|

Bot ended the day down about $15 - Slow ride down from the morning's high of +$500 I guess a Tuesday may not have been the best choice of days to start running an algo that basically thrives in volatility.

|

|

|

|

|

| # ? May 17, 2024 19:13 |

|

How does the algorithm do on VIX crushing days? I know there were a good amount of hedge funds that went bankrupt shorting vix into February and March

|

|

|

|

FreelanceSocialist posted:A hit just like the Toyota FJ. Right? I'm skeptical that this will do anything to Ford's share price anytime soon. Jeep still exists. I guess if I take a lesson from Tesla, the fewer cars you sell the higher your stock price should be. On the other hand if we see a picture of OJ Simpson in a new white Bronco, Ford may become a meme stock.

|

|

|

|

Lote posted:How does the algorithm do on VIX crushing days? Basically it will do well whenever there's long-lasting (on an intra-day scale) movements in either direction. It didn't do great today because things were mostly flat after 12. I'm not holding anything overnight with this bot. In any case backtest gives +13k for the month of March given a buying allowance of $10k to buy SPXL/SPXU, TZA/TNA - I might add more budget/pairs as I get more comfortable with the system. The backtest also assumes optimal execution, so I wouldn't expect it would do quite that well - and I'm honestly not sure what would have happened on the days where trading was getting halted.

|

|

|

|

backtest assuming optimal exec is no backtest at all

|

|

|

|

2 for 2 this week at buying spy options at 9:35, panicking and cursing myself as it loses value most of the day, not listening to discord yelling at me to sell at +30% by 1-2pm, and closing for over 100% at 3:50. Do I double down again and go for three?? The answer is yes I will probably lose it all tomorrow.

|

|

|

|

drunken officeparty posted:2 for 2 this week at buying spy options at 9:35, panicking and cursing myself as it loses value most of the day, not listening to discord yelling at me to sell at +30% by 1-2pm, and closing for over 100% at 3:50. Just play with your gains from today, then it's house money.

|

|

|

|

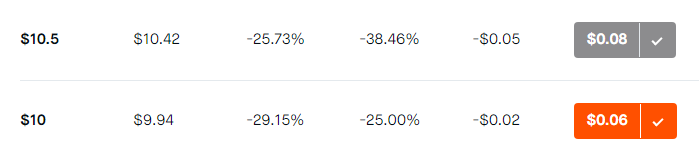

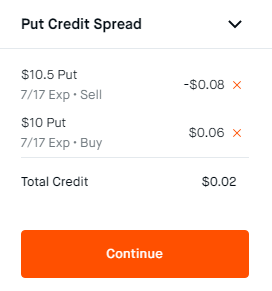

Inner Light posted:Could you elaborate on your general strategy for limiting potential losses / risk management while selling options? I've stayed away due to 'selling to open' being associated with a large potentially uncapped loss. I'm selling covered put credit spreads on high volume bullish stocks. High volume stocks are where you can find the most lottery tickets, you're lending money to people who are trying to hit a powerball jackpot. Sometimes they win, but you also take a smaller version of the same bet, so if you do lose, you can just pay them off with your own winnings from that slightly smaller jackpot. If the stock keeps going up and following its trend, you win regardless. If it goes sideways, you still win. Example: NIO is trading at $14.00 and is very bullish right now. In the same transaction: Sell a 7/17 OOTM put at $10.5 strike price Buy a 7/17 OOTM put at $10 strike price   If the stock ends over at expiration on 7/17 $10.5, you keep your investment plus the $2 premium. You risk $8, so you want you probability of success to be >75%. Because this stock is extremely high volume, there are a lot of people out there going for insane strike prices at very close expirations, but overall it's still very bullishly trending and would need to lose 40% of its value in 3 days to lose. You buy many of these pairs of put spreads at various strike prices going down to spread out risk even more. Personally, I just loving hate time decay as a 'thing'. I get it, it increases the volatility so you can make ~sIcK pLaYz~ but I'd rather play the role of the banker and see time decay work in my favor. Seeing your account growing throughout the day regardless is awesome, you feel like you're cheating the system. Even if the puts start gaining value because the stock is dropping, which is bad for this system, come tomorrow the time decay will put money back in your account. Buying on Monday is the best because the theta will still have a lot of meat on the bone and lowers your overall risk. Since options are a human-powered market, most people seeing expiration coming will abandon ship by mid-week and the put price will plummet, which works in your favor. You can either execute when you feel like you've got enough from the spread or just hold it to the end of the expiration to maximize your gains, which is what I do. By the way I'm an idiot and may have done the math wrong here, it's just an example. Don't trust me, do your own research. I'm just saying it feels loving great and like you're the casino, which is basically what you are. You're scraping up the money that people dropped on the floor at the bar while they were partying on a Saturday night. Sometimes the stock price will crash and you'll lose all your investment but the high number of small wins should overcome that if you're picking the right bullish+high volume stocks. Selling naked calls and puts is a great way to lose all your money and then some. Just look at what happened to James Cordier. He was doing the opposite if what I'm doing but without taking that parallel bet with the gamblers to cover freak occurrences in price action.

|

|

|

|

I just don't understand why everything has to be so roundy all the time. What was wrong with this?  Real answer: (less aerodynamic, out of visual style, hurts people way worse when you hit them while texting) But gently caress I wish I could resurrect my old truck. Also uhhh don't do the math about how long 1990 was ago unless you want to feel bad and slightly worried.

|

|

|

|

skipdogg posted:Just play with your gains from today, then it's house money. Itís like you are actively trying to not get invited to my yacht

|

|

|

|

AHH F/UGH posted:I'm selling covered put credit spreads on high volume bullish stocks. High volume stocks are where you can find the most lottery tickets, you're lending money to people who are trying to hit a powerball jackpot. Sometimes they win, but you also take a smaller version of the same bet, so if you do lose, you can just pay them off with your own winnings from that slightly smaller jackpot. If the stock keeps going up and following its trend, you win regardless. If it goes sideways, you still win.

|

|

|

|

vaccine pump After Hours... nice

|

|

|

|

Last time we talked MRNA it felt like the consensus was itís a case of Trump pumping those close to him. Up bigly after hours on more trial news. Do we still think its prospects are dim?

|

|

|

|

Yeah actually that's correct I was forgetting about the 0.40x100 + premium part, it was just an example and I don't actually own that spread so I was eyeballing it. That said, if you have a high chance of winning, it's still worth it in the long run. I'm not sure what the chance of profitability is on those options. edit: I checked and it would have to be 96.1%, which actually isn't that hard to find, and in reality you could probably go with ~90%+ chance of profitability because the option doesn't really take the trend into account.

|

|

|

|

AHH F/UGH posted:Yeah actually that's correct I was forgetting about the 0.40x100 + premium part, it was just an example and I don't actually own that spread so I was eyeballing it. That said, if you have a high chance of winning, it's still worth it in the long run. I'm not sure what the chance of profitability is on those options. I get it but with the NIO example doing that weekly you can win 20 times then lose once and your gains are wiped out and it's a Chinese stock so we can't forget it could be pulling a Luckin or something and actually have that big a drop in a week

|

|

|

|

uh oh https://twitter.com/SqueezeMetrics/status/1283154060565258240?s=20 tomorrow, look out below

|

|

|

|

thats why they had to Vaccine Pump immediately lmao

|

|

|

|

exit both UAL and AAL on this Vaccine pump. don't wanna be holding this in earnings next week....

|

|

|

|

Are you shorting TSLA through earnings? I'm living vicariously through you on this one

|

|

|

|

not with this big rear end position, no. plan will likely be to reduce it to like half the size to ride through earnings so I'm part of it. then will reevaluate for the Add/Close depending on earnings action. I'm guessing Adding after earnings jump up lol fuuuck unless I hit a good target before earnings to close the whole position which doesn't seem likely here before the 22nd

|

|

|

|

DoubleT2172 posted:I get it but with the NIO example doing that weekly you can win 20 times then lose once and your gains are wiped out and it's a Chinese stock so we can't forget it could be pulling a Luckin or something and actually have that big a drop in a week It's a long-term strategy with a very high winrate, and obviously if you are more careful with your your entries should be better than making $2 while needing a 96% win rate entry. Something like risk $40 to make $15 with a 75% win rate would be where I usually look. The name of the stock doesn't matter as long as it's bullishly trending and high volume. You're not going to get 1000% gains in a day but you will get consistent gains over the course of a year or whatever (in theory)(lol)(haha). It's about consistently winning and eating the losses when they come and spreading out risk and snowballing your gains into larger contract sizings and a more and more vertical spread every week. People often say that selling naked calls and puts is picking up pennies in front of a steamroller. Well, put credit spreads is picking up pennies in front of a kid on a big wheel.

|

|

|

|

Seems like a great way to earn income from the stock market with an established bankroll. Iím over here gambling 50 bucks on 1dte options like Iím addicted to lotto scratchers

|

|

|

|

skipdogg posted:Seems like a great way to earn income from the stock market with an established bankroll. Shorter the time till expiration, the shorter you should hold onto it. In my opinion, options that are a week out are the funnest for day trading as long as I make sure to SELL BY THE END OF THE DAY.

|

|

|

|

Is it possible for someone to invite me to the discord channel? I have private messaging set up. Thanks!

|

|

|

|

MomJeans420 posted:Are you shorting TSLA through earnings? I'm living vicariously through you on this one Tsla will book a profit. I want to short it so bad but I think they will rocket up through the end of July.

|

|

|

|

Also I should really stress that there is a very good reason you should do put credit spreads on meme stocks and I mean that seriously. The more delusional gamblers there are, there better prices you're going to get on the puts. Meme stocks tend to trend until they die. NIO has a low stock price but an insane volume due to people thinking it's China's TSLA which makes it almost perfect for this. You can do it with more expensive stocks but that means you need to have more collateral. It doesn't matter at all what the fundamentals are, whether or not it's another a Luckin Coffee, these are weeklies. Here's a good example of a play you would make on SNAP:   SNAP is trending up and very liquid. It's a bit of a dip-buy. I would probably like this play more on Monday than today as I generally tend to buy all my put credit spreads on Monday because that's when the most meat is on the bone. If you tried this play on Monday when SNAP was higher the extra premium would probably have been enough to balance out the time decay.  Risk $50 to make $14. It's a little close to the edge, but you have as of today a 74% chance of winning so technically this is on sale as you'd be making 2% EV. That said, I generally consider meme stocks to have a higher % win chance than is actually showing due to how the function as a whole from trader bias. I'll see tomorrow if this was a good pick or not and if I'm wrong I'll own up. Again, I'm a moron so don't take anything I say as gospel. AHH F/UGH fucked around with this message at 01:14 on Jul 15, 2020 |

|

|

|

Selling options is a very cool and viable way of making money but the cash you need is absurd, and the people who are learning about them are the exact people who should never ever sell options because they will gently caress it up and end up owing hundreds of thousands of dollars because they're loving idiots on Robin Hood.

|

|

|

|

jokes posted:Selling options is a very cool and viable way of making money but the cash you need is absurd, and the people who are learning about them are the exact people who should never ever sell options because they will gently caress it up and end up owing hundreds of thousands of dollars because they're loving idiots on Robin Hood. And then kill themselves over the weekend when Robinhood's stupid rear end UI shows them -700k when that isn't true

|

|

|

|

https://twitter.com/yayalexisgay/status/1283065952620306432?s=19 Thats about right.

|

|

|

|

"the dog ate my homework" only its a virus instead of a dog

|

|

|

|

10 q is a word salad with heavy force majeure and wide confidence bands followed by the shrug emoji.

|

|

|

|

jokes posted:Selling options is a very cool and viable way of making money but the cash you need is absurd, and the people who are learning about them are the exact people who should never ever sell options because they will gently caress it up and end up owing hundreds of thousands of dollars because they're loving idiots on Robin Hood. Yeah thatís why we take the smaller side bet that matches the people who are buying the put as protection against owing money in exchange for some premium loss, Iíll take losing $10 from an option so that I donít end up owing someone $50,000 randomly because Jeff Bezos dies in a plane crash or something. But yeah most people are idiots who donít understand what theyíre doing. Theyíre also the ones that I am lending money to in anticipation that they have hosed up in some way. You also donít need much money to do put credit spreads.

|

|

|

|

Is there any risk on not being able to fill both sides of the spread or does the broker handle that for you? Edit: I guess you buy the put first? Jenkl fucked around with this message at 02:43 on Jul 15, 2020 |

|

|

|

You close them at the same time in the same transaction and the app/software knows you're trying to do that. I can't think of any software that doesn't automatically do this, most of them (such as Robinhood and ToS) understand and automatically group them, though of course you can still close them individually if you wanted to for some reason. You set one price that is the difference of the two contracts that you want to fill and when both can be closed, you'll fill both at the same time. It's a bit like having a single contract, essentially. That's one of the other good things about PCSes: the closer they get to expiration and barely any premium left to scrape up, you can always find someone who is trying to GTFO of their nearly-worthless puts at $0.01-0.02 before they go to zero, so if you really, really want to free your buying power for one reason or another you can just give up that one or two dollars and take it out instantly.

|

|

|

|

Lote posted:Tsla will book a profit. I want to short it so bad but I think they will rocket up through the end of July. yeah :/

|

|

|

|

I don't see any way they wouldn't beat those forecasts, I think most people who would have bought Teslas before lockdown still won't cancel.

|

|

|

|

Forgive me if this isnt the place for questions on the fundamentals but I am just a quarantined gambler trying to find a new vice. Can someone explain to me (or point me in the direction of) how SPXL works? Also: better lucky than good

cr0y fucked around with this message at 04:31 on Jul 15, 2020 |

|

|

|

SPXL is Direxion's 3x Large Cap Bull ETF for the S&P 500. Essentially it mimics the S&P 500 but it moves 3x as much up and down as the actual index does. It's great during Bull markets but can sap your account faster than an actual S&P 500 index crash would as well. It's basically for people who are hyper-bullish on the S&P 500

|

|

|

|

AHH F/UGH posted:SPXL is Direxion's 3x Large Cap Bull ETF for the S&P 500. Essentially it mimics the S&P 500 but it moves 3x as much up and down as the actual index does. That's as much as I understood from googling but how do they technically do it?

|

|

|

|

|

| # ? May 17, 2024 19:13 |

|

"How does a leverasged ETF work?" needs to be in the OP somehow lol also "How does UVXY/TVIX work?" "How does USO work?" etc. if I may be so bold  edit: for everyone reading the huge rear end 12-page OP of course!

|

|

|