|

Doctor Spaceman posted:Yeah, I was a bit inaccurate. I knew what you meant. One of the biggest issues at the moment is that the value of the home is not taken into account. Someone living in a $120,000 granny flat in Nambucca heads is treated the same as someone living in a 5 million dollar home in Hunter's hill. By treating the family home as an asset, even on a generous sliding scale, would help with this inequity. It would also remove the barrier that older people have when it comes to downsizing their home. At the moment, when the person in my example in hunter's hill sells their place they lose their pension. Whereas if it was already being counted as an asset they would not have this mental block. I would also like to see a Government program to assist with reverse mortgages.

|

|

|

|

|

| # ? May 11, 2024 23:26 |

|

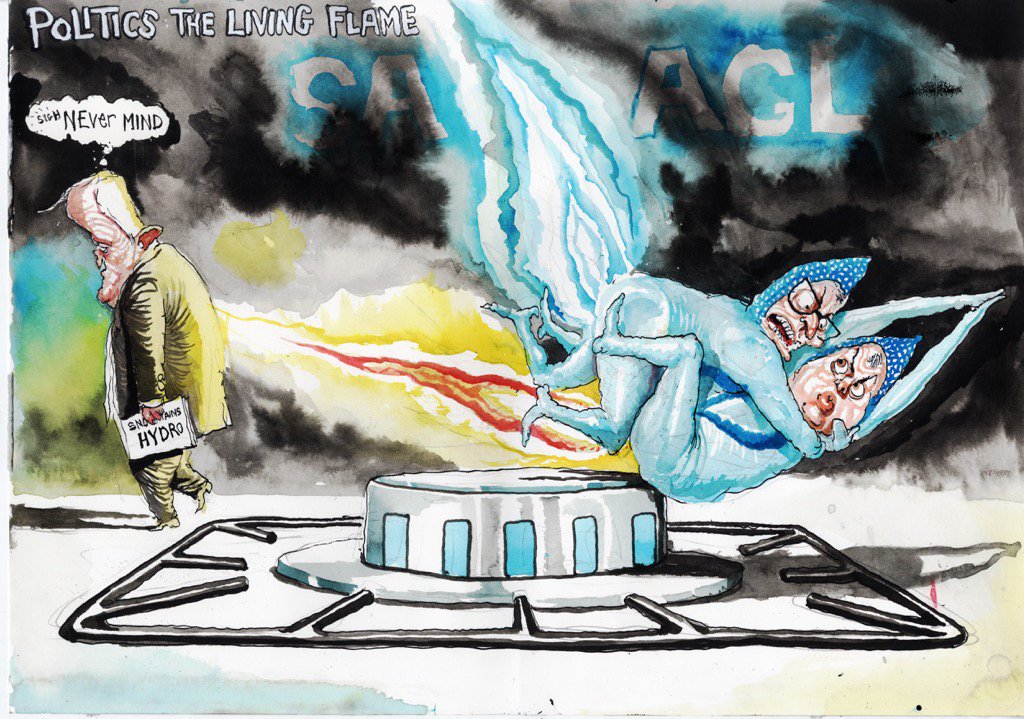

Multi billion dollar engineering project designed in 6 months Mr Speaker. Nothing could go wrong.

|

|

|

|

The ABC posted:Gaming company Tabcorp has been fined $45 million for breaching anti-money laundering and counter-terrorism financing laws. I'm not a fineologist but that seems like a pretty solid 'you done hosed up son'

|

|

|

|

The Before Times posted:This government likes to harp on about intergenerational theft and this is the hugest projection because they're robbing the young to feed the pensioners as we speak

|

|

|

|

G-Spot Run posted:To clarify I wouldn't either, but I think I've had pretty average earnings and time worked for a mid 30s woman and I have less than $50k in super. I would need to pull it all for a house deposit at current medians, and that would leave me retiring with maybe $100k? I don't even know how much you're meant to have but it doesn't seem like that's how much you're theoretically supposed to have. So it's just setting up another Boomer-esque pension crisis or starvation as above Realistically you need at least $100k deposit for most home loans these days  Holy gently caress Weatherill has really pissed him off. That's gold. Maybe Dandrews should jump in for some extra poo poo stirring.

|

|

|

|

Freudian Slip posted:I knew what you meant. One of the biggest issues at the moment is that the value of the home is not taken into account. Someone living in a $120,000 granny flat in Nambucca heads is treated the same as someone living in a 5 million dollar home in Hunter's hill. You'd have to factor in the fact that a person might have bought that $5M house forty years ago for about $20k, worked their arse off then to pay it off and have been simply swallowed up by urban expansion and insane house/land price inflation. Just because their house is worth a lot now isn't a great reason to kick great-gran and great-pa out on the street because their "millionaires".

|

|

|

|

I can understand a desire to be generous with these things, but $5m is really getting up there.

|

|

|

|

Alternatively the state could own all the property and rip down old buildings as areas become to sprawled out. No one has to worry about house prices or having somewhere sensible to live

|

|

|

|

In light of the fact that breaking the law is reprehensible now that unions want to apply sense to it have a bunch of laws that are still valid in WATFA posted:Did you know it is illegal to challenge someone to a duel under WA’s Criminal Code? Even more remarkably, there have been nine charges resulting in a conviction under that archaic offence over the past 10 years.

|

|

|

|

Bogan King posted:In light of the fact that breaking the law is reprehensible now that unions want to apply sense to it have a bunch of laws that are still valid in WA Hey that's still illegal in tassie too.

|

|

|

|

I would blow Dane Cook posted:Hey that's still illegal in tassie too. If you get caught trying to dual someone you deserve your punishment. Just punch on ya fucker.

|

|

|

|

Looks like WA has one thing going for it, no one can travel there with Dutton. It's an offence to travel with more than 50kg of potatoes edit: This was fixed as of 31/12/2016 so you may get Dutton'd Bogan King fucked around with this message at 06:55 on Mar 16, 2017 |

|

|

|

Duelling was actually an example in my law degree of a strict liablity offence.

|

|

|

|

So has this kind of reactionary response from federal government/leaders to state leaders / policy announcements occurred before? I don't have a memory of such occurrences and it seems so petty.

|

|

|

|

chyaroh posted:You'd have to factor in the fact that a person might have bought that $5M house forty years ago for about $20k, worked their arse off then to pay it off and have been simply swallowed up by urban expansion and insane house/land price inflation. Just because their house is worth a lot now isn't a great reason to kick great-gran and great-pa out on the street because their "millionaires". That's why I am suggesting Government intervention on reverse mortgages. If you have a $5 million and decide that you want to draw down at $1,000 a week. You would be able to do so for far longer than your life expectancy. No need to kick them out of home, but there is an incentive for them to move into more reasonable accommodation. One of the many issues with house market is octogenarians living alone in massive houses, which are not designed for their stage of life. Some hold on because it's the family home, others fear losing the pension.

|

|

|

I would blow Dane Cook posted:Duelling was actually an example in my law degree of a strict liablity offence. So you can be convicted of dueling even if you didn't know you were dueling? Sounds odd to me. How often do people get into unwitting duels?

|

|

|

|

|

trunkh posted:So has this kind of reactionary response from federal government/leaders to state leaders / policy announcements occurred before? I don't have a memory of such occurrences and it seems so petty.

|

|

|

|

Urcher posted:So you can be convicted of dueling even if you didn't know you were dueling? Sounds odd to me. How often do people get into unwitting duels? Ignorance of the law is no defence.

|

|

|

JBP posted:Ignorance of the law is no defence. Strict liability is about ignorance of what you were doing, ignorance of the law is different.

|

|

|

|

|

Can't duel somebody Can't cowardpunch somebody loving political correctness gone mad mr speaker

|

|

|

|

aejix posted:Jay Weatherill moves from laying down the gauntlet to completely loving roasting Frydenburg at a press conference: Quality.

|

|

|

|

Fun fact, if Weatherill was in WA he would have been arrested for murdering Fartenberg in todays duel.

|

|

|

|

Urcher posted:Strict liability is about ignorance of what you were doing, ignorance of the law is different. It's a joke due to that being a commonly used phrase and we are talking about duels.

|

|

|

|

Bogan King posted:Fun fact, if Weatherill was in WA he would have been arrested for murdering Fartenberg in todays duel. Is a one sided beatdown considered a duel? How about verbally taking the steel cap boots to someone's ribs? Your Honor my client wishes to plead the incident was a thrashing, not a duel.

|

|

|

|

Urcher posted:So you can be convicted of dueling even if you didn't know you were dueling? Sounds odd to me. How often do people get into unwitting duels? Not "a" duel. Duel. The old Steven Spielberg movie. A friend of mine attacked me with the video case. Some stupid argument about who had the coolest bicycle clips. I got him back though. I peed in his mum's steam iron. He had yellow T-shirts for a week.

|

|

|

|

V for Vegas posted:I peed in his mum's steam iron. He had yellow T-shirts for a week.

|

|

|

|

Came here to post the new FDotM but got distracted by pee iron

|

|

|

|

And the other new FDotM, inspired by the original FDotM

|

|

|

|

V for Vegas posted:Not "a" duel. Duel. The old Steven Spielberg movie. A friend of mine attacked me with the video case. Some stupid argument about who had the coolest bicycle clips. I got him back though. I peed in his mum's steam iron. He had yellow T-shirts for a week. That's sick. What kind of monster irons t-shirts anyway? BRB putting pleats in my t-shirts and picking out some suspenders to wear with my shorts.

|

|

|

|

Bogan King posted:https://twitter.com/SkyNewsAust/status/842181014600400897 I wonder if they're poo poo scared of the bubble popping before the boomers have a chance to use their houses to fund their retirement homes I mean greed and fear of the inevitable recession happening on their watch may be also be big motivations but needing to fund 10-15 years of aged care for old farts with little equity in their homes would be a pretty big burden on whichever department pays for that poo poo

|

|

|

|

Solemn Sloth posted:So Victoria has been floating some potential changes to the Residential Tenancies Act including support for 5/10 year leases, limiting rent increases, allowing long term tenants to make modifications and banning no pet clauses. what are they going to do? stop renting out their houses and cop the new vacancy tax? speaking of which, I'm trying to get my landlord/agent to fix some poo poo and it's been dragging out even though I've sent in one of those notice to landlord forms. The handy man has checked it all out, should I just say gently caress it and get consumer affairs to get involved? I'm not fussed if I don't get offered a renewal on this place at the end of the lease

|

|

|

|

JBP posted:It's a joke due to that being a commonly used phrase and we are talking about duels.  Not on MY AusPol Not on MY AusPol

|

|

|

Cartoon posted:Humour? It's OK. They didn't know what they were doing.

|

|

|

|

|

gay picnic defence posted:what are they going to do? stop renting out their houses and cop the new vacancy tax? If they're 7 property mortgages in debt to own everything they can't afford to leave anything vacant anyway.

|

|

|

|

quote:Superannuation for housing deposits would facilitate intergenerational theft http://mobile.abc.net.au/news/2017-03-16/super-for-housing-deposits-intergenerational-theft/8360890

|

|

|

|

DancingShade posted:If they're 7 property mortgages in debt to own everything they can't afford to leave anything vacant anyway. They'll have to sell to the people they outbid who were just looking for a place to live

|

|

|

|

"I'm going to shirtfront, Mr Potter"

|

|

|

|

Using superannuation for your first home deposit is fine when you are never going to be able to retire anyway

|

|

|

|

I wonder how you'd go about organising some sort of homebuyers strike where no current or would-be owner occupiers bought property for a few months

|

|

|

|

|

| # ? May 11, 2024 23:26 |

|

Put interest rates up a few times?

|

|

|