHPH lot. Talk about good with money!

|

#

¿

Mar 19, 2018 17:24

#

¿

Mar 19, 2018 17:24

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

That miner guy is great. I feel he forgot something during his research, based on his power confusion.Well, I'm going to wait for the power company to come out before having the 2nd opinion, but I will call an EE and see what they are talking about after I hear from the power company. And no on the cooling already existing, but I've been putting a lot of time and talking to people regarding cooling these things since they run insanely hot. Thankfully my former business has literally mirrored issues (heat generation, moving fresh air in and warm air out, cooling, keeping the environment clean, etc) to the coin mining so I'm decently versed in that from experience, but not on this large of a scale and obviously these miners generate a good bit *more* heat. That's why I've been researching for the last 30 to 50 days about how people doing large miner facilities handle their heat issues, how data facilities do it, etc. just to get ideas and concepts. On a side note it's actually really interesting how (some?) large data centers keep that poo poo cool, I wish I could visit one sometime just to see all the infrastructure involved with the whole place

|

#

¿

Mar 20, 2018 06:06

#

¿

Mar 20, 2018 06:06

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Lol, I missed that part. Dude hasn't even been in a datacenter before. Just wow.

|

#

¿

Mar 20, 2018 16:55

#

¿

Mar 20, 2018 16:55

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

That "average 9% ROI" his uncle is touting is probably from the post-recession run-up period anyway.

|

#

¿

Mar 21, 2018 01:54

#

¿

Mar 21, 2018 01:54

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

To be fair, subprime is a decent market segment to be in if the lender knows WTF they are doing and every major bank is not out there writing thousands of them a day with investor money. Even people with crappy credit scores have a need to borrow money. There are people out there with lower scores because of past sins that have always managed to make the payment on their house and car notes and will probably contribute to do so. If you manage to keep LTV in check and have a decently diverse portfolio in terms of borrowers, you can make s good buck. It was 100% LTV liar loans being given to anyone with a pulse coupled with over leverage by banks that screwed everything up.

|

#

¿

Mar 21, 2018 06:12

#

¿

Mar 21, 2018 06:12

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

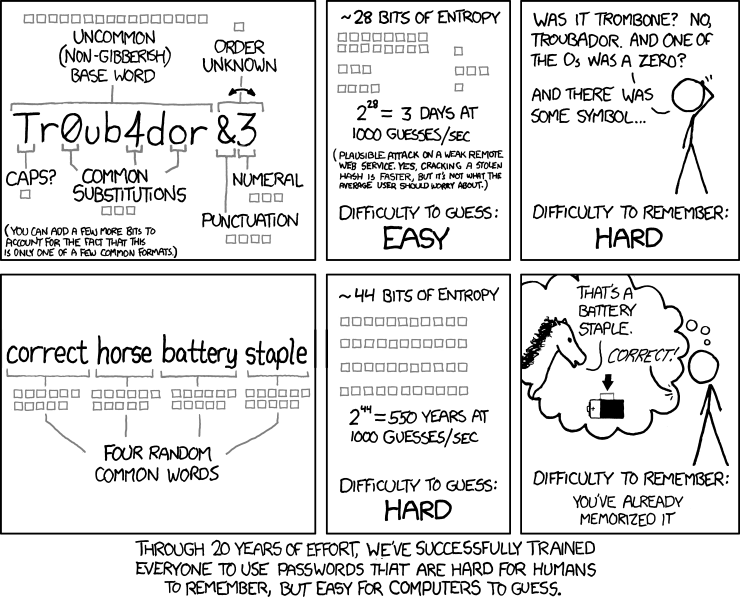

So what do you do for websites with 3 challenge questions and they don't let you use the same "answer" for all 3?

And what do you do when you have multiple financial institutions that all demand this?

This isn't sarcastic or snarky, I genuinely want to know what your system is.

I tried to do this, but if your "answer" has nothing to do with the question, how do you remember the answer to a recovery question when challenged? I have enough trouble remembering my important passwords. How do I remeber 3 additional "passwords" per important site? If you reuse, fair enough, probably more secure to say "my answer to a car question is password1 and my answer to a pet question is password2" than use a real car and pet, but now it's still cross-site and exploitable. And I guess you could write it all down but heaven help if you lose that post-it.

I use a password manager, have it generate random strings that I use for the answers, and then store the question and answer in the password manager as well.

Iíd honestly buy a 944 turbo if I could ever find one locally

|

#

¿

Mar 25, 2018 21:50

#

¿

Mar 25, 2018 21:50

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

At my old job I worked with a guy that took a few years off. He got a nice severance when the plant closed, and didn't really have any expenses so he took a few years off. When his money started to get low he started looking and nobody would hire him because they thought he was lazy. I tried getting him a job here but my manager couldn't get past the "three years off" part. So it's definitely a thing.

|

#

¿

Mar 29, 2018 19:25

#

¿

Mar 29, 2018 19:25

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

$40k a year with $300k in debt? Jesus. Bad decisions alllll around.

|

#

¿

Mar 30, 2018 00:34

#

¿

Mar 30, 2018 00:34

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

....and no freedom to be your own boss. Donít you feel just awful now missing out on that.

|

#

¿

Apr 3, 2018 13:53

#

¿

Apr 3, 2018 13:53

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Update full of lulz!quote:Update: I just discovered that I owe the IRS $50k that I don't have, because I traded in cryptos.

I posted a while back here: https://www.reddit.com/r/personalfinance/comments/84huks/i_just_discovered_that_i_owe_the_irs_50k_that_i/. I owe the IRS $50k that I never actually received because I traded altcoins last year and didn't realize I had to pay capital gains on the trades. And then I continued not to sell my altcoins because I thought they'd go back up since they crashed so hard. God... was that a mistake.

So now I got $20k in total assets but owe the IRS $50k.

I talked to a tax lawyer. He said the IRS would probably be OK with a payment plan but we'd have to talk to them. And I could pay $20k now and the extra $30k over a long period of time (like 10 years). In the mean time I won't be able to accumulate much in the way of my own savings.

I sold my crypto today because my lawyer urged me to. If I don't, and it crashes further, it would only make things worse. I'll get to use the losses to deduct a pittance from my income taxes each year. But I'll still owe more than I get to deduct. And I have to pay interest on it.

I basically don't get to have savings for the next 10 years. I probably won't be needing much help from /r/personalfinance for a while, seeing how I'm never gonna have finances.

Anyway my life is ruined. Thought I'd let you guys know, so you can learn from these mistakes.

|

#

¿

Apr 4, 2018 04:48

#

¿

Apr 4, 2018 04:48

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

There are some great threads from Cryptard Tax Truthers. Apparently some of them conclude that because the IRS info doesn't specifically use cryptocurrency to cryptocurrency exchanges, they clearly don't want you to consider exchanges taxable events. Despite an asset swap clearly being a taxable event which 2014-21 outlines, plus all the other asset taxation guidance (525, 551, etc).

Rose colored glasses for the lulz.

https://www.reddit.com/r/personalfinance/comments/89mcup/before_picking_an_accountant_if_you_have_crypto/

|

#

¿

Apr 4, 2018 14:33

#

¿

Apr 4, 2018 14:33

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

My boyfriend cheated and we own a condo together. Please help critique my plan for dividing the asset.quote:I am not trying to be a gold digger at all - I just want to keep living in and contributing to my home after my poo poo head boyfriend cheated on me. All advice welcome.

Yeah there's literally no reason for it, all it does is create the headache they're currently in. Honestly any sort of joint home ownership apart from marriage is a buy idea, IMHO. The parents should have bought it in their name only and charged them rent on it. And I speak from experience, having jointly owned a house with my wife and her abusive dad (it's me, I'm the BWM).

quote:Dad wants me and my bro to "buy" house for him

https://www.reddit.com/r/personalfinance/comments/8b6l7j/dad_wants_me_and_my_bro_to_buy_house_for_him/

[Edit] So it appears I would need to speak to a professional about this. I've read in this thread about an estate planning attorney or accountant. The money is in my name now, I want to see if this is doable, maybe set up a trust to own the home or something. If this is not doable, I need facts to present my dad. Not "It's fraud!" But more things like WHY it's fraud or why it's not a good plan. To them it seems like a "simple" thing to put my name, so I need some ammo. Thanks for providing a lot already.

I'll try to make this quick but detailed

My dad wants me and my brother to "buy" a house for him. My dad and bro will be living in the house, I will not.

He has all of the down payment and he will be paying the mortgage. He has been depositing money into our accounts for a few years in preparation. Why does he need us? He is on Medicare and is afraid of losing it as a result of buying the house. The house would be a huge asset and would raise all sorts of questions, where the money came from, etc. The money is clean, but we are aware of the red flags big amounts of cash raises and of asset rules of Medicare. He's been saving money for a long time but does not make enough to qualify for a mortgage. I'm fairly confident he and my bro could pay for the house simply on their incomes and the savings, but of course me and my bro would be on the hook if something happened to his income. My bro and my dad will be living in the house, I'm simply involved because of income requirements and to "pay" the deposit. One of my fears is this can make it harder for me to buy a house on my own for my family. My dad and bro say they just need me on for the "income" and down payment and I can just take my name off later when I want to buy my own house.

My question, is how can I accomplish this without screwing up my chances for buying a house for my growing family. I want to avoid jeopardizing anything or causing any tax complications.

I want to know how I can approach this in the cleanest way possible. I don't know the people to see or the processes that need to be taken or the forms to be filled out. My dad and bro are in the process of talking to a real estate guy but I want to know what I'm getting into here.

Thanks guys!

|

#

¿

Apr 11, 2018 04:47

#

¿

Apr 11, 2018 04:47

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Most bad with money things are not financially optimal but are fine IF you can afford it. When you start making dramatic life sacrifices for suboptimal things, that's when it becomes true BWM.

Yep. It's basically 'wanna-be upper crust middle class folks buying horses' that's BWM because they generally can't afford anything to go wrong. Same as if they bought a high-end sports car that needs $5k in rubber every couple years plus dealer maintenance.

Every couple of years, that's cute.

|

#

¿

Apr 11, 2018 15:17

#

¿

Apr 11, 2018 15:17

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

I think this thread actually loves horses.

In 20 years this will have morphed into a pro-horse thread. Like how the GIECO gecko originally hated the insurance company.

|

#

¿

Apr 12, 2018 17:08

#

¿

Apr 12, 2018 17:08

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

This one from /r/personalfinance is stressing me out a bit, especially due to the bolded bit:

Can you make money by borrowing at a higher rate and investing at a lower rate? The math suggests you can. What am I missing?

Edited to add their post title.

|

#

¿

Apr 13, 2018 04:37

#

¿

Apr 13, 2018 04:37

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

Yeah, gently caress that guy.

|

#

¿

Apr 14, 2018 06:31

#

¿

Apr 14, 2018 06:31

|

|

- Adbot

-

ADBOT LOVES YOU

|

|

|

#

¿

May 5, 2024 17:30

|

|

- SiGmA_X

- May 3, 2004

-

SiGmA_X

|

quote:Boyfriend buying a house, wants me to live and pay half of mortgage while not building any equity in case of marriage

https://www.reddit.com/r/personalfinance/comments/8cga2v/boyfriend_buying_a_house_wants_me_to_live_and_pay/

Hey PF! Iíve been looking around and canít seem to find anything that quite covers this situation.

My boyfriend is in the process of buying a house and putting a 20% down payment. We are both sick of renting and he has the ability, so it feels like a good decision. I would rather pay him rent than give my money to someone else (I am not able to afford to buy my own home in our city as it is very expensive). He makes about 2x as much as I do but I agreed to split the mortgage 50/50 and have a joint account for any house-related expenses.

The problem arises with equity. Since the house is in his name and he contributed a significant amount up front ($120k), I donít expect to be on the deed to the home. Since we are planning on getting married in the next 2 years, I do, however want an agreement that whatever rent I am paying now will count towards equity in the home if we do get married (if we break up, I will walk away with nothing).

Does this seem fair? He says that only 10% of my contributions will count towards the equity on the home since the first 15 years of mortgage payments go almost entirely to interest. I understand heís taking on all of the risk (loan in his name, tying up his cash in the house etc.) but I want my contributions to count towards something in the event we do get married. He wants the house to be his premarital asset until weíve been married 5-10 years and Iíve paid into it enough to consider it ours.

What do you think? Have you been in a similar situation?

Edit: I should note there is a chance Iíll be putting $10k in up front to help with the down payment. We would just consider this paying rent up front and not part of the down payment.

Edit 2: thanks everybody! I think you confirmed what I already knew. Iíll consider all payments as rent, and expect nothing in return. I also think Iíll decline paying any rent up front to him, and suggest that he covers costs of maintenance and repairs. I will take the savings from hopefully negotiating a fair rental price with him and continue saving for my own down payment. I have about $20k so far, which isnít a lot but my only bills are rent/utilities (no student loans or car payment and I make a good salary for a recent graduate).

|

#

¿

Apr 15, 2018 21:24

#

¿

Apr 15, 2018 21:24

|

|