|

lmao

|

|

|

|

|

| # ? Jun 3, 2024 16:03 |

|

this will free CEOs from shortsighted demands by shareholders and we'll enter in a new responsible utopian age

|

|

|

|

it owns that trump is doing everything possible to extend this bubble and worsen the inevitable crash

|

|

|

|

President Trump proposes new rule that all stockbrokers respond to any drop of 5% or more in the major stock indices by shaking their heads and saying "nope, that's not possible" until it goes back up

|

|

|

|

1982 Subaru Brat posted:President Trump proposes new rule that all stockbrokers respond to any drop of 5% or more in the major stock indices by shaking their heads and saying "nope, that's not possible" until it goes back up Trump will make it illegal for stocks to decrease in price.

|

|

|

|

triple sulk posted:lmao HRC wanted to do yearly reports to “fix capitalism”.

|

|

|

|

If the rate of profit falls in a forest and no one hears it did it happen?

|

|

|

|

StashAugustine posted:If the rate of profit falls in a forest and no one hears it did it happen?

|

|

|

|

etalian posted:Trump will make it illegal for stocks to decrease in price. Works for China (his influence on this), after all.

|

|

|

|

Horseshoe theory posted:Works for China (his influence on this), after all. lol https://money.cnn.com/2018/08/17/technology/chinese-tech-stocks/index.html quote:The country's major players -- Baidu (BIDU), Alibaba (BABA) and Tencent (TCEHY) -- have lost hundreds of billions of dollars in market value in the past few months.

|

|

|

|

Here's hoping that all stocks crash and burn soon enough.

|

|

|

|

Horseshoe theory posted:Here's hoping that all stocks crash and burn soon enough. I hope there is a 90s style tech sector crash except on the global level.

|

|

|

|

https://twitter.com/TurdyMcFergy/status/1030624732411043840 holy poo poo this is making me angry; this is why we can't have nice things he recognizes the pay is abnormal for cashiers, he recognizes they're super successful and once they point out "so uh it's cause we're kinda a cooperative" he flips his poo poo it's so loving common with right wing and ever more so with centrists who see ideology and politics on the same level choice of a sports team to support or taste in music; they think it's 100% detached from everyone's life and with zero implications in social context

|

|

|

|

Teal posted:https://twitter.com/TurdyMcFergy/status/1030624732411043840

|

|

|

|

comedyblissoption posted:people are heavily propagandized from birth to be bootlickers. they are institutionally trained and raised like brains in a vat to be Obedient Workers. ideas like workers should own the business are filtered out completely and beaten out of peoples' skulls Americans are trained from birth to be like that the horse who kills himself in animal farm from overwork.

|

|

|

|

Teal posted:https://twitter.com/TurdyMcFergy/status/1030624732411043840 just eat sheet cake! why won't you let us stick cameras in the face of vulnerable people and work with the police to identify them?!

|

|

|

|

etalian posted:Americans are trained from birth to be like that the horse who kills himself in animal farm from overwork. His name was Boxer and he made it to Sugarcandy Mountain

|

|

|

|

oh wait, correcting my last post, i believe he was sold for meat, hides, and glue

|

|

|

|

etalian posted:Americans are trained from birth to be like that the horse who kills himself in animal farm from overwork. trained to worship and turned into glue when that worship is no longer profitable

|

|

|

|

Teal posted:https://twitter.com/TurdyMcFergy/status/1030624732411043840 And that company's name? Albert Einstein

|

|

|

|

Epic High Five posted:trained to worship and turned into glue when that worship is no longer profitable It's why Bernie will need re-education camps in which people will forced to do things like slap their manager.

|

|

|

|

etalian posted:It's why Bernie will need re-education camps in which people will forced to do things like slap their manager. Keep going

|

|

|

|

if it's real, I'd be interested to hear what his response ACTUALLY was pretty unlikely someone who believes in the sacred power of kings would respond well to finding out that the job is so great because it's a socialist collective and doing the basic math to reach "hey if I'm creating 25 an hour of value just by cashiering, why is everybody else who does it making $8/hr?"

|

|

|

|

NNick posted:HRC wanted to do yearly reports to “fix capitalism”. I couldn't find a source for this. Can you help? Thanks! I didnt find a quote.

|

|

|

|

https://twitter.com/eurogamer/status/1030775397636558850

|

|

|

|

Dawncloack posted:I couldn't find a source for this. Can you help? yeah it was a vox article https://www.google.com/amp/s/www.vox.com/platform/amp/2015/7/24/9031597/hillary-clinton-quarterly-capitalism

|

|

|

|

https://twitter.com/stevesaretsky/status/1029894397658193920 global real estate crash soon pls

|

|

|

|

mila kunis posted:https://twitter.com/stevesaretsky/status/1029894397658193920

|

|

|

|

Canada and Australia are the most likely first dominos to fall right?

|

|

|

|

Epic High Five posted:Canada and Australia are the most likely first dominos to fall right? london with brexit i bet, that's going to drop property values by a shitton

|

|

|

|

mila kunis posted:https://twitter.com/stevesaretsky/status/1029894397658193920 Owned

|

|

|

|

also that "understanding the cycles" comment seems to indicate that the wise men in the room are getting the gently caress out of the market as fast as possible

|

|

|

|

Epic High Five posted:also that "understanding the cycles" comment seems to indicate that the wise men in the room are getting the gently caress out of the market as fast as possible it is amazing how consistently people forget that they're called bubbles because they pop

|

|

|

|

Epic High Five posted:

garry tan, partner of the venture capital firm initialized vc, and partner of y combinator back in the day (and like 6th employee of palantir the consulting-cum-government-contracts company), basically used this exact argument and the actual words "grab the means of production" to try to get peeps to start companies (cursed fact)

|

|

|

|

CoolCab posted:london with brexit i bet, that's going to drop property values by a shitton Nah, they'll wipe out even the tiny figleaf of controls on who can buy property in the UK and capital flight will do the rest, and the Tories will say "See! House prices have gone up 10 percent! Brexit is a success!" (assuming the pound only moderately shits itself, making property even cheaper for foreign speculators, rather than drops completely into freefall, but that's a big assumption).

|

|

|

|

Epic High Five posted:Canada and Australia are the most likely first dominos to fall right? maybe, but once JYNA trips is when poo poo gets real

|

|

|

|

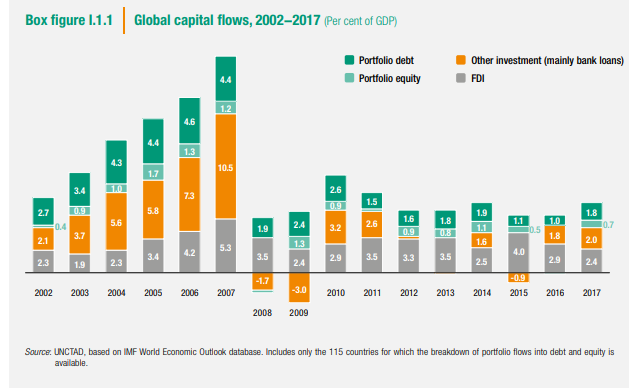

quote:But Turkey is just the most extreme example of the growing debt crisis beginning to hit economies that depend on foreign capital flows and investment in order to grow (and that’s most). I have raised this prospect of an emerging economy debt crisis in previous posts, most recently with the fall of the Argentine peso. A strong dollar (the main currency of loans), rising interest rates (with the Fed and now the Bank of England hiking policy rates) and higher oil prices for those that must import energy (eg Argentina, Turkey, Ukraine, South Africa etc): are the factors triggering this impending crisis – not seen since the Asian/EM crisis of 1998. https://thenextrecession.wordpress.com/2018/08/03/a-new-global-credit-crunch-to-come/

|

|

|

|

looney tunes economics

|

|

|

|

You'd think whoever made that post about not being hired by the co-op would have remembered that military pay is more or less equal (if you don't count rated officers or flag officers)

|

|

|

|

|

| # ? Jun 3, 2024 16:03 |

|

Turkey was the classic "success" story 1. Wall street banks loan massive amounts of money 2. Money is used to pump up things like real estate construction sprees 3. Eventually for various reasons the above magic it can only go up speculation doesn't last 4. In the Turk's case they are now holding $225 billion in debt originally denominated in much stronger foreign currencies.

|

|

|